KEY EVENTS TO WATCH FOR:

Thursday, November 17, 2022

8:30 AM ET. U.S. Weekly Export Sales

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (expected 225K; previous 225K)

Jobless Claims, Net Chg (previous +7K)

Continuing Claims (previous 1493000)

Continuing Claims, Net Chg (previous +6K)

8:30 AM ET. November Philadelphia Fed Business Outlook Survey

Business Activity (expected -6; previous -8.7)

Prices Paid (previous 36.3)

Employment (previous 28.5)

New Orders (previous 15.9)

Prices Received (previous 30.8)

Delivery Times (previous -12.6)

Inventories (previous -1.7)

Shipments (previous 8.6)

8:30 AM ET. October New Residential Construction - Housing Starts and Building Permits

Total Starts (expected 1.41M; previous 1.439M)

Housing Starts, M/M% (expected -2.0%; previous -8.1%)

Building Permits (expected 1.50M; previous 1.564M)

Building Permits, M/M% (expected -4.1%; previous +1.4%)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 3580B)

Working Gas In Storage, Net Chg (Cbf) (previous +79B)

11:00 AM ET. Nov. Federal Reserve Bank of Kansas City Survey of Tenth District Manufacturing

Mfg Activity Idx (previous -22)

6-Mo Exp Prod Idx (previous -1)

Mfg Composite Idx (expected -5; previous -7)

6-Mo Exp Composite Idx (previous -1)

2:00 AM ET. SEC Closed Meeting

4:30 PM ET. Foreign Central Bank Holdings

4:30 PM ET. Federal Discount Window Borrowings

Friday, November 18, 2022

10:00 AM ET. October State Employment and Unemployment

10:00 AM ET. 3rd Quarter Quarterly Retail E-Commerce Sales

10:00 AM ET. October Existing Home Sales

Existing Sales (expected 4.37M; previous 4.71M)

Existing Sales, M/M% (expected -7.2%; previous -1.5%)

Unsold Homes Month's Supply (previous 3.2)

Median Price (USD) (previous 384800)

Median Home Price, Y/Y% (previous +8.4%)

10:00 AM ET. October Leading Indicators

Leading Index, M/M% (expected -0.4%; previous -0.4%)

Leading Index

Coincident Index, M/M% (previous +0.2%)

Lagging Index, M/M% (previous +0.6%)

10:00 AM ET. 3rd Quarter Advance Quarterly Services

5-Year Inflation Forecast (previous 2.9%)

End-Mo Current Idx (previous 65.6)

1030/1530 11/18 EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl)

Crude Oil Stocks, Net Chg (Bbl)

Gasoline Stocks (Bbl)

Gasoline Stocks, Net Chg (Bbl)

Distillate Stocks (Bbl)

Distillate Stocks, Net Chg (Bbl)

Refinery Usage

Total Prod Supplied (Bbl/day)

Total Prod Supplied, Net Chg (Bbl/day)

12:00 PM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf)

Working Gas In Storage, Net Chg (Cbf)

2:00 PM ET. Federal Open Market Committee meeting minutes published

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The STOCK INDEXES: The December NASDAQ 100 was lower overnight as it consolidates some of the rally off November's low. Overnight trading sets the stage for a lower opening when the day session begins trading.Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 11,381.24 would signal that a short-term top has been posted. If December extends the rally off October's low, the 62% retracement level of the August-October crossing at 12,547.94 is the next upside target. First resistance is the 50% retracement level of the August-October crossing at 12,150.94. Second resistance is the 62% retracement level of the August-October crossing at 12,547.94. First support is the 50-day moving average crossing at 11,454.42. Second support is the 20-day moving average crossing at 11,381.24.

The December S&P 500 was lower overnight as it consolidates some of the rally off October's low. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought and are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at 3804.32 would signal that a short-term top has been posted. If December extends the rally off the October 13th low, the 75% retracement level of the August-October decline crossing at 4136.35 is the next upside target. First resistance is the 62% retracement level of the August-October declinecrossing at 4024.30. Second resistance is the 75% retracement level of the August-October decline crossing at 4136.35. First support is the 10-day moving average crossing at 3902.50. Second support is the 20-day moving average crossing at 3864.29.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: December T-bonds were lower overnight as it consolidates some of the rally off November's low. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off October's low, the 38% retracement level of the August-October decline crossing at 128-06 is the next upside target. Closes below the 20-day moving average crossing at 121-18 would signal that a short-term top has been posted. First resistance is the overnight high crossing at 126-27. Second resistance is the 38% retracement level of the August-October decline crossing at 128-06. First support is November's low crossing at 118-03. Second support is October's low crossing at 117-19.

December T-notes was steady to slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off October's low, October's high crossing at 113.300 is the next upside target. Closes below the 20-day moving average crossing at 111.027 would signal that a short-term top has been posted. First resistance is October's high crossing at 113.300. Second resistance is the 50% retracement level of the August-October decline crossing at 115.142. First support is the 20-day moving average crossing at 111.027. Second support is November's low crossing at 109.105.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

ENERGIES:December crude oil was steady to lower overnight. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If December extends the decline November's high, the October 18th low crossing at $81.30 is the next downside target. Closes above last-Friday's high crossing at $90.10 would confirm that a short-term low has been posted. First resistance is last-Friday's high crossing at $90.10. Second resistance is November's high crossing at $93.74. First support is the October 18th low crossing at $81.30. Second support is September's low crossing at $75.70.

December heating oil was steady to lower overnight. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at $3.5015 would open the door for additional weakness near-term. Closes above Tuesday's high crossing at $3.7173 would temper the near-term bearish outlook.First resistance is November's high crossing at $3.9565. Second resistance is June's high crossing at $4.0651. First support is the 50-day moving average crossing at 3.5015. Second support is the October 21st low crossing at $3.4435.

December unleaded gas was lower overnight as it extends the decline off November's low. Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at $2.4742 would open the door for a possible test of the October 18th low crossing at 2.3526. Closes above Monday's high crossing at $2.6586 would confirm that a short-term low has been posted. First resistance is Monday's high crossing at $2.6586. Second resistance is November's high crossing at $2.8172. First support is the 50-day moving average crossing at $2.4742. Second support is the October 18th low crossing at $2.3526.

December Henry natural gas was higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the decline off November's high, the 62% retracement level of the 2020-2022 crossing at 5.393 is the next downside target. Closes above the 50-day moving average crossing at 6.814 would signal that a short-term low has been posted. First resistance is last-Monday's high crossing at 7.221. Second resistance is the October 6th high crossing at 7.436. First support is the 62% retracement level of the 2020-2022 crossing at 5.393. Second support is the March 15th low crossing at 4.872.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The December Dollar was higher overnight as it consolidates some of the decline off September's high. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If December extends the aforementioned decline, the 50% retracement level of this year's rally crossing at $104.650 is the next downside target. Closes above the 20-day moving average crossing at $109.638 would signal that a short-term low has been posted. First resistance is the 10-day moving average crossing at $108.061. Second resistance is the 20-day moving average crossing at $109.638. First support is Tuesday's low crossing at $105.155. Second support is the 50% retracement level of this year's rally crossing at $104.650.

The December Euro was lower overnight as it consolidates some of the rally off September's low. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off September's low, the 38% retracement level of the 2021-2022 decline crossing at $1.07137 is the next upside target. Closes below the 20-day moving average crossing at $1.00893 would signal that a short-term top has been posted. First resistance is August's high crossing at $1.04650. Second resistance is the 38% retracement level of the 2021-2022 crossing at $1.07137. First support is the 10-day moving average crossing at $1.02324. Second support is the 20-day moving average crossing at $1.00893.

The December British Pound was lower overnight as it consolidates some of the rally off September's low. Overnight trading sets the stage for a steady to lower opening when the day session begins trading.Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off September's low, the 50% retracement level of the 2021-2022 decline crossing at 1.2312 is the next upside target. Closes below last-Wednesday's low crossing at 1.1344 would signal that a short-term top has been posted. First resistance is the 38% retracement level of the 2021-2022 decline crossing at 1.1858. Second resistance is the 50% retracement level of the 2021-2022 decline crossing at 1.2312. First support is last-Wednesday's low crossing at 1.1344. Second support is the November 4th low crossing at 1.1156.

The December Swiss Franc was lower overnight as it consolidates some of the rally off November's low. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that additional gains are possible. If December extends the rally off November's low, August's high crossing at 1.07550 is the next upside target. Closes below the 20-day moving average crossing at 1.02466 would signal that a short-term top has been posted. First resistance is Tuesday's high crossing at 1.07275. Second resistance is August's high crossing at 1.07550. First support is the 10-day moving average crossing at 1.04217. Second support is the 20-day moving average crossing at 1.02466.

The December Canadian Dollar was lower overnight as it consolidates some of the rally off October's low. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought and are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $74.05 would signal that a short-term top has been posted. If December extends the rally off October's low, September's high crossing at $77.18 is the next upside target. First resistance is the September 20th crossing at $75.62. Second resistance is September's high crossing at $77.18. First support is the 10-day moving average crossing at $74.75. Second support is the 20-day moving average crossing at $74.05.

The December Japanese Yen was slightly lower overnight as it extends this week's trading range. Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off October's, the August 23rd high crossing at 1.074410 is the next upside target. Closes below the 20-day moving average crossing at 0.069347 would signal that a short-term top has been posted. First resistance is Tuesday's high crossing at 0.072925. Second resistance is the August 23rd high high crossing at 1.074410. First support is the 20-day moving average crossing at 0.069347. Second support is October's low crossing at 0.066235.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

PRECIOUS METALS: Decembergold was steady to lower overnight as it consolidates some of the rally off November's low. Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off November's low, August's high crossing at $1824.60 is the next upside target. Closes below the 20-day moving average crossing at $1696.30 would signal that a short-term top has been posted. First resistance is Tuesday's high crossing at $1791.80. Second resistance is August's high crossing at $1824.60. First support is the 10-day moving average crossing at $1740.70. Second support is the 20-day moving average crossing at $1696.30.

December silver was lower overnight and sets the stage for a lower opening when the day session begins trading later this morning. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $20.289 would confirm that a short-term top has been posted. If December resumes the rally off October's low, the 50% retracement level of the March-August decline crossing at $22.466 is the next upside target. First resistance is Tuesday's high crossing at $22.380. Second resistance is the 50% retracement level of the March-August decline crossing at $22.448. First support is the 20-day moving average crossing at $20.385. Second support the 50-day moving average crossing at $19.731.

December copper was lower overnight as it consolidates some of the rally off October's low. The low-range trade overnight sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 3.6017 would signal that a short-term top has been posted. If December renews the rally off September's low, the 50% retracement level of this year's decline crossing at 4.0450 is the next upside target. First resistance is Monday's high crossing at 3.9600. Second resistance is the 50% retracement level of this year's decline crossing at 4.0450. First support is the 10-day moving average crossing at 3.7496. Second support is the 20-day moving average crossing at 3.6017.

GRAINS http://quotes.ino.com/ex changes/?c=grains

December corn was lower overnight as it extends the trading range of the past six-days. Overnight trading sets the stage for a lower opening when the day sessions begins trading. Stochastics and the RSI are neutral to neutral to bearish signaling that sideways to lower prices are possible near-term. If December extends the decline off last-Monday's high, the August 26th low crossing at $6.47 1/4 is the next downside target. Closes above the 50-day moving average crossing at $6.79 3/4 would temper the near-term bearish outlook. First resistance is the 10-day moving average crossing at $6.64 1/2. Second resistance is the 50-day moving average crossing at $6.79 3/4. First support is Tuesday's low crossing at $6.51 1/4. Second support is the August 26th low crossing at $6.47 1/4.

December wheat was lower overnight and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If December extends the decline off October's high, September's low crossing at $7.91 1/4 is the next downside target. Closes above the 50-day moving average crossing at $8.62 would temper the near-term bearish outlook. First resistance is the 20-day moving average crossing at $8.35 1/2. Second resistance is the 50-day moving average crossing at $8.62. First support is the overnight low crossing at $7.93 3/4. Second support is September's low crossing at $7.91 1/2.

December Kansas City wheat was lower overnight and sets the stage for a lower opening when the day session begins trading later this morning. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the October 28th low crossing at $9.15 1/4 would open the door for additional weakness near-term. If December extends the rally off the October 28th low, the 38% retracement level of the May-August decline crossing at $10.26 3/4 is the next upside target. First resistance is November's high crossing at $9.91. Second resistance is the 38% retracement level of the May-August decline crossing at $10.26 3/4. First support is the October 28th low crossing at $9.15 1/4. Second support is the September 19th low crossing at $8.96 1/4.

December Minneapolis wheat was lower overnight and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. Closes above November's high crossing at $9.93 1/4 would temper the near-term bearish outlook. If December extends the decline off November's high, the September 19th low crossing at $9.06 1/2 is the next downside target. First resistance is November's high crossing at $9.93 1/4. Second resistance is October's high crossing at $10.24 1/4. First support is last-Thursday's low crossing at $9.29. Second support is the September 19th low crossing at $9.06 1/2.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

January soybeans was lower overnight and is breaking out to the downside of the trading range of the past three-weeks. Overnight weakness sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI have turned neutral to bearish signaling sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at $14.22 would confirm that a short-term top has been posted. If January resumes the rally off October's low, the 62% retracement level of the September-October decline crossing at $14.55 1/4 is the next upside target. First resistance is last-Monday's high crossing at $14.69. Second resistance is the 62% retracement level of the September-October decline crossing at $14.55 1/4. First support is the 50-day moving average crossing at $14.22. Second support is the October 19th low crossing at $13.66 3/4.

December soybean meal was lower overnight and is working on a possible inside day as it extends the trading range of the past four-days. The low-range overnight trade sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If December extends the decline off October's high, the October 18th low crossing at $398.80 is the next downside target. Closes above the 20-day moving average crossing at $414.90 would temper the bearish outlook. First resistance is the 20-day moving average crossing at $414.90. Second resistance is October's high crossing at $440.50. First support is the October 18th low crossing at $398.80. Second support is the October 26th low crossing at $406.40.

December soybean oil was lower overnight as it extends the decline off last-Friday's high. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. If December extends this week's decline, the 50-day moving average crossing at 69.03 is the next downside target. If December resumes the rally off September's low, June's high crossing at 79.29 is the next upside target. First resistance is last-Friday's high crossing at 78.64. Second resistance is June's high crossing at 79.29. First support is the 50-day moving average crossing at 69.03. Second support is the October 13th low crossing at 64.05.

LIVESTOCKhttp://quotes.ino.com/exchanges/?c=livestock

December hogs closed up $0.28 at $85.60.

December hogs posted an inside day with a higher close on Wednesday. The mid-range close sets the stage for a steady to higher opening when Thursday's session begins trading. Stochastics and the RSI have turned neutral to bullish signaling that sideways to higher prices are possible near-term. If December renews the rally off October's low, August's high crossing at $91.35 is the next upside target. Close below the 50-day moving average crossing at $83.40 confirm that a short-term top has been posted. First resistance is November's high crossing at $87.58. Second resistance is October's high crossing at $89.80. First support is the 50-day moving average crossing at $83.40. Second support is the October 9th low crossing at $81.35.

December cattle closed up $0.60 at $151.88.

December cattle closed higher on Wednesday. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If December extends this week's decline, the 50-day moving average crossing at $150.36 is the next downside target. If December renews the rally off September's low, the June-2015 high on the monthly continuation chart crossing at $156.48 is the next upside target. First resistance is October's high crossing at $154.20. Second resistance is the June-2015 high on the monthly continuation chart crossing at $156.48. First support is the 50-day moving average crossing at $150.36. Second support is the October 14th low crossing at $146.90.

January Feeder cattle closed up $0.63 at $183.65.

January Feeder cattle posted an inside day with a higher close on Wednesday as it consolidated some of Tuesday's decline. The mid-range close sets the stage for a steady to higher opening when Thursday's session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways trading is possible near-term. If January extends this week's decline, October's low crossing at $172.10 is the next downside target. If January renews the rally off October's low, the 62% retracement level of the August-October decline crossing at $184.56 is the next upside target. First resistance is the 50-day moving average crossing at $185.53. Second resistance is November's high crossing at $187.50. First support is Tuesday's low crossing at $182.38. Second support is October's low crossing at $172.10.

FOOD & FIBERhttp://quotes.ino.com/ex changes/?c=food

December coffee closed lower on Wednesday as it extends the decline off August's high. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If December extends the decline off August's high, the 75% retracement level of the 2020-2022 rally crossing at $14.74 is the next downside target. Closes above the 20-day moving average crossing at $17.45 would signal that a low has been posted. First resistance is the 20-day moving average crossing at $17.45. Second resistance is November's high crossing at $18.34. First support is the 75% retracement level of the 2020-2022 rally crossing at $14.74. Second support is the 87% retracement level of the 2020-2022 rally crossing at $13.04.

December cocoa closed slightly higher on Wednesday. The high-range close sets the stage for a steady to slightly higher opening on Thursday. Stochastics and the RSI have turned neutral to bearish signaling sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 24.09 would signal that a short-term top has been posted. If December extends the rally off September's low, the June 6thhigh crossing at 25.89 is the next upside target.

March sugar closed slightly lower on Wednesday. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off September's low, April's high crossing at 20.63 is the next upside target. Closes below the 10-day moving average crossing at 19.37 would confirm that a short-term top has been posted while opening the door for additional weakness near-term.

December cotton closed slightly lower on Wednesday as it extends the trading range of the past two-weeks. The low-range close sets the stage for a steady to lower opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the aforementioned rally, the reaction high crossing at 97.77 is the next upside target. Closes below the 20-day moving average crossing at 81.54 would signal that a top has been posted.

Thanks a ton tallpine!

Crude is getting crushed which is probably the biggest negative on grains right now.

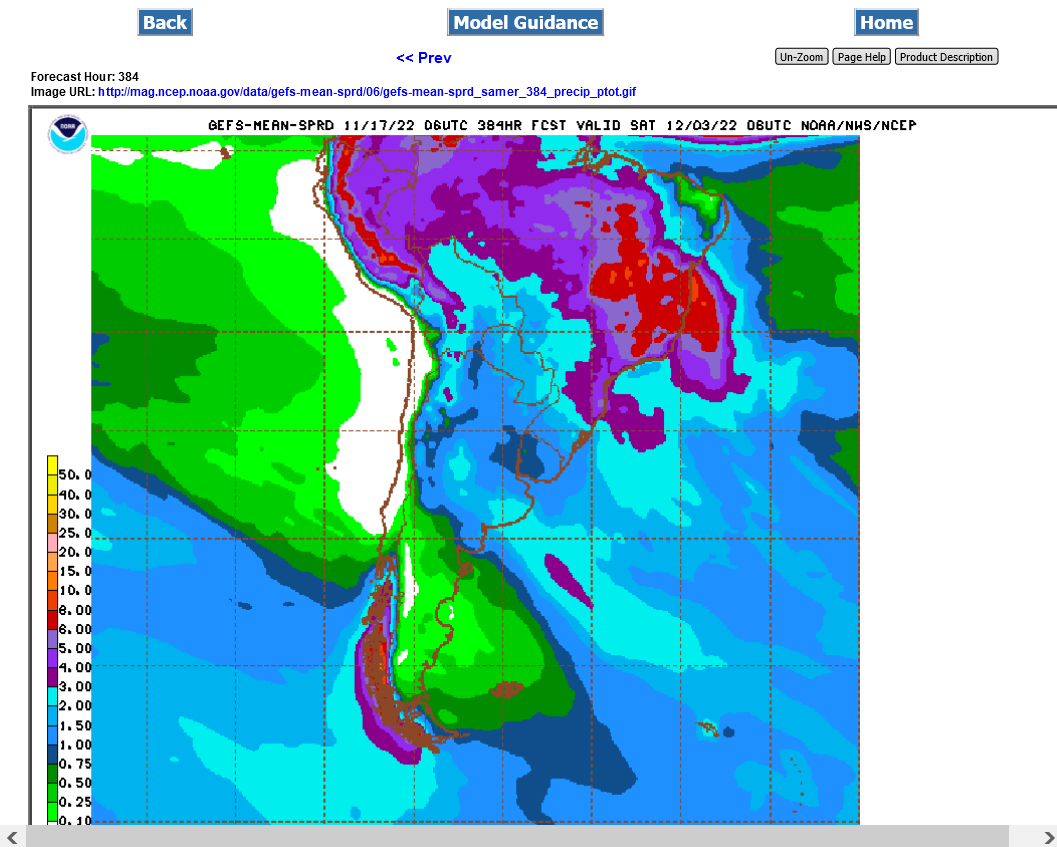

Still the pocket of less than ideal rain in key production, N.Argentina drought areas but at least SOME rain. 2 weeks below for the last GFS ensemble.

Great rains for coffee.

https://mag.ncep.noaa.gov/Image.php