Continue here please.

Even though the models are showing slightly warmer at the end of week 2, I don't thiink that has been the reason for the climb today. Near-term forecasts are cold for the next week. And usage/drawdown is getting a headstart.

Also, no change in current policies for future oil and gas rig development.

JMHO

We are in a"seasonal" uptrend time frame, but I would say if you're long and you get in a daily rally, take your money from time to time and get back in at a lower point. It's going to gyrate for a while

thanks mark and jim,

previous ng thread

https://www.marketforum.com/forum/topic/64852/

from earlier this mrning

As traders and analysts parsed the latest forecasts for clues on the intensity of this month’s frigid temperatures and the timing of when the cold pattern will start to fade, natural gas futures were up slightly early Wednesday. The March Nymex contract was trading 2.9 cents higher at $2.864/MMBtu at around 8:50 a.m. ET. As…

February 10, 2021

metmike: all the 12z guidance came in quite a bit colder

A rally like this was so overdue. It still warms to near normal 2/22 on both at 12Z, but as Mike alluded to, the HDDs for most days before then increased enough to cause a dramatic aggregate increase. Added to that the near record cold on the way for late week/early next week, it was no surprise at all that it turned around from steep losses last night to big gains today. The amazing thing to me was how low it traded last night with the record cold coming and not warming to near normal til 2/22! But it took even colder models at 6Z/12Z to finally get NG to wake up.

thanks larry

last weeks report

for week ending January 29, 2021 | Released: February 4, 2021 at 10:30 a.m. | Next Release: February 11, 2021

-192 bcf

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/29/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 01/29/21 | 01/22/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 582 | 641 | -59 | -59 | 609 | -4.4 | 562 | 3.6 | |||||||||||||||||

| Midwest | 719 | 780 | -61 | -61 | 735 | -2.2 | 670 | 7.3 | |||||||||||||||||

| Mountain | 158 | 170 | -12 | -12 | 138 | 14.5 | 140 | 12.9 | |||||||||||||||||

| Pacific | 261 | 275 | -14 | -14 | 210 | 24.3 | 218 | 19.7 | |||||||||||||||||

| South Central | 970 | 1,014 | -44 | -44 | 956 | 1.5 | 901 | 7.7 | |||||||||||||||||

| Salt | 281 | 288 | -7 | -7 | 286 | -1.7 | 272 | 3.3 | |||||||||||||||||

| Nonsalt | 689 | 726 | -37 | -37 | 671 | 2.7 | 629 | 9.5 | |||||||||||||||||

| Total | 2,689 | 2,881 | -192 | -192 | 2,648 | 1.5 | 2,491 | 7.9 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,689 Bcf as of Friday, January 29, 2021, according to EIA estimates. This represents a net decrease of 192 Bcf from the previous week. Stocks were 41 Bcf higher than last year at this time and 198 Bcf above the five-year average of 2,491 Bcf. At 2,689 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

Latest Release Feb 04, 2021 Actual-192B Forecast-192B Previous-128B

U.S. Natural Gas Storage

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Feb 11, 2021 | 10:30 | -181B | -192B | ||

| Feb 04, 2021 | 10:30 | -192B | -192B | -128B | |

| Jan 28, 2021 | 10:30 | -128B | -136B | -187B | |

| Jan 22, 2021 | 10:30 | -187B | -174B | -134B | |

| Jan 14, 2021 | 10:30 | -134B | -130B | ||

| Jan 07, 2021 | 10:30 | -130B | -114B |

temps for the previous report

temps for tomorrows report

mild for early feb except the east/southeast

+++++++++++++++++

Natural gas futures probed higher early Thursday, testing the $3/MMBtu barrier as higher confidence in frigid temperatures this month and the prospect of a hefty storage withdrawal boosted prices. The March Nymex contract was up 8.7 cents to $2.998/MMBtu at around 8:50 a.m. ET. Analysts at EBW Analytics Group attributed the early price gains Thursday…

February 11, 2021

for week ending February 5, 2021 | Released: February 11, 2021 at 10:30 a.m. | Next Release: February 18, 2021

-171 bcf bearish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (02/05/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 02/05/21 | 01/29/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 529 | 582 | -53 | -53 | 577 | -8.3 | 525 | 0.8 | |||||||||||||||||

| Midwest | 666 | 719 | -53 | -53 | 703 | -5.3 | 626 | 6.4 | |||||||||||||||||

| Mountain | 150 | 158 | -8 | -8 | 129 | 16.3 | 132 | 13.6 | |||||||||||||||||

| Pacific | 257 | 261 | -4 | -4 | 204 | 26.0 | 209 | 23.0 | |||||||||||||||||

| South Central | 915 | 970 | -55 | -55 | 914 | 0.1 | 874 | 4.7 | |||||||||||||||||

| Salt | 261 | 281 | -20 | -20 | 272 | -4.0 | 269 | -3.0 | |||||||||||||||||

| Nonsalt | 654 | 689 | -35 | -35 | 641 | 2.0 | 604 | 8.3 | |||||||||||||||||

| Total | 2,518 | 2,689 | -171 | -171 | 2,527 | -0.4 | 2,366 | 6.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,518 Bcf as of Friday, February 5, 2021, according to EIA estimates. This represents a net decrease of 171 Bcf from the previous week. Stocks were 9 Bcf less than last year at this time and 152 Bcf above the five-year average of 2,366 Bcf. At 2,518 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Feb 11, 2021 Actual-171B Forecast-181B Previous-192B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Feb 11, 2021 | 10:30 | -171B | -181B | -192B | |

| Feb 04, 2021 | 10:30 | -192B | -192B | -128B | |

| Jan 28, 2021 | 10:30 | -128B | -136B | -187B | |

| Jan 22, 2021 | 10:30 | -187B | -174B | -134B | |

| Jan 14, 2021 | 10:30 | -134B | -130B | ||

| Jan 07, 2021 | 10:30 | -130B | -114B |

GFS showing a warming trend late 2nd week. I don't think the EE is going to be much different. We about to find out.

thanks mark!

actually the warming kicks in late in week 1.

The extreme/record low -----AO bounces back to near 0 in less than a week. the nao also increases to near 0, as well as the pna.

The very amplified flow that featured cross polar flow and a very far south excursion of the polar vortex to just north of the North Dakota canadian border, will quickly de amplify and become more zonal in less than a week.

a west to east jet stream instead of air masses coming from the far north.

However, a blob of dense, extreme arctic cold dumped deeply south into the us early next week will be tough to dislodge as 2 major snowstorms lay down a couple of heavy snow tracks....1 early in the week, the other one, 3 days later...... that will help to sustain the cold longer...delay the moderation.

February 12, 2021

Index action over the last several days for Rockies/ Plains

| Feb | Oil Index | Gas Index | ||||

| Actual | ND Sweet | Henry Hub | North Border-Watford | North Border-Ventura | Cheyene Hub | NW WY Pool |

| 8th | 48.32 | 3.205 | 2.815 | 4.185 | 3.44 | 3.365 |

| 9th | ||||||

| 10th | 49.03 | 3.705 | 3.315 | 6.885 | 5.54 | 4.545 |

| 11th | 49.03 | 5.91 | 5.52 | 15.08 | 14.775 | 9.46 |

And its -14 F in Williston ND rght now.

thanks very much Joe!

Always great to hear from you.man, thats some extreme cold!!!

Prices today are mainly reacting the current and upcoming EXTREME cold.

Moderating temps after a week, are keeping a lid on the price and prevented us from testing $3 today.

Actually, we spiked higher and sold off back close to $2.9 near the close because of the huge pattern change to much milder in week 2.

15 Rigs running and I have 1

Feb Directors cut December Prod:

| Directors Cut | 2/13/2021 | ||||||||

| NDIC | |||||||||

| Oil | M over M | M over M | Gas | M over M | M over M | ||||

| Mth | Mthly cum | Bbls/ D | Mthly cum | Mcf/ D | |||||

| Dec | 36,956,504 | 1% | 1,192,145 | -3% | 89,680,150 | 4% | 2,892,908 | 0% | |

| Nov | 36,736,201 | -3% | 1,224,240 | 0% | 86,323,059 | -3% | 2,887,402 | 0% | |

| Oct | 37,909,008 | 3% | 1,223,107 | 0% | 89,083,281 | 5% | 2,873,654 | 2% | |

| Sept | 36,649,997 | 1% | 1,221,667 | 5% | 84,453,374 | 3% | 2,815,112 | 7% | |

| Aug | 36,126,492 | 12% | 1,165,371 | 12% | 81,692,742 | 14% | 2,635,250 | 14% | |

| July | 32,304,503 | 21% | 1,042,081 | 17% | 71,375,125 | 21% | 2,302,356 | 17% | |

| June | 26,703,268 | 0% | 890,109 | 4% | 59,198,681 | -1% | 1,973,289 | 2% | |

| May | 26,640,218 | -27% | 859,362 | -30% | 59,771,779 | -27% | 1,928,122 | -29% | |

| April | 36,572,571 | -17% | 1,219,086 | -15% | 81,365,042 | -16% | 2,712,168 | -13% | |

| March | 44,276,463 | 1,428,273 | 96,902,755 | 3,125,895 | |||||

| All time highs | |||||||||

| Oil | 1,519,037 | Bbls/D | 11/30/19 | ||||||

| Gas | 3,145,172 | Mcf/D | 11/30/19 | ||||||

| Rig count | 218 | 5/29/2012 | |||||||

thanks joe!

looks like production still is not close to recovering to pre covid levels.

No and it won't at current rig count. Bakken/Three Forks decline is too severe.

What rig count is necessary to get back to all time highs?

Since decline curves vary by age of well (very steep 1st three yrs then levels off) and completion data (IPs per well) not presented orderly by NDIC not possible to calculate. In my opinion the trend continues to decline at 15 Rigs. My guess is there needs to be 2X or 3X times the number of existing Rigs just to stabilize the existing production.

sounds like the recipe for higher prices ahead, joe,

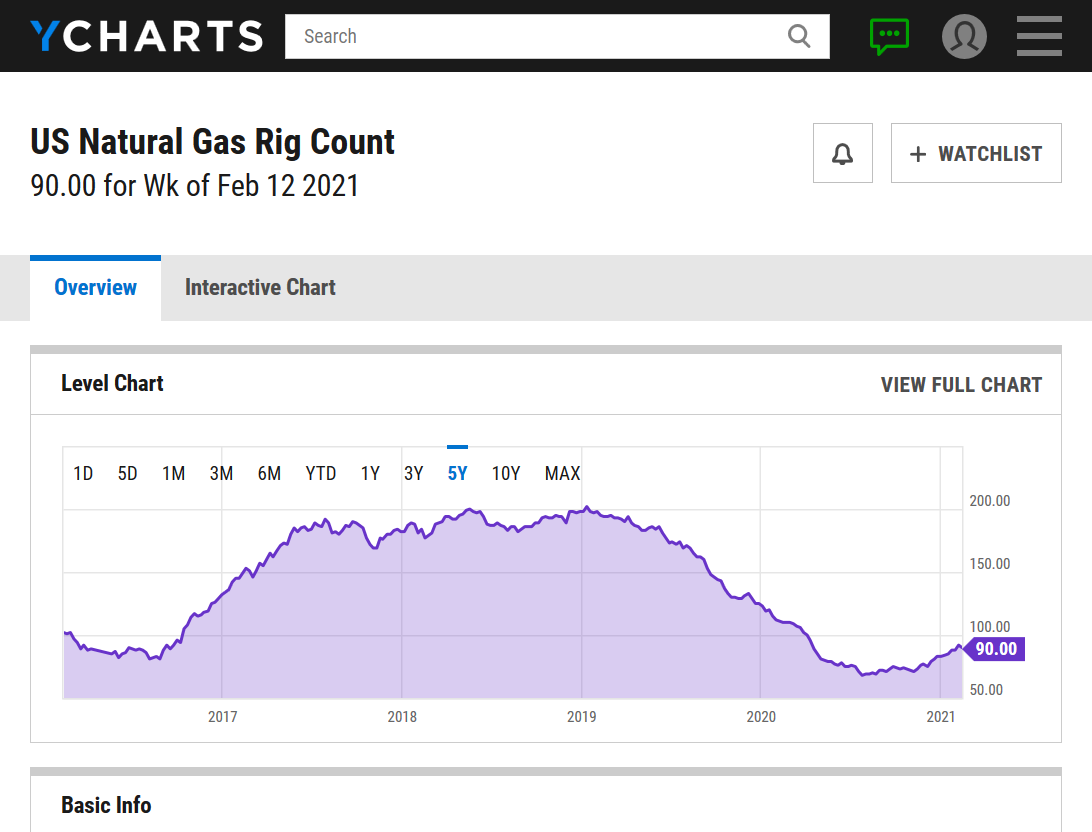

https://ycharts.com/indicators/us_gas_rotary_rigs

Baker Hughes reported on Friday that the number of oil and gas rigs in the United States rose by 5 last week. The total number of active oil and gas rigs in the U.S. is now 397—or 393 fewer than this time last year.

The oil and gas rig count has risen for twelve weeks, during which time the rig count has increased by 87.

The oil rig count increased by 7 this week, and the number of gas rigs dipped by 2. The number of miscellaneous rigs remained unchanged.

The EIA’s estimate for oil production in the United States for the week ending February 5 was 11.0 million barrels, an increase of 100,000 bpd from the week prior, but still 2.1 million bpd off the all-time high reached last March.

Canada’s overall rig count increased this week by 5. Oil and gas rigs in Canada are now at 176 active rigs and down 79 year on year.

The Permian basin saw another increase this week in the number of rigs, by 5, bringing the total active rigs in the Permian to 203, or 205 below this time last year.

In the prior thread on 2/9, I said this:

"Although the record cold should already be dialed in, I predict that there will be one or two days later this month on which it goes up very strongly even without colder wx forecasts. The news stories will then mention the record cold as the reason as it if somehow it hadn't already been dialed in."

---------------------------------------------

This is precisely what happened yesterday as per NGI and was posted here:

"Natural gas futures climbed in early trading Friday as surging physical prices and production freeze-offs illustrated the impact of frigid temperatures sweeping through the Lower 48. The March Nymex contract was up 5.7 cents to $2.925/MMBtu at around 8:45 a.m. ET.

The weather models trended warmer overnight, according to Bespoke Weather Services. The firm attributed the strength in futures prices early Friday to soaring prices in the physical market driven by 'the incoming wave of extreme cold.'"

So, NG went up sharply on a day with warmer, not colder, models/fcasts. Maxar was a whopping 11 HDD warmer! The 0Z/6Z GEFS were a whopping 17 HDD warmer than the 0Z of the day before! Mike often says that NG largely cares about late week 2 because it then projects that trend beyond week 2. Well, the models were actually warmer for 2/24-6 with warmer than normal rather than near normal then. Models the day before had low 20s HDD (near normal) for then. However, EPS/GEFS had warmed to ~18 (warmer than normal) for that same period yesterday morning.

And this was even after a bearish EIA the day before. At one time, NG was up 12 cents! NG can be weird in this way. Although many days have wx fcast changes and NG price trends in sync, Feb 13 is an example of days when that is not at all the case. And as I posted earlier, I was saying that there was some underlying bearish influence(s) that was holding NG down despite colder model/fcast changes. Mike was saying it was because of warming in week 2 to get it to near normal late week 2. But as I said, that warming had been in models for a number of runs and was not new info to be dialed in. While that warming late week 2 was still there, models/fcasts were adding in a significant # of HDD in the aggregate for before late week 2. We'll never agree, but that's ok and that's done. It is almost as if yesterday were a makeup for those days earlier when NG was being held down. There was no good reason from a wx change standpoint that NG had risen 12 cents yest at one point as wx changes were warmer. But yet that kind of thing happens on some days because they're sometimes not in sync/timing is off/they makeup for prior days that were off the other way/nonwx factors have more influence some days, etc.

Mike, can you think of a wx change reason why NG was up as high as 12 cents yesterday?

"Mike, can you think of a wx change reason why NG was up as high as 12 cents yesterday?"

You have it in your head that I think every reaction in ng is/was caused by a change in the weather......even when I correct you on that, like I am here.........again.

Going back to the previous thread, you neglected to include or even remember my last response to your thoughts that you copied/past above:

By metmike - Feb. 9, 2021, 10:53 p.m.

" I agree totally larry."

https://www.marketforum.com/forum/topic/64852/#65467

Not sure what else to add. I posted the reason for yesterdays's spike higher yesterday here/below, including the the HDD's overnight were warmer:

https://www.marketforum.com/forum/topic/65479/#65528

https://www.marketforum.com/forum/topic/65479/#65552

i can add some additional insight on prices yesterday.

After the brief big spike higher from the approaching record cold, the market sold off to the lows of the day session and closed there, which is obviously a sign of the market looking ahead to Sunday Night/next week, when the forecast will get increasingly warmer from progression of extremely cold days early in the forecast being replaced by much milder days at the end of the forecast(week 2).

So HDD's should continue to go LOWER next week with the pattern change to more zonal flow flushing out the extreme cold.

That's really showing up now in the extended forecasts:

https://www.marketforum.com/forum/topic/65479/#65561

Later week 2 will be a key to prices next week and where the new upper level trough sets up. If its in Western North America, with ridging to the east, we really warm up and the weather is bearish.........as depicted on the latest GFS ensemble mean forecast near the end of February.

If it shifts back into the Midwest, it will turn bullish.

Regardless, it's tough to get too bearish ng in the months of March/April. NG goes up something like 90% of the time. Crashing prices in 2020 during that period last year were a covid fluke.

Mike just said: "You have it in your head that I think every reaction in ng is/was caused by a change in the weather......even when I correct you on that, like I am here.........again.

Going back to the previous thread, you neglected to include or even remember my last response to your thoughts that you copied/past above:"

-----------------------------------------------------------------

In the prior thread (last post of it), Mike had said in response to that post of mine predicting 1-2 days later in Feb. of a strong spike higher on days when the forecast wasn't colder:

"I agree totally larry.

we have some extremely bullish eia reports coming up.

1. just that by itself will help to keep the market propped up......until the reports are out.

2. seasonals are starting to turn up and are very strong in march/april.

you dont want to be short ng in mar/april without a real good reason

3. almost everybody would agree that the lows are solidly in"

-------------------------------------------------------------------------------

Mike,

1. In retrospect, you're correct as you, indeed, did support the idea of spikes in Feb without colder wx changes per the quoted post just above. As it was the very next post, I was sloppy in not paying attention to it when I made today's first post. I could have done better.

2. I largely agree with you about the late session weakness. I don't see the 12Z models having caused this as they were actually a little colder than prior runs and also weren't warmer late. But the market overall seemed to not want to be long for the Sun nite open/there were a bunch of longs who decided to go flat. I do think that some of that drop was due to it having been up strongly earlier even on a day with warmer early forecast/models.

3. What amazing cold is occurring especially way down in TX! And it isn't just the strength of the cold. It is also the duration, which supports the good chance of not one but TWO heavy snows in DFW next week just 3 days apart! As a wx follower, this is exciting. I looked back at DFW records and couldn't find a single instance of a 3"+ with them mainly in the teens, which is what is expected for the first big snow! Some models suggest it could be as much as 4-6+". The NWS has 4-6".

Also, I couldn't find a single instance of two major snows at DFW just 3 days apart. So, IF it happens, that would be history, too.

4. Due to the very long duration and intense cold so far south into TX, large freezeoffs are another bullish factor.

Larry,

Wonderful as usual on compiling and sharing stats for extreme/anomalous weather events.

This one is way up there.

Any early guesses on the next 3 EIA numbers?

I'm getting enough use of my left arm back to do 2 hand typing again, so that should help me to be more productive on the keyboard, instead of using 1 finger.

Mike,

Hopefully your arm fully heals up fairly soon. Your continued posting shows your devotion to this board.

NG: looking for the first 200+ draw of this winter on this week's report and only the 2nd ever 300+ draw next week! And the following week could easily be well into the 100s but that's still a ways out.

NG up strongly out of the gate this evening. I'm sure it is due mainly to the current record cold again. However, unlike Fri AM, the models were actually a little colder day on day with GEFS +4 and EPS +8 12Z today vs 12Z Fri. Also, I think this weekend has come in a bit colder than forecasted. Yes, it still warms to near normal on the models on 2/22 and then even goes slightly warmer than normal thereafter. So, the aggregate HDD as fully expected continues to decline as front very cold days get replaced by near to slightly warmer than normal back days. BUT, the days before 2/22 cooled off some vs Friday's runs, especially 2/19-21. So, I don't think there's much for shorts to hang their hat on right now.

I’ll throw in some bearish thoughts because I always like the bearish side. If this was January, we would be off to the races. Fact is, you have just described the end of winter. It will be March in 2 weeks during a forecast, if it holds up, is warming. Still large amounts of gas in storage.

Not to put words in Mikes mouth, but as he would say, the market knows all of this and bulls need to be fed.

Now that I have said all that, watch the market rally to $4

Thanks Jim!

Gap higher open because of how extreme this historical cold is as well as 2 huge Winter weather events this week, that will help to sustain the deep freeze that much longer....just too much and overwhelming to everything else.

Interesting that the high, right after the open was 3.051 and the low, 3.007 was also during the first minute of trading in the front month March ng contract.

The high on Friday was 2.980, so there is a bullish upside gap between 2.980 and 3.007(todays low).

Filling that gap, trading back down to 2.980, will put in a gap and crap, buying exhaustion formation which is bearish.

The weather models in week 2 are currently too warm for us to build on the gap higher.

This is a very tricky area for ng. The next 3 EIA numbers will be very bullish, with one of them historically bullish -300 bcf drawdown as Larry suggested.

But as you noted, we should have this pretty much dialed in.

Seasonals turn up strongly by the end of February, in some years, earlier than that.

No question in anybody's mind that ng already made a solid bottom early last month.

Larry,

Great call last week on questioning the markets lack of acting more bullish than it did on a couple of days with this extreme cold in the forecast.

In retrospect it probably just under appreciated the enormity of it until it was actually here.

Seeing extreme winter conditions in the news so far south and for so long, seems even more impressive than imagining it based on weather models.

Or...last weeks bearish withdrawal is calling into question this over blown notion of all the supposed off shore demand as well as our own.

Thanks, Mike. NG can be weird in the way. You'd think it would better dial in this kind of thing further back in time but then it almost acts as if it is playing catchup later when the EIA reports approach.

Here we go again!!

I think they are going to be low.

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Feb 18, 2021 | 10:30 | -181B | -171B | ||

| Feb 11, 2021 | 10:30 | -171B | -181B | -192B | |

| Feb 04, 2021 | 10:30 | -192B | -192B | -128B | |

| Jan 28, 2021 | 10:30 | -128B | -136B | -187B | |

| Jan 22, 2021 | 10:30 | -187B | -174B | -134B | |

Amid reports of power outages and production freeze-offs resulting from an intense cold blast stretching down into the Gulf Coast over the holiday weekend, natural gas futures were sharply higher in early trading Tuesday. The March Nymex contract was trading at $3.095/MMBtu at around 8:50 a.m. ET, up 18.3 cents from Friday’s settlement. A result…

I wonder what the greenies come back is going to be when fossil fuel supporters point to people freezing in Texas because windmills froze, combined with the rolling blackouts that California had last summer when it got so hot. Hard to charge those electric cars in either situation, let alone trying to stay alive when it's so cold outl

Their comeback is that this was caused by global warming/climate change and is even more reason for us to get rid of fossil fuels, so that this kind of extreme weather will go away.................100% seriously.

Global warming causes everything

Started by metmike - Feb. 16, 2021, 1:06 a.m.

https://www.marketforum.com/forum/topic/65704/

NG and electric shortage

10 responses |

Started by wglassfo - Feb. 15, 2021, 2:10 a.m.

You can't escape the irony of green energy being unreliable and fossil fuel being reliable, but people die because they freeze to death when they have not heat or it's too hot and renewable energy isn't there because solar panels are covered in snow or the wind mills are froze. That windmill blades are being buried at a precipitous rate, etc etc.

If one thing don't kill you the other will.

I still think they should use those old windmill blades for the southern border wall. Do you have any idea that once those blades start breaking down, how uncomfortable those fiberglas shards would be?

Weather 2 weeks out only slightly warmer. Not much of an influence. But the second round of extreme winter weather crossing the nation, with the cold and snow, should be an influence on today's actions. Power outages, freeze offs, high power demand, etc. Kinda like yesterday.

February 17, 2021

metmike: Impossible to predict where the extremely volatile front month is going.

Temperatures for tomorrows EIA report. Frigid North/Central. Mild Southeast and Southwest. Should be a hefty drawdown.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Feb 18, 2021 | 10:30 | -252B | -171B | ||

| Feb 11, 2021 | 10:30 | -171B | -181B | -192B | |

| Feb 04, 2021 | 10:30 | -192B | -192B | -128B | |

| Jan 28, 2021 | 10:30 | -128B | -136B | -187B | |

| Jan 22, 2021 | 10:30 | -187B | -174B | -134B | |

| Jan 14, 2021 | 10:30 | -134B | -130B |

A more likely forecast.

Latest Release Feb 18, 2021 Actual-237B Forecast-252B Previous-171B Bearish vs expectations but that's a big number https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Feb 18, 2021 | 10:30 | -237B | -252B | -171B | |

| Feb 11, 2021 | 10:30 | -171B | -181B | -192B | |

| Feb 04, 2021 | 10:30 | -192B | -192B | -128B | |

| Jan 28, 2021 | 10:30 | -128B | -136B | -187B | |

| Jan 22, 2021 | 10:30 | -187B | -174B | -134B | |

| Jan 14, 2021 | 10:30 | -134B | -130B |

Dang! All dressed up, and nowhere to go. The premium of this report, has already been made.

As of 12Z Sun vs 12 Fri, I have the main models a bit warmer day by day although the GEFS appeared to have more of a warmer change vs Fri. All fwiw.

Thanks much Larry!

Mark started a new ng thread a couple of days ago and I was in Louisville this past weekend but have been catching up the last few hours.

https://www.marketforum.com/forum/topic/65814/