“The Fed would like to see wage growth decrease further. The Fed’s concern centers on the fact that higher wages feed into higher demand for goods and services, which contributes to higher prices.”

-

Tom Hainlin, national investment strategy director at U.S. Bank Wealth Management

++++++++++++++++++

I'm no economist and am just reporting what this source states with no editorial comments, other than it stinks to be paying so much more money for everything compared to a couple of years ago.

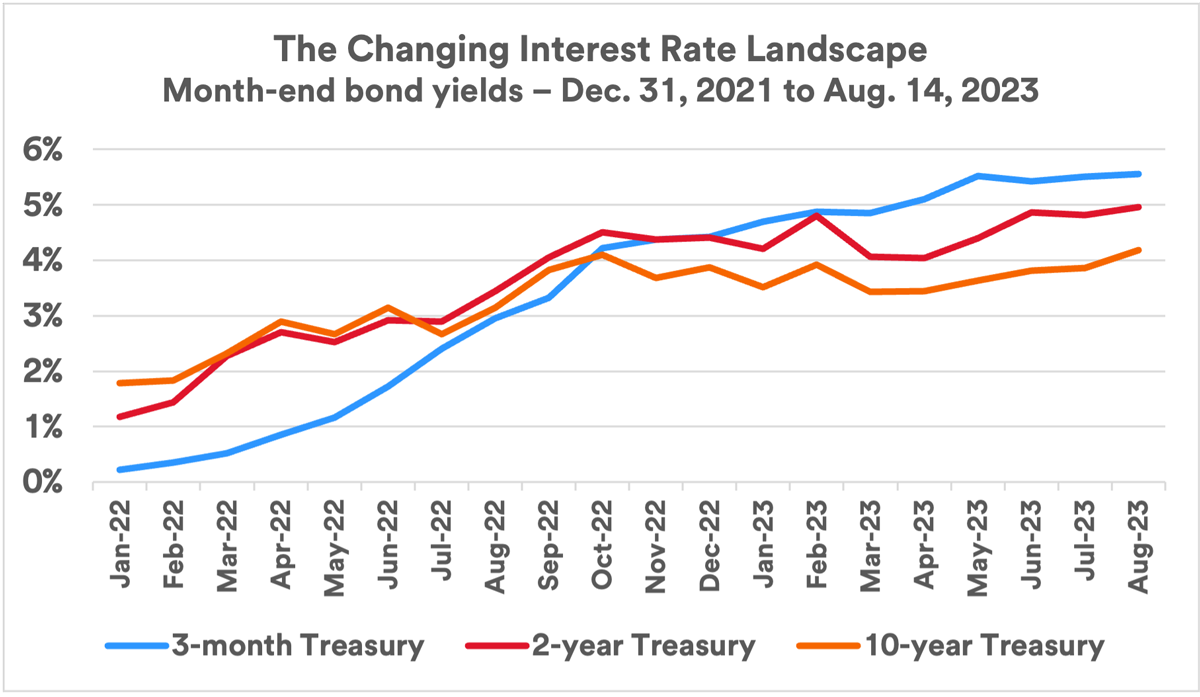

And that the record/near record increase in interest rates over such a short period has to also have some unintended negative consequences. I mean, wouldn't it just be a perfect world where the Fed could just adjust interest rates to fix whatever problems we have in the economy.

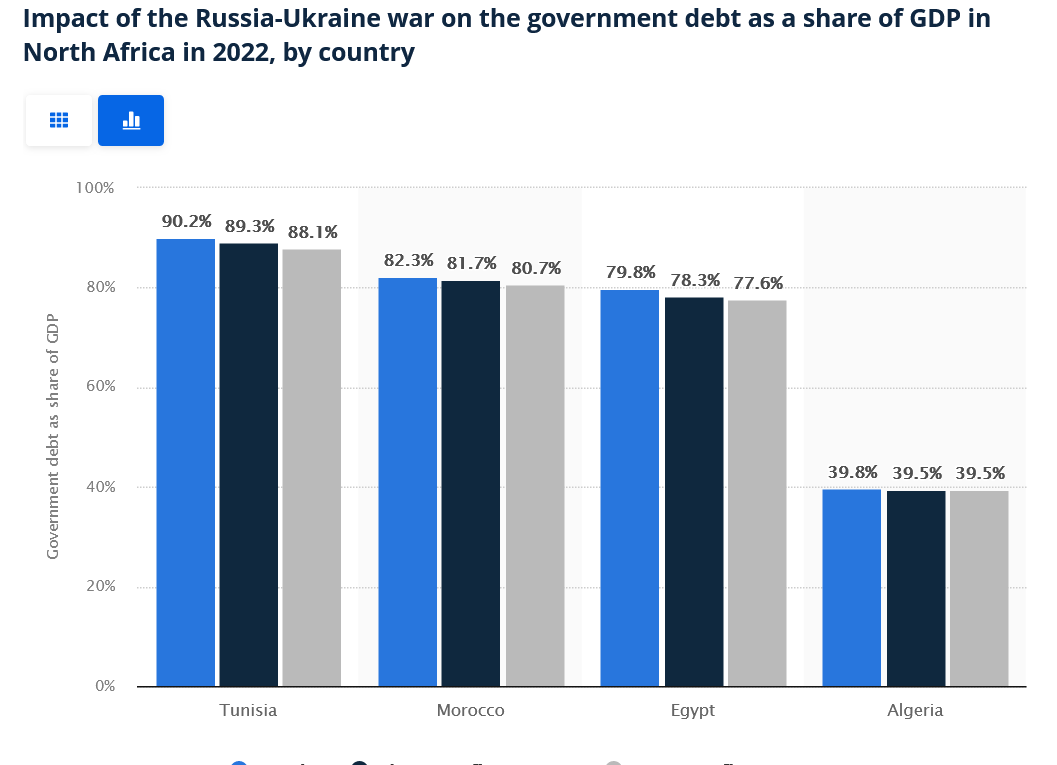

And also that ending the war in Ukraine, would decrease GLOBAL inflation, especially for food/energy prices as well as causing LESS PAIN in other realms too. Less massive money from US tax payers going out. Ending of massive killing/death. Less property destruction. ......and many other benefits besides cutting inflation.

By Masa Ocvirk on August 15, 2023

This latest suspension of the Grain Initiative by Russia will therefore put a greater burden on EU’s continued support of Ukraine. The EU will need to strike a balance between addressing the concerns of the farmers and continuing to facilitate Ukrainian grain exports. So far it has been able to mitigate internal market disruptions from the influx of Ukrainian grain and compensate affected farmers with funds from the Common Agricultural Policy Crisis Reserve. However, according to the Spanish Presidency of the Council of the EU, these funds for 2023 are already depleted. This is on top of the challenges concerning future financial support for Ukraine’s recovery and reconstruction, for which the EU is expected to revise its Multiannual Financial Framework in order to provide stable funding for Ukraine as well as its own green and digital transition. Without this stable funding and budget support in place, the EU will be unable to sustain its level of support for Ukraine.

In terms of energy (fossil fuel) prices, the 2022 Russian invasion of Ukraine (was an economic shock that) cost consumers or buyers (in the world) primarily 2.85% of the pre-invasion annual GDP ($2.7 trillion) in five months following the invasion.

++++++++++++

https://www.imf.org/external/datamapper/PCPIPCH@WEO/WEOWORLD/VEN%20-%20Inflation%20rate%20average%20consumer%20prices.png)

++++++++++++++

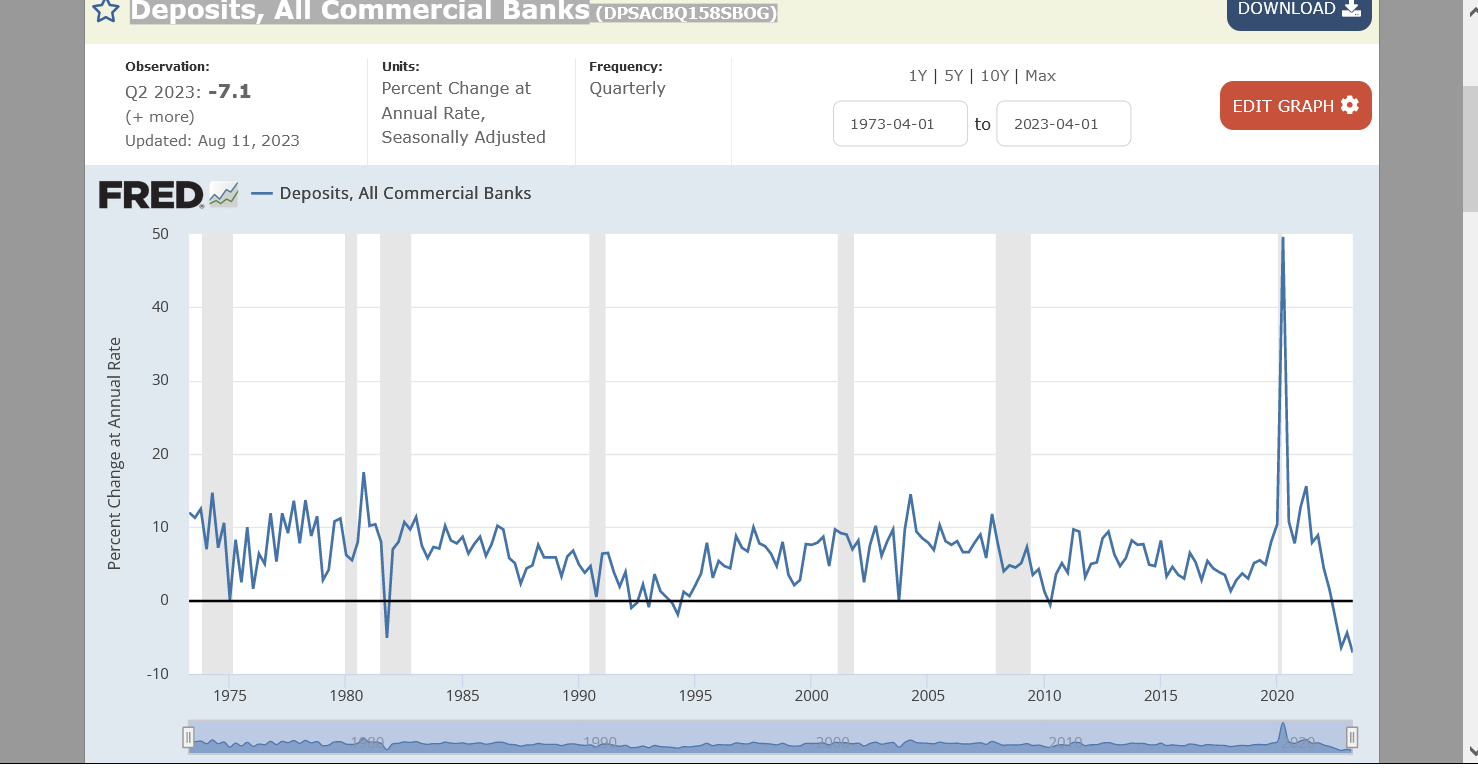

This guy seems to be an alarmist that is in the business of selling his newsletter/predictions but the graph that he shows (about banks losing deposits at a record rate because of huge increase rate hikes) as the cause for this unthinkable crisis is unprecedented. He knows more than me, so I'll not discard what he states.

https://www.youtube.com/watch?v=ZmclAa74cfY

+++++++++++++++

https://fred.stlouisfed.org/series/DPSACBQ158SBOG Is the spike lower mostly being caused by the spike higher from the Fed dumping trillions into the system as a massive OVER reaction to fight COVID and now, just an expected, short term reaction/consequence?

Is the spike lower mostly being caused by the spike higher from the Fed dumping trillions into the system as a massive OVER reaction to fight COVID and now, just an expected, short term reaction/consequence?

Or will it lead to more banks failing as Steve insists above?

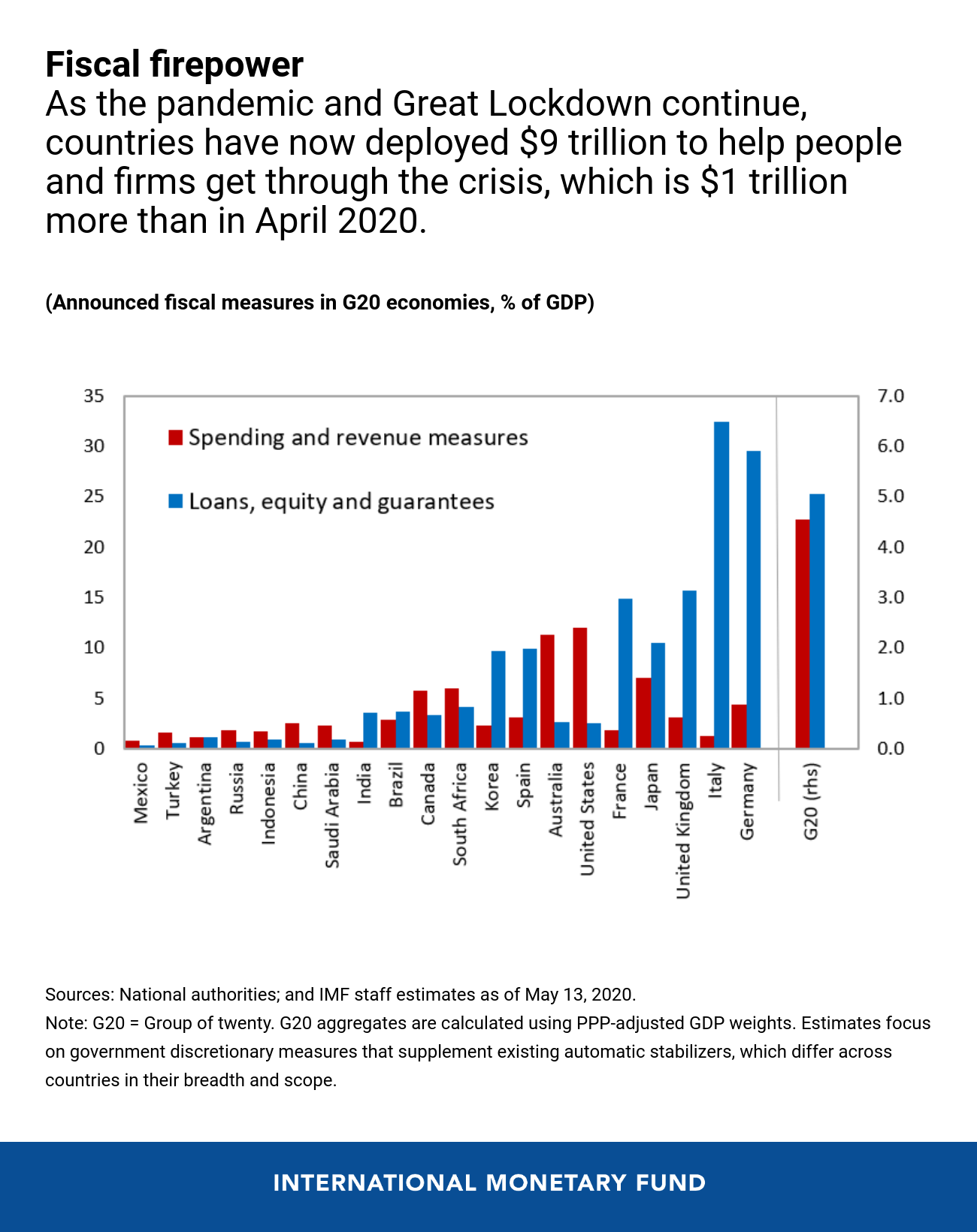

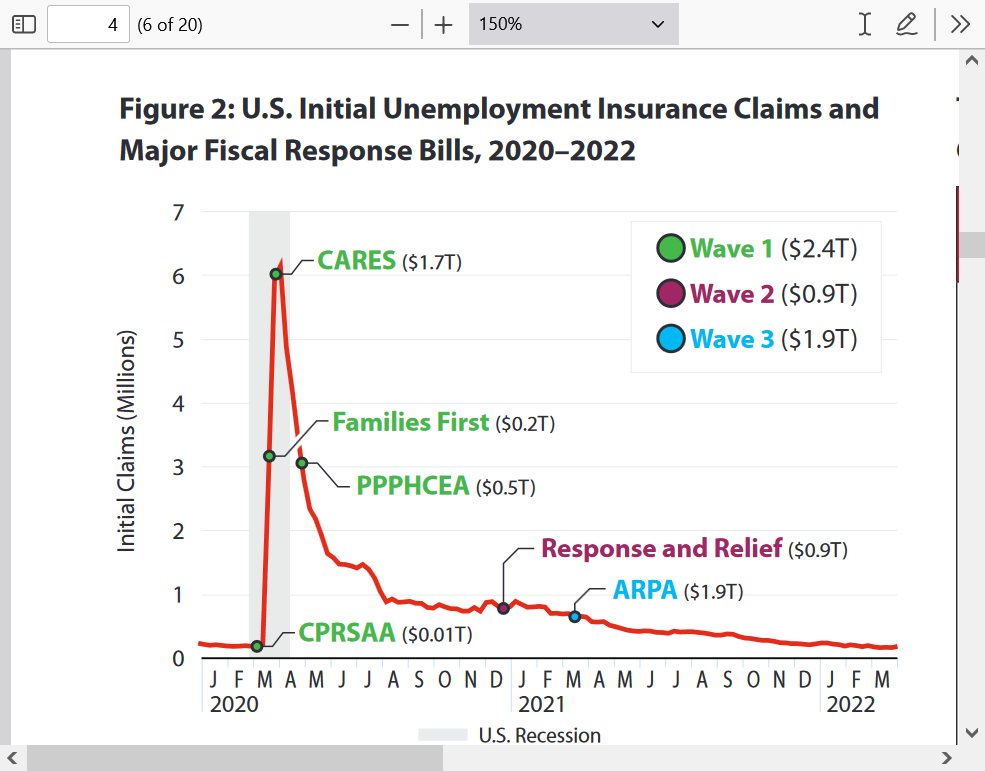

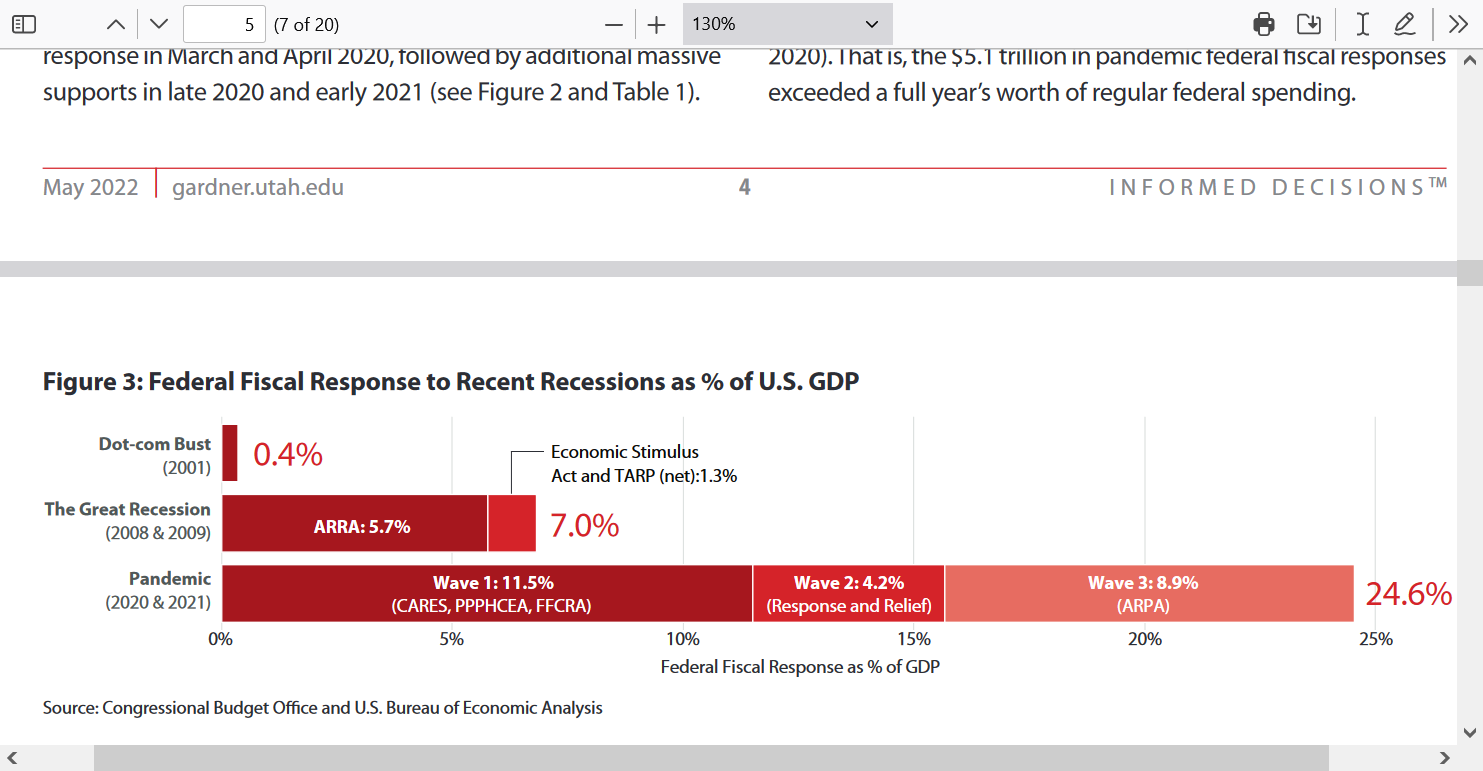

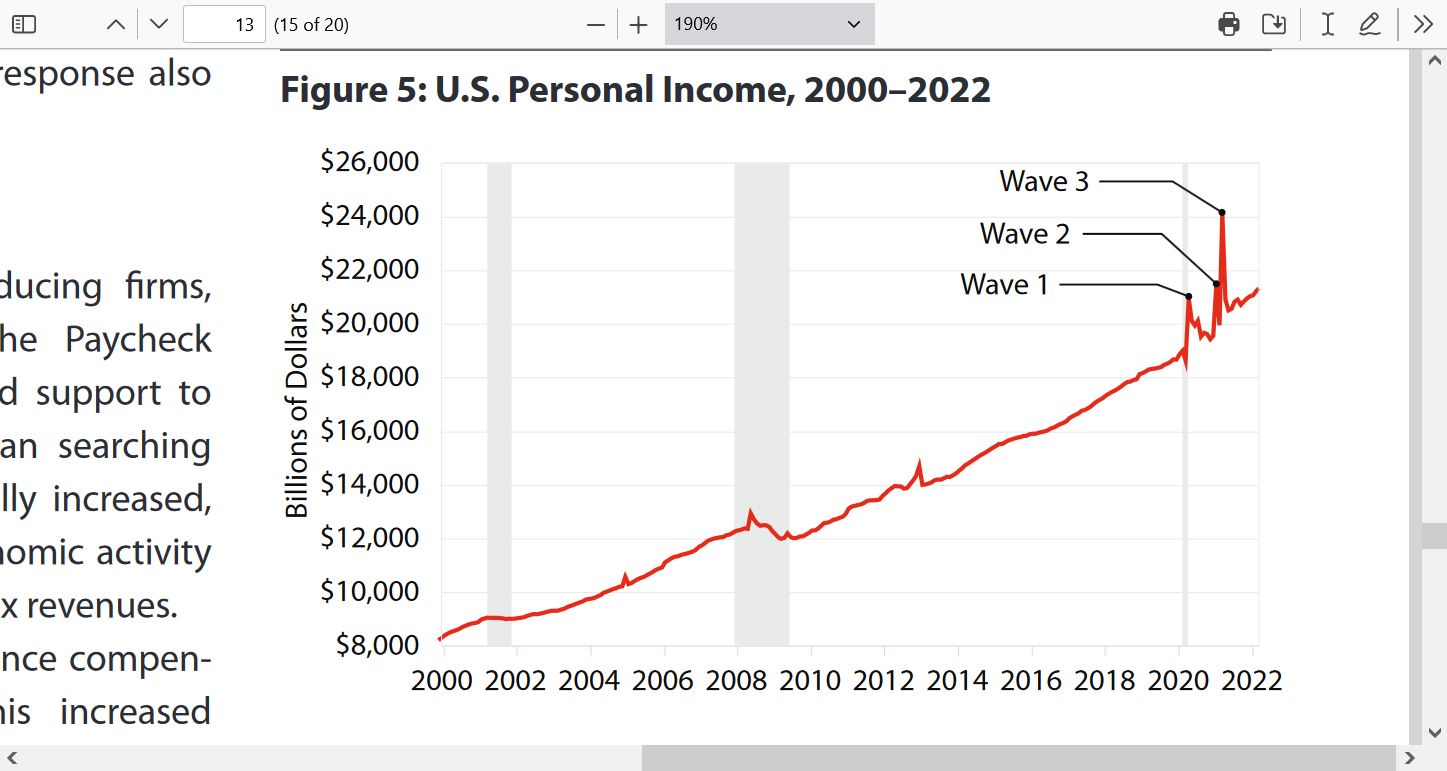

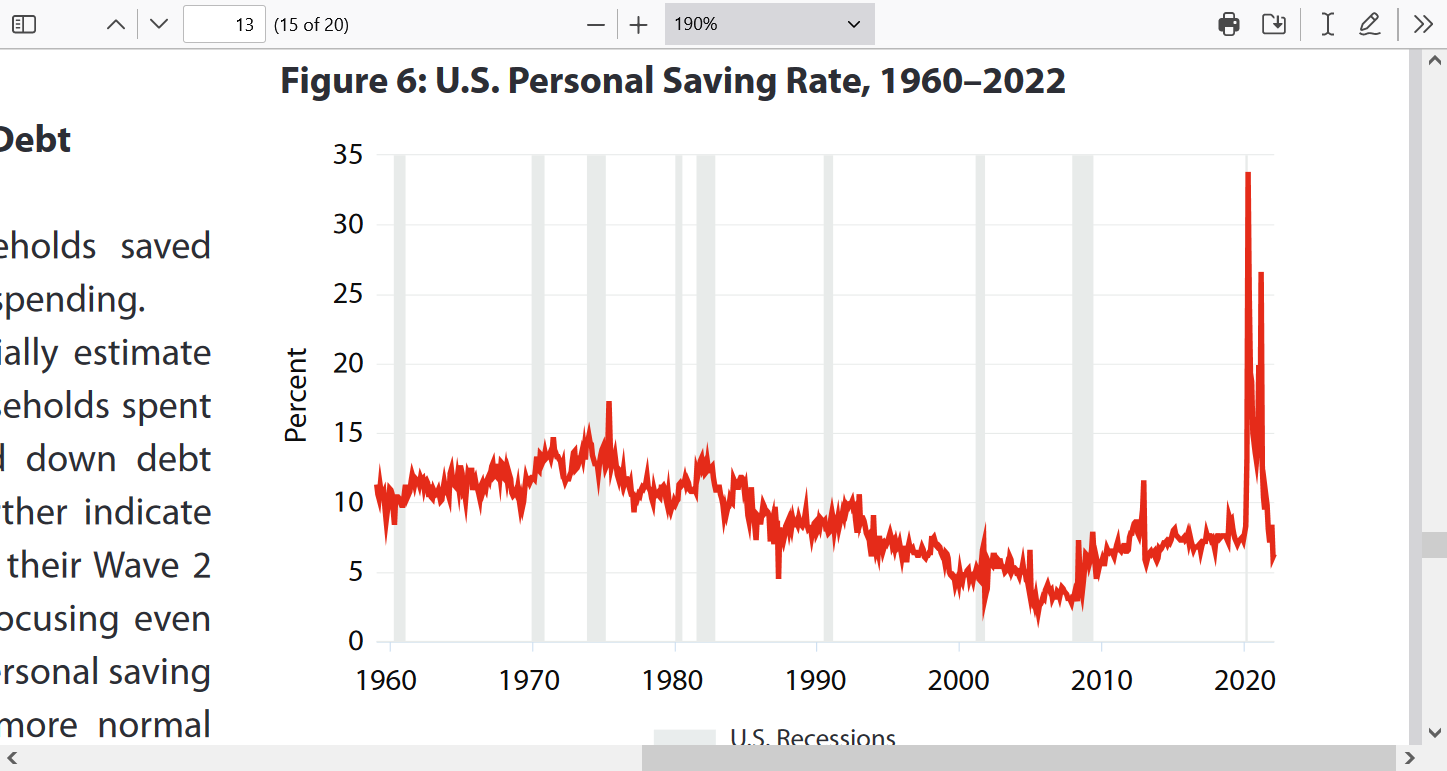

The US had 5 total stimulus and relief programs totaling 5 trillion dollars from Trump/Biden

A breakdown of the fiscal and monetary responses to the pandemic

https://www.investopedia.com/government-stimulus-efforts-to-fight-the-covid-19-crisis-4799723

https://www.nytimes.com/interactive/2022/03/11/us/how-covid-stimulus-money-was-spent.html

Many other countries did the same thing.

++++++++++

Tracking the $9 Trillion Global Fiscal Support to Fight COVID-19

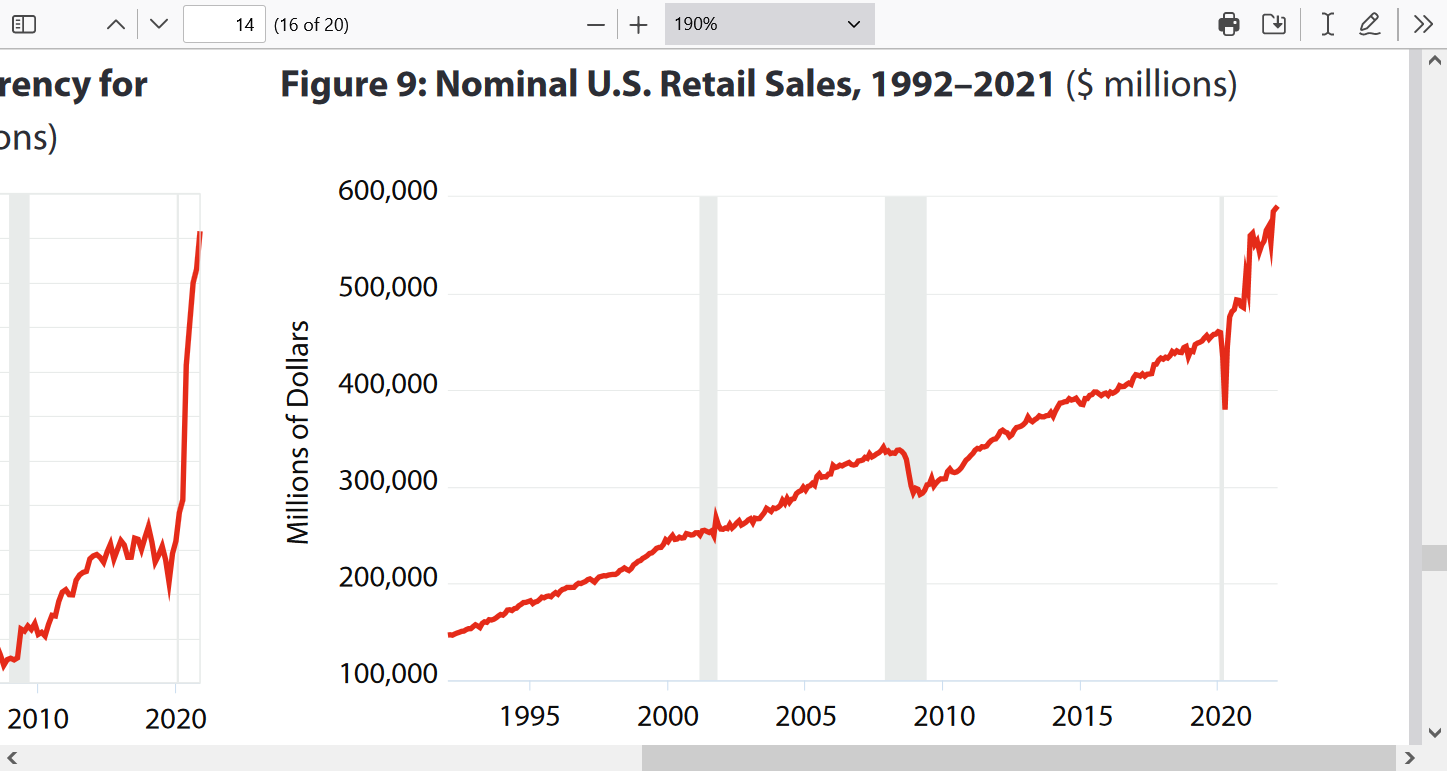

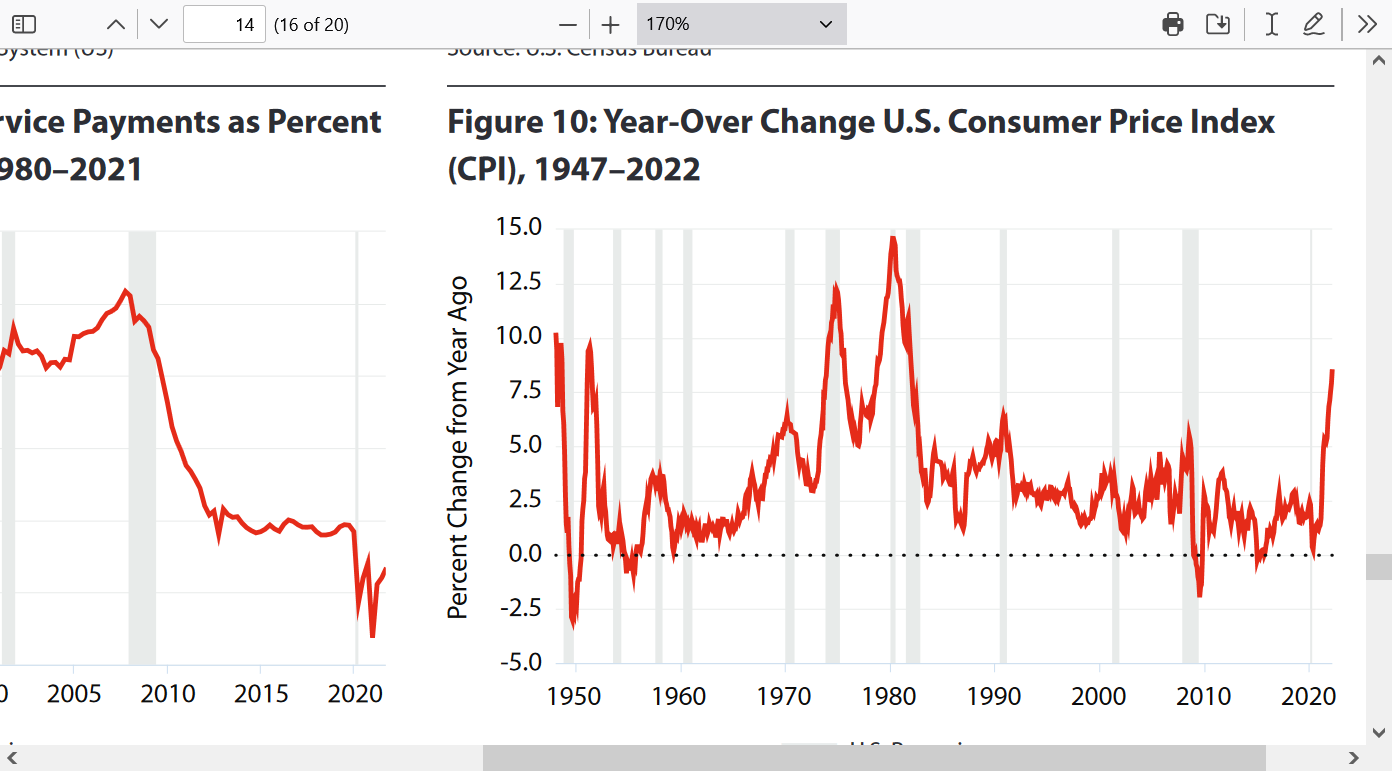

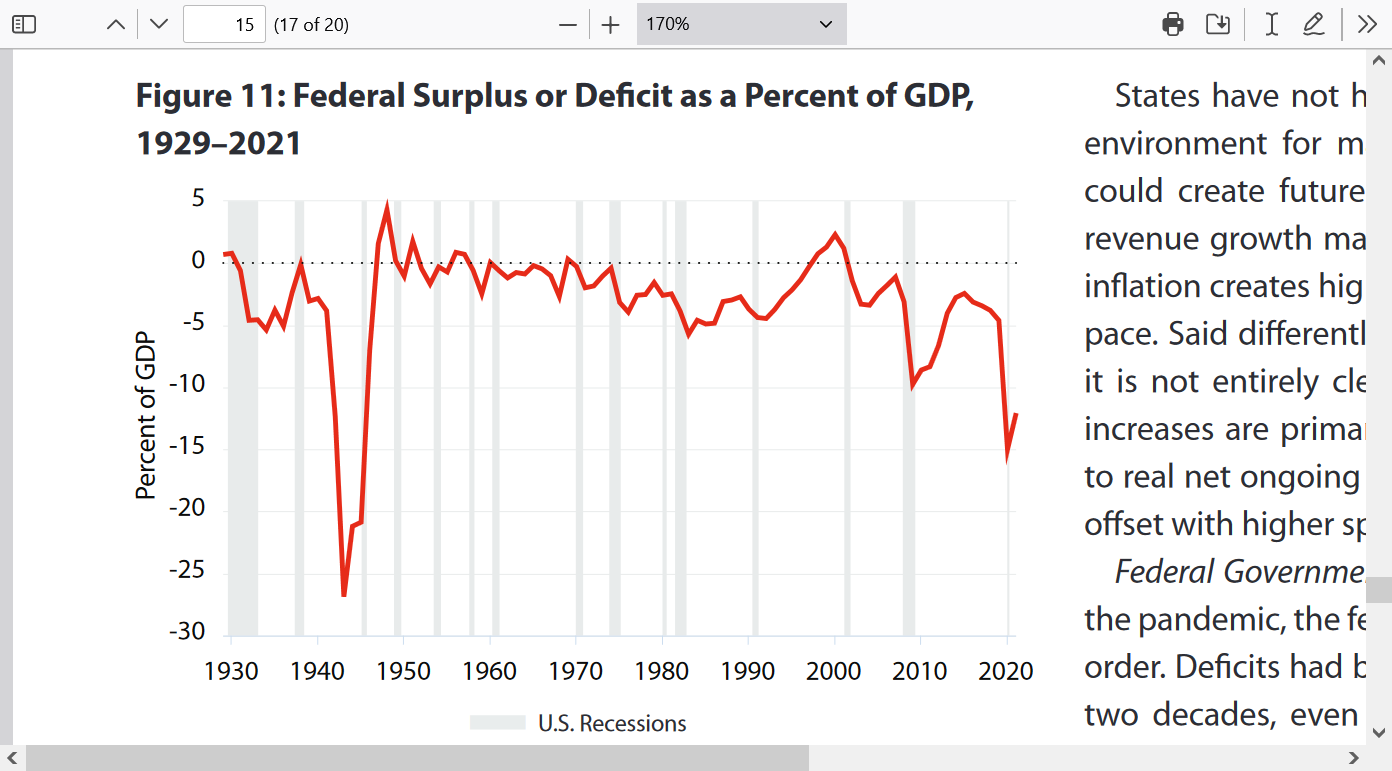

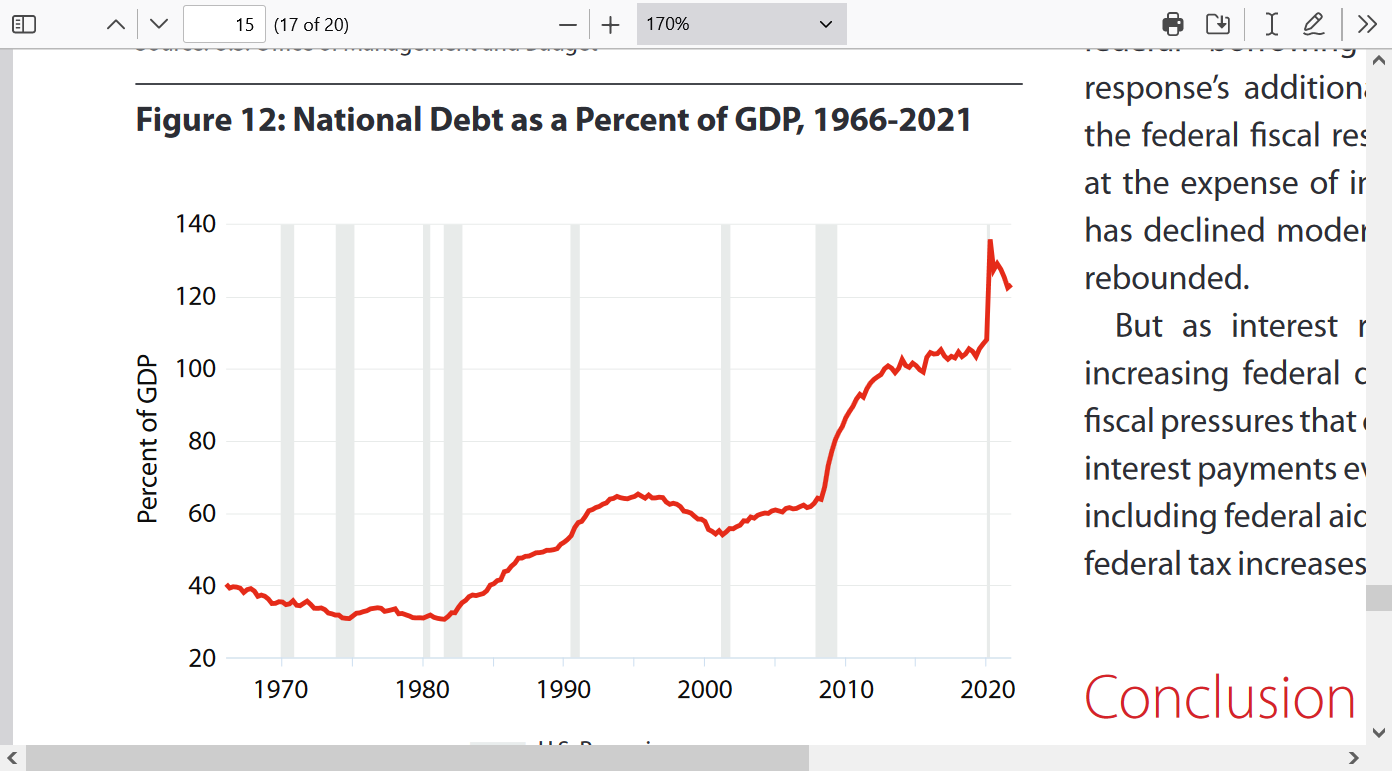

Some profound graphs in this discussion copied below. Some are pretty mind boggling. There's not better way to display data!

The Unprecedented Federal Fiscal Policy Response to the COVID-19 Pandemic and Its Impact on State Budgets

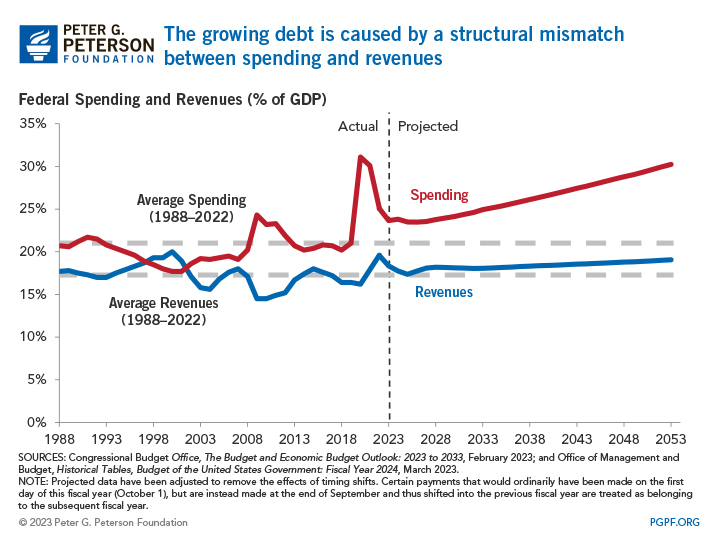

Phil Dean Chief Economist and Public Finance Senior Research Fellow Massive fiscal stimulus supported the economy during the pandemic, but also contributed to goods shortages,inflation, and long-term debt.

https://gardner.utah.edu/wp-content/uploads/Fiscal-Stimulus-May2022.pdf?x71849

++++++++++

+++++++++++++++++++++++

+++++++++++++++++++++++

+++++++++++++++++++++++++++++++

+++++++++++++++++++++++++++++++

+++++++++++++++++++++

+++++++++++++++++++++

+++++++++++++++

+++++++++++++++++++

+++++++++++++

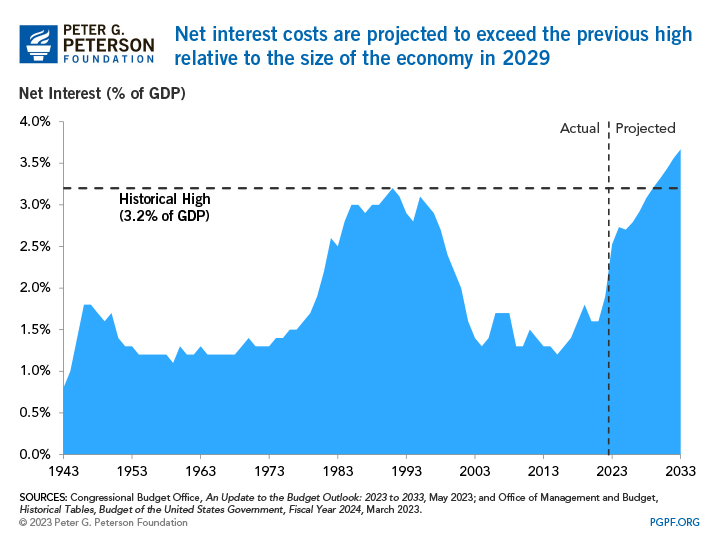

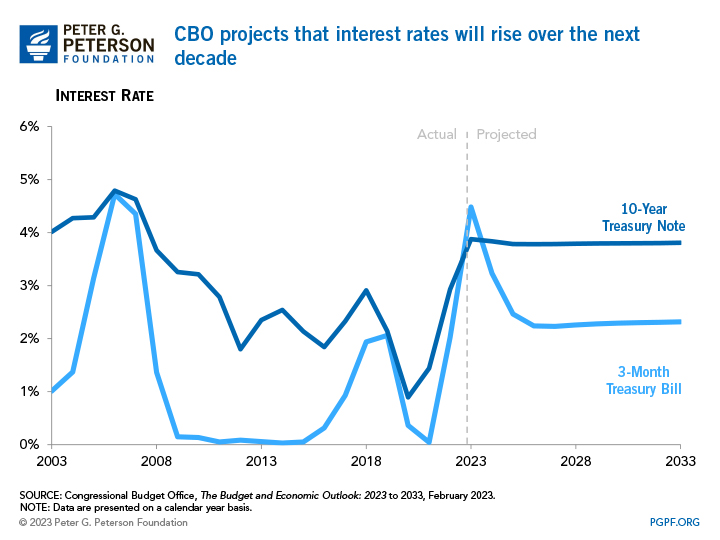

metmike: Here's the thing on the last graph. When interest rates were near 0, the interest on the National Debt is much smaller than where they are now........which is crushing!

https://www.pgpf.org/budget-basics/what-are-interest-costs-on-the-national-debt

++++++

++++++

+++++++++++

++++++++++

++++++++

++++++++

+++++++++++

+++++++++++

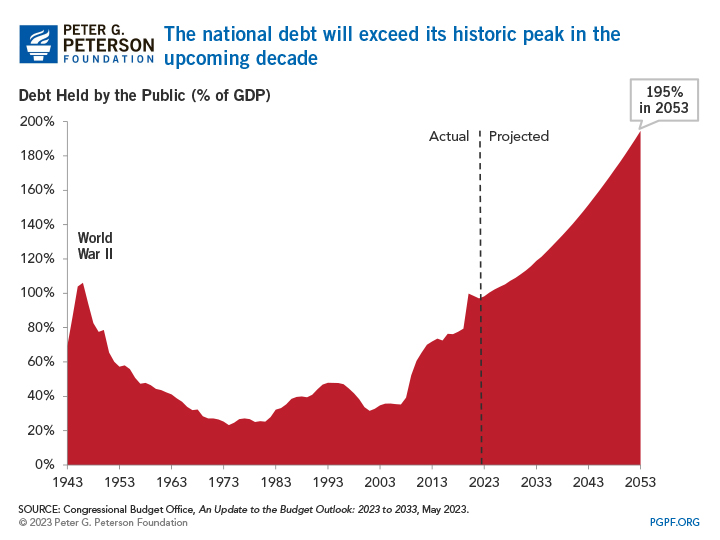

Rising interest rates and growing national debt cause federal interest costs to rise. And interest costs, in turn, contribute to the growth of federal spending — continuing a vicious cycle of borrowing, interest, and higher debt. Interest costs also crowd out opportunities for investment in other important priorities. In fact, the government is already on a path to spending more on interest costs than its spending on education, research and development, and infrastructure combined. If unaddressed, the growing borrowing costs will pose significant challenges for our nation’s fiscal future.