Nov. 5: CBOT #soybeans break through $11/bushel for the first time since July 14, 2016.

Thursday's high at the time of this post is $11.12-3/4 for the most-active.

That is $2.94 higher than the 2020 low of $8.18-1/2 set on April 21.

So the question is:

Why are beans going up

In our local we have strong corn prices with chicago over 4.00 in multiple months

I will give you my take which is nothing but a wild guess

Concern about SA crop conditions [dry]

China needs beans and/or food

2019 USA crop was over estimated

Another stimulus pkg. The only unknown about a stimulus pkg is how big. Dollar seems to want to weaken although nothing as of yet says it will weaken

Biden will be willing to trade with china

It seems that grain prices will remain flat for yrs and then suddenly seem to play catch up with inflation

Take yer pick, maybe none of the above, but I think we will see stronger grain prices, on average in the yrs ahead

Now that doesn't mean I am wildly bullish as we have sold considerable crop at good prices. Protection in case this rally disappears. When the plate goes around, nothing wrong with taking a cookie, especially if the cookie is profitable

Thanks Wayne!

Record demand from China has been the biggest factor, I think.

Thanks Wayne and Mike.

The strength in Soybeans caught me by surprise. I think it might be a market to keep an eye on. Maybe early in a bigger move.

I think Wayne hit on the fundamentals.

I have been looking around for some tech views of the market. I am not a chart guy but have read Murphy's book a couple times. :) Most of the tech stuff I read I dont really understand.

When I look at monthly continuation, I see some resistance around $12 from the June '16 high. I guess I also think I see a H&S top Sept '12 with a neckline that would put resistance about $12.60. After that who knows.

ETA: Current local soybean basis is about $0.21 better than 3 year average basis even after strong move up in futures.

I think that when you get parabolic moves up to ration supplies, they often feature panic buying near the end/top which doesn't care about charts or previous highs. There are enough buy at the market type orders near the top from traders crying uncle to overcome any resistance.

Those speculators brave enough to be selling at extreme highs and a parabolic move up are picking a top. If they are too early, they can sometimes turn into the same ones crying uncle shortly after that when their drawdown exceeds expectations by a wide margin.

I don't know if that's what might be happening here. If the weather in South America turns adverse, then its likely. Brazil is buying our beans right now. They are sold out and the new crop is months out and they planted late in number 1 producing Matto Grosso because of drought.

We have a La Nina that enhances chances of drought but thats not my prediction, just something to watch and the market has dialed in risk premium for that.

If the weather ends of near perfect for SA the next few months, then it may keep a lid on all of that.

However, drought over a significant area will cause prices to go much higher and could blow thru previous highs.

Big rains coming up in much of Brazil the next 2 weeks!

The area's to watch now, that will turn drier are N. Argentina and very far south Brazil.

https://www.marketforum.com/forum/topic/60884/

Re: Re: Re: INO Morning Market Commentary

By metmike - Nov. 6, 2020, 3:34 p.m.

Congrats to our US producers!

I suggest that those who consider forward contract sales on their crops, do consider some sales on the way up here over the next 2 months. There is no way you can't make a nice profit at these prices. Do not try to pick a top and do assume, that when we are within shouting distance of the Brazil harvest, let's say in January, that prices could plunge from a spike high before then(from rationing the shortage of old crop).

With the current La Nina lasting into 2021, odds of a drought in the US next year are elevated. With the current, extremely bullish fundamentals, a drought in the US would cause all time record highs in the beans by a wide margin and corn would spike much higher too.............but this is wild speculation.

Leave the speculation to the speculators who make and lose money based on taking on risk. Farmers are interested in taking OFF risk.

The biggest risk in selling beans early is having a drought on your farm in 2021. This can be protected by replacing the sales with calls, if you are comfortable with that strategy.

Then there is crop insurance in case you have a failure. I am not an expert on the rules regarding this protection.

I am just suggesting that you consider locking in some wonderful prices for a small portion of your 2021 crop if/when we get some crazy spikes higher here, especially beans as the market bids up the price to ration the remaining(short) old crop.

Use the market to maximize your 2021 profits.

NOPA U.S. #soybean crush in October hit an all-time monthly record of 185.245 mln bu, well above the average analyst guess of 177.123 mbu (which would still have been an Oct record).

Soyoil stocks rose to 1.487 bln lbs, above year-ago but below 2y ago. Trade guess was 1.448 bln.

Very impressive comeback today suggests the top is NOT in.

Great to see good prices again! I fear too many farmers sold too much too soon. I started selling when I could get $10 cash out of the field. Still have half of my beans in the bin, and am long on paper although I've been in and out many times. I wasn't real happy when I got up this morning and saw bean futures. I've got stops in tonight so I'll sleep just fine.

No positions in corn except long in the bin

I've been buying a few feeder cattle and hog calls for next spring (hogs next fall)

It's hard to go wrong in a market like this bowyer!

You've been in the business for decades and probably have a great marketing strategy. I can tell that you understand the markets extremely well.

Producers use the markets to reduce risk by locking in opportunities to sell at wonderful prices.

Not sure how wonderful you want that price to be but prices always hit a top when everybody is the most bullish and thinks that we are going higher.

I actually have some confidence that prices have not topped and think theres a chance we could spike a few bucks higher than this if prices need to ration demand that is greater than the dwindling supply right now.

New supplies won't come to the rescue from Brazil for a couple of months(early harvest).

So the table is set for a parabolic move higher.........but what if China has bought all they need for the next few months and stops buying at this crazy high rate until after the Brazil harvest?

Not saying that will happen but if the market got news like that, the bullishness may have peaked already.

Since SA now produces more beans than the US, we can sort of pretend this is late May in the Northern Hemisphere a couple of decades ago and the market is completely running out of old crop beans until the US new crop is harvested.

It's possible, if the weather turns very wet in the drought areas of Brazil that this could stop prices from going much higher.

At the same time, a worsening of the drought in Brazil, in December 2020, just like if we had a worsening drought in June 2000, with extremely low stocks, could send beans to new highs by a wide margin.

How much adversity is already dialed in at $12?

So far, this high price doesn't appear to be causing major cutbacks in demand that we know must happen in the next 2 months because bean stocks can't go to 0.

Just some things to think about.

Thanks mike ! I wish I had a good marketing strategy , but it seems I am wrong as often as I'm right. I decided last night to reduce my soybean futures position by half. Like you, I feel that beans can still explode higher, but maybe they won't ! I sit back and wonder why do I want to buy $12 beans? I remember selling cash corn for $8.30 and not feeling good about the sale ! Of course there were a lot of predictions then, that corn was going to $12. I'd be thrilled to get $5 corn now ! If prices do explode higher, I'll be doing some multi year hedging. Thanks for the forum , Mike I'll be holding my beans in the bin until maybe summer or before new crop is available. Basis could get very good if beans are hard to come by, I may do a HTA and set basis then.

This move as just got my attention. Thank you MF!

I haven't speculated in grains since the 80's when I was a young pup trying to catch a repeat of the 70's grain inflation that never happened. If this is a new shift happening beneath our feet, it has huge implications. I am not good at posting charts but my recall is that the stock market performed poorly in the years 1965-1982. Stock averages currently trade at a PE of 22-1. It doesn't mean we can't go higher. It doesn't mean we are about to crash. But IF general inflation is unfolding (finally), then you might want to consider other places to park your money for the next 10 - 15 years.

Thanks much joj!

Definitely the DX crashing (makes the price of everything in dollars go up) and potential inflation(attracting big fund money to all commodities right now) are a factor and there is a farmer strike in Argentina, but by far, the biggest factor fueling this move has been unprecedented demand from China this year.

They literally bought out all the soybeans in South America and not only did this mean massive buying of our beans this year from China, the unheard of dynamic, for recent years has happened. SA buying their beans from the US, because they ran out!

And now the US is almost out of beans, so the price has to soar higher to ration that extremely low supplies.

There is still more demand right now than there are supplies for the next 2 months. Stocks can't go negative, so the only way to cut the demand is to ration the supply with even higher prices, since $12, still has not done that.

You are probably familiar with parabolic moves at market tops in the past with similar dynamics.

This could be one of them. When we get much above this, crazy things can happen. Margin calls, shorts squeezes, panic buying, hedges coming off, traders calling "uncle".

The days leading up to the top could be limit up days................not sure but its the ideal environment. Followed finally, by a final buying exhaustion and limit down. I have no clue on how high that might be but the new crop beans in Brazil, coming to the rescue are still 2 months away.

It's not likely that the market will wait that long to put in the top but we may not have seen anything yet.

So until Brazil' new crop is harvested in February/March, anything could happen and it will likely get MORE volatile over the next month.

Its interesting to note that the weather for Brazil right now is VERY bearish. Imagine what the beans would be doing if the weather was bullish!

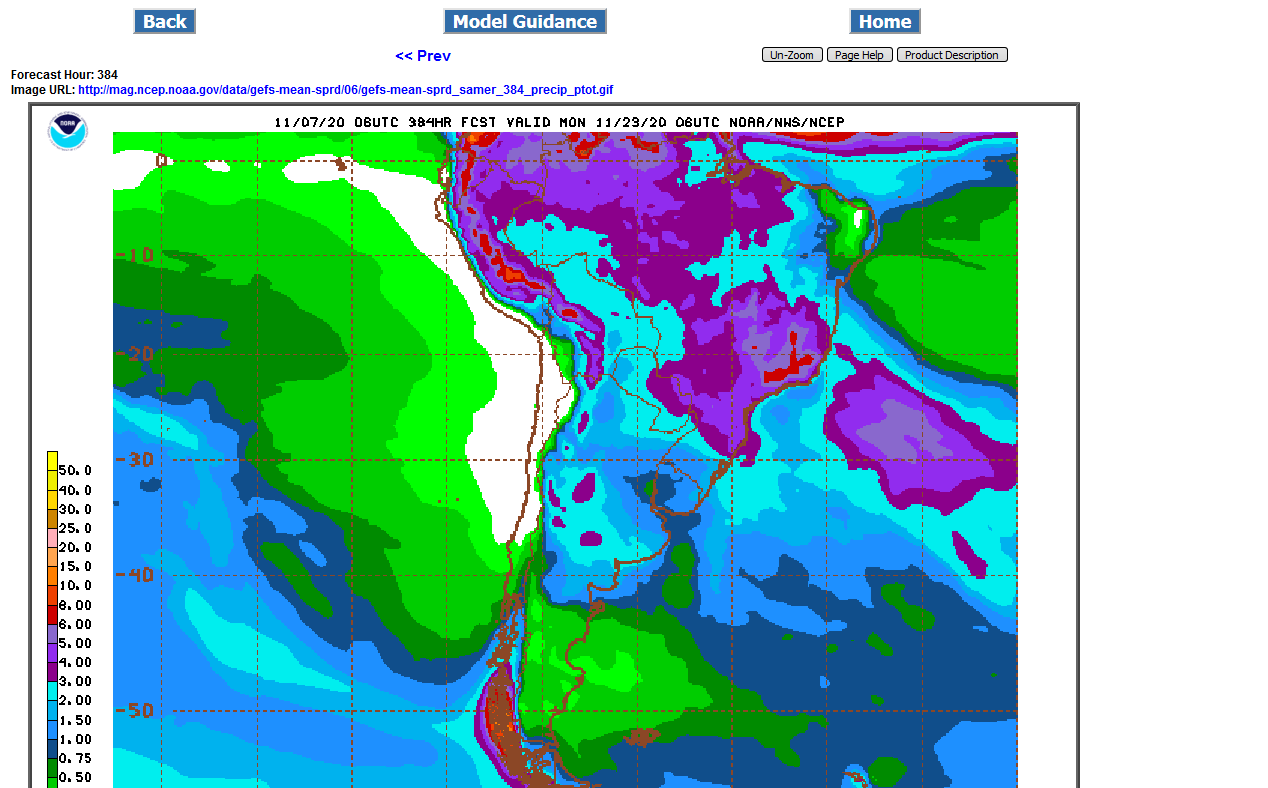

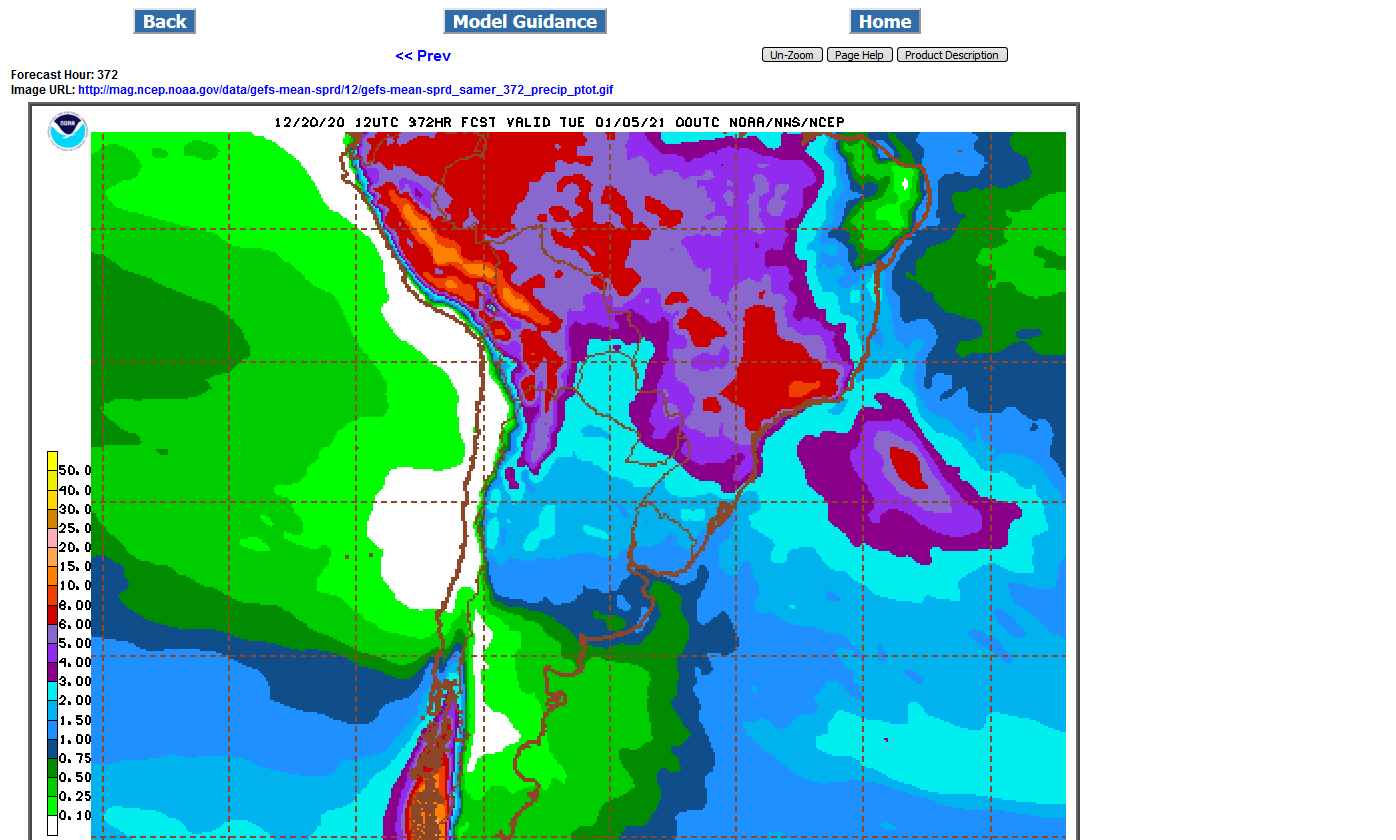

2 week rains robust for Brazil but a bit low for Argentina, especially the far southern parts of their key growing region

To see that, go here

https://www.marketforum.com/forum/topic/62048/

Does anybody remember when wheat hit 21.00 or a bit higher???

I remember that Wayne,

It was the Hard Red Spring wheat.

The HRS Minn. wheat.

The cost of March spring wheat hit $24 a bushel Monday, double its cost two months ago.

https://www.csmonitor.com/Business/2008/0227/p01s05-usec.html

Beans opened around 1275, made a high just over 1280 during the first minute and are at 1276+, +12c and above last weeks high and of course at LOC highs.

This is not a weather market but is a demand rationing market. We are out of beans until the SA harvest in February and demand is greater than what's left at this price.............so the price must go high enough to cut some of that demand.

South America Dec/Jan 2020/21

Beans could finish with a reversal down today.

Currently down 11c.

This news is probably a big part of it:

https://www.reuters.com/article/argentina-grains-strike-idUSL1N2J70I5

BUENOS AIRES, Dec 27 (Reuters) - Argentina’s influential chamber of soyoil manufacturers and exporters on Sunday spiced up an offer to striking workers, seeking to end a more than two-week standoff that has bogged down exports from one of the world’s main breadbaskets.

The CIARA-CEC chamber said it would top up salaries by 35% in 2020, a central demand of the striking workers, many of whom stayed on the job through the height of the coronavirus pandemic. The group also offered a 70,000 peso (about $840) bonus to compensate for the risks entailed.

The chamber said on social media its offer represented “the highest salaries in the Argentine private sector.”

Argentina is the top international supplier of soymeal livestock feed used to fatten hogs, cattle and poultry from Europe to Southeast Asia. It is also a major exporter of corn, wheat and raw soybeans.

Employees of soy processing factories in Argentina’s main agricultural export hub of Rosario, on the Parana River, say they want wage increases big enough to compensate for high inflation and risks from working during the COVID-19 pandemic.

A source with one of the companies involved in the dealmaking told Reuters the offer had improved on the COVID bonus, the key sticking point in the negotiations.

The striking workers did not immediately respond to the latest offer. Argentina’s government has urged the parties to meet on Tuesday to resolve their differences.

International sales of farm products are Argentina’s main source of export dollars needed to stabilize the anemic peso currency and help fund coronavirus relief efforts.

Rosario port terminals have not received soybeans since the strike started on Dec. 9, delaying the loading of more than 100 cargo ships. The Urgara union of port-side grains inspectors and SOEA oilseed workers organization are also on strike.

The strikes have affected the operations of international agro-giants such as Cargill Inc, Bunge Ltd and Louis Dreyfus Co, and has sent soybean prices skyrocketing to six-year highs on the Chicago exchange.

“Beans could finish with a reversal down today.

Currently down 11c.

This news is probably a big part of it:”

In my experience bull markets have reversals on bullish news when all information is priced in and perhaps over priced.

Thanks joj,

Good point.

I guess I should have clarified that the reversal down yesterday that did happen was not predicting a top or pattern change. It was a reaction to the news about the strike, that caused us to reverse lower after being sharply higher.

That can be the sign of a top but it appears that we are still not close enough to the Brazil harvest for new crop beans to come to the rescue for that.

Especially with Argentina's weather having turned bullish.

In my obj. zone of 1288-1290 for a few weeks now. Watch the close but sure feels like the funds want $13 beans.

Many producers sold out of both corn and beans so this rally if not back in (re ownership) means nothing. But it does make you think of some sales of new crop.