Posted by China Briefing

China’s yuan is gaining global momentum as Russia is set to use the currency in settlements with other world economies, while Brazil and China are ditching the dollar in bilateral trade.

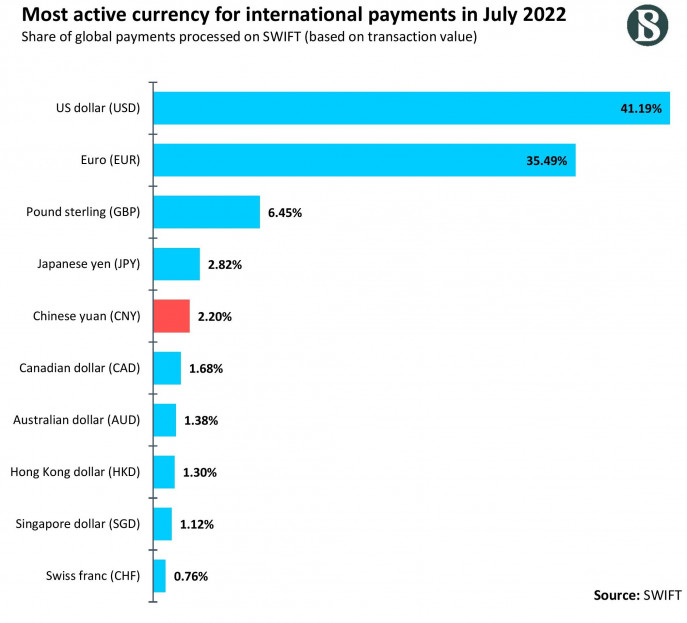

According to the International Monetary Fund (IMF), the share of US-dollar-denominated foreign exchange reserves stood at 59.8%, as of Q3 2022, down from 72% in 1999. International players are continuing to switch from the greenback to other currencies for their reserves, overseas trade, and banking services.

The de-dollarization push “is related to the United States and to some extent the European Union using their currencies and the US dollar as a trade weapon to punish countries who are not following what the United States wants them to do,” echoed Chris Devonshire-Ellis, chairman of Dezan Shira & Associates, who has a thirty-year investment and business career in China, Russia and Asia.

“The weaponization of the US dollar against specific targeted currencies and governments that the United States doesn’t agree with has been going on for some time,” Devonshire-Ellis told Sputnik. “In the last 12 months this has intensified, especially regarding the situation with Russia…..It’s notable that the decision to freeze assets was not held in any international court of arbitration, it was imposed by the United States government. Now, when the United States behaves in this way, it makes other countries on a global basis wary of using the US dollar as a base currency.”

“The US dollar is a debt-based currency,” Devonshire-Ellis explained. “If you look at the debt of the United States, it’s significantly higher than its annual GDP. (NB: Trading Economics put it at 129% of annual GDP by end 2022).

It is going to lead to problems in terms of how you value the US dollar when faced with a debt larger than their own production. That is going to spur arguments around the US dollar value. The US owes a lot of countries a lot of money, the viability and the sustainability of that is going to be called into increasing question.”

Dumping the Dollar: Will a new BRICS currency replace the US currency for trade?

The proponents of de-dollarisation say that this process would reduce other countries’ dependence on the US dollar and the US economy, which could help mitigate the impact of economic and political changes in the US on their own economies. Moreover, countries can reduce their exposure to currency fluctuations and interest rate changes, which can help to improve economic stability and reduce the risk of financial crises.

“The dollar’s share of global foreign-exchange reserves fell below 59 per cent in the final quarter of last year, extending a two-decade decline, according to the IMF’s Currency Composition of Official Foreign Exchange Reserves data,” the paper stated. “Strikingly, the decline in the dollar’s share has not been accompanied by an increase in the shares of the pound sterling, yen and euro, other long-standing reserve currencies… Rather, the shift out of dollars has been in two directions: a quarter into the Chinese renminbi, and three quarters into the currencies of smaller countries that have played a more limited role as reserve currencies.”

Also read: Petrodollar vs Petroyuan: Can China overthrow US in the global oil market?

To punish Russia for its invasion of Ukraine, western governments froze $300 billion of Russia’s foreign currency reserves last year, roughly half the total, and expelled Russian banks from the Swift international payments system.

As Jason Hollands, managing director of investment platform Bestinvest, explains, “The so-called dollar “weaponisation” has rattled many countries and not just Russia.”

“Countries willing to continue to trade with Russia, like India and China, have started doing so in rupees and yuan instead, triggering talk of the de-dollarisation of the international trading order.”

He added that Brazil and China are now trading with each other in yuan, helping to establish the Chinese renminbi as an international currency and dollar challenger.

The BRICS currency

Taking this forward, the BRICS collective — made up of Brazil, Russia, India, China and South Africa — are also mulling creating a new currency to facilitate trade. It is reported that the new financial agreement could be seen as soon as in August when the countries meet for their annual summit in South Africa.

Sources have disclosed that Russia is behind the idea, as it has faced economic sanctions from the West over invasion of Ukraine

This shows that the BRICS nations are intending to change the dollar-dominated system, which would eventually lead to de-dollarisation across the globe.

For the Chinese, who are today the world’s top oil importer, they see this move as only logical. But beyond that, moving away from the petrodollar is a strategic priority for countries like China and Russia. Both aim to ultimately reduce their dependency on the dollar, limiting their exposure to US currency risk and the politics of American sanctions regimes.

As experts state — such a move would chip away at the US dollar’s role as the world’s reserve currency, spurring “de-dollarisation.”

https://www.youtube.com/watch?v=_KQCl5PDaxQ

https://www.tbsnews.net/features/panorama/can-yuan-replace-mighty-dollar-reserve-currency-497706

This sense of security has allowed the US to undertake reckless geopolitical stances, often at the cost of its allies, let alone developing countries. For example, the US sanctions on Russia have not only have failed to prevent Russian progression, but have depreciated other major currencies, including those of its allies like euro and the pound, by at least 11% since the start of 2022, a World Bank report from August suggests.

This sense of security has allowed the US to undertake reckless geopolitical stances, often at the cost of its allies, let alone developing countries. For example, the US sanctions on Russia have not only have failed to prevent Russian progression, but have depreciated other major currencies, including those of its allies like euro and the pound, by at least 11% since the start of 2022, a World Bank report from August suggests.

One study by Barry Eichengreen and Camille Macaire found that replacing the dollar as the global reserve currency would neither be easy nor would it be quick. But they also concluded that yuan reserves are increasing across countries that have tighter relationships with China. They believe that the renminbi has the potential to become an alternative to the US dollar in a multipolar world and it might take a few decades for the yuan to gain parity with the greenback.

A flood of nations is trying to cut dependance on the dollar, fearing ‘weaponisation’ by the US. But it won’t be easy.

https://www.aljazeera.com/features/2023/3/7/will-russia-sanctions-dethrone-king-dollar

Russia’s invasion of Ukraine in February 2022 triggered a wave of US-led financial sanctions against Moscow. The two most powerful among them have been the decision by Western governments to freeze nearly half ($300bn) of Russia’s foreign currency reserves and the removal of major Russian banks from SWIFT, an interbank messaging service that facilitates international payments.

These sanctions, which some have called the “weaponisation” of the dollar, have predictably made Russia and China, the two biggest geopolitical rivals of the US, promote their alternative financial infrastructures.

But it isn’t just Beijing and Moscow. From India to Argentina, Brazil to South Africa and the Middle East to Southeast Asia, nations and regions have accelerated efforts in recent months towards arrangements aimed at reducing their dependence on the dollar. At the heart of these de-dollarisation initiatives is the fear in many capitals that the US could someday use the power of its currency to target them the way it has sanctioned Russia, according to political economists and sanctions experts.

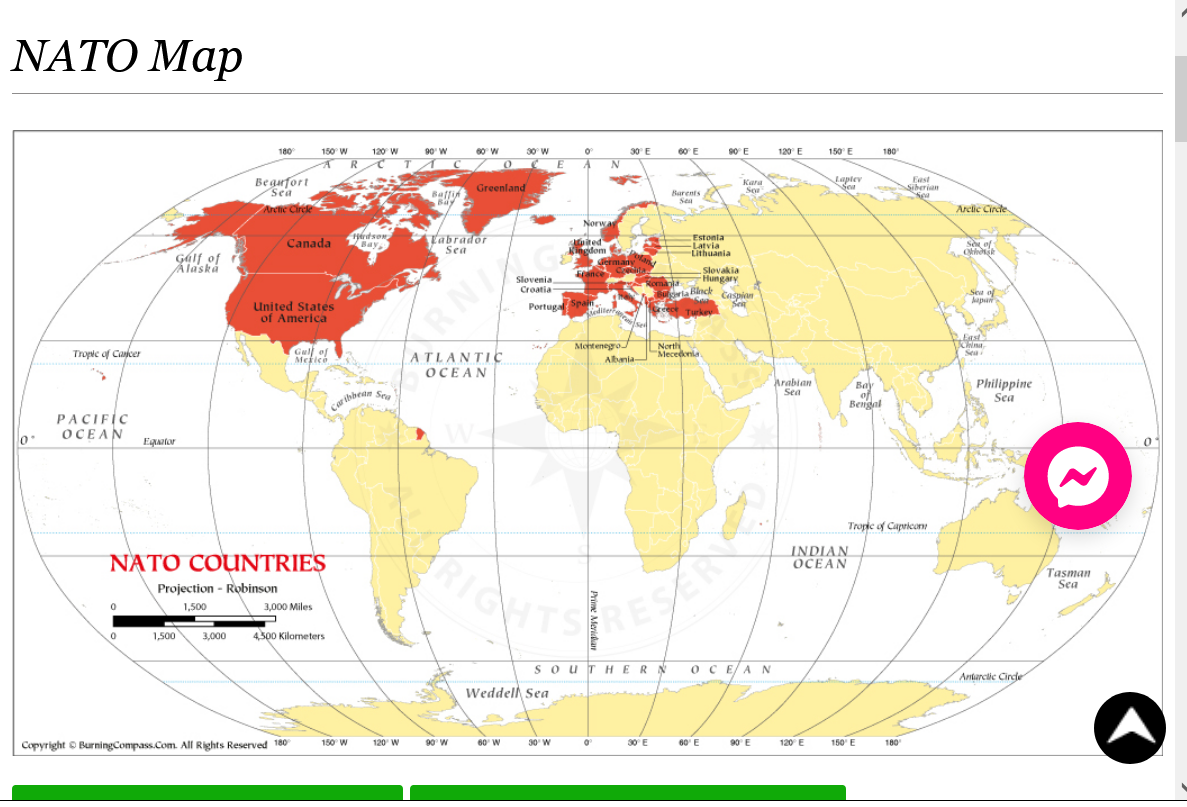

Global Populations:

30 NATO countries = 949 million

NON NATO countries

China 1.4 billion

India 1.4 billion

Africa 1.3 billion

South America 450 million

Middle East 420 million

Russia 143 million

Total NON NATO above = 5.11 billion people

Other countries = 2 billion

The NON NATO counties at the top are not all supporting our war with RUSSIA. Some have actually taken Russia's side(China/Middle East) . They outnumber NATO.

However, the propaganda we read/hear comes from sources that tell us that NATO is the center of the universe and the US is always right about everything and its our job to eliminate the evil in the world(as defined by us) and countries that disagree are wrong or even evil themselves.

Many NON NATO countries do not see it that way.

This is 2023 and China WILL BE overtaking our economy in the next few years. Not only likely but its just a matter of how many years.......for sure before the end of this decade......near 100% chance.

Indias massive population is also growing much stronger.

They are part of 5+ billion people that are increasingly motivated to replace our currency, many who don't like us because of our 7 decades worth of blatant interference in the affairs of dozens of other countries based on abusing our military and financial weight.

The war in Ukraine has just accelerated their motivation to replace the dollar.

China, which has recently been transformed from just an adversary to a relationship rapidly escalating towards an enemy. We are in the early part of WW=3, and our relationship with several countries outside of NATO are headed towards enemy status.

WW-3 has likely already begun and can accelerate faster than what anybody imagined.

The OPEC+ oil cuts were clearly designed to HELP Russia and HURT the US using the most powerful currency the Middle East possesses against us.......OIL.

NON NATO countries in white below.

https://www.cnn.com/2023/04/04/europe/finland-joins-nato-intl/index.html

It includes the protection offered by NATO’s Article 5 principle, which states that an attack on one member of NATO is an attack on all members. It’s been a cornerstone of the 30-member alliance since it was founded in 1949 as a counterweight to the Soviet Union.

Our country is drowning in catastrophic debt and we are flushing hundreds of billions down the toilet in counter productive causes halfway around the world, one in particular thats killed hundreds of thousands and will require 1 trillion from the US for rebuilding.

The Congressional Budget Office (CBO) just released updated budget and economic projections, which highlighted the nation’s unsustainable fiscal outlook. One of the most significant findings from that report is that the federal government’s borrowing costs have increased rapidly over the past year and will grow through the next decade. Most notably:

Rising interest payments can crowd out other priorities in the federal budget and lead to a cycle of higher deficits, growing debt, and even more interest payments in the future.

+++++++++++++++++

Some/much of the higher interest rate hikes causing this, from the Fed are to control the inflation that the Ukraine war caused from the massive, global supply side dynamics resulting from energy and food disruptions.

No problem-o. Just call it "The Putin price hike" and pretend we didn't play any role.

Just like this weeks conflict with Taiwan is all China's fault. They forced McCarthy to insist on the Taiwanese president coming to the US to have personal meetings with him.

Then, when/if China reacts, it will have nothing to do with anything the US caused/did.

Just think about all the good things that all that money used to obliterate Ukaine and kill their people(and Russians) could have done for our people/country!!!

Or to help the really needy/poor people in the world.

We are wasting our money/resources and killing our country and the only entity benefiting is the military industrial complex........which lavishes lobby and contribution bribes to the corrupt politicians to keep it going.

https://www.marketforum.com/forum/topic/94068/#94116

https://www.marketforum.com/forum/topic/94068/#94117

March 23, 2023

WASHINGTON, March 23 (Reuters) - U.S. Treasury Secretary Janet Yellen said on Thursday she remained confident the U.S. dollar was going to remain the global reserve currency even as she remarked that Russia and China may want to develop an alternative to it, which she described as difficult to achieve. (Reporting by David Lawder, writing by Kanishka Singh, editing by Chris Reese)

++++++++++++++++

Russia and China may want to develop an alternative to it?...........but no problem-o? Or that clearly India and the Middle East would use that alternative too.........and likely others.

We should remember that Yellen is a Biden puppet and US war against Russia cheerleader that refuses to do her job telling us about the massive damage the war is doing to our economy and to the world or the risks going forward, like this one.

Instead, she's an extremely powerful charlatan selling Americans false war propaganda and wrecking our economy with her really bad, delusional interpretations based mostly on politics.

https://www.marketforum.com/forum/topic/94351/#94372

With the United States out of the picture, China can take control of the world

https://www.foxnews.com/opinion/china-war-dollar-really-about-ruling-world

"Indias massive population is also growing much stronger.

They are part of 5+ billion people that are increasingly motivated to replace our currency, many who don't like us because of our 7 decades worth of blatant interference in the affairs of dozens of other countries based on abusing our military and financial weight. "

DIDN'T THE WORLD BANK JUST NAME AN INDIA GUY TO HEAD IT UP? LOL

EDIT: THOUGHT SO PLUS......... GASP!!! HE A CLIMATE ALARMIST!! HAHAHHAAAAAAA

Thanks, Jean,

The world bank is something completely different than what we'd been discussing earlier.

WASHINGTON, May 18, 2018 - The United Nations and the World Bank Group today signed a Strategic Partnership Framework (SPF), which consolidates their joint commitment to cooperate in helping countries implement the 2030 Agenda for Sustainable Development.

Both these organizations started out with pure objectives and altruistic motives but some corrupt people with no accountability saw an opportunity to hijack climate science, by creating the IPCC(InterGOVERNMENTAL Panel on Climate Change) as the worlds authority for climate religion followed by climate scientists, most who work for governments.

They rewrote climate history to wipe out the recent warm periods and created climate models that double the real amount of warming. Using bad mathematical equations based on flawed physics. Some of this has to be intentional because we've accurately measured the amount of heat radiation being captured by CO2 and its half of whats in the models but they won't change the models because the global climate models are political tools.

This was the last report.

The IPCC regular reports are seen as the bible for the fake climate crisis religion.

Science corruption

19 responses |

Started by metmike - March 20, 2023, 5:50 p.m.

https://www.marketforum.com/forum/topic/93926/

Anyway, most of what these 2 organizations do is wonderful for the poor people in the world. I strongly support that.

But they have twisted science to really mess things up tremendously when it comes to fossil fuels.........to generate ten of trillions in funding this decade.

The fake Inflation Reduction Act is an example of almost 500 billion available that wouldn't exist without a fake climate crisis.

Labeling the beneficial gas, building block for life, CO2 as pollution as the increase of CO2 greens up the planet and its only half the optimal level for most life.

This has led to massive crony capitalism to exploit this field by pushing things like low yielding, intermittent wind energy(and batteries) which are wrecking the planet by destroying natural landscapes, killing birds, bats and whales and tearing up the earth to get raw materials.

While fossil fuels green up the planet and have caused a climate optimum for life.

We are destroying the planet to save it. Seriously!

"The world bank is something completely different than what we'd been discussing earlier."

IT WAS YOUR INDIA COMMENTS THAT MADE ME RECALL THE NEW PRES. OF THE WORLD BANK. I JUST NEEDED TO GET IT OFF MY BRAIN. LOL

OTHER THAN THAT ~ IMO. ANY & ALL "BANKS" ARE INTER-CONNECTED IN ONE WAY OR ANOTHER....POLITICALLY ~ IDEOLOGY, IS RAMPANT, IN THEM ALL.

THIS WORLD IS A MESS!