This point is profound!

+++++++++++++++++++++++

Re: Re: Re: Re: ANOTHER SPECTACULAR EV ROAD TRIP

By cutworm - April 13, 2024, 9:18 a.m.

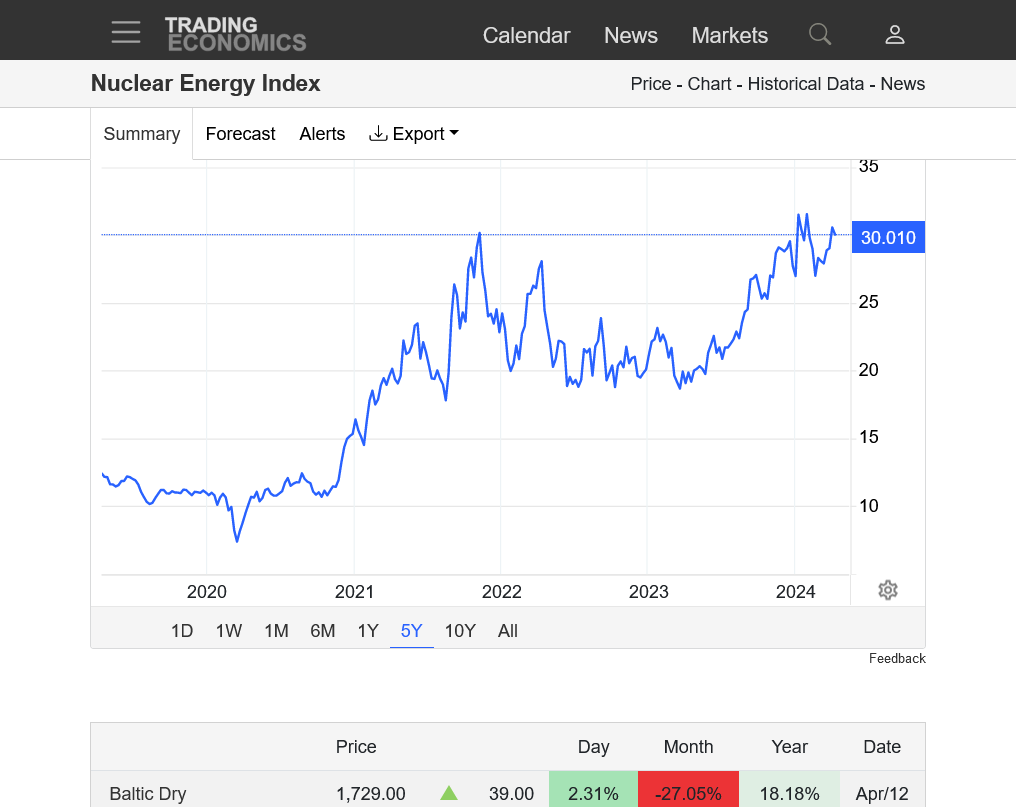

Currently 30.10 or 23% of its high in 2011

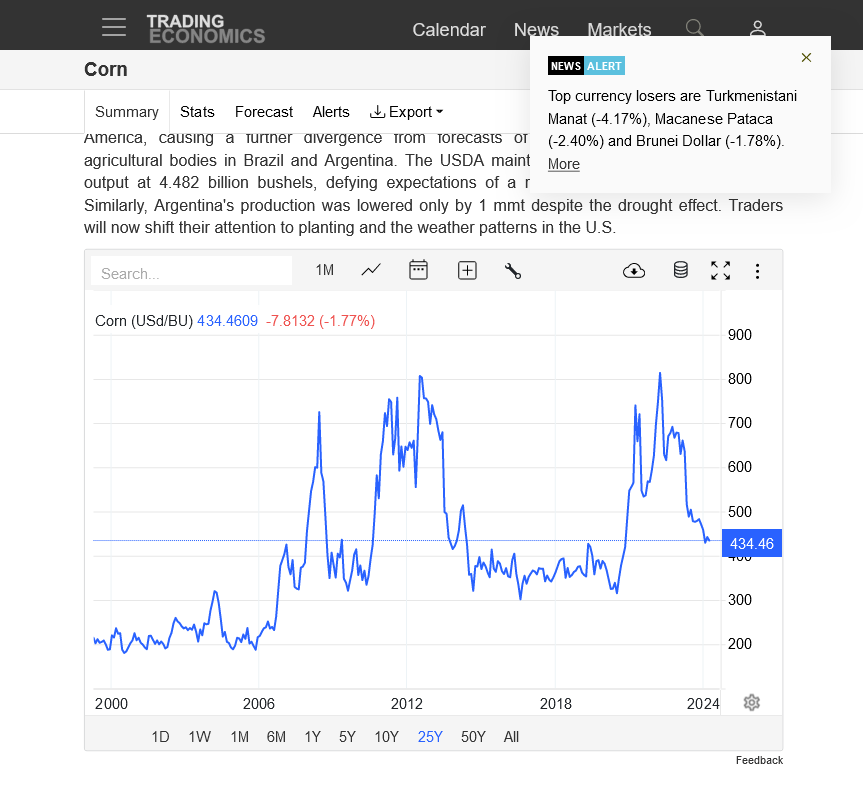

Looks a little different in a different time span.

Nuclear Energy Index - Price - Chart - Historical Data - News (tradingeconomics.com)

Not saying nuclear is bad, just pointing out the reference points can and do make all the difference.

++++++++++++++

Well stated, cutworm!

In a short while, I'll prove cutworm right by posting all the times frames for the markets that were in that thread and we can see how the different time frames tell different stories for each market!

Here's some different markets at different time frames:

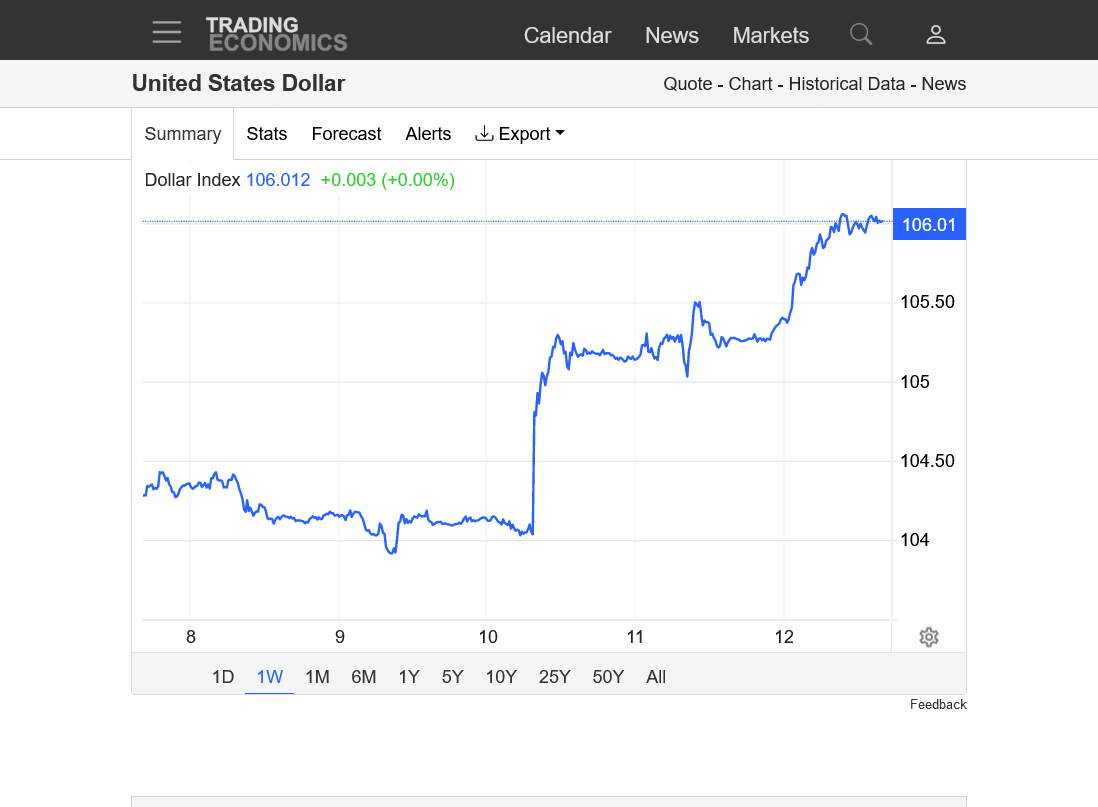

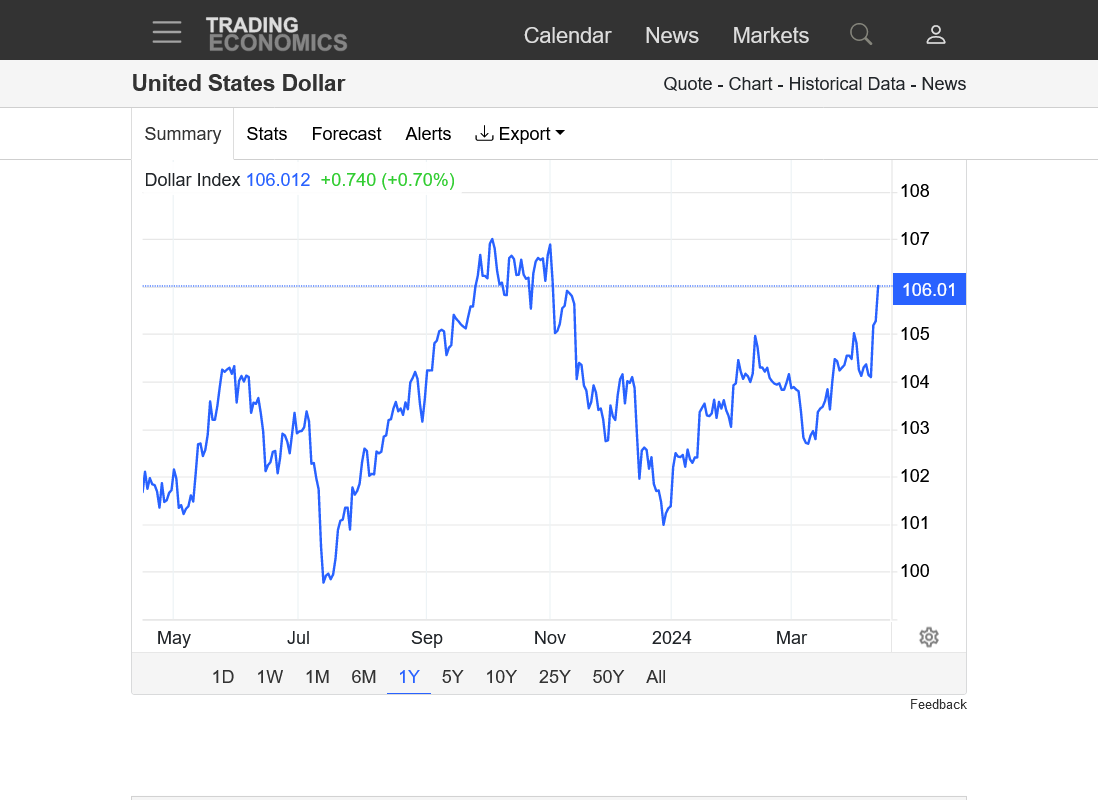

Clearly, with the dollar this week we've seen safe haven buying ahead of a potential Middle East conflict:

1. 1 week

2. 1 year

3. 5 years

4. 10 years

5. 50 years

https://tradingeconomics.com/united-states/currency

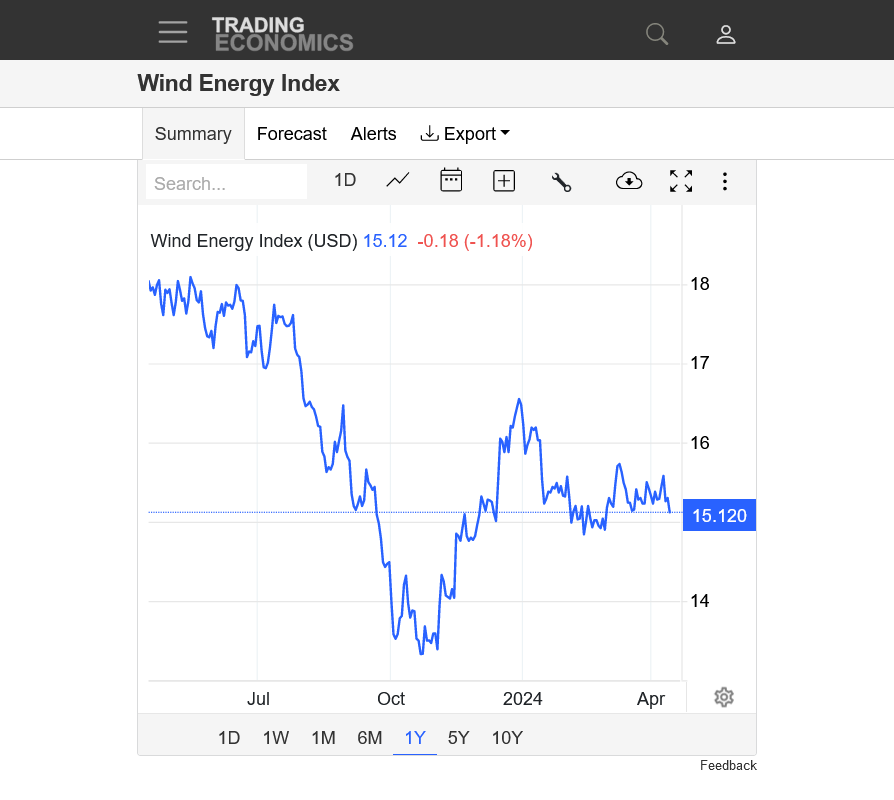

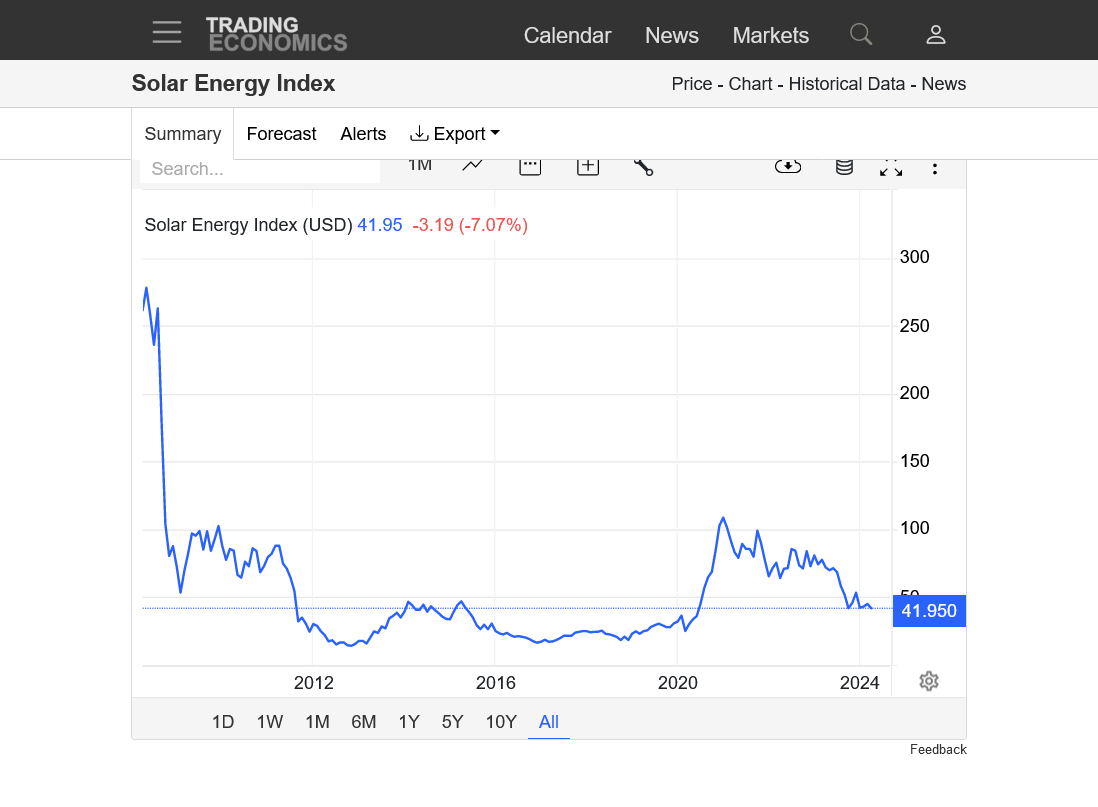

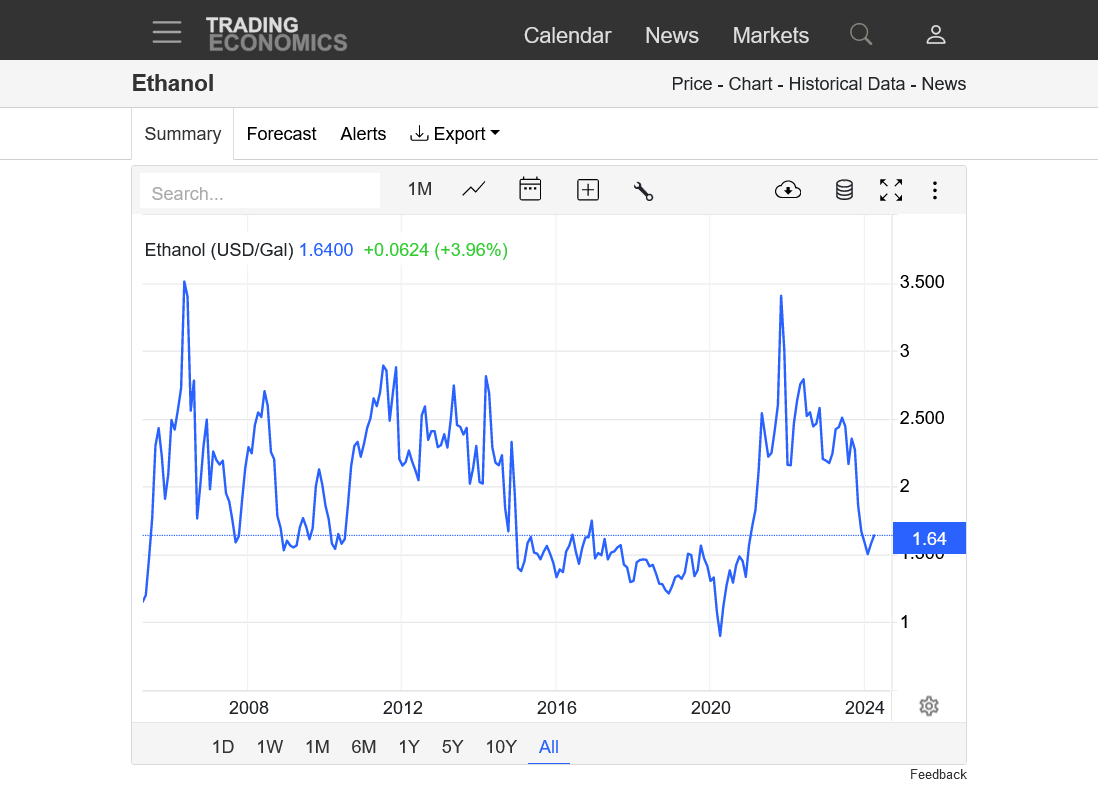

Wind, Solar, Ethanol and Nuclear from shorter to longer time frames below:

WIND

https://tradingeconomics.com/commodity/wind

SOLAR

https://tradingeconomics.com/commodity/solar

ETHANOL

https://tradingeconomics.com/commodity/ethanol

NUCLEAR

https://tradingeconomics.com/commodity/nuclear

1. Of those 4 markets, the only one that looks strong, very strong in fact is NUCLEAR ENERGY. Up 300% from 10-ish to 30-ish since early 2020. The market is telling us something. People want to invest in nuclear energy because its authentic clean/green and extremely reliable. Hurray!!!

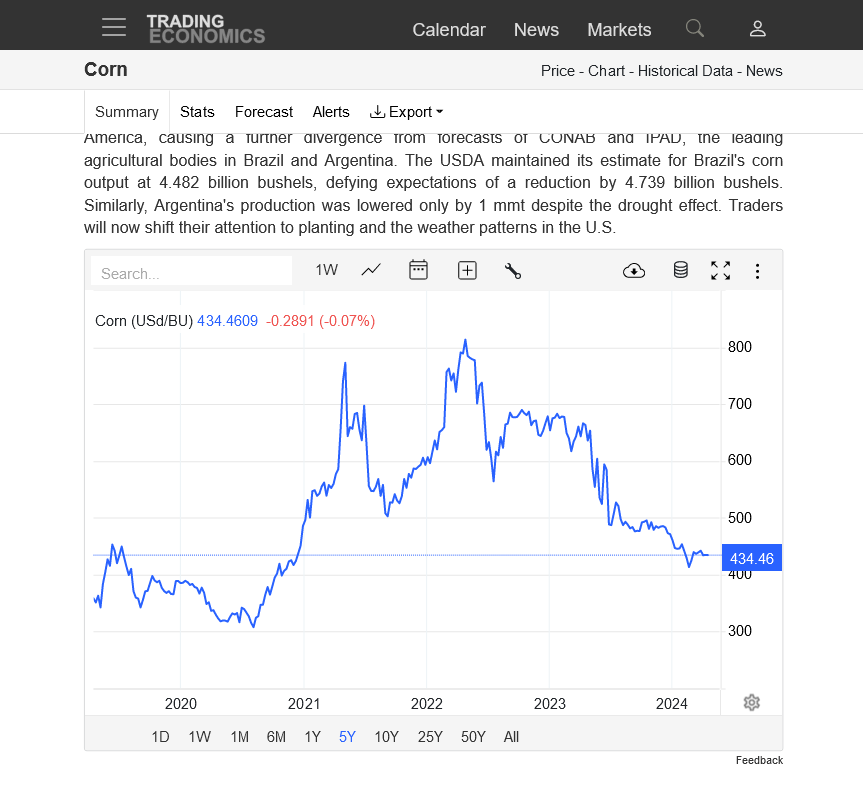

2. Ethanol has been getting crushed the past 2 years(one might guess electric cars replacing combustion engines is a factor that will hurt demand but mostly corn prices dropping). Down 50%.

3. Wind has dropped from a spike high of 26 to 15 the past 3 years and doing almost as bad.

4. The worst by far has been solar. Down from a spike high of 120-ish to 42 the past 3 years.

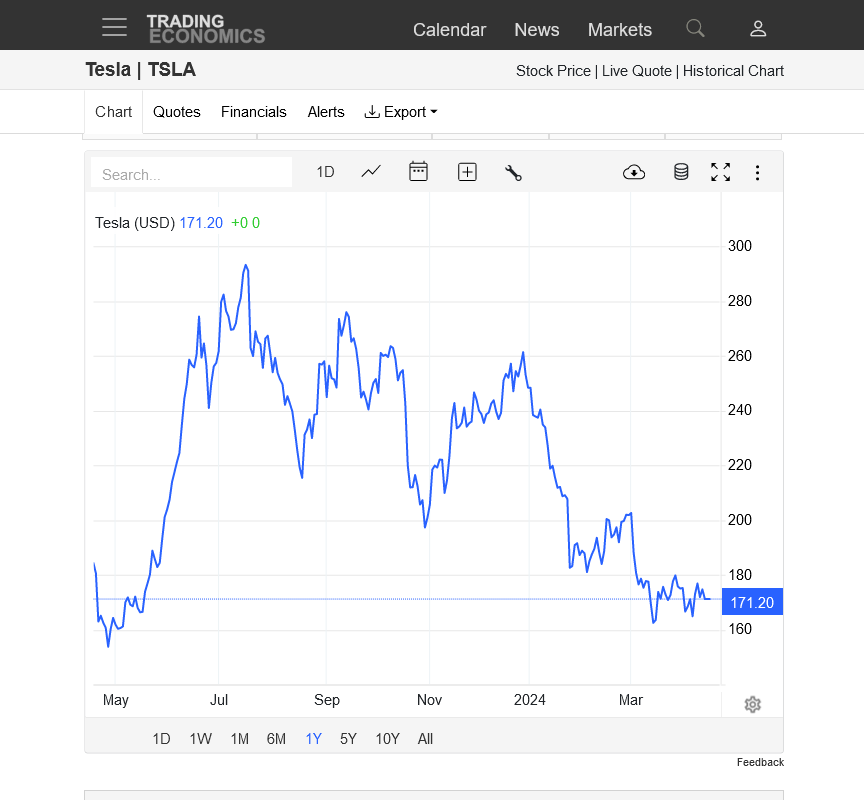

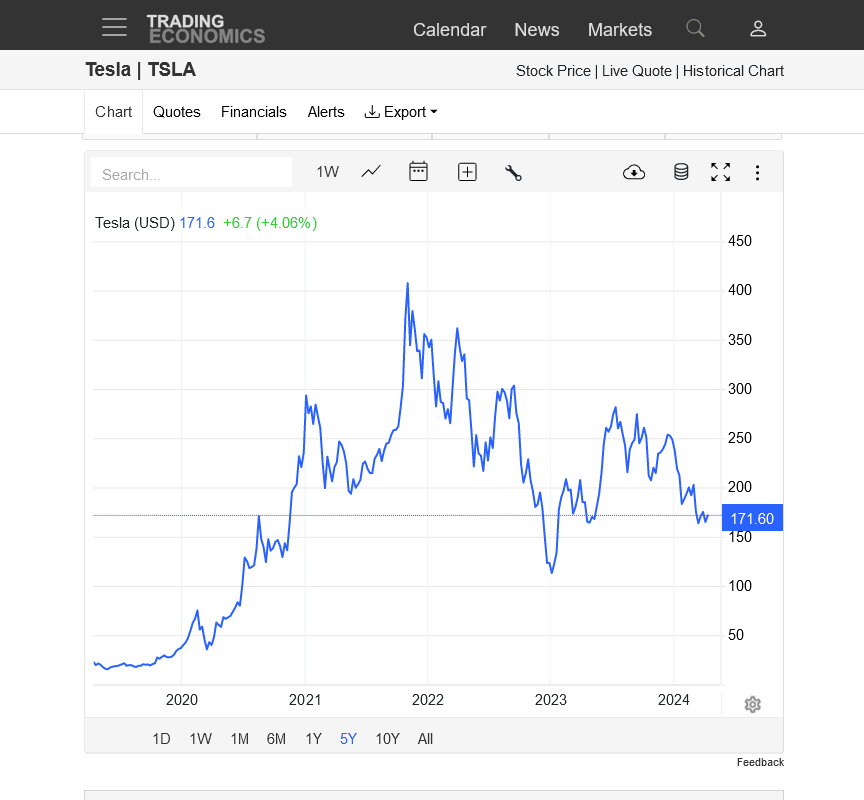

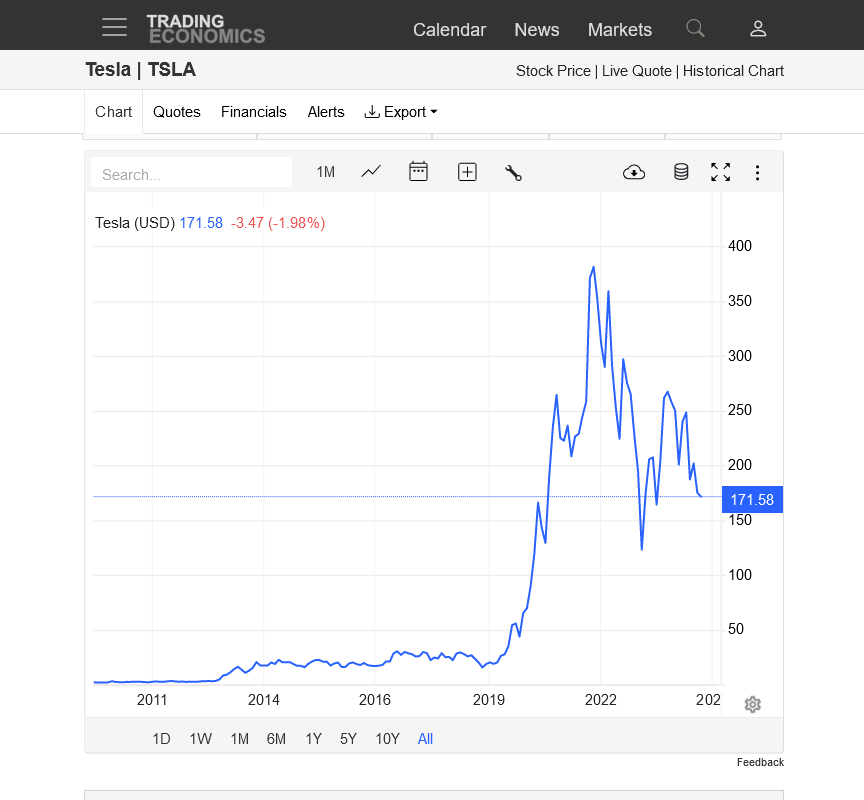

Let's look at Tesla on the next page which is a good indicator for the electric car industry.

++++++++++++++++++

The corn chart confirms reasoning for ethanol's drop. Peaking 2 years ago, like ethanol.

Our producers will remember corn prices starting with a 1 as recently as late 2005(during harvest-sub $2).

The ethanol market started shortly after that.

Since then, corn prices have stayed ABOVE $3!

https://tradingeconomics.com/commodity/corn

cutworm,

Your post on this really was one of the best!

There are many hundreds of markets that we could graph like this but for convenience/preference, I'm just sticking to the ones related to renewable energy here which is of great personal interest.

On to Tesla:

ANOTHER SPECTACULAR EV ROAD TRIP

26 responses |

Started by 12345 - Jan. 5, 2024, 2:12 p.m.

https://www.marketforum.com/forum/topic/101621/

Tesla, like solar and wind, has been taking a huge beating. Less than half of its price from just over 2 years ago.

While solar and wind peaked in early 2021, just over 3 years ago, Tesla's peak occurred later the same year, November 2021.

The only thing that will bring Tesla back is if somebody invents a new battery technology that allows something like double the amount of storage the current lithium batteries in electric cars can store.

The extreme enthusiasm over electric cars that caused the spike higher was largely based on promises that have greatly under performed. Huge subsidies, mandates and so on forced on the market by a government with an agenda that also rewarded crony capitalism for a product that's inferior to the combustion engine vehicles.

Enough people bought them to expose the numerous flaws.

It's possible that much better batteries and other positive changes could bring Tesla back.

From this thread:

FOOD COST INFLATION UPDATE

Started by 12345 - April 14, 2024, 11:47 p.m.

https://www.marketforum.com/forum/topic/103178/

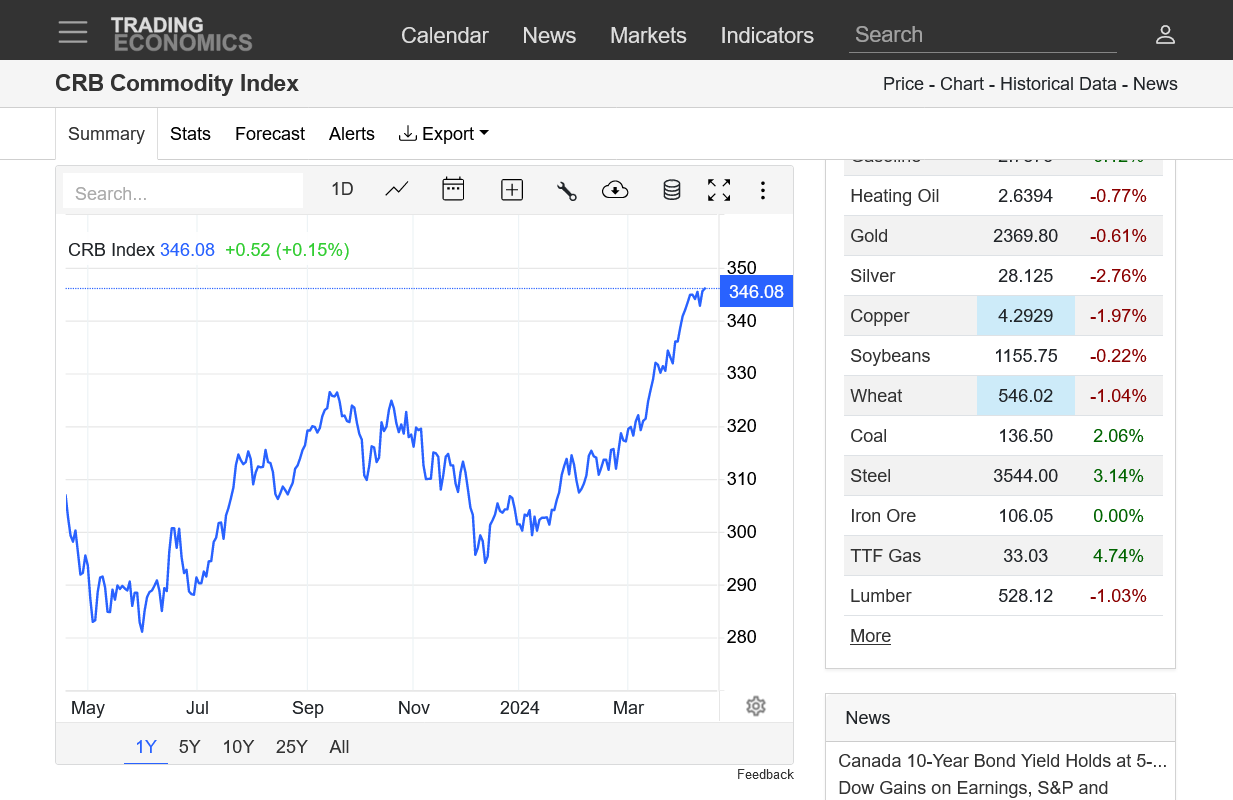

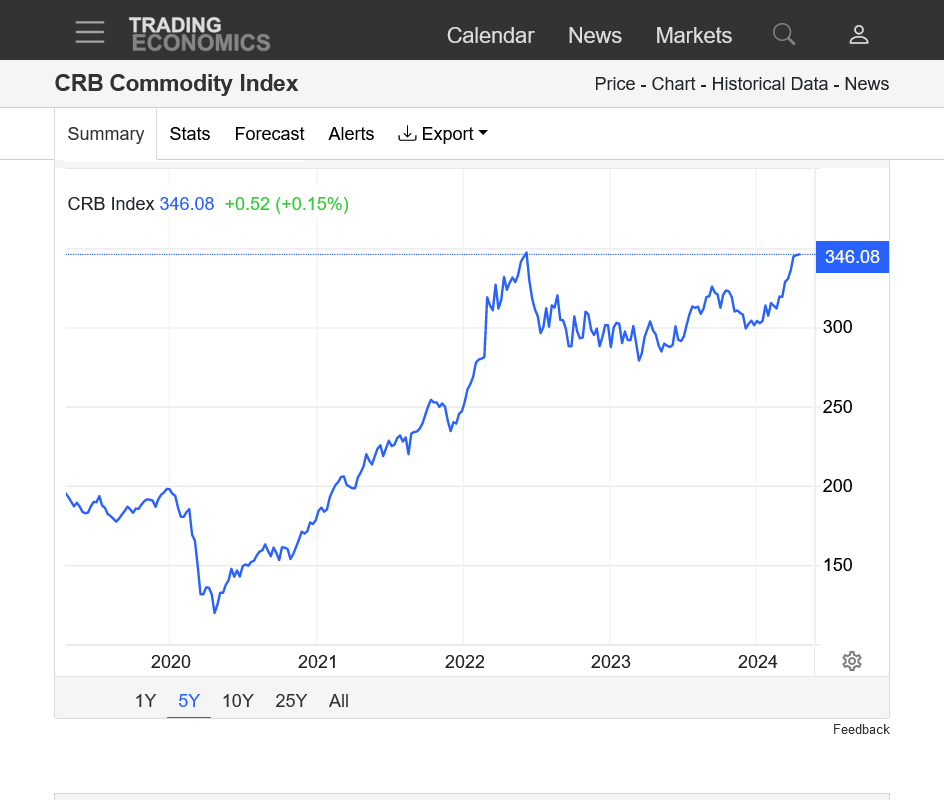

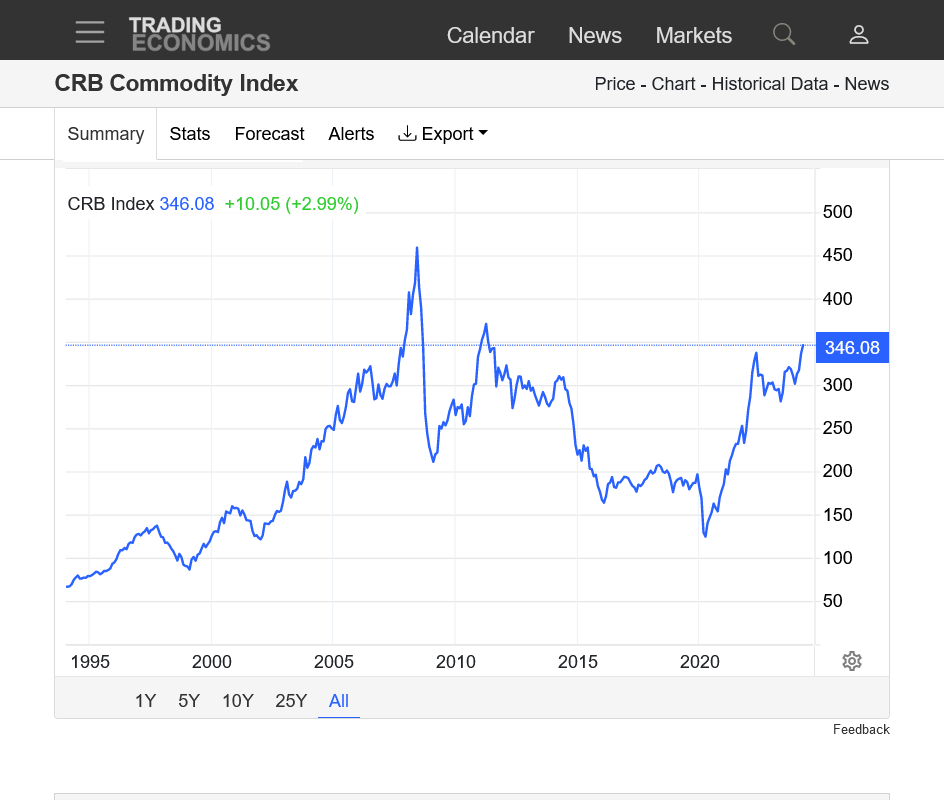

CRB Index Charts:

1. 1 year

2. 5 years

3. 30 years

https://tradingeconomics.com/commodity/crb