KEY EVENTS TO WATCH FOR:

Thursday, January 19, 2023

8:30 AM ET. January Philadelphia Fed Business Outlook Survey

Business Activity (previous -13.8)

Prices Paid (previous 26.4)

Employment (previous -1.8)

New Orders (previous -25.8)

Prices Received (previous 24.3)

Delivery Times (previous -11.9)

Inventories (previous -2.7)

Shipments (previous -6.2)

8:30 AM ET. December New Residential Construction - Housing Starts and Building Permits

Total Starts (previous 1.427M)

Housing Starts, M/M% (previous -0.5%)

Building Permits (previous 1.342M)

Building Permits, M/M% (previous -11.2%)

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 205K)

Jobless Claims, Net Chg (previous -1K)

Continuing Claims (previous 1634000)

Continuing Claims, Net Chg (previous -63K)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 2902B)

Working Gas In Storage, Net Chg (Cbf) (previous +11B)

11:00 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 439.607M)

Crude Oil Stocks, Net Chg (Bbl) (previous +18.961M)

Gasoline Stocks (Bbl) (previous 226.776M)

Gasoline Stocks, Net Chg (Bbl) (previous +4.114M)

Distillate Stocks (Bbl) (previous 117.716M)

Distillate Stocks, Net Chg (Bbl) (previous -1.069M)

Refinery Usage (previous 84.1%)

Total Prod Supplied (Bbl/day) (previous 17.627M)

Total Prod Supplied, Net Chg (Bbl/day) (previous -0.563M)

4:30 PM ET. Federal Discount Window Borrowings

4:30 PM ET. Foreign Central Bank Holdings

Friday, January 20, 2023

8:30 AM ET. U.S. Weekly Export Sales

10:00 AM ET. ABA Economic Advisory Committee economic forecast

10:00 AM ET. December Existing Home Sales

Existing Sales (previous 4.09M)

Existing Sales, M/M% (previous -7.7%)

Unsold Homes Month's Supply (previous 3.3)

Median Price (USD) (previous 370700)

Median Home Price, Y/Y% (previous +3.5%)

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The STOCK INDEXES: The March NASDAQ 100 was lower overnight following Wednesday's key reversal down as it consolidates some of the rally off the January 6th low. Overnight trading sets the stage for a lower opening when the day session begins trading.Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 11,191.45 would temper the near-term friendly outlook. If March resumes the rally off this month's low, the 38% retracement level of the August-October decline crossing at 11,849.67. First resistance is Wednesday's high crossing at 11,759.50. Second resistance is the 38% retracement level of the August-October decline crossing at 11,849.67. First support is the 20-day moving average crossing at 11,191.45. Second support is the January 6thlow crossing at 10,751.00.

The March S&P 500 was lower overnight as it extends the decline off Tuesday's high. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI have turned bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 3903.61 would temper the near-term friendly outlook. If March resumes the rally off December's low, the 62% retracement level of the August-October decline crossing at 4045.36 is the next upside target. First resistance is the 62% retracement level of the August-October decline crossing at 4045.36. Second resistance is the 75% retracement level of the August-October decline crossing at 4155.39. First support is the 20-day moving average crossing at 3903.61. Second support is the January 6th low crossing at 3819.00.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: March T-bonds were slightly lower overnight due to profit taking as it consolidates some of its recent gains. Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off the December 30th low, the 62% retracement level of the August-October decline crossing at 133-30 is the next upside target. Closes below the 50-day moving average crossing at 127-18 would signal that a short-term top has been posted. First resistance is the overnight high crossing at 132-31. Second resistance is the 62% retracement level of the August-October decline crossing at 133-30. First support is the 10-day moving average crossing at 129-26. Second support is the 20-day moving average crossing at 128-08.

March T-notes were slightly lower in late-overnight trading as they consolidates some of the rally off December's low. Overnight weakness sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off the December 30th low, the 62% retracement level of the August-October decline crossing at 116.235 is the next upside target. Closes below the 50-day moving average crossing at 113.168 would signal that a short-term top has been posted. First resistance is the 62% retracement level of the August-October decline crossing at 116.235. Second resistance is the 75% retracement level of the August-October decline crossing at 118.112. First support is the 10-day moving average crossing at 114.213. Second support is the 20-day moving average crossing at 113.247.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

ENERGIES:Februarycrude oil was lower overnight as it extends Wednesday's downside reversal. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought and are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 10-day moving average crossing at $77.14 would signal that a short-term top has been posted. Closes above the January 3rd high crossing at $81.50 would renew the rally off December's low while opening the door for a possible test of the November 11th high crossing at $88.10. First resistance is Wednesday's high crossing at $82.38. Second resistance is the November 11th high crossing at $88.10. First support is the 10-day moving average crossing at $77.14. Second support is January's low crossing at $72.46.

February heating oil is was lower overnight as it consolidates some of the rally off the January 5th low. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI remain neutral to bullish signaling that sideways to higher prices are possible near-term. If February extends the rally off this month's low, December's high crossing at $3.3543 is the next upside target. Closes below the 10-day moving average crossing at $3.1605 would temper the near-term friendly outlook. First resistance is Wednesday's high crossing at $3.3375. Second resistance is December's high crossing at $3.3543. First support is the 10-day moving average crossing at 3.1605. Second support is the January 5th low crossing at $2.9200.

February unleaded gas was slightly lower overnight as it consolidates some of the rally off December's low. Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If February extends the rally off December's low, November's high crossing at $2.6682 is the next upside target. Closes below the 20-day moving average crossing at $2.3762 would signal that a short-term top has been posted. First resistance is Wednesday's highcrossing at $2.5966. Second resistance is November's high crossing at $2.6682. First support is the 10-day moving average crossing at $2.4159. Second support is the 20-day moving average crossing at $2.3762.

February natural gas was steady to slightly higher overnight as it consolidates some of Wednesday's decline but remains below broken support marked by the 87% retracement level of the 2020-2022 rally crossing at 3.491. Overnight trading sets the stage for a steady to slightly higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If February extends the decline off November's high, the July-14-2021 low crossing at 3.193 is the next downside target, Closes above the 20-day moving average crossing at 4.169 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at 4.169. Second resistance is the December 27th high crossing at 5.245. First support is the July-14-2021 low crossing at 3.193. Second support is the July-2021 low crossing at 3.165.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The March Dollar was steady to slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off September's high, the 87% retracement level of the March-September rally crossing at $99.229 is the next downside target. Closes above the 20-day moving average crossing at $103.224 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $103.224. Second resistance is the 50-day moving average crossing at $104.559. First support is the 75% retracement level of the March-September rally crossing at $101.331. Second support is the 87% retracement level of the March-September rally crossing at $99.229.

The March Euro was slightly higher overnight as it extends the trading range of the past four-days. Overnight trading sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March renews the rally off September's low, the May 31st 2022 high crossing at $1.09680 is the next upside target. Closes below the 20-day moving average crossing at $1.07402 would signal that a short-term top has likely been posted. First resistance is Wednesday's high crossing at $1.09275. Second resistance is the May 31st 2022 high crossing at $1.09680. First support is the 20-day moving average crossing at $1.07402. Second support is the 50-day moving average crossing at $1.05900.

The March British Pound was steady to slightly higher overnight as it extends the rally off January's low. Overnight trading sets the stage for a steady to slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off January's low, December's high crossing at 1.2477 is the next upside target. Closes below the 50-day moving average crossing at 1.2085 would signal that a short-term top has been posted while opening the door for a possible test of the 38% retracement level of the September-December rally crossing at 1.1697. First resistance is Wednesday's high crossing at 1.2452. Second resistance is December's high crossing at 1.2477. First support is the 50-day moving average crossing at 1.2085. Second support is January's low crossing at 1.1861.

The March Swiss Franc was steady to slightly lower overnight as it consolidates some of Wednesday's rally. Overnight strength sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off November's low, the 75% retracement level of the 2021-2022 decline crossing at 1.12550 is the next upside target. Closes below the 50-day moving average crossing at 1.07688 would confirm that a short-term top has been posted. First resistance is the 62% retracement level of the 2021-2022 decline crossing at 1.10351. Second resistance is the 75% retracement level of the 2021-2022 decline crossing at 1.12550. First support is the 50-day moving average crossing at 1.07688. Second support is the January 6th low crossing at 1.06915.

The March Canadian Dollar was steady to slightly lower overnight as it extends Wednesday's downside breakout of the recent trading range. Overnight trading sets the stage for a steady to slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. Closes below the 20-day moving average crossing at $74.08 would signal that a short-term top has been posted. If March renews the rally off January's low, November's high crossing at $75.71 is the next upside target. First resistance is last-Friday's high crossing at $75.10. Second resistance is November's high crossing at $75.71. First support is the 20-day moving average crossing at $74.08. Second support is the January's low crossing at $73.10.

The March Japanese Yen was steady to slightly higher in late-overnight trading and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off October's, the May-2022 high crossing at 0.080525 is the next upside target. Closes below the 20-day moving average crossing at 0.076800 would signal that a short-term top has been posted while opening the door for additional weakness near-term. First resistance is Tuesday's high crossing at 0.079190. Second resistance is the May-2022 high crossing at 0.080525. First support is the 20-day moving average crossing at 0.076800. Second support is the January 6th low crossing at 0.074830.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

Februarygold was higher overnight as it consolidates some of the losses of the previous two-days but remains poised to extend the rally off November's low. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If February extends the rally off November's low, the 75% retracement level of the March-October decline crossing at $1975.80 is the next upside target. Closes below the 20-day moving average crossing at $1856.90 would signal that a short-term top has been posted. First resistance is Tuesday's high crossing at $1931.80. Second resistance is the 75% retracement level of the March-October decline crossing at $1975.80. First support is the 10-day moving average crossing at $1889.10. Second support is the 20-day moving average crossing at $1856.90.

March silver was lower overnight as it extends the December-January trading range. Overnight trading sets the stage for a lower opening when the day session begins trading later this morning. Stochastics and the RSI are bearish signaling that sideways to lower prices are possible near-term. Closes below the January 5th low crossing at $23.260 would open the door for additional weakness near-term. If March renews the rally off October's low, the 87% retracement level of the March-August decline crossing at $25.938 is the next upside target. First resistance is the 75% retracement level of the March-August decline crossing at $24.779. Second resistance is the 87% retracement level of the March-August decline crossing at $25.938. First support the January 5th low crossing at $23.260. Second support is the 50-day moving average crossing at $22.927.

March copper was lower overnight as it consolidates some of the rally off the January 4th low. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off the November 28th low, the 75% retracement level of the March-July-2022 decline crossing at 4.4773 is the next upside target. Closes below the 20-day moving average crossing at 3.9529 would signal that a short-term top has been posted. First resistance is Wednesday's high crossing at 4.3550. Second resistance is the 75% retracement level of the March-July-2022 decline crossing at 4.4773. First support is the 10-day moving average crossing at 4.1058. Second support is the 20-day moving average crossing at 3.9529.

GRAINS http://quotes.ino.com/ex changes/?c=grains

March corn was lower overnight as it consolidates some of the rally off December's low. Overnight trading sets the stage for lower opening when the day sessions begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends last-week's rally, the 75% retracement level of the October-December decline crossing at $6.92 1/2 is the next upside target. Closes below the 50-day moving average crossing at $6.62 1/4 would signal that a short-term top has been posted. First resistance is the 75% retracement level of the October-December decline crossing at $6.92 1/2. Second resistance is the 87% retracement level of the October-December decline crossing at $7.01 3/4. First support is Tuesday's low crossing at $6.68 3/4. Second support is the 50-day moving average crossing at $6.62 1/4.

March wheat was steady to fractionally higher overnight and sets the stage for a steady to fractionally higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $7.56 1/2 would signal that a short-term low has been posted. If March resumes this month's decline, the September 6th 2022 low crossing at $6.93 1/2 is the next downside target. First resistance is 50-day moving average crossing at $7.77. Second resistance is the December 30th high crossing at $7.99. First support is the 75% retracement level of the 2020-2022 rally crossing at $7.24 1/4. Second support is the September 6th 2022 low crossing at $6.93 1/2.

March Kansas City wheat was slightly lower overnight as it extends Wednesday's loss. Overnight trading sets the stage for a lower opening when the day session begins trading later this morning. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the aforementioned rally, the 50-day moving average crossing at $8.76 3/4 is the next upside target. If March renews the decline off the December 27th high, the January 31st 2022 low crossing at $7.80 is the next downside target. First resistance is the 50-day moving average crossing at $8.76 3/4. Second resistance is the December 27th high crossing at $8.94 3/4. First support is the January 10th low crossing at $8.03 1/4. Second support is the January 31st 2022 low crossing at $7.80.

March Minneapolis wheat was steady to higher overnight and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If March renews this month's decline, August's low crossing at $8.75 3/4 is the next downside target. Closes above the 50-day moving average crossing at $9.28 1/4 would confirm that a short-term low has been posted. First resistance is the 50-day moving average crossing at $9.28 1/4. Second resistance is the December 30th high crossing at $9.40. First support is last-Wednesday's low crossing at $8.90. Second support is August's low crossing at $8.75 3/4.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

March soybeans were steady to slightly higher overnight as they consolidate some of Wednesday's loss. Overnight trading sets the stage for a steady to higher opening. Stochastics and the RSI are overbought and are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $15.00 1/4 would signal that a short-term top has been posted. If March extends the rally off the January 5th low, last-June's high crossing at $15.72 1/2 is the next upside target. First resistance is Wednesday's high crossing at $15.48 1/2. Second resistance is last-June's high crossing at $15.72 1/2. First support is the 20-day moving average crossing at $15.00 1/4. Second support is the 50-day moving average crossing at $14.74 1/4.

March soybean meal was steady to slightly higher overnight and sets the stage for a steady to higher opening when the day session begins trading. Stochastics and the RSI are overbought, diverging and are turning neutral to bearish warning of a possible downside correction. Closes below the 20-day moving average crossing at $466.00 would signal that a short-term top has been posted. If March extends the rally off October's low, the August 29th high on the monthly continuation chart crossing at $488.40 is the next upside target. First resistance is Wednesday's high crossing at $487.00. Second resistance is the August 29th high on the monthly continuation chart crossing at $488.40. First support is the 20-day moving average crossing at $466.00. Second support is the December 19th low crossing at $443.40.

March soybean oil was steady to slightly higher overnight as it extends the trading range of the past two-weeks. Overnight strength sets the stage for a steady to slightly higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above last-Monday's high crossing at 64.43 would mark an upside breakout of this month's trading range while opening the door for additional short-term gains. If March renews the decline off December's high, the December 16th low crossing at 61.47 is the next downside target. First resistance is last-Monday's high crossing at 64.43. Second resistance is the 50-day moving average crossing at 65.79. First support is the December 16th low crossing at 61.47. Second support is December's low crossing at 58.50.

Thanks tallpine!

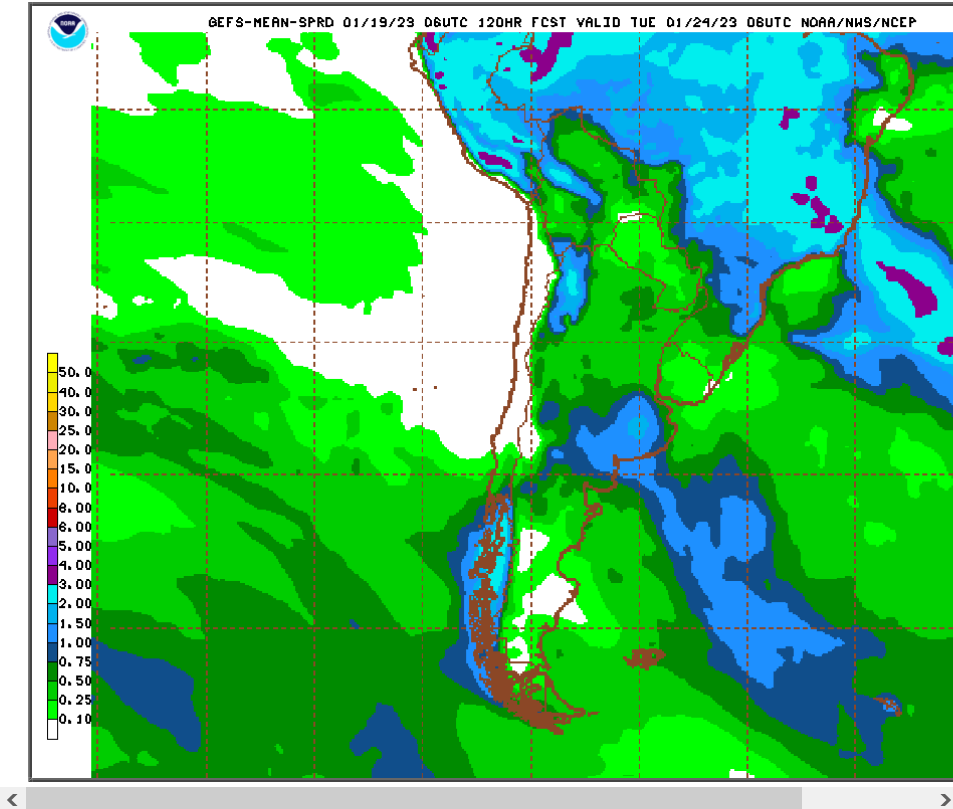

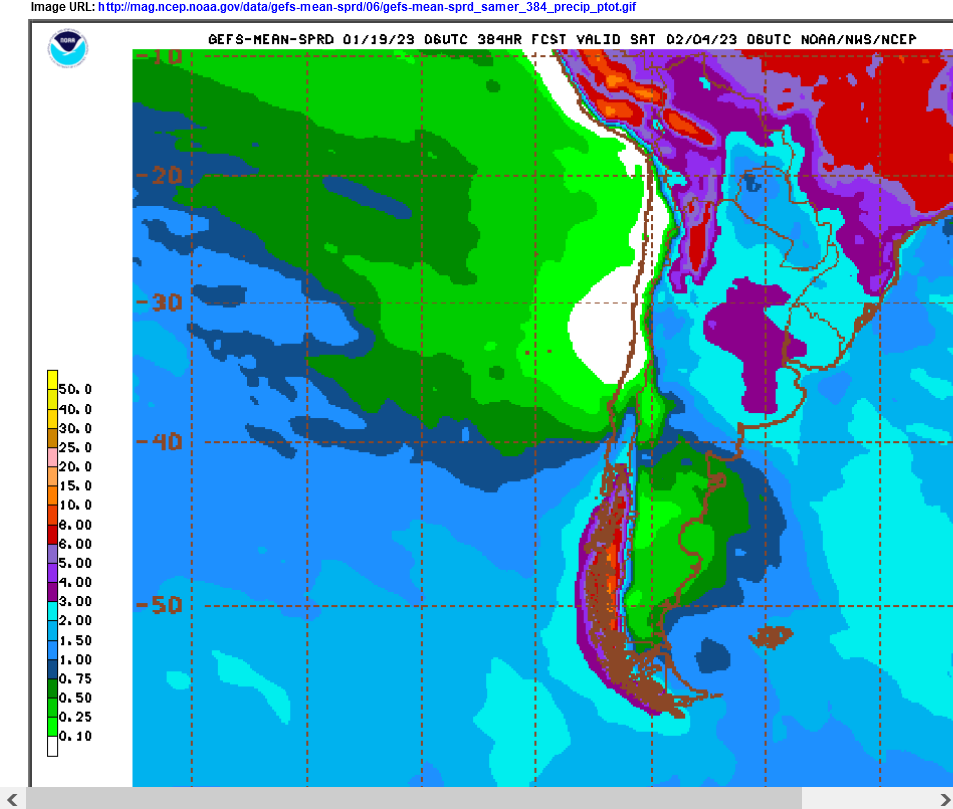

Argentina rains will be getting 1 day closer as each page of the calendar turns..........but still almost a week away.

1. GEFS 6z run for 5 days......rains are all SOUTH of bean growing country.

2. GEFS 6z for 15 days........beans get 3 inches of rain in week 2.

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.90day.figb.gif

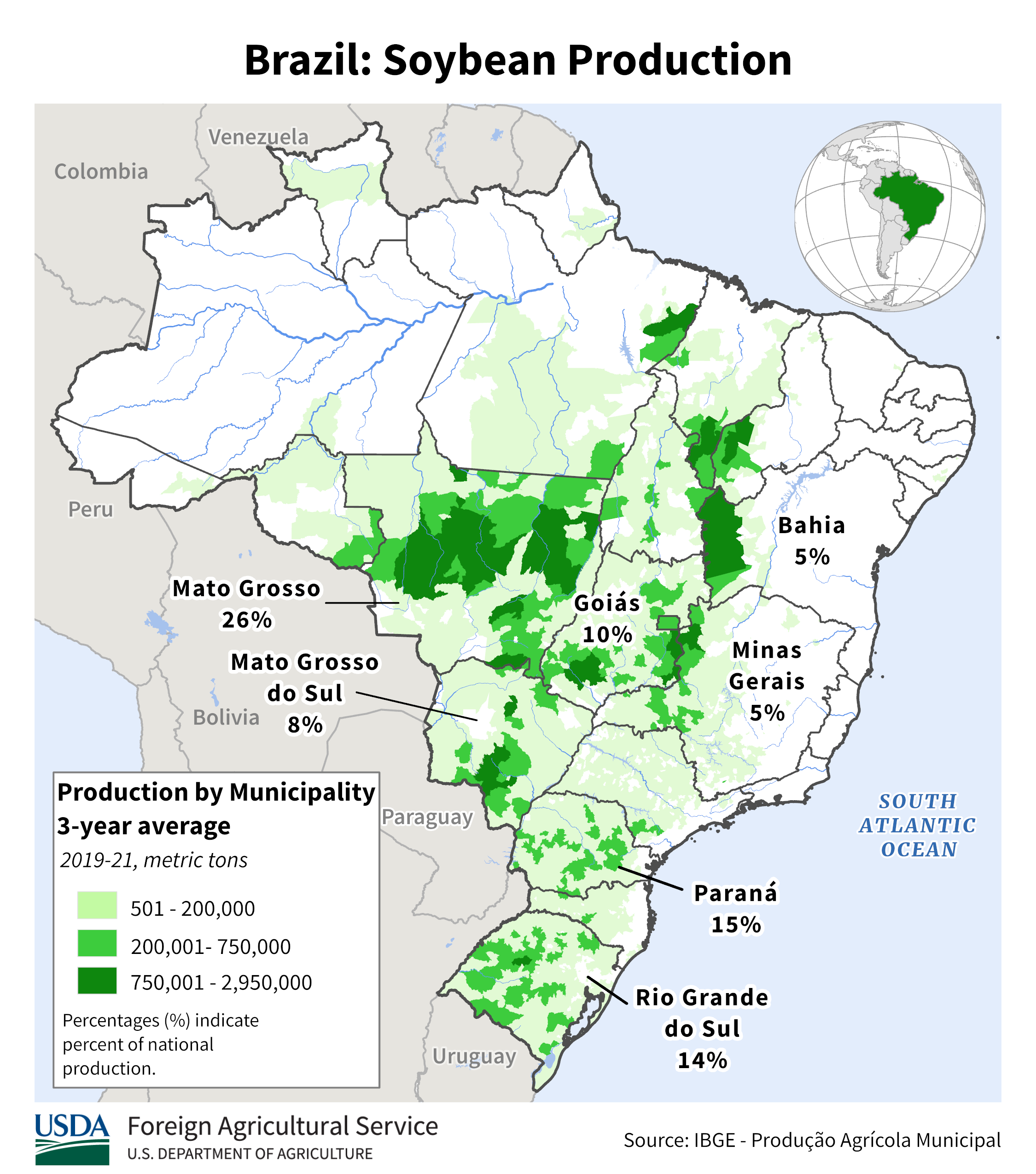

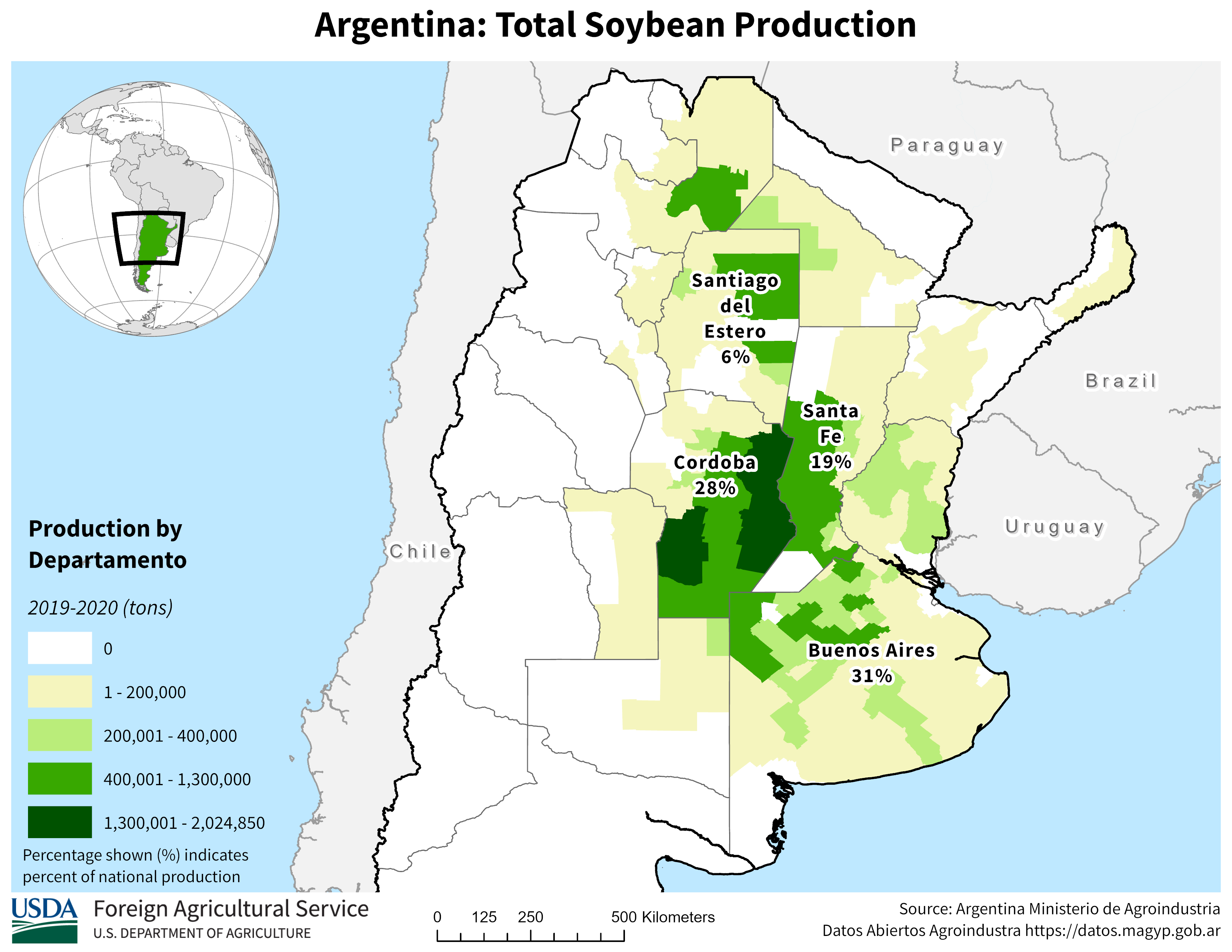

South America soybean production below

https://ipad.fas.usda.gov/rssiws/al/ssa_cropprod.aspx

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Soybean.png