Good afternoon, MarketForum

I believe grains have been trading equity liquidation rather than underlining grain news, fundamentals and technicals. C, S, S products have now had decent retracements at primary or half primary weekly time zones. W, O, and rice refused to go lower after 10:30 a.m. this morning, in my mind exhibiting grain growing issues rather than equity liquidation.

I will try to buy tonight/tomorrow at slightly lower lows than today's lows using the June week 3 options as the cost of being wrong totally outweighs the cost.

Consider a 660 CN call at 15 or a 1700 SN call at 19. (Liquidity may be an issue!)

MetMike, others---need some discussion!

Tim

Can't think of a better topic for MarketForum tjc!!!!

Thanks.

I was preparing for a radio show and on the radio for over 20 minutes but just got off and can provide the latest after catching up more.

The crop rating coming out in a few minutes is expected to be pretty good and that may have been a factor as well as good weather to finish planting beans.

But the weather pattern is bullish for the crop in the ground!

Here's the latest weather:

https://www.marketforum.com/forum/topic/83844/

Crop conditions:

https://www.marketforum.com/forum/topic/85679/

It's likely that we're trading a bit of buy the rumor, sell the fact type action in the weather.

The market has had a hot/dry Summer forecast with high confidence for a seasonal forecast for many months because of the long lived La Nina that will continue for a few more months.

We dialed in alot of extra risk premium with those expectations.

Now the heat ridge is here. Who is surprised?

Every forecast source that I saw since early Spring emphasized widespread hot and dry for Summer.

If we stay this way, eventually the market will likely go higher from estimates of crop reductions from hot/dry.

I was long CN briefly yesterday evening but covered for -1c when perceiving the market was NOT trading hot/dry in the 2 week forecast.

We're -14c from where I covered. That's a wonderful trade in my book......minimizing losses are more important that maximizes profits in many cases.

You can lose all your money being aggressive and wrong and not acknowding it or adjusting the mentality to minimize the loss.

There's always more trades.

So it's a quandary for me here.

Trying to pick the exact time that the market will suddenly trade the hot/bullish weather should not mean holding on and waiting.........I'd be behind -14c right now with that mentality.

I will never buy calls/puts because you can be right and still lose money. You actually pay for the time value and the sellers always sell them at a price that greatly increases THEIR chances of them expiring worthless, so they can collect all the premium...........which happens most of the time.

Don't know the price at this moment but if you buy a CN 660 call at 15 as you suggest, then if CN goes to 675.........you break even.

I don't like corn having to rally 10c for me to break even.

No risk?

Actually a VERY HIGH risk of losing what ever premium I paid for the call/put but limited to just that risk and not more.

In this volatile market, to get a 660 call at that price, CN may need to be trading lower than that and need the price to bounce 20c to break even.

I don't follow prices of options and I totally understand that you trade options for your reasons tjc which I respect but am just passing on my perspective.

As a meteorologist that watches the weather round the clock, I can get in or out in a flash based on weather changes while the market is open. Futures are the way to go with that strategy.

Holding a call with more staying power because it allows me to withstand a big move against me until I might be right is exactly the opposite of MY trading strategy.

If I'm right, the market should react right away. I get in early from seeing weather pattern changes before the market reacts. That's my entire strategy.

If it doesn't then I may have miscalculated because the reason I got in, DID NOT result in other people, seeing the same thing putting on the same position as I anticipated.

There's other things the market can be reacting to also.

Added: tjc has been trading for an extremely long time and has great understanding of markets and likes using options. I assume this is with skill/profits, so please only apply the comments above to metmike's trading and for others to have a general understanding of some concepts.

Regardless of the vehicle being used trading.......options or futures we can discuss the reasons for why the markets do what they do using the exact same market moving reasoning!!!

Market is acting much better very early this morning.

Not sure why the beans have been the strong upside leader since last nights open.

It was the downside leader Friday/Monday.

Maybe traders reversing?

Probably something else. Maybe waiting until after the crop report (beans are still being planted) and expectations on the crop report..........now we trade weather?

Corn just sold off 8c from the highs in a flash and made new day time lows by a few ticks after that last post.

Still not a market focused mostly on bullish weather.

The spec longs have been loading up for months ahead of the hot/dry Summer. Could be they are exhausted and this weather is only meeting expectations?

The best weather trades come from UNexpected weather.

Seasonals start pulling hard to the downside at this time of year........as the crop gets closer to being harvested and new crops becomes new supplies.

Extreme heat can bring flash drought. If this pattern evolves into that and the forecast stays bullish.........we should go higher.

I could see shorting beans, but shorting corn right now seems highly dangerous. We haven't even heard from anyone that the crops are stressed yet, but we know it's coming.

Thanks Jim!

Beans are 20c off their highs now, +2c. Corn near the lows and -8c.

WN is -20c adding to the pressure!

What's corn worth when crop conditions drop approximately 5% for this coming Monday and another 5-10% the week after that.

And those are just numbers for discussion. Not predictions. But based on current ES and the world situation we are in, is $2-$3-$4 higher, unreasonable?

Thanks Jim,

Corn conditions will NOT be dropping close to those numbers.

Corn conditions might drop 1-2% next week?

Then, if we don't get any rain, anywhere and the heat stayed, another 4-8%? But we will get some rain(Upper Midwest) and the heat will break in some places.

We have to dry the soils down first.

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Just speculating. Im sure someone has charted grain value vs ES. Throw in a war, late planting, inhospitable weather, outrageous fuel and fertilizer prices. Corn doesnt have many positives other than having a relatively good start. Where do we go and how far? Beans are a safer short. Just thinking out loud digitally.

tjc,

This is YOUR discussion. Did you open it to read what other people state?

The unexpected strength in beans overnight and much earlier may have been tied to the crop report showing something not as good as expected.

Beans are down almost 30c from the highs and -8c.

Ive been watching Nov. I have made a couple short trades when it got above $15.50. Made some decent money.

We are probably not going to see much action until the Fed meeting tomorrow.

I'm pretty sure now, after watching close for the last day, what the biggest problem is for the bulls right now.

The GFS ensemble keeps putting out some decent rains around the periphery of the dome in the Upper Midwest, including IA.

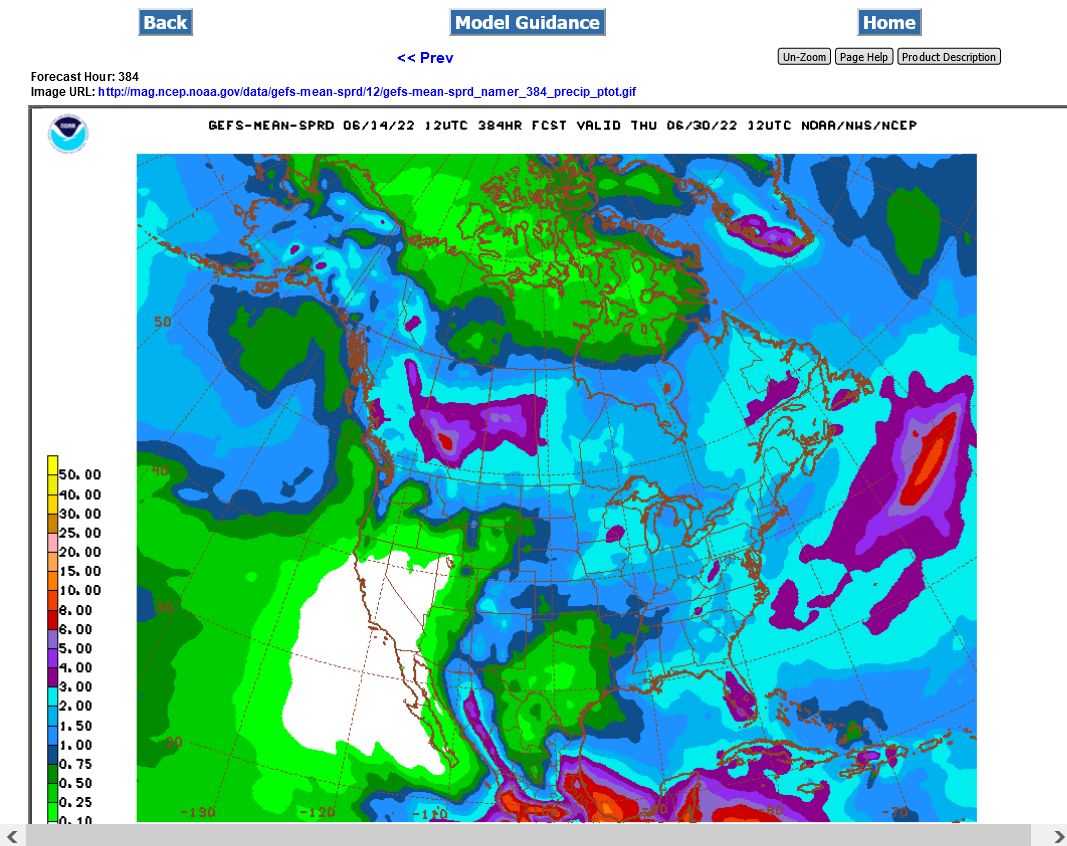

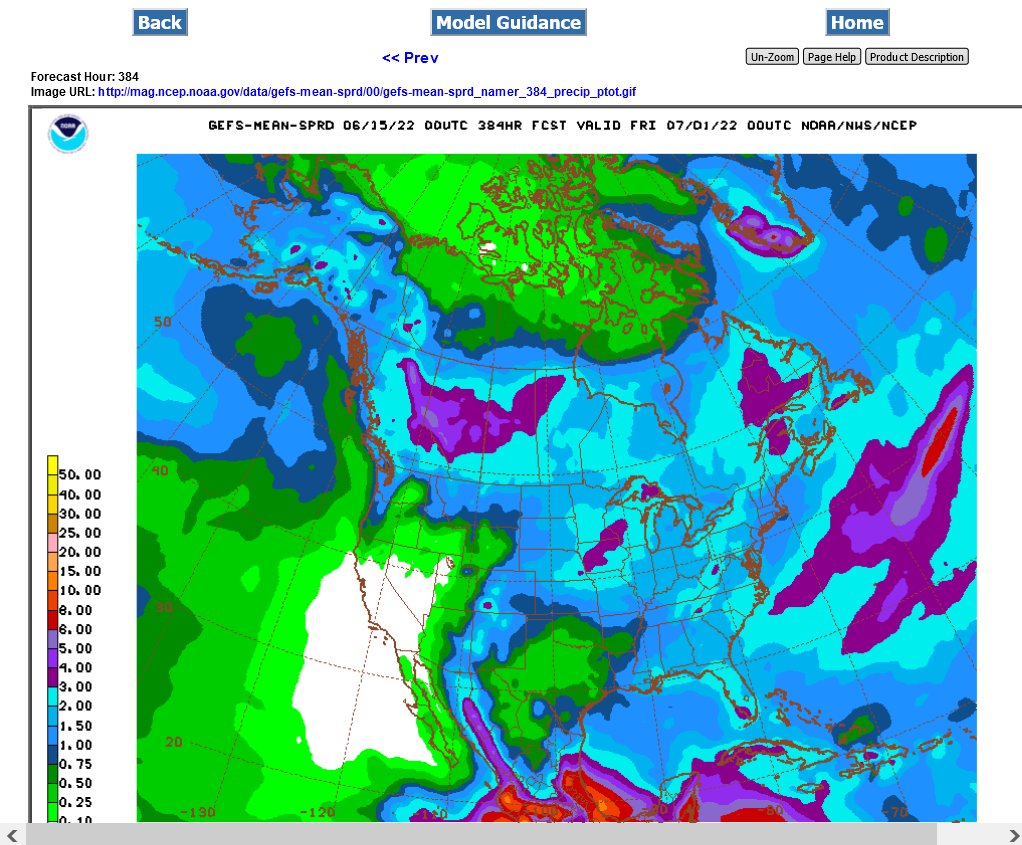

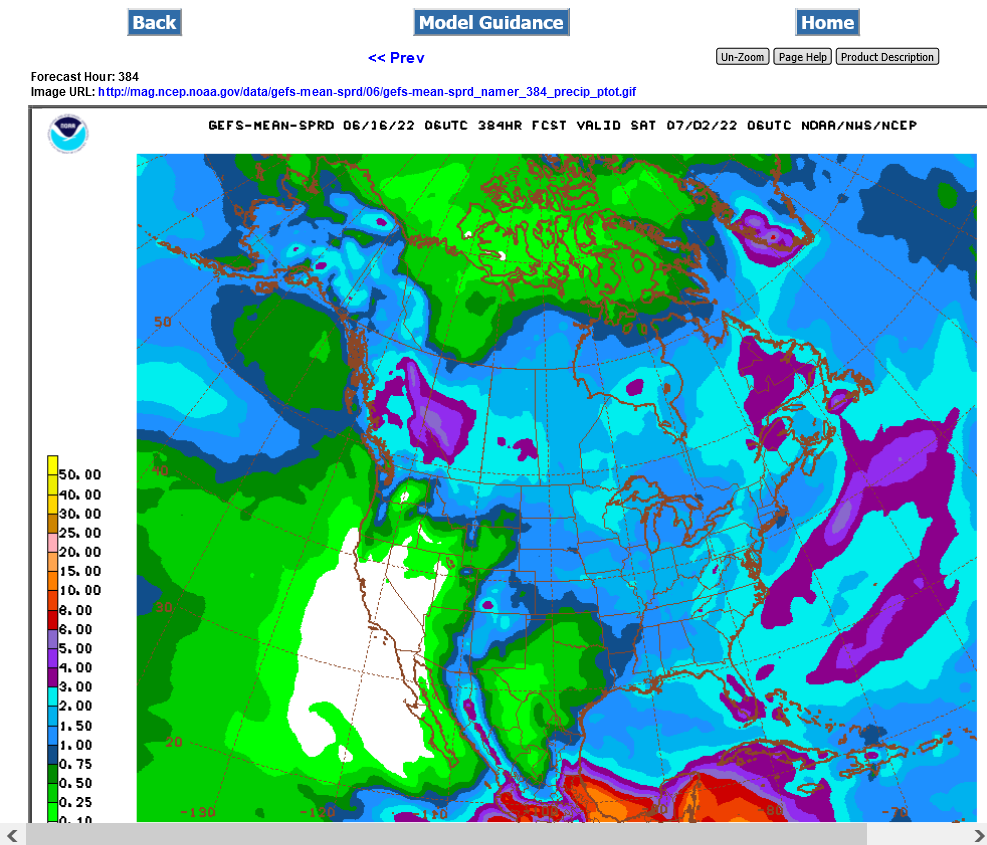

The map below is for 2 week totals. Light blue is 2" or more. Purple is 3 inches.

This would not make sense............except that the Southwest seasonal monsoon will be kicking in a bit early this year and with gusto late this week.

You can see the plume of moisture below coming up thru Mexico, then e.AZ/NM/CO on the backside of the heat ridge/dome.

There will still be moisture left after rounding the periphery/top of the dome, which may also have some frontal activity between the intense heat to the south and cooler air to the north.

Rains increasing a bit in week 2 for the Midwest.

15 day total below for the just out for the GFS ensemble mean.

Rain event tonight in NE/IA is right over some of the driest areas.

NE crop ratings dropped from dryness.

Latest National radar images

https://www.wunderground.com/maps/radar/current

This link below provides some great data. After going to the link, hit "Mesoanalysis" then, the center of any box for the area that you want, then go to observation on the far left, then surface observations to get constantly updated surface observations or hit another of the dozens of choices.

Here's where to see rain amounts: Found a great new link/site that shows us how much precip fell(from 1 hr to 72 hours) for different periods to share with you. https://www.iweathernet.com/total-rainfall-map-24-hours-to-72-hours Data Update Cycle: The 1-hr mosaic is updated every 5 min (approx). All other mosaics are now updated hourly, including the 48h and 72h maps. The site does not allow me to copy the actual images/data here, as we do with all the other links above..........so just go to the link! |

As mentioned last night, the plume of monsoonal moisture is showing up in the 6-10 day forecast below.....or it will when the updated map for June 15 shows up here.

Use this link for the update:

https://www.cpc.ncep.noaa.gov/products/predictions/610day/

The grains have finally been reacting positively the last 24 hours with rain amounts greatly reduced in the Upper Midwest, especially IA and continued intense heat.

Compare that to the one earlier and note the decrease in the 2 week totals on this last GFS ensemble mean forecast.

In bull markets, the front month/old crop almost always leads the charge higher........however, the exception is when the new crop growing in the ground is seriously threatened.

That represents back month supply and those months will often be stronger, like we see today.

CN= +13c

CZ =+17c

SN= +14c

SX =+17c

Long weekend with holiday on Monday.

back months were leading again much of today.

this is related to the back months, growing in the ground, new crop being threatened. Old crop is in the bin.

also, bear spreads gaining like this is a bad sign for bulls if the weather outlook improves.

I wouldn’t want to have a position over this,long weekend……but that’s me and not advise.

we could easily gap up or down by double digits on monday

Today is kind of a messed up day since crude puking is probably having an affect on other markets.

You're probably right Jim!

Hello Forum

Sorry to not have posted. Called away to Colorado. RIP

Corn call filled. While on road, instructed acount rep to place an order for 10 cent gain, otherwise to allow expiriation to rule.

Thanks to Thursday, 10 cent winner. Glad not to be long.

MetMike, I apologise for starting a post and not participating. Used phone for trade, but limited access and frankly could not post.