Fight inflation (hike rates)

Support employment (lower rates)

Today's data showing a less than expected 2.7% inflation rate, as well as the poor job numbers recently reported, gives the Fed the green light to lower rates at the next meeting and perhaps more after that.

Understandably, the S&Ps spiked higher regaining much of yesterday's sharp decline.

All things being equal, the mkt should hold these gains and perhaps push through yesterday's high. If it instead stalls out, that would be bearish action and I'd be looking to short it.

Then again, that may just be worth what you paid for it. ;-)

https://www.npr.org/2025/12/18/nx-s1-5647510/inflation-economy-prices-affordability

https://www.cnbc.com/2025/12/18/cpi-inflation-report-november-2025.html

++++++++++++

The stock market will especially like this because as joj stated, it gives them the green light to lower interest rates which makes interest bearing investment options less competitive with stocks, amongst other things.

+++++++++++++++

The impact of Trump's tariff's are inflationary for several reasons.

1. They impose an immediate tax by the ADDITIONAL AMOUNT of the tariff that US companies, then consumers pay for goods. This is indisputable.

2. There are also supply chain negative. Cutting off free trade agreements with trading partners will always reduce supplies in some markets. Always! Which ones depend on the unpredictable dynamics of individual dynamics. Free trade will always maximize US company and consumer access to global supplies of products.

3. Tariffs and the current leadership is long term negative to the relationships with our trading partners. Their impact imposes dynamics that become permanent when trading partners replace us with agreements from stable leaders that offer reliable terms they can trust .

4. Tariffs are costing jobs, not adding them. The additional costs, especially to smaller businesses cause less expansion and some contraction/cutting costs to make up for the higher costs of tariffs. The last thing that they do is incentivize countries overseas to move business to the US, which is currently being run by a madman that in the middle of the night could suddenly change the terms of any agreements with anybody about anything during another unhinged screed.

5. America's respect in much of the world is at an all time low since numbers have been tracking it.

6. Ronald Reagan was a strong advocate of FREE TRADE even though he did use tariffs SELECTIVELY(as an exception) based on a SMART, RATIONAL strategy to manage particular issues with particular countries that WERE EFFECTIVE. And don't believe the lies that try to mischaracterize his position. Reagan was also NOT A FAN OF DONALD TRUMP as Trump has stated on his Twilight Zone presidential plaques in the White House.

https://www.factcheck.org/2025/10/reagans-words-on-tariffs/

I see Mm is still suffering so what's new. Inflation is no where or down, take your pick. Job losses were by a good measure from our fed gov finally getting rid of 300,000 fake jobs from a bloating top heavy centralized socialist democrat gov, the fed shut down did hurt some 4th quarter numbers and finally had the fed not been led by a crazed lib who used politics not policy to rule things would even be brighter. And the best shocker of all with energy going the way its going among other things the first 1/2 of next year looks like a huge up term in most areas. Must be tough to have a guy living rent free inside your head but our economy is also showing more net take home pay to boot leading in '26. Ohh by the way how is that Epstein thing going? I see the latest horrific pics out

Trump were of him with some candidates at his queen contest but their faces were black out. All the while we find billions shipped to illegal Somalis and Minnesota pols led by the guy Kammala chose to be VP. Jesus, what a mess.

Thanks very, VERY much for your opinions, mcfarm!

Ohh by the way how is that Epstein thing going?

++++++++++++++++++

I started a new thread here yesterday to explain that exactly. Did you read it?

Let me guess, the Fox/MAGA version is the only one that you will ever believe(just another D hoax, right?).

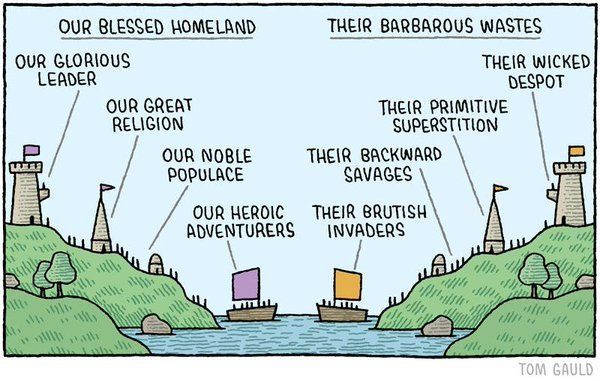

Regardless, I encourage you to keep expressing it here so that non MAGA readers will be better able to understand why up is down and down is up in MAGA world.

Epstein files

Started by metmike - Dec. 20, 2025, 7:18 a.m.

https://www.marketforum.com/forum/topic/116665/

gee I don't know MM. How is the Epstein file going. Sure seems like another major dem mess doesn't. Did you ever explain how the dems have been chasing Trump for over a decade now but yet somehow never released all the bad stuff about Trump? Guess you forgot. How about that, so strange. You think for 1 second if there was bad stuff it would not of made it out, really. Seems to be lots of dem stuff and friends of dems, So strange. How is that inflation thing going you been pushing for a year? New rumors of a huge dent to put in our once ever growing deficit, So strange guess you missed that as well. How is that boarder thing going? How many of you leftys thought that would be now at zero entries.....zero, From millions to zero and you all laughed. New predictions of huge {impossible you said} economic growth. Seems you batting record is somewhere near the early 60's Mets but you just keep right on. And by the way I never predicted or accused like you did. Trump may of well done some awful things with Epstein but you have no evidence and you know it. Conjecture, guessing, assuming, accusations, by the boat load. In this country what you have done is not part of our system. Now we find out that Wray and fake Ag raided Trumps bedroom and never once had probable cause. That is sort of a big deal ya know. And I hope they both get jail time that they deserve. In fact sure sounds like the Russia hoax used all over again doesn't it

Thanks very much, mcfarm for giving us the MAGA view.

I was really hoping to get your opinion of Trump's speech last week, if you don't mind.

Trumps speech

Started by metmike - Dec. 17, 2025, 10:14 p.m.

https://www.marketforum.com/forum/topic/116624/

++++++++++++++++++

WxFollower was also inquiring about your thoughts here:

By WxFollower - Dec. 15, 2025, 7:47 p.m.

mcfarm, cutworm, and others,

What are your thoughts about this?

++++++++++

metmike: Larry was asking for thoughts about Trump's Rob Reiner comments. What do you think, mcfarm and cutworm?

well here is more Maga in your sufferring mind. Finally after 5 years just announced yesterday. 315000 votes illegally certified in the last Presidential election in Fulton county Georgia. yes 315000 votes in the fairest and most honest election ever they said. That is difference right there. Some of us detest lying cheating and stealing no matter where it comes from and some of us do not care if the event happens to negatively affect Trump or generally speaking the right

Geesh, mcfarm, you will continue to believe anything that you want to be true!

Let me help you out, here.

Those votes were counted and validated 3 times, the last time they were HAND COUNTED! More than any county in the country. ....with the Trump Rs scrutinizing every step.

So what if a clerical error was made initially. The clerical error had no impact on the number of votes for Biden or Trump.

Let's say that in 2020 you grew 1,000 acres of corn and after harvest, measured a whopping 200 bushels/acre yield as measured by counting all the kernels and the accurate weights, the empirical data of what was left AFTER harvest. Then you measured again.............and again including measuring each kernel of each ear and got the exact same result.........200 bushels/acre.

But then, 5+ years later, some moron(the corrupt DOJ/Donald Trump in this case) said, "mcfarm didn't sign the right form when he was at the grain elevator in October 2020, so we can't believe all those measured and remeasured and remeasured again corn yields, including the one that counted every kernel and used the best scales for weighing that technology has.

SO NOW THE MORON WANTS MCFARM TO GIVE BACK HALF THE MONEY FOR HIS CORN BECAUSE HE SAYS THAT MCFARM ONLY HAD 100 bushel corn based entirely on mcfarm not signing the right form.

Who would believe the moron???

Answer: LESS THAN the number that used to believe him!

https://www.newsweek.com/republicans-identify-maga-poll-11211564

Dec 15, 2025

The poll found that 50 percent of Republicans associated with MAGA while 50 percent felt more linked to the Republican Party. In April, 57 percent of Republicans associated with MAGA and 43 percent felt more kinship with the Republican Party.

++++++++++++++++++++

mcfarm,

Just to remind you that I voted for Trump in 2016 AND 2024 but did not vote in 2020 because both of them were so bad. So your constantly accusing me of having TDS or out to get Trump anytime I provide facts that you don't like is rooted in your imagination.

After the 2020 election, I spent many hundreds of hours OBJECTIVELY investigating the results. I made many hundreds of posts here updating you.

I found that the 2020 election, based on it passing more tests, more scrutiny, more recounts, more hand recounts, more everything was the most proven authentic election in U.S. history by an extremely wide margin.

All the authentic proof below............ignored by you. Instead, you will believe anything Trump and his minions say(the current, most corrupt DOJ in history) that has ZERO credibility and ZERO authentic proof.

Re: around 200 trancripts released from jan 6th

By metmike - June 17, 2023, 5:54 p.m.

Election night fraud

Started by rockitck - July 26, 2022, 11:19 a.m.

https://www.marketforum.com/forum/topic/87530/

https://www.marketforum.com/forum/topic/87530/#87549

Describing those facts/truth in the earlier posts as gibberish.......suggests that we can add yet another republican non believer to the list of the election truth deniers.

Here's just a few of them:

mikelindells election tape

11 responses |

Started by mcfarm - Feb. 6, 2021, 8:58 a.m.

https://www.marketforum.com/forum/topic/65299/

https://www.marketforum.com/forum/topic/72115/

By metmike - March 17, 2021, 1:07 p.m.

Wonderful discussion here:

The truth about voter fraud:

https://www.brennancenter.org/sites/default/files/legacy/The%20Truth%20About%20Voter%20Fraud.pdf

++++++++++++++++++++++++++++++++++++++++

Maricopa audit

Started by wglassfo - July 7, 2021, 9:30 a.m.

https://www.marketforum.com/forum/topic/72061/

Arizona recount

5 responses |

Started by metmike - June 3, 2021, 5:34 p.m.

https://www.marketforum.com/forum/topic/70449/

State election officials try to stop election audits

6 responses |

Started by wglassfo - May 26, 2021, 4:22 p.m.

https://www.marketforum.com/forum/topic/70014/

Arizona Election audit. My favorite story so far.

22 responses |

Started by TimNew - May 21, 2021, 7:30 p.m.

https://www.marketforum.com/forum/topic/69771/

Snake Oil Salesman Mike Lindell

Started by metmike - May 13, 2021, 12:16 a.m.

https://www.marketforum.com/forum/topic/69324/

mikelindells election tape

11 responses |

Started by mcfarm - Feb. 6, 2021, 8:58 a.m.

https://www.marketforum.com/forum/topic/65299/

Election Fraud in Ga

29 responses |

Started by TimNew - Dec. 5, 2020, 5:14 a.m.

https://www.marketforum.com/forum/topic/62268/

https://www.marketforum.com/forum/topic/62268/#62292

https://www.marketforum.com/forum/topic/62268/#62317

https://www.marketforum.com/forum/topic/62268/#62385

oh boy! more vote-switching "evidence"

9 responses |

Started by GunterK - Jan. 4, 2021, 10:02 p.m.

https://www.marketforum.com/forum/topic/63755/

Umm, we have a major problem here: "Trump Pressured GA Secretary of State to 'Find' Votes"

15 responses |

Started by WxFollower - Jan. 3, 2021, 8:28 p.m.

https://www.marketforum.com/forum/topic/63694/

Chart reading and the Election line chart for Wisconsin/Michigan

16 responses |

Started by rockitck - Dec. 27, 2020, 11:23 p.m.

https://www.marketforum.com/forum/topic/63393/

is this where we have come to as a country?

17 responses |

Started by mcfarm - Dec. 19, 2020, 8:07 a.m.

https://www.marketforum.com/forum/topic/63002/

forensic analysis of Dominiion software

4 responses |

Started by GunterK - Dec. 15, 2020, 11:02 a.m.

https://www.marketforum.com/forum/topic/62756/

Wisconsin case: Trump side didn't think it was worth calling even a single witness.

2 responses |

Started by WxFollower - Dec. 14, 2020, 3:21 p.m.

https://www.marketforum.com/forum/topic/62730/

Sedition Defined

14 responses |

Started by joj - Dec. 12, 2020, 2:39 a.m.

https://www.marketforum.com/forum/topic/62603/

latest on the election

8 responses |

Started by GunterK - Dec. 12, 2020, 7:46 p.m.

https://www.marketforum.com/forum/topic/62634/

mail in ballots explained again

6 responses |

Started by mcfarm - Dec. 13, 2020, 7:40 a.m.

https://www.marketforum.com/forum/topic/62662/

supremes turn back Texas challenge

15 responses |

Started by mcfarm - Dec. 11, 2020, 7:31 p.m.

https://www.marketforum.com/forum/topic/62596/

Dominion spokesperson says....

7 responses |

Started by GunterK - Dec. 8, 2020, 8:29 p.m.

https://www.marketforum.com/forum/topic/62426/

Hi Mike

26 responses |

Started by wglassfo - Dec. 8, 2020, 12:26 a.m.

https://www.marketforum.com/forum/topic/62389/

Is there a there there

5 responses |

Started by wglassfo - Dec. 7, 2020, 4:40 p.m.

https://www.marketforum.com/forum/topic/62373/

the election.... "death by a thousand cuts"

13 responses |

Started by GunterK - Dec. 3, 2020, 1:10 a.m.

https://www.marketforum.com/forum/topic/62128/

more anomolies explained

6 responses |

Started by mcfarm - Dec. 6, 2020, 5:18 p.m.

https://www.marketforum.com/forum/topic/62320/

Votes manipulated

22 responses |

Started by wglassfo - Dec. 1, 2020, 5:40 p.m.

https://www.marketforum.com/forum/topic/62042/

send all others home and then count the fake ballots?

9 responses |

Started by mcfarm - Dec. 3, 2020, 10:35 p.m.

https://www.marketforum.com/forum/topic/62206/

Greetings from Dominion.... all is well

4 responses |

Started by GunterK - Dec. 3, 2020, 11:16 a.m.

https://www.marketforum.com/forum/topic/62142/

Lin Wood Sidney Powell

Started by wglassfo - Dec. 2, 2020, 11:17 p.m.

https://www.marketforum.com/forum/topic/62122/

Fraud or perjury

6 responses |

Started by wglassfo - Dec. 2, 2020, 6:58 p.m.

https://www.marketforum.com/forum/topic/62105/

dominion

5 responses |

Started by mcfarm - Dec. 2, 2020, 10:45 a.m.

https://www.marketforum.com/forum/topic/62081/

Georgia GOP Election Official Speaks Out

Started by joj - Dec. 2, 2020, 5:13 p.m.

https://www.marketforum.com/forum/topic/62096/

Chris Krebs Speaks Out

12 responses |

Started by joj - Dec. 1, 2020, 7:05 a.m.

https://www.marketforum.com/forum/topic/62024/

Votes manipulated

22 responses |

Started by wglassfo - Dec. 1, 2020, 5:40 p.m.

https://www.marketforum.com/forum/topic/62042/

reasons to wonder about the fraud

12 responses |

Started by mcfarm - Nov. 29, 2020, 8:42 a.m.

https://www.marketforum.com/forum/topic/61936/

Why this election was a fraud

24 responses |

Started by wglassfo - Nov. 26, 2020, 10:21 a.m.

https://www.marketforum.com/forum/topic/61803/

Re: Re: Capitol Insurrection News

By metmike - Jan. 27, 2021, 9:55 p.m.

https://www.marketforum.com/forum/topic/64730/#64841

https://www.marketforum.com/forum/topic/72115/#72145

Arizona clown show continues

2 responses |

Started by metmike - Aug. 23, 2021, 12:36 p.m.

https://www.marketforum.com/forum/topic/74108/

Mike Lindell......a complete nut job!

14 responses |

Started by metmike - Aug. 6, 2021, 7:41 p.m.

https://www.marketforum.com/forum/topic/73263/

sure MM you are right. you are always right, right up to the time we apply the law. Go find that tape of the Fulton Co attorney standing there and fully admitting they broke the law and yet somehow skipping over the part where it took 5 years to admit that tidbit, Wow that seems really similar to how the Biden doj had every bit of info the Trump doj had about the DC pipe bomber and just like magic the Trump team solved what the Biden team had not a clue about....and the Trump team not only solved it they did it in months...so damn odd....could you say almost like the Biden team was ordered to stand down.....as crazy ass Joe would say "son of a bitch"......and that sound eerily similar to the fake Mara Logo raid where they have now discovered they had no probable cause but were ordered by Wray and the demented AG to raid anyway.....Wow after the last few years who would ever think the crazed left would ever go so far.....most anyone who cared to look, that's who

Georgia state Rule 183-1-12-.12 states that after polls close, and in order to tabulate results, “the poll manager and the two witnesses shall cause each ballot scanner to print three tapes of the tabulated results and shall sign each tape indicating that it is a true and correct copy of the tape produced by the ballot scanner.” This was not properly done for more than 130 tapes, which accounts for around 315,000 votes

On Friday, Fulton County Superior Court Judge Robert McBurney granted the election board access to the country’s 2020 ballots. He ruled that the election board must pay for the matter, which Fulton County has estimated it will cost nearly $400,000 to comply with the subpoena. The judge has ordered the county to produce a detailed cost list by January 7.

Placing a bet here. There will not be a damn thing done by Jan 7th. Odds are 100% not a damn thing.

Thanks, mcfarm.

Yep, that is right as rain!

And it had ZERO impact on the votes, which AFTER THAT were, counted over, then HAND COUNTED over after that.

If you measured 3.57 inches in 3 separate, accurately calibrated rain gauges on your property on November 3, 2020 and somebody, 5 years later told you that when you bought the rain gauges you forget to fill out the paperwork SO IT DIDN'T RAIN ON NOVEMBER 3, 2020 at your farm, what would your opinion be of that person(if it wasn't Donald Trump)??

The last thing that was done was to hand count the votes. You don't get more accurate than that.

One of the most important things with our democracy is to do everything possible to count every vote. That's exactly what they did. Throwing out 300,000 votes over a clerical error that was TRUMPED by the counting afterwards than double Trumped by the hand counting after that would violate the intent of our democracy and Constitution.

Regardless, of that fact, I appreciate you expressing the MAGA point of view on this, mcfarm.

Merry Christmas!

just who has crossed over Larry. Read this quote from MM and tell us what key word did he leave out? Just like the crazy libs and the boarder from some reason they always leave out some key word and hopefully no one will notice. The word with the boarder is legal. And now MM has started a new example. Count every vote he says....every single vote and storm the bastille as well!!!!! Uhmm he only omitted "legal"

e of the most important things with our democracy is to do everything possible to count every vote .......by MM....and

by the way we used to more open about us being special and exceptional, for example we used to use the accurate word 'republic" and it meant something

Thanks very much, mcfarm!

When I state "count every vote" and when non MAGA people state "count every vote" it's automatically assumed to mean legal votes.

That's the meaning in almost every legit realm when people are counting things.

Only in this one, where one side completely invents(and repeats) an imaginary force that takes away millions of THEIR votes and adds millions of votes for THE OPPONENT to steal elections based on a cult leader (with a huge following) that repeats over and over that the 2020 presidential election was stolen from him.

We've seen more recounts, then hand recounts, legal challenges and intense scrutiny of the 2020 election by a wide margin over any other election to make it the most PROVEN election in history by a wide margin.

Yet one other side, in the millions still without a shred of evidence to support their case keeps repeating that the election was stolen and Donald Trump was the real winner. And the source is.............Donald Trump insisting that Donald Trump won the 2020 election but the Ds and Joe Biden stole it from him.

The reason for all of this is that Donald Trump refuses to admit when he is wrong about anything and he refuses to admit that he lost the 2020 election. He even tried to overturn the election with an Insurrection that emphatically violated the American people and his vows to uphold the Constitution and our democracy.

As a scholastic chess coach to over 6,000 students the past 3 decades, the most important thing that I teach is not the chess playing, it's the good sportsmanship during the competition. Most kids are NOT going to be grand masters. Only 1 kid wins each game. However, every single student of every single game can practice good sportsmanship. That means, at the very least acknowledging who won the game when it's over. When we lose, we CONGRATULATE the winner, with a "good game" or "congratulations" and a first bump or hand shake. Not just most of the time..............every single time, including the toughest losses.

Then, we LEARN THE MOST from our losses because we can go back and see the mistakes that caused the loss and use them to BECOME BETTER PLAYERS while displaying the best character traits during and after the games. Respecting the opponent AT ALL TIMES, regardless of their gender or race or age or school or the tournament environment. The person on the other side of the chess board is another human being. Their objective is to CRUSH THEM on the chess board playing a game that uses plastic pieces, while learning how to be a good human being at the same time to the human beings on the other side of the chess board.

Incredibly, the most powerful man in the world and the president of the United States can't practice even the most basic good sportsmanship qualities. By far, he's the person most often in the public eye and by far he's the one with the worst character traits. The worst possible example for our children growing up. The worst role model. If I wanted to teach a lesson to our kids about Donald Trump, the lesson would just be "behave completely the opposite of President Trump"!!

I respect every human being, regardless of their political opinion and accept whatever people's political opinion is, especially when it's different than mine but will say with 100% certainty, as somebody dedicating their lives to developing the minds and character of the youth in my community that Donald Trump's influence on people is the diametrically opposed, polar opposite of what I'm trying to teach young people and I know MAGA parents want their children to grow up behaving with character traits that line up with what most chess coaches teach in our chess programs and NOT how Donald Trump behaves .

There is an EXTREME disconnect because, when you belong to a cult it short circuits your rational brain and critical thinking. By definition, everything is twisted like a pretzel to conform with the cult leader's tenets, even when it emphatically violates your personal standards and core beliefs about Christianity or morality or how you think human beings should behave or what we teach our kids.

The cult leader gets a free pass on everything they do by definition of the cult.

MAGA is the biggest cult in United States history. However, its wonderful to see, here in late 2025, millions of MAGA cult members breaking free from this cult.

Sportsmanship and Democracy

https://rsc.byu.edu/notes-amateur/sportsmanship-democracy

++++++++++++++++

mcfarm,

You liked President Reagan, didn't you?

![]()

https://rosebowlinstitute.org/programs/sportsmanship-civility/

Sportsmanship and good citizenship are deeply interconnected concepts. The mentality of “winning at all costs” and an over-emphasis on “gamesmanship,” or seeking ways to tilt the game in one’s favor, undermines the spirit and enjoyment of the game and undercuts the health of a democracy. By prioritizing sportsmanship—emphasizing fairness, respect, teamwork, humility, and integrity—we cultivate values that are essential to being a good citizen. Ultimately, a commitment to being a good sport is a commitment to being a good citizen, and both are essential to the future of our country.

++++++++++++++++=

You and cutworm like Thomas Sowell too!

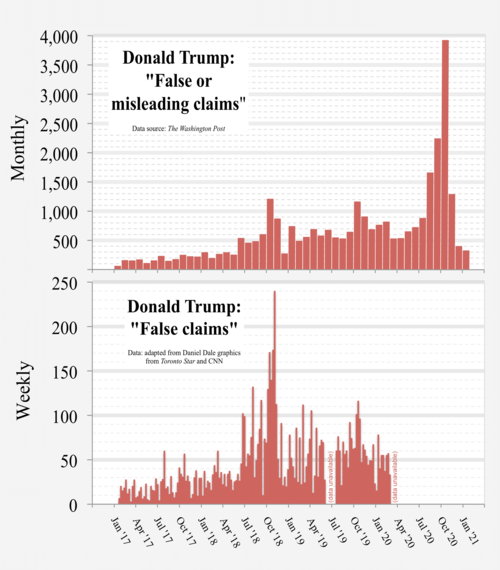

https://en.wikipedia.org/wiki/False_or_misleading_statements_by_Donald_Trump

Just a reminder, I don't hate President Trump. I voted for him in 2016 and 2024. This is just speaking out about the truth, using authentic, empirically based evidence which is INDEPENDENT of my political views.

Hate(and love)

Started by metmike - Oct. 17, 2023, 4:15 p.m.

The president posted on Truth Social over 100 times overnight, also touting his own economic policies and efforts to end foreign wars.

Or as Larry stated:

TwilightZone 2025

https://thehill.com/business/5665840-trump-powell-lawsuit-fed-buildings/

++++++++++

https://english.news.cn/20251230/cd6aa8ab8b08466fb62cabd02e716af1/c.html

+++++++++++++++++++++

If you belong to MAGA, this seems like a great idea. For the rest of us:

President’s decision on successor to Jay Powell comes at pivotal moment for world’s most important central bank

https://www.ft.com/content/a08f1b78-4816-4ff1-819c-e67e59c8d767

Is this the reason for the metals crash and weakness in the stock market???

The talking heads on CNBC who are pro institutional types like the new Fed chair nominee. He wants to shrink the Fed balance sheet which is currently at 6 trillion. That is, on balance, contractionary policy. That surprised many, including myself. That is taking AWAY the punch bowl from the party. Is it possible that Trump doesn't understand this basic lever? Or, is Warsh going to do a 180, and be a Trump tool?

It is hard for me to believe that Trump has suddenly gone main stream.

Regarding the metals, economic contraction is a bearish move. But they were ripe for a fall. Mike, I think you were on to something when you mentioned the huge volume in the first hour of trading of the night session that put in the high (capitulation).

Thanks very much, joj!

For sure record high volume can tell us a great deal but I sure didn't call the top in the metals until it was in the rear view mirror.

Funny thing is that you and I were congratulating cutworm on his great call on silver's historic move up in January.........just hours before the top.

If anybody deserves credit for breaking the news first about the highs being in for silver, it's this guy

By fayq - Jan. 30, 2026, 4:49 a.m.

Now mkt lower =---silver and gold--------->> so--!!

++++++++++++

Congrats fayq for alerting our small world at MarketForum!