I LIKE THIS GUY... HE ALWAYS MAKES COMMON SENSE, IMO.

Will Conflict In The Middle East Make INFLATION Worse? (Answered)

The answer is that there is a potential for this to happen.

Most dangerous time in decades??

https://www.marketforum.com/forum/topic/99673/

Ukraine has been adding over 1% to global inflation from energy/food disruptions(supply side)!

This new war could make is much worse, mainly with energy prices which impact the cost of everything.

Good previous discussion/data on this topic:

Federal focuses on fighting inflation

Started by metmike - Aug. 26, 2023, 10:24 p.m.

https://www.marketforum.com/forum/topic/98565/

I'm not an economist and don't understand everything about how the current, extremely unusual dynamics will be impacting the future economy and inflation.

The guy on your video mentioned this metric below.

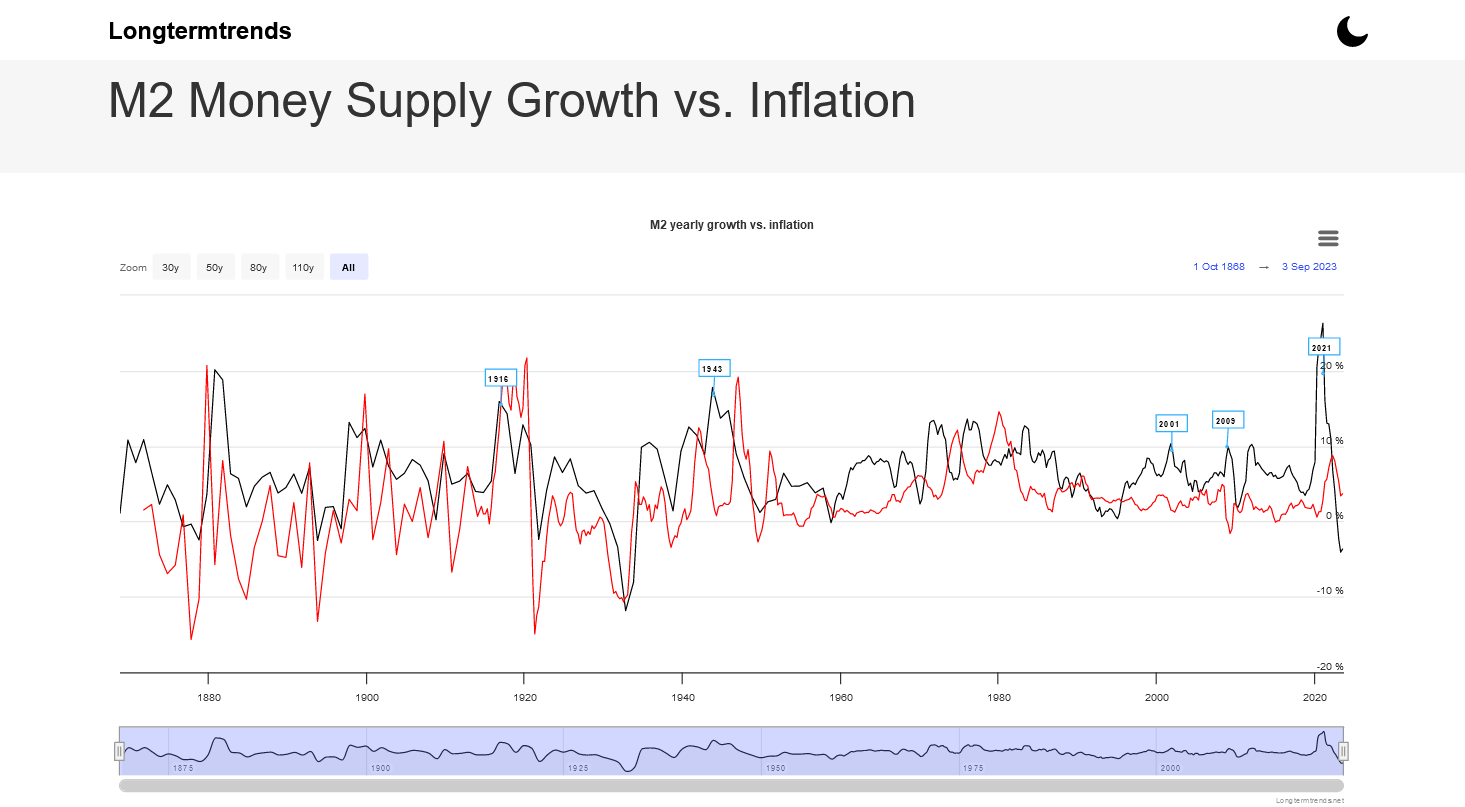

1. It shows the M2 growth rate in black at a record obliterating 26.31% in 2021.

2. The last number (for Jul-Sept 2023) had crashed to -3.65%, the lowest in 80 years and lowest since the Great Depression.

3. It's not just being in negative territory but the change from the highest ever to the 2nd lowest ever in just a 2 year period that makes it so amazing.

4. Unsure about the impacts. Will the really low levels here help to address the damage/inflation from the really high levels that happened from flooding the Market with money to keep COVID from collapsing the economy in 2020/early 2021? Or, will it be too much too fast and cause the bonds and banks to collapse because those markets are so sensitive to interest rate changes?

https://www.longtermtrends.net/m2-money-supply-vs-inflation/

https://www.ig.com/uk/glossary-trading-terms/m2-money-supply-definition

M2 is used as an indicator of possible increases or decreases in inflation levels. This is because it is a broader measure of the money supply in an economy than when compared with M1 – which only looks at money that is in the hands of the public.

As a result, M2 offers a more comprehensive overview of inflation levels because if the M2 monetary supply is increased, inflation could rise. Equally, if M2 supply is restricted by central banks, inflation could fall. However, it is generally accepted that there is a lag of between 12 to 18 months for inflation levels to respond to increased monetary supply.

Also, inflation will only rise if monetary supply is increased but economic output remains the same. If economic output increases alongside money supply, then inflation might not increase at all.

Central banks can influence M2 supply by either issuing more money into the economy or by incentivising people to spend less. Quantitative easing is one way that a central bank can increase money supply and stimulate the economy.

To reduce the supply of M2 in an economy, a central bank might issue bonds or other government-backed securities which lenders can buy; in doing so, they loan the government money. This means that a central bank’s money reserves increase at the expense of the money available in the economy.

Central banks can also increase or decrease interest rates to influence M2. If interest rates are lower, borrowing will likely become more popular, which will increase the supply of money. Conversely, if interest rates rise, then the cost of borrowing will also go up which will deter people from taking out loans. This will decrease the M2 money supply in an economy

++++++++++

Other Countries below:

Includes M2 Growth on 115 economies standardised by CEIC.

https://www.ceicdata.com/en/indicator/united-states/m2-growth

+++++++++++++

https://www.marketplace.org/2023/06/13/u-s-money-supply-is-shrinking-does-that-mean-were-all-doomed/

++++++

https://www.barrons.com/articles/pregnant-workers-fairness-act-how-it-passed-6dddab7d

September 03, 2023 — 05:06 am EDT

++++++++++++

++++++++++