joj gave us this great idea with his quote below:

https://www.marketforum.com/forum/topic/77011/#81402

Re: Re: Re: Re: Quote of the day February

By joj - Feb. 5, 2022, 12:34 p.m.

MM,

I just read through all of the quotes. They are great food for the soul.

This one is about being a contrarian and doesn't measure up to the high spirit of those you posted but it IS market related:

"Something that everyone knows isn't worth knowing." - Bernard Baruch

++++++++++++++++++++++++++++++++++++++++++++++++

By TimNew - Feb. 5, 2022, 12:36 p.m.

"Something that everyone knows isn't worth knowing." - Bernard Baruch

Not exactly universal truth, but most certainly applicable in markets.

+++++++++++++++++++++++++++++

By metmike - Feb. 5, 2022, 12:51 p.m.

Great one joj.

I've known this particular, related quote since I was first teaching myself to trade in the early 1990's:

“Those who know don't tell and those who tell don't know.”

― Michael Lewis, Liar's Poker

https://www.goodreads.com/author/quotes/776.Michael_Lewis

You just gave me a great idea, joj. Have a quote of the day in the traders section!

We can start it with yours! Thanks, man!

More quotes from others are encouraged/welcome!

Great idea for learning, Mike!

What I said on 2/3/22 in NG thread:

“You could be the greatest analyzer of supply and demand ever but if your timing is not followed by the market, well…… That’s why I’ve been recommending options as an option to consider or just remaining flat, my favorite position!”

Here are a couple I pulled off on a search:

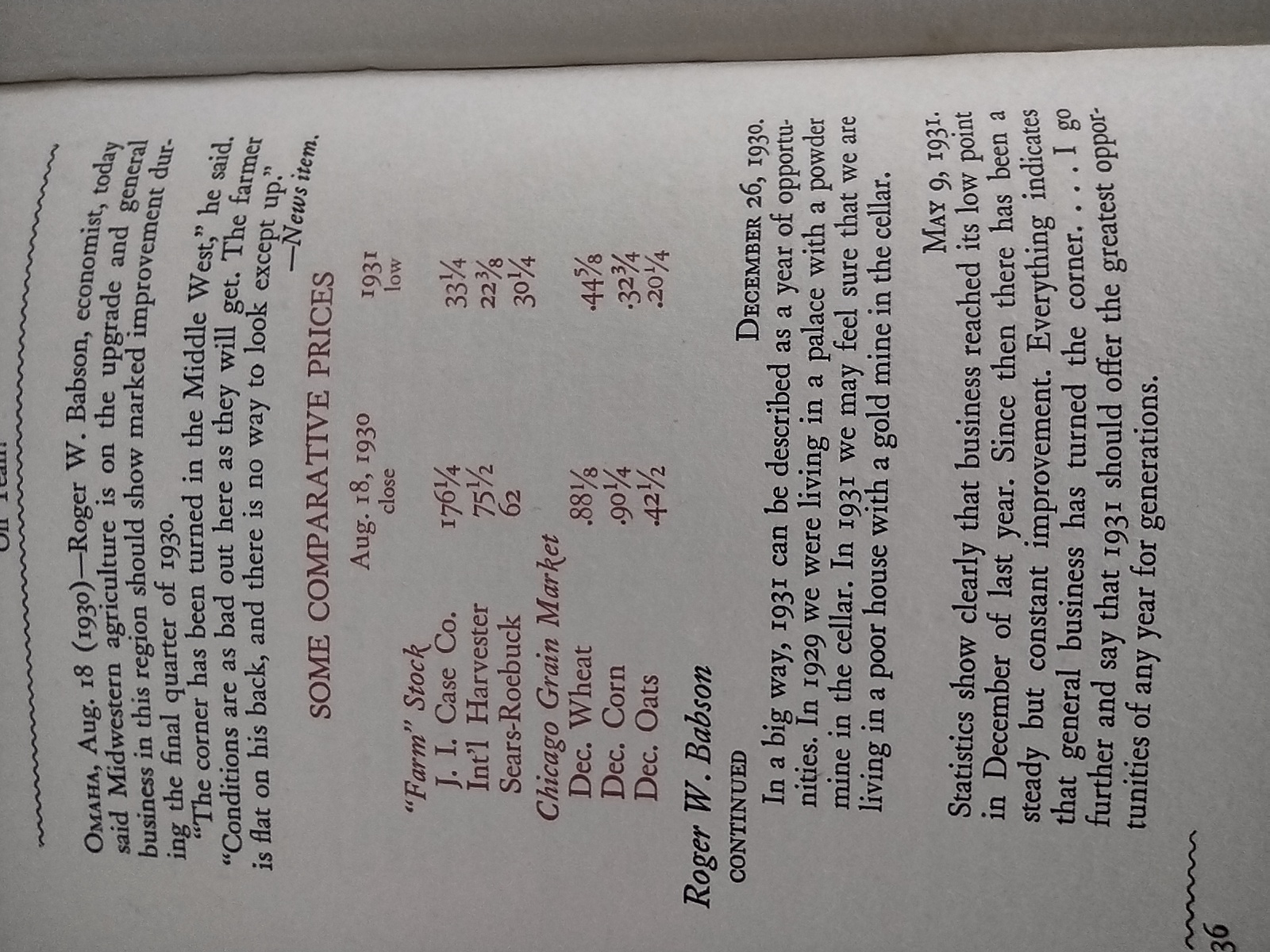

"Economists' unanimity that bad business is ahead is the most reassuring news possible. It is very unlikely that this will be the one time they're right."

- Malcom Forbes

"My precept to all who build is, that the owner should be the ornament to the house, and not the house to the owner." - Cicero

"Business demands faith, compels earnestness, requires courage, is honestly selfish, is penalized for mistakes, and is the essence of life." - William Feather

"Some see private enterprise as a predatory target to be shot, others as a cow to be milked, but few are those who see it as a sturdy horse pulling the wagon."

- Winston Churchill

"No nation was ever ruined by trade." - Ben Franklin

"In investing, what is comfortable is rarely profitable." - Robert Arnott

"Amateurs think about how much money they can make. Professionals think about how much money they could lose." – Jack Schwager.

"Are you willing to lose money on a trade? If not, then don't take it. You can only win if you're not afraid to lose. And you can only do that if you truly accept the risks in front of you."

- Sami Abusad.

Great ones joj/Larry!

“The men on the trading floor may not have been to school, but they have Ph.D.’s in man’s ignorance.”

― Michael M. Lewis, Liar's Poker

“Courage is a hard thing to figure. You can have courage based on a dumb idea or mistake, but you're not supposed to question adults, or your coach or your teacher, because they make the rules. Maybe they know best, but maybe they don't. It all depends on who you are, where you come from. Didn't at least one of the six hundred guys think about giving up, and joining with the other side? I mean, valley of death that's pretty salty stuff. That's why courage it's tricky. Should you always do what others tell you to do? Sometimes you might not even know why you're doing something. I mean any fool can have courage. But honor, that's the real reason for you either do something or you don't. It's who you are and maybe who you want to be. If you die trying for something important, then you have both honor and courage, and that's pretty good. I think that's what the writer was saying, that you should hope for courage and try for honor. And maybe even pray that the people telling you what to do have some, too.”

― Michael Lewis, The Blind Side: Evolution of a Game

“People in both fields operate with beliefs and biases. To the extent you can eliminate both and replace them with data, you gain a clear advantage.”

― Michael Lewis, Moneyball: The Art of Winning an Unfair Game

“Every form of strength is also a weakness. Pretty girls tend to become insufferable because, being pretty, their faults are too much tolerated. Possessions entrap men, and wealth paralyzes them.”

― Michael Lewis, Moneyball: The Art of Winning an Unfair Game

They didn't trade beans in'31

Thanks becker!

"The price of a commodity will never go to zero. When you invest in commodities futures, you are not buying a piece of paper that says you own an intangible of the company that can go bankrupt."

–Jim Rogers.

Never go to zero?

https://www.eia.gov/todayinenergy/detail.php?id=46336

Here was the historic thread at MarketForum with us watching and commenting live as crude crashed well below zero for the first and probably last time ever:

https://www.marketforum.com/forum/topic/50726/#50823

+++++++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 1:34 p.m.

Hit $1.03.

Will we trade below $1??

Make that 1.02 for the low........so far. Watching to see if we can get below $1.

This is like the day last month, that UNL dropped below 38c

++++++++++++++++++++++++++++

By metmike - April 20, 2020, 1:54 p.m.

90c was the low so far.

Whoops..............we just hit 67c......52c.

Historic day for crude!

++++++++++++++++++++++++

By metmike - April 20, 2020, 1:57 p.m.

CLK hit 19c.

I can't imagine when it last traded that low........OMG it traded 1c!!!

Crude traded to 1 penny!!!! For real, that just happened.

Somebody bought and sold crude for 1 cent.

++++++++++++++++++++++++++++++

By TimNew - April 20, 2020, 1:58 p.m.

Pretty soon, they'll be paying us to fill our tanks.

++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:09 p.m.

IT WENT NEGATIVE!!

++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:09 p.m.

Holy Cow...Holy Cow, Crude is trading negative!!!

The low has been -$1.43

++++++++++++++++++++

By metmike - April 20, 2020, 2:17 p.m.

OK, what planet are we on?

CLK has spiked to -$3.70.

This means that somebody can buy a contract of crude, get 1,000 barrels of oil AND get paid $6 for it..........last price

Make that -$7 on the last trade.

There is no place for it to go, so they are paying to get rid of it!

++++++++++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:24 p.m.

And that contract expires tomorrow correct? So there could be one more day of this bloodletting?

++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:29 p.m.

-$35.60!

+++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:29 p.m.

We often see it the day BEFORE expiration.

Am thinking this is a squeeze. A bunch of traders caught long who are screaming uncle and panic selling or being forced out by massive margin calls with nobody wanting to buy the falling knife.

Crude is down $33 and is negative $14 -$14/barrel for the front month May.

Make that -$26........yeah this is a long squeeze, the opposite of a short squeeze that causes upward spikes from lack of supply.

Long squeezed almost never happen because when you have alot of supply, prices tend to be stable and not volatile.

-$37.........

-$40 down $56+ on the day

+++++++++++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:34 p.m.

Historic! We may never see anything like that again.

+++++++++++++++++++++++

By metmike - April 20, 2020, 2:38 p.m.

Looks like -$40.32 is going to be the low, since the main trading session with the huge funds that were trapped long is over.

Yes, we just bounced to $-28.00

Who ever thought that a +$12 bounce in crude.............normally in a bull market takes many days. would happen in a few minutes........and we would still be deeply negative.

Good chance that the lows are in.

The ones getting out when the price was in double digit negative territory were FORCED out with a squeeze. Forced liquidation from margin calls and other factors with expiration tomorrow.

++++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:46 p.m.

Yes Jim. Traders that were watching this, will remember it forever.

Hopefully from the sidelines.

I really can't imagine normal speculators selling crude when it was negative.

The selling was an exhaustion/panic driven squeeze of the longs that HAD TO GET OUT no matter what.

Surely there were some big, high risk traders willing to buy and sell down here.

How many that deal in cash trades and actually have storage, bought crude today.............got paid $30,000 for 1,000 barrels and got the crude too?

That is like Twilight Zone trading (-:

+++++++++++++++++++++++++++++++++++++++++++

By TimNew - April 20, 2020, 3 p.m.

Before today, I honestly thought it could not go below 0.

++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 3:05 p.m.

It looks like today may be the last trading day for CLK-the May, front month contract, not tomorrow as I suspected, so this makes more sense.

The new front month, June never traded below $20 and has bounced back to $21, down just $4 on the day.

"I have two basic rules about winning in trading as well as in life: 1. If you don't bet, you can't win. 2. If you lose all your chips, you can't bet."

-Larry Hit

“Knowledge is literally prediction,” said Morey. “Knowledge is anything that increases your ability to predict the outcome. Literally everything you do you’re trying to predict the right thing. Most people just do it subconsciously.” A”

― Michael Lewis, The Undoing Project: A Friendship That Changed Our Minds

“Confirmation bias,” he’d heard this called. The human mind was just bad at seeing things it did not expect to see, and a bit too eager to see what it expected to see. “Confirmation bias is the most insidious because you don’t even realize it is happening,” he said. A scout would settle on an opinion about a player and then arrange the evidence to support that opinion. “The”

― Michael Lewis, The Undoing Project: A Friendship That Changed Our Minds

“In the land of the blind the one-eyed man is king”

― Michael Lewis, Liar's Poker

“You want loyalty, hire a cocker spaniel.”

― Michael Lewis, Liar's Poker

+++++++++++++++++++++++++++++++++

This doesn't just go for politics....it's goes for traders and PAID trading advice too!

https://www.marketforum.com/forum/topic/77011/#77012

Neither political party has a franchise on the truth.

If you believe one party all the time......................you will believe in lies some of the time.

metmike, MarketForum

The last 12z European model was another -3 CDD's but it also was +1 HDD's.

I'm thinking that the market at this moment, is not counting a few CDD's here and there but instead is LOOKING AT THE HOT OVERALL PATTERN.

In other words..........so what if this or that model adds or subtracts X number of CDD's. If the NEW pattern is staying hot overall..........those model variations don't mean diddly squat when it comes to how much extra natural gas will be used/burned in the month of May to generate electricity for AC/cooling demand.

Re: Re: Re: Re: Re: Natural Gas April 26, 2022

By metmike - May 5, 2022, 3:54 p.m.

https://www.marketforum.com/forum/topic/84046/#84061

By cutworm - May 5, 2022, 1:40 p.m.

Some in the interest markets were worried about 75 point increases in the furure but the fed chairman said no 75 point increases. So I guess the unknown is now known.

Its kind of like when Mike trades the weather in the grains it's the change in the maps that matters

++++++++++++++++++++++++

By metmike - May 5, 2022, 1:59 p.m.

Excellent point cutworm!

It's what happens compared to expectations!

For instance, as a general principle, if we/the market expected X+4 amount of damage from something bullish and only X+3 amount of damage occurred, X+3 amount of damage was actually bearish to market expectations and prices.

Same thing with bearish X-4 expected and the result coming up short with only X-3 and the market having a bullish reaction in a RELATIVE sense(compared to expectations)

If there were NO EXPECTATIONS for anything to happen, X-3 happening would have been clearly bearish.

On algorithms being used to jerk around traders in the ng market:

https://www.marketforum.com/forum/topic/84142/#84205

By WxFollower - May 8, 2022, 10:14 p.m.

Mike said:

“Yeah, I know it sounds complicated and almost unethical but it happens. Larry will confirm it. I'm certain that there are countless algos that I'm not familiar with at all and this example probably is a bit flawed but it explains some of the shenanigans going on in natural gas and other market trading at times.”

——————

Mike, Yes I can confirm 100% that this occurred regularly when I was trading. A lot of funny business going on, which was a big turnoff and helped lead me to be done with it.

The irony is that with humility, a trader can actually get a better feel for the "subjective approach" to trading. He then can follow his "hunches" and anticipate some pretty good opportunities. His humility will save him in the end, because he will be the first to recognize his error, and adjust accordingly.

Thanks kris, great point!

Humility is mega important for long term successful trading!

Euphoria might not sound like such a bad thing — to a certain extent there’s nothing wrong with feeling happy when we do something right. But there’s a difference between “satisfaction” and “euphoria.”

Euphoria implies a rush of emotions that creates a real high. This can make us overexcited when trading and ultimately lead to poor decisions.

Have you ever been so pleased with yourself for executing a few profitable trades that you convinced yourself you were a trading prodigy, then ended up losing more money than you gained because of your confidence?

Don’t let your positive emotions get the better of you. Instead, take a deep breath and a step back, and don’t trade immediately until you’ve calmed down. Trading plans can also help with this, as we’ll soon see.

Ultimately, all traders are here to make money — even if you plan on donating your earnings to charity! But there’s a difference between wanting to make money and taking excessive risks to make it.

Greedy traders fall on the wrong end of that spectrum.

Have you ever watched an asset price rise, known it was a bubble that would eventually burst, but still been unable to accept it was time to back out? Instead, you’ve kept hanging in, believing you could make maximum profits?

Our greed stops us and clouds our judgment.

Instead, emotionally balanced traders are more rational. They’re happy to accept moderate profits instead of taking unnecessary risks to make excessive profits.

To a certain extent, we all react in the same way to phenomena like greed and fear. But that doesn’t mean that we’re all the same! It’s essential to learn the ins and outs of your psychology as an individual.

Next time you’re trading, take note of how you react to various triggers. What is your natural impulse when you face a loss? At what point do you begin to become uncomfortable? Are you naturally good at judging when it’s time to sell?

metmike: This entire article is wonderful, but only part of it related to humility is copied above. The last point is EXACTLY what kris stated! Everybody and every system is different.

An investment in knowledge pays the best interest.

Benjamin Franklin

“The goal of a successful trader is to make the best trades. Money is secondary.”

– Alexander Elder

“Risk comes from not knowing what you’re doing.”

– Warren Buffett