Don't really trade crude but tend to keep an eye on it.

Looks like some support around $65-67 (spring early summer lows).

Will this hold?

Thanks for starting the new thread, buck!

1. 10 years. Note the spike higher in early 2022, from Biden's war with Putin, using Ukraine

2. 1 year. July-Aug-Sep 2023 rally that collapsed since then. At major support right now.

3. 1 month: Collapsing lower!

https://tradingeconomics.com/commodity/crude-oil

+++++++++++++++++++

+++++++++++++++++++

Gasoline prices are even WEAKER than crude because of falling demand. Bad sign for the economy.

https://tradingeconomics.com/commodity/gasoline

Previous thread on this:

THE COST OF GASOLINE.....

16 responses

Started by 12345 - Oct. 17, 2023, 8:24 p.m.

Weekly US ending stocks of crude oil, including the SPR

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

Lowest stocks since 1985 thanks to President Biden draining the SPR for political reasons, in anticipation of his war with Russia

Weekly ending stocks for unleaded gasoline.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

In good shape-average/above average-demand is falling

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

HO/Diesel stocks are easily the lowest for this time of year in history

https://nymag.com/intelligencer/2023/11/why-gas-is-getting-cheaper-amid-the-israel-hamas-war.html

+++++++++++++

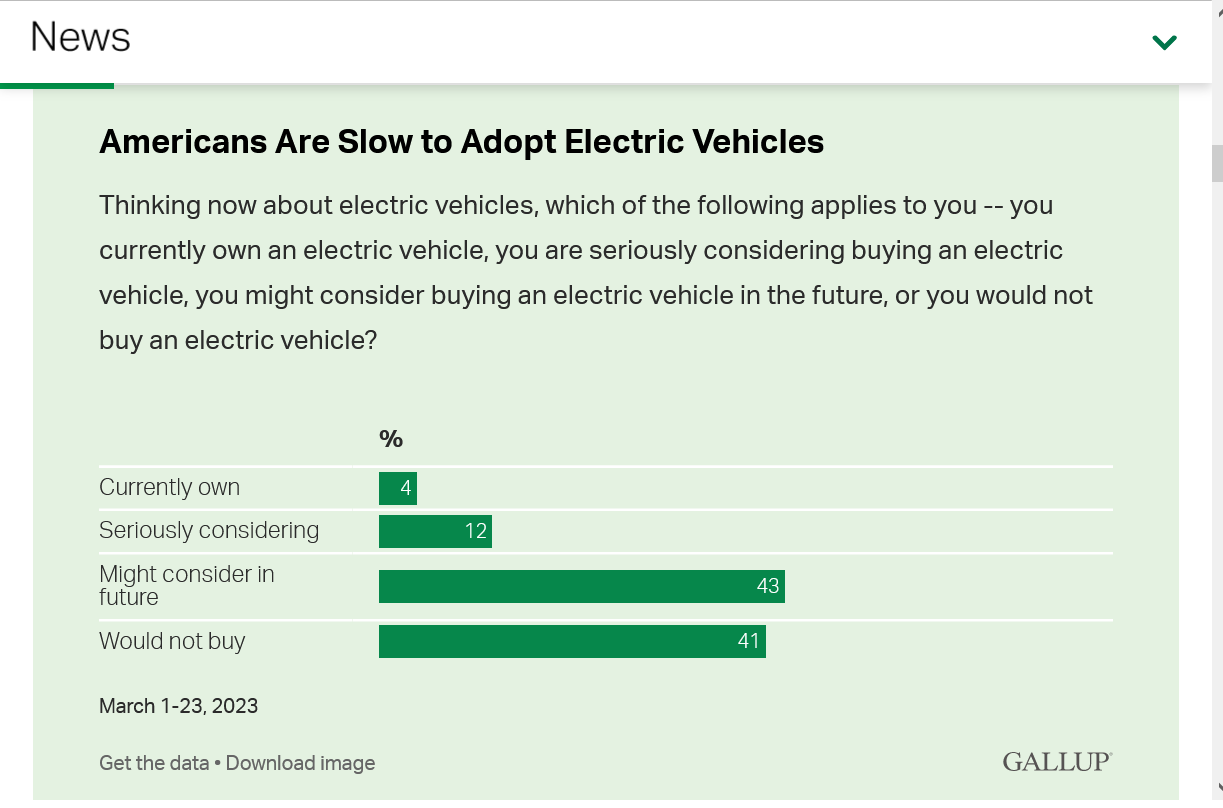

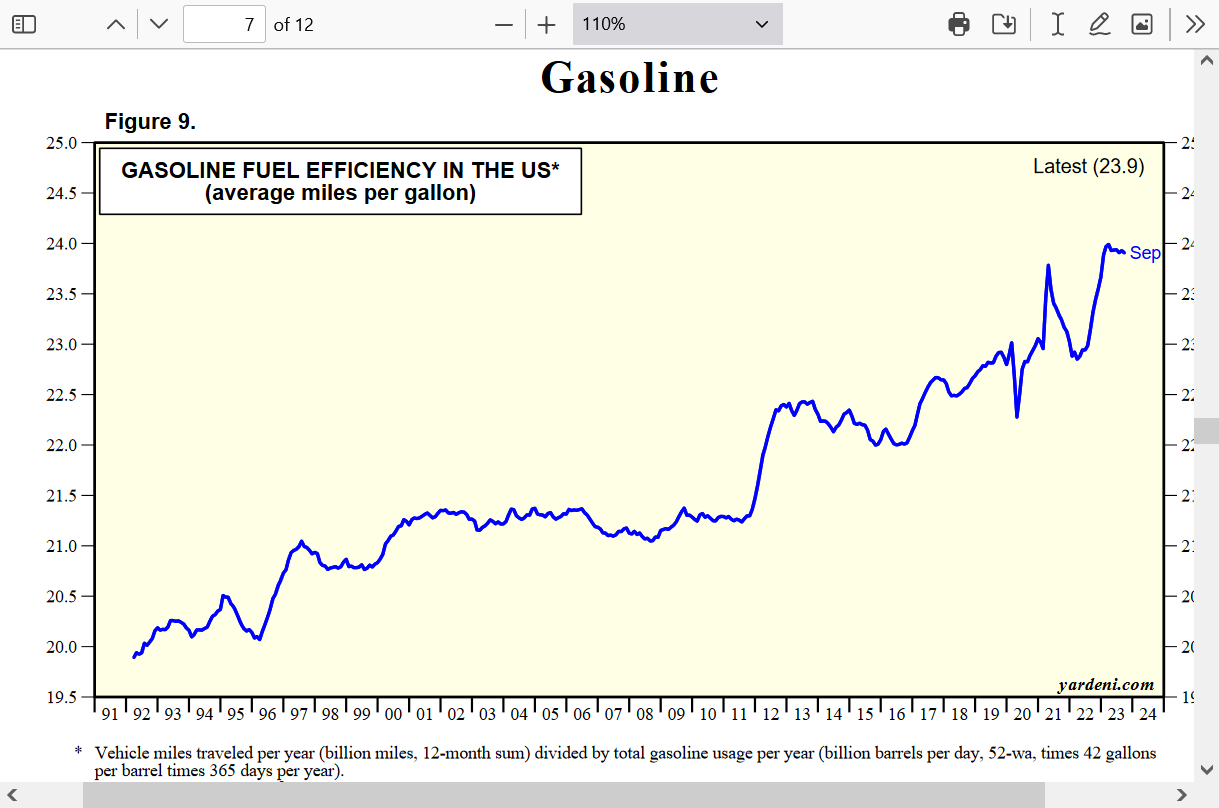

Another factor that they failed to mention is that 4% of Americans have electric cars which is cutting down on gasoline demand by, maybe 2% because people don't use them for long trips. Also, newer vehicles are getting much better fuel efficiency and some hybrids, like my youngest son Mac, uses get close to 50 mpg(gas and electric)!!

https://news.gallup.com/poll/474095/americans-not-completely-sold-electric-vehicles.aspx

https://news.gallup.com/poll/474095/americans-not-completely-sold-electric-vehicles.aspx

++++++++++++++++++

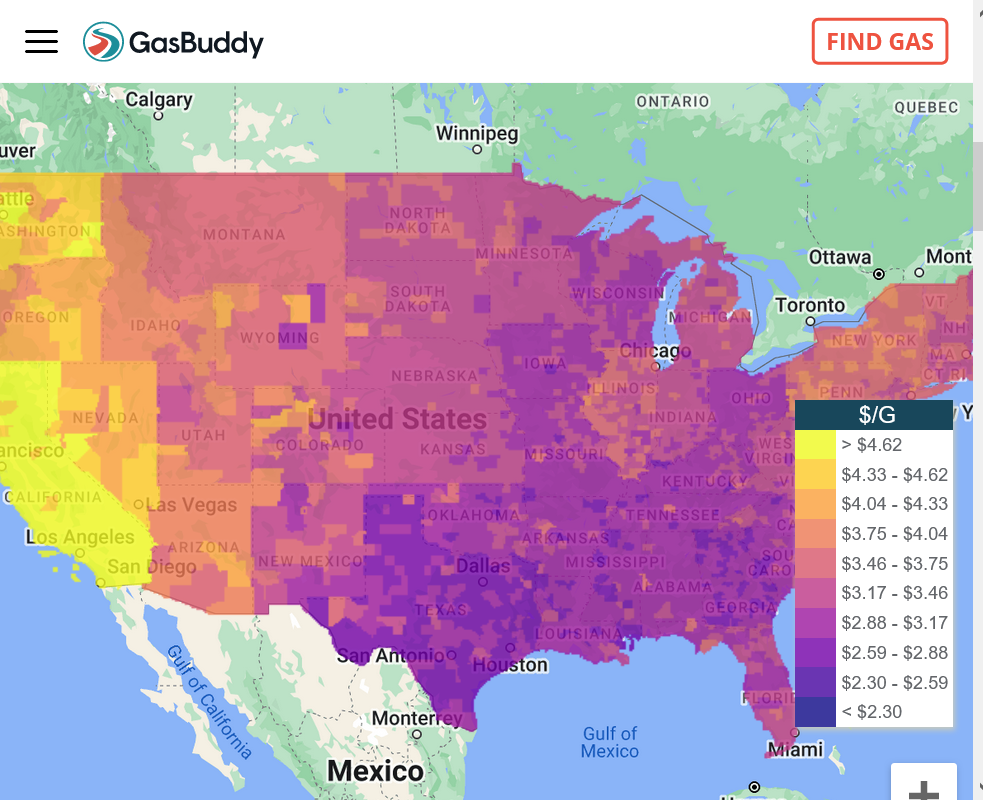

https://www.gasbuddy.com/gaspricemap?lat=38.822395&lng=-96.591588&z=4

https://www.tradingsim.com/blog/why-do-gasoline-and-oil-futures-move-differently

I recently stumbled onto this incredible site, which happens almost every day to those of us constantly searching the internet for NEW information to learn NEW things and not rely on what we think that we know or what our favorite site tells us we should know.

Energy Briefing:

US Gasoline Weekly

Yardeni Research, Inc

https://www.yardeni.com/pub/gasoline.pdf

+++++++++++++

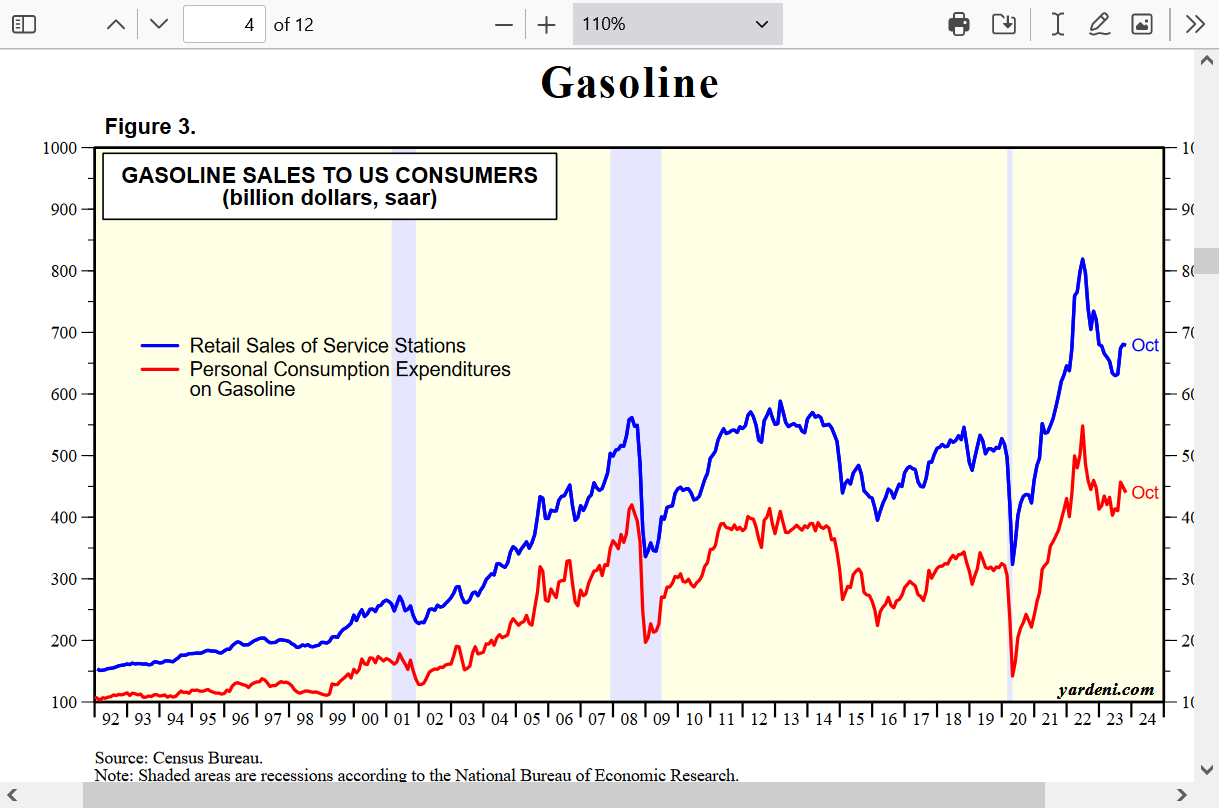

Wonderful graphs! Here's a few:

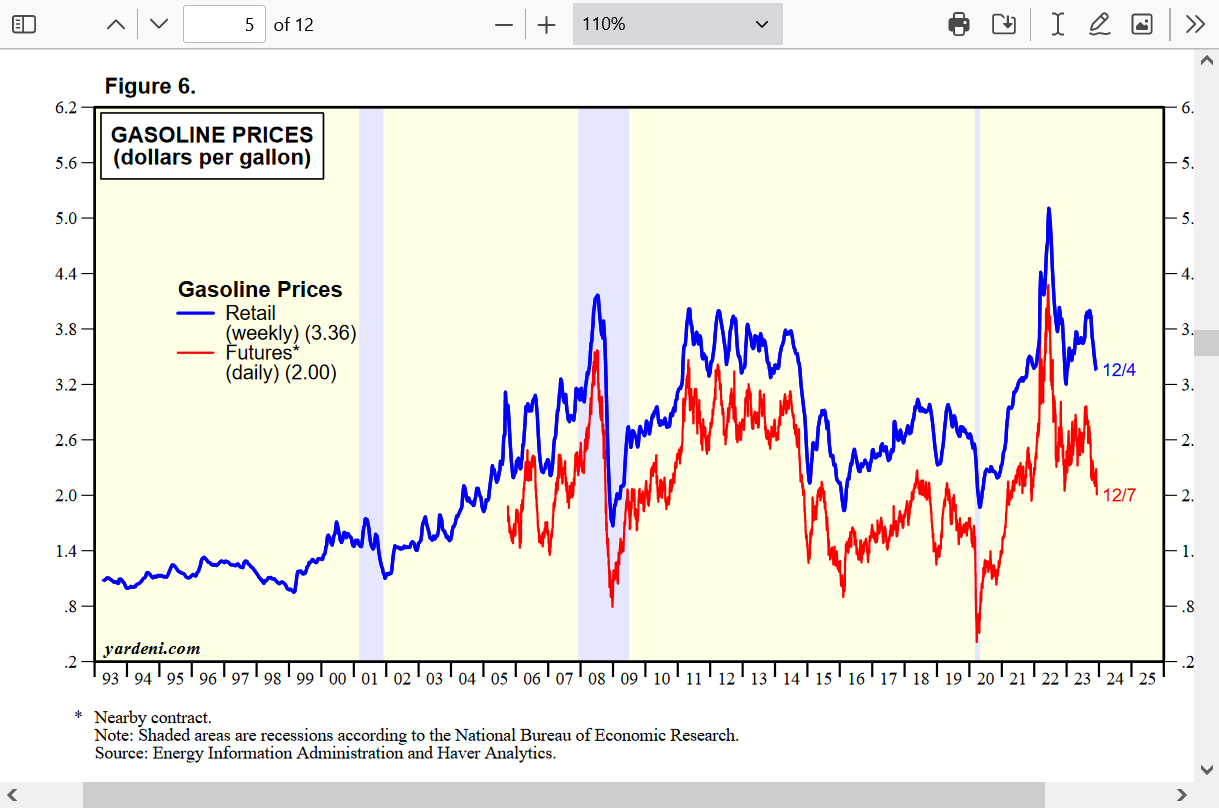

The recent plunge in gas prices is related to the drop in sales/demand in the US on this long term chart below after the major peak in 2022. The Oct numbers shows a recovery on this graph. You will note the spikes lower during recessions that are shaded as a visual guide. 2008/09 and 2020(COVID) are 2 that stand out the most. The question in this case is whether this current spike lower means we're headed into a recession?

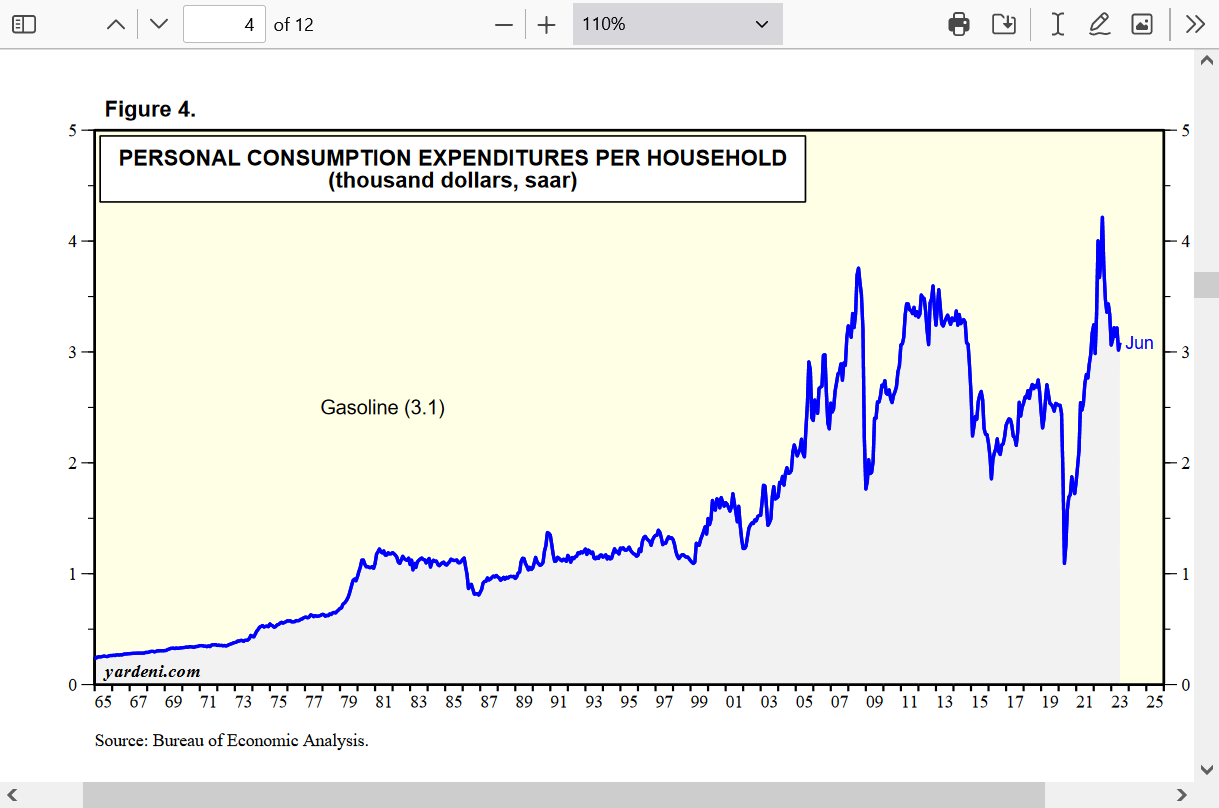

Pretty good correlation below with the chart above!

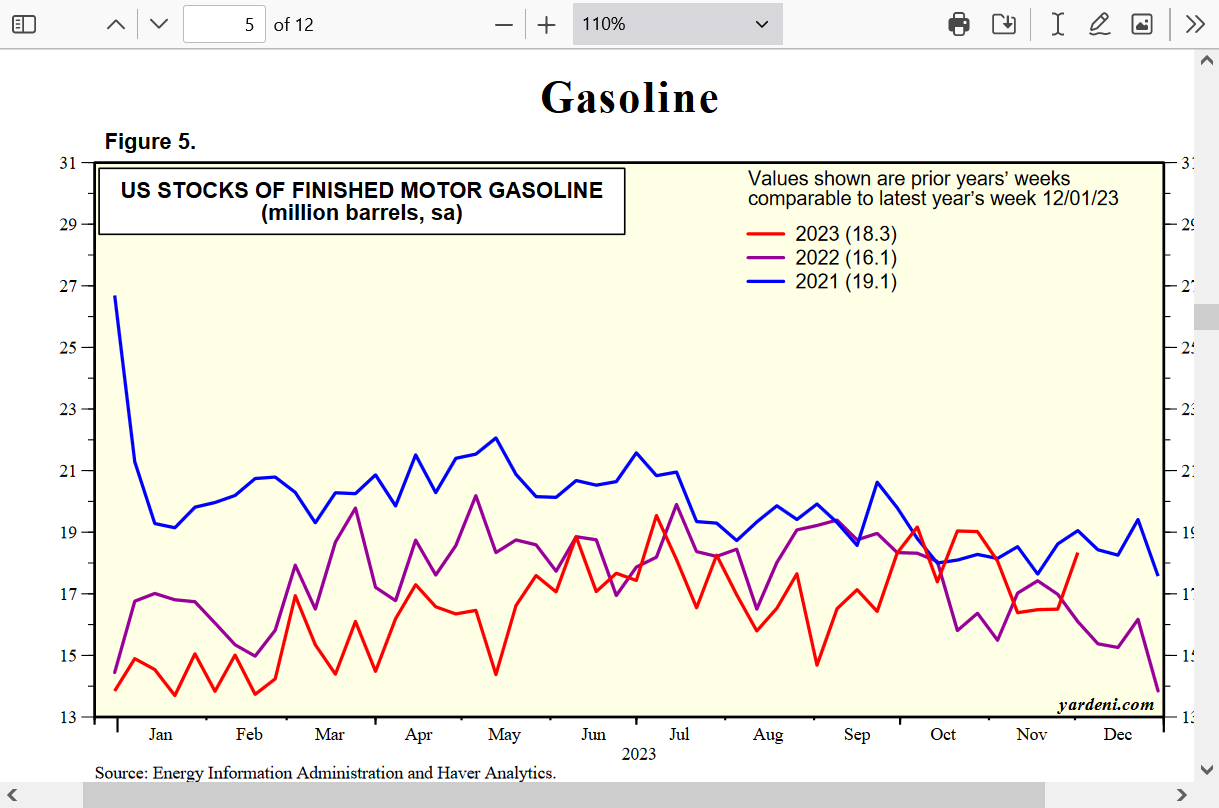

Unlike Heating oil and Crude that have historically low stocks, gasoline stocks are in good shape...........which is a big reason for why the price has been dropping. Orange below is 2023.

Note the MAJOR top in gas prices in early 2022.

Fuel efficiency has been slowly improving the past 3+ decades(and prior to that)!!!

The day that crude traded NEGATIVE in 2020! One that some of us will remember forever!!!

These are the posts in a thread here that day.

https://www.marketforum.com/forum/topic/99719/#99723

Re: Re: Re: "SAFE HAVEN" COMMODITIES

By metmike - Oct. 16, 2023, 2:06 p.m.

With regards to crude oil as a safe haven, I have one word: COVID!

Early in the COVID pandemic, in the Spring of 2020 when the world was panicking and crude demand was collapsing from shut downs, crude spiked BELOW $0!!!

Recalling that day and historic event with live posting here is still fun to do.

https://www.marketforum.com/forum/topic/81406/#81649

Re: Re: Quote of the day-traders February

By metmike - Feb. 11, 2022, 1:19 a.m.

Thanks becker!

"The price of a commodity will never go to zero. When you invest in commodities futures, you are not buying a piece of paper that says you own an intangible of the company that can go bankrupt."

–Jim Rogers.

Never go to zero?

https://www.eia.gov/todayinenergy/detail.php?id=46336

Here was the historic thread at MarketForum with us watching and commenting live as crude crashed well below zero for the first and probably last time ever:

https://www.marketforum.com/forum/topic/50726/#50823

+++++++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 1:34 p.m.

Hit $1.03.

Will we trade below $1??

Make that 1.02 for the low........so far. Watching to see if we can get below $1.

This is like the day last month, that UNL dropped below 38c

++++++++++++++++++++++++++++

By metmike - April 20, 2020, 1:54 p.m.

90c was the low so far.

Whoops..............we just hit 67c......52c.

Historic day for crude!

++++++++++++++++++++++++

By metmike - April 20, 2020, 1:57 p.m.

CLK hit 19c.

I can't imagine when it last traded that low........OMG it traded 1c!!!

Crude traded to 1 penny!!!! For real, that just happened.

Somebody bought and sold crude for 1 cent.

++++++++++++++++++++++++++++++

By TimNew - April 20, 2020, 1:58 p.m.

Pretty soon, they'll be paying us to fill our tanks.

++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:09 p.m.

IT WENT NEGATIVE!!

++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:09 p.m.

Holy Cow...Holy Cow, Crude is trading negative!!!

The low has been -$1.43

++++++++++++++++++++

By metmike - April 20, 2020, 2:17 p.m.

OK, what planet are we on?

CLK has spiked to -$3.70.

This means that somebody can buy a contract of crude, get 1,000 barrels of oil AND get paid $6 for it..........last price

Make that -$7 on the last trade.

There is no place for it to go, so they are paying to get rid of it!

++++++++++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:24 p.m.

And that contract expires tomorrow correct? So there could be one more day of this bloodletting?

++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:29 p.m.

-$35.60!

+++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:29 p.m.

We often see it the day BEFORE expiration.

Am thinking this is a squeeze. A bunch of traders caught long who are screaming uncle and panic selling or being forced out by massive margin calls with nobody wanting to buy the falling knife.

Crude is down $33 and is negative $14 -$14/barrel for the front month May.

Make that -$26........yeah this is a long squeeze, the opposite of a short squeeze that causes upward spikes from lack of supply.

Long squeezed almost never happen because when you have alot of supply, prices tend to be stable and not volatile.

-$37.........

-$40 down $56+ on the day

+++++++++++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:34 p.m.

Historic! We may never see anything like that again.

+++++++++++++++++++++++

By metmike - April 20, 2020, 2:38 p.m.

Looks like -$40.32 is going to be the low, since the main trading session with the huge funds that were trapped long is over.

Yes, we just bounced to $-28.00

Who ever thought that a +$12 bounce in crude.............normally in a bull market takes many days. would happen in a few minutes........and we would still be deeply negative.

Good chance that the lows are in.

The ones getting out when the price was in double digit negative territory were FORCED out with a squeeze. Forced liquidation from margin calls and other factors with expiration tomorrow.

++++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:46 p.m.

Yes Jim. Traders that were watching this, will remember it forever.

Hopefully from the sidelines.

I really can't imagine normal speculators selling crude when it was negative.

The selling was an exhaustion/panic driven squeeze of the longs that HAD TO GET OUT no matter what.

Surely there were some big, high risk traders willing to buy and sell down here.

How many that deal in cash trades and actually have storage, bought crude today.............got paid $30,000 for 1,000 barrels and got the crude too?

That is like Twilight Zone trading (-:

+++++++++++++++++++++++++++++++++++++++++++

By TimNew - April 20, 2020, 3 p.m.

Before today, I honestly thought it could not go below 0.

++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 3:05 p.m.

It looks like today may be the last trading day for CLK-the May, front month contract, not tomorrow as I suspected, so this makes more sense.

The new front month, June never traded below $20 and has bounced back to $21, down just $4 on the day.