The forecast is looking bullish for the grains-higher open likely. Let's start with rains.

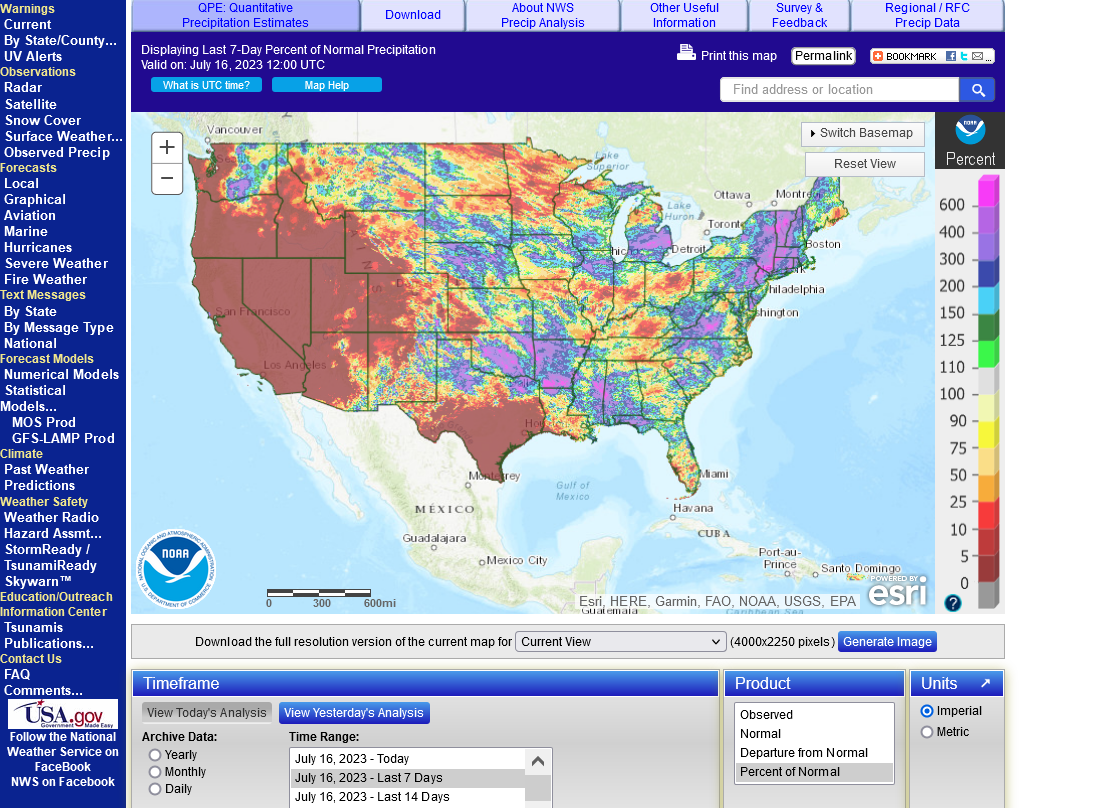

1. The past 7 days % average

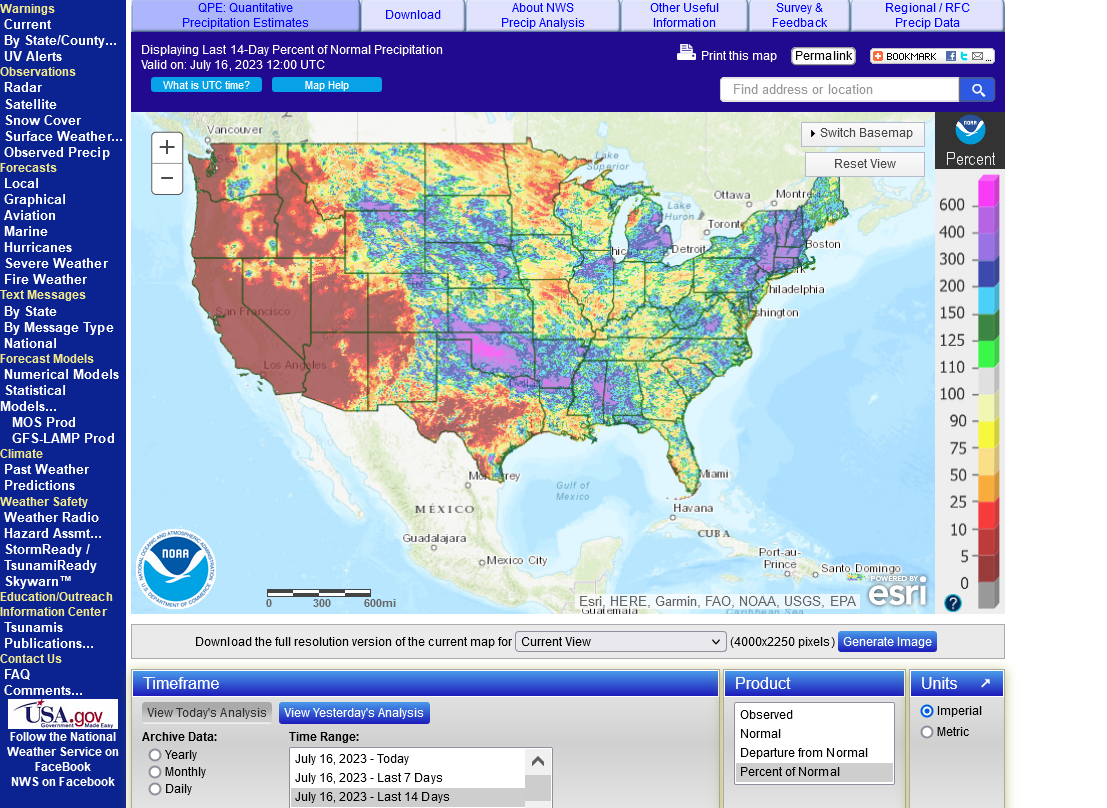

2. The past 14 days % average

3. The past 30 days % average

The latest automated NWS 6-10 and 8-14 day outlooks had normal to below normal rains with heat building, especially in the West during week 2.

https://www.marketforum.com/forum/topic/83844/#83852

Below, was the last 12z GEFS rain totals for 384 hours-16 days.

The farther northwest you go in the Midwest, the less rain in the forecast.

Despite the dryness and increasing heat, the dome of death remains anchored in the Southwest and the Midwest remains in (tricky) northwest flow. This is August 1st below.

Northwest flow can feature active perturbations coming around the periphery of the heat ridge and dropping into the Midwest. Their ability to generate rains is often tied to how much moisture return takes place ahead of them. The typical Bermuda high that brings in moisture this time of year has been altered by the unusual Atlantic warmth. We have a trough in the East instead. This has been a factor in the excessive rains in the Northeast.

If the trough backs up westward, father into the Midwest, it becomes very bearish. If it shifts east and the dome builds east, it becomes very bullish.

Right now, you could say we are bearish for the southeast Midwest but increasingly bullish the farther you go northwest.

Models are not capable of resolving convective systems in northwest flow very well.

Forecasts in this type of regime are known to bust badly........from less rain than forecast and sometimes big rain amount surprises. Summer convective systems are the most difficult to forecast ahead of time.

So keep your eyes on the radars. The markets will react to this at times.

https://www.marketforum.com/forum/topic/83844/

https://www.wunderground.com/maps/radar/current

This link below provides some great data. After going to the link, hit "Mesoanalysis" then, the center of any box for the area that you want, then go to observation on the far left, then surface observations to get constantly updated surface observations or hit another of the dozens of choices.

|

This will be a gap higher open for the corn and maybe for the beans too.

We got the gap higher in corn which is holding.

Filling that gap would be a gap and crap short term buying exhaustion formation and bearish.

The low today in beans is just below the high on Friday, so not quite a gap. It's only been 36 minutes but beans are not acting very good without much follow thru after opening +13c.

This means very little about where we will be in 12 hours, so take the comments with a grain of salt, other than, if the market was feeling a serious threat, we would have had better follow thru.

The below average rains in the forecast for many areas, especially northwest are the main threat but the northwest flow INSTEAD of a heat ridge keeps it from doing too much damage.

We sold off, almost closed the gap higher in corn (filling it is a gap and crap short term buying exhaustion signal/bearish) then bounce after the EE came out. Rains increasing in the southern belt right now are a wildcard.

you never want to be long if the radars light up too much in July.

radar trends can cause 10c spikes in a couple minutes for beans….in either or both directions.

as long as the radar behaves the forecast is not bearish right now (for the WCB).

Latest weather updates on tallpines thread(6z GEFS increased rains in WCB), including a key item that cutworm enlightened us with that I had no clue about(thanks cutworm)

Overall weather still bullish:

https://www.marketforum.com/forum/topic/97340/

+2% for corn=expected

+4% for beans 2% expected

+4% HRS 0% expected

-3% cotton ? expected

Keep in mind that seasonally, the crop ratings are usually slowly declining in mid July, so this is unusual but that's what happens when an extremely moisture starved crop, suddenly gets big rains at this time of year.

This is bearish to prices news, but the weather is turning MORE bullish!

++++++++++++++++

U.S. #corn conditions increase as expected, but #soybeans rose more than expected. Spring #wheat conditions rose against expectations for steady. Winter wheat harvest is well behind normal pace.

metmike: if you remember, beans did not got up as much as expected last week(+1% vs +2% expected), so their condition improvement expectation was really just delayed to some extent.

7-10-23 report:

Latest weather still bullish!

Still bullish!

https://www.marketforum.com/forum/topic/97401/#97407

Heat Fill for Corn

Started by metmike - July 14, 2023, 2:47 p.m.

Latest weather here. Continues to shift more bearish

Is not tonight a failed attempt to test the highs? (bean oil new high front month)

Cant be any hotter than what we already knew??

Thanks tjc,

I was never interested in buying tonight regardless of the opening. The week 2 forecast is just not bullish enough and there are too many models that have decent rains with the cooler weather in week 2.

However, there are still some that are pretty dry and that's sure not bearish even with cooler temps.

Elevated CO2 levels is especially helpful to crops that are moisture starved because the stomata don't need to open as wide to get CO2 and the moisture loss from transpiration is much less.

The market isn't trading that 1 iota tonight but I'm just thinking of crop ratings being better than expected with this dry weather down the road.

My grass and landscaping are growing like a jungle, despite us only having around a 10 day period during the last 2 months with great rains( almost 7 inches goes along way).

This isn't helping anybody with their trading ideas tonight, however. Just me rambling about my favorite topic.

I'll post some weather info at the new thread for this week shortly.