Heating degree days passed up cooling degree days earlier this month and they will be driving natural gas prices for the next 5 months.

An increase in cold, especially during week 2 caused ng prices to open higher this evening and we added to those gains(spiked up) when the US model came out even colder than the previous model........which had been colder than the previous ones.

However, the US operational model is a cold outlier at this point.........at the extreme end of cold of all the models.

The NGX open was 2.240 and last price was 2.260+.0.46.

Our high was 2.270, which was just above Friday's high of 2.262.

Natural gas fundamentals are horrible right now, with supplies gushing in. NG in storage is almost 500 bcf higher than last year at this time and we've caught up to the 5 year average for the first time in 2 years.

October 13, 2019 update:

The dominant imposing factor for prices this year has been massive, record large injections that have increased supplies faster than any time in history and crushed prices.

Prices plunged from 3.000 during the Spring down to below 2.200 in early August, when we hit a seasonal bottom. Cheap prices and record heat on weather models, then propelled us to an impressive short covering rally to just above 2.700 in mid September. The record heat continued into early Oct. but it was just too late in the cooling season to help anymore and prices collapsed, while injections were bearish vs expectations.

The market is getting some support at the moment from week 2 forecasts turning colder. Seasonals often turn down in this time frame thru November, particularly when temperatures are mild. Prices are pretty low right now, however and early season sustained cold will usually attract more speculative buying than late season cold.

Why is that?

In March/April, the market knows that Spring is right around the corner and the cold's staying power is limited. In Oct/Nov sustained cold that stick around and defines Winter has the potential to use up a lot of natural gas and draw down storage significantly. This Winter, it will take much colder than usual temperatures to achieve that because supplies are gushing in.

NG 7 days

Natural gas 3 months below

This seasonal price chart below is for 2 decades, ending back in 2009.

We should note from this chart that prices often bottom in late August................and we did have a bottom in that time frame with a stronger than usual rally in September, thanks to the heat using up so much natural gas for cooling.

That top was well defined in September and it will take some sustained, cold to go higher than that.

Late October thru early December is very often a weak period for ng prices. When its warm during that period, its extraordinarily tough for prices to go up.

Last week's EIA report.

for week ending October 4, 2019 | Released: October 10, 2019 at 10:30 a.m. | Next Release: October 17, 2019

+98 bcf. Bearish.

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/04/18) | 5-year average (2014-18) | |||||||||||||||||||||||

| Region | 10/04/19 | 09/27/19 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 854 | 826 | 28 | 28 | 786 | 8.7 | 852 | 0.2 | |||||||||||||||||

| Midwest | 1,009 | 973 | 36 | 36 | 866 | 16.5 | 977 | 3.3 | |||||||||||||||||

| Mountain | 203 | 199 | 4 | 4 | 180 | 12.8 | 205 | -1.0 | |||||||||||||||||

| Pacific | 296 | 291 | 5 | 5 | 262 | 13.0 | 316 | -6.3 | |||||||||||||||||

| South Central | 1,054 | 1,029 | 25 | 25 | 850 | 24.0 | 1,074 | -1.9 | |||||||||||||||||

| Salt | 229 | 220 | 9 | 9 | 190 | 20.5 | 278 | -17.6 | |||||||||||||||||

| Nonsalt | 825 | 809 | 16 | 16 | 661 | 24.8 | 796 | 3.6 | |||||||||||||||||

| Total | 3,415 | 3,317 | 98 | 98 | 2,943 | 16.0 | 3,424 | -0.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,415 Bcf as of Friday, October 4, 2019, according to EIA estimates. This represents a net increase of 98 Bcf from the previous week. Stocks were 472 Bcf higher than last year at this time and 9 Bcf below the five-year average of 3,424 Bcf. At 3,415 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2014 through 2018. The dashed vertical lines indicate current and year-ago weekly periods.

7 day temps that went into last weeks EIA report. Record heat in the Southeast.....but too late in the year to matter.

7 day temperatures for this Thursdays report:

Forecast for this Thursday +97 bcf?

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 17, 2019 | 10:30 | 97B | 98B | ||

| Oct 10, 2019 | 10:30 | 98B | 97B | 112B | |

| Oct 03, 2019 | 10:30 | 112B | 105B | 102B | |

| Sep 26, 2019 | 10:30 | 102B | 89B | 84B | |

| Sep 19, 2019 | 10:30 | 84B | 78B | 78B | |

| Sep 12, 2019 | 10:30 | 78B | 82B | 84B |

Natural Gas Intelligence Monday morning:

Cold Shift Over Weekend Boosts November Natural Gas Early

metmike: High supplies will make it tougher to keep going higher.....unless it keeps looking colder than the current forecast.

Monday's weather:

The 12Z guidance was in fact colder across the board in week 2, especially in the East and Southeast!

Natural Gas Intelligence:

Monday after the close: Colder Shift in Weather Data Snaps Losing Streak for Natural Gas Futures

Tuesday Morning: No Major Changes to Late October Pattern as Natural Gas Futures Steady

8:55 AM

Natural gas futures were trading close to even early Tuesday as the latest forecasts continued to show colder temperatures spreading into the eastern United States during the last week of October. The November Nymex contract was trading 0.8 cents higher at $2.288/MMBtu shortly after 8:30 a.m. ET. Read More

Tuesday Weather:

Both the operational and ensemble GFS mid day models were quite a bit colder which immediately gave the ng a pop to new highs.

Tuesday after the close:

Forecasts Stay Locked On Late October Cold as Natural Gas Futures Rally Continues

5:28 PM

Forecasts Tuesday strengthened what was already shaping up to be a chilly late October pattern, lifting bulls’ spirits and propelling prompt-month natural gas futures to a second straight day of gains. The November Nymex contract climbed 5.9 cents to settle at $2.339/MMBtu; further along the strip, December added 3.4 cents to $2.532, while January settled at $2.647, up 2.5 cents

NGI after the close Wednesday:

Loose Natural Gas Market Needing More Cold as Futures Slide

5:36 PM

Doubts over the durability of late October cold, combined with the prospect of another triple-digit weekly inventory build, saw natural gas futures fail to hang onto early gains Wednesday. After probing as high as $2.384/MMBtu early in the session, the November Nymex contract slid throughout the day to eventually settle at $2.303, off 3.6 cents; December dropped 3.7 cents to $2.495.

metmike: The US operational model came out MUCH milder, the Euro operational was slightly milder but the ensembles for both were actually a bit colder.

Thursday Morning NGI:

Models Shift Colder as ‘Massive’ EIA Build Expected; Natural Gas Futures Bounce Higher

9:00 AM

Channeling momentum from colder overnight forecast trends, natural gas futures bounced higher in early Thursday trading. The November Nymex contract was up 4.5 cents to $2.348/MMBtu at around 8:40 a.m. ET. Read More

for week ending October 11, 2019 | Released: October 17, 2019 at 10:30 a.m. | Next Release: October 24, 2019

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/11/18) | 5-year average (2014-18) | |||||||||||||||||||||||

| Region | 10/11/19 | 10/04/19 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 880 | 854 | 26 | 26 | 809 | 8.8 | 871 | 1.0 | |||||||||||||||||

| Midwest | 1,044 | 1,009 | 35 | 35 | 903 | 15.6 | 1,007 | 3.7 | |||||||||||||||||

| Mountain | 205 | 203 | 2 | 2 | 177 | 15.8 | 207 | -1.0 | |||||||||||||||||

| Pacific | 296 | 296 | 0 | 0 | 264 | 12.1 | 320 | -7.5 | |||||||||||||||||

| South Central | 1,093 | 1,054 | 39 | 39 | 874 | 25.1 | 1,101 | -0.7 | |||||||||||||||||

| Salt | 246 | 229 | 17 | 17 | 201 | 22.4 | 290 | -15.2 | |||||||||||||||||

| Nonsalt | 847 | 825 | 22 | 22 | 672 | 26.0 | 811 | 4.4 | |||||||||||||||||

| Total | 3,519 | 3,415 | 104 | 104 | 3,025 | 16.3 | 3,505 | 0.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,519 Bcf as of Friday, October 11, 2019, according to EIA estimates. This represents a net increase of 104 Bcf from the previous week. Stocks were 494 Bcf higher than last year at this time and 14 Bcf above the five-year average of 3,505 Bcf. At 3,519 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2014 through 2018. The dashed vertical lines indicate current and year-ago weekly periods.

Natural Gas Futures Steady After EIA Reports 100 Bcf-Plus Storage Build

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Oct 17, 2019 Actual104B Forecast106 BPrevious98B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 17, 2019 | 10:30 | 104B | 106B | 98B | |

| Oct 10, 2019 | 10:30 | 98B | 97B | 112B | |

| Oct 03, 2019 | 10:30 | 112B | 105B | 102B | |

| Sep 26, 2019 | 10:30 | 102B | 89B | 84B | |

| Sep 19, 2019 | 10:30 | 84B | 78B | 78B | |

| Sep 12, 2019 | 10:30 | 78B | 82B | 84B | R |

NGI after the close on Thursday:

Intraday Volatility Leaves Natural Gas Futures Slightly Higher; Cash Slides

5:15 PM

Weather data volatility spilled over into the natural gas futures market on Thursday, with prices swinging in and out of positive territory amid mixed..

NGI FRIDAY morning:

Model Disagreement Continues as Natural Gas Futures Called Lower

Friday weather:

https://www.marketforum.com/forum/topic/41268/

Friday after the close:

November Natural Gas Futures Steady on Mild Weather; Spot Gas Slides Again

5:24 PM

After a week marked by significant swings, natural gas futures held relatively steady on Friday as weather models remained at odds over long-term cold. The November Nymex natural gas futures contract traded both sides of even before eventually settling a mere two-tenths of a cent higher at $2.320/MMBtu. December also rose fractionally to $2.517.

metmike: NG rallied after the 1:30pm close to finish on new highs. The European model guidance did come out colder during that time frame. I wouldn't think that TS Nestor was much of a factor but can't rule that out completely.

Saturday Weather:

Monday morning NGI:

Cold Seen Weakening as November Natural Gas Called Lower

8:54 AM

Natural gas futures were trading lower early Monday as forecasts over the weekend eased off on expected cold later this month. The November Nymex contract was down 3.1 cents to $2.289/MMBtu shortly after 8:30 a.m

Weather Monday:

Monday after the close:

Natural Gas Futures Open Week With Sharp Fall; Cash Mixed as Cooler Air Looms

5:00 PM

A new production high, weak Henry Hub cash and a warmer shift in weather outlooks swept the rug out from under natural gas futures on Monday. After plunging as much as 10.7 cents lower day/day, the November Nymex gas futures contract settled at $2.238, down 8.2 cents. December fell 7.6 cents to $2.441

7 day temperatures for this Thursday's EIA below, ending last Friday. Chilly in the Midwest.

The prediction is for another 100+ bcf injection.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 24, 2019 | 10:30 | 106B | 104B | ||

| Oct 17, 2019 | 10:30 | 104B | 106B | 98B | |

| Oct 10, 2019 | 10:30 | 98B | 97B | 112B | |

| Oct 03, 2019 | 10:30 | 112B | 105B | 102B | |

| Sep 26, 2019 | 10:30 | 102B | 89B | 84B | |

| Sep 19, 2019 | 10:30 | 84B | 78B | 78B |

I thought it was down too much early this afternoon so I bought a Dec contract. Sold it and made a quick small profit. I'm still slightly long on a Jan contract, long the contract and short the call. It is a looser but the theta on that call is starting to catch up now.

Thanks Grant!

Today was an example of what will happen when cold comes out of the forecast. It's not that we are going to unusual warmth either.

A mild November forecast will cause sub $2 ng prices. If that would happen in the next week, I think we will be down below $2 that soon...........but I'm not forecasting a mild November, just saying that is what will probably happen IF forecasts turn that warm.

Some models the last few days are going for more zonal flow later in week 2 which would moderate this cold.

That said, the -AO and -NAO argue for potentially colder than model forecasts. The last 768 hour Euro has some record breaking cold hitting the Northcentral US...........take that long range forecast with a grain of salt.

What are your thoughts on November?

Below is the latest 768 hour European model, picking up where the other models end, at 384 hours, towards the end of the first week in November(5th)....then going out at 24 hour intervals to November 22nd.

Not sure how much the market will pay attention. None at all if we see a big warm up on maps during week 2 for the remainder of this week.

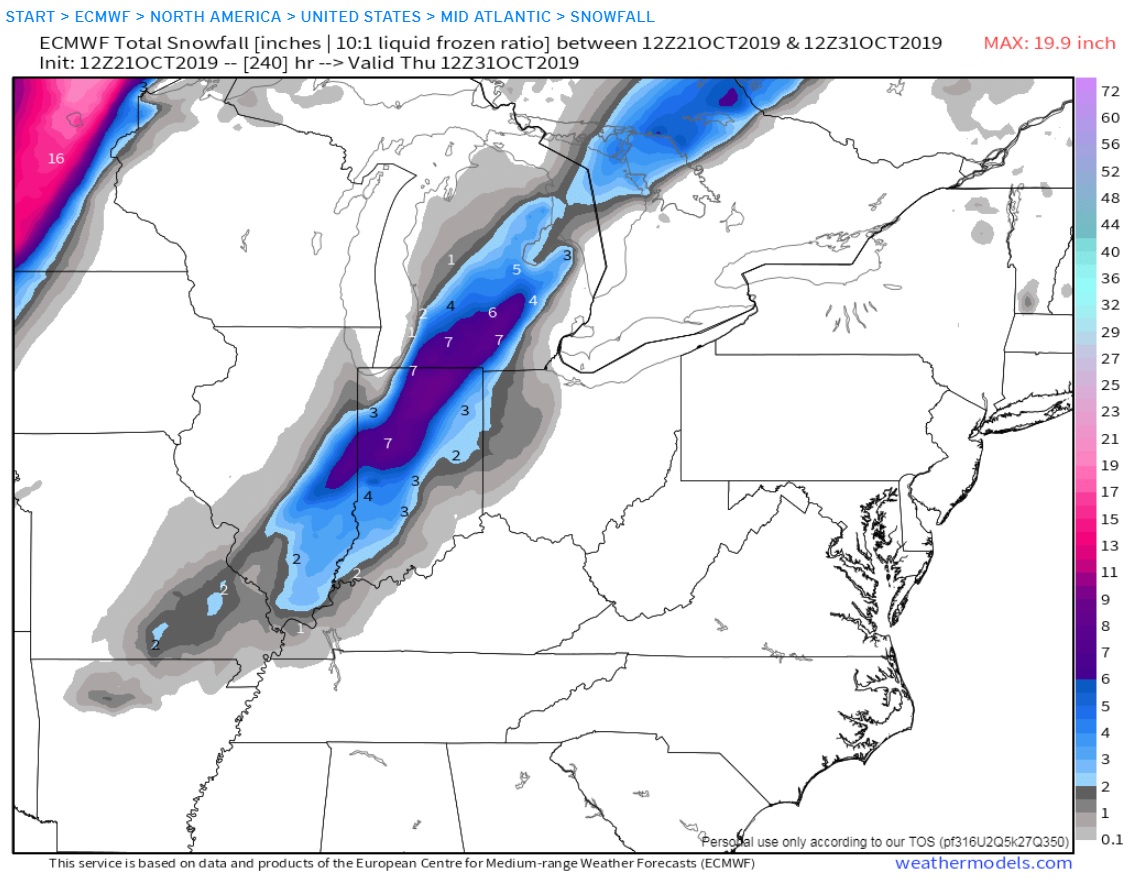

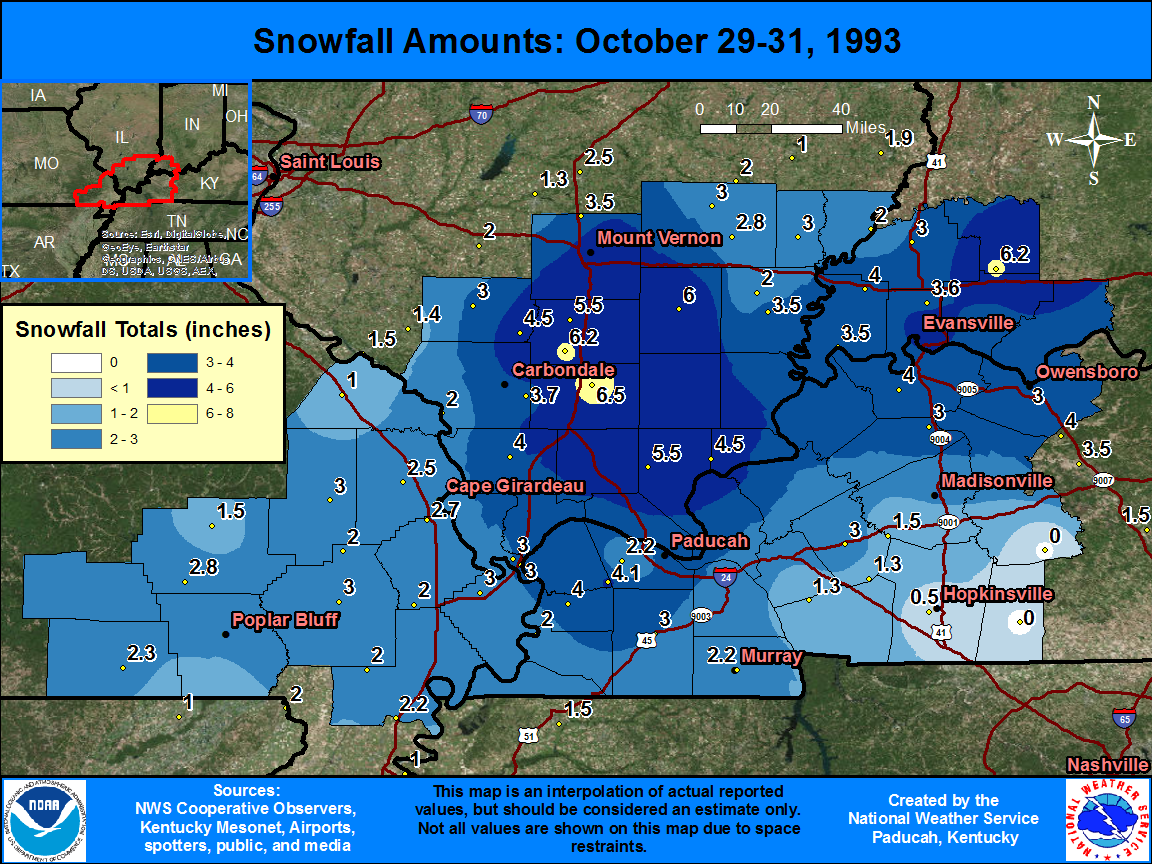

1993 anyone? This is the 240hr Operational Euro which is painting some snow the morning of Halloween. I know it probably won't happen but I love winter weather and I'm glad it's that time of the year where hour 240 is always interesting somewhere :-) . There was a huge cold air outbreak around Halloween 1993. Snowed as far south as Montgomery Alabama that day.

Thanks Grant!

I remember that one vividly and it was actually the day before Halloween here in Evansville, Oct 30th which was a Saturday.

I went sledding with the kids and we made a snow man in the backyard.

I went Trick or Treating with the kids the next day with the snow on the ground and sub freezing temps.

I'm guessing our snow was just over 6 inches and it was a record for October but will retrieve the records.

Snow storms have always been my favorite too. When I moved down here in September 1982 from Cincinnati(6 months) to be chief meteorologist at WEHT after living in Michigan, it was thought to be temporary and farther south than I would have preferred because of less snow(but I was going to any tv station that would hire me-including applying at Fairbanks Alaska)

OK, we got a total of 4.6 inches from that event, 3.7 inches fell on October 30th(most of which was very early in the morning.

The 3.7 inches is a record for 24 hours in October.

Our record snow for November is 6.9 inches set on the 28th in 1958.

That snow event in 1993 is the biggest snow in the records until the event on Nov 28th almost a month later to show how anomalous the Oct 1993 event was.

Go to snowfall at the link below

https://www.weather.gov/pah/EvansvilleDailyNormalsAndRecords

Maybe I can retrieve some wx maps of that storm now.

OK, even better:

https://www.youtube.com/watch?v=uzosOgVFQJY

A surprise snowstorm hit the Cincinnati area on the weekend of Oct. 30-31, 1993. When it ended on Sunday, there were 6.2 inches on the ground, marking the first White Halloween on record in the region. The 5.9 inches of snow on Saturday – Halloween Eve - was a record for a single day in October. The next day, the coldest high temperature for Halloween - just 36 degrees – kept a lot of trick-or-treaters home.

I was going to grab that image from Paducah, I see you got it. As for my thoughts on November, I think we will start off below average for the first week to ten days and then modify. The question is how warm by week three. That can be bad as a warm third or fourth week in November usually ends in some sort of severe weather outbreak. As for my position in NG, I hope it doesn't get too warm that third week.

I remember taking the kids Trick or Treating that year! Great memories! Should have had abominable snow man costumes!

Thanks cutworm!

US model and Canadian model are much colder overnight! Not surprising with the -NAO.

NGI Tuesday morning.

Forecasts Colder Overnight, but Natural Gas Still ‘Woefully Oversupplied’

Nudge Futures Higher on Prospects of Cold; Cash Slides

Variability in the latest weather models worked in favor of natural gas bulls on Tuesday, with data pointing to chillier temperatures at the end of October/early November. With strong cash prices in tow, the supportive weather data boosted November Nymex gas futures by 3.4 cents to settle at $2.272. December climbed less than a penny to $2.449.

Cash prices continued to strengthen as a strong weather system tracked across the Midwest and into the East with rain and snow, while others were fresh on its tail. One glaring exception to the overall market strength was in the Permian Basin, where prices once again plunged below zero. The NGI Spot Gas National Avg. ultimately jumped a dime to $2.010.

There is no denying that the United States is on the cusp of widespread cold as the latest weather data showed a series of weather systems intensifying as each one travels across the country, according to NatGasWeather. In the near term, a strong weather system with rain and snow continued tracking across the Midwest and into the East, along with cooler conditions as overnight temperatures dip into the 20s to 40s.

A reinforcing cold shot was forecast to follow into the Midwest and east/central United States Thursday to Saturday for stronger national demand, the forecaster said. However, a pronounced break over the eastern half of the United States was still expected late this weekend with highs in the 60s to 80s.

“...The strongest cold shot in the series remains on track to advance into the northern and central United States Oct. 28-Nov. 3 with widespread lows of teens to 30s for strong demand,” NatGasWeather said. It is this system that the midday Global Forecast System weather model showed being more extreme and moving deeper into the South.

However, a warmer flow is within the eastern third during this time period, leading to more widespread above-normal temperatures from the Midwest to South and East, according to Maxar’s Weather Desk. There is additional warm risk if a more amplified pattern takes shape across the East, and this is reflected best within the European model as it supports above-normal anomalies.

“While a week of solid cold is helpful, is it going to be enough to resume the strong rally if warming quickly follows, especially when considering yet another record in production?” NatGasWeather said.

Indeed, production hit record levels over the weekend and has proven to be resilient over the last four months even as Henry Hub prices have averaged just above $2.25 in that time, according to Mobius Risk Group.

“The typical season decline in demand from mid-July through the fall has helped to keep production levels in the limelight versus demand intensity/degree day,” the Houston-based firm said.

The average storage injection over the past seven weeks has been 95 Bcf, with average weekly population-weighted degree days totaling 68, according to Mobius. Under similar weather conditions during the spring, the seven-week average injection was 103 Bcf.

“Directionally, it is clear the market has tightened as prices have fallen; however, a storage surplus of approximately 500 Bcf, more than 5 Bcf/d of year/year production growth and at least four more weeks until withdrawals begin is enough to embolden market bears who have continually looked for selling opportunities.”

Weather aside, there are some other supportive fundamentals at play, according to Bespoke Weather Services.

Liquefied natural gas intake continues to hold near 7 Bcf, and power burns were revised a little stronger and now show some improvement over last week, the firm said. “So the balance picture in total today is a little improved day/day, although still is quite weak overall.”

With the weather pattern showing some cold on the way entering November, price support in the low $2.20s may be able to hold for awhile, according to the firm. “Durability is still our biggest concern” and thus, Bespoke maintains a neutral near-term view with the current combination of weather and fundamentals.

The price improvement experienced after Permian associated gas volumes started flowing on Kinder Morgan Inc.’s Gulf Coast Express (GCX) has taken a dramatic turn only a month after the 2 Bcf/d pipeline’s full in-service.

After nearing $2 in the weeks after GCX went online, Permian cash prices have sunk to the bargain-basement levels experienced this summer. Waha cash plunged 43 cents to average only 5 cents on Tuesday, although trades were seen as low as minus 30 cents. Other regional pricing hubs traded only marginally higher.

The price weakness was to be expected as rampant production growth in the Permian has necessitated additional gas takeaway in the region. Kinder Morgan executives have indicated that GCX is already running full, and the targeted startup for the second Permian project, Permian Highway Pipeline, has been extended from October 2020 to early 2021.

In a recent note, Goldman Sachs analysts said with Permian Highway delayed, they expect “the extended bottleneck to keep Waha gas prices under pressure for longer, with relief dependent on seasonal support to demand and exports to Mexico.”

And with temperatures in California starting to recede a bit, demand in that downstream market is waning. SoCal Citygate spot gas tumbled 39 cents to $3.475.

Prices elsewhere in Texas were stronger from the chillier temperatures on tap for the rest of the week. Katy next-day gas climbed 13 cents to $2.065.

Similar strength was seen in the Midcontinent, although Southern Star jumped a more pronounced 19.5 cents to $1.745 on some restrictions set to be implemented.

From Wednesday to Thursday, Southern Star Pipeline is scheduled to conduct emergency shutdown tests around the Blackwell compressor station in Kay County, OK. While several meters and compressor stations would be restricted during this time, the most critical of the limitations would be at the Blackwell compressor station itself, which directs gas toward Southern Star’s Market Area.

Flows through Blackwell have averaged 530 MMcf/d over the past 30 days, and operational capacity is to be limited to 311 MMcf/d for the two-day period, according to Genscape Inc. Around 219 MMcf/d of flows would be restricted at a time when the latest forecasts indicate that regional temperatures will be about 10 cooling degree days colder than seasonal averages.

Planned maintenance was also set to begin Wednesday on Texas Gas Transmission (TGT), limiting capacity at the Columbia compressor station in Caldwell Parish, LA, through Saturday. Flows through the station have averaged 1.11 Bcf/d (maxing at 1.13 Bcf/d) over the past 30 days, and would be limited to 1.04 Bcf/d during this event, according to Genscape. On average, this should limit 70 MMcf/d northbound to TGT’s mainline.

Given the slightly colder-than-normal outlook for the downstream Midwest market for the rest of the week, prices were up between 10 cents and 20 cents across the region.

Similar increases were seen across Louisiana as well as Appalachia. The exception in the Northeast producing region was at Tennessee Zn 4 313 Pool, where next-day gas shot up 29 cents .

Natural Gas Called Lower as Weather Models Show Cold Easing into November

8:27 AM

metmike: Warming up in November but a blast of cold before then.

Wednesday weather:

Wednesday after the close

Near-term Cold, Strong Cash Keep Nymex Prompt Month Supported

5:27 PM

Natural gas futures continued to strengthen at the front of the curve Wednesday as weather models moved in greater alignment regarding projected cold over the next couple of weeks. The Nymex November gas futures contract rose 1.0 cent to $2.282/MMBtu, but with chilly air seen waning after the first week of November, the December contract slipped 2.2 cents to $2.427.

The front month, November expires on the 29th, next Tuesday. Volume in the next month, December has passed up November. Tonight, it's almost double.

Big spikes have happened in the last couple of trading days before expiration.

There have been huge speculator shorts in the ng market this year, which leaves the market vulnerable for short covering towards expiration if there is still alot of open interest from these shorts..........so buying surges and spikes higher.

The November has been stronger than December this week with the approaching cold and the front month usually reacts stronger anyway.

EIA report out Thursday/tomorrow at 9:30pm will, as always be a big price determinant. Usually we see an initial big spike up or down instantly after the release.

If updated weather models/forecasts are much warmer or colder, then the market will shrug off much of the EIA storage report and go with the weather.

Many model run updates of the US model had been getting colder the last 2 days which is keeping us supported but not cold enough for us to break out to the upside, especially since week 2 still moderates and supplies are gushing in.

The last 0z run of US model products just out was actually a bit milder(less cold).

If we keep taking cold out, and November is mild, NGZ will likely trade down to $2 in November. If November is several degrees above average in the Midwest/East. ngz could drop well below $2!!

It's trading at $2.433 right now, so that's over $4,000/contract..........but mainly on much above temperatures in widespread fashion for those high populations centers mentioned above.

EIA Storage Report Offers No Surprises, Natural Gas Futures Slip

11:34 AM

The Energy Information Administration (EIA) reported an 87 Bcf injection into natural gas storage inventories for the week ending Oct. 18, coming in.

++++++++++++++++++++++++++++++++++++++++++++++++++++

for week ending October 18, 2019 | Released: October 24, 2019 at 10:30 a.m. | Next Release: October 31, 2019

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/18/18) | 5-year average (2014-18) | |||||||||||||||||||||||

| Region | 10/18/19 | 10/11/19 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 898 | 880 | 18 | 18 | 823 | 9.1 | 886 | 1.4 | |||||||||||||||||

| Midwest | 1,069 | 1,044 | 25 | 25 | 930 | 14.9 | 1,034 | 3.4 | |||||||||||||||||

| Mountain | 208 | 205 | 3 | 3 | 177 | 17.5 | 209 | -0.5 | |||||||||||||||||

| Pacific | 297 | 296 | 1 | 1 | 262 | 13.4 | 322 | -7.8 | |||||||||||||||||

| South Central | 1,134 | 1,093 | 41 | 41 | 893 | 27.0 | 1,129 | 0.4 | |||||||||||||||||

| Salt | 268 | 246 | 22 | 22 | 216 | 24.1 | 303 | -11.6 | |||||||||||||||||

| Nonsalt | 866 | 847 | 19 | 19 | 677 | 27.9 | 825 | 5.0 | |||||||||||||||||

| Total | 3,606 | 3,519 | 87 | 87 | 3,087 | 16.8 | 3,578 | 0.8 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,606 Bcf as of Friday, October 18, 2019, according to EIA estimates. This represents a net increase of 87 Bcf from the previous week. Stocks were 519 Bcf higher than last year at this time and 28 Bcf above the five-year average of 3,578 Bcf. At 3,606 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2014 through 2018. The dashed vertical lines indicate current and year-ago weekly periods.

Thursday's weather:

A new shot of cold early in week 2 on the just updated US model spiked the ng higher when it was coming out.

Also, the front month November is expiring next Tuesday and has some long lived shorts that need(ed)to cover.

October 24, 2019

Natural gas futures picked up a few cents Thursday after the latest storage data likely gave traders some pause ahead of what is expected to be the most significant cold blast of winter so far. After briefly dipping to $2.269, the November Nymex natural gas futures contract went on to settle at $2.316, up 3.4 cents. December climbed 3.8 cents to $2.465.

Cash prices retreated across the majority of the United States as rather comfortable conditions were seen over the eastern part of the country to close out the week. Although hot weather lingered on the West Coast, preemptive power outages across California helped send the NGI Spot Gas National Avg. down 5.0 cents to $2.005.

With another week or so before the gas market winter season (November-March) gets under way, all eyes have been on weather. Although mostly comfortable temperatures are expected on Friday, weather conditions are expected to turn dramatically cooler beginning this weekend when the strongest cold shot in the coming series is forecast to arrive in the Rockies and Plains, according to NatGasWeather.

The blast is expected to linger in those areas through the early part of next week and then rapidly advance across the southern and eastern United States mid and late next week, the firm said. Temperatures are forecast to be 15-30 degrees colder than normal with this system for much stronger-than-normal national demand.

Although the latest Global Forecast System weather model wasn't quite as frigid with next week's cold shot, it did show the chilly air lingering a day or two longer, according to NatGasWeather. What could be more important is that the model, which had been quick to return warmth to the outlook beyond Day 15, still showed Nov. 6-8 to be much milder. Daily heating degree days were seen easing back to near or below normal, “when they need to be much above normal to be considered bullish.”

To be sure, it would take significant sustained cold to flip overwhelmingly bearish market sentiment. Although DTN forecasters call for lingering cold across the Rockies and Plains in Week 4 and an almost identical week/week demand profile from Week 3, returning nuclear units from maintenance outages may slightly dampen total demand for natural gas, according to EBW Analytics Group.

Early projections for an 8 Bcf injection “stand in stark contrast to the year-ago week when blistering cold brought a 134 Bcf withdrawal,” the firm said.

The November Nymex contract has gravitated toward $2.30 all week, but with the contract’s expiration next Tuesday, some volatility could arise in the coming days.

“There's a lot of speculative shorts that might still need to exit before Tuesday's November expiration, which could help keep prices supported until then. Not always, of course,” NatGasWeather said.

On Thursday, futures moved higher despite government storage data that was in line with expectations. However, that could be because the Energy Information Administration’s (EIA) reported 87 Bcf build was below the low to mid-90s Bcf injection that market analysts expected last week.

“In addition, many market participants expected this storage week to deliver a triple-digit injection back in late September,” Mobius Risk Group said.

Although weekly injection expectations have fallen and subsequent downward revisions have been made to end-of-season estimates, the market understandably remains apprehensive about buying a curve that has not rewarded “discount” buying in several months, according to Mobius.

Indeed, the latest EIA storage statistic continues to reflect a market that is very loose, especially given the weather that was in place at the time, according to Bespoke Weather Services.

“But more attention will likely be placed on next week’s number as we do appear to have tightened somewhat this week, but in our view, not to a bullish level, barring durable cold.”

The front month of natural gas, November contract expires next Tuesday. NG prices become much less predictable during this time frame, especially since we've been having some long lived large(short) speculator positions getting covered which has added to the buying at times this week.

Friday weather:

NGI Friday after the close:

Slightly Warmer Shift in Coming Chill Drives Nymex NatGas Lower; Cash Softens

Natural gas futures traders took the curve down a notch Friday as the latest weather data moved the needle slightly lower in terms of the overall demand picture for the next couple of weeks. The November Nymex contract settled 1.6 cents lower, and December slipped fractionally to $2.459.

Gap higher on last nights open is still open...at the moment.

Cold pattern has more staying power into November than the expected warm up from Friday but still moderates and this is more of a selling set up for me.....with milder solutions unless the extended pattern turns much colder.

With a -NAO, this is not surprising.

NG front month expires Tuesday. Volatility is often noted ahead of expirations.

Natural Gas Intelligence Monday Morning:

Weekend Forecasts Show ‘Steep Spike’ in Demand; Natural Gas Futures Higher

9:00 AM

A clear colder shift in guidance over the weekend had natural gas futures trading sharply higher early Monday. The November Nymex contract was up 7.5 cents to $2.375/MMBtu at around 8:30 a.m. ET.

metmike: The last run of the 6z GFS ensembles after 6am was especially cold(had around 10HDD's more than yesterdays 12z run for instance). Entirely from an early week 2 cold wave.

The AO looks to be plunging strongly negative during week 2 and we are getting into the time of year when that can be a big contributor in flushing cold air masses from high latitudes to the middle latitudes............so moderation in temperatures in November will have this indice against it.

https://www.marketforum.com/forum/topic/15793/

With such a wide spread opening up during week 2, there is a higher than usual amount of uncertainty.

Monday Weather:

https://www.marketforum.com/forum/topic/41897/

Colder than Friday with potential for much colder in Great Lakes/Northern Tier in week 2 and beyond if -AO pattern flex's it's meteorological muscle in pushing cold air in Canada southward.

Associated with this pattern is a powerful upper level ridge(Alaska and vicinity) and downstream trough(Southeast Canada to Upper Great Lakes) couplet that is very favorable for cold air delivery southward, across Canada into the US. ....especially cold from the Plains to Midwest to Northeast.

US 12z operational model was MUCH warmer than any recent runs.

Ensembles were colder early in week 2 but much warmer after that.

There could still be a spike higher from NGX expiring but unless the models turn much colder late in week 2, the highs are probably in.

Confirmation of that would be when/if we fill the gap higher from last night and trade down to Monday's high of 2.479 for NGZ.

This would lay down a gap and cap, very negative chart formation........when the price opens higher than the previous days highs, then is no longer able to hold those gains, and trades back into the previous days range.....suggesting a buying exhaustion just took place.

Weather models, like the European model could save the day as early as a couple of hours from now if they come out much colder than these US model solutions.

Operational European model, unlike the GFS operational model was colder and I have to correct my earlier post after looking at the total heating degree days on the GFS ensemble products, they were close to the previous model.

The European ensemble is COLDER overall too by a fairly significant amount but has the moderating at the end.

We are seeing the front month experiencing a HUGE spike higher here, one of the risks of natural gas prices when get this close to expiration(tomorrow)....especially in a ng, which has some long lived HUGE spec shorts that have had to cover ahead of expiration.

Natural Gas Intelligence after the close on Monday:

Colder Shift in Weather Data Leads to Big Gain for Natural Gas Futures; Cash Rallies Too

5:21 PM

Natural gas futures surged Monday as all weather models trended colder for the coming weekend and next week. Even with production hitting another new high, a strong cash market helped send the November Nymex contract up 14.6 cents to $2.446/MMBtu. December climbed 9.6 cents to $2.555.