SA is starting harvest and although behind, due to some weather delays, as we were told on this forum the crop, will get harvested in SA, which I totally agree. I might have some quality issues in mind, some acres not harvested, but the lower quality of some beans may require some production to simply stay home and enter the domestic market, but at this early time one would think enough good beans would be available for export demand

Some pics of wet field soil conditions, roads backed up and impassable, due to excess water can be seen but Brazil is a huge area and not all of Brazil is flooded

Although the Safrina crop will be impacted to some extent, due to later planting, there will be a second corn crop. perhaps not as good/acre yield The 1st full season corn crop is not as good as the expected yield, but corn will be harvested and used both domesticly and exported

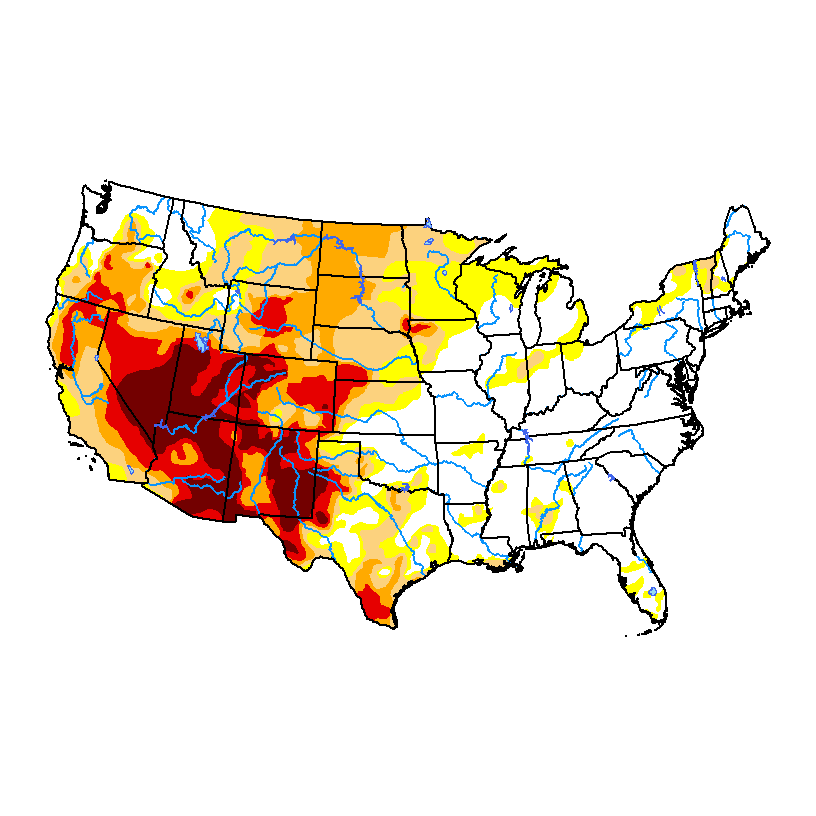

Argentina is a bit dry but again not all the acres are affected. In the USA we have a drought but it is early and a couple good rains will change that very quickly

SO: though world stocks may be a bit low and new crop may not be as much, are we on the brink of disaster. I think it is a bit early to call the new crop a disaster. Although this may be a demand market, if supply is enough lower then demand may increase the price to ration supply, or not if supply is enough

In other words we don't know much about new crop in SA and the USA

So: Was Fridays price action just more side ways price or was this the start of a break out to higher prices

If side ways price action, then so much for that

If the start of higher prices then why>>

Concern over new crop supplies???

Maybe just a general commodity price increase due to inflation

My money is on a general price increase due to inflation and new crop supply will be some thing for a later date for a decision, perhaps as late as June or even July or earlier in perhaps April/May

Regardless I am not selling any more of my small supply of old crop and am long all my new crop

Do you disagree with my thinking???

Those are wonderful thoughts Wayne.

Since this is not currently a weather market, I can't tell you if this is the top or not or when that might be based on the weather.

I will say that speculators, along with fundamentals can push prices extremely high for short periods(and they can get higher than this) and these are all golden opportunities for producers to sell.

The markets originally started way back when for producers and end users to exchange products. The liquidity that we have today, is in part from so many speculators in the market. Their main objective is to try to make money taking risk speculating.

The main objective of a producer or end user is to REDUCE risk in their business. Lock in favorable prices so they can accomplish mission #1.......running a profitable business.

If you have old crop beans and corn left but $14 and near $6 isn't high enough to sell..............that's perfectly fine but it's because you are being a speculator.

Are you being greedy? Of course you are but you will make more money if you are right and your business is to maximize profits too, right?

When corn was below $3.50 recently and beans under $9, you would have done anything for $4+ and $10+ and wishing you had sold when prices were there.

Now we are MUCH, MUCH higher than that and you are waiting for higher prices.

That's what happens in bull markets to the bulls(and farmers have a bullish mentality stamped into their brains because of their business). They always think prices can or will go higher until we are long past the top.............and its obvious...and the highest prices have passed by.

Here are some facts that I think we can bank on:

1. Almost the entire reason for this was that 3 typhoons obliterated China's crop in a 1 month period last August/September. They didn't let the cat out of the bag because they wanted to obtain massive amounts of corn and beans to replace their lost supplies before prices soared. They have locked in record sales at much lower prices and in fact, enough sales shipped and on the books to draw down supplies to precariously low levels now. The rest of the world is now dealing with what China knew with certainty would happen over 6 months ago(because they knew what they had to buy in order to replace the 2020 field production losses-we didn't).

https://www.marketforum.com/forum/topic/64916/#64948

2. The world is now speculating that this is the new normal. We are running out of food. There is massive inflation. We can't produce enough anymore even with record crops. Those are minor factors but go to the link above and see what the main reason is.......that the number 1 producer in the world, with the most people to feed in the world had something happen that has never happened in history to their crops. 3 typhoons ripped thru a key production area in 1 month when the crops were very vulnerable. Whatever crop production numbers China gave us are bs. If they were true, China would not have needed to buy up all the corn and beans in the world to replace that obliterated 2020 crop and China's prices for corn have been DOUBLE our price recently..........so they ran out of corn(and beans) when their production numbers that we saw, suggested they should have more.

So this is NOT the new normal. It was a first ever in weather history and we didn't get the entire truth because China didn't tell us.

3. What will happen now? Unless we have 2 years in a row with the same extraordinary type weather (drought would do it too) hitting a main production area of the Northern Hemisphere and reducing yields/production, then world stocks will rebuild and prices will crash lower and leave all the bulls with their mouths open and pockets empty well before the new crop is made. In fact, if the early part of the growing season is favorable, the highs should be in...........unless extreme adversity hits at some point after that.

4. The cure for low prices...........is low prices. The cure for high prices..............is high prices. Acreage will be way up and producers will be nursing their crops will optimal fertilizer and spraying and not sparing any input costs because these prices stimulate much higher production. Same thing will happen in China. Just an average growing season and world food production could be huge. Don't forget that increasing CO2 is massively increasing crop yields. For beans, the 135 ppm increase in CO2 over the last century+ equates to an increase of 27% in crop growth. They don't want you to know that but they can't stop an atmospheric scientist with an interest in agronomy from using authentic science to verify it and post it on this forum, with the proof........repeatedly.

https://www.marketforum.com/forum/topic/62784/

5. What do the weather indicators suggest for the upcoming growing season? There are 2 items that favor adverse weather. 1 is that we have a La Nina(cool water in the East/Central tropical Pacific, the other is that we are having some modest global cooling(which is mostly being caused by the La Nina) with global temperatures in Feb 2021, the lowest in 7 years. Again, that's another item that they don't want you to know. We are supposed to believe that all bad weather is caused by global warming...........even when we are actually having global cooling:

https://www.marketforum.com/forum/topic/66308/#66311

The polar vortex was supposed to be caused by global warming. The drought out West and wildfires last year were supposed to be from global warming. Problem with that is that they were caused by the La Nina, which is cool temperature anomalies in the East/Central tropical Pacific and we have had some modest global cooling in association with that..................NOT global warming.

Global warming = more EL NINO'S =reduced risk for drought in the US Cornbelt=more rains for US Cornbelt

Global cooling = more La Nina's =increased risk for widespread drought =less rains.

Global warming is why the US Cornbelt has had the LEAST amount of major drought in recorded history, during the last 40 years.

Just 2 droughts.

Last one was 2012, from the 2010/11 early 2012 La Nina.

Previous one in 1988 from the La Nina.

We have another La Nina at this time and fairly widespread drought associated with it. The longer it lasts this year, the more likely the Cornbelt will have drought issues this growing season.

I'll go ahead and start another thread that focus's on weather for the upcoming growing season later this weekend.

Great question and a great response.

Mike, you touched on something we haven’t talked about here much. Just how much of China’s crop was wiped out last year. Cleverly, they kept their mouth shut and bought cheap. Sounds like something else they did, but that’s a topic for another forum. (G)

SA has a record bean crop being harvested and we all know all to well, that prices can correct in a hurry or they could explode. We’re are we? Id love to know...where is that crystal ball!

Thanks Jim!

On the China explanation, this is not something that I read anywhere and confirmed. It's based on my observations of the weather and what happened. There are other explanations. If I am right, we can never know because that authentic data will probably never be released. However, what it means is that this was mainly caused by a weather anomaly, after numerous years without an extreme weather event wiping out massive production(best growing conditions in history the past 40 years thanks to climate change and the increase in CO2).

The most likely outcome in 2021 is a reversion to the mean...........back to more record production with the added incentive of high prices.

If we have just average weather this year in the US, prices will not be close to this in a few months.

I keep reading that if there is any sort of threat to the US crop this year, prices will quickly soar to new highs because stocks are so low.

This is true and it gets the bulls all excited. The ones excited should be the speculators because that is totally speculative.

But the reality is that odds favor a reversion to the mean with record acres and a massive crop. This outcome has played out over and over and over...........but the chance of adversity this year, because of the La Nina is enough to blind some people that should be taking advantage of these short lasting, extraordinarily favorable prices for their business.

The last 2 widespread droughts in the Cornbelt, 2012 and 1988 were caused by La Nina's. But that doesn't mean THIS La Nina will cause a drought. Think about the 30 other years since 1988 when there WASN'T a drought. Best growing conditions since weather has been recorded!

One thing that producers worry about, is selling beans at just $14 and corn at just $6 if beans went to $20 and corn to $9. Why not just wait to see. Yeah, that will work, if you want to sell beans at $12 and corn at $5 or less if we have a reversion to the mean, the most likely outcome.

Bulls always get too bullish close to the top and nobody can pick the exact top. This is not what I'm even trying to do. The top could be $20, I have no idea because the weather in May/June/July is unknown.

Just a reality check to discern between treating your transactions as being part of the business and treating them as speculation.

Here's the growing season weather forecast:

Related to this.............China is committed to producing a huge crop this year to rebuild supplies. If this happens, we won't see the same demand from China for our corn/beans. This was NOT the new normal.

If we have just an average crop in 2021, prices will not be anywhere close to where they are right now.

BEIJING, March 5 (Reuters) - China’s government said on Friday it will raise its minimum purchase price for wheat and rice and expand corn planting areas this year, reiterating earlier plans to boost grain output after prices soared last year.

The moves, outlined by Premier Li Keqiang and the state economic planning agency in annual reports to parliament, also come after the COVID-19 pandemic last year fuelled food security jitters in the world’s most populous country.

“Ensuring that our people have enough food remains a top priority for our government. We are resolved to ensure food security for our 1.4 billion people, and we know we can achieve this,” said Li in his 2021 work report.

The government cut those support prices in 2018 after stocks of the grains ballooned. However, this year it lifted the minimum price for wheat for the first time since 2014 amid a renewed focus on food security.

Surging corn prices have also pushed animal feed mills to use more wheat, tightening supplies of the grain.

Recognising the competition for land between soybeans and corn, the state planner prioritised higher corn acreage and said production of soybeans would be stable this year, changing prior years’ trends of large increases in output. It also said it would support production of grains on barren land."

China will also work to conserve fertile black soil in the northeast while adding more high quality farmland, said Li.

Great comments, Mike ! I keep track of local grain bids and like to look back at what the bids were a year ago. Oct. delivery corn one year ago was $3.25. Oct delivery corn today is $4.56 !

Oct delivery beans March 9 2020 was $8.58. March 9 2021 $12.41....almost $4/bu higher

I think I'll sell more today

Wonderful to hear from you bowyer!

Happy for you guys reaping some awesome prices!

The current big precip maker will hit some very dry spots and is bearish the grains/beans.

But this 1 event will not come close to alleviating the drought/dryness.

It remains to be seen what china does with the black soil in North East China

1st of all they have a water shortage, which limits the choice of crops

Corn production will be limited to areas which will support high intake of water such as corn at the expense of soybean hectares

They will cut back on soybean crops thus presumably buying more soy beans

Now what they are doing better

Many farms are 10 hectares farmed by older people. They are making larger areas and using better machinery although they still do manual work

As for barren soil ,that is land that was destroyed by erosion which was deforested and then eroded. They will plant those hectares back to trees, but not corn as it is very steep side hills. Flat ground does not erode by water very fast and become barren

They have wet lands which will remain to supply other water needs, but that is limited as the water and crops are not in the same place. Wet lands and pasture seem to be a better mix of resources

The machinery is better than manual but is a far cry from NA farming practices

China is famous for proclaiming big advances but when the test comes communist do not always live up to their expectations

So

To think they will grow a lot more grain is suspect at best

What they will do is grow crops better suited to the region including trees and wet lands which will slow down and eventually stop the soil from losing fertility

But to expect a big corn crop, this will come , mostly at the expense of other crops such as rice and soybeans

Remember this is communist china and they will talk the big talk but actually doing it is another story

they are still in the process of re-building there hog herd even though some disease has emerged one would think they have a better handle on control measures

More hogs equal more feed grains from some place and they won't grow all of the extra in China

Some basic research will help understand what they can and can't do

I agree they will not likely have a crop failure like last yr but our own drought is still a question

Australia finally harvested a crop after two yrs of drought but Australia will have smaller droughts most yrs some place

Water shortage? What part of China? There wasn't much of that country that wasn't under water for 3 months last year.

If China has a normal crop this year it will be bigger than what they had last year. You don't have so much water that it almost takes out the worlds largest dam and not have massive crop damage.

"To think they will grow a lot more grain is suspect at best"

No Wayne!

In every other time in history when we had near record prices of any commodity, especially a crop, what did the market do?

It always did backflips trying to increase supply.

Almost every producer everywhere that can, will be maximizing the amount of corn/beans they can plant and increasing inputs.

China is no different.

You can doubt the specifics of what they tell us but:

1. They will respond to the current storage/supply shortage by increasing new crop supplies.

2. They will be responding to the huge prices higher from #1 by increasing new crop supplies.

3. The chances of them being clobbered with extremely adverse weather, similar to the 3 typhoons in Aug/Sept in 2021 are maybe 1 out of 20 chance. The risk would be mostly drought. It can happen for 2 years in a row but I'll take my chances on the reversion to the mean which is almost always the case.

By wglassfo - March 8, 2021, 3:20 a.m.

Let me give the forum some info that hasn't had wide spread coverage in the Ag sector

Brazil is getting some serious flooding with some few million acres that will not be harvested. Cattle are being moved to higher ground, corn planters sit in flooded fields. This is in the high producing areas of Brazil. Mean while Argentina is still in drought conditions. Now we all know that some where in the middle the conditions are good for crops assuming the area is suitable for row crops

An agronomist in Brazil is telling us that SA will not produce a bumper crop and the chances of a good second Safrina crop of corn are dwindling with delayed planting due to flooding

I know the loss of 50 million bu of beans will not be a total disaster, given total estimated production but with low ending stks in NA any yield reduction this yr counts for more than yrs when stks are plentiful

To nites price action means some body is watching the weather and harvest progress, with some price premium

The next 10-14 days might be drier in Brazil and harvest might resume in some places, currently flooded. However, I am not a weather person so please, on the 10-14 day, do not take my weather estimates seriously

Also some crops are most likely still developing as Brazil is a big place and too much water can harm plant growth

Just a note of caution re: estimated crop production for SA