KEY EVENTS TO WATCH FOR:

Tuesday, May 23, 2023

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, Y/Y% (previous +1.5%)

Latest Wk, Y/Y% (previous +1.6%)

9:45 AM ET. May US Flash Manufacturing PMI

PMI, Mfg (previous 50.4)

9:45 AM ET. May US Flash Services PMI

PMI, Services (previous 53.7)

10:00 AM ET. May Richmond Fed Business Activity Survey

Mfg Idx (previous -10)

Shipments Idx (previous -7)

10:00 AM ET. April New Residential Sales

New Home Sales (previous 683K)

New Home Sales, M/M% (previous +9.6%)

New Home Sales Months Supply (previous 7.6)

1:00 PM ET. April Money Stock Measures

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous +3.7M)

Gasoline Stocks, Net Chg (Bbls) (previous -2.5M)

Distillate Stocks, Net Chg (Bbls) (previous -0.9M)

Wednesday, May 24, 2023

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 214.9)

Composite Idx, W/W% (previous -5.7%)

Purchase Idx-SA (previous 165.4)

Purchase Idx-SA, W/W% (previous -4.8%)

Refinance Idx (previous 468.2)

Refinance Idx, W/W% (previous -7.7%)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 467.624M)

Crude Oil Stocks, Net Chg (Bbl) (previous +5.04M)

Gasoline Stocks (Bbl) (previous 218.33M)

Gasoline Stocks, Net Chg (Bbl) (previous -1.381M)

Distillate Stocks (Bbl) (previous 106.233M)

Distillate Stocks, Net Chg (Bbl) (previous +0.08M)

Refinery Usage (previous 92.0%)

Total Prod Supplied (Bbl/day) (previous 19.558M)

Total Prod Supplied, Net Chg (Bbl/day) (previous -0.606M)

2:00 PM ET. Federal Open Market Committee meeting minutes published

Thursday, May 25, 2023

8:30 AM ET. U.S. Weekly Export Sales

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 242K)

Jobless Claims, Net Chg (previous -22K)

Continuing Claims (previous 1799000)

Continuing Claims, Net Chg (previous -8K)

8:30 AM ET. 1st Quarter 2nd estimate GDP

Annual Rate, Q/Q% (previous +1.1%)

Chain-Weighted Price Idx, Q/Q% (previous +4.0%)

Corporate Profits, Q/Q%

PCE Price Idx, Q/Q% (previous +4.2%)

Purchase Price Idx, Q/Q%

Real Final Sales, Q/Q%

Core PCE Price Idx, Q/Q%

Consumer Spending, Q/Q% (previous +3.7%)

8:30 AM ET. 1st Quarter Preliminary Corporate Profits

8:30 AM ET. April Chicago Fed National Activity Index (CFNAI)

NAI (previous -0.19)

NAI, 3-mo Moving Avg (previous 0.01)

10:00 AM ET. April Pending Home Sales Index

Pending Home Sales (previous 78.9)

Pending Home Sales Idx, M/M% (previous -5.2%)

Pending Home Sales Idx , Y/Y% (previous -23.2%)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 2240B)

Working Gas In Storage, Net Chg (Cbf) (previous +99B)

11:00 AM ET. May Federal Reserve Bank of Kansas City Survey of Tenth District Manufacturing

Mfg Activity Idx (previous -21)

6-Mo Exp Prod Idx (previous 14)

Mfg Composite Idx (previous -10)

6-Mo Exp Composite Idx (previous 3)

4:30 PM ET. Federal Discount Window Borrowings

4:30 PM ET. Foreign Central Bank Holdings

Friday, May 26, 2023

8:30 AM ET. April Personal Income and Outlays

Personal Income, M/M% (previous +0.3%)

Consumer Spending, M/M% (previous +0%)

PCE Price Idx, M/M% (previous +0.1%)

PCE Price Idx, Y/Y% (previous +4.2%)

PCE Core Price Idx, M/M% (previous +0.3%)

PCE Core Price Idx, Y/Y% (previous +4.6%)

8:30 AM ET. April Advance Report on Durable Goods

Durable Goods-SA, M/M% (previous +3.2%)

Dur Goods, Ex-Defense, M/M% (previous +3.5%)

Dur Goods, Ex-Transport, M/M% (previous +0.3%)

Orders: Cap Gds, Non-Def, Ex-Air, M/M% (previous -0.4%)

Shipments: Cap Gds, Non-Def, Ex-Air, M/M% (previous -0.4%)

8:30 AM ET. April Advance Economic Indicators Report

10:00 AM ET. May University of Michigan Survey of Consumers - final

End-Mo Sentiment Idx (previous 63.5)

End-Mo Expectations Idx (previous 60.5)

12-Month Inflation Forecast (previous 4.6%)

5-Year Inflation Forecast (previous 3.0%)

End-Mo Current Idx (previous 68.2)

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The STOCK INDEXES: The June NASDAQ 100 was slightly lower overnight as it consolidates some of this year's rally. Overnight trading set the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends this year's rally, the August-2022 high crossing at 13,983.00 is the next upside target. Closes below the 20-day moving average crossing at 13,362.80 would signal that a short-term top has been posted. First resistance is the August-2022 high crossing at 13,983.00. Second resistance is the 75% retracement level of the 2022-decline crossing at 14,245.67. First support is the 10-day moving average crossing at 13,570.42. Second support is the 20-day moving average crossing at 13,362.80.

The June S&P 500 was slightly lower overnight as it consolidates some of last-Thursday's upside breakout of the April-May trading range. Overnight trading sets the stage for a steady to slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends last-week's rally, February's high crossing at 4244.00 is the next upside target. Closes below the 20-day moving average crossing at 4147.65 would signal that a short-term top has been posted. First resistance is last-Friday's high crossing at 4227.25. Second resistance February's high crossing at 4244.00. First support is the 20-day moving average crossing at 4147.65. Second support is the 50-day moving average crossing at 4103.57.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: June T-bonds were higher overnight as it consolidates some of last-week's decline. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If June extends the decline off April's high, the 50% retracement level of the October-January rally crossing at 126-10 is the next downside target. Closes above the 20-day moving average crossing at 130-07 would signal that a short-term low has been posted. First resistance is the 10-day moving average crossing at 129-09. Second resistance is the 20-day moving average crossing at 130-07. First support is last-Friday's low crossing at 126-26. Second support is the 50% retracement level of the October-January rally crossing at 126-10.

June T-notes were higher overnight as it consolidates some of this month's decline. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If June extends this month's decline, the 62% retracement level of the 2022-2023 rally crossing at 112.157 is the next downside target. Closes above the 20-day moving average crossing at 115.052 would temper the near-term bearish outlook. First resistance is the 20-day moving average crossing at 115.052. Second resistance is the May 11th high crossing at 116.160. First support is the 50% retracement level of the 2022-2023 rally crossing at 113.116. Second support is the 62% retracement level of the 2022-2023 rally crossing at 112.157.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

ENERGIES:Junecrude oil was steady to slightly lower overnight. Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 50-day moving average crossing at $74.49 would signal that a short-term low has been posted. If June renews the decline off April's high, the March 24th low crossing at $67.02 is the next downside target. First resistance is the 50-day moving average crossing at $74.46. Second resistance is the April 24th high crossing at $79.18. First support is the March 24th low crossing at $67.02. Second support is the May 4th low crossing at $63.64.

June heating oil was slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought and are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below last-Monday's low crossing at 2.2812 would signal that a short-term top has been posted. If June extends the rally off May's low, the 50-day moving average crossing at 2.4770 is the next upside target. First resistance is the 50-day moving average crossing at 2.4770. Second resistance is the April 25th high crossing at $2.5377. First support is last-Monday's low crossing at 2.2812. Second support is May's low crossing at 2.1500.

June unleaded gas was steady to slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off May's low, the April 25th high crossing at $2.6295 is the next upside target. Closes below the 20-day moving average crossing at $2.4831 would signal that a short-term top has been posted. First resistance is the April 25th high crossing at $2.6295. Second resistance is the 75% retracement level of the April-May decline crossing at $2.6834. First support is the 20-day moving average crossing at $2.4831. Second support is last-Monday's low crossing at $2.4017.

June natural gas was slightly lower overnight as it consolidates some of last-week's rally. Overnight trading sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off May's low, the 25% retracement level of the December-May decline crossing at 2.877 is the next upside target. Closes below the 20-day moving average crossing at 2.321 would signal that a short-term top has been posted. If June renews the decline off March's high, the September-2020 low on the monthly continuation chart crossing at 1.795 is the next downside target. First resistance is last-Friday's high crossing at 2.685. Second resistance is the 25% retracement level of the December-May decline crossing at 2.877. First support is the 20-day moving average crossing at 2.321. Second support is the May 5th low crossing at 2.031.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The June Dollar was lower overnight as it consolidates some of the rally off May's low. Overnight trading and sets the stage for a steady to lower opening when the day session begins trading later this morning. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off May's low, the March 15th high crossing at $104.720 is the next upside target. Closes below the 20-day moving average crossing at $101.875 would signal that a short-term top has been posted. First resistance is the25% retracement level of the 2022-2023 decline crossing at $103.594. Second resistance is the March 15th high crossing at $104.720. First support is the 10-day moving average crossing at $102.395. Second support is the 20-day moving average crossing at $101.875.

The June Euro was steady to slightly higher overnight as it consolidates some of this month's decline. Overnight trading sets the stage for a steady to slightly higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If June extends this month's decline, the 38% retracement level of the 2022-2023 rally crossing at 1.05914 is the next downside target. Closes above the 20-day moving average crossing at $1.09672 would signal that a short-term low has been posted. First resistance is the 10-day moving average crossing at $1.08906. Second resistance is the 20-day moving average crossing at $1.09672. First support is the 25% retracement level of the 2022-2023 rally crossing at 1.07774. Second support is the 38% retracement level of the 2022-2023 rally crossing at 1.05914.

The June British Pound was steady to slightly higher overnight and sets the stage for a steady opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices near-term. Multiple closes below the 50-day moving average crossing at 1.2435 would open the door for additional weakness near-term. If June renews the rally off the March 8th low, the 62% retracement level of the 2021-2022 decline crossing at 1.2784 is the next upside target. First resistance is the May 10th high crossing at 1.2692. Second resistance is the 62% retracement level of the 2021-2022 decline crossing at 1.2784. First support is the 50-day moving average crossing at 1.2435. Second support is April's low crossing at 1.2293.

The June Swiss Franc was higher overnight as it consolidates some of this month's decline. Overnight strength sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are oversold but are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 1.12423 would signal that a short-term low has been posted. If June extends the decline off May's high, April's low crossing at 1.09640 is the next downside target. First resistance is the 20-day moving average crossing at 1.12423. Second resistance is May's high crossing at 1.13940. First support is the 25% retracement level of the 2022-2023 rally crossing at 1.10794. Second support is April's low crossing at 1.09640.

The June Canadian Dollar was steady to slightly lower overnight as it consolidates some of the decline off May's high. Overnight trading sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at $73.97 would signal that a short-term top has been posted while opening the door for additional weakness near-term. Closes above the 10-day moving average crossing at $74.28 would temper the near-term bearish outlook. First resistance is the 10-day moving average crossing at $74.28. Second resistance is May's high crossing at $75.18. First support is the 50-day moving average crossing at $73.97. Second support is April's low crossing at $73.23.

The June Japanese Yen was steady to slightly higher overnight as it consolidates some of the decline off the May 4th high. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If June extends the decline off the March's high, the 75% retracement level of the 2022-2023 rally crossing at 0.071337 is the next downside target. Closes above the 20-day moving average crossing at 0.074114 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at 0.074114. Second resistance is the 50-day moving average crossing at 0.075367. First support is the November-21st-2022 low crossing at 0.072425. Second support is the 75% retracement level of the 2022-2023 rally crossing at 0.071337.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

Junegold was steady to slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading later this morning. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If June extends the decline off May's high, the 38% retracement level of the September-May rally crossing at $1923.90 is the next downside target. Closes above the 20-day moving average crossing at $2010.30 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $2010.30. Second resistance is the May 4th high crossing at $2085.40. First support is the March 22nd low crossing at $1953.70. Second support is the 38% retracement level of the September-May rally crossing at $1923.90.

July silver was slightly lower overnight as it consolidates some of this month's decline and sets the stage for a slightly lower opening when the day session begins trading later this morning. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends this month's decline, the 50% retracement level of the March-April rally crossing at $23.289 is the next downside target. Closes above the 20-day moving average crossing at $24.951 would temper the near-term bearish outlook. First resistance is the 20-day moving average crossing at $24.951. Second resistance is the May 5th high crossing at $26.435. First support is the 50% retracement level of the March-April rally crossing at $23.289. Second support is the 62% retracement level of the March-April rally crossing at $22.541.

July copper was lower overnight as it extends the trading range of the past six-days. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain bearish signaling that sideways to lower prices are possible near-term. If July renews the decline off April's high, the 62% retracement level of the 2022-2023 rally crossing at 3.6247 is the next downside target. Closes above the 20-day moving average crossing at 3.8136 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at 3.8136. Second resistance is the 50-day moving average crossing at 3.9444. First support is last-Wednesday's low crossing at 3.6525. Second support is the 62% retracement level of the 2022-2023 rally crossing at 3.6247.

GRAINS http://quotes.ino.com/ex changes/?c=grains

July corn was higher overnight as it consolidates some of last-week's sharp decline. Overnight trading sets the stage for a steady to higher opening when the day sessions begins trading. Stochastics and the RSI are oversold, diverging but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends the decline off April's high, the 62% retracement level of the 2020-2022 rally crossing at $5.27 1/2 is the next downside target. Closes above the 20-day moving average crossing at $5.83 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $5.83. Second resistance is the May 8th high crossing at $6.00. First support is the December-2021 low crossing at $5.48 3/4. Second support is the 62% retracement level of the 2020-2022 rally crossing at $5.27 1/2.

July wheat was lower overnight as it extends the decline off last-Tuesday's high. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends the decline off March's high the March-2021 low crossing at $5.71 is the next downside target. Closes above the 50-day moving average crossing at $6.71 1/4 would confirm that a low has been posted. First resistance is last-Tuesday's high crossing at $6.64 1/4. Second resistance is the 50-day moving average crossing at $6.71 1/4. First support is the overnight low crossing at $5.96 1/4. Second support is the March-2021 low crossing at $5.71.

July Kansas City wheat was lower overnight as it extends the decline off last-Wednesday's high. Overnight trading sets the stage for a lower opening when the day session begins trading later this morning. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $8.24 1/2 would confirm that a short-term top has been posted while opening the door for additional weakness near-term. Closes above the 10-day moving average crossing at $8.60 1/4 would temper the near-term bearish outlook. First resistance is the 10-day moving average crossing at $8.60 1/4. Second resistance is last-Wednesday's high crossing at $9.18 3/4. First support is the overnight low crossing at $8.07 1/4. Second support is May's low crossing at $7.36 1/4.

July Minneapolis wheat was lower overnight as it extends the decline off last-Wednesday's high. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends the aforementioned decline, May's low crossing at $7.69 is the next downside target. Closes above the 50-day moving average crossing at $8.48 1/2 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $8.26. Second resistance is the 50-day moving average crossing at $8.48 1/2. First support is the overnight low crossing at $7.93. Second support is the May 3rd low crossing at $7.69.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

July soybeans were higher overnight as they consolidate some of last-week's sharp decline. Overnight trading sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends the decline off April's high, the July 22nd 2022 low crossing at $12.99 is the next downside target. Closes above the 20-day moving average crossing at $13.93 1/2 would signal that a short-term low has been posted while opening the door for additional short-covering gains. First resistance is the 10-day moving average crossing at $13.67 1/4. Second resistance is the 20-day moving average crossing at $13.93 1/2. First support is the July 22nd 2022 low crossing at $12.99. Second support is the 38% retracement level of the 2020-2022 rally crossing at $12.94 3/4.

July soybean meal were steady to slightly lower overnight as they extend the decline off last-Monday's high. Overnight trading sets the stage for a steady to slightly lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends the decline off March's high, the 50% retracement level of the 2020-2023 rally crossing at $388.80 is the next downside target. Closes above last-Monday's high crossing at $442.30 would confirm that a low has been posted. First resistance is the 20-day moving average crossing at $425.20. Second resistance is last-Monday's high crossing at $442.30. First support is the overnight low crossing at $407.50. Second support is the 50% retracement level of the 2020-2023 rally crossing at $388.80.

July soybean oil was steady to slightly lower overnight. Overnight trading sets the stage for a steady to slightly lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If July extends this month's decline, the 75% retracement level of the 2020-2022 rally crossing at 40.19 is the next downside target. Closes above the 20-day moving average crossing at 50.75 would signal that a low has been posted while opening the door for a possible test of the 50-day moving average crossing at 53.40. First resistance is the 20-day moving average crossing at 50.75. Second resistance is the 50-day moving average crossing at 53.40. First support is the 62% retracement level of the 2020-2022 rally crossing at 46.42. Second support is the 75% retracement level of the 2020-2022 rally crossing at 40.19.

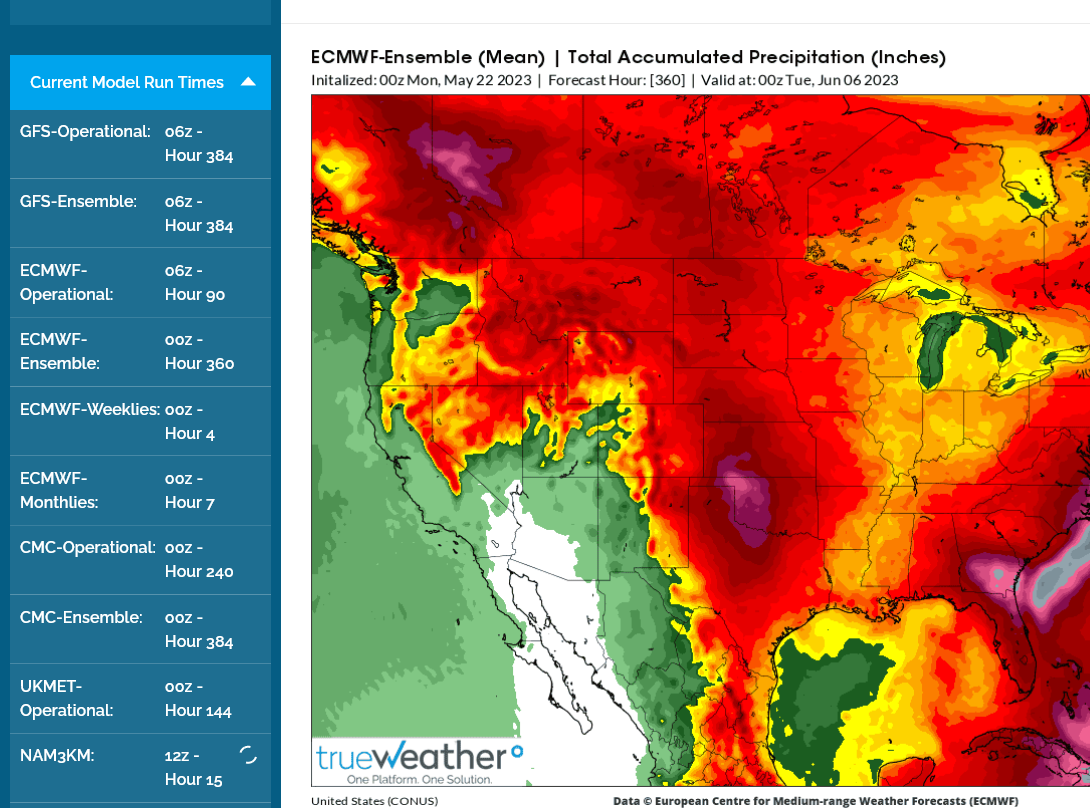

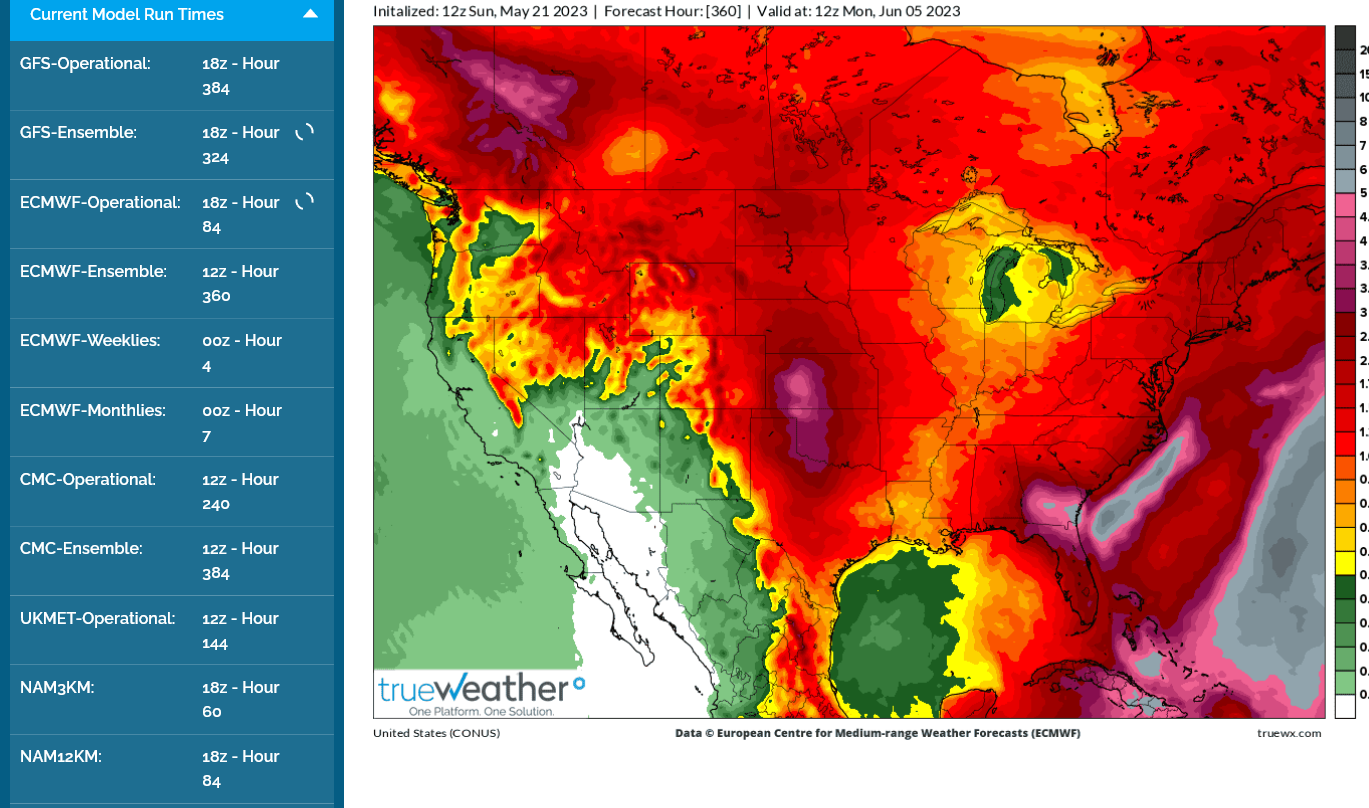

I'm still convinced the weather is bullish/too dry. The market took awhile to react strongly last night/early this morning. The last EE run was even drier overnight for most of the Cornbelt.

1. Latest European model 0z run 5-22-23

2. Previous one from yesterday afternoon 12z run 5-21-23

https://www.marketforum.com/forum/topic/95354/

By metmike - May 21, 2023, 8:12 p.m.

Thanks, tallpine!

To me, the weather looks too dry for C and S the next 2 weeks and is bullish. Especially the central and eastern Cornbelt.

W is still bearish because of big rain in the S.Plains.

EE last 12z run for total rains:

https://www.marketforum.com/forum/topic/94944/#95303

Re: Re: Re: Re: Re: Re: Natural Gas 5-4-23

By metmike - May 21, 2023, 6:02 p.m.

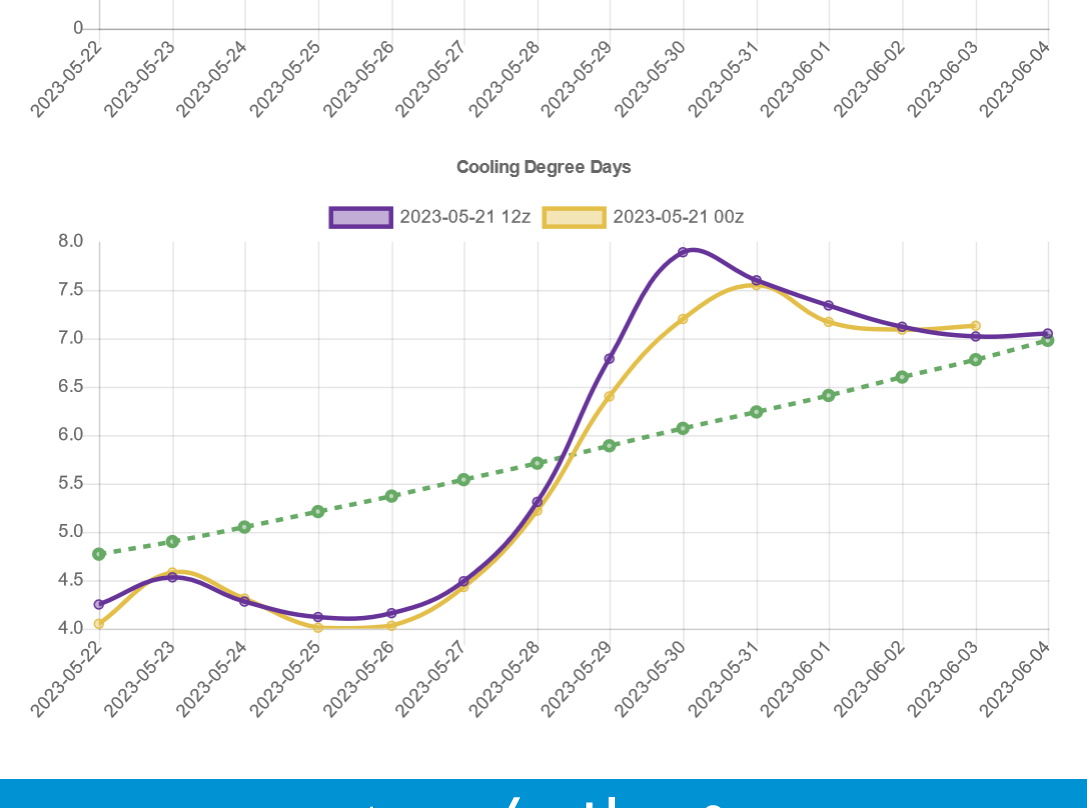

I can't get too bulish ng here with the heat in the NorthCentral US(where not too many people live) and not the South or Southeast.

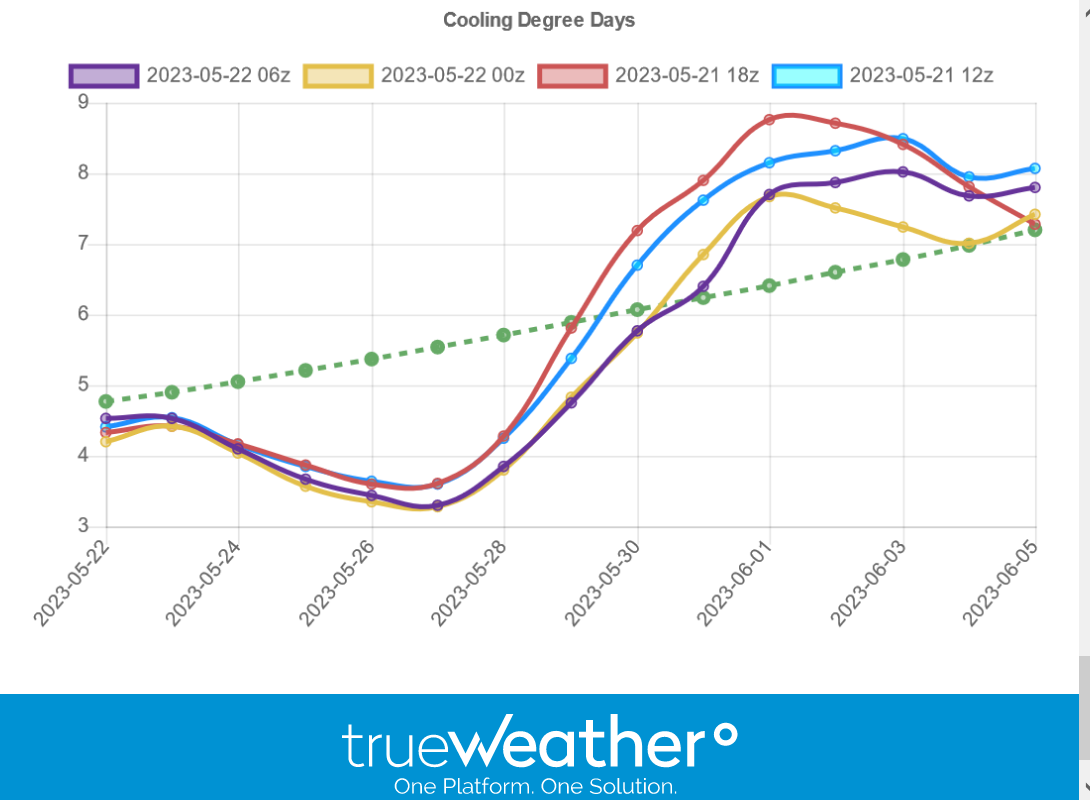

CDDs are actually less than they were on Friday.

Here's the CDDs from the EE. Last run in purple was +2 CDDs vs the previous run. However, the pattern is cooler than any day last week, including Friday. The total CDDs for the 2 week period are right at average(cool this week, offsetting warm week 2, then near the average at the end). Last week, the week 2 warmth was greater!

https://www.marketforum.com/forum/topic/94944/#95353

With forecasts stubbornly withholding impressive summer heat, natural gas futures failed to build on last week’s momentum in early trading Monday. The June Nymex contract was down 7.9 cents to $2.506/MMBtu at around 8:45 a.m. ET. Futures rallied last week on signs of weakening supply, with bullish sentiment helped along by a tighter-than-expected Energy Information…

+++++++++++++++++++++++++++++++++++++++

YEP!

Last 4 GEFS solutions below. Even less CDDs.