https://www.usatoday.com/story/money/2023/05/03/fed-interest-rate-hike-live-updates/70170191007/

WASHINGTON-- The Fed’s most aggressive rate-hiking campaign in 40 years may be history.

The Federal Reserve raised its key short-term interest rate by a quarter percentage point Wednesday and signaled it could now pause if inflation continues to ease as expected.

In a statement after a two-day meeting, the Fed removed previous guidance that “some additional policy firming (rate hikes) may be appropriate” to lower yearly inflation to its 2% target.

Instead, the Fed said its policymaking committee “will closely monitor incoming information and assess the implications for monetary policy.

“In determining the extent to which additional policy firming may be appropriate to return inflation to 2% over time, the Committee will take into account” its rate hikes so far, the lags with which they affect the economy and inflation, and “economic and financial developments.”

Dumb and dummer.

Bernanke, yellen, powell --- these three names will go down in history as the most inept of the last 1,000 years. Negative real interest rates - lol - could it be more ironic?. Congress being responible for the public purse? Maybe, maybe not? Ok, just totally kidding on that notion, but debt will become burdensome for the yet unborn.

Mike, I check this site everyday. Looking careful to make a good score in the grain mkt, if/when. TY for the good work you doing here -

Agree with your opinion, becker.

You're a good man for making the nice comment to make me feel good!

I know we have alot of readers that don't post much(which is fine) and just come to get reliable information and its always great to hear from you.

Inflation Still 'Stubbornly High' And Isn't Easing Fast Enough Toward 2% Target

In the interview, Barkin said the Fed’s message after its meeting last week was “explicitly not a pause” in its rate increases “or even necessarily a peak.” Instead, he said, it provided “the optionality to do more, if you need to do it. And also the optionality to wait if waiting is appropriate.”

Barkin’s remarks were broadly similar to what other Fed officials have said in recent days. John Williams, president of the New York Fed, noted Tuesday that “we haven't said we're done raising rates.”

Rather, Williams said, the Fed is no longer indicating that it will raise rates at each meeting. Instead, he said, the central bank will do what it deems necessary based on the latest economic data, including bank lending trends.

Williams also stressed that the Fed was unlikely to cut its key rate this year, even though investors expect three rate cuts this year, according to CME's Fedwatch tool.

The Fed will keep rates at a high enough level to restrain the economy “for quite some time,” Williams said. “I do not see any need ... to cut interest rates this year.”

Thanks, Jean.

You want the biggest helper to ease inflation?

End the war in Ukraine! And at the same time, it would increase global productivity/GDPs and give consumers more buying power with their increased incomes.

They won't tell us the truth about that though because they need American's to keep believing in the false war propaganda.

'

May 27, 2022

Relative to a no-war counterfactual, the model sees the war as reducing the level of global GDP about 1.5 percent and leading to a rise in global inflation of about 1.3 percentage points. The adverse effects of geopolitical risks in the model operate through lower consumer sentiment, higher commodity prices, and tighter financial conditions.

Impact of Russia-Ukraine war inflation on struggling economies

The Russian invasion of Ukraine has continued to cause global supply chain disruptions. As a result, the prices of essential commodities such as fuel and food have increased globally. For instance, both Russia and Ukraine account for almost one-third of global wheat exports. The war has caused shortages that have increased food insecurity due to the soaring food prices. Most affected are poor countries that are already grappling with other issues such as climate change.

According to the World Bank Group, Lebanon is one of the countries that Russia-Ukraine war inflation hit hardest. In August this year, the World Bank estimated that food inflation in Lebanon increased by around 122% in real terms.

++++++++++

https://www.barrons.com/articles/war-in-ukraine-driving-global-inflation-51657294183

April 6, 2023

The report’s analysis, however, reveals the unequal burden of the cost-of-living crisis. It finds that inflation was 2 percentage points higher for the poorest 10% of the population compared to the wealthiest 10%. This difference exceeded 5 percentage points in some countries in the region, including Moldova, Montenegro, and North Macedonia.

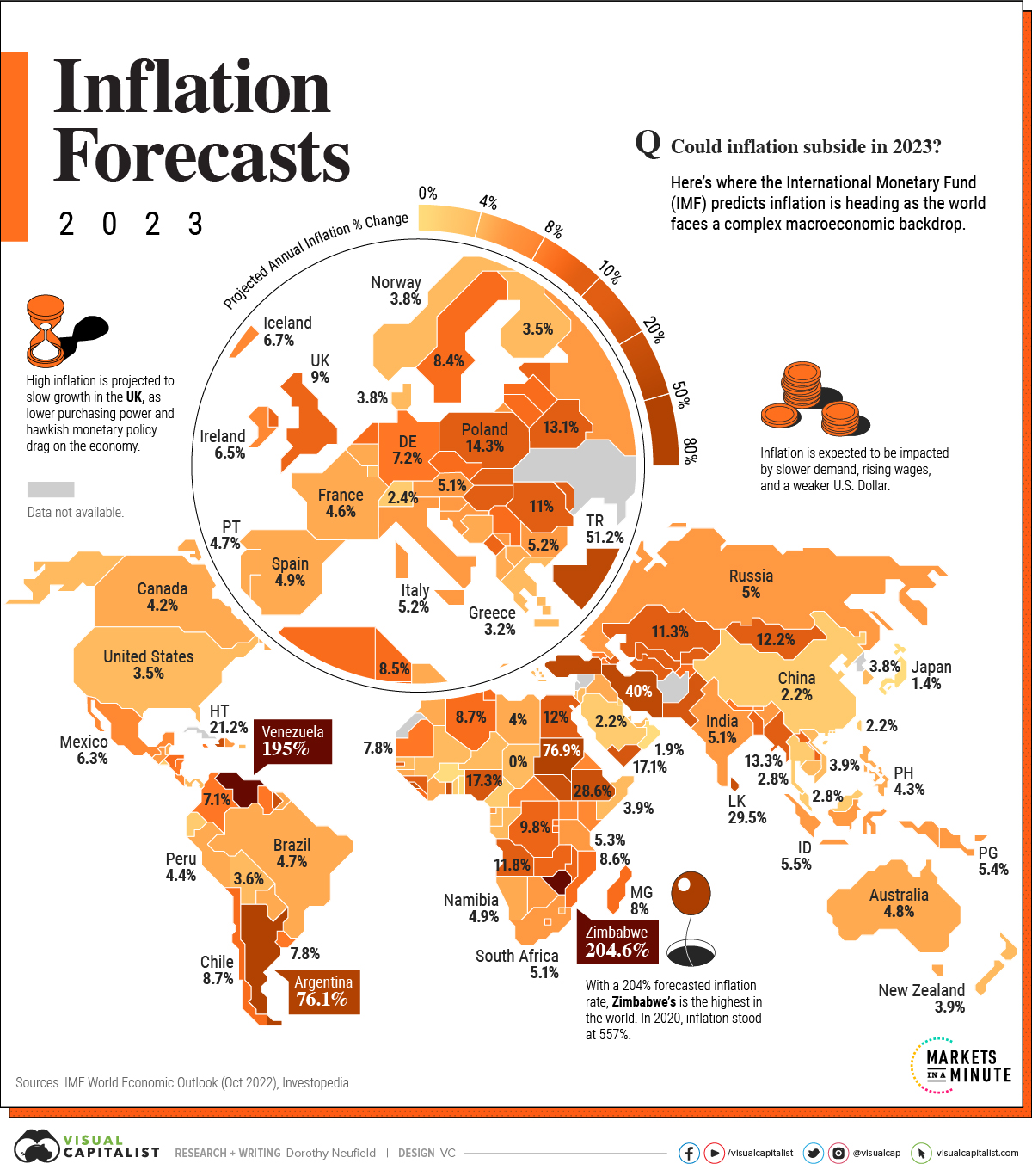

https://www.visualcapitalist.com/mapped-2023-inflation-forecasts-by-country/

There are so many victims of this war between the US and Russia that we know about but the world's poorest people, many thousands of miles away are usually left out of the discussion.

WELLLLLLLL.......... ALL THESE ILLEGAL ALIENS SURE AIN'T HELPIN' LOWER INFLATION, THAT'S A FACT. IF IT WEREN'T FOR THEM & THE FAKE WARS, WE'D BE IN PRETTY GOOD SHAPE, IMO.

NOT ONLY DO THE ILLEGALS WORK "OFF THE BOOKS", THEY SEND MOST OF THEIR $$$$$$$$ BACK HOME!! I COULD PUT A PRETTY GOOD DENT IN THAT, WITH JUST ONE EXECUTIVE ORDER.

The current administration does not want the scrimmage in Ukraine or at the border to end.

Let the Ukraine military really go on the offensive and over in 30 days. The Russian women/mothers will rise up and demand an end when their male population is diminished. Putin might choke on a chicken bone, or 'something'. Likewise, without the distraction of totally unproductive border invasion, the economic 'rules' of market free play will be restored.

Once these wars are over, petroleum prices tumble, pressure to level off/decrease 'public aid' and unemployment, and sensibility about spending WILL spur nongovernmental productivity. Closing the border will also restore civility to PROPER immigration.

Thanks, tic!

The markets are at an elevated risk for a black swan type event As long as the war continues.

if you have a big position in anything and news breaks that Russia just used a nuclear weapon, you better hope the markets are open so that your stops will be hit if you have the wrong position.

closed markets mean massive gaps on the next open And stops can’t help minimize the losses. …..a reason to be cautious with position trades Which are held while the markets are closed.

if you are lucky and on the right side……you make big money but for the wrong reason when trading.

Good luck happens but can’t replace skill.

bad luck happens too and skill WILL more than offset that in the long run!