Time for a new NG thread. Europe/LNG is still one of the dominant factors affecting NG prices. Recently, at least about every other day I've been reading about this as having a strong effect on a particular day's prices.

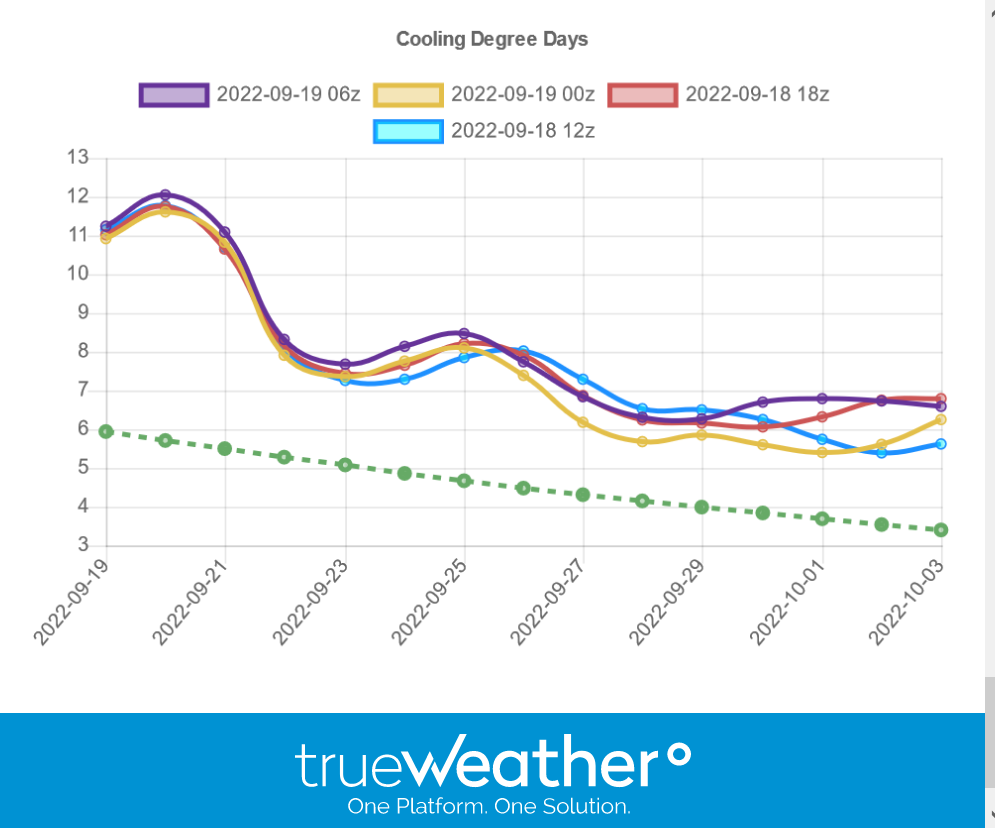

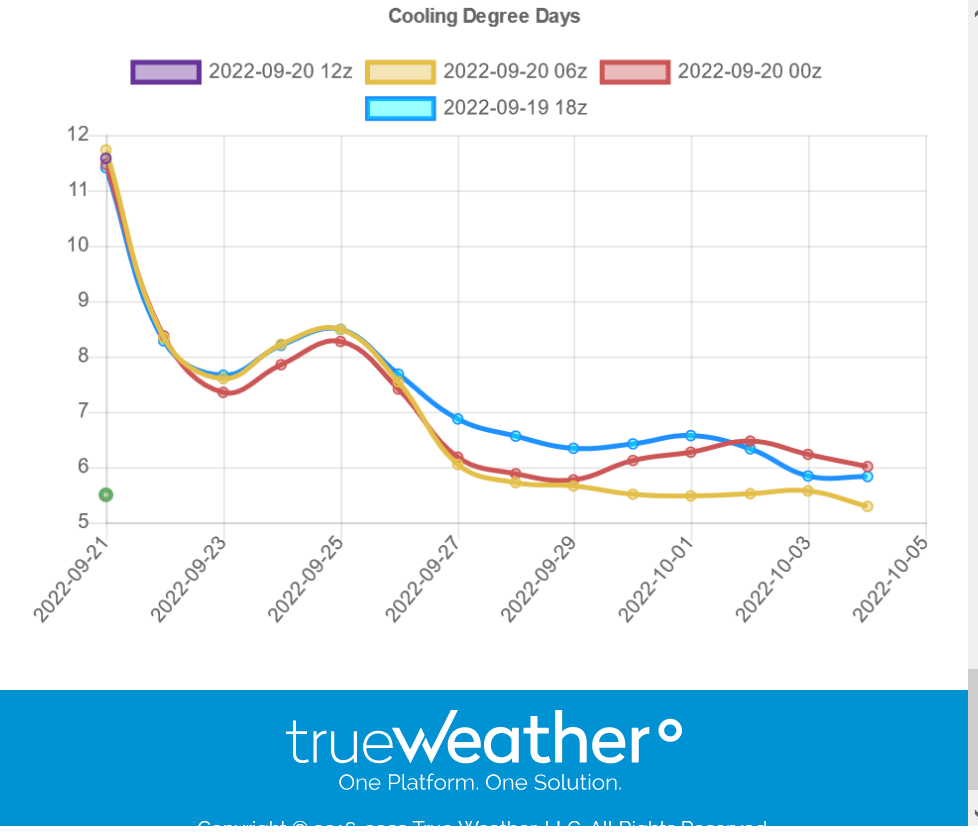

metmike: CDD's really have not changed much this week. So why did NG decide to rally this much now based on the same forecast?

Seasonals.....often strong buying between now and the start of the heating season which is when we need to have a large amount of gas in storage to meet high Winter residential demand for heating.

The export market has been greatly expanded since 2017, making GLOBAL demand and pricing(energy crisis in Europe) MUCH, MUCH more powerful and often the most important of all factors for pricing US natural gas.

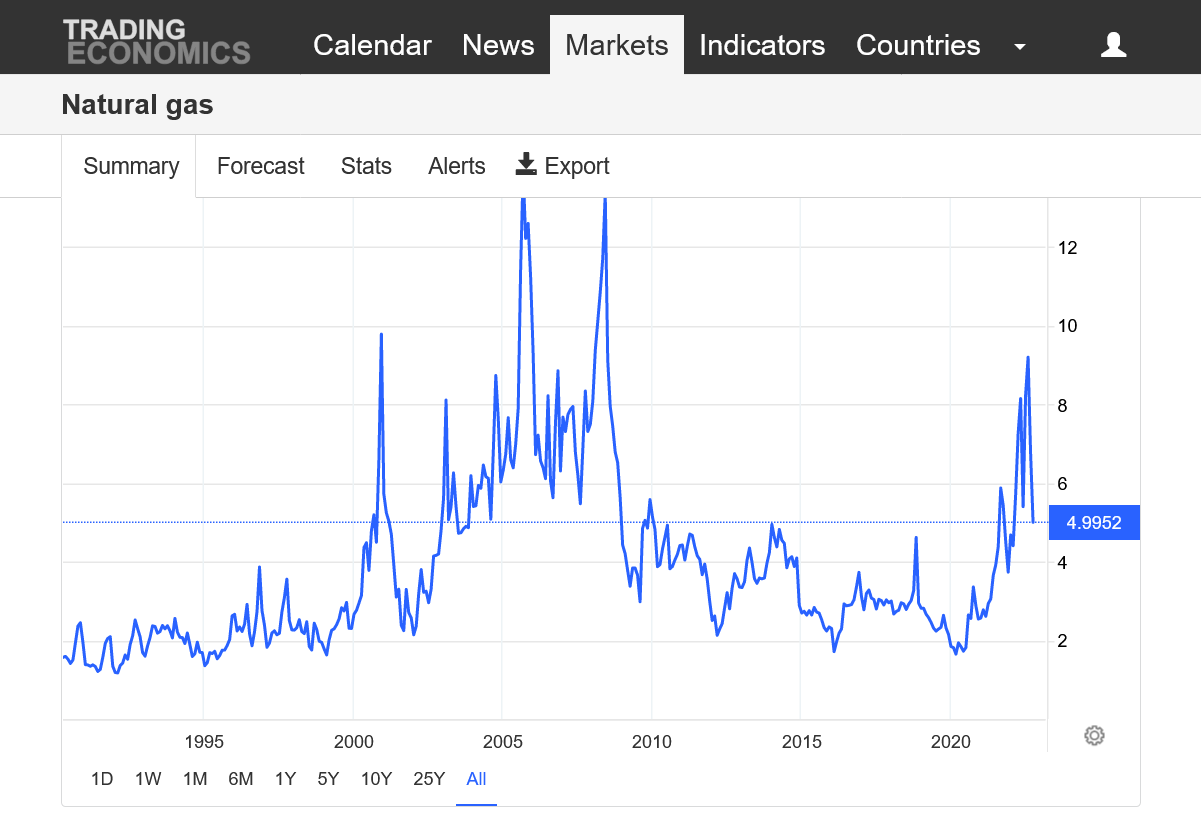

So this graph below would/will look MUCH different if you took just very recent years and those to come.

The most important thing to note on the graph below from last Thursday's EIA report is the blue line. As long as it sits towards the bottom of the 5 year average, the sensitivity of the market to supply concerns(here and in Europe) ahead of the key, heating demand season will be elevated!

https://ir.eia.gov/ngs/ngs.html

for week ending September 2, 2022 | Released: September 8, 2022 at 10:30 a.m. | Next Release: September 15, 2022

Working gas in storage was 2,694 Bcf as of Friday, September 2, 2022, according to EIA estimates. This represents a net increase of 54 Bcf from the previous week. Stocks were 222 Bcf less than last year at this time and 349 Bcf below the five-year average of 3,043 Bcf. At 2,694 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

Temperatures from last week for tomorrow's EIA report, released at 9:30 am-CDT.

Extreme heat Southwest and points northeast of there. Close to average Eastern half with a slight warm bias in the Northeast.

Should be bullish vs historical average but the market dialed this in already. The number that matters most on Thursday is the one the market is expecting....and will compare the measured/released injection to.

https://ir.eia.gov/ngs/ngs.html

for week ending September 9, 2022 | Released: September 15, 2022 at 10:30 a.m. | Next Release: September 22, 2022

+77 BCF = Bearish!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/09/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 09/09/22 | 09/02/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 661 | 635 | 26 | 26 | 728 | -9.2 | 759 | -12.9 | |||||||||||||||||

| Midwest | 809 | 776 | 33 | 33 | 871 | -7.1 | 876 | -7.6 | |||||||||||||||||

| Mountain | 163 | 159 | 4 | 4 | 193 | -15.5 | 195 | -16.4 | |||||||||||||||||

| Pacific | 235 | 238 | -3 | -3 | 240 | -2.1 | 275 | -14.5 | |||||||||||||||||

| South Central | 904 | 887 | 17 | 17 | 962 | -6.0 | 1,020 | -11.4 | |||||||||||||||||

| Salt | 187 | 182 | 5 | 5 | 216 | -13.4 | 246 | -24.0 | |||||||||||||||||

| Nonsalt | 717 | 705 | 12 | 12 | 746 | -3.9 | 774 | -7.4 | |||||||||||||||||

| Total | 2,771 | 2,694 | 77 | 77 | 2,994 | -7.4 | 3,125 | -11.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,771 Bcf as of Friday, September 9, 2022, according to EIA estimates. This represents a net increase of 77 Bcf from the previous week. Stocks were 223 Bcf less than last year at this time and 354 Bcf below the five-year average of 3,125 Bcf. At 2,771 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

metmike: Like yesterday, when NG soared higher and before that, when it plunged, the temperature/CDD forecast has not changed much this week.

12Z GFS ensemble was +6 CDDs and bullish.

You can see the (lack of) impact it's having on the NGV contract right now which is almost -$9,000/contract.

It's mid-September. The weather is often NOT the price driver that it would be in the key heating and cooling seasons........high residential demand.

The ups earlier in the week and especially the plunge on Thu (the weekly EIA really wasn't that bearish as the WSJ poll had +75 for the mean vs the +77 actual) were apparently largely related to the threat of and then the averting of a RR strike, which would have disrupted the transportation of coal and thus increased demand for NG for electricity generation:

Natural gas futures snapped a five-day rally and plunged in Thursday trading. The October Nymex gas futures contract fell 79.0 cents day/day and settled at $8.324/MMBtu after officials said a railway strike had been avoided and the latest government inventory report proved bearish.

The sell-off came amid reports Thursday that an agreement had been reached to avert a rail workers strike.

“Disrupted freight rail lines could have snarled supply chains and cost the U.S. economy an estimated $2 billion per day,” EBW Analytics Group senior analyst Eli Rubin said. He added that a strike threatened to curtail coal supplies and boost demand for natural gas, adding fuel to the recent rally.

“In the energy sector,” Rubin said, “disrupted freight coal transportation could have further strained precariously low coal inventories, leading coal operators to conserve scarce supplies, reduce coal generation, and increase the call on power sector gas demand.”

However, President Biden on Thursday announced a tentative agreement to avert a walkout, alleviating coal delivery concerns and worries about economic fallout.

Despite all of the talk about Biden's CC related oil/gas production policies leading to a reduction in domestic production vs potential, NG per NGI has reached record high levels this month:

"Production early this month reached record levels above 100 Bcf/d, according to Bloomberg estimates, and output continued to hold near that level Thursday."

My question to Mike and others: Is there something that Biden has done to lead to reduced US NG production? In other words, would it have been even higher than this record? Or is this expected reduction not til the future?

I recall a discussion Mike and I had about a reduction in a particular type of NG well that Mike had pointed out that might later lead to NG production reductions.

Larry,

Very glad that you asked.

The cure for high prices........is high prices.

In this case, it took much longer than usual and the response is muted because the government is throwing money out to big investors in green energy thru subsidies, grants, tax reduction and other schemes that don't apply to fossil fuel investments.

The fake inflation reduction act is a continuation of that but on a ramped up, federal scale.

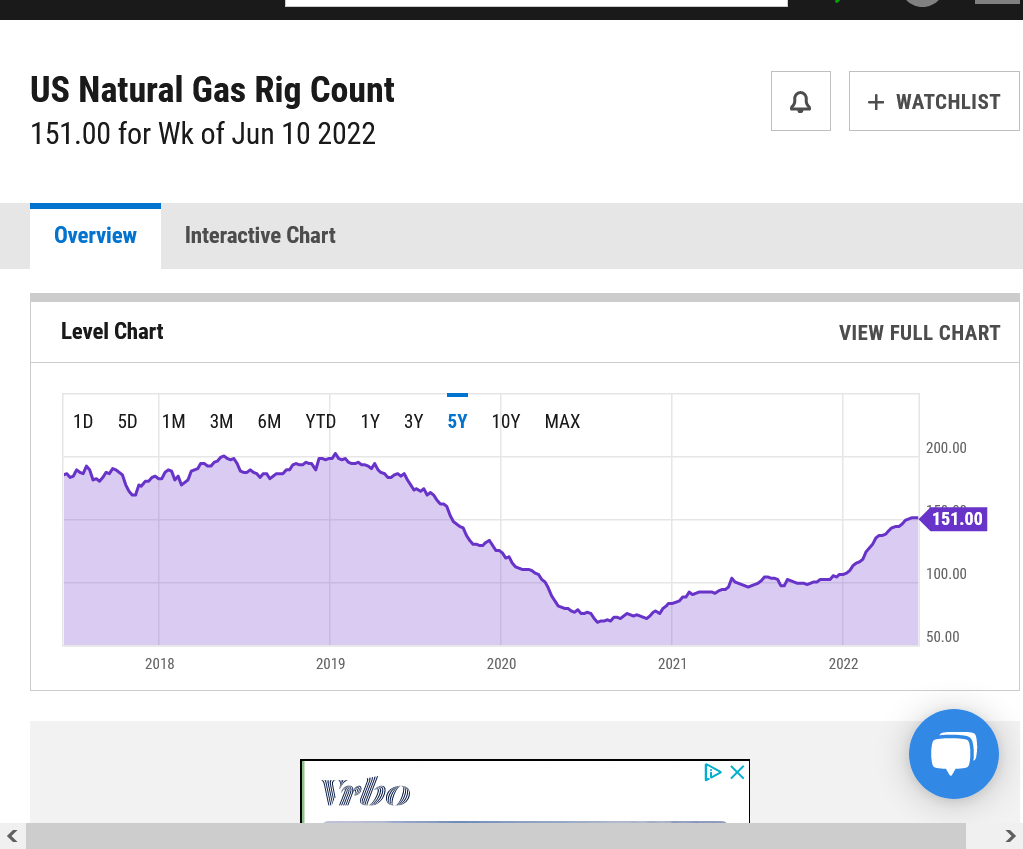

A decade ago, when prices were this high the rigs searching for natural gas were MUCH higher because big investors and big energy didn't see the writing on the wall for fossil fuels longer term.

These are long term plays, not just what they can capture from high prices at the moment.

This may help a bit:

++++++++++++++++++++++++++

https://www.marketforum.com/forum/topic/85535/#85659

Highest price for natural gas in 14 years. Every time prices increased, even half this much the rig count jumped higher so that supplies would gush out as the big investors saw incentive to make more money.

The cure for high prices is...............high prices.

Not any more with fossil fuels. The government is suppressing new supplies by disadvantaging new money investments in fossil fuels to stifle future profits with its war on fossil fuels.

https://ycharts.com/indicators/us_gas_rotary_rigs

Investment moneys in this business have seen the writing on the wall, long before Biden took over(Obama made it crystal clear). There are other factors at play with regards to production/well too.

https://www.eia.gov/dnav/ng/hist/e_ertrrg_xr0_nus_cm.htm .png)

This is also playing a huge role:

Fertilizer/Natural Gas Prices. Energy crisis in Europe because of unreliable fake green/anti environmental energy! August 2022 https://www.marketforum.com/forum/topic/88331/

This is also related:

California tells electric car owners NOT to charge vehicles. Energy crisis in California because of unreliable, fake green/anti environmental energy! September 2022 https://www.marketforum.com/forum/topic/88534/

Previous related posts:

https://www.marketforum.com/forum/topic/86116/#86128

https://www.marketforum.com/forum/topic/61677/#62033

Added 9-19-22:

NEW: Biden causes natural gas prices to soar higher: Europe's self inflicted energy crisis. Killing US coal. E15 gas this Summer...increasing pollution and food inflation for political marketing. Fossil fuels are the life blood of civilization.

https://www.eia.gov/todayinenergy/detail.php?id=53159

+++++++++++++++++++++++++++++++++++++++++++++++++

https://www.eia.gov/todayinenergy/detail.php?id=52659

https://www.eia.gov/todayinenergy/detail.php?id=51358

https://www.eia.gov/todayinenergy/detail.php?id=52758

++++++++++++++++++++++++++++

https://www.weforum.org/agenda/2022/03/eu-energy-russia-oil-gas-import/

Related discussion/much more details:

Fertilizer/Natural Gas Prices/Europe crisis

Started by metmike - Aug. 25, 2022, 3:38 p.m.

metmike: CDD's are rarely a huge deal in late September. However, this year, they are 50% higher than average for that time frame. The amount in storage is still near the bottom of the 5 year average and the market wants to see that refilled to a comfortable level before the heat season/Winter begins.

Also, exports pick up soon(end of November?), after the repairs are finished to the damaged export facility in TX. ....this means additional demand of something like 15 BCF/week? This is extremely bullish. That equates to something like an additional 300 BCF of demand/use over the entire heating season/Winter.

Larry may have a better estimate.

metmike: On CDDs. With time, the current near record heat days on the front end of the forecast with HIGH CDDs, are being replaced by much milder ones at the end of the forecast (early Oct) so the dropping CDDs is a bit deceptive. Regardless, it's delusional to think the market will rally on October heat. Especially since October cold waves, mainly mid/late month have led to some upward price spikes in the past.

Against a backdrop of broader energy market anxieties over a potential escalation in the conflict in Ukraine, natural gas futures rallied in early trading Wednesday. The October Nymex contract was up 23.0 cents to $7.947/MMBtu as of around 8:45 a.m. ET. West Texas Intermediate front month crude oil futures were trading $1.02 higher at $84.96/bbl.…

metmike: Last week, we were told that Ukraine was winning the war!

7 day temps for last week and this week's EIA were on the bearish side because the places in the south that can be the hottest at this time of year......were actually the coolest.

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

https://ir.eia.gov/ngs/ngs.html

for week ending September 16, 2022 | Released: September 22, 2022 at 10:30 a.m. | Next Release: September 29, 2022

+103 BCF that was BIG/BEARISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/16/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 09/16/22 | 09/09/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 690 | 661 | 29 | 29 | 748 | -7.8 | 784 | -12.0 | |||||||||||||||||

| Midwest | 844 | 809 | 35 | 35 | 900 | -6.2 | 907 | -6.9 | |||||||||||||||||

| Mountain | 168 | 163 | 5 | 5 | 196 | -14.3 | 199 | -15.6 | |||||||||||||||||

| Pacific | 237 | 235 | 2 | 2 | 240 | -1.3 | 278 | -14.7 | |||||||||||||||||

| South Central | 935 | 904 | 31 | 31 | 986 | -5.2 | 1,038 | -9.9 | |||||||||||||||||

| Salt | 199 | 187 | 12 | 12 | 226 | -11.9 | 253 | -21.3 | |||||||||||||||||

| Nonsalt | 736 | 717 | 19 | 19 | 760 | -3.2 | 786 | -6.4 | |||||||||||||||||

| Total | 2,874 | 2,771 | 103 | 103 | 3,071 | -6.4 | 3,206 | -10.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,874 Bcf as of Friday, September 16, 2022, according to EIA estimates. This represents a net increase of 103 Bcf from the previous week. Stocks were 197 Bcf less than last year at this time and 332 Bcf below the five-year average of 3,206 Bcf. At 2,874 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 103 Bcf into natural gas storage for the week ended Sept. 16. The result exceeded analysts’ expectations and soothed market concerns about ample supplies for the coming winter, keeping pressure on Nymex natural gas futures. The build marked the largest of the year,…

metmike: The weather is NOT a factor. 15 years ago, a potential hurricane in the Gulf of Mexico would have cause the natural gas market to be on fire. Fracking/shale production on land has replaced much of the GOM production but one can still imagine a scenario of a major hurricane aimed at the WESTERN GOM causing a spike higher. Most of the forecasts now are too far east.

But the last 12z GFS continue to be farther west than the European model but NOT far enough west to hit energy structures(which would be on the western/weak side of the hurricane anyways).

I sure wouldn't want to be short any energy markets ahead of a potential major hurricane strike in the W. GOM.

NG spiked down to -$7,000/contract on the day.

It's not too early to be looking for major cold patterns in October that should generate the seasons first significant HDDs and be seen as bullish.

Nothing there right now.

We actually have a decent shot of late Sept HDDs now and thru the next week or so but not enough to make a difference..........they are offset by a plunge in CDDs.

By Jacob Dick

September 26, 2022

That could mean growth in European LNG demand will more than double the 50 Bcm/year outlined in the March joint agreement between the Biden administration and the EU, according to Rystad. Analysts also projected LNG would meet 50% of Europe’s natural gas demand through 2030, before growing to 75% of demand by 2040.

metmike: How can this be? We are being told by Biden that natural gas and coal will be gone by 2030?

Sorry to interject politics into it but they know dang well the fake climate crisis is about crony capitalism using things like anti environmental fake green wind turbine schemes and political agenda. The press release below is fairy tale hogwash:

100 percent carbon pollution-free electricity (CFE) by 2030, at least half of which will be locally supplied clean energy to meet 24/7 demand;

metmike: They are lying to us!

metmike: Nothing weather-wise affecting ng right now.

CDDs fall and HDDs rise seasonally at this time of year.

They intersect around October 4th based on averages.

Near record heat in the middle of the country last week! Could be a seasonally small-ish injection.

7 day temps last week for the EIA report on Thursday at 9:30am.

metmike: News from Ukraine is more important than US weather right now.

metmike: November contract is front month today.

for week ending September 23, 2022 | Released: September 29, 2022 at 10:30 a.m. | Next Release: October 6, 2022

+103 BCF = BEARISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/23/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 09/23/22 | 09/16/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 721 | 690 | 31 | 31 | 775 | -7.0 | 807 | -10.7 | |||||||||||||||||

| Midwest | 879 | 844 | 35 | 35 | 930 | -5.5 | 937 | -6.2 | |||||||||||||||||

| Mountain | 176 | 168 | 8 | 8 | 200 | -12.0 | 203 | -13.3 | |||||||||||||||||

| Pacific | 243 | 237 | 6 | 6 | 243 | 0.0 | 283 | -14.1 | |||||||||||||||||

| South Central | 958 | 935 | 23 | 23 | 1,010 | -5.1 | 1,052 | -8.9 | |||||||||||||||||

| Salt | 204 | 199 | 5 | 5 | 237 | -13.9 | 257 | -20.6 | |||||||||||||||||

| Nonsalt | 754 | 736 | 18 | 18 | 772 | -2.3 | 795 | -5.2 | |||||||||||||||||

| Total | 2,977 | 2,874 | 103 | 103 | 3,157 | -5.7 | 3,283 | -9.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,977 Bcf as of Friday, September 23, 2022, according to EIA estimates. This represents a net increase of 103 Bcf from the previous week. Stocks were 180 Bcf less than last year at this time and 306 Bcf below the five-year average of 3,283 Bcf. At 2,977 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 06, 2022 | 10:30 | 103B | |||

| Sep 29, 2022 | 10:30 | 103B | 94B | 103B | |

| Sep 22, 2022 | 10:30 | 103B | 93B | 77B | |

| Sep 15, 2022 | 10:30 | 77B | 73B | 54B | |

| Sep 08, 2022 | 10:30 | 54B | 54B | 61B | |

| Sep 01, 2022 | 10:30 | 61B | 58B | 60B | |

| Aug 25, 2022 | 10:30 | 60B | 58B | 18B | |

| Aug 18, 2022 | 10:30 | 18B | 34B | 44B | |

| Aug 11, 2022 | 10:30 | 44B | 39B | 41B | |

| Aug 04, 2022 | 10:30 | 41B | 29B | 15B | |

| Jul 28, 2022 | 10:30 | 15B | 22B | 32B | |

| Jul 21, 2022 | 10:30 | 32B | 47B | 58B |

Seasonally/historically, on average total US HDDs pass up CDDs this week.

With slight global warming, that date has been delayed by several days in recent decades but I'm not sure if that has been dialed into the products used.

Regardless, its only a minuscule factor. The absolute HDDs or CDDs matter and how they compare/deviate from average does too. The change compared to the old average or instead the last decade average is not going to be massive.

A week with average temperatures in the month of January, for instance would be close to nuetral for the natural gas market/traders.

The same temps occurring in November or March would be very bullish because they would gobble up much more natural gas for residential heating than average for that particular time frame.

Natural gas futures plummeted on Monday, with a plethora of weak market signals – including the potential for five straight triple-digit storage injections – sending November prices as much as 46 cents below Friday’s close. The November Nymex contract ultimately settled Monday at $6.470/MMBtu, down 29.6 cents. Spot gas prices recovered on Monday, led by…

Tuesday am:

metmike: Actually, we've reversed strongly higher the past 5 hours. Up $3,000 on the day and up $4,000 since the lows just before 6am. Weather isn't a factor? Decent shots of HDDs, several days above average but the weather maps don't look that much different than yesterday when we crashed lower. Could be there's enough cold to support us from going any lower/caused us to hold.

Noon: I take that back and admit to not following the NG weather closely because of the time of the year. It does look very chilly and overnight maps were colder, especially the 6z GFS Ensemble, late in the period, exactly when the NG reversed higher.

Natural gas futures rallied on Tuesday, with overall thin liquidity resulting in a likely overdone response to a temporary decline in production. Despite an unsupportive near-term outlook, the November Nymex gas futures contract jumped 36.7 cents to $6.837/MMBtu. December futures climbed 37.1 cents to $7.174. Spot gas prices rose almost across the board, outside of…

+++++++++++++

metmike: Beats me where the price of NG is going!

metmike: Enough October cold in the forecast to be bullish. The HO/RB spread shot up 20c today from the cold being greatest in the Northeast/Mid Atlantic that uses heating oil!

metmike: We'll see what the EIA report shows.

7 day temps for the EIA this morning.

Very cool Eastern 1/3rd, Ian in the Southeast!

Very warm in the Plains.

+129 BCF. Wow, one of the biggest injections in history!

NG still trading positive though.

https://ir.eia.gov/ngs/ngs.html

for week ending September 30, 2022 | Released: October 6, 2022 at 10:30 a.m. | Next Release: October 13, 2022

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/30/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 09/30/22 | 09/23/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 756 | 721 | 35 | 35 | 806 | -6.2 | 833 | -9.2 | |||||||||||||||||

| Midwest | 916 | 879 | 37 | 37 | 966 | -5.2 | 970 | -5.6 | |||||||||||||||||

| Mountain | 184 | 176 | 8 | 8 | 205 | -10.2 | 208 | -11.5 | |||||||||||||||||

| Pacific | 247 | 243 | 4 | 4 | 247 | 0.0 | 286 | -13.6 | |||||||||||||||||

| South Central | 1,003 | 958 | 45 | 45 | 1,048 | -4.3 | 1,074 | -6.6 | |||||||||||||||||

| Salt | 225 | 204 | 21 | 21 | 256 | -12.1 | 266 | -15.4 | |||||||||||||||||

| Nonsalt | 778 | 754 | 24 | 24 | 792 | -1.8 | 808 | -3.7 | |||||||||||||||||

| Total | 3,106 | 2,977 | 129 | 129 | 3,271 | -5.0 | 3,370 | -7.8 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,106 Bcf as of Friday, September 30, 2022, according to EIA estimates. This represents a net increase of 129 Bcf from the previous week. Stocks were 165 Bcf less than last year at this time and 264 Bcf below the five-year average of 3,370 Bcf. At 3,106 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Oct 06, 2022 Actual129B Forecast113B Previous103B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 06, 2022 | 10:30 | 129B | 113B | 103B | |

| Sep 29, 2022 | 10:30 | 103B | 94B | 103B | |

| Sep 22, 2022 | 10:30 | 103B | 93B | 77B | |

| Sep 15, 2022 | 10:30 | 77B | 73B | 54B | |

| Sep 08, 2022 | 10:30 | 54B | 54B | 61B | |

| Sep 01, 2022 | 10:30 | 61B | 58B | 60B |

metmike: NG down $2,000/contract here after midnight. It's going to take some major cold and/or worsening problems in Europe to rally prices a great deal if this much supply keeps gushing into the market. We could make up the big storage deficit pretty quickly, with the blue line on the graph from the last page, starting to bounce up from near the bottom of the 5 year average, where it's been for the past 6 months.

metmike: That +129 BCF injection(3rd highest ever) has clobbered the bulls. On top of that, the late week 2 forecast is looking milder.

Natural gas futures were trading close to even early Monday as supportive weekend weather trends were not enough to outweigh the soft shoulder season supply/demand dynamics leading to huge storage builds. After tumbling 22.4 cents in Friday’s trading, the November Nymex contract was off 1.5 cents to $6.733/MMBtu at around 8:50 a.m. ET. Over the…

metmike: US weather looks a bit more bearish to me.

Temps for the EIA just released:

Chilly East, Warm/West.

HUGE, but expected.

https://ir.eia.gov/ngs/ngs.html

for week ending October 7, 2022 | Released: October 13, 2022 at 10:30 a.m. | Next Release: October 20, 2022

HUGE........but close to the estimates, not a shocker bearish like last week. The market has dialed in the supplies gushing into the price!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/07/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 10/07/22 | 09/30/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 782 | 756 | 26 | 26 | 831 | -5.9 | 856 | -8.6 | |||||||||||||||||

| Midwest | 952 | 916 | 36 | 36 | 993 | -4.1 | 1,001 | -4.9 | |||||||||||||||||

| Mountain | 190 | 184 | 6 | 6 | 209 | -9.1 | 211 | -10.0 | |||||||||||||||||

| Pacific | 249 | 247 | 2 | 2 | 251 | -0.8 | 289 | -13.8 | |||||||||||||||||

| South Central | 1,058 | 1,003 | 55 | 55 | 1,075 | -1.6 | 1,096 | -3.5 | |||||||||||||||||

| Salt | 253 | 225 | 28 | 28 | 268 | -5.6 | 275 | -8.0 | |||||||||||||||||

| Nonsalt | 804 | 778 | 26 | 26 | 808 | -0.5 | 821 | -2.1 | |||||||||||||||||

| Total | 3,231 | 3,106 | 125 | 125 | 3,357 | -3.8 | 3,452 | -6.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,231 Bcf as of Friday, October 7, 2022, according to EIA estimates. This represents a net increase of 125 Bcf from the previous week. Stocks were 126 Bcf less than last year at this time and 221 Bcf below the five-year average of 3,452 Bcf. At 3,231 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

The U.S. Energy Information Administration (EIA) reported an injection of 125 Bcf natural gas into storage for the week ended Oct. 7. The print marked the fourth straight triple-digit injection this shoulder season, though the market had anticipated the increase, and Nymex natural gas futures inched higher. Analysts on the online energy platform Enelyst said…

metmike: Market up sharply from increased HDDs!

+4 HDDs for the European model and for the GFS, a whopping +12 HDDs overnight\ between the 6z and the 18z run, 12 hours earlier!

addition: still looks like warming late in the period

Huge gap lower for NG this evening. All because of the Week 2 warm up from last weeks maps getting closer and amplifying.

Natural gas futures fell sharply in early trading Monday following bearish weekend forecast trends, extending losses from late last week. Coming off a 28.8-cent sell-off on Friday, the November Nymex contract was down another 45.6 cents to $5.997/MMBtu at around 8:40 a.m. ET. Models trended warmer over the weekend by dropping demand from the outlook…

++++++++++++++++++++

Yep! Gap lower last evening is wide open and serving as an extremely bearish downside breakaway gap.

Temps last week for this week's EIA. Chilly in the East, so maybe not as bearish as the last 2 massive/near record high injections, 129, then 125 BCF (billion cubic feet).

https://www.marketforum.com/forum/topic/88807/#89665

+++++++++++

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

+111 BCF huge number for the amount of HDD's last week

Look at the blue line below on the graph taking a sharp turn/curve upwards after tracking near the bottom of the 5 year average all year. Supplies are GUSHING in.

We're headed towards the 5 year average and at this rate, could pass it up before the end of the year if temps remain mild! Still -183 BCF below it right now.

https://ir.eia.gov/ngs/ngs.html

for week ending October 14, 2022 | Released: October 20, 2022 at 10:30 a.m. | Next Release: October 27, 2022

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/14/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 10/14/22 | 10/07/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 812 | 782 | 30 | 30 | 858 | -5.4 | 877 | -7.4 | |||||||||||||||||

| Midwest | 987 | 952 | 35 | 35 | 1,023 | -3.5 | 1,030 | -4.2 | |||||||||||||||||

| Mountain | 195 | 190 | 5 | 5 | 211 | -7.6 | 212 | -8.0 | |||||||||||||||||

| Pacific | 249 | 249 | 0 | 0 | 253 | -1.6 | 290 | -14.1 | |||||||||||||||||

| South Central | 1,099 | 1,058 | 41 | 41 | 1,104 | -0.5 | 1,116 | -1.5 | |||||||||||||||||

| Salt | 271 | 253 | 18 | 18 | 281 | -3.6 | 282 | -3.9 | |||||||||||||||||

| Nonsalt | 828 | 804 | 24 | 24 | 823 | 0.6 | 834 | -0.7 | |||||||||||||||||

| Total | 3,342 | 3,231 | 111 | 111 | 3,448 | -3.1 | 3,525 | -5.2 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,342 Bcf as of Friday, October 14, 2022, according to EIA estimates. This represents a net increase of 111 Bcf from the previous week. Stocks were 106 Bcf less than last year at this time and 183 Bcf below the five-year average of 3,525 Bcf. At 3,342 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

NG has dropped over $10,000/contract in less than a week, so we may have gotten ahead of ourselves with almost the entire heating season ahead.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Oct 20, 2022 Actual111B Forecast105B Previous125B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 20, 2022 | 10:30 | 111B | 105B | 125B | |

| Oct 13, 2022 | 10:30 | 125B | 123B | 129B | |

| Oct 06, 2022 | 10:30 | 129B | 113B | 103B | |

| Sep 29, 2022 | 10:30 | 103B | 94B | 103B | |

| Sep 22, 2022 | 10:30 | 103B | 93B | 77B | |

| Sep 15, 2022 | 10:30 | 77B | 73B | 54B |

After some hiccups earlier in Thursday’s session, natural gas futures managed to finish in the red for a fifth straight trading day as traders digested another massive storage injection. The November Nymex gas futures contract settled at $5.358/MMBtu, down 10.4 cents on the day. December slid 9.0 cents to $5.838. Spot gas prices continued to…

+++++++++++++++++

metmike: They must be referring to this. Time to break out the Winter outlooks here! This is being driven by the extremely long lived La Nina.

https://www.cpc.ncep.noaa.gov/products/predictions/long_range/seasonal.php?lead=2

+++++++++

HDD's have been plunging and that continued overnight. The price has dropped around $15,000/contract in just over a week. That, along with a massive increase in supplies gushing in, as shown by the last 3 monster EIA reports is as bearish as it gets.

From the NGI article linked below:

Even so, it’s too early to “write off winter” at this point in the season, according to TPH.

-----------------

So, it is too early to write off winter on October 21st? You don't say!

Thanks Larry!

2 weeks ago, yesterday just before the first incredibly bearish, 129 BCF injection from the EIA, natural gas was trading $22,000/contract higher than this! I just went back and reviewed the last 2+ weeks. Pretty amazing period in natural gas history with these injections.

Also, this got me wondering what sector of traders pushed us down this far so fast? So I found this awesome site that shows, not just prices but the COT. Unfortunately, it doesn't look possible to cut/paste there stuff to do an analysis here but here's the link: https://www.barchart.com/futures/quotes/NG*0/interactive-chart?cot=true

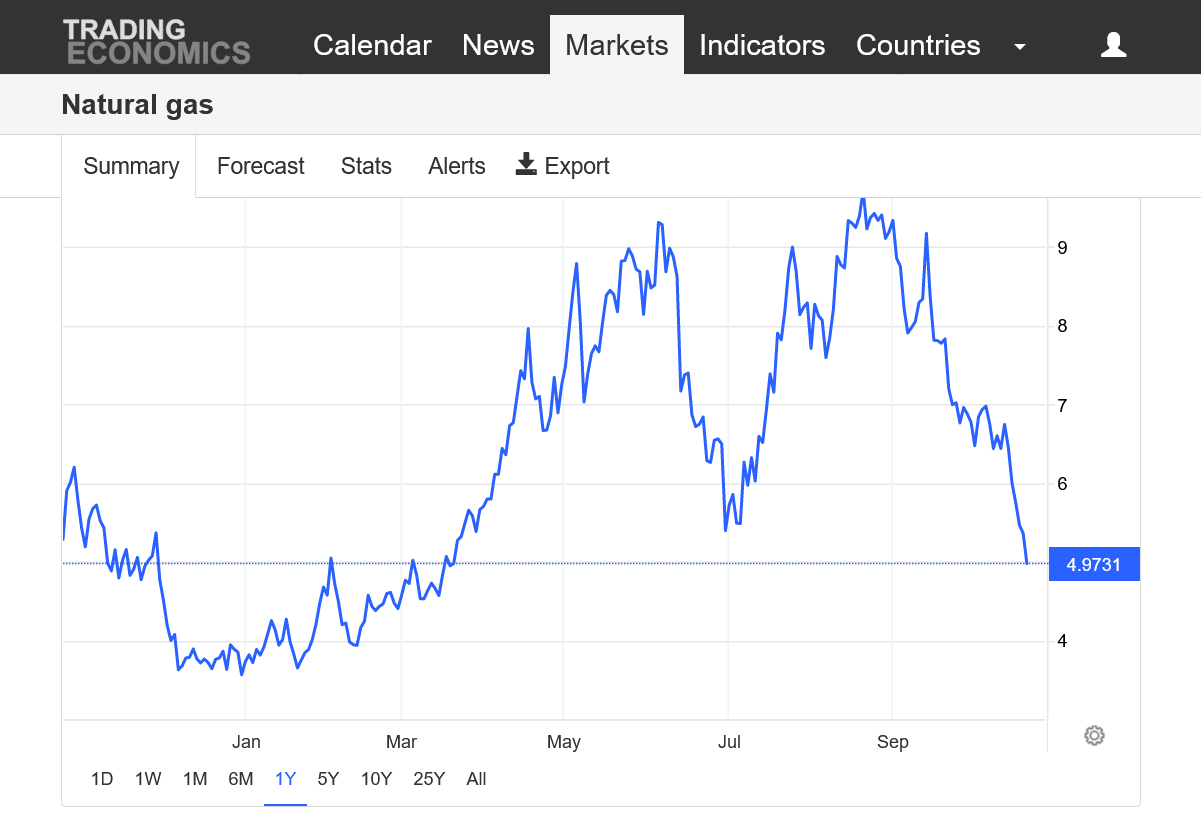

With the 2 highs, first in June, then August at $10, we clearly had a double top. Here, 2 months later, ng is trading $50,000/contract less and half that price, below $5. That's never happened before in history. The gap lower on Sunday night, below support at $6.3 was a huge downside break out. With todays additional -4,000/contract, ng has is almost $15,000/contract less than last Friday. Dang, wish I could copy those charts. I'll find others.

Ice, COT report. I've never followed this and don't have time to figure it out at the moment but am posting the link for future reference: https://www.cftc.gov/dea/futures/nat_gas_lf.htm

Here's some great charts. They don't show gaps, like the one we had Sunday Night. I just realized that we don't show ng price charts much and its been a huge oversight on my part. Sorry about that. I shrunk them to reduce space.

https://tradingeconomics.com/commodity/natural-gas

With more mild early winter weather on tap, and with storage refilling quickly, natural gas futures added to their recent losses in early trading Monday. Coming off a 39.9-cent sell-off in the previous session, the November Nymex contract was down 6.1 cents to $4.898/MMBtu at around 8:45 a.m. ET. Plummeting futures prices reflect a market…

+++++++++++++++++

NG has had a few more HDDs on recent model runs, though the pattern overall is still above average temps. It's reversed higher this morning. The price is down $50,000/contract since the Summer highs, down 50%, so at some point it has to stop going lower no matter how bearish the injections and weather.

Front month expiration is on Thursday-27th too and I noted that December now has more volume than the expiring November. https://www.energygps.com/HomeTools/ExpiryCalendar

| Expiry Calendar - 10/21/2022 to 12/31/2023 | ||||

| Crude Oil Futures | NY Harbor ULSD Futures | Henry Hub Natural Gas Futures | RBOB Gasoline Futures | |

| Contract Month | CL | HO | NG | RB |

| Nov 2022 (X) | 10/20/2022 | 10/31/2022 | 10/27/2022 | 10/31/2022 |

New NG thread is here:

https://www.marketforum.com/forum/topic/89973/