As we've been projecting, there's a pattern change coming up which will increase rain chances from west to east, starting in week 2. Actually late in week 1 for the far WCB. The Plains are still looking wet.

However, the back side of the upper level tough in the Eastern US will still deflect/dry up rain chances in the ECB and make it harder to rain into early week 3?

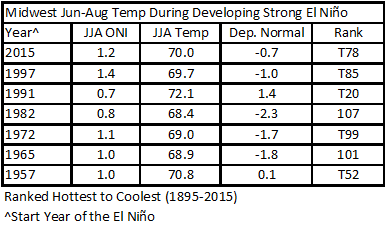

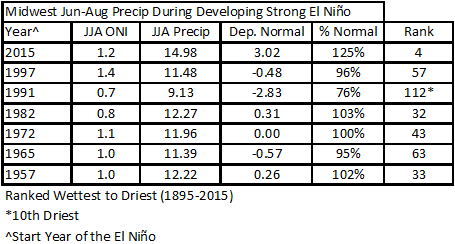

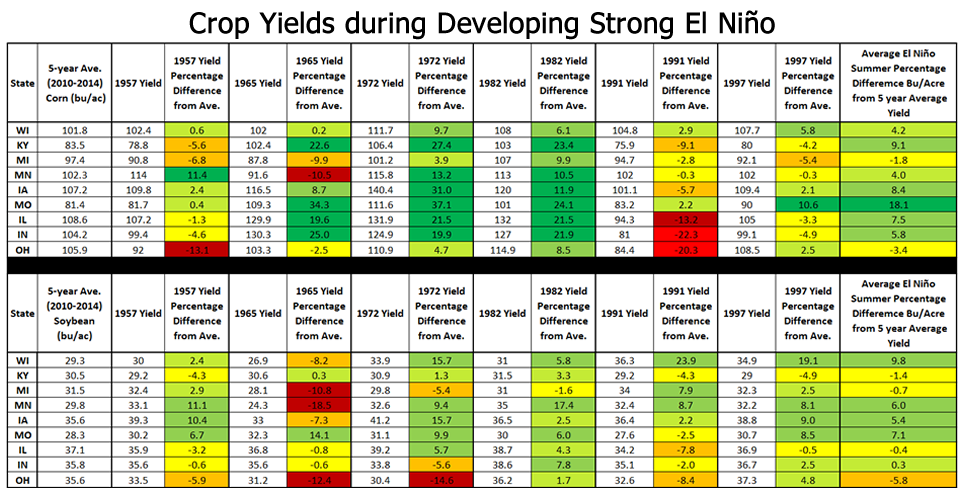

This WILL BE an El Nino Summer. The weather analog is favorable for good growing weather but not 100% because each El Nino year is different.

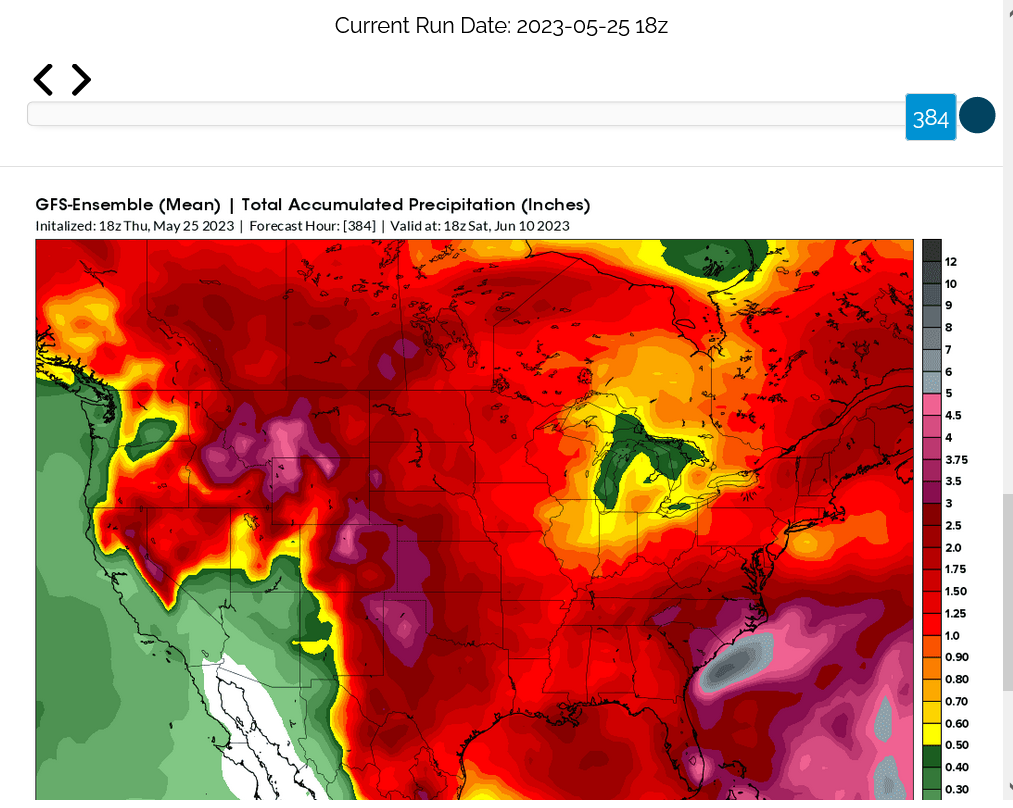

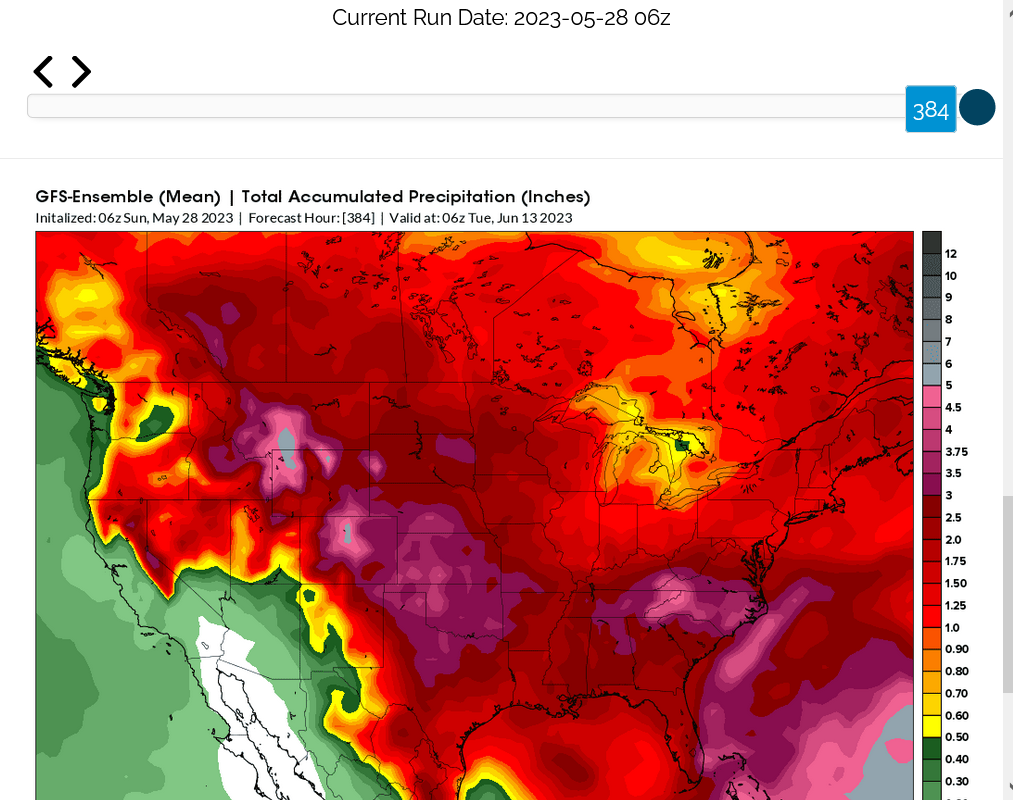

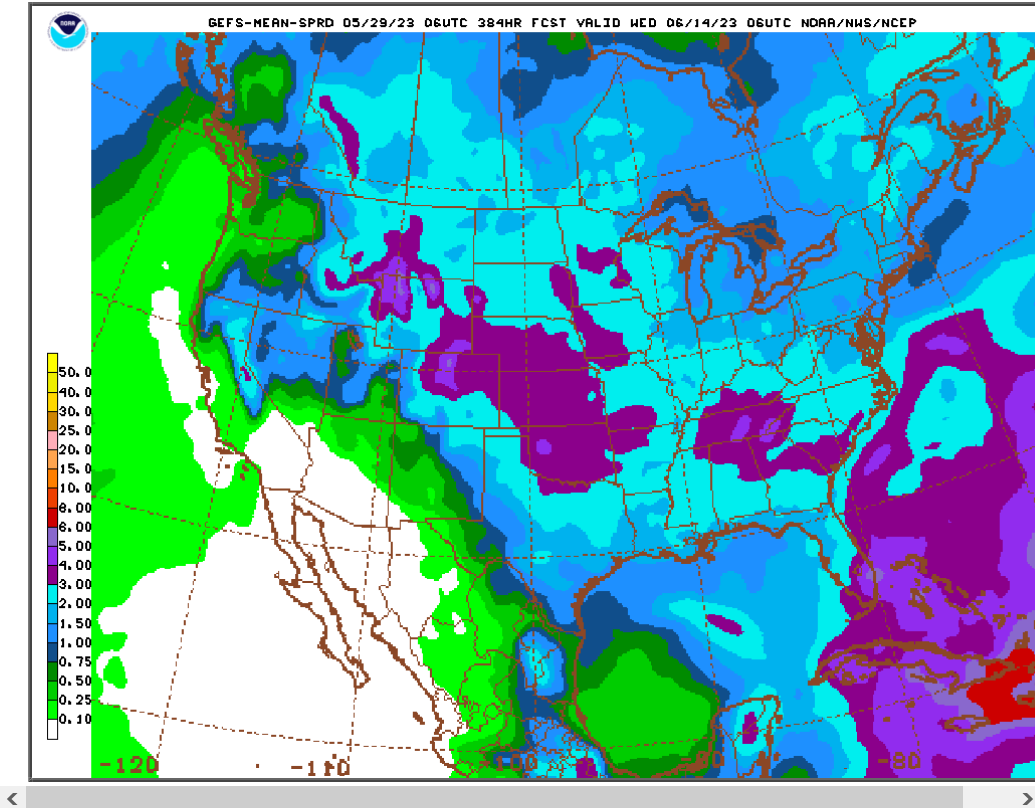

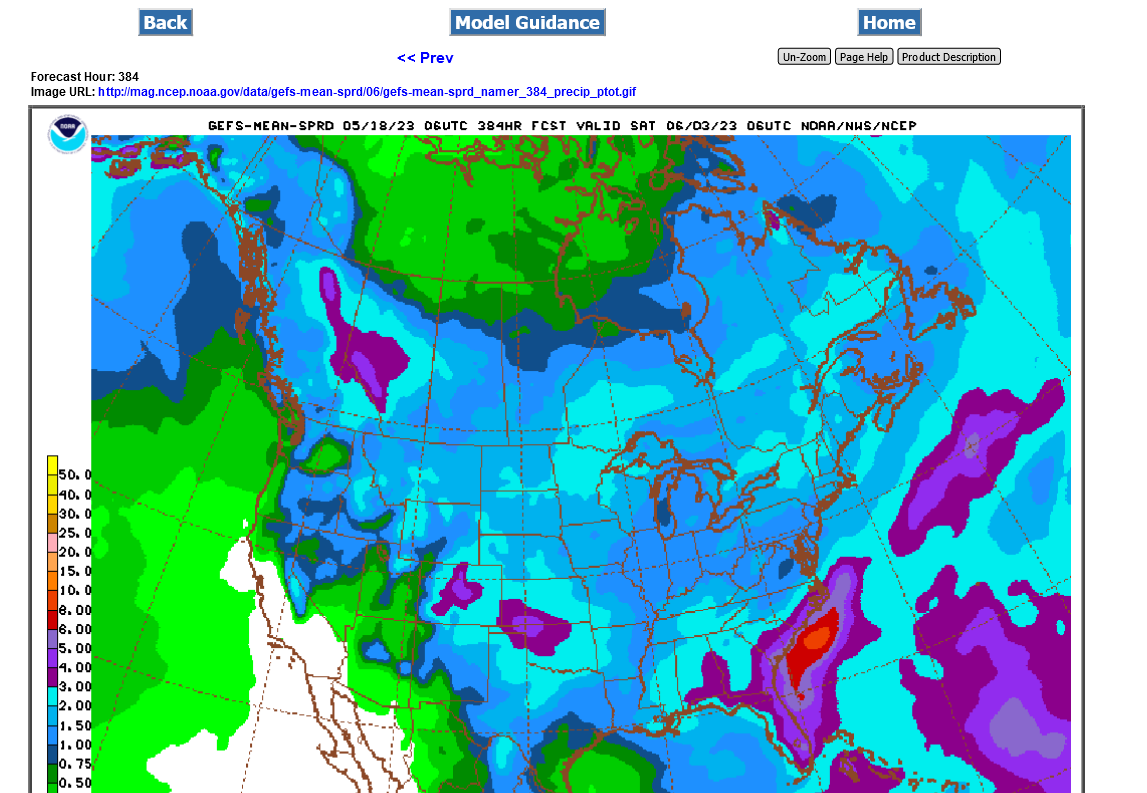

Note the changes below in the last 60 hours. Rains increasing from west to east but still not much for IL-IN-OH.

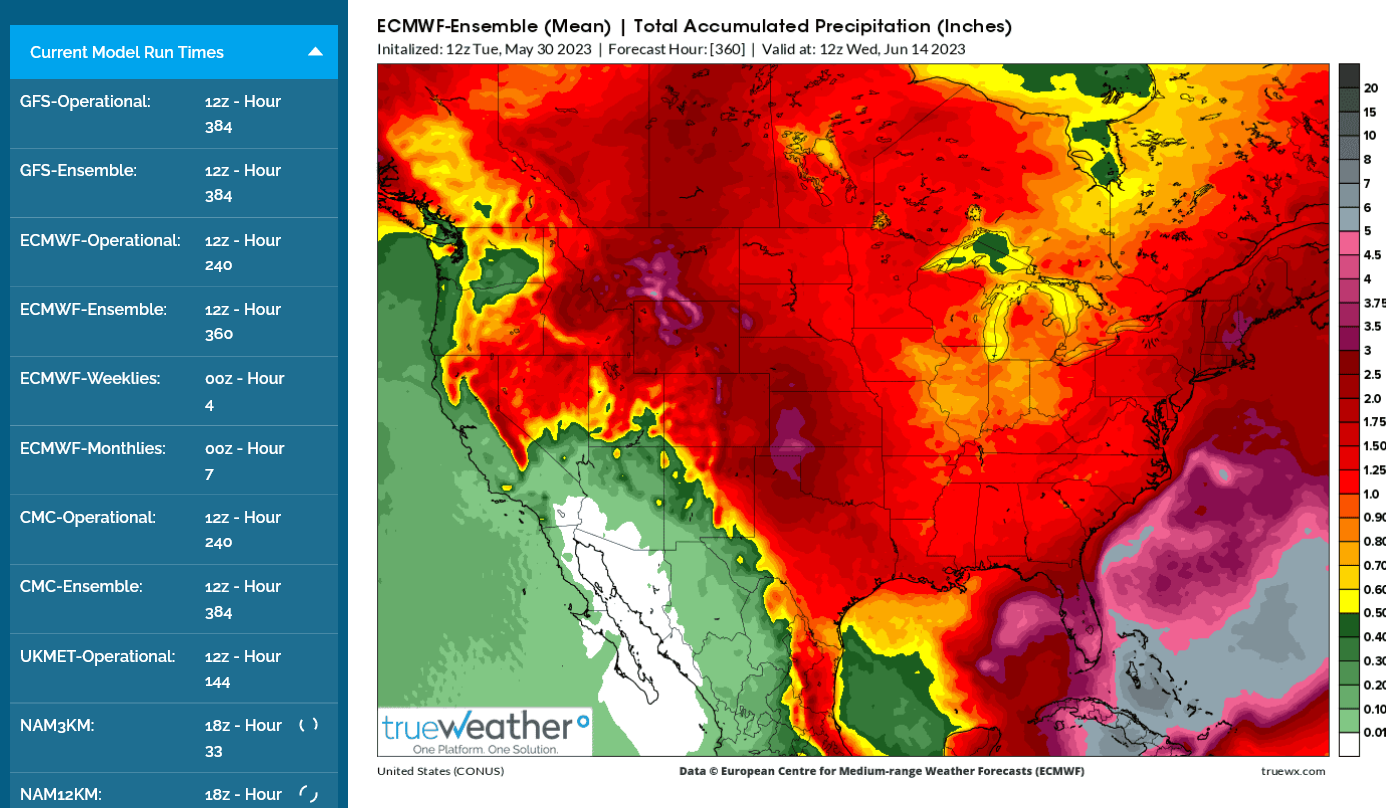

1. Total rains from Thursday evening forecast

2. Total rains from early Sunday forecast

+++++++++++++++

+++++++++++++++++++++++++

+++++++++++++++++++++++++

Though I pay good money for the service above and they a great job........their color shading on the maps above really stinks!

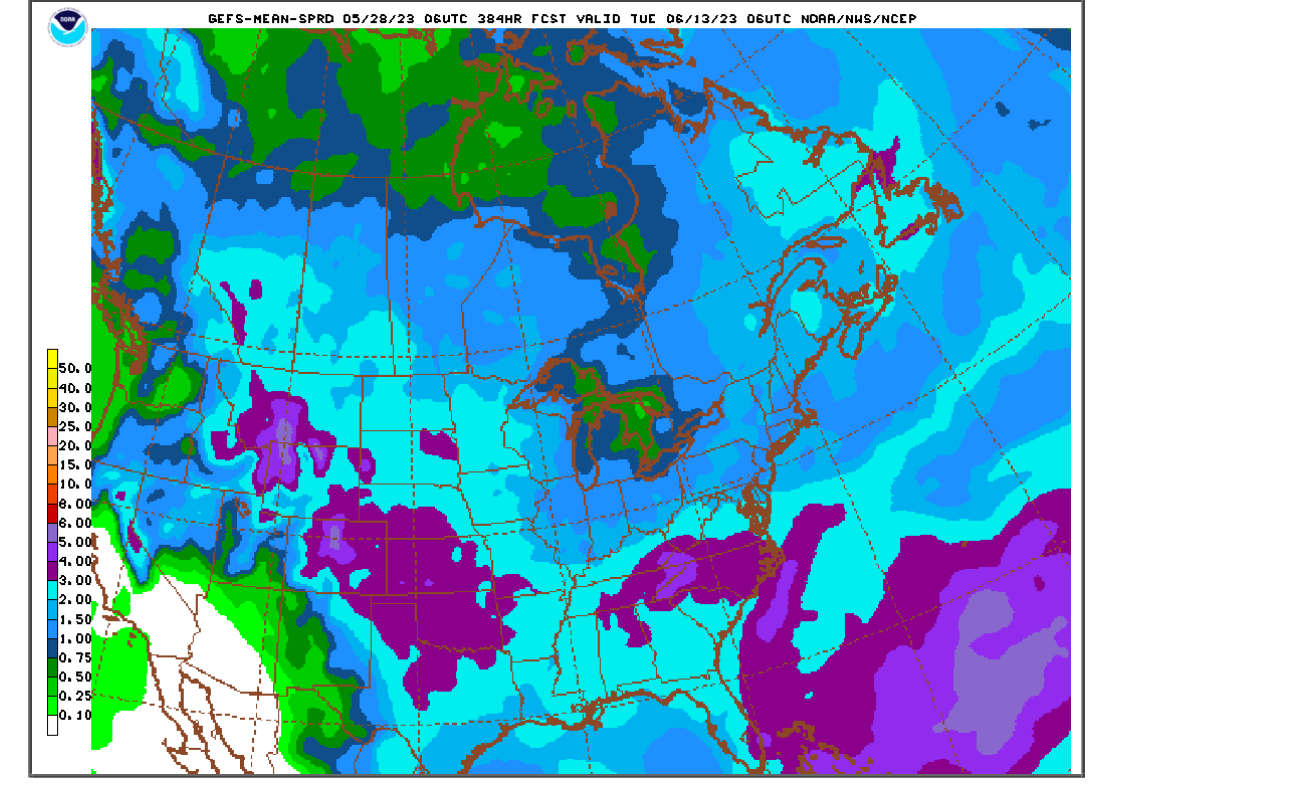

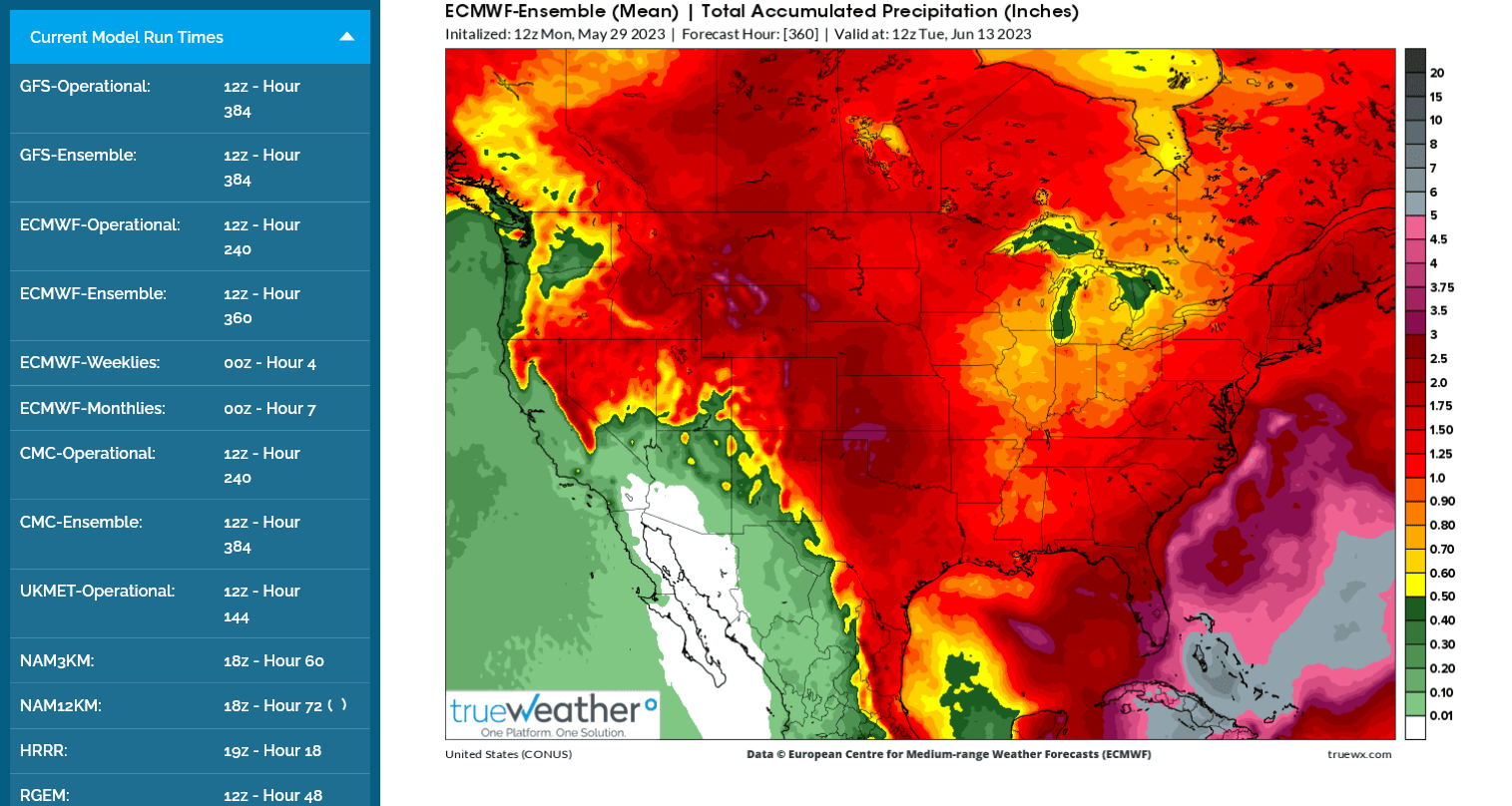

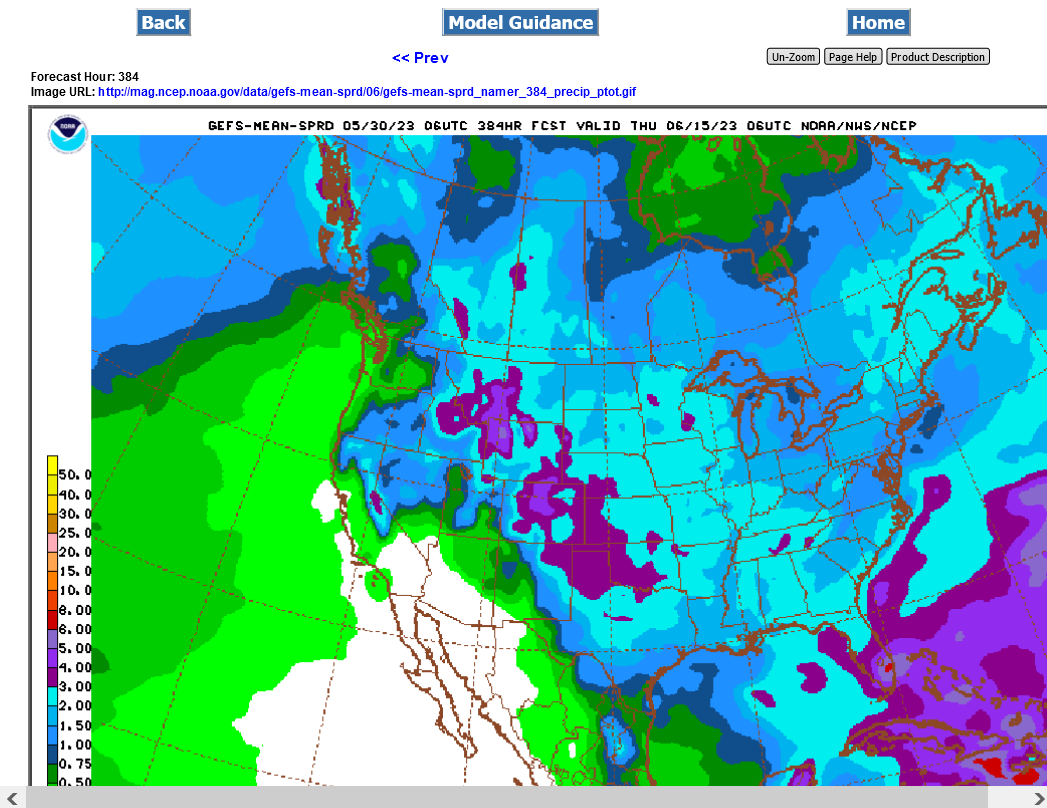

Here's a better FREE version from the last 6z GEFS. The light blue is 2+ inches. Anything inside of that is below average rains. The BELOW average area may be shrinking this week. If so, the bearishness of the C and S markets will be increasing. However, if that dry area does not shrink or if it expands..........BULLISHNESS will increase in the C and S markets. ALL of those areas need rain ASAP to maintain very high yield potential!

Only 1 year, 1991 featured notably hotter and drier than average growing season weather when there was a strong El Nino developing!!!

This greatly increases the odds for above trend yields this Summer for all crops in the Midwest and potential for RECORD yields.

https://mrcc.purdue.edu/mw_climate/elNino/impacts.jsp

so corn and bean looking lower tom night?

CC,

good question.

there are several other things to consider in the current high risk uncertain environment but in most years, wx is at the top.

if the pattern continues to increase rains farther east the next few model runs, then grains will likely be under heavier selling pressure as the week goes on.

Here are some items to consider.

funds already have a huge short, which makes me want to be long on bullish wx But not on weather getting less bullish.

corn set off buy signals last week with a technical bottom and strength in all indicators……but bullish wx was a huge factor.

the strong day Fri could have been short covering before the holiday with the rains still looking like week 3 and the 2 week forecast still bullish. I wouldn’t want to be short tomorrow if there was no rain in the forecast. Hot and dry and we could be limit up on Tuesday. Much more upside to bullish than downside to bearish.

some areas in the Cornbelt may start to lose yield potential if it stays dry for another 2 weeks Considering There will be some heat coming up this week. So the timing of the pattern change is critical. delaying the rains or not keeping them moving east into IL,IN,OH can still have a bullish spin.

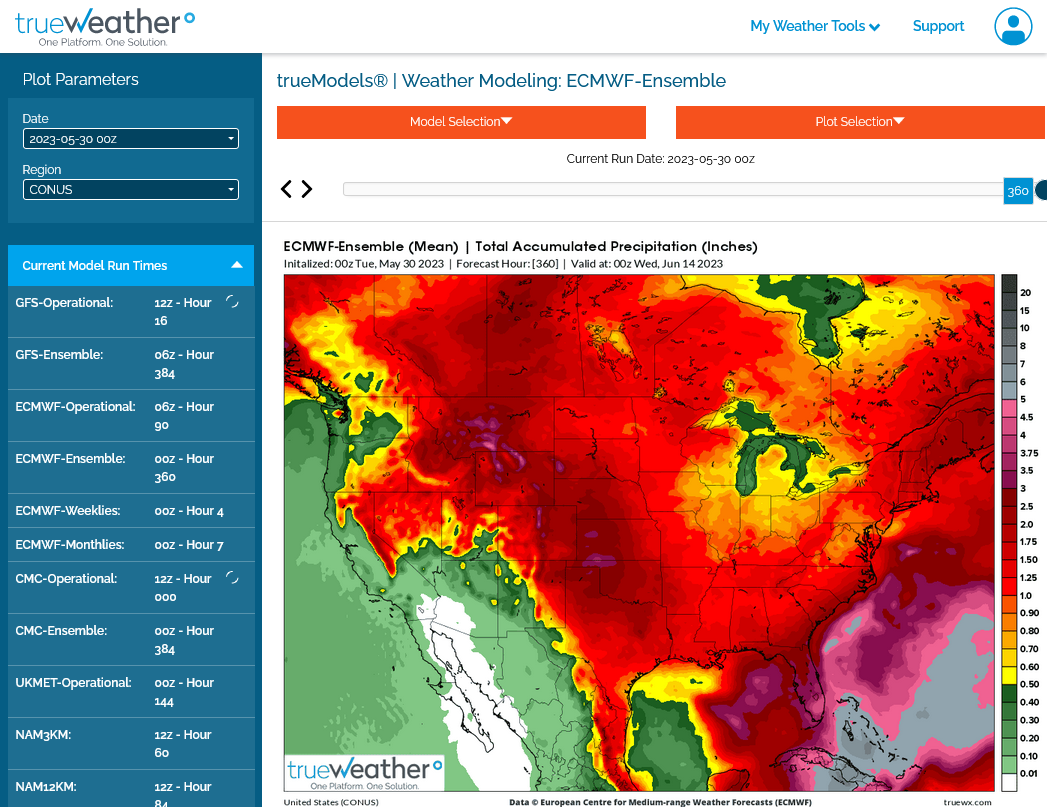

the European model is notably drier than the GFS. This pattern is NOT one with a Bermuda High along the East Coast pumping in copious moisture Which is high confidence widespread rains with active wx systems in the midwest.

instead a trough in the East and northwest to west flow in the Midwest makes the perturbations in the fast flow less efficient rain producers.

this means there WILL be rain makers coming in from the west in the new unblocked upper level flow pattern but they will not eradicate dryness in some areas.

Changing coverage and amounts ahead of each system could be great short term or day trades in June.

the pattern will need to get wetter for the grains to just collapse lower. If it slowly gets wetter, then we take big chunks of risk premium out, with bounces possible in between.

over The last 24 hours, the progression of rains eastward has sort of stalled out On the wettest GEFS.

for instance, the one from 3 runs ago, took the 2 inch total rains for 2 weeks across all of IA.

2 runs ago pulled it back to c.IA.

1 run ago and back across all of IA.

last run and it’s pulled back again.

and this is the wettest model. The European model does not have 2 inches anywhere in IA Yet.

If that doesn’t change in the next day, we could see a continuation of the bullish spin on Friday when we open tomorrow night.

Thanks Mike keep us posted tomorrow

The last 0z EE was still pretty dry and bullish. However the lat 6z GEFS has gotten much wetter.

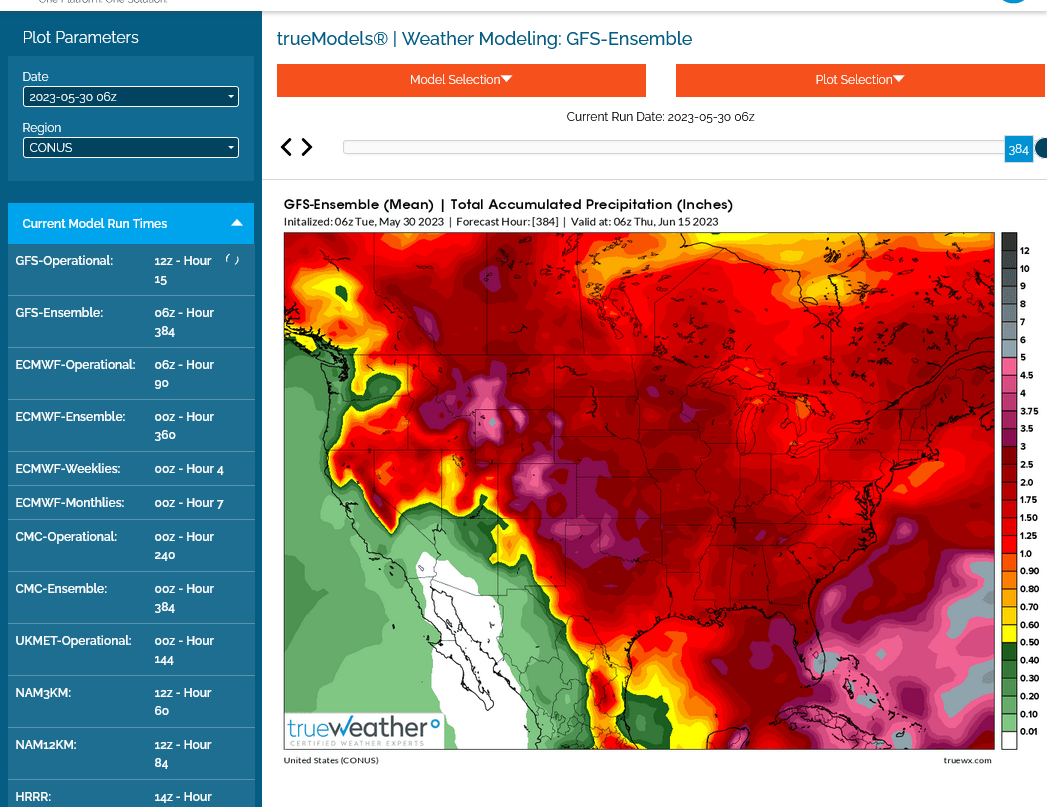

2 inches total almost everywhere in the Cornbelt now with 3 inches across MN to sw IA.

Wow, this is almost double the amount of the EE.

The biggest difference in the pattern is the GEFS builds an upper ridge in the Southern US to replace the trough.

so instead of the recent pattern of suppressing GOM moisture and reinforcing cold fronts going thru dry the GEFS new pattern features a more active jet stream with perturbations aimed at the Midwest with GOM moisture flowing north for rain making.

The EE hangs on to remnants of the old pattern thru 2 weeks.

the Canadian model looks like the GEFS even though the EE is the best model…….but can be wrong.

Here was the last 6z GEFS: Total rains thru 2 weeks/384 hours.

This seems too wet to me!

Let's compare that map to the same one from 11 days ago below which was MUCH drier on a day that featured the spike lows for this move earlier in the month.

https://www.marketforum.com/forum/topic/95198/#95274

"The last 6z GEFS run was DRIER for the central Cornbelt!! Possibly why we've recovered from very steep losses."

Perhaps I have no clue what I'm talking about I looked at the forecast earlier it showed rain in Iowa chance of thunderstorms each afternoon and now the latest forecast took all the rain out..

I know exactly what can cause that to happen, CC. It's called "being long/bullish"

https://forecast.weather.gov/MapClick.php?x=195&y=176&site=dmx&zmx=&zmy=&map_x=195&map_y=175

Current conditions at

Lat: 41.53°NLon: 93.65°WElev: 942ft.

Tuesday

A 40 percent chance of showers and thunderstorms, mainly after 1pm. Mostly sunny, with a high near 88. South wind 7 to 13 mph, with gusts as high as 18 mph. New rainfall amounts of less than a tenth of an inch, except higher amounts possible in thunderstorms.

Tuesday Night

A 40 percent chance of showers and thunderstorms. Mostly cloudy, with a low around 65. South wind 6 to 11 mph. New rainfall amounts between a tenth and quarter of an inch, except higher amounts possible in thunderstorms.

Wednesday

A 50 percent chance of showers and thunderstorms, mainly after 2pm. Mostly sunny, with a high near 88. South wind 6 to 10 mph. New rainfall amounts of less than a tenth of an inch, except higher amounts possible in thunderstorms.

Wednesday Night

A 50 percent chance of showers and thunderstorms, mainly after 2am. Partly cloudy, with a low around 66. New rainfall amounts of less than a tenth of an inch, except higher amounts possible in thunderstorms.

Thursday

A chance of showers and thunderstorms before 8am, then a slight chance of showers between 8am and 2pm, then a chance of showers and thunderstorms after 2pm. Mostly sunny, with a high near 89. Chance of precipitation is 40%.

Thursday Night

A 40 percent chance of showers and thunderstorms, mainly before 8pm. Partly cloudy, with a low around 67.

Friday

Showers likely and possibly a thunderstorm, mainly after 2pm. Mostly sunny, with a high near 89. Chance of precipitation is 60%.

Friday Night

Showers likely and possibly a thunderstorm before 8pm, then a chance of showers and thunderstorms between 8pm and 2am, then a chance of showers after 2am. Partly cloudy, with a low around 66. Chance of precipitation is 60%.

Saturday

A 50 percent chance of showers. Mostly sunny, with a high near 89.

Saturday Night

A 50 percent chance of showers. Partly cloudy, with a low around 65.

Sunday

A 30 percent chance of showers. Mostly sunny, with a high near 91.

You can get all the weather here:

https://www.marketforum.com/forum/topic/83844/

Scroll down to see the 7 day, and extended maps.

The key item discussed here and what ultimately matters the most this month to the crop and traders are the NEW days in the forecast at the end of the period that were not there way back on Friday and what is that telling us about the June weather pattern that we didn't know on Friday!

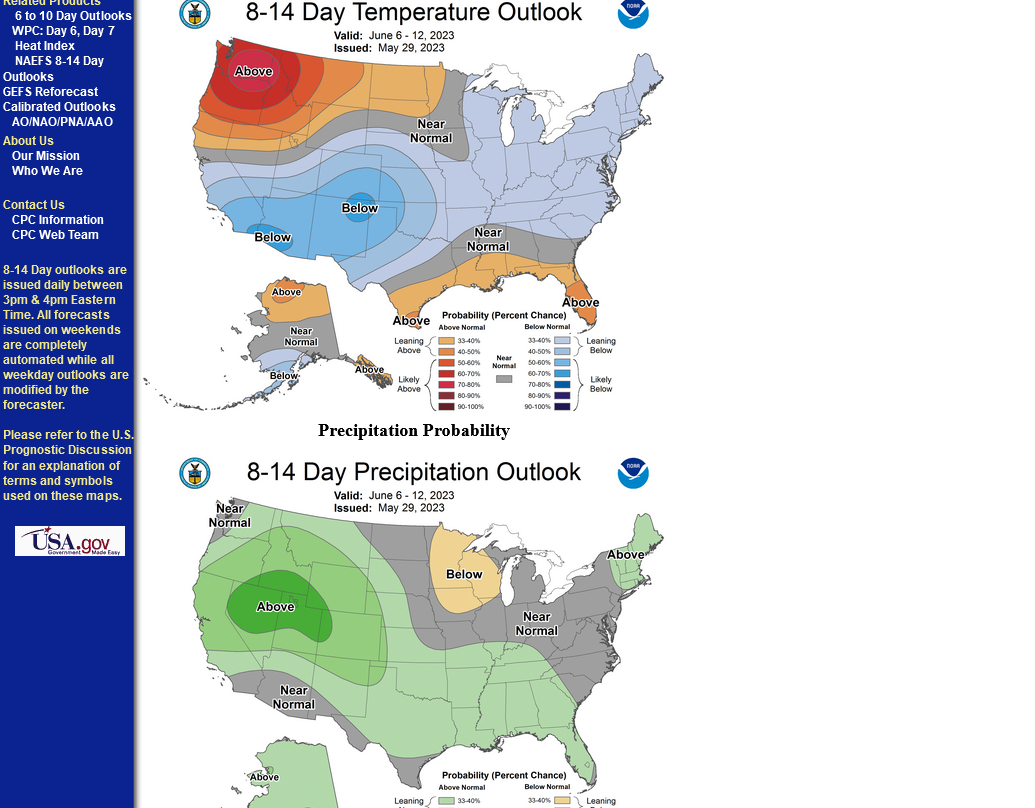

The NWS 8-14 day outlook captures that period. It was dry everywhere in the Cornbelt every day last week and in fact thru yesterday AFTER I started this thread.

Here it is today:

Despite the updates getting more and more bearish, the bulls can hang their hats on the European model that's the driest right now(but still not as dry as it was late last week):

What do I think?

At the moment, based on the latest guidance, I'm in the drier/less bearish camp of the EE based on the pattern. Dryness in the Midwest is NOT going away with this pattern. The GEFS seems much too wet.

However, The GEFS is often what the market trades and temps are NOT going to be hot in week 2+ with this pattern and there is no sign of a rain suppressing heat dome.

actually inaccurate ..i am not long corn .. would never have stayed in after the late week rally ..am long wheat and do like when the general grain tone is higher..so was asking...any thoughts regarding wheat specifcally?

MetMike

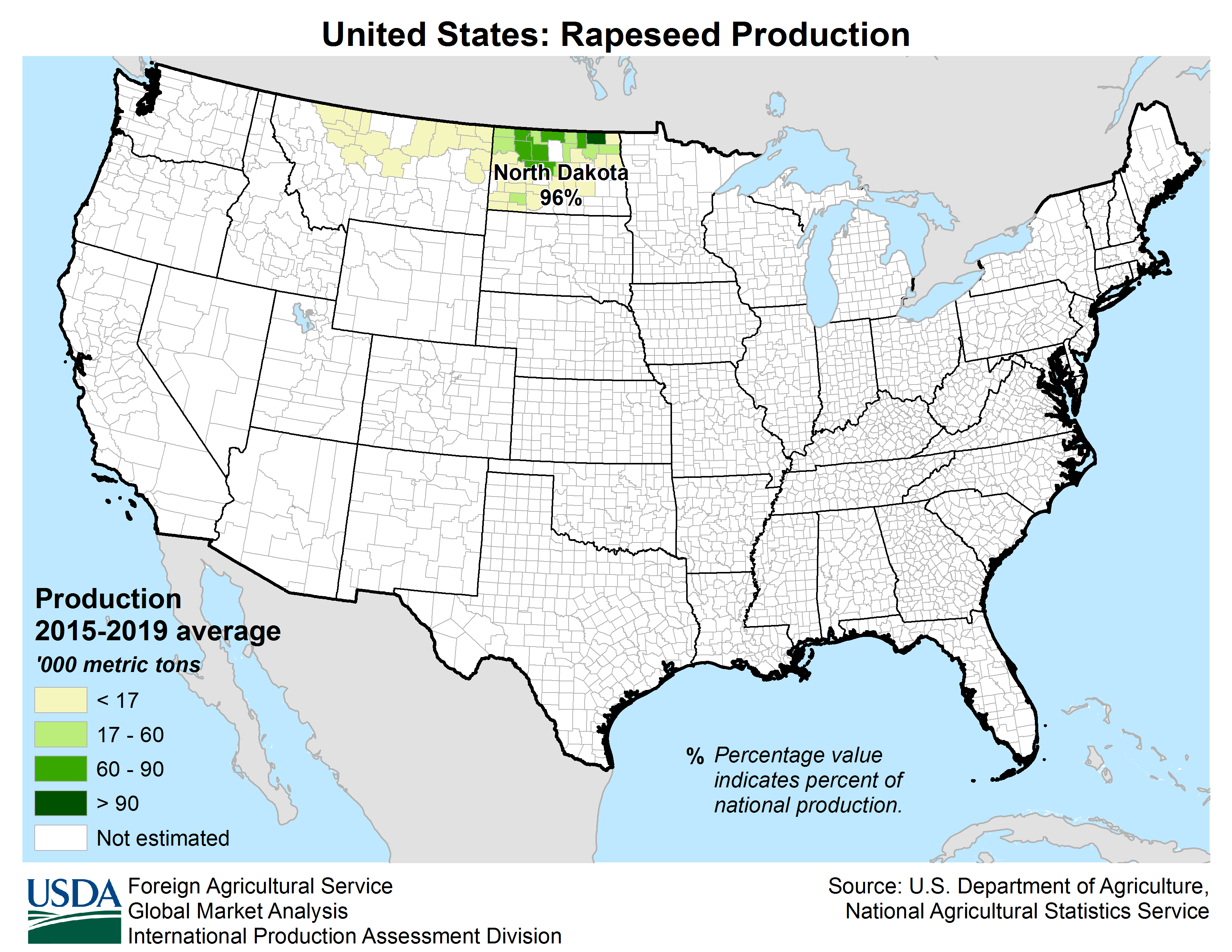

Any meteorological insight for canola?

Canola is a new one here, tjc! Are you trading it?

Since ND is the King of Canola in the USA, whatever the weather is like in ND can be a big factor. Canola and Rapeseed oil are basically the same thing.

I've never followed, no less traded it and have no clue on what planting progress is or important fundamentals needed to make a guess on where the price might be headed or how the crop might be fairly.

The ND weather, however is looking non threatening this month with the short term hot/dry morphing into cooler temps and increasing rain chances for ND.

https://www.agmrc.org/commodities-products/grains-oilseeds/canola-profile

Total production by year

https://www.uscanola.com/crop-production/

Production by states

https://www.uscanola.com/crop-production/promote-canola-acres/

https://www.uscanola.com/crop-production/

++++++++++

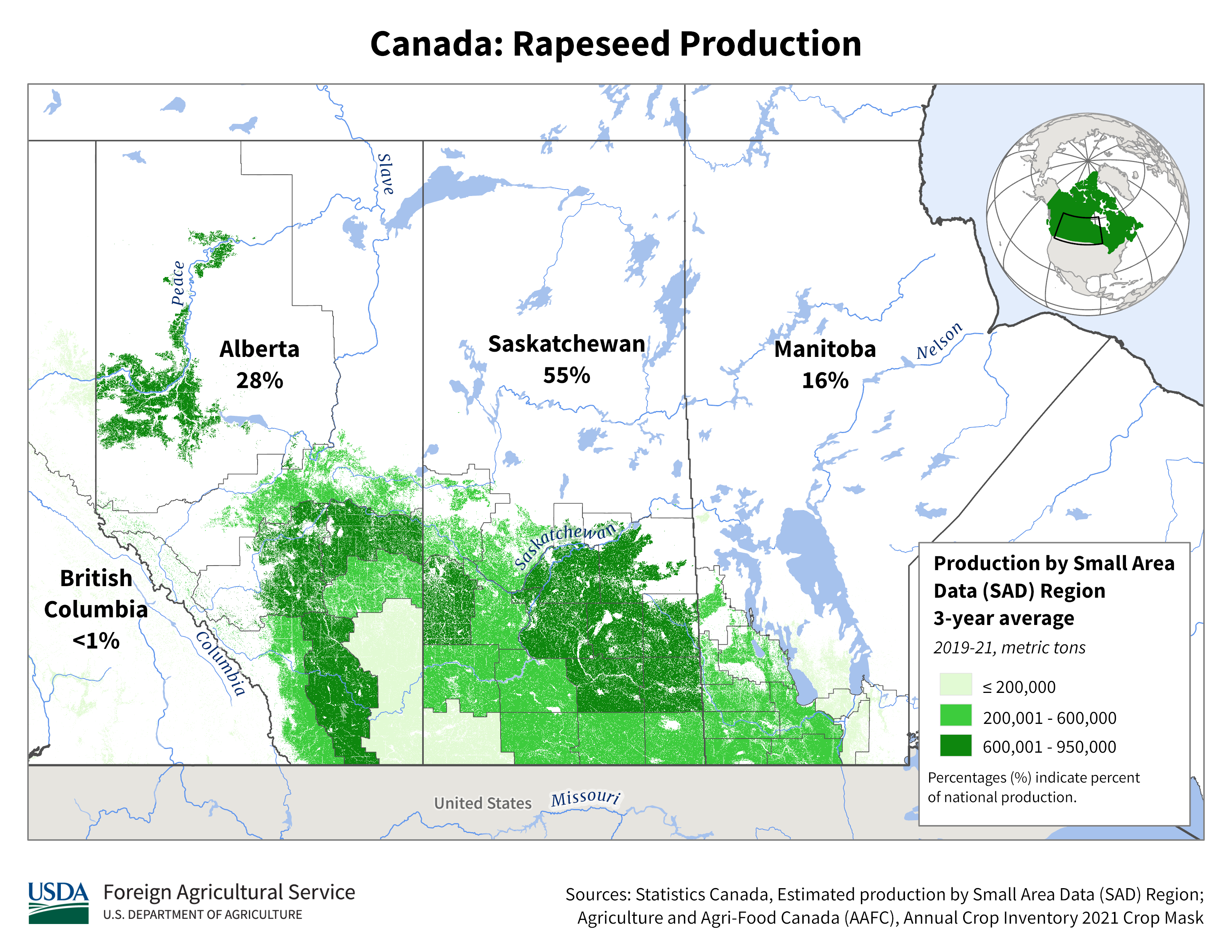

Canola is a HUGE deal in Canada. I think thats how the name rapeseed got changed to CANola! I'm thinking their production blows away the production in the US.

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Canada/Canada_Rapeseed.png

https://www.canolacouncil.org/about-canola/industry/

Canola is grown by 43,000 Canadian farmers who produce about 20 million tonnes of canola annually. Canola is now one of the most widely grown crops in Canada, generating about one-quarter of all farm crop receipts.

Every year, approximately 20 million acres of Canadian farmland turn brilliant yellow as canola comes into bloom. The crop is primarily grown in the western provinces of Alberta, Saskatchewan and Manitoba. Some canola is also grown in British Columbia, Ontario and Quebec.

Although canola acreage has remained fairly steady over the past decade, total production has increased because of increases in average yield. The industry’s goal is to increase average yields to 52 bushels/acre to meet global market demand of 26 million tonnes by 2025. Read more about the industry’s Keep it Coming 2025 strategy.

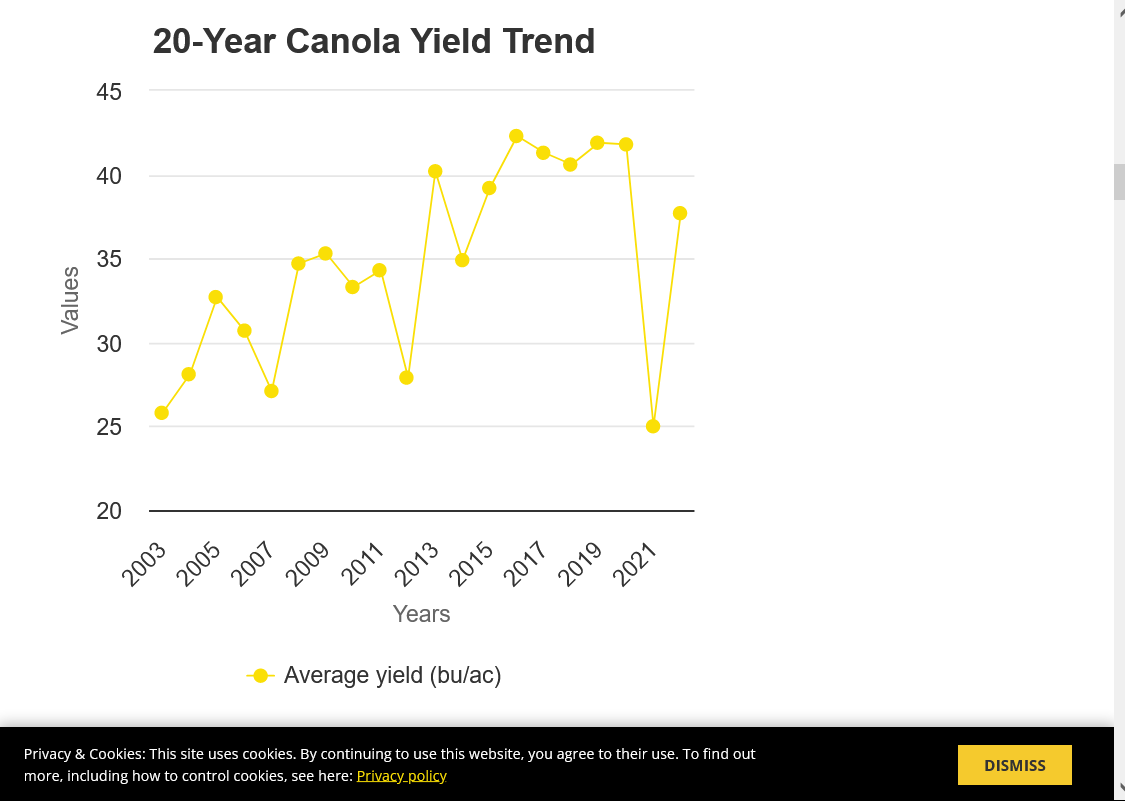

metmike: The natural La Nina drought hurt yields in 2021 which rebounded last year with better but not perfect weather. The increase in CO2 continues to boost yields of all crops.

metmike: The natural La Nina drought hurt yields in 2021 which rebounded last year with better but not perfect weather. The increase in CO2 continues to boost yields of all crops.

Cc,

On your long/bullish wheat position. The weather play is mostly played out with the massive drop in price already dialing in these beneficial rains.

How much they help the worst crop in KS the past several decades will be interesting to see. There will be some improvement in crop ratings but this is unprecedented to go from the worst ratings in modern history to beneficial weather in KS, during key heading/grain filling.

There should be a near record abandonment because the crop was too far gone in areas of the Plains but in the areas where it wasn't, especially the eastern districts could have decent yields.

NE has been hit with some bad wheat grain fill weather this month.

All the weather is here:

https://www.marketforum.com/forum/topic/83844/

All the grains under very early light pressure after opening close to unch.

You should distinguish between soft wheat (Chicargo) ,and hard red (Kansas City). Different stories different price outlook?

Good point cutworm.

the HRW/SRW spread that has been at an extreme has been collapsing recently But still at $2.

tonight, the HRW is down 14c but srw is only down the 6c.

another item is upcoming wheat harvest with seasonal pressure.

the usda had a shockingly low HRW number before the rains But world stocks increase and demand/exports of US wheat have been low.

+++++

the last 18z gefs was not as wet which is consistent with the drier EE but still not as dry. Im in the drier camp.

Canola

Yes, long.

Bought anticipating daily and weekly low timeframe, but as usual, bought Wednesday, a couple days too early.

Stop is in place.

European continues to project continuation of DRY in Canadian provinces. We will see.

(Might get drug down (out) by bean price decline. So far, corn helping out)

STOPPED-----------weather wet??

Thanks tjc!

This was the last 6z GEFS total rain. Pretty wet. Light blue is 2+ inches. The EE is still drier:

+++++++++++++

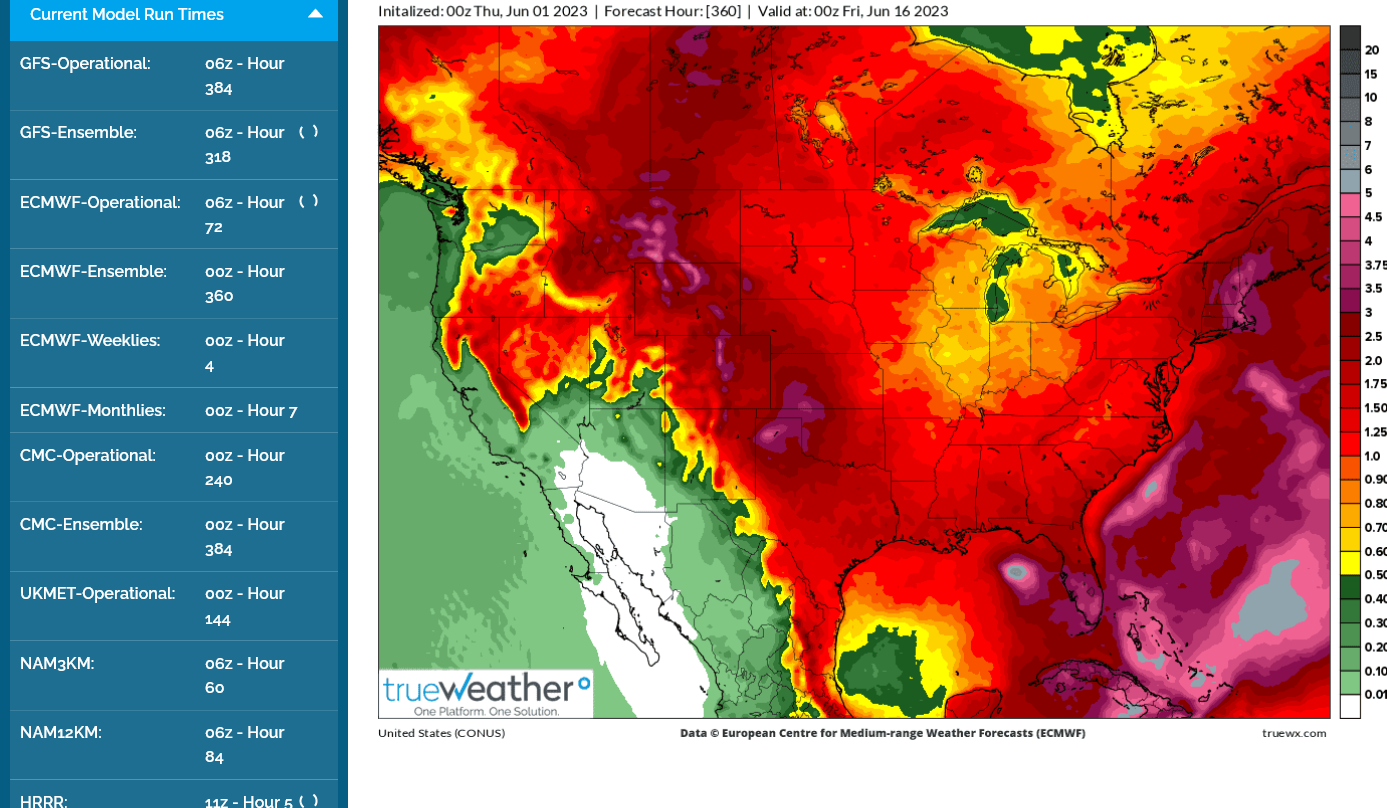

Here's the 2 models from the paid service with crappy colors but good service.

1. Last 6z GEFS-wetter Darker reds 2+ inches most places

2. Last 0z EE- holding drier

May 30: Most-active CBOT #soybeans settle below $13 per bushel for the first time since Dec. 20, 2021. Tuesday's 3% loss was the worst for any single session since Sept. 30, 2022. Macroeconomic concerns and chances for U.S. rains next week weighed on markets.

Mike

The trader Mike will look to "see" a change in forecast to get long.

When is the next GOV run, so I can watch hour(s) ahead for the Private forecasts showing buying has already begun?

I assume grains will move UP soon, then recorrect, and eventually form a base. (Corn low on lead month probably IN)

Hi tjc,

I'll just wait for the weather models and not make any assumptions. The EE is so much drier than the other models but the wetter GEFS being pretty bearish indicates a conflict unresolved. I'm still leaning with the drier model but even on that one, the PATTERN today is not AS dry as last week.

The just out 12z EE below still has less than an inch of rain in much of the C/E Cornbelt the next 2 weeks. It's been steadfastingly dry like this the last couple of days and we saw the beans drop 40c despite that.

The first corn rating was slightly lower than expected so I suspect we open a bit higher tonight. Agree that front month corn is the strongest of the grains by a wide margin and likely made its lows......unless the weather actually turns wet in these dry areas.

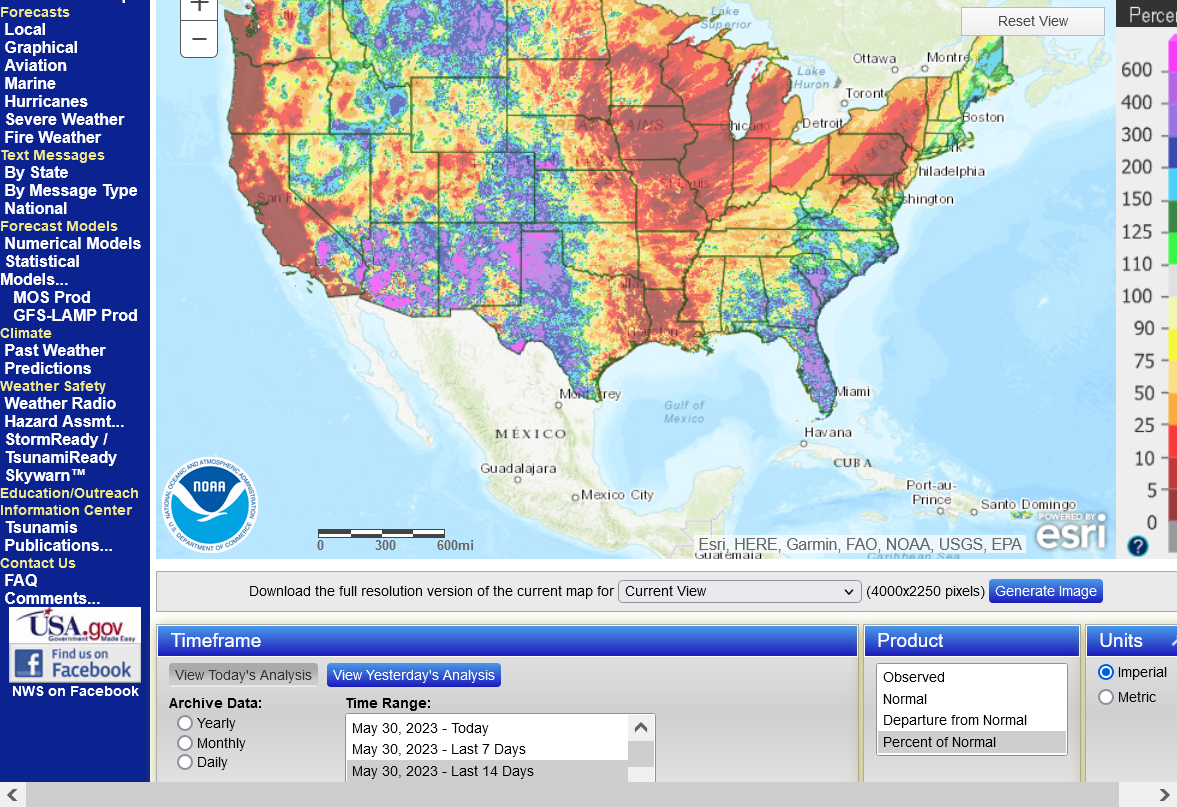

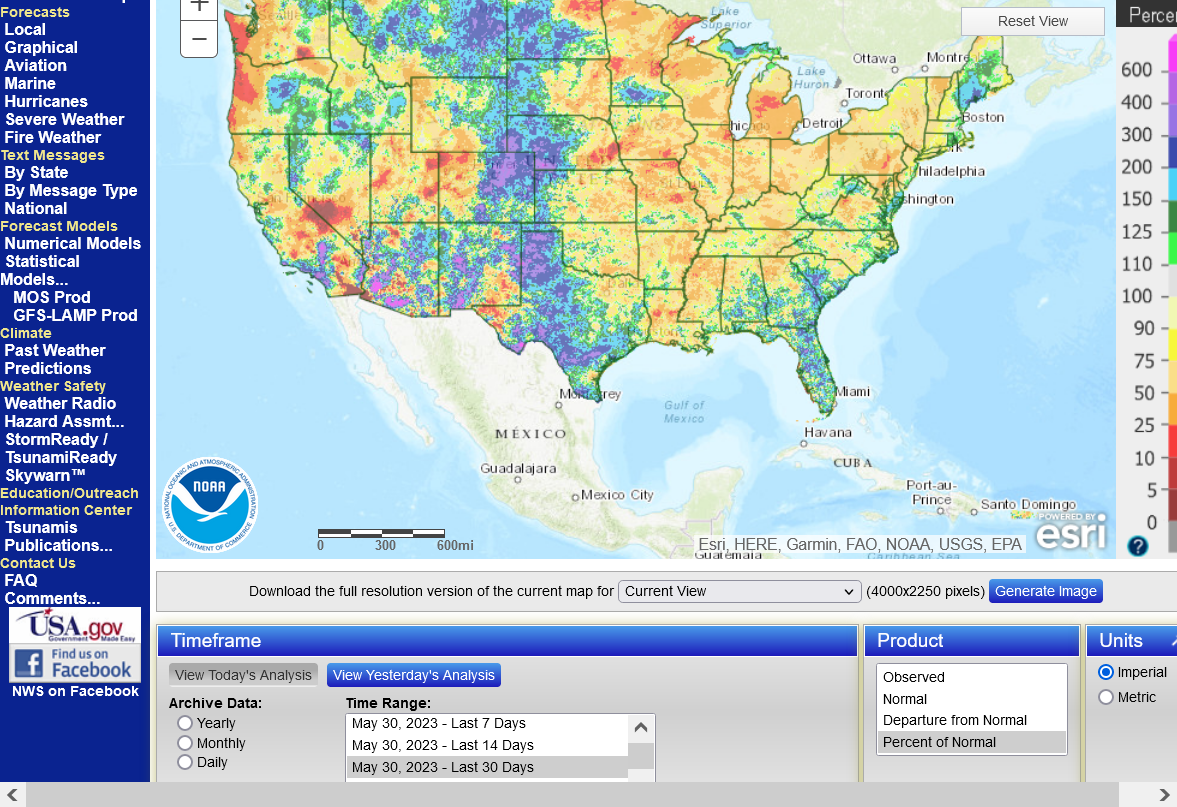

This is the current problem for the entire Midwest. Great for the W.Plains to help eradicate the drought.

1. Rain the last 14 days

2. Rain the last 30 days

https://water.weather.gov/ahps/

Re: Re: INO Morning Market Commentary

By metmike - May 31, 2023, 2:13 p.m.

Front month Beans and wheat are going to reverse higher today the way it looks.

I continue to side with the much drier European ensemble model that continues to stay pretty dry thru 2 weeks(The GEFS is the wettest with almost double the rains in the Cornbelt).

None of the models show a heat ridge or dome that would completely suppress rains. So even the EE has some rain chances. This was the last 0z EE for you bulls:

8:09 am CDT: I take the last paragraph back. The NON EE models do show an upper level heat ridge building in from the south. This is part of why they are so much wetter because of more GOM moisture and jet stream energy riding on top of the ridge, tracking across the Midwest with a potential, version of a ring of fire type pattern. Lots of uncertainty in the mid-June and beyond forecast.

tjc,

This one's for you!

Biobased Diesel Daily@BiobasedDiesel

Biobased Diesel Daily@BiobasedDiesel

·

#rapeseed #soybeans #usedcookingoil #UCO #methylester #biodiesel #imports #China #Europe #biobaseddiesel