KEY EVENTS TO WATCH FOR:

Tuesday, July 4, 2023

N/A U.S. Independence Day. Financial markets closed

Wednesday, July 5, 2023

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 216.1)

Composite Idx, W/W% (previous +3.0%)

Purchase Idx-SA (previous 170.3)

Purchase Idx-SA, W/W% (previous +2.8%)

Refinance Idx (previous 439.2)

Refinance Idx, W/W% (previous +3.3%)

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, Y/Y% (previous +0.6%)

Latest Wk, Y/Y% (previous +0.5%)

10:00 AM ET. May Manufacturers' Shipments, Inventories & Orders (M3)

Total Orders, M/M% (previous +0.4%)

Orders, Ex-Defense, M/M% (previous -0.4%)

Orders, Ex-Transport, M/M% (previous -0.2%)

Durable Goods, M/M%

Durable Goods, M/M%

10:00 AM ET. July IBD/TIPP Economic Optimism Index

Economic Optimism Idx (previous 41.7)

6-Mo Economic Outlook (previous 34.5)

2:00 PM ET. Federal Open Market Committee meeting minutes and economic forecast

4:00 PM ET. June Domestic Auto Industry Sales

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous -2.4M)

Gasoline Stocks, Net Chg (Bbls) (previous -2.9M)

Distillate Stocks, Net Chg (Bbls) (previous +0.8M)

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The Dow posted an inside day with a slightly higher close on Monday as it extends the rally off last-Monday's low. The high-range close sets the stage for a steady to higher opening when Wednesday's day session begins trading. Stochastics and the RSI are bullish signaling that sideways to higher prices are possible near-term. If the Dow extends the rally off last-Monday's low, the December-2022 high crossing at 34,712.28 is the next upside target. Closes below the 50-day moving average crossing at 33,636.68 would confirm that a short-term top has been posted. First resistance is June's high crossing at 34,588.68. Second resistance is the December-2022 high crossing at 34,712.28. First support is the 20-day moving average crossing at 33,979.93. Second support is the 50-day moving average crossing at 33,636.68.

The September NASDAQ 100 closed slightly higher on Monday. The high-range close sets the stage for a steady to higher opening when Wednesday's night session begins trading. Stochastics and the RSI are neutral to bullish signaling sideways to higher prices are possible. If September resumes this year's rally, the 87% retracement level of the 2021-2022-decline on the weekly continuation chart crossing at 15,957.86 is the next upside target. Closes below the 20-day moving average crossing at 15,041.81 would signal that a short-term top has been posted. First resistance is the June 16th high crossing at 15,475.50. Second resistance is the 87% retracement level of the 2020-2022-decline on the weekly continuation chart crossing at 15,957.86. First support is the 20-day moving average crossing at 15,041.81. Second support is June's low crossing at 14,420.00.

The September S&P 500 closed slightly higher on Monday. The high-range close sets the stage for a steady to higher opening when Wednesday's night session begins trading. Stochastics and the RSI are overbought but remain bullish signaling that sideways to higher prices are possible near-term. If September renews the rally off March's low, the 75% retracement level of the 2022 decline on the weekly chart crossing at 4505.40 is the next upside target. Closes below the 20-day moving average crossing at 4404.61 would signal that a short-term top has been posted. First resistance is June's high crossing at 4493.75. Second resistance is the 75% retracement level of the 2022 decline on the weekly chart crossing at 4505.40. First support is the 20-day moving average crossing at 4404.61. Second support is the June 8th low crossing at 4305.75.

INTEREST RATES? http://quotes.ino.com/ex?changes/?c=interest ""

September T-bonds closed down 5/32's at 126-24.

September T-bonds closed lower on Monday as it extends June's trading range. The low-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September renews the decline off April's high, the 87% retracement level of the March-April rally crossing at 124-19 is the next downside target. Closes above the 50-day moving average crossing at 128-22 would confirm that a short-term low has been posted while opening the door for additional gains near-term. First resistance is the 50-day moving average crossing at 128-22. Second resistance is the May 11th high crossing at 132-13. First support is the 75% retracement level of the March-April rally crossing at 125-30. Second support is the 87% retracement level of the March- April rally crossing at 124-19.

September T-notes closed down 115-pts. at 111.290.

September T-notes closed lower on Monday. The low-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. Closes above the 20-day moving average crossing at 113.023 would signal that a short-term low has been posted. If September extends the decline off May's high, March's low crossing at 110.275 is the next downside target. First resistance is the June 13th high crossing at 114.000. Second resistance is June's high crossing at 115.000. First support is the 87% retracement level of March's rally crossing at 111.243. Second support is March's low crossing at 110.275.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

August crude oil closed lower on Monday. The low-range close sets the stage for a steady to lower opening when Wednesday's day session begins. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 50-day moving average crossing at $71.54 would signal that a short-term low has been posted while opening the door for additional short-term gains. Closes below the June 12th low crossing at $66.96 would open the door for a possible test of May's low crossing at $63.90. First resistance is the 50-day moving average crossing at $71.54. Second resistance is the June 21st high crossing at $72.72. First support is the June 12thlow crossing at $66.96. Second support is May's low crossing at $64.41.

August heating oil posted an outside day down as it closed lower on Monday. The low-range close sets the stage for a steady to lower opening when Wednesday's day trading session begins. Stochastics and the RSI are turning neutral to bearish with today's loss signaling that sideways to lower prices are possible near-term. Closes below the June 12th low crossing at 2.2878 would confirm that a short-term top has been posted. If August renews the rally off May's low, the 38% retracement level of the 2022-2023 decline crossing at 2.6107 is the next upside target. First resistance is the April 24th high crossing at 2.5349. Second resistance is the 38% retracement level of the 2022-2023 decline crossing at 2.6107. First support is the June 12th low crossing at $2.2876. Second support is the May 31st low crossing at $2.2301.

August unleaded gas posted an outside day down as it closed sharply lower on Monday. The low-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the June 12th low crossing at 2.3901 would open the door for a possible test of June's low crossing at 2.3394. If August extends the rally off the June 23rd low, June's high crossing at 2.5905 is the next upside target. First resistance June's high crossing at 2.5905. Second resistance is the 87% retracement level of the April-May decline crossing at 2.6394. First support is the June 12th low crossing at 2.3901. Second support is June's low crossing at 2.3394.

August Henry natural gas posted an inside day with a lower close on Monday. The mid-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are turning neutral signaling that sideways trading is possible near-term. If August resumes this month's rally, the 25% retracement level of the 2022-2023 decline crossing at 3.193 is the next upside target. Closes below the 50-day moving average crossing at 2.560 is the next downside target.First resistance is last-Monday's high crossing at 2.828. Second resistance is the 25% retracement level of the 2022-2023 decline crossing at 3.193. First support is the 50-day moving average crossing at 2.560. Second support is the June 1st low crossing at 2.244.

CURRENCIES? http://quotes.ino.com/ex?changes/?c=currencies ""

The September Dollar closed lower on Monday. The mid-range close sets the stage for a steady to lower opening when Wednesday's session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off the June 22nd low, May's high crossing at 104.205 is the next upside target. If September renews the decline off May's high, May's low crossing at 100.340 is the next downside target. First resistance is last-Friday's high crossing at 102.430. Second resistance is May's high crossing at 104.205. First support is the June 22nd low crossing at 101.485. Second support is May's low crossing at 100.340.

The September Euro closed slightly lower on Monday. The high-range close sets the stage for a steady to slightly higher opening when Wednesday's day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $1.09095 would signal that a short-term top has been posted. If September renews the rally off May's low, May's high crossing at 1.11710. First resistance is the June 22nd high crossing at $1.10615. Second resistance is May's high crossing at 1.11710. First support is the 20-day moving average crossing at 1.09095. Second support is May's low crossing at $1.07025.

The September British Pound posted an inside day with a slightly lower close on Monday. The mid-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are neutral to bearish signaling sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at 1.2567 would open the door for additional weakness near-term. If September renews the rally off May's low, the 75% retracement level of the 2022-2023 decline crossing at 1.3253 is the next upside target. First resistance is the June 22nd high crossing at 1.2874. Second resistance is the 75% retracement level of the 2022-2023 decline crossing at 1.3253. First support is the 50-day moving average crossing at 1.2567. Second support is June's low crossing at 1.2390.

The September Swiss Franc posted an inside day with a lower close on Monday. The mid-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below last-Friday's low crossing at 1.11790 would signal that a short-term top has been posted. If September renews the rally off May's low, May's high crossing at 1.14920 is the next upside target. First resistance is the June 16th high crossing at 1.13410. Second resistance is May's high crossing at 1.14920. First support is last-Friday's low crossing at 1.11790. Second support is May's low crossing at 1.10700. Third support is the 38% retracement level of 2022-2023 rally crossing at 1.010197.

The September Canadian Dollar posted an inside day with a lower close on Monday. The mid-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 75.49 would signal that a short-term top has been posted. If September renews the rally off May's low, the September 12th high crossing at 77.11 is the next upside target. First resistance is the 38% retracement level of the 2021-2022 decline crossing at 76.28. Second resistance is the September 12th high crossing at 77.11. First support is last-Friday's low crossing at 75.34. Second support is the 50-day moving average crossing at 74.68.

The September Japanese Yen closed lower on Monday. The low-range close sets the stage for a steady to lower opening when Wednesday’s day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off March's high, the October-2022 low crossing at 0.069270 is the next downside target. Closes above the 20-day moving average crossing at 0.071561 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at 0.071561. Second resistance is the 50-day moving average crossing at 0.073394. First support is last-Friday's low crossing at 0.069755. Second support is the October-2022 low crossing at 0.069270.

PRECIOUS METALS? http://quotes.ino.com/ex?changes/?c=metals ""

August gold closed slightly lower on Monday. The mid-range close sets the stage for a steady to slightly lower opening when Wednesday's day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $1950.60 would signal that a short-term low has been posted. If August extends the decline off May's high, the 50% retracement level of the 2022-2023 rally crossing at $1892.30. First resistance is the 20-day moving average crossing at $1950.60. Second resistance is the 50-day moving average crossing at $1989.00. First support is last-Thursday's low crossing at $1911.40. Second support is the 50% retracement level of the 2022-2023 rally crossing at $1892.30.

September silver closed slightly higher on Monday. The mid-range close sets the stage for a steady to higher opening when Wednesday's day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 23.584 would signal that a low has been posted. If July renews the decline off May's high, the 75% retracement level of the March-May rally crossing at 21.708 is the next downside target. First resistance is the 20-day moving average crossing at 23.584. Second resistance is the 50-day moving average crossing at 24,310. First support is June's low crossing at 22.140. Second support is the 75% retracement level of the March-May rally crossing at 21.708.

September copper closed higher on Monday. The mid-range close sets the stage for a steady to higher opening when Wednesday's day session begins trading. Stochastics and the RSI are oversold but are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 50-day moving average crossing at 3.8022 would signal that a short-term low has been posted. If September resumes the decline off June's high, June's low crossing at 3.6600 is the next downside target. First resistance is June's high crossing at 3.9640. Second resistance is May's high crossing at 4.0100. First support is June's low crossing at 3.6600. Second support is May's low crossing at 3.5650.

GRAINS? http://quotes.ino.com/ex?changes/?c=grains "

December Corn closed down $0.01 1/4-cents at $4.93 1/2.

December corn closed lower on Monday as it extended the decline off June's high. The low-range close sets the stage for a steady to lower opening when Wednesday's night session begins trading. Stochastics and the RSI are oversold but remain bearish signaling that sideways to lower prices are possible near-term. If December extends the aforementioned decline, the September 2022 low crossing at $4.62 1/2 is the next downside target. Closes above the 50-day moving average crossing at $5.36 3/4 would signal that a short-term low has been posted. First resistance is the 50-day moving average crossing at $5.36 3/4. Second resistance is the 20-day moving average crossing at $5.56 1/2. First support is today's low crossing at $4.88 3/4. Second support is the September 2022 low crossing at $4.62 1/2.

September wheat closed down $0.09 1/4-cents at $6.41 3/4.

September wheat closed lower on Monday as it extends the decline off June's high. The low-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are becoming oversold but remain bearish signaling that sideways to lower prices are possible near-term. If September extends the aforementioned decline, the June 8th low crossing at $6.23 1/4 is the next downside target. Closes above the 20-day moving average crossing at $7.75 3/4 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $7.75 3/4. Second resistance is the 10-day moving average crossing at $7.02. First support is today's low crossing at $6.38. Second support is the June 8th low crossing at $6.23 1/4.

September Kansas City Wheat closed down $0.03 1/2-cents at $7.96 1/2.

September Kansas City wheat closed lower on Monday. The low-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off June's high, the June 14th low crossing at $7.76 3/4 is the next downside target. Closes above the 10-day moving average crossing at $8.35 1/4 would temper the near-term bearish outlook. First resistance the 10-day moving average crossing at $8.35 1/4. Second resistance is June's high crossing at $8.89 1/2. First support is the June 14th low crossing at $7.76 3/4. Second support is the May 31st low crossing at $7.61 3/4.

September Minneapolis wheat closed down $0.07 3/4-cents crossing at $8.09 1/4.

September Minneapolis wheat closed lower on Monday as it extends the decline off June's high. The low-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are becoming oversold but remain bearish signaling that sideways to lower prices are possible near-term. If September extends the aforementioned decline, the June 14th low crossing at $8.01 1/4 is the next downside target. Closes above the 10-day moving average crossing at $8.47 3/4 would signal that a short-term top has been posted. First resistance is the 10-day moving average crossing at $8.47 3/4. Second resistance is June's high crossing at $8.94 1/2. First support is the June 14th low crossing at $8.01 1/4. Second support is the June 7th low crossing at $7.92 3/4.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

November soybeans closed up $0.10 1/2-cents at $13.53 3/4.

November soybeans closed higher on Monday as it extended last-Friday's huge rally that was triggered by a bullish quarterly grain stocks and planted acreage report. Profit taking ahead of the July 4th holiday tempered early session gains. The low-range close sets the stage for a steady to slightly higher opening when Wednesday's day session begins trading. Stochastics and the RSI have turned bullish signaling that sideways to higher prices are possible near-term. If November extends the rally off the June 28th low, the 87% retracement level of the 2022-2023 decline crossing at $14.07 1/2 is the next upside target. Closes below the 20-day moving average crossing at $12.73 1/2 would signal that a short-term top has likely been posted. First resistance is today's high crossing at $13.91 3/4. Second resistance is the 87% retracement level of the 2022-2023 decline crossing at $14.07 1/2. First support is the 10-day moving average crossing at $13.21 1/4. Second support is the 20-day moving average crossing at $12.73 1/2.

December soybean meal closed down $1.30 at $396.00.

December soybean meal closed lower on Monday as it consolidated some of the rally off last-Thursday's low. The low-range close sets the stage for a steady to lower opening when Wednesday's day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 10-day moving average crossing at $398.60 would signal that a short-term low has been posted. If December extends the decline off June's high, the June 8th low crossing at $362.40 is the next downside target. First resistance is the 75% retracement level of the March-May decline crossing at $418.80. Second resistance is June's high crossing at $438.90. First support is last-Thursday's low crossing at $375.30. Second support is the June 8th low crossing at $362.40.

December soybean oil closed up 122-pts. at 60.19.

December soybean oil closed higher on Monday as it extends the rally off May's low.The high-range close sets the stage for a steady to higher opening when Wednesday's day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off May's low, January's high crossing at 61.68 is the next upside target. Closes below the 20-day moving average crossing at 54.27 would signal that a short-term top has been posted. First resistance is February's high crossing at 60.52. Second resistance is January's high crossing at 61.68. First support is the 20-day moving average crossing at 54.27. Second support is the 50-day moving average crossing at 51.28.

LIVESTOCKhttp://quotes.ino.com/exchanges/?c=livestock

August hogs closed up $2.13 at $94.73.

August hogs closed higher on Monday as it extends the rally off May's low. The high-range close sets the stage for a steady to higher opening when Wednesday's day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If August renews the rally off May's low, the 75% retracement level of the 2022-2023 decline crossing at $100.14 is the next upside target. Closes below the 20-day moving average crossing at $88.93 would signal that a short-term top has been posted. First resistance is the 62% retracement level of the 2022-2023 decline crossing at $95.45. Second resistance is the 75% retracement level of the 2022-2023 decline crossing at $100.14. First support is the 20-day moving average crossing at $88.93. Second support is the 50-day moving average crossing at $87.16.

August cattle closed down $0.50 at $176.68.

August cattle closed lower on Monday as it consolidated some of the rally off the June 21st low. The mid-range close sets the stage for a steady to lower opening on Wednesday. Stochastics and the RSI are overbought but remain bullish signaling that sideways to higher prices are possible near-term. If August extends last-week's rally, June's high crossing at $178.10 is the next upside target. Closes below the 10-day moving average crossing at $172.67 would temper the near-term friendly outlook. First resistance is June's high crossing at $178.10. Second resistance is unknown. First support is the 10-day moving average crossing at $172.67. Second support is the June 21st low crossing at $168.10.

August Feeder cattle closed up $0.35 at $247.93.

August Feeder cattle closed higher on Monday as it extends the rally off the June 21st low. The high-range close sets the stage for a steady to higher opening when Wednesday's day session begins trading. Stochastics and the RSI are overbought but remain bullish signaling that sideways to higher prices are possible near-term. If August extends the rally off last-Wednesday's low into uncharted territory, upside targets will be hard to project. Closes below last-Tuesday's gap crossing at $235.25 is the next upside target. First resistance is last-Friday's high crossing at $248.08. Second resistance is unknown. First support is last-Tuesday's gap crossing at $235.25. Second support is June's low crossing at $226.70.

FOOD & FIBERhttp://quotes.ino.com/ex changes/?c=food

September coffee posted an inside day with a higher close on Monday as it consolidates some of the decline off June's high. The low-range close sets the stage for a steady to lower opening on Wednesday. Stochastics and the RSI are oversold but remain neutral to bearish signaling sideways to lower prices are possible near-term. If September extends the decline off June's high, the 87% retracement level of the January-April rally crossing at $15.20 is the next downside target. Closes above the 20-day moving average crossing at $17.41 would temper the near-term bearish outlook. First resistance is the 10-day moving average crossing at $16.59. Second resistance is the 20-day moving average crossing at $17.41. First support is the 75% retracement level of the January-April rally crossing at $15.88. Second support is the 87% retracement level of the January-April rally crossing at $15.20.

September cocoa closed higher on Monday as it extends this year's rally. The high-range close sets the stage for a steady to higher opening on Wednesday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off March's low, monthly resistance crossing at 34.29 is the next upside target. Closes below the 20-day moving average crossing at 32.12 would signal that a short-term top has been posted.

October sugar closed higher on Monday due to short covering ahead of the July 4th holiday. The high-range close sets the stage for a steady to higher opening on Wednesday. Stochastics and the RSI are oversold but are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 24.42 would signal that a short-term low has been posted. If October renews the decline off June's high, the 50% retracement level of the October-April rally crossing at 21.34 is the next downside target.

December cotton closed sharply higher for the third day in a row on Monday and closed above the 50-day moving average crossing at 80.78 confirming that a low has been posted. The high-range close sets the stage for a steady to higher opening on Wednesday. Stochastics and the RSI are bullish signaling sideways to higher prices are possible near-term. If December extends the rally off June's low, June's high crossing at 82.49 is the next upside target. If December renews this year's decline, the November 28th -2022 low crossing at 74.25 is the next downside target.

Thanks tallpine!

The market dialed in more thoughts about the crop (bullish beans) after the USDA rating again last night, then bearish weather pressured prices today.

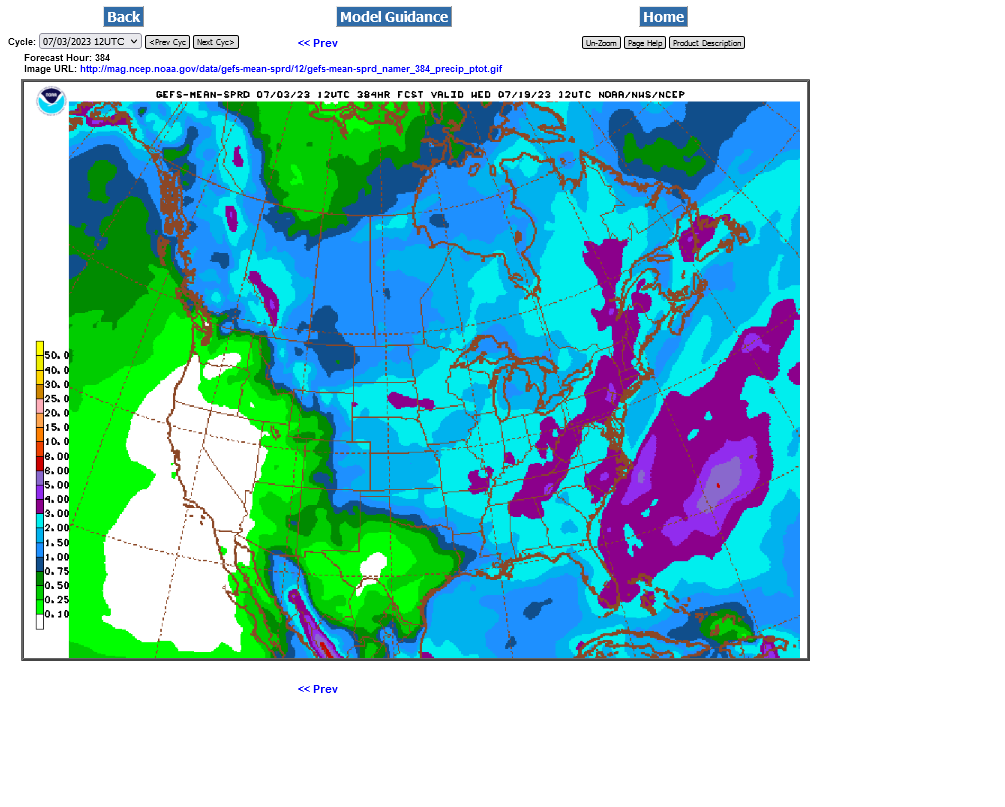

Last 12z GEFS. 2 inches most places the next 2 weeks.