++++++++++++

I have no idea how serious this might be for the United States.

Comments?

Ya know , Mike , this looks like another example of your " captured minds " rhetoric.

You would think the world is convinced China is about to dominate the world when ,actually , they may be more vulnerable to "disaster" than the US due to their debt.

The European countries explored the new world hundreds of years ago at least in part for it's riches which they needed to satisfy their debts - same old story.

You can't keep borrowing money to pay back money you've borrowed!

John

quite the coincidence you brought this up now. Just yesterday listened to a awesome economic instructor at a local small college, Dr Matt Will. He was explaining the dark economic clouds approaching China. They have built something like 20 million new apartment buildings that are now sitting empty on a wager that it will spur their economy. Much like our 2008 mortgage debacle led by our lib in congress. Add to this the fact that millions of Americans are invested, whether they know it or not, in various funds and indexes directly related to the approaching mess in China. Which leads to the next shiny object China and Russia will have all of us gazing at shortly, the attack on Taiwan.

Thanks, John and mcfarm!

Yes, there's a great deal more going on here than we know/understand.

+++++++++++++++++++

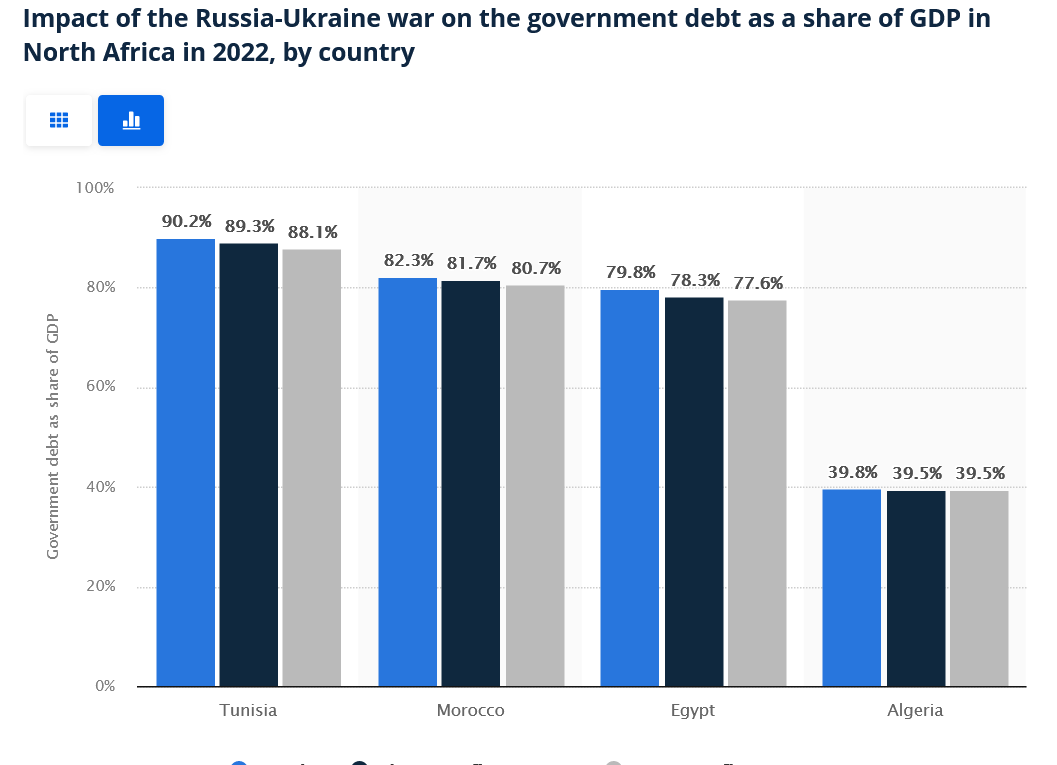

metmike: These articles below are especially eye opening! As I've been saying, our war with Russia, using Ukraine is hurting poor countries the most.

++++++++++++++

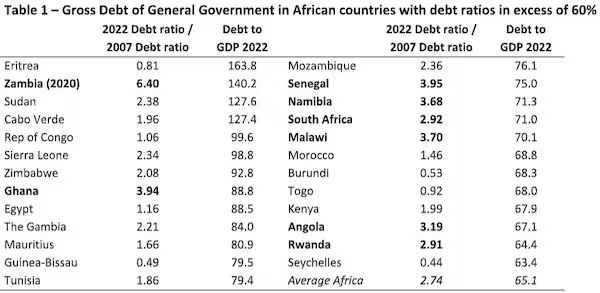

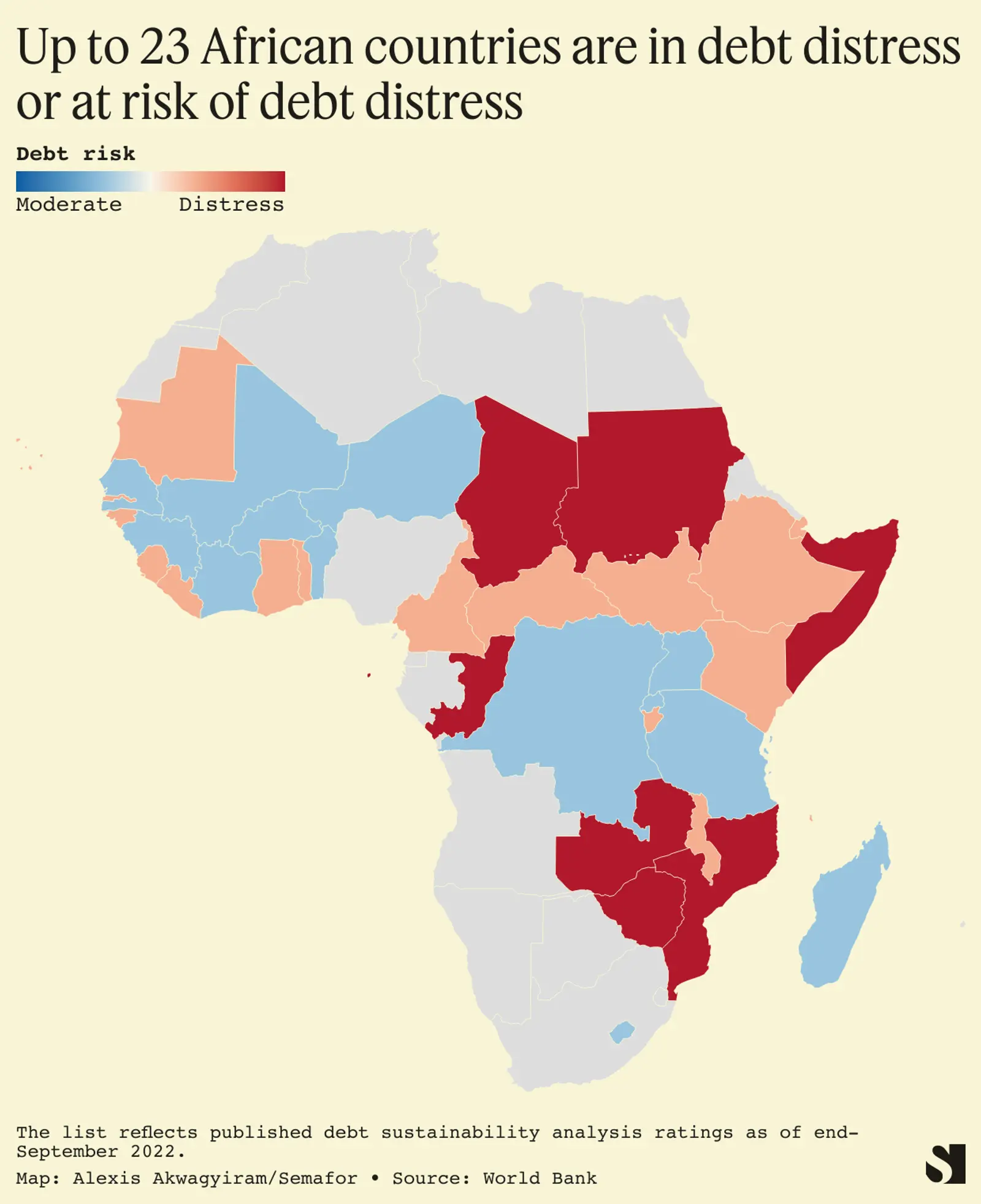

Africa’s debt is at its highest level in over a decade. With debt service sucking up increasingly large proportions of budgets and revenues, a wave of defaults in the world’s most vulnerable countries is on the horizon—and the cost of avoiding defaults could be even worse.

++++++++++++++++++

++++++++++++++++++

http://country.eiu.com/article.aspx?articleid=982147881&Country=Nigeria&topic=Economy&subtopic=Ou_4

+++++++++++++++

https://onlinelibrary.wiley.com/doi/full/10.1111/anti.12921

Africa faces a new debt crisis fuelled by Chinese and Western lending. At the forefront is Zambia, which defaulted on Eurobond payments in 2020. The article sets the developing Africa-wide crisis within a relational comparison that draws the current Zambian moment together with the financial collapse of the 1980s. By placing Chinese lending within a comparative global frame, we make three contributions. First, Zambia provides a “spatial fix” for capital, but such African borrowing is not passive and shapes hegemonic struggles between China and the US. Thus secondly, Africa's relationship with debt is co-constituent in the remaking of the global economy, as signalled by the contested execution and interpretation of development-as-modernisation. Finally, a relational comparison of the two debt crises demonstrates that global capitalist hegemony is, partly, engineered by the consent and coercion of African governments, yet the human costs of borrowing are fully borne by the world's poorest.

++++++++++++++++++

https://www.reuters.com/markets/global-public-debt-hits-record-92-trillion-un-report-2023-07-12/

LONDON, July 12 (Reuters) - Global public debt surged to a record $92 trillion in 2022 as governments borrowed to counter crises, such as the COVID-19 pandemic, with the burden being felt acutely by developing countries, a United Nations report said.

Domestic and external debt worldwide has increased more than five times in the last two decades, outstripping the rate of economic growth, with gross domestic product only tripling since 2002, according to the Wednesday report, released in the run up to a G20 finance ministers and central bank governors' meeting July 14-18.

"Markets may seem not be suffering – yet. But people are," U.N. Secretary-General Antonio Guterres told reporters. "Some of the poorest countries in the world are being forced into a choice between servicing their debt, or serving their people."

Developing countries owe almost 30% of the global public debt, of which 70% is represented by China, India and Brazil. Fifty-nine developing countries face a debt-to-GDP ratio above 60% - a threshold indicating high levels of debt.

REUTERS/Evgenia Novozhenina/File Photo Acquire Licensing Rights

LONDON, July 12 (Reuters) - Global public debt surged to a record $92 trillion in 2022 as governments borrowed to counter crises, such as the COVID-19 pandemic, with the burden being felt acutely by developing countries, a United Nations report said.

Domestic and external debt worldwide has increased more than five times in the last two decades, outstripping the rate of economic growth, with gross domestic product only tripling since 2002, according to the Wednesday report, released in the run up to a G20 finance ministers and central bank governors' meeting July 14-18.

"Markets may seem not be suffering – yet. But people are," U.N. Secretary-General Antonio Guterres told reporters. "Some of the poorest countries in the world are being forced into a choice between servicing their debt, or serving their people."

Developing countries owe almost 30% of the global public debt, of which 70% is represented by China, India and Brazil. Fifty-nine developing countries face a debt-to-GDP ratio above 60% - a threshold indicating high levels of debt. "Debt has been translating into a substantial burden for developing countries due to limited access to financing, rising borrowing costs, currency devaluations and sluggish growth," the UN report added.

Furthermore, the international financial architecture made access to financing for developing countries both inadequate and expensive, the UN said, pointing to net interest debt payments exceeding 10% of revenues for 50 emerging economies worldwide.

++++++++++++++++++++++

https://www.interregional.com/en/global-debt/

The indicators of worsening and rapidly escalating external debt over the last two years prompt us to say that the world is currently facing a major debt crisis, which can be highlighted as follows:

In sum, given the negative forecast for global economic trends, including the increasingly complex global debt crisis, particularly for developing and poor countries, fears are growing of a new wave of debt defaults. If that happens, it will not cause a global financial crisis because of the small size of those economies relative to the global economy. However, the crisis in developing and poor economies will remain, and those economic pressures may cause dangerous repercussions in those countries, such as worsening famine and further political and social turmoil.

https://www.reuters.com/markets/asia/country-garden-how-bad-is-chinas-property-crisis-2023-08-17/

add to that the fact that the commy type dictatorial gov of China does not allow short selling. They will force you and loan you to buy but they have no freedom of stock marketing and shock of shock and apparently no one in the Biden administration knows that China will lie about any of its economic, military, agricultural or even covid lab experiments.

I am no geopolitics/geoeconomics expert, far from it, but here are my thoughts and my take on what I suspect has been a long time coming for China.

China has seen incredible technological development and growth since the 1990s when many US companies (and other global companies) started moving their manufacturing to China because labor was almost literally dirt cheap.

The influx of foreign money to develop the country is a large part of what has brought China to the state they are today.

That said, in the last approximately 10 years, there has been an ever increasing push by many countries to significantly reduce dependency on products made in China.

The first G7 summit that Pres. Biden attended after taking office, spent a lot of time focusing on the redistribution of manufacturing across multiple continental regions. For instance, the plan was to declare Canada, USA and Mexico to be the “North American Manufacturing Region”. Mainland Europe plus UK/Great Britain was to be the European Manufacturing Region.

The end goal(s) are straightforward enough: return manufacturing to areas closer to where the products will be used, decrease reliance on Chinese made goods, increase local jobs, and promote cross-border trade. As a bonus, I also like to believe that the overall quality of goods would increase. Remember that there was a time when Made in USA meant a high quality good, like hand tools (made in USA Craftsman tools vs China made Craftsman tools? There is a difference). At the moment, Made in USA is almost more of an advertising tagline to promote sales based on patriotism. Don’t get me wrong, I’m not offended by this, and often the made in USA stuff currently being produced is still of a higher quality than the Chinese equivalent, but you also pay a noticeably higher price. So these economic / manufacturing regions still have a ways to go before they can really “compete” with China.

China faces another major economic threat, this one from within. With the massive influx of foreign money for development has come a steady push for increases in quality of living amongst Chinese citizens. They have been demanding better pay, better working conditions, and they now desire many of the “Western” standards of living. Things like diamond jewelry and privately owned automobiles have become more and more commonplace over the last 20-30 years. This from a country where 30 years ago only the elite had cars larger/nicer than a tuk tuk. For a country with a population size well over 1 billion, it’s not a sustainable rate of growth. China has been scrambling to build literally hundreds of coal fired power plants across the country to just try and meet the ever growing demands for electricity by the country.

I think the Ukraine war has also opened the eyes of the “western” nations to the concept of reducing dependency on any 1 country as a near sole supplier of any particular resource. In the case of Russia, oil and natural gas reserves. For China, it would be cheap consumer goods and rare earth minerals. China has been posturing militarily for a while now. They haven’t actually done anything just yet, but they keep making moves that are making NATO nervous.

When the Ukraine war kicked off, the NATO powers moved quickly to sanction Russia and quickly tried to reduce the need for cheap Russian natural gas. The result was a realization on just how much they were reliant on Russia for their standard of living. I think those same NATO countries are realizing that if China makes some moves that NATO doesn’t like, the NATO countries are going to be in really rough shape if they decide to then sanction China and embargo/ban Chinese made goods.

So the smart move is to relocate manufacturing back to home countries and rebuild the manufacturing sectors for those countries/regions. Do this now before something major actually does happen, then the felt effects will be reduced. But by doing this, and by encouraging the citizens to buy locally produced goods, countries are hurting China economically, which I personally don’t have a problem with. The world has been far too reliant for far too long on Chinese made goods.

When I buy things now, no matter where it’s from (Amazon, local stores, etc.) I actually will try to look for products that aren’t made in China. I don’t always go out of my way to try and find a Made in USA product as often that doesn’t exist at this time, but I’m fine with something made in Korea, Taiwan, Mexico, etc.

Wonderful thoughts, madmechanic!

Thanks for taking the time to elequently express so many of them.