Sept. 1 U.S. #corn stocks are more likely to come in under expectations when supplies are ample, but they often surprise high when supplies are thinner. The 2023 trade guess is middle-of-the-road (1.43 bbu), similar to last year's, which preceded a "bullish" number.

My personal belief is that more traders expected a lower number because of the very dry finish and so the number compared to THAT was bearish.

Increasing CO2 continues to make ALL plants more drought tolerant/water efficient because they don't need to open their stomata as wide to get CO2 and don't transpire out as much moisture during that process.

That's in addition to CO2s massive positive contribution using the law of photosynthesis. 46% of the corn plant is made up of CARBON and 100% of it comes from the CO2 in the air. 100%!

Increasing CO2 is massively greening up the planet and boosting the yields of ALL crops. ALL crops!

If we took away climate change and gave this years crops the climate and CO2 from 100 years ago, instead of what it just experienced, yields would be down -24%.

Each +5ppm of CO2 adds 1% to crop yields on average.

From years 1873 to 2023 = 290 ppm to 420 ppm = +130 ppm

+130 ppm/5 ppm = +24%

The optimal level for CO2 is 900 ppm, more than double where were are now. Benefits are less and less as we go higher but are still huge for the next 200 ppm.

Name one source that is telling you the truth about that?

Here's the actual science from 250 published scientific articles. Yet, they are silent because the gatekeepers have CENSORED this information.

https://www.marketforum.com/forum/topic/69258/#69259

USDA revised the 2022 harvests of #corn & #soybeans slightly lower based on the Sept. 1 stock results. Pretty much as expected.

U.S. #wheat production tops all trade estimates, rising 10% on the year. Spring wheat came in significantly better than was measured in August. Bigger HRW and SRW crops, too.

so wheat is going down even further?

Thanks, cc!

As you noted, the report was especially bearish wheat. Not sure if that means we keep going lower.

I believe wheat is ridiculously cheap here.. But they can keep down the front months until they like.... The roll over differential is huge

I'll try to get some wheat price charts for you.

Here's the just updated NOAA October/30 day forecast.

Good for drying corn in the field and timely harvesting. Very low risk for high winds to damage corn in the field with stalk lodging which is when the stalks break BELOW the ears because of high winds.

More on this in the crop condition thread.

+++++++++++++

Never saw a long range forecast like this issued on a weekend.

30 day forecast link:

https://www.cpc.ncep.noaa.gov/products/predictions/30day/

All the outlook period products:

https://www.cpc.ncep.noaa.gov/products/forecasts/

Technical discussion:

https://www.cpc.ncep.noaa.gov/products/predictions/long_range/fxus07.html

MetMike

If anything, many early harvest yields appear to be suffering from TOO LITTLE moisture. Combining beans at 7-9 moisture rather than 13-15 significantly reduces yield.

This week forecast shows no significant rain. Yields will be 'reduced' due to "ideally dry" harvest conditions? However, harvest pressure may PEAK this week.

Look for significant continued grain price erosion tonight.

Seasonal low Oct 3/5??

Trade well!

Thanks much for that great insider info!

Yes, this might be the week with the most havesting done this year but there are some very unusual dynamics going on.

The Mississippi River is extraordinarily low again for the 2nd year and impacted barge traffic which is killing the basis:

https://www.marketforum.com/forum/topic/99207/#99323

Also, the forecast is looking pretty dry the next 2 weeks.

So no improvement on the M river level AND the potential for this to turn bullish wheat at some point if it stayed dry into November.

I'm shifting the discussion to the crop condition thread, if you don't mind.

Great call on the wheat coffeeclotch!

yep and i blew it as usual

Me too!

A good trade seriously considered but not taken hurts to watch all day.

But not nearly as bad as an uncertain trade taken because we have a gut feeling and some evidence that goes bad and makes the account go lower.

You can't lose or make money watching and there will be hundreds of other opportunities.

Please note that this is the pep talk for people that had the right trade idea and missed an opportunity.

There is not much you can say to somebody that loses a bunch of money to make them feel better, other than GET OVER IT ASAP and put it behind you and look forward to the next opportunity.

Markets have an abundance of those and the fun/challenges are often in the analysis leading up to the trade.

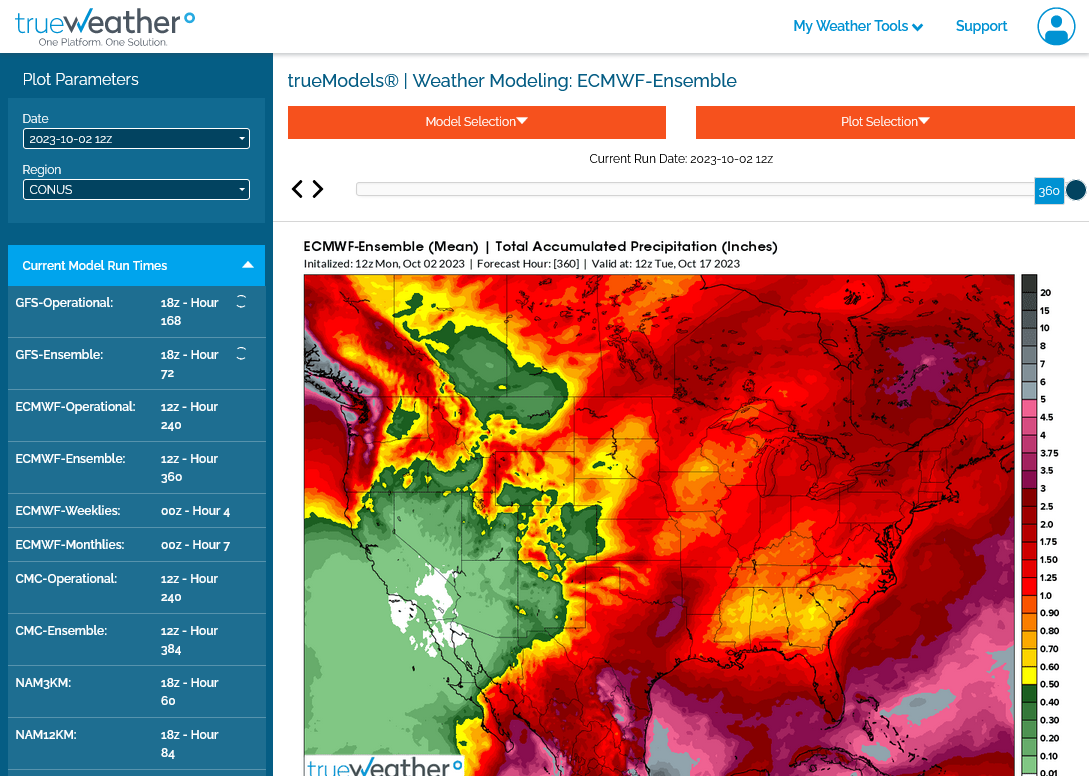

With regards to weather, this was the last European model total rains.

See the other threads for the rest of the comprehensive weather.

What Went Wrong with the Grain Markets Last Friday?

"So to answer the question posed by the title of this piece, “What Went Wrong with the Grain Markets Last Friday?”, my answer is “Nothing”. The markets; corn, soybeans, and all the wheats, made perfect sense if we look at both sides of the supply and demand ledger rather than just one. "