KEY EVENTS TO WATCH FOR:

Tuesday, July 18, 2023

8:30 AM ET. June Advance Monthly Sales for Retail & Food Services

Overall Sales-SA, M/M% (expected +0.5%; previous +0.3%)

Sales, Ex-Auto, M/M% (expected +0.3%; previous +0.1%)

Sales, Ex-Auto & Gas, M/M% (previous +0.4%)

8:55 AM ET. Johnson Redbook Retail Sales Index

Retail Sales Mo-to-Date, Y/Y% (previous -0.4%)

Latest Wk, Y/Y% (previous -0.4%)

9:15 AM ET. June Industrial Production & Capacity Utilization

Industrial Production, M/M% (expected +0.0%; previous -0.2%)

Capacity Utilization % (expected 79.5%; previous 79.6%)

Capacity Utilization, Net Chg (Pts.) (previous -0.2)

10:00 AM ET. July NAHB Housing Market Index

Housing Mkt Idx (expected 56; previous 55)

10:00 AM ET. May Manufacturing & Trade: Inventories & Sales

Total Inventories (expected +0.2%; previous +0.2%)

4:00 PM ET. May Treasury International Capital Data

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous +3.0M)

Gasoline Stocks, Net Chg (Bbls) (previous +1.0M)

Distillate Stocks, Net Chg (Bbls) (previous +2.9M)

Wednesday, July 19, 2023

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 208.4)

Composite Idx, W/W% (previous +0.9%)

Purchase Idx-SA (previous 165.3)

Purchase Idx-SA, W/W% (previous +1.8%)

Refinance Idx (previous 416)

Refinance Idx, W/W% (previous -1.3%)

8:30 AM ET. June New Residential Construction - Housing Starts and Building Permits

Total Starts (expected 1.48M; previous 1.631M)

Housing Starts, M/M% (expected -9.3%; previous +21.7%)

Building Permits (expected 1.48M; previous 1.491M)

Building Permits, M/M% (expected -0.7%; previous +5.2%)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 458.128M)

Crude Oil Stocks, Net Chg (Bbl) (previous +5.946M)

Gasoline Stocks (Bbl) (previous 219.452M)

Gasoline Stocks, Net Chg (Bbl) (previous -0.004M)

Distillate Stocks (Bbl) (previous 118.181M)

Distillate Stocks, Net Chg (Bbl) (previous +4.815M)

Refinery Usage (previous 93.7%)

Total Prod Supplied (Bbl/day) (previous 18.701M)

Total Prod Supplied, Net Chg (Bbl/day) (previous -2.534M)

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The STOCK INDEXES: The September NASDAQ 100 was slightly lower overnight as it consolidates some of Monday's rally. The stage is set for a slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends this year's rally, the 87% retracement level of the 2021-2022-decline on the weekly continuation chart crossing at 15,957.86 is the next upside target. Closes below last-Monday's low crossing at 15,063.25 would confirm that a short-term top has been posted. First resistance is Monday's high crossing at 15,882.75. Second resistance is the 87% retracement level of the 2021-2022-decline on the weekly continuation chart crossing at 15,957.86. First support is last-Monday's low crossing at 15,063.25. Second support is the June 26th low crossing at 14,853.50.

The September S&P 500 was slightly lower overnight as it consolidates some of Monday's rally, which posted a new high for the year. Overnight trading sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off March's low, the 87% retracement level of the 2022 decline crossing at 4639.07 is the next upside target. Closes below last-Monday's low crossing at 4411.25 would confirm that a short-term top has been posted. First resistance is Monday's high crossing at 4565.75. Second resistance is the 87% retracement level of the 2022 decline crossing at 4639.07. First support is the 10-day moving average crossing at 4497.40. Second support is the 20-day moving average crossing at 4462.69.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: September T-bonds was higher overnight as it extends the rally off the July 10th low. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the aforementioned rally, the 50-day moving average crossing at 127-16 is the next upside target. Closes below the 10-day moving average crossing at 125-13 would temper the near-term friendly outlook. First resistance is the 50-day moving average crossing at 127-16. Second resistance is the 50% retracement level of the April-July decline crossing at 128-21. First support is the 10-day moving average crossing at 125-13. Second support is the July 10th low crossing at 122-30.

September T-notes were higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are becoming overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends this month's rally, the 50-day moving average crossing at 113.201 is the next upside target. Closes below the 10-day moving average crossing at 111.275 would signal that a short-term top has likely been posted. First resistance is the 50-day moving average crossing at 113.201. Second resistance is June's high crossing at 115.000. First support is the 10-day moving average crossing at 111.275. Second support is the July 6th low crossing at 110.050.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

ENERGIES:Augustcrude oil was higher overnight as it consolidates some of the decline off last-Thursday's high. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $72.06 would signal that a short-term top has been posted. If August renews the rally off the June 28th low, the 75% retracement level of the April-May decline crossing at $77.85 is the next upside target. First resistance is last-Thursday's high crossing at $77.33. Second resistance is the 75% retracement level of the April-May decline crossing at $77.85. First support is the 10-day moving average crossing at 74.20. Second support is the 20-day moving average crossing at $72.06.

September heating oil was slightly higher overnight as it consolidates some of the decline off last-Friday's high. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, April's high crossing at 2.6618 is the next upside target. Closes below the 20-day moving average crossing at 2.4794 would signal that a short-term top has been posted. First resistance is April's high crossing at 2.6618. Second resistance is the 50% retracement level of the 2022-2023 decline crossing at 2.7273. First support is the 10-day moving average crossing at 2.5531. Second support is the 20-day moving average crossing at 2.4794.

September unleaded gas was higher overnight as it consolidates some of the decline off last-Thursday's high. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, April's high crossing at $2.6388 is the next upside target. Closes below the 20-day moving average crossing at 2.4748 would signal that a short-term top has been posted. First resistance is last-Thursday's high crossing at $2.6211. Second resistance is April's high crossing at $2.6388. First support is the 10-day moving average crossing at $2.5412. Second support is the 20-day moving average crossing at $2.4748.

September natural gas was slightly higher overnight and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off June's high, June's low crossing at 2.249 is the next downside target. If September renews the rally off June's low, the June 26th high crossing at 2.911 is the next upside target. First resistance is the June 26th high crossing at 2.911. Second resistance is the 25% retracement level of the 2022-2023 decline crossing at 3.193. First support is Monday's low crossing at 2.477. Second support is the June 1st low crossing at 2.249.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The September Dollar was slightly lower overnight and remains poised to extend this month's sharp decline. Overnight trading sets the stage for a slightly lower opening when the day session begins trading later this morning. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off the July 6th high, the March 30th low on the weekly continuation chart crossing at $97.730 is the next downside target. Closes above the 20-day moving average crossing at $101.660 would signal that a short-term low has been posted. First resistance is the 10-day moving average crossing at $101.907. Second resistance is the 20-day moving average crossing at $101.660. First support is last-Friday's low crossing at $99.260. Second support is the March 30th -2022 low on the weekly continuation chart crossing at $97.730.

The September Euro was slightly higher overnight as it extends the rally off May's low. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, the March 30th -2022 crossing at $1.15190 is the next upside target. Closes below the 20-day moving average crossing at 1.10431 would signal that a short-term top has been posted while opening the door for additional weakness near-term. First resistance is the overnight high crossing at $1.13105. Second resistance is the March 30th -2022 crossing at $1.15190. First support is the 10-day moving average crossing at 1.11162. Second support is the 20-day moving average crossing at 1.10431.

The September British Pound was steady to slightly higher overnight following a two-day correction off last-Thursday high. Overnight trading and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices near-term. If September extends the rally off May's low, the 75% retracement level of the 2022-2023 decline crossing at 1.3253 is the next upside target. Closes below the 20-day moving average crossing at 1.2834 would signal that a short-term top has been posted. First resistance is last-Friday's high crossing at 1.3146. Second resistance is the 75% retracement level of the 2022-2023 decline crossing at 1.3253. First support is the 10-day moving average crossing at 1.2951. Second support is the 20-day moving average crossing at 1.2834.

The September Swiss Franc was higher overnight as it extends the rally off May's low. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, the January 2019 high crossing at 1.18680 is the next upside target. Closes below the 20-day moving average crossing at 1.13830 would signal that a short-term top has been posted. First resistance is last-Friday's high crossing at 1.17535. Second resistance is the January 2019 high crossing at 1.18680. First support is the 10-day moving average crossing at 1.15078. Second support is the 20-day moving average crossing at 1.13830.

The September Canadian Dollar was slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 10-day moving average crossing at $75.64 would signal that a short-term top has been posted. If September renews the rally off July's low, the September-12th -2022 high crossing at $77.11 is the next upside target. First resistance is the 38% retracement level of the 2022-2023 decline crossing at $76.28. Second resistance is the September-12th -2022 high crossing at $77.11. First support is the 10-day moving average crossing at $75.64. Second support is the 50-day moving average crossing at $75.04.

The September Japanese Yen was slightly higher overnight. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, the 38% retracement level of the January-July decline crossing at 0.074017 is the next upside target. Closes below the 20-day moving average crossing at 0.071255 would signal that a short-term top has been posted. First resistance is last-Friday's high crossing at 0.073585. Second resistance is the 38% retracement level of the January-June decline crossing at 0.074017. First support is the 20-day moving average crossing at 0.071255. Second support is June's low crossing at 0.069755.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

Precious Metals: Augustgold was higher overnight and sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If August extends the rally off June's low, the 50-day moving average crossing at $1972.40 is the next upside target. Closes below the 20-day moving average crossing at $1937.90 would signal that a short-term top has been posted. First resistance is the 50-day moving average crossing at $1972.40. Second resistance is June's high crossing at $2000.70. First support is the 20-day moving average crossing at $1937.90. Second support is June's low crossing at $1900.60. Third support is the 50% retracement level of the September-May rally crossing at $1892.30.

September silver was slightly higher overnight and sets the stage for a slightly higher opening when the day session begins trading later this morning. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If July extends the rally off June's low, the 75% retracement level of the May-June decline crossing at $25.561 is the next upside target. Closes below the 20-day moving average crossing at $23.534 would signal that a short-term top has been posted. First resistance is the overnight high crossing at $25.280. Second resistance is the 75% retracement level of the May-June decline crossing at 25.561. First support is the 50-day moving average crossing at $24.001. Second support is the 20-day moving average crossing at $23.534.

September copper was lower overnight as it extends the decline off last-Friday's high and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at 3.7864 would signal that a short-term top has been posted. If September renews the rally off the June 29th low, June's high crossing at 3.9640 is the next upside target. First resistance June's high crossing at 3.9640. Second resistance is May's high crossing at 4.0100. First support is the 50-day moving average crossing at 3.7864. Second support is the June 29th low crossing at 3.6830.

GRAINS http://quotes.ino.com/ex changes/?c=grains

Grains: December corn was higher overnight and is poised to extend the rally off last-Thursday's low. Overnight trading sets the stage for a higher opening when the day sessions begins trading. Stochastics and the RSI have turned bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off last-Thursday's low, the 50-day moving average crossing at $5.30 is the next upside target. Closes below the 10-day moving average crossing at $5.01 would signal that a short-term top has likely been posted. If December renews the decline off the June 21st high, the September 2022 low crossing at $4.62 1/2 is the next downside target.First resistance is the 50-day moving average crossing at $5.30. Second resistance is the 20-day moving average crossing at $5.32 1/2. First support is last-Thursday's low crossing at $4.81. Second support is the September 2022 low crossing at $4.62 1/2.

September wheat was higher overnight. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI have turned neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $6.78 would signal that a short-term low has been posted. If September renews the decline off June's high, May's low crossing at $5.87 3/4 is the next downside target. First resistance is the 20-day moving average crossing at $6.78. Second resistance is June's high crossing at $7.70 1/4. First support is last-Thursday's low crossing at $6.22. Second support is May's low crossing at $5.87 3/4.

September Kansas City wheat was higher overnight and sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are turning bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $8.28 would signal that a short-term low has been posted while opening the door for additional gains near-term. If September renews the decline off July's high, July's low crossing at $7.87 1/4 is the next downside target. First resistance is July's high crossing at $8.55 3/4. Second resistance is June's high crossing at $8.89 1/2. First support is last-Wednesday's low crossing at $7.92. Second support is July's low crossing at $7.87 1/4. Third support is the June 14th low crossing at $7.76 3/4.

September Minneapolis wheat was steady to slightly higher overnight. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off July's low, April's high crossing at $9.10 1/2 is the next upside target. Closes below the 20-day moving average crossing at $8.55 1/2 would temper the near-term friendly outlook. First resistance is Monday's high crossing at $9.00. Second resistance is April's high crossing at $9.10 1/2. First support is the 20-day moving average crossing at $8.55 1/2. Second support is the 50-day moving average crossing at $8.37 1/4. Second support is July's low crossing at $8.07 1/4.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

November soybeans were higher overnight and sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If November extends the rally off May's low, the 87% retracement level of the 2022-2023 decline crossing at $14.07 1/2 is the next upside target. Closes below the 20-day moving average crossing at $13.38 1/4 would signal that a short-term top has been posted. First resistance is the 87% retracement level of the 2022-2023 decline crossing at $14.07 1/2. Second resistance is the December 2022 high crossing at $14.27 3/4. First support is the 20-day moving average crossing at $13.38 1/4. Second support is the 50-day moving average crossing at $12.62 1/2.

December soybean meal was higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are bullish signaling that sideways to higher prices are possible near-term. If December renews the rally off the June 29th low, the 75% retracement level of the March-May decline crossing at $418.80 is the next upside target. Closes below the 50-day moving average crossing at $387.20 would confirm that a short-term top has been posted. First resistance is July's high crossing at $4.15 1/4. Second resistance is the 75% retracement level of the March-May decline crossing at $418.80. First support is the July 7th low crossing at $3.84 3/4. Second support is the June 29th low crossing at $374.60.

December soybean oil was higher overnight as it extends the trading range of the past two-weeks. Overnight strength sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If December renews the rally off May's low, the 75% retracement level of the 2022-2023 decline crossing at 65.45 is the next upside target. Closes below the 20-day moving average crossing at 58.26 would signal that a short-term top has been posted. First resistance is the 62% retracement level of the 2022-2023 decline crossing at 61.75. Second resistance is the 75% retracement level of the 2022-2023 decline crossing at 65.45. First support is the 20-day moving average crossing at 58.26. Second support is the June 29th low crossing at 54.67.

thanks tallpine

no Change in the weather forecast

still bullish

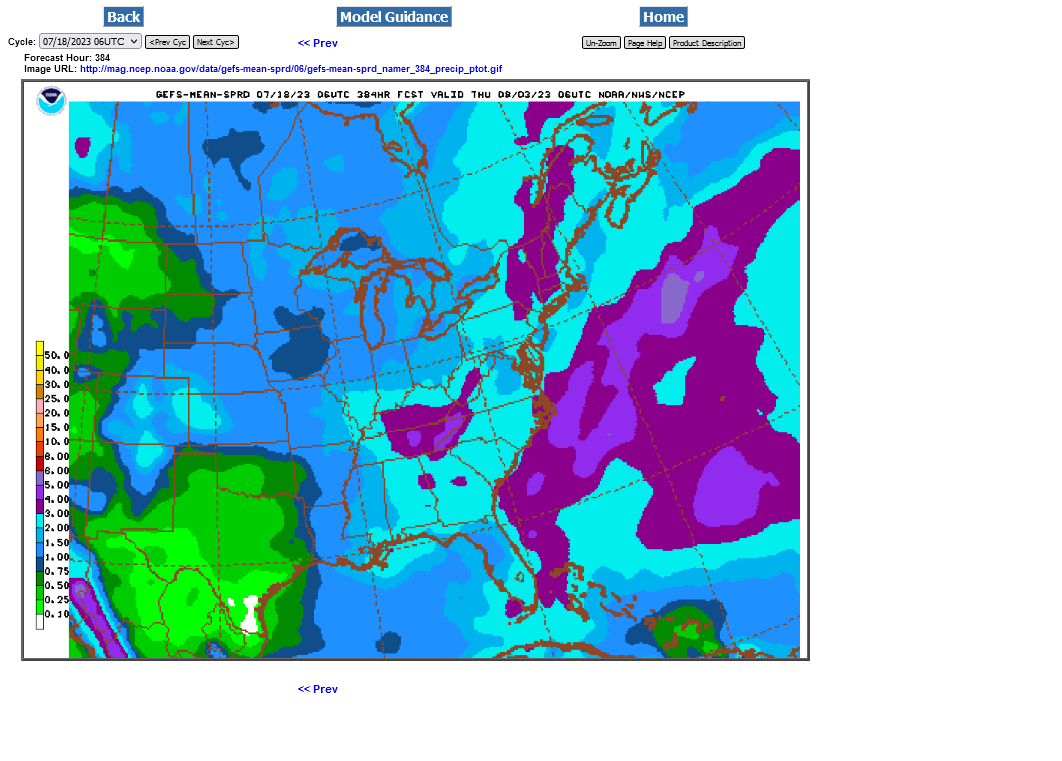

Last GEFS

1. Northwest flow still at 2 weeks. No Bermuda high to pump moisture for perterbations in the flow. Dome is still in the Southwest but some of the heat spills in from the West but not intentense. If the trough to the east backs up, even just a little it can get less bullish pretty fast

2. An inch to slightly less in most of the belt. The Southeast, towards the Ohio River has the best chance for rains.

The Canadian model is always out an hour before the GEFS and 2 hours before the European model. The market doesn't pay that much attention to it.

Still 2 different camps of solutions. 1 is bearish-with a majority, that features fast potentially active w to northwest flow. The other is bullish-a significant minority.

When we average them out, we get something that doesn't look like hardly any of the solutions. It's pretty dry/bullish.

384h GZ 500 forecast valid on Aug 03, 2023 12 UTC

Looks to me like funds covering their shorts today, especially in corn!