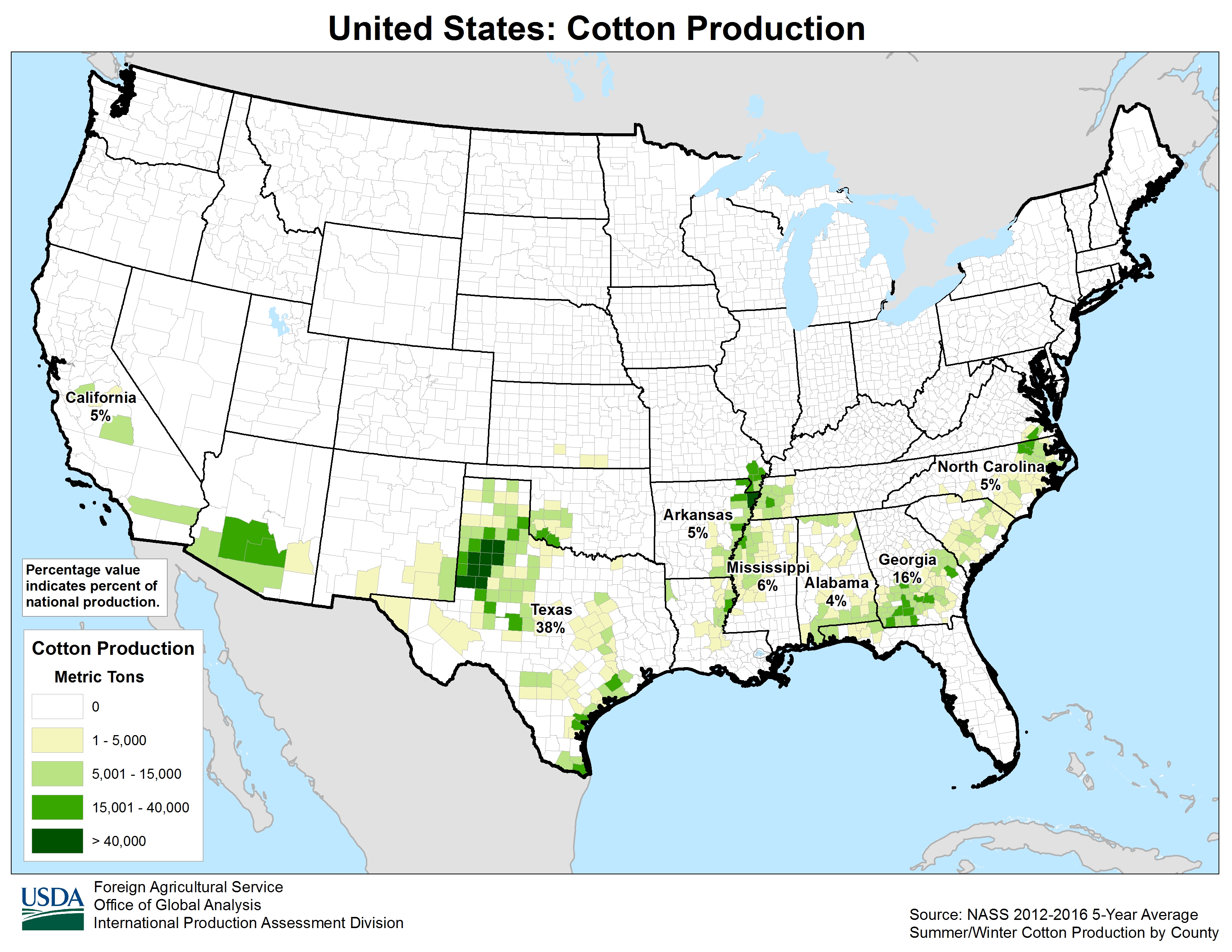

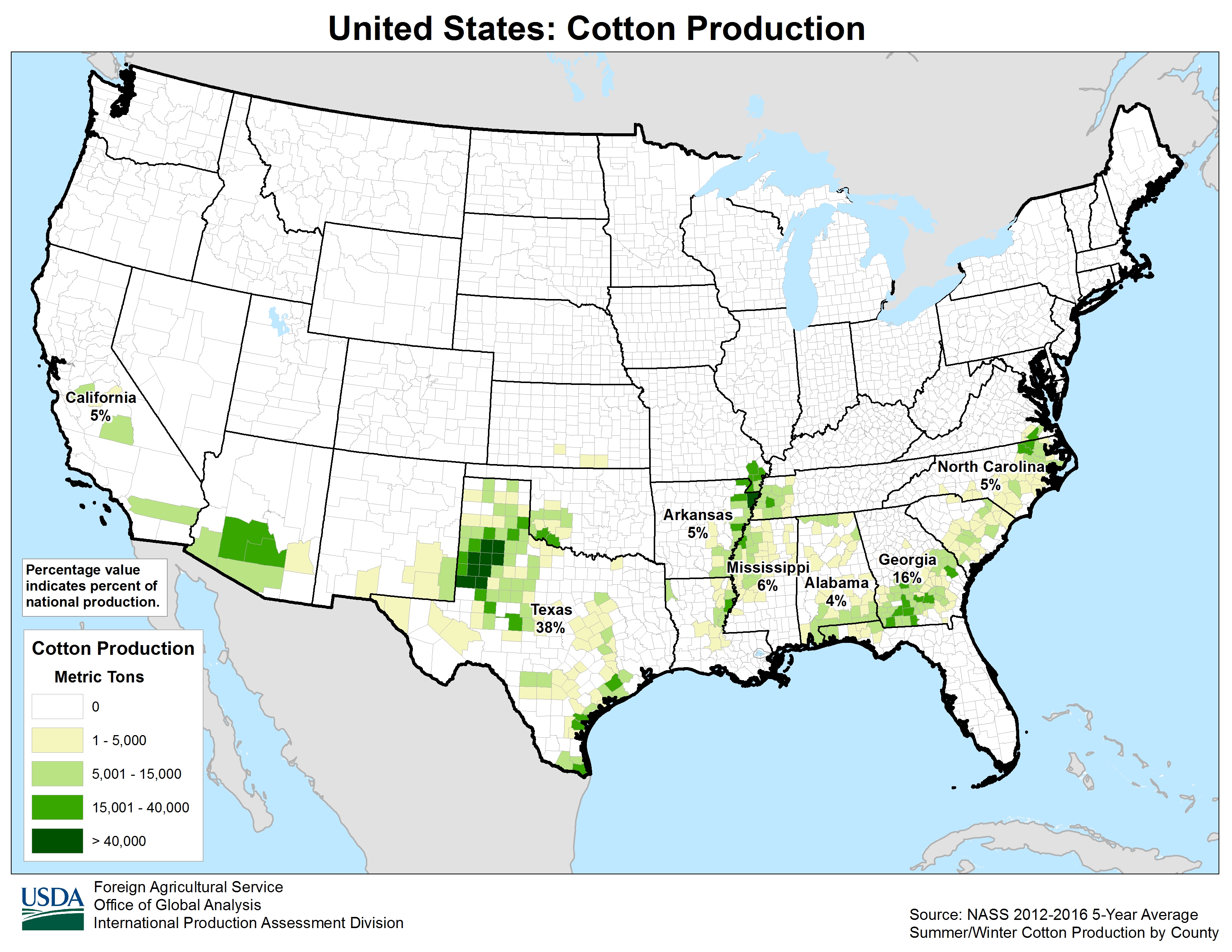

As expected, with Larry on top of it last week, the ratings for the cotton crop plunged, mainly because of the Georgia crop being devastated by hurricane Michael.

https://release.nass.usda.gov/reports/prog4218.txt

Gd/Ex dropped by a whopping 7%. P/VP increased by 6% with the VP increasing by a very whopping 5%.

Georgia crop that had catastrophic losses from hurricane Michael, went from 59% Gd/Ex to 16%.

P/VP went from 9% to an incredible 54%,

Here is a production map for cotton. This one shows the % production by state. Georgia, which had major damage from Michael produces a whopping 16% of the cotton crop, 2nd to only Texas which produces an even more whopping 38%

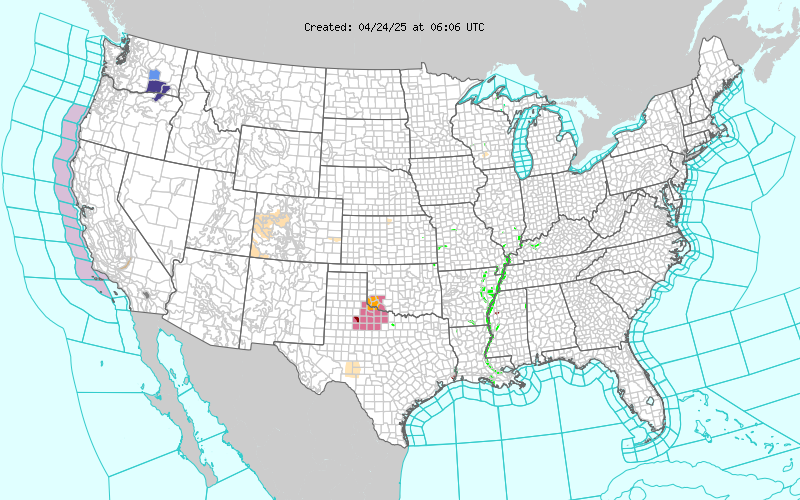

Here are the latest warnings across the country:. The dark purple is a freeze warning. The bright purple is a hard freeze warning. The blue is a frost advisory.

The potentially damaging cold has moderated in Texas. The heavy rain threat is mostly southeast of cotton country.

There will also be heavy rains in Texas the next week but the heaviest rains are predicted to be just southeast of highest producing cotton country, although there will be UNWANTED, less heavy rains for some of TX cotton country.

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Previous comments on cotton from last week:

By cliff-e - Oct. 14, 2018, 11:43 p.m.

Is the production needed? Trump screwed the cotton market as well.

Reductions by China.

http://apps.fas.usda.gov/export-sales/cottfax.htm

++++++++++++++++++++++++++++++++++++++++++++++++++++

By metmike - Oct. 15, 2018, 12:27 a.m.

Actually, cotton prices this year have been around the highest they've been in the past 4 years:

Historical price perspective on cotton. Charts below.

3 month-major top in June!!

| |

| |

| |

| |

Good morning, MarketForum

Last week I posted, prior to the report, that I opined a daily and weekly LOW had been achieved in cotton. The implication being cotton should rally for several/many weeks.

The report had minimal effect, but the hurricane certainly changed the fundamentals. (Proof, in my opinion, that technicals precede fundamentals.)

I am currently long calls that expire Friday. Looking for a daily 'high' close Tuesday or Wednesday to close out trade. Will look to purchase futures next week in next daily low time frame.

Thanks tjc,

Today's price weakness, despite the confirmation of catastrophic losses in Georgia last weeks suggests that the cotton market doesn't care.

Lack of a stronger price spike higher last week from Hurricane Michael indicates what cliff suggested.............that this production does not matter that much.......at the moment at least.

It sounds like continued drops in China importing CT from the US will largely depend on a good Indian crop to provide replacements at a low enough price to make it cheaper than paying the 25% tariff to the US.

Regarding Michael, this undoubtedly (in my mind at least and is supported by the new weekly condition in GA/AL/NC in addition to assuming ~100K loss in FL) will end up on its own having caused at least a 5% drop in the US crop and possibly as much as 8% from those 4 states, combined, if the worst fears are realized. Just a 5% US crop drop would be a new record high for any one hurricane going back at least to 1964 per USDA records. The current record holders for the US crop as a whole are the 3% losses from both 1999’s Floyd (530K bales NC/SC) and 2016’s Matthew (410K bales NC/SC/GA). Next are the 2% losses from both 2017’s Irma (400K bales GA) and 2008’s Gustav (300K bales LA/MS). 2004 also had 2% losses (350K bales), but that was from a combo of 3 storms. Why is Michael's US damage % much worse? It was a combo of tracking right through the heart of a very highly concentrated large crop (SW GA/SE AL/NW FL), it was still getting stronger all the way to landfall thus meaning slower weakening after landfall, it wasn't small, the dense crop started only 50 miles inland and largely was all within 200 miles of the Gulf, and open bolls were near 90% open and with under 20% harvested.

Note that in addition to Michael SE losses, TX is in the midst of really lousy harvest wx. First of all, ~3 MBs of the crop had sub 32 lows yesterday with many hours of sub-32 in most cases. This is a good 2 weeks earlier than average. About 20% of the TX crop was then still immature (bolls still unopened). So, ~600K bales may have had some growth stopped for the season. That could mean ~100K lost (wild guess).

In addition regarding the open bolls, high winds yesterday gusting to 50 in more northern locations behind the front may have lead to some bolls blown to the ground (another 100K??). Furthermore, it has been quite wet and chilly in much of the prime areas of NW TX/SW OK with 3-5” of rain already haven fallen this month at Childress and Lubbock with another 1” or so forecasted in much of the area the next 7 days along with cloudy/well below normal temperatures. Normal rainfall for the entire month is only ~2”. This combo of wet/cold cannot be good for the harvest and will undoubtedly lead to still more TX (and SW OK) losses in the coming weeks. Considering how much open, un-harvested CT is still there, a several 100K loss from this alone wouldn’t be surprising. And with El Niño supporting the wet/chill, this overall pattern may even continue into November.

So, what I think will be 5%+ losses from Michael will very likely not be the full story this harvest season when all is said and done. Could we eventually see a grand total 10%+/2MB+ US crop drop from the combo of Michael and TX/OK harvest losses? I don’t at all think that would be a stretch based on doing the math. Furthermore, a 10%+ US harvest season loss wouldn’t be unprecedented as 12-15% harvest season losses from a combo of causes actually occurred in 1969, 1993, and 1995 and not too far below 10% occurred in both 1999 (8%) and 2000 (9%). Then the next question would be, IF losses like this were to end up being the case, whether or not the market would then be able to continue to absorb the US crop reductions via export losses to China. That’s the big unknown. I have no idea and will not even try to predict that. Currently, it isn’t suggesting it will rise anytime soon and could have more down days like today. My goal as a poster is to provide data/facts rather than to make trade recommendations.

The latest NWS extended guidance is pretty wet in TX. Also wet in the Midwest in the 8-14 day period.

I don't agree with it being that wet.

We've been having some great discussions on cotton over the past 10 days Larry! You also started the discussion on Michael early this month when nobody had a clue that it would ever become a major hurricane.

By George, I think we should make this our post of the week!

Invest 91L/possible future Michael in W Caribbean as of 10/5

Started by WxFollower - Oct. 5, 2018, 3:37 p.m.

" I believe that the newly designated Invest 91L, currently in the western Caribbean, is likely going to turn into TS+ Michael next week in the Gulf. Keep tabs on this one, folks, as it could end up having big impacts on parts of the SE US late next week."

https://www.marketforum.com/forum/topic/14525/

https://www.marketforum.com/forum/topic/14717/

Previous Cotton posts:

https://www.marketforum.com/forum/topic/14719/

https://www.marketforum.com/forum/topic/15065/

https://www.marketforum.com/forum/topic/15192/

https://www.marketforum.com/forum/topic/15277/