Addition: Thanks to Relevant Radio asking me to comment on the potential food crisis on Wednesday, I was inspired to investigate and learn more about this topic and am sharing the profoundly significant items learned in this thread:

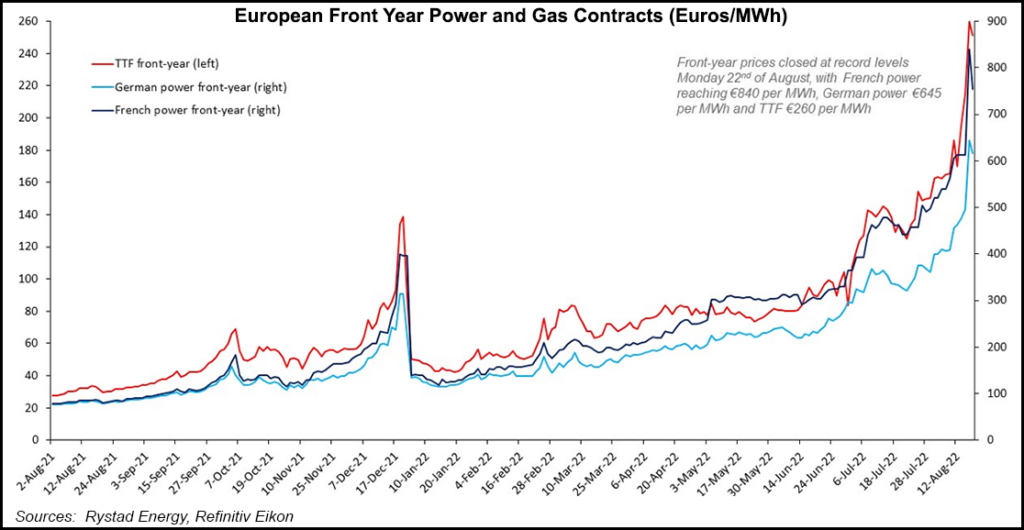

1. Current natural gas prices in the US have tripled in a short period of time. In Europe, however, natural gas prices are 7 times higher than the US and 10 times higher than 1 year ago. In today's age, we are constantly bombarded with news of fake crisis's. This one is an entirely legit crisis that is being downplayed because of #2 below! The legit threat of not having energy to power or heat your house if you live in Europe.

2. So bad that many European countries have reopened closed coal plants and are burning coal again. Going back to extremely reliable coal because fake green energy failed miserably. The most important element to judge an energy source's value is based on it always being there when you need it most. Not just during periods when the wind is blowing hard.

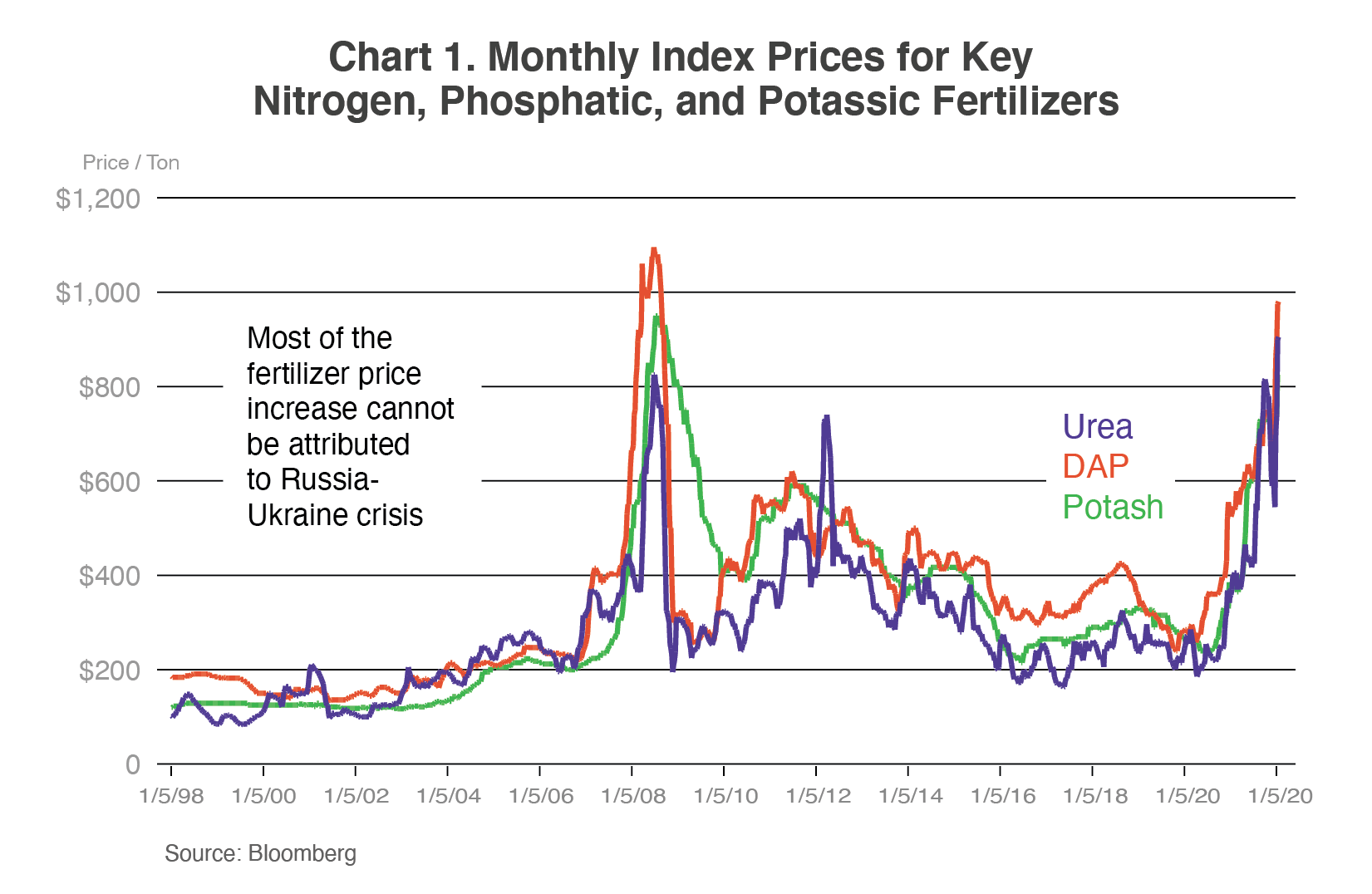

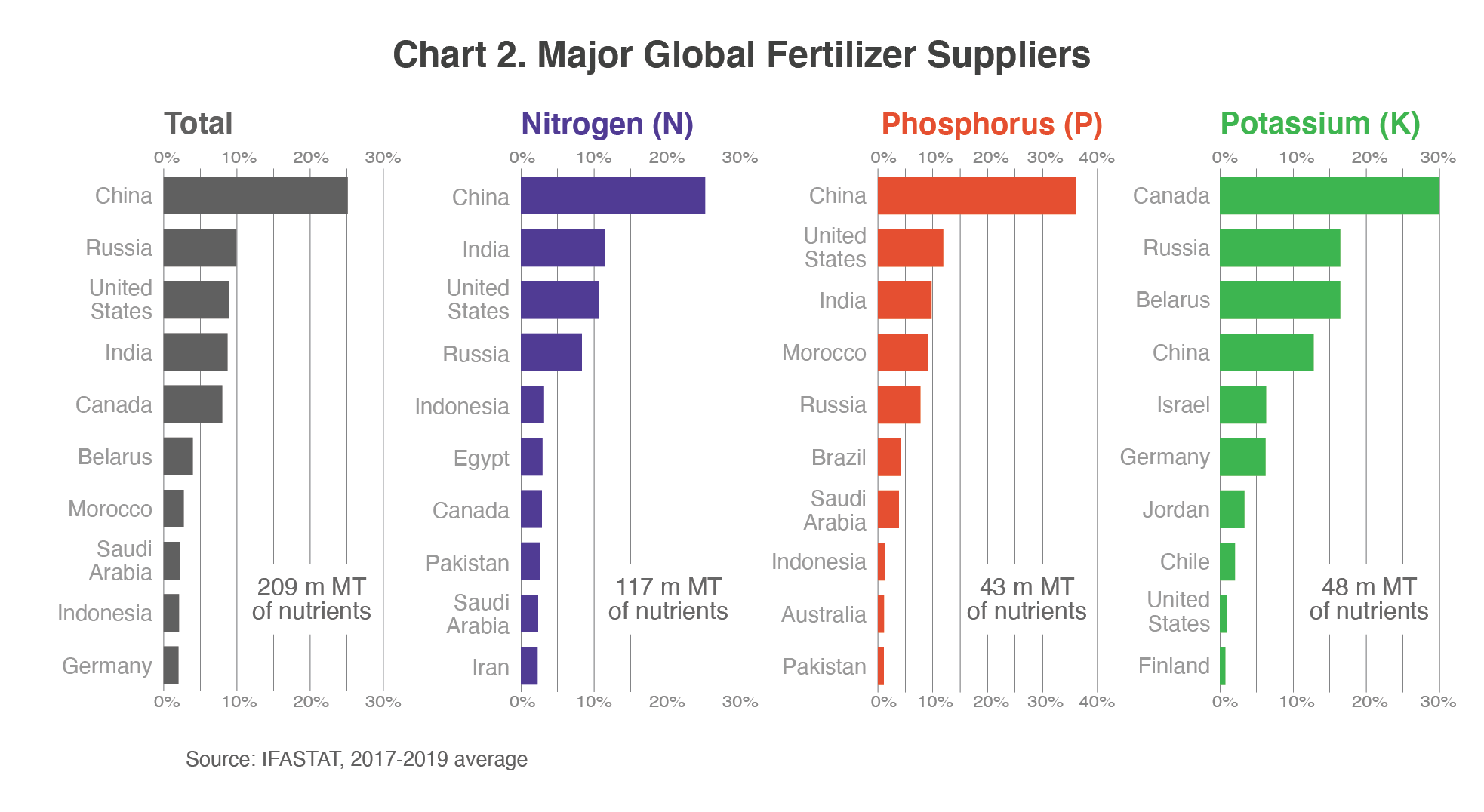

3. Natural gas price fertilizer prices

fertilizer prices food prices. The majority of the cost to produce fertilizer (especially nitrogen) is natural gas. The biggest determinant to crop yields in the developed world is fertilizer use. The prices and associated costs are part of farmers input costs which factors into planting decisions and...........if fertilizer becomes too expensive results in cutting back application rates which reduces crop yields.

food prices. The majority of the cost to produce fertilizer (especially nitrogen) is natural gas. The biggest determinant to crop yields in the developed world is fertilizer use. The prices and associated costs are part of farmers input costs which factors into planting decisions and...........if fertilizer becomes too expensive results in cutting back application rates which reduces crop yields.

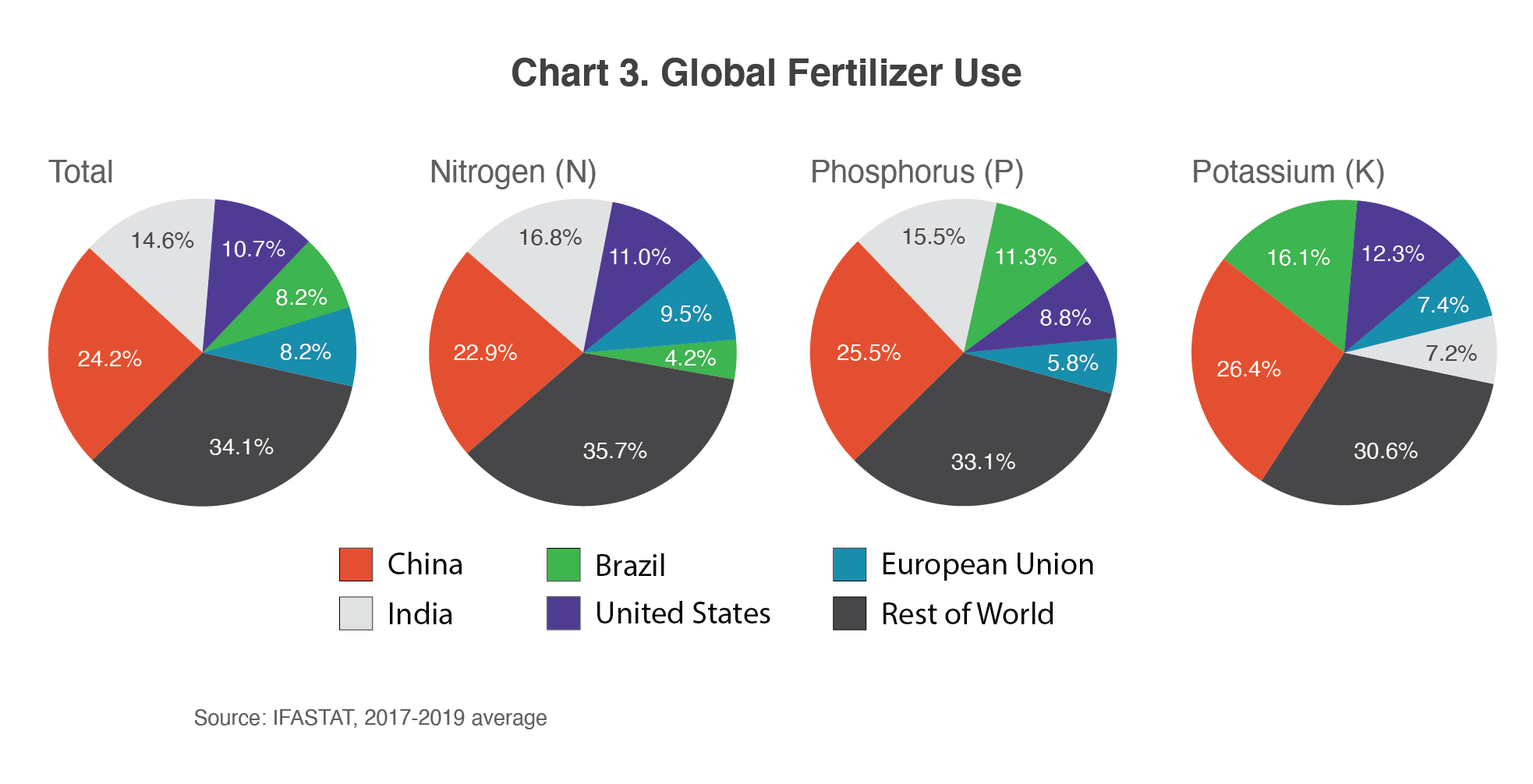

4. The growing 2022 crop and that which is being harvested were NOT affected by high fertilizer rates which had not hit the markets before decisions were made on input prices. This years global crop will end up being near the record, thanks to increases in production in China, India, Canada, Russia and Australia offsetting some losses in production elsewhere.

5. The sky high price of fertilizer right now, however might impact 2023 crops and beyond. Planted crop acreage could be affected and fertilizer application rates might be affected. Bottom line..........the higher the price of natural gas is and the longer it stays extremely high, the greater the impact will be on fertilizer prices and eventually food production, then food prices down the road.

6. They are trying to blame this entirely on Russia. Don't believe it. Russia is only a factor because of Europe's really bad energy supply/delivery choices to cut CO2 emissions to meet the bogus Climate Accord commitments based on an entirely fake climate crisis. If Europe had just continued to use the same very reliable energy sources they depended on in the 1990's, there would NOT be an energy crisis right now. Same thing in California. This is what happens when you replace very reliable, dense fossil fuels with unreliable, diffuse solar and extremely ANTI environmental, planet wrecking wind energy that has mainly advanced from crony capitalism via massive governmental support schemes.

Thanks again Relevant Radio!

+++++++++++++++++++++++++++++++++++++

Previous thread below:

Currently, the very high price of natural gas is playing a key role in causing fertilizer prices to be very high(because its the majority of the cost in production for nitrogen)........which in turn is playing a huge role in higher food prices.

In the US, the price of natural gas has tripled over the last 2 years and is at the highest level in 14 years. Part of this is from the low amount of ng in storage, currently near the bottom of the 5 year average.

https://www.cnbc.com/quotes/@NG.1

%20in%20real%20time.png)

Update with today's EIA report.

https://www.marketforum.com/forum/topic/87816/#88328

Note the blue line is very close to the bottom of the 5 year average!

In Europe, however ng in storage is precariously low headed into Winter and has resulted in unimaginable prices.

Late last year, the price of natural gas and electricity in Europe spiked to 5 times higher compared to the middle part of the year, 2021 and it seemed almost impossible to sustain.

After quickly dropping at the start of this year to only being 2 times higher than a year earlier, prices have been on a relentless tear upwards, currently at 10 times higher than a year ago.

This is mind blowing. In the US, we are experiencing the highest ng gas prices in over 14 years but the price in Europe recently has been 7 times HIGHER than what we pay.

The cost of electricity has surged to record highs across Europe this week, following a meteoric rise in natural gas prices that could pave the way for painfully high consumer rates across the continent through the winter and well beyond.

Electricity futures across much of the continent jumped above 600 euros/MWh this week, an exponential gain from the roughly 20-30 euros/MWh average over the last decade. In a note on Wednesday, Rystad Energy analysts wrote that records have been broken on an hourly and daily basis throughout the month.

“Should the current trend continue, then winter power prices will be punishing for European consumers large and small,” said Rystad analyst Fabian Rønningen. German and French power prices hit fresh highs Thursday

The European power crisis has been gaining momentum throughout the summer. French nuclear availability issues, depleted hydro reservoirs due to drought and declining output at aging nuclear and coal plants have exacerbated the situation along with low wind output.

Analysts at Engie EnergyScan said this week that fundamentals are unlikely to change anytime soon given hot forecasts, calm weather conditions further curbing wind and the anxiety gripping the market over whether Russia will further cut deliveries next month. The situation has grown so dire that European energy ministers are again reportedly considering an emergency summit to address the snowballing crisis.

I would never have believed this could happen........ except that this is one of the risks for what can happen when you too quickly abandon the power dense, reliable fossil fuels(in his case coal) and follow fairy tale, fake green energy schemes.

Wonderful article below, written early this year.

Center for Agricultural Profitability

Fertilizer Costs: What is Driving the Increase and How Can Growers Manage It?

https://cap.unl.edu/crops/fertilizer-costs-what-driving-increase-and-how-can-growers-manage-it

How does this impact fertilizer costs:

To produce fertilizer, facilities use globally priced raw materials and substantial amounts of energy to convert the raw chemical materials into forms farmers can use. For example, anhydrous ammonia is produced by the Haber-Bosch process in which nitrogen is combined with hydrogen to synthesize the ammonia, using natural gas as the source of the hydrogen, as well as the energy, for synthesizing. Natural gas is an essential element for most nitrogen fertilizers, and accounts for 70% to 90% of the production variable costs in the synthesis process. So, natural gas prices have an outsized impact on nitrogen fertilizer prices. Because, natural gas prices have risen dramatically over the past few months, especially in Europe, it has forced many EU nitrogen plants to close. Because plants built for this process typically require three to five years to build, the long-run impact is that when a demand surge occurs, the response time to fulfill supply via an additional production facility will lag about three to five years at a significant price tag.

https://www.fas.usda.gov/data/impacts-and-repercussions-price-increases-global-fertilizer-market

This graph shows a similar price spike in 2008.

To refresh your memory, crude spiked to near $150 and natural gas to $13 back then (which caused a recession) and also the spike higher in fertilizer prices.

In 2022, the same thing is happening.......except that natural gas in storage is critically short in Europe and low in the US and will NOT be replenished for many months........so the cost to make fertilizer MUST follow natural gas prices.

The price of natural gas and fertilizer track pretty closely much of the time.

++++++++++++++++++++

Another secret about fossil fuels:Haber Bosch process-fertilizers feeding the planet using natural gas-doubling food production/crop yields. September 2019

Related to the cost of production, here's another great article from late last year.

Fertilizer costs are going even higher. One would think that it will favor soybeans over corn and change acreage accordingly in 2023.

What do you producers think? Will it change your decision on what to plant next year?

Wonderful balance table showing the variable costs for each crop at the start of 2022.

Estimated Costs of Crop

Production in Iowa–20

Ag Decision Maker

https://www.extension.iastate.edu/agdm/crops/pdf/a1-20.pdf

What do you guys think?

Iowa is prime, very fertile, incredibly high yielding black dirt so producers will get more bang for their buck vs the brown, thicker, clay type soils here in S. Indiana.

What do you think cutworm?

Interesting

From the summaries on page 13 , production costs per bushel appear to have steadily decreased ,

Hmmmm?

Am I missing something? Let me go back and look at some line items.'Ill edit later

Edit: Seems land and machinery costs net have gone down

While labor, seed chemicals etc. have increased. Hmmmm again.

mm-I have no comment Iowa vs Indiana - I'm from Jersey-we've got our own problems here and they ain't always agriculture problems!

John

Thanks John,

Good point. There do seem to be some odd things in there that contradict what I thought and can't be explained clearly.

So we are actually covering 3 topics on the same thread here because they are so connected with each other and the current dynamics are off the charts profound.

Natural gas price fertilizer prices

fertilizer prices food prices

food prices

Again, the reason for this is here:

Another secret about fossil fuels: Haber Bosch process-fertilizers feeding the planet using natural gas-doubling food production/crop yields. September 2019

https://www.marketforum.com/forum/topic/39215/

Editor OilPrice.com

https://www.yahoo.com/lifestyle/europe-gas-price-now-equivalent-230000506.html

"Such record gas prices are hitting industries in Germany and the rest of Europe, with companies announcing production halts or curtailments "until further notice" amid soaring energy costs. Industries have warned that reduced production and operations could lead to a collapse of supply and production chains. Governments are scrambling to secure enough gas for the winter while walking a tight rope between alleviating the cost burdens on households and avoiding an industrial collapse and a wave of bankrupt energy companies.

As a result of the gas crunch and a heatwave constraining supply and output from other fuel sources, year-ahead electricity prices continue to soar in Europe, with German power prices, the European benchmark, jumping to over $508 (500 euro) per megawatt-hour on Tuesday—a new record.

Despite faster storage builds than usual, Germany will only have enough natural gas to cover two and a half months of consumption this winter if Russia completely suspends deliveries, Klaus Müller, the president of Germany's energy regulator, told Bloomberg this week.

"The burden of high gas and oil prices will actually mean that we are going to see some steep contraction in the European economies next year," Amrita Sen, director of research at Energy Aspects, told Bloomberg on Wednesday.

U.S. Natural Gas Prices Rally, Too

European prices are at record highs and at around seven times higher than U.S. benchmark prices. But the U.S. prices at Henry Hub have surged, too, to the highest they have been in 14 years."

How could this have happened? Nobody will acknowledge this part of the reason, but I will show it to you right now.

Several things made Europe vulnerable but the biggest one was very self inflicted bad decisions to eliminate coal and not fully understanding/planning responsibly for the huge reliability issues of fake green energy schemes.

The graph below depicts what happened.

Lignite, is just "soft" coal.

You can see from the graph that 30 years ago, Germany relied on coal (soft and hard) and nuclear to generate the VAST majority of its power/electricity.

Those sources (coal/nuclear) are at the top for the most reliable of all. ..... 24 hours a day, 365 days a year.

At the same time, in the early 1990's, they were only using a minuscule amount of renewables to generate energy and not much natural gas, much of which is delivered by pipeline from Russia in 2022.

This was their self inflicted bad decision:

They cut their use of extremely reliable sources(coal/nuclear) down by 50% and replaced the void with extremely unreliable sources of massive renewables (wind/solar) which was increased by 10X compared to 30 years ago and natural gas by 2X from Russia.

They did it entirely because burning coal emits CO2. They did it to meet commitments in the fake climate crisis accord. This was a self inflicted decision based entirely on the politics of the fake climate crisis.

Now, they have to back track because of the laws of energy and physics in the real world. Those laws are indisputable and make it impossible to ever replace fossil fuels with just wind and solar.

https://www.cleanenergywire.org/factsheets/germanys-energy-consumption-and-power-mix-charts

So the UNTHINKABLE is happening in Europe!

They're actually having to restart coal burning plants that were shut down because of the fake climate crisis. This is an outrage and embarrassment for the green party and also a piece of news that they are trying to minimize coverage of.

https://www.dw.com/en/germanys-energy-u-turn-coal-instead-of-gas/a-62709160

Just a few quick comments. overall a good piece of research

Estimated Costs of Crop

Production in Iowa–20

Ag Decision Maker

https://www.extension.iastate.edu/agdm/crops/pdf/a1-20.pdf

Overall every farm is different. Overall a good piece of research. A lot of price change after 2021,and still changing. Some quick exampels:

Here on my farm Nitrogen cost are higher $600/ ton compared to $403 used in example

Crop insurance rates are higher $8-$12 higher for corn

John " From the summaries on page 13 , production costs per bushel appear to have steadily decreased".

If you look at page 13 you notice that they used 165 bu / acre till 2018 then they switched to using 30-year trend yields.*

*Foot not 1/ Starting in 2019, reference yields for corn and soybean budgets reflect 30-year trend yields.

More latter busy day today

cutworm,

Thanks so much for your expert comments as a professional crop/food producer..........farmer.

https://www.marketforum.com/forum/topic/88331/

Q. “When is an environmentalist not an environmentalist?”

A. “When it comes to industrial wind turbines”

The month of August saw fresh inflation highs, with Eurozone inflation jumping to 9.1%. Energy was unsurprisingly the biggest driver, although the annual rate of energy inflation fell to a slightly less staggering 38.3% from 39.6% in July.

"But that only tells part of the story. German year-ahead power prices, Europe’s benchmark, hit €1,000/MWh per megawatt-hour for the first time on Monday. At start of 2020 it was just below €40."

That will be devastating for consumers when they face higher bills, though the shock will be cushioned by government price caps and subsidies."

metmike: €1,000/MWh divided by €40/MWh = 25 times higher this week vs 2020! This would be like paying $50 for a gallon of gasoline at the pump!

++++++++++++++++++++++++++

Updated Aug. 31, 2022 9:13 am ET

https://www.reuters.com/world/europes-alternatives-if-russia-cuts-off-gas-supply-2022-08-30/

metmike: They continue to deceive about this key factor....... the OVER reliance on unreliable fake green energy and closing of coal plants in favor of natural gas because it has only 50% of the CO2 emissions as extremely reliable coal generated power.

https://www.marketforum.com/forum/topic/88331/#88344

The headlines everywhere should read: "Coal generated power plants rescue Europe's energy crisis!"

But that would be admitting the truth and acknowledging just one of the many indisputable fatal flaws in the fake green energy schemes based on laws of physics, geology/mining, engineering, energy, environmentalism, ornithology(birds), chiropterology(bats) and meteorology.

It never ceases to amaze me that the militant climate people totally ignore fossil energy shortage and the threat of people freezing to death all in an effort to achieve THEIR goals. If you spend anytime on twitter and challenge some of these people, the fold like a broken chair.

About Nitrogen fertilizer:

I talked to my supplier yesterday and she could not get any prices even for delivery now in the off season. I normally contract some this time of year. She said none to be had right now, that might just be a tie up at the river terminal at this time or ....she had no idea.

Thanks cutworm! Please keep us posted as a producer actually dealing with the reality of fertilizer dynamics first hand.

We can pick out different news articles that say certain things(many of them written to downplay the seriousness of the crisis) and the majority of them are written by sources that are fake green energy cheerleaders that try to hide the truth of the biggest boondoggle in world history.

https://www.marketforum.com/forum/topic/88534/

metmike: They almost all connect this issue with Russian gas and are protesting that but have actually been bamboozled with a fake green energy policy scheme for the past 2 decades and energy decisions based on THAT are the real reason.

Every source is trying to blame Russia and the Nord Stream gas issues.

The real reason is Europe's really bad energy policy decisions replacing CO2 emitting fossil fuels

with fake green energy and natural gas, instead of extremely reliable coal.

Here it is again with a picture/graph that shows it EXACTLY!

https://www.marketforum.com/forum/topic/88331/#88344

This was caused by the fake climate crisis, junk science, DISinformation about environmentalism and crony capitalism in cahoots with governments that imposed agenda, based on commitments in the completely fraudulent Climate Accord.

If Russia caused this, then how did Europe do so well more than a decade ago BEFORE the Nord Stream natural gas pipelines to deliver natural gas to Russia?

Answer...........coal(and nuclear).

+++++++++++++++++++++++

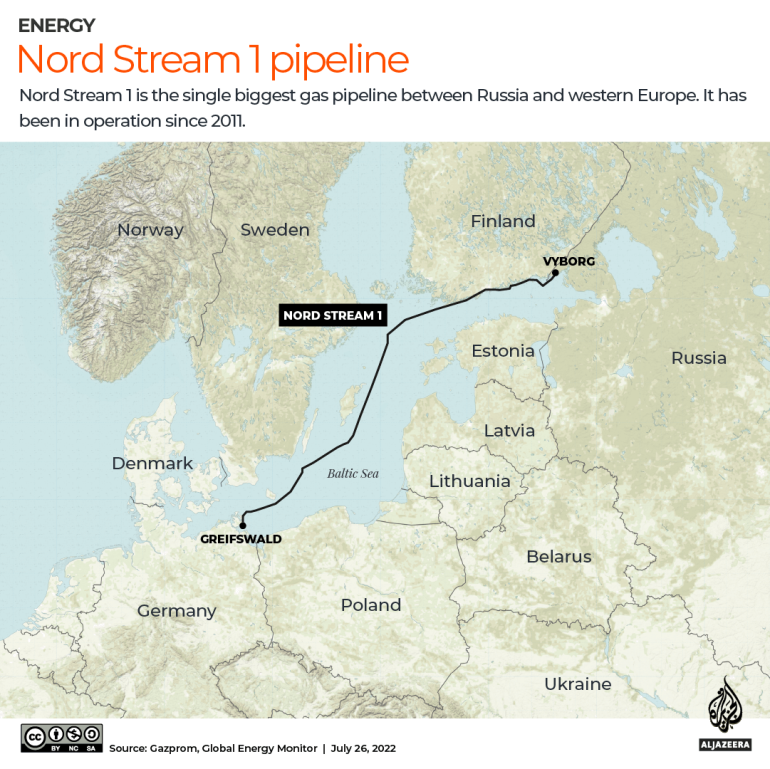

https://www.aljazeera.com/news/2022/7/26/explainer-nord-stream-1-gas-pipeline-russia-germany-europe

https://en.wikipedia.org/wiki/Nord_Stream

The Nord Stream projects have been fiercely opposed by Central and Eastern European countries as well as the United States due to concerns that the pipelines would increase Russia's influence in Europe, and the knock-on reduction of transit fees for use of the existing pipelines in Central and Eastern European countries.

++++++++++++++++++++++++++++++

Countries by natural gas proven reserves (2014), based on data from The World Factbook. Russia has the world's largest reserves.

metmike: See how dumb it was to shut down coal burning plants and switch to Russian natural gas?

Russia and the Middle East have most of the worlds natural gas.

I've been warning that this was going to happen for a long time:

Killing Coal

Started by metmike - Nov. 21, 2021, 10:57 p.m.

It's mind boggling to me how they are completely covering up the biggest reason for this in Europe and feeding people what they want them to think.

They just keep making things up as they go to avoid telling the truth about the REAL reason.....see graph below.

This energy crisis has been inevitable from the get go because of the impossible fake green energy schemes. It had to happen because of the laws of physics and energy. Plans that blatantly violate them using crony capitalism and government imposed mandates that are actually wrecking the environment in the long run with the worst environmental energy source by several orders of magnitude.........wind.

It's almost comical how they react so dishonestly at times.

Earlier this year, knowing their energy schemes are failing, they decided to vote in order to change the status of the fossil fuel, natural gas.

Now, natural gas is considered GREEN, even though it emits CO2.

Why is that? So that they can continue on this path and pretend its working, while changing the rules to make it work.

https://fortune.com/2022/08/08/eu-calls-natural-gas-green-critics-dont-buy-it/

How long will that last?

As long as they need natural gas to be green............they pretend that its temporary but their total solar/wind scheme can never work, especially since going totally to electric cars and eliminating the combustion engine will add an additional 40% of electricity demand to a system in crisis now because it can't meet the current demand.

And their plan is based on a grid scale battery storage system that doesn't exist and will have to be invented.

If they were honest and showed the truth, people would be flabbergasted.

++++++++++++++++++++

Again, this is the REAL reason below and also why they are re opening coal burning plants but trying to hide it.

Going 100% to renewables and electrifying cars can NEVER work. NEVER as in NEVER, EVER can work and NEVER could work using their current blue print and Europe is just getting a glimpse at their energy future right now.

https://www.marketforum.com/forum/topic/88331/#88344

I've been predicting this exactly would happen.

Now it's happening and their efforts to deflect and cover up the REAL reasons are disgraceful/pathetic.

You can redefine the laws of nature and call the beneficial gas, CO2=pollution and make up fake green energy, anti environmental schemes on paper and sell this climate/energy snake oil to the world for crony capitalism and political agenda's but every single time you apply that in the real world, the laws of nature, physics, meteorology, climate and energy win.

The planet is massively greening up during this scientific climate optimum for life and we are almost as warm as the previous 3 warmings like this in the last 3.500 years but still not as warm as the Holocene Climate Optimum from 9,000 to 5,000 years ago.

To put it more concisely.

Coal derived energy and its interests must be shunned and obliterated(their main, extremely reliable source of energy in the 1990's) using whatever false narratives, changing of the goal posts, anti science/environmental deceit and damage to the energy delivery system/consumers.

There are choices to be made in the real world based on accountability when green fairy energy plans go from paper/words/promises to physical realities.

https://wattsupwiththat.com/2022/09/08/breaking-fracking-ban-will-be-scrapped-in-the-uk/

https://wattsupwiththat.com/2022/09/07/putin-responds-to-truss-eu-energy-price-cap-keep-freezing/

“Severe and long-lasting recession”

The wave of insolvencies has just begun, and is “picking up speed”, writes Blackout News. “What we are seeing now is just the tip of an iceberg. Increased energy prices are affecting all industries, whether directly, as in the case of steel mills and bakeries, or indirectly, as in the case of shoe retailer Görtz. If politicians do not take countermeasures here, Germany will fall into a severe and long-lasting recession, with mass unemployment and a massive loss of prosperity.”

Mike Maguire

September 12, 2022 12:56 pm

https://www.marketforum.com/forum/topic/88331/#88344