What's the Better Safe Haven, Gold or Crude Oil?

The recent outbreak of violence in the Middle East has put the spotlight back on safe haven markets, predominantly crude oil and gold.

Last week saw WTI crude oil gain 6% from Friday to Friday, though total open interest decreased.

December COMEX gold added 5.5% while its open interest increased during the week.

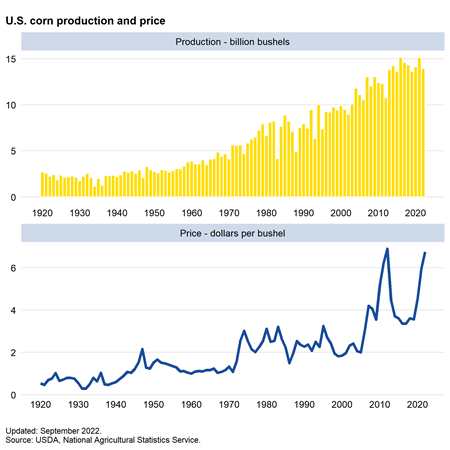

Corn: As King of the grain and oilseed sector, this market gains attention when North American weather threatens production, predominantly in the United States. Historically the US has been the top producer, user, and exporter of corn. However, last year saw the US lose the title of top exporter to Brazil with this year expected to be similar.

Thanks for bringing that up, Jean.

I can clear up some complete myths by investors/speculators.

Gold is NOT a good safe haven and is an awful hedge against inflation.

It's driven by supply/demand considerations and speculation like most other commodities.

You might still have some unfulfilled prophesy speculators that buy it during shaky times that cause it to go up because enough people think it will go up but history below shows that doesn't last and its more about the fundamentals driving that specific market.

https://alphaarchitect.com/2023/05/gold/

In terms of gold’s value as an inflation hedge, the following example should help provide an answer. On January 21, 1980, the price of gold reached a then-record high of $850. On March 19, 2002, gold was trading at $293, well below its price 20 years earlier. The inflation rate for the period from 1980 through 2001 was 3.9 percent. Thus, gold’s loss in real purchasing power was about 85 percent. How is gold an inflation hedge when it lost 85 percent in real terms over 22 years?

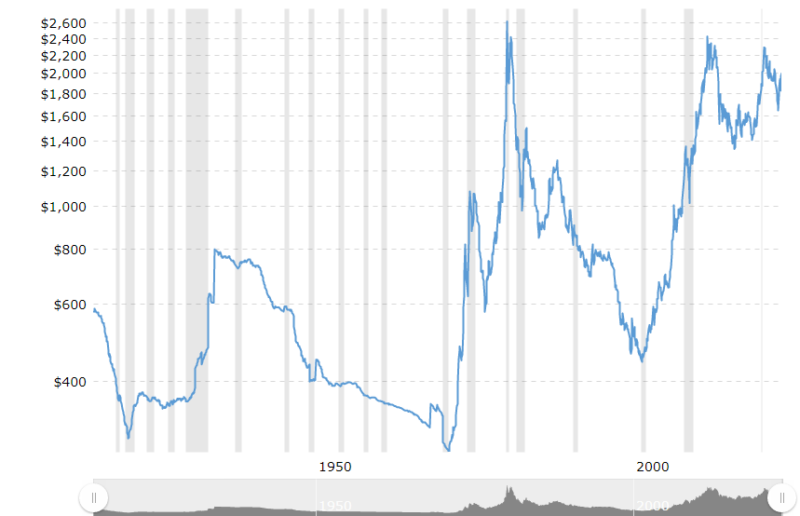

Here’s an example with an even more extended period. As seen in the chart below, with gold now trading at around $2,000, it has lost more than 20 percent of its real value (inflation-adjusted) from its peak of about $2,533 in February 1980. That’s more than 42 years with a significant loss in real value.

With regards to corn, it's an awful safe haven.

The main price drivers are supply/demand fundamentals that determine the amount in storage and the stocks/use ratio.

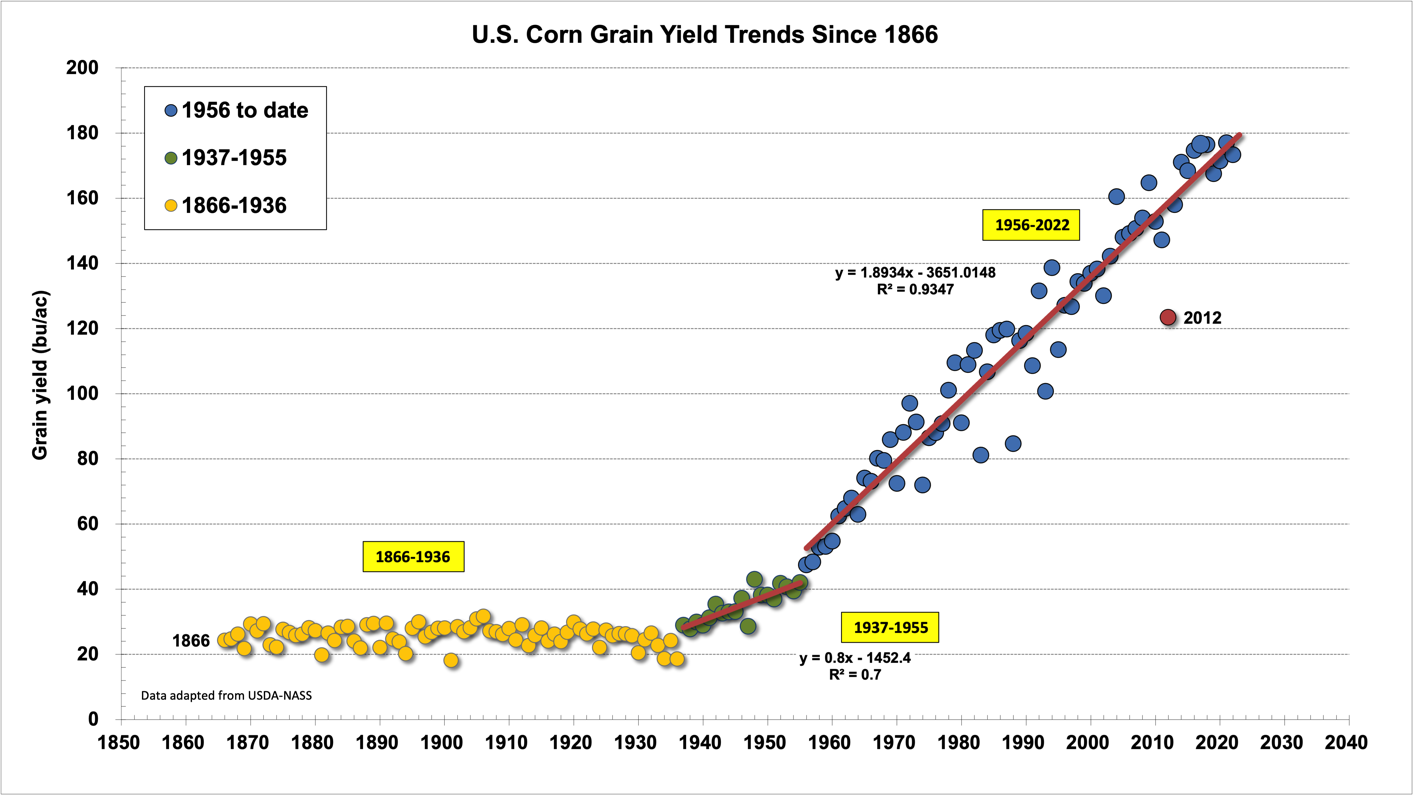

The weather is the biggest supply determinant, which has been the best for growing crops in the last 1,000 years, along with the beneficial CO2 also boosting yields of all crops a great deal.

Global demand has also been greatly increasing with new supplies barely keeping up with increasing demand.

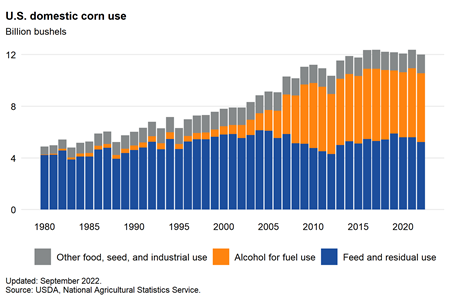

If the fake green crowd had it there way and got rid of animals that we eat and got rid of the combustion engine(which is where the 10% corn ethanol goes into our gasoline), corn prices would collapse as the world would be overwhelmed with far too much corn. Those acres would go to other crops, which would also increase supplies and put pressure on some food prices/many commodities grown in the ground(a good thing).

https://www.marketforum.com/forum/topic/69258/#71265

+++++++++++++

https://www.ers.usda.gov/topics/crops/corn-and-other-feed-grains/feed-grains-sector-at-a-glance/

Note the bar chart below. All the demand/use comes from animal feed in blue and ethanol for combustion engines in orange.

Those are 2 things that Biden and his fake green energy schemes say need to go.

Electric cars use ZERO ethanol!

That fact alone should have every person in agriculture voting for the R party if their way of living is a key factor.

With regards to crude oil as a safe haven, I have one word: COVID!

Early in the COVID pandemic, in the Spring of 2020 when the world was panicking and crude demand was collapsing from shut downs, crude spiked BELOW $0!!!

Recalling that day and historic event with live posting here is still fun to do.

https://www.marketforum.com/forum/topic/81406/#81649

Re: Re: Quote of the day-traders February

By metmike - Feb. 11, 2022, 1:19 a.m.

Thanks becker!

"The price of a commodity will never go to zero. When you invest in commodities futures, you are not buying a piece of paper that says you own an intangible of the company that can go bankrupt."

–Jim Rogers.

Never go to zero?

https://www.eia.gov/todayinenergy/detail.php?id=46336

Here was the historic thread at MarketForum with us watching and commenting live as crude crashed well below zero for the first and probably last time ever:

https://www.marketforum.com/forum/topic/50726/#50823

+++++++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 1:34 p.m.

Hit $1.03.

Will we trade below $1??

Make that 1.02 for the low........so far. Watching to see if we can get below $1.

This is like the day last month, that UNL dropped below 38c

++++++++++++++++++++++++++++

By metmike - April 20, 2020, 1:54 p.m.

90c was the low so far.

Whoops..............we just hit 67c......52c.

Historic day for crude!

++++++++++++++++++++++++

By metmike - April 20, 2020, 1:57 p.m.

CLK hit 19c.

I can't imagine when it last traded that low........OMG it traded 1c!!!

Crude traded to 1 penny!!!! For real, that just happened.

Somebody bought and sold crude for 1 cent.

++++++++++++++++++++++++++++++

By TimNew - April 20, 2020, 1:58 p.m.

Pretty soon, they'll be paying us to fill our tanks.

++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:09 p.m.

IT WENT NEGATIVE!!

++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:09 p.m.

Holy Cow...Holy Cow, Crude is trading negative!!!

The low has been -$1.43

++++++++++++++++++++

By metmike - April 20, 2020, 2:17 p.m.

OK, what planet are we on?

CLK has spiked to -$3.70.

This means that somebody can buy a contract of crude, get 1,000 barrels of oil AND get paid $6 for it..........last price

Make that -$7 on the last trade.

There is no place for it to go, so they are paying to get rid of it!

++++++++++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:24 p.m.

And that contract expires tomorrow correct? So there could be one more day of this bloodletting?

++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:29 p.m.

-$35.60!

+++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:29 p.m.

We often see it the day BEFORE expiration.

Am thinking this is a squeeze. A bunch of traders caught long who are screaming uncle and panic selling or being forced out by massive margin calls with nobody wanting to buy the falling knife.

Crude is down $33 and is negative $14 -$14/barrel for the front month May.

Make that -$26........yeah this is a long squeeze, the opposite of a short squeeze that causes upward spikes from lack of supply.

Long squeezed almost never happen because when you have alot of supply, prices tend to be stable and not volatile.

-$37.........

-$40 down $56+ on the day

+++++++++++++++++++++++++++++++++

By Jim_M - April 20, 2020, 2:34 p.m.

Historic! We may never see anything like that again.

+++++++++++++++++++++++

By metmike - April 20, 2020, 2:38 p.m.

Looks like -$40.32 is going to be the low, since the main trading session with the huge funds that were trapped long is over.

Yes, we just bounced to $-28.00

Who ever thought that a +$12 bounce in crude.............normally in a bull market takes many days. would happen in a few minutes........and we would still be deeply negative.

Good chance that the lows are in.

The ones getting out when the price was in double digit negative territory were FORCED out with a squeeze. Forced liquidation from margin calls and other factors with expiration tomorrow.

++++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 2:46 p.m.

Yes Jim. Traders that were watching this, will remember it forever.

Hopefully from the sidelines.

I really can't imagine normal speculators selling crude when it was negative.

The selling was an exhaustion/panic driven squeeze of the longs that HAD TO GET OUT no matter what.

Surely there were some big, high risk traders willing to buy and sell down here.

How many that deal in cash trades and actually have storage, bought crude today.............got paid $30,000 for 1,000 barrels and got the crude too?

That is like Twilight Zone trading (-:

+++++++++++++++++++++++++++++++++++++++++++

By TimNew - April 20, 2020, 3 p.m.

Before today, I honestly thought it could not go below 0.

++++++++++++++++++++++++++++++

By metmike - April 20, 2020, 3:05 p.m.

It looks like today may be the last trading day for CLK-the May, front month contract, not tomorrow as I suspected, so this makes more sense.

The new front month, June never traded below $20 and has bounced back to $21, down just $4 on the day.

MIKE ~ LOL I DO GET A KICK OUT OF "SAFE HAVENS" SAFE HAVENS ARE THE MONIES YA DON'T WRECKLESSLY SPEND... IMO

Gold going to $5000 "soon" - are you kidding me?

"I am not sure if much of what is written regarding markets – especially the gold market – is based upon ignorance or just intellectual dishonesty. In either case, I am absolutely sick of it.

I saw an article recently that suggests that gold is going to $5000 for the specific reason of the Fed easing on its interest rate raising cycle. And, history proves this to be absolutely a false hope."

Silver is the other big one, Jean.

Tons of charlatans trying to get you to buy silver with bs outlooks and them making commissions.

I guess you could call it a type of churning but with new clients that are disposable.

https://www.investopedia.com/terms/c/churning.asp

However, this is how they get away with alot of it:

‘You have a best interest standard in the brokerage world. You have a fiduciary standard for RIAs. In precious metals, there is no standard.’