| Date | Prior | Current | Rating | |

| Empire State Mfg_M/M | May-22 | 24.60 | -11.60 | D+ |

| Philly Fed Mfg_M/M | May-22 | 17.60 | 2.60 | C |

| Industrial Production_M/M | Apr-22 | 0.90 | 1.10 | C+ |

| Existing Home Sales_M/M | Apr-22 | 5.77M | 5.61M | C |

| Housing Starts_M/M | Apr-22 | 1.793M | 1.724M | C- |

| Housing Permits_M/M | Apr-22 | 1.873M | 1.819M | C- |

| Housing Market Index_M/M | May-22 | 77.00 | 69.00 | C- |

| Leading Indicators_M/M | Apr-22 | 0.30 | -0.30 | C- |

| E-Commerce Retail Sales_Q/Q | Q1:2022 | 1.70 | 2.40 | C+ |

| Retail Sales_M/M | Apr-22 | 0.5 | 0.9 | C+ |

| Jobless Claims_W/W | 5/14/2022 | 203K | 218K | C- |

Not a very encouraging week.

Mfg, in "too soon to tell" mode is showing a bit of weakness. Empire State showed a dramatic turnaround ending in deep negative, and Philly Fed dropped to a paltry 2.6, both in May. Industrial Production showed a 2nd positive month with a strong 1.1 in April.

Housing also showed a bit of weakness with Existing, Starts and Permits showing a drop along with the leading indicator Index. Not surprising with increased mortgage rates, but it's another warning shot.

Leading indicators also showed a drop. Housing Starts are a major component of that metric.

Jobless Claims edged up but remain historically low. With the record number of Job Openings and Voluntary Quits, this will remain the case. As always, I look at Jobless Claims as the "Canary in the coal mine". If we see steady uptics, it will be a bad sign.

The lone bright spot this week is Retail Sales and E_Commerce, Apr and Q1 respectively. No one is surprised as E-Commerce takes a progressively larger share of retail, a trend that will most certainly continue.

Can't possibly go with more than a C- this week. We could consider that we are seeing the begining of eco-contraction, but it's too soon to tell. The intial Q1 GDP reading of -1,4 is also concerning. Let's see what next week brings.

On a positive note, Atl Fed is showing a Q2:22 GDP forecast of 2.4 as of 5/18. Q2 closes 6/30 and the contributing metrics will continue to trickle in through most of Q3, so a lot can happen.

What a wonderful gift to MarketForum Tim!

thanks so much.

tied up today a bit with my wifes new carbon capture business and am managing a tick disease but will comment more later….thanks

Considering the plummeting value of our purchasing power, I would think that it's taking a serious toll on the real economy already.

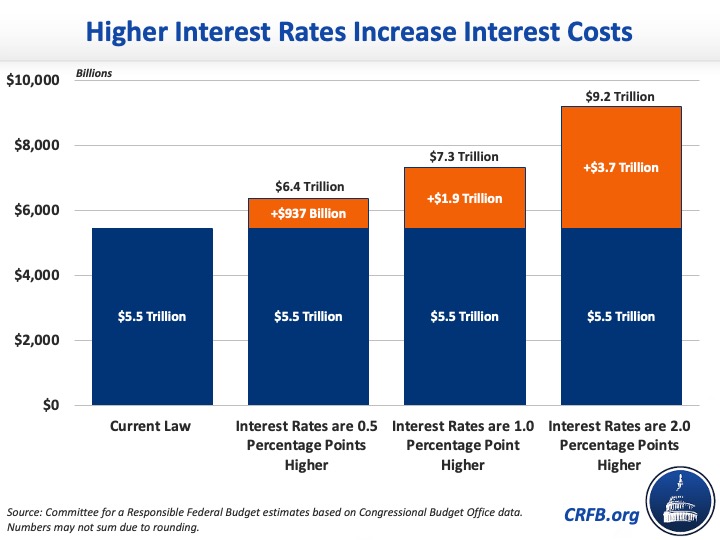

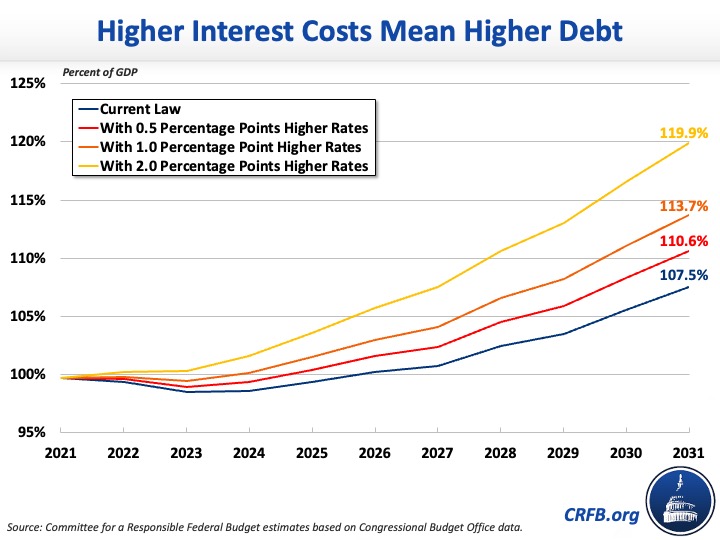

Increasing interest rates means the interest on the astronomical debt is going to crush us!

https://www.crfb.org/blogs/how-would-higher-interest-rates-affect-interest-payments

At 1.9 percent, the average interest rate on ten-year Treasury notes is slightly above the 1.8 percent CBO projected it would be this quarter. While interest rate projections are highly uncertain, should they continue to outperform CBO’s forecast, the result will be more debt and more spending needed to service that debt.

metmike: The US has been using (abusing) money with blatant, fiscal irresponsibility like they are playing monopoly with made up rules that let them print new money and manufacture ways to avoid having to reconcile with realities that control most realms using money.

People insisting that this can't go on forever, have been saying it for a very long time. Long enough, with it continuing to go on the same way anyways, that the markets are convinced that it really can go on forever.

NO IT CAN'T!

The huge problem is that when that time finally comes (and it will) that proves it couldn't go on forever..........we won't be able to adjust our way out by tweaking a few things here and there to have a soft landing or effectively spread out of the pain.

When it happens, there could be collapses from the imbalances building up with time to unsustainable levels that can't last.

Like all bubbles, the popping results in restoring a healthier situation at levels that make much more sense based on reality.

Just 1 discussion on it(it's not just the US)

https://www.aei.org/op-eds/the-global-economy-is-a-giant-bubble-that-could-pop/

Absoutely no question that our biggest single issue is inflation.

Agree Tim!

The problem is that to address inflation this extreme, in this case, we have to do some pretty extreme things to curb excessive demand causing it.........which always slows down the economy.

but it doesn’t always need to be an excessive demand issue!

in this case we also have severe supply issues causing much of the problems, especially in energy (which affects the price of everything because EVERYTHING has transportation costs).

So if you stifle demand so that it doesn't exceed the limited supply........you kill economic growth and cause a recession.

The best solution would be to encourage massive supplies, especially in the fossil fuel sector which also increases growth of the economy at the same time.

That increase, which always happens has had an unusually slow response and long lag time because the war on fossil fuels the past decade has caused the big money to go to fake green energy plays(solar and especially really bad wind) that are getting all the government support and grant money as well as tax breaks.

With carbon tax penalties and new strict regulations promises right around the corner, they already just about killed coal and have started targeting ng.

This HAD to happen based on the plan to replace fossil fuels. I've been saying this for a decade because it was so obvious. The war on fossil fuels is causing many of these problems with a promise that green fairy dust and magic will somehow replace a wonderful, cheap, abundant and reliable fuel and system set up to conveniently and effectively bring it to the market quickly to satisfy unlimited demand.

Killing Coal

14 responses |

Started by metmike - Nov. 21, 2021, 10:57 p.m.

This is what got it started and it was absolutely INTENTIONAL!

Obama KNEW this would happen to prices, so did others.

I may be a fairly smart scientist from Indiana but there is no way that all these things could be crystal clear to me for over a decade and these gatekeepers IN THE KNOW AND FORCING THIS ON THE WORLD were somehow oblivious.

https://www.youtube.com/watch?v=ma1gwZYw1cY

Biden didn't start it but he is carrying the baton. After a brief suspension in the plan to kill fossil fuels for 4 years(Europe continued with the plan though), Biden, on day 1 signed us back up with the fake climate crisis Accord, stopped the Key Stone pipe line to help with his war on oil and began aggressive legislation to kill natural gas.

https://www.marketforum.com/forum/topic/84294/#84357

Why hasn't the obvious been so obvious, so that we could have avoided this?

Because the messages and false narratives have all been "Fossil fuels are killing the planet and the only way to save the planet is to kill fossil fuels"

Under this guise, they were able to trick people into thinking the current climate optimum for life on this greening planet is actually..........a climate crisis and the only way to save the earth is to get rid of fossil fuels.

Slight global warming is for real but the benefits outweigh the negatives......which has already been shown on the NTR forum dozens of times.

Unintended consequences of the ESG rage ridding the world of crude oil usage would be the restricted supply and resultant inflationary pressures on the limited supply of products and fuels manufactured from crude to meet growing demands that support:

The domino effects of tinkering with the supply chain of fossil fuels are supply shortages and soaring prices for the consumers, for not only electricity, but for the thousands of products that support the entire medical industry, all branches of the military, airports, electronics, communications, merchant ships, container ships and cruise liners, as well as asphalt for roads, and fertilizers to help feed the world.

Life without petroleum-based products

started by metmike - May 21, 2022, 10:46 p.m.