KEY EVENTS TO WATCH FOR:

Monday, July 24, 2023

8:30 AM ET. June Chicago Fed National Activity Index (CFNAI)

NAI (previous -0.15)

NAI, 3-mo Moving Avg (previous -0.14)

9:45 AM ET. July US Flash Manufacturing PMI

PMI, Mfg (previous 46.3)

9:45 AM ET. July US Flash Services PMI

PMI, Services (previous 54.1)

Tuesday, July 25, 2023

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, Y/Y% (previous -0.3%)

Latest Wk, Y/Y% (previous -0.2%)

9:00 AM ET. May U.S. Monthly House Price Index

9:00 AM ET. May S&P CoreLogic Case-Shiller Indices

10-City Idx, M/M% (previous +1.7%)

10-City Idx, Y/Y% (previous -1.2%)

20-City Idx, M/M% (previous +1.7%)

20-City Idx, Y/Y% (previous -1.7%)

National Idx, M/M% (previous +1.3%)

National Idx, Y/Y% (previous -0.2%)

10:00 AM ET. July Consumer Confidence Index

Cons Conf Idx (previous 109.7)

Expectation Idx (previous 79.3)

Present Situation Idx (previous 155.3)

10:00 AM ET. July Richmond Fed Business Activity Survey

Mfg Idx (previous -7)

Shipments Idx (previous -5)

1:00 PM ET. June Money Stock Measures

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous -0.8M)

Gasoline Stocks, Net Chg (Bbls) (previous -2.8M)

Distillate Stocks, Net Chg (Bbls) (previous -0.1M)

N/A U.S. Federal Open Market Committee meeting

Wednesday, July 26, 2023

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 210.7)

Composite Idx, W/W% (previous +1.1%)

Purchase Idx-SA (previous 163.2)

Purchase Idx-SA, W/W% (previous -1.3%)

Refinance Idx (previous 446.4)

Refinance Idx, W/W% (previous +7.3%)

10:00 AM ET. June New Residential Sales

New Home Sales (previous 763K)

New Home Sales, M/M% (previous +12.2%)

New Home Sales Months Supply (previous 6.7)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 457.42M)

Crude Oil Stocks, Net Chg (Bbl) (previous -0.708M)

Gasoline Stocks (Bbl) (previous 218.386M)

Gasoline Stocks, Net Chg (Bbl) (previous -1.066M)

Distillate Stocks (Bbl) (previous 118.194M)

Distillate Stocks, Net Chg (Bbl) (previous +0.013M)

Refinery Usage (previous 94.3%)

Total Prod Supplied (Bbl/day) (previous 20.767M)

Total Prod Supplied, Net Chg (Bbl/day) (previous +2.066M)

2:00 PM ET. U.S. interest rate decision

Federal Funds Rate

Federal Funds Rate Change (Pts)

Fed Funds Rate-Range High (previous 5.25)

Fed Funds Rate-Range Low (previous 5.00)

FOMC Vote For Action (previous 11)

FOMC Vote Against Action (previous 0)

Discount Rate (previous 5.25)

Discount Rate Change (Pts) (previous +0.00)

Discount Rate-Range High

Discount Rate-Range Low

Thursday, July 27, 2023

8:30 AM ET. U.S. Weekly Export Sales

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims

Jobless Claims, Net Chg

Continuing Claims

Continuing Claims, Net Chg

8:30 AM ET. June Advance Report on Durable Goods

Durable Goods-SA, M/M% (previous +1.7%)

Dur Goods, Ex-Defense, M/M% (previous +3%)

Dur Goods, Ex-Transport, M/M% (previous +0.6%)

Orders: Cap Gds, Non-Def, Ex-Air, M/M% (previous +0.7%)

Shipmnts: Cap Gds, Non-Def, Ex-Air, M/M% (previous +0.2%)

8:30 AM ET. 2nd Quarter Advance estimate GDP

Annual Rate, Q/Q% (previous +2.0%)

Chain-Weighted Price Idx, Q/Q% (previous +4.1%)

PCE Price Idx, Q/Q% (previous +4.1%)

Purchase Price Idx, Q/Q%

Real Final Sales 1st Est, Q/Q%

Core PCE Price Idx, Q/Q%

Personal Consumption, Q/Q% (previous +4.2%)

8:30 AM ET. June Advance Economic Indicators Report

10:00 AM ET. June Pending Home Sales Index

Pending Home Sales (previous 76.5)

Pending Home Sales Idx, M/M% (previous -2.7%)

Pending Home Sales Idx , Y/Y% (previous -22.2%)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf)

Working Gas In Storage, Net Chg (Cbf)

11:00 AM ET. July Federal Reserve Bank of Kansas City Survey of Tenth District Manufacturing

Mfg Activity Idx (previous -10)

6-Mo Exp Prod Idx (previous 15)

Mfg Composite Idx (previous -12)

6-Mo Exp Composite Idx (previous -2)

4:30 PM ET. Federal Discount Window Borrowings

4:30 PM ET. Foreign Central Bank Holdings

Friday, July 28, 2023

8:30 AM ET. June Personal Income and Outlays

Personal Income, M/M% (previous +0.4%)

Consumer Spending, M/M% (previous +0.1%)

PCE Price Idx, M/M% (previous +0.1%)

PCE Price Idx, Y/Y% (previous +3.8%)

PCE Core Price Idx, M/M% (previous +0.3%)

PCE Core Price Idx, Y/Y% (previous +4.6%)

8:30 AM ET. 2nd Quarter Employment Cost Index

ECI, Q/Q% (previous +1.2%)

ECI, Y/Y% (previous +4.8%)

10:00 AM ET. July University of Michigan Survey of Consumers - final

End-Mo Sentiment Idx (previous 64.4)

End-Mo Expectations Idx (previous 61.5)

12-Month Inflation Forecast (previous 3.3%)

5-Year Inflation Forecast (previous 3.0%)

End-Mo Current Idx (previous 69.0)

3:00 PM ET. June Agricultural Prices

Farm Prices, M/M% (previous -2.8%)

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The STOCK INDEXES: The September NASDAQ 100 was higher overnight as it consolidated some of last-week's decline. Overnight trading sets the stage a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 15,423.27 would confirm that a short-term top has been posted. If September renews this year's rally, the December-2021 high on the weekly continuation chart crossing at 16,659.50 is the next upside target. First resistance is last-Wednesday's high crossing at 16,062.75. Second resistance is the December-2021 high on the weekly continuation chart crossing at 16,659.50. First support is the 20-day moving average crossing at 15,423.16. Second support is the 50-day moving average crossing at 14,870.05.

The September S&P 500 was was slightly higher overnight as it consolidates some of last-Thursday's decline. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought but are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 4496.85 would confirm that a short-term top has been posted. If June extends the rally off March's low, the 87% retracement level of the 2022 decline crossing at 4639.07 is the next upside target. First resistance is last-Wednesday's high crossing at 4609.25. Second resistance is the 87% retracement level of the 2022 decline crossing at 4639.07. First support is the 10-day moving average crossing at 4550.38. Second support is the 20-day moving average crossing at 4496.85.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: September T-bonds was higher overnight as it consolidates some of last-Thursday's sharp decline. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the aforementioned rally, the 50% retracement level of the April-July decline crossing at 128-21 is the next upside target. Closes below last-Thursday's low crossing at 125-29 would signal that a short-term top has been posted. First resistance is the 50% retracement level of the April-July decline crossing at 128-21. Second resistance is June's high crossing at 129-16. First support is last-Thursday's low crossing at 125-29. Second support is July's low crossing at 122-30.

September T-notes were steady to slightly higher overnight as it consolidates some of last-Thursday's decline. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September renews this month's rally, the 50-day moving average crossing at 113.101 is the next upside target. Closes below last-Thursday's low crossing at 112.000 would confirm that a short-term top has been posted. First resistance is the 50-day moving average crossing at 113.101. Second resistance is June's high crossing at 115.000. First support is last-Thursday's low crossing at 112.000. Second support is the July 6th low crossing at 110.050.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

ENERGIES:Septembercrude oil was slightly higher overnight as it extends the rally off June's low. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought, diverging but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off the June 28th low, the 87% retracement level of the April-May decline crossing at $79.23 is the next upside target. Closes below the 20-day moving average crossing at $73.29 would signal that a short-term top has been posted. First resistance is the 75% retracement level of the April-May decline crossing at $77.14. Second resistance is the 87% retracement level of the April-May decline crossing at $79.23. First support is last-Monday's low crossing at 73.78. Second support is the 20-day moving average crossing at $73.29.

September heating oil was higher overnight as it extends the rally off May's low and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, the 62% retracement level of the 2022-2023 decline crossing at 2.8561 is the next upside target. Closes below the 20-day moving average crossing at 2.5360 would signal that a short-term top has been posted. First resistance is the overnight high crossing at 2.7819. Second resistance is the 62% retracement level of the 2022-2023 decline crossing at 2.8561. First support is last-Monday's low crossing at 2.5454. Second support is the 20-day moving average crossing at 2.5361.

September unleaded gas was higher overnight as it extends the rally off May's low. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, the June-2022 high crossing at $2.8215 is the next upside target. Closes below the 20-day moving average crossing at 2.5383 would signal that a short-term top has been posted. First resistance is the overnight high crossing at $2.7941. Second resistance is the June-2022 high crossing at $2.8215. First support is the 10-day moving average crossing at $2.6450. Second support is the 20-day moving average crossing at $2.5383.

September natural gas was slightly higher overnight and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends last-week's rally, the June 26th high crossing at 2.911 is the next upside target. If September renews the decline off June's high, June's low crossing at 2.249 is the next downside target. First resistance is the June 26th high crossing at 2.911. Second resistance is the 25% retracement level of the 2022-2023 decline crossing at 3.193. First support is last-Monday's low crossing at 2.477. Second support is the June 1st low crossing at 2.249.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The September Dollar was steady to higher overnight as it extends the rally off last-Tuesday's high. Overnight trading sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $101.360 would signal that a short-term low has been posted. If September renews the decline off the July 6th high, the March 30th low on the weekly continuation chart crossing at $97.730 is the next downside target. First resistance is the 20-day moving average crossing at $101.360. Second resistance is the 50-day moving average crossing at $102.273. First support is last-Tuesday's low crossing at $99.220. Second support is the March 30th -2022 low on the weekly continuation chart crossing at $97.730.

The September Euro was lower overnight as it extends the decline off last-Tuesday's high. Overnight weakness sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 1.10785 would signal that a short-term top has been posted while opening the door for additional weakness near-term. If September renews the rally off May's low, the March 30th -2022 high crossing at $1.15190 is the next upside target. First resistance is last-Tuesday's high crossing at $1.13105. Second resistance is the March 30th -2022 high crossing at $1.15190. First support is the 20-day moving average crossing at 1.10784. Second support is the 50-day moving average crossing at 1.09542.

The September British Pound was steady to slightly lower overnight as it extends the decline off July's high. Overnight trading and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices near-term. Closes below the 20-day moving average crossing at 1.2855 would signal that a short-term top has been posted. If September resumes the rally off May's low, the 75% retracement level of the 2022-2023 decline crossing at 1.3253 is the next upside target. First resistance is the July 14th high crossing at 1.3146. Second resistance is the 75% retracement level of the 2022-2023 decline crossing at 1.3253. First support is the 20-day moving average crossing at 1.2855. Second support is the 50-day moving average crossing at 1.2670.

The September Swiss Franc was steady to slightly higher overnight and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 1.14599 would signal that a short-term top has been posted. If September resumes the rally off May's low, the January 2019 high crossing at 1.18680 is the next upside target. First resistance is last-Tuesday's high crossing at 1.17650. Second resistance is the January 2019 high crossing at 1.18680. First support is the 10-day moving average crossing at 1.16490. Second support is the 20-day moving average crossing at 1.14599.

The September Canadian Dollar was steady to slightly higher overnight as it extends the trading range of the past two-week's. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are neutral signaling that sideways trading is possible near-term. If September renews the rally off July's low, the September-12th -2022 high crossing at $77.11 is the next upside target. Closes below the July 18th low crossing at $75.57 would signal that a short-term top has been posted. First resistance is the 38% retracement level of the 2022-2023 decline crossing at $76.28. Second resistance is the September-12th -2022 high crossing at $77.11. First support is the July 18th low crossing at $75.57. Second support is the 50-day moving average crossing at $75.12.

The September Japanese Yen was slightly higher overnight as it consolidates some of last-week's decline. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off July's high, June's low crossing at 0.069755 is the next downside target. If September renews the rally off May's low, the 38% retracement level of the January-July decline crossing at 0.074017 is the next upside target. First resistance is July's high crossing at 0.073585. Second resistance is the 38% retracement level of the January-June decline crossing at 0.074017. First support is last-Friday's crossing at 0.071065. Second support is June's low crossing at 0.069755.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

Precious Metals: Augustgold was slightly higher overnight and sets the stage for a steady to higher opening when the day session begins trading later this morning. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $1945.70 would signal that a short-term top has been posted. If August renews the rally off June's low, June's high crossing at $2000.70 is the next upside target. First resistance is June's high crossing at $2000.70. Second resistance is the May 15th high crossing at $2046.50. First support is the 20-day moving average crossing at $1945.70. Second support is June's low crossing at $1900.60.

September silver was steady to slightly lower overnight as it consolidates some of the rally off June's low. Overnight trading sets the stage for a slightly lower opening when the day session begins trading later this morning. Stochastics and the RSI are overbought but are turning neutral to bearish signaling that sideways to higher prices are possible near-term. If July extends the rally off June's low, the 75% retracement level of the May-June decline crossing at $25.561 is the next upside target. Closes below the 20-day moving average crossing at $23.958 would signal that a short-term top has been posted. First resistance is last-Thursday's high crossing at $25.475. Second resistance is the 75% retracement level of the May-June decline crossing at 25.561. First support is the 10-day moving average crossing at $24.805. Second support is the 20-day moving average crossing at $23.958.

September copper was slightly higher overnight and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at 3.7804 would signal that a short-term top has been posted. If September renews the rally off the June 29th low, June's high crossing at 3.9640 is the next upside target. First resistance June's high crossing at 3.9640. Second resistance is May's high crossing at 4.0100. First support is the 50-day moving average crossing at 3.7804. Second support is the June 29th low crossing at 3.6830.

GRAINS http://quotes.ino.com/ex changes/?c=grains

Grains: December corn was sharply higher overnight as it renewed the rally off July's low. Overnight trading sets the stage for a sharply higher opening when the day sessions begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off July's low, the 62% retracement level of the June-July decline crossing at $5.73 is the next upside target. Closes below the 20-day moving average crossing at $5.21 1/4 would signal that a short-term top has been posted. First resistance is the 62% retracement level of the June-July decline crossing at $5.73. Second resistance is the 75% retracement level of the June-July decline crossing at $5.92 3/4. First support is the 50-day moving average crossing at $5.32 1/4. Second support is the 20-day moving average crossing at $5.21 1/4.

September wheat was sharply higher overnight as it erased all of last-Friday's decline. Overnight trading sets the stage for a sharply higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off July's low, June's high crossing at $7.70 1/4 is the next upside target. Closes below the 50-day moving average crossing at $6.60 3/4 would signal that a short-term top has been posted. First resistance is June's high crossing at $7.70 1/4. Second resistance is the 38% retracement level of the 2022-2023 decline crossing at $7.95 1/4. First support is the 20-day moving average crossing at $6.75. Second support is the 50-day moving average crossing at $6.60 3/4.

September Kansas City wheat was sharply higher overnight as it extends the rally off July's low. Overnight trading sets the stage for a sharply higher opening when the day session begins trading later this morning. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends this month's rally, the 50% retracement level of the 2022-2023 decline crossing at $9.46 3/4 is the next upside target. Closes below the 50-day moving average crossing at $8.26 3/4 would signal that a short-term top has been posted. First resistance is the overnight high crossing at $9.02. Second resistance is the 50% retracement level of the 2022-2023 decline crossing at $9.46 3/4. First support is the 20-day moving average crossing at $8.31. Second support is the 50-day moving average crossing at $8.26 3/4.

September Minneapolis wheat was sharply higher overnight as it extends the rally off May's low. Overnight trading sets the stage for a sharply higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off July's low, the 50% retracement level of the 2022-2023 decline crossing at $9.60 3/4 is the next upside target. Closes below the 20-day moving average crossing at $8.61 1/4 would confirm that a short-term top has been posted. First resistance is the 38% retracement level of the 2022-2023 decline crossing at $9.16 1/4. Second resistance is the 50% retracement level of the 2022-2023 decline crossing at $9.60 3/4. First support is the 20-day moving average crossing at $8.61 1/4. Second support is the 50-day moving average crossing at $8.41 1/2.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

November soybeans were higher overnight as they extend the rally off May's low. Overnight trading sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If November extends the rally off May's low, the May-2022 high crossing at $14.35 is the next upside target. Closes below the 20-day moving average crossing at $13.51 3/4 would signal that a short-term top has been posted. First resistance is the 87% retracement level of the 2022-2023 decline crossing at $14.07 1/2. Second resistance is the May-2022 high crossing at $14.35. First support is the 20-day moving average crossing at $13.51 3/4. Second support is the July 7th low crossing at $13.15 1/2.

December soybean meal was higher overnight as it consolidates some of the decline off last-Wednesday's high. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $397.90 would confirm that a short-term top has been posted. If December resumes the rally off the June 29th low, the 87% retracement level of the March-May decline crossing at $428.00 is the next upside target. First resistance is the 75% retracement level of the March-May decline crossing at $418.80. Second resistance is the 87% retracement level of the March-May decline crossing at $428.00. First support is the 20-day moving average crossing at $397.90. Second support is the 50-day moving average crossing at $388.60.

December soybean oil is was sharply higher overnight as it extends the rally off May's low. Overnight weakness sets the stage for a sharply higher opening when the day session begins trading. Stochastics and the RSI are overbought, diverging but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December renews the rally off May's low, the 75% retracement level of the 2022-2023 decline crossing at 65.45 is the next upside target. Closes below the 20-day moving average crossing at 59.76 would signal that a short-term top has been posted. First resistance is the 75% retracement level of the 2022-2023 decline crossing at 65.45. Second resistance is the 87% retracement level of the 2022-2023 decline crossing at 68.81. First support is the 20-day moving average crossing at 59.76. Second support is the June 29th low crossing at 54.67.

Thanks, tallpine!

Latest weather here:

https://www.marketforum.com/forum/topic/97527/

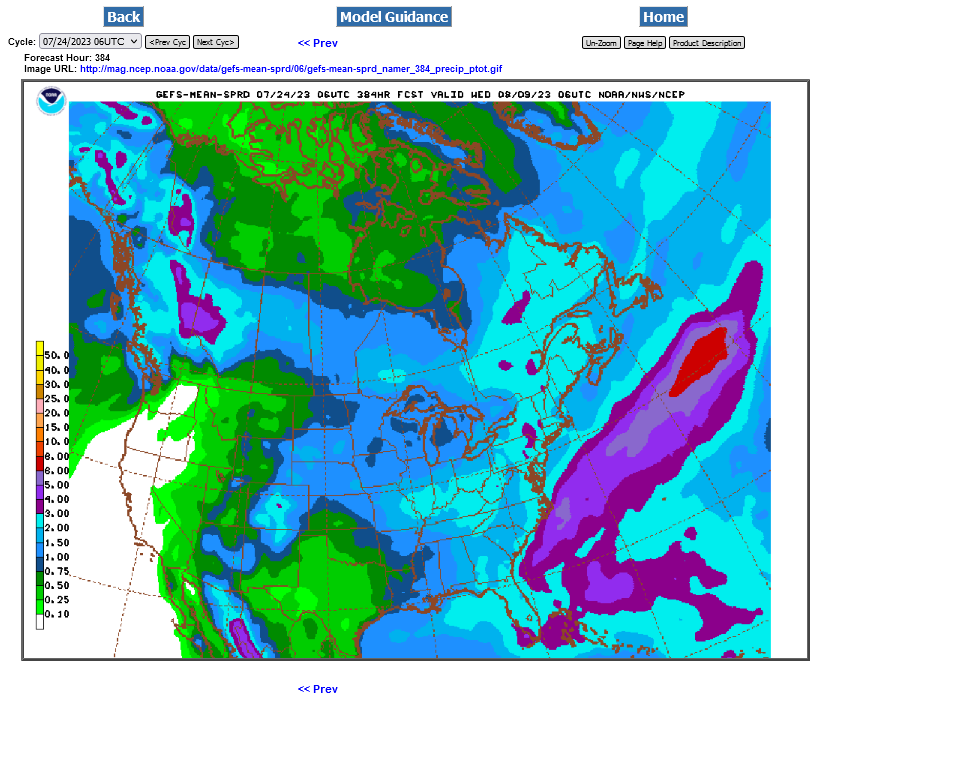

Weather for grains is bullish but there are some models not so bullish.

Last 6z GEFS is the driest for the N/Northwest half of the belt and most bullish.

Lots of HEAT, mainly this week.

This is corn's 2nd worst enemy during filling, sometimes even worse than a cool drought!

HeatFill for Corn

Started by metmike - July 14, 2023, 2:47 p.m.

https://www.marketforum.com/forum/topic/97257/

Highs for days 3-7:

https://www.wpc.ncep.noaa.gov/medr/medr_max.shtml

+++++++++++++++++++++++++++++++++++++++++++++++

Lows days 3-7 below:

https://www.wpc.ncep.noaa.gov/medr/medr_min.shtml