I have to say, I'm pretty impressed with beans strength. There is nothing bullish about beans. Sales and exports are slow, there is a big crop developing as we speak.

My personal opinion is they should be $2-3 cheaper. It's funny reading analytical opinions where they keep grinding on potential Chinese demand (and have been for weeks/months) but it never materializes.

Thanks Jim!

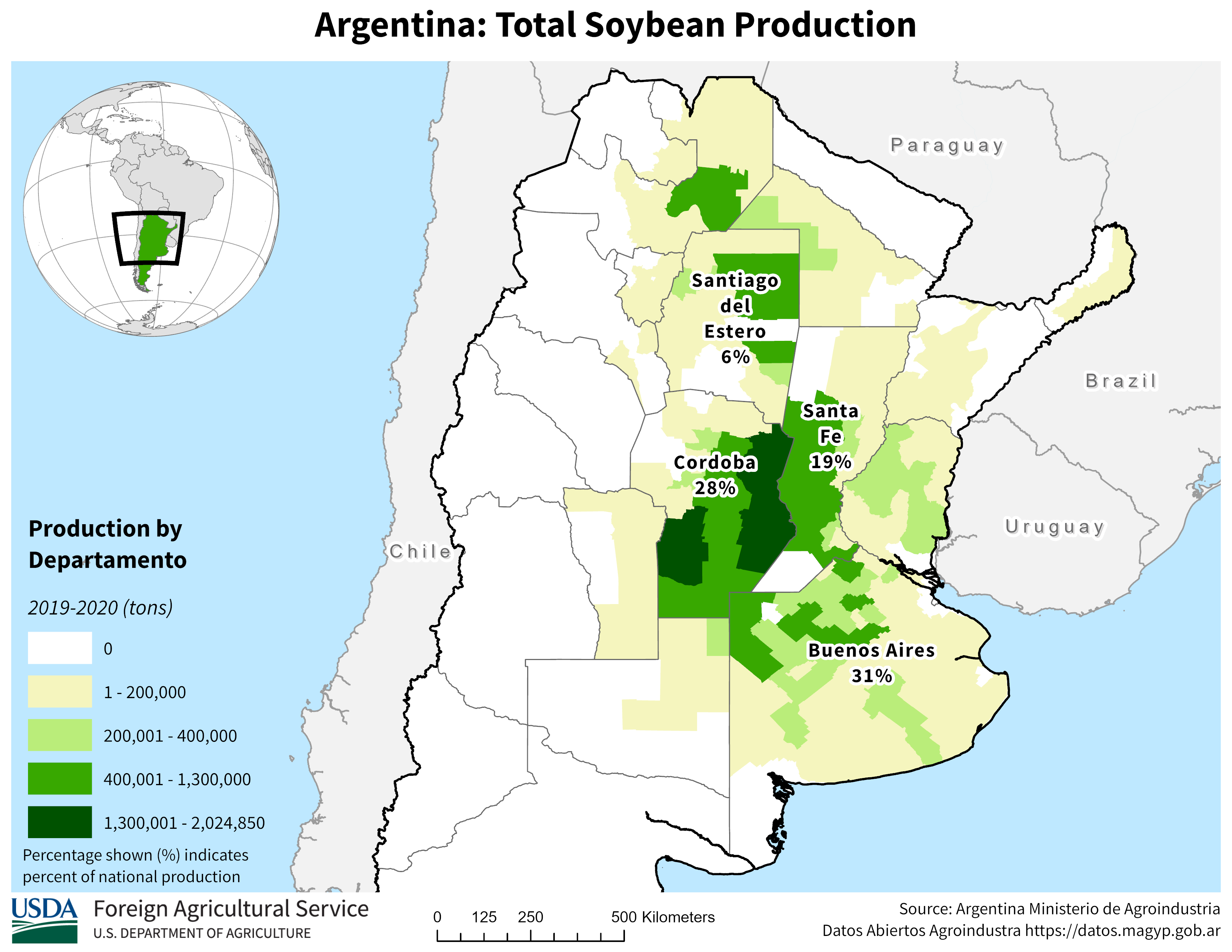

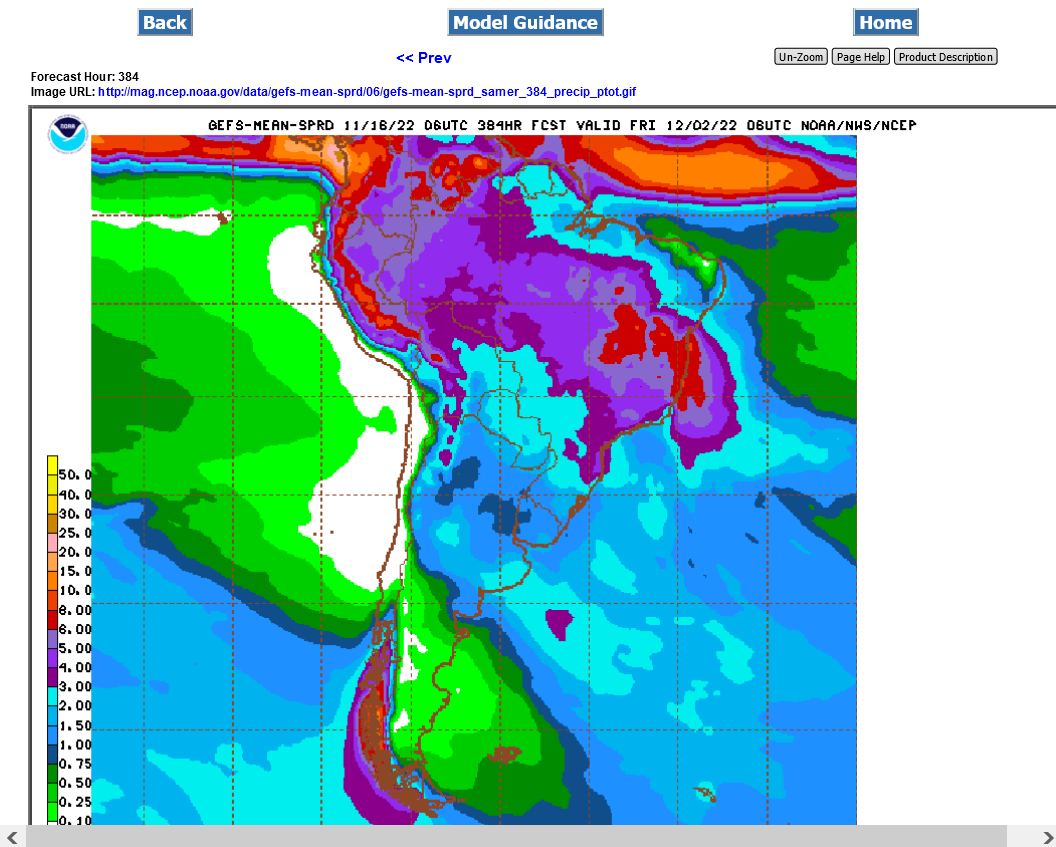

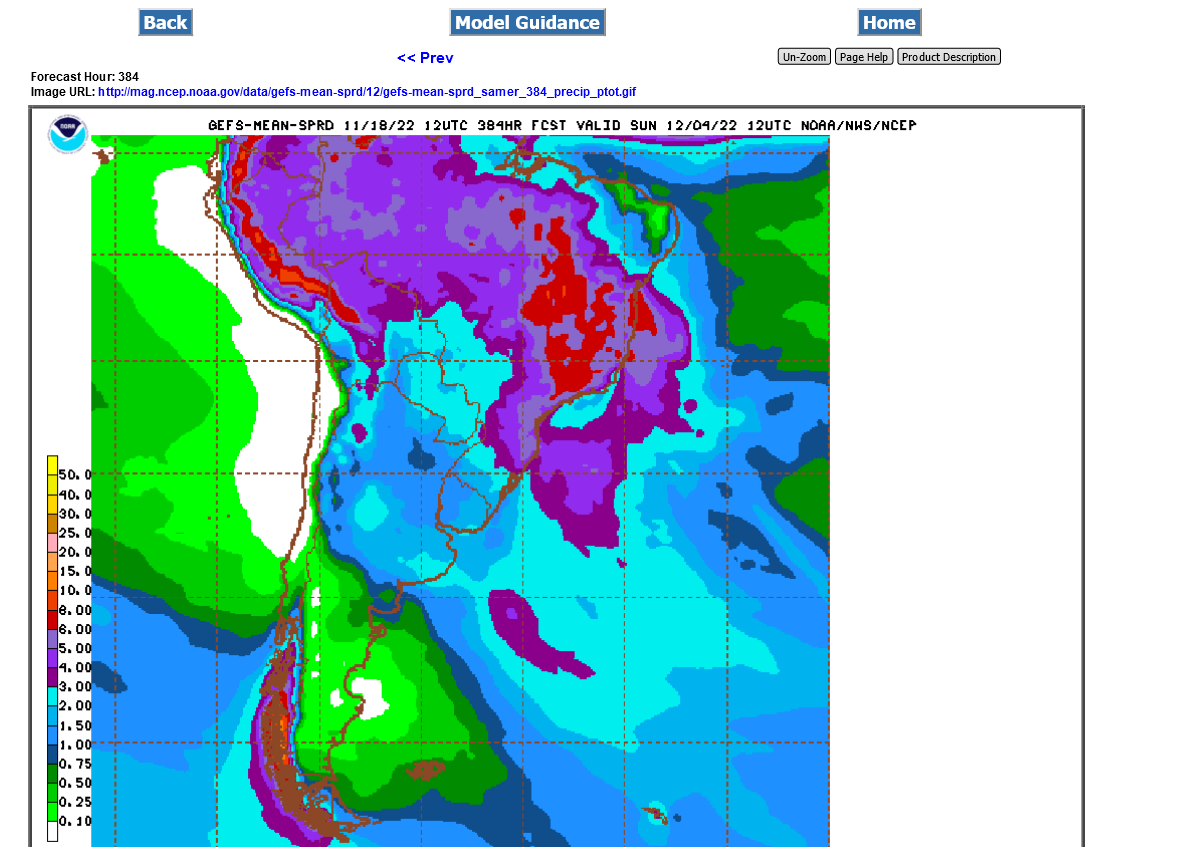

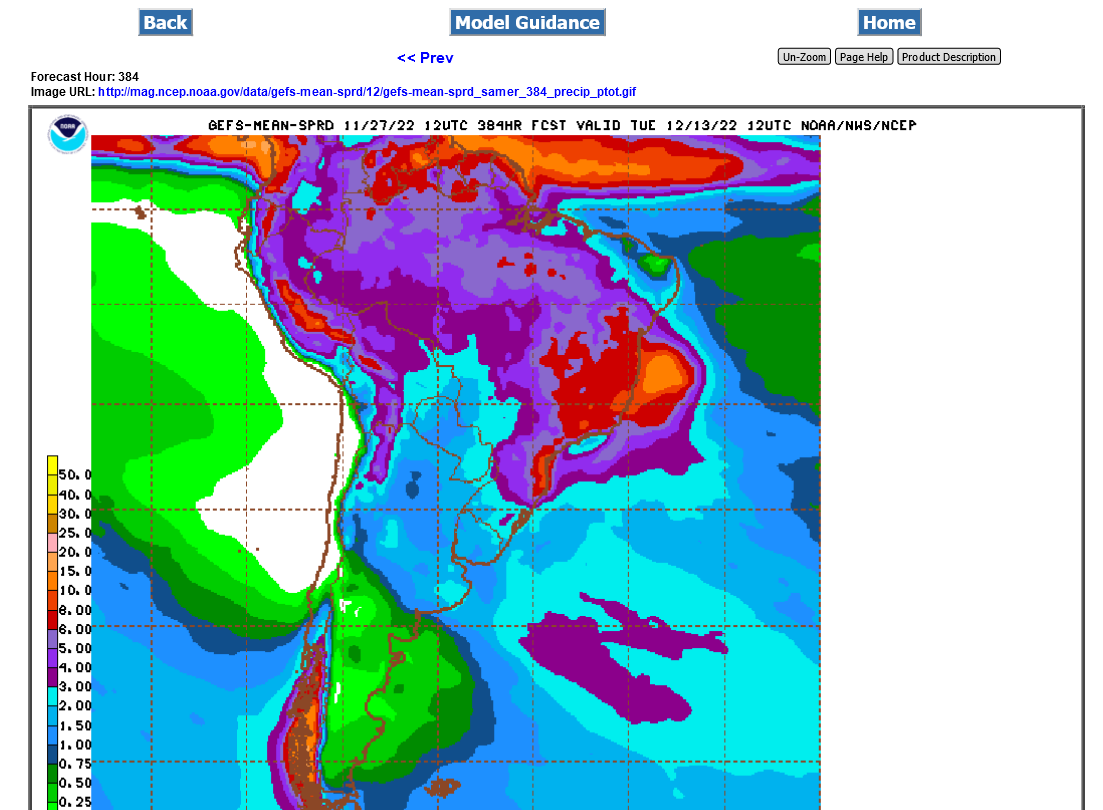

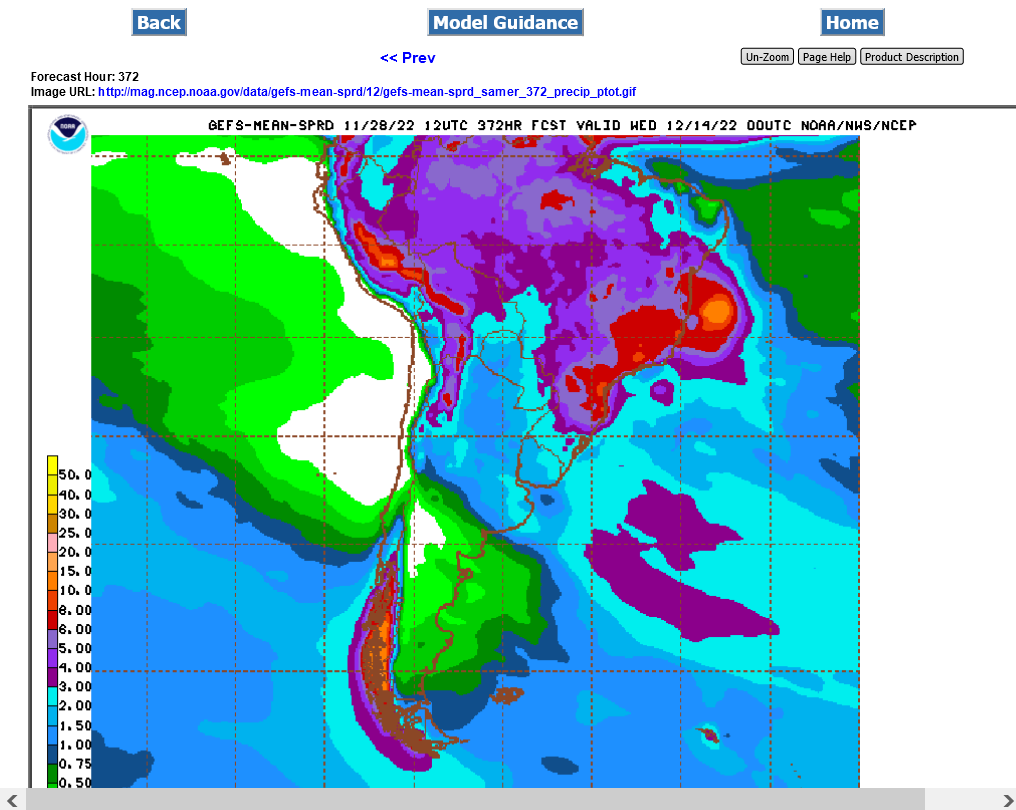

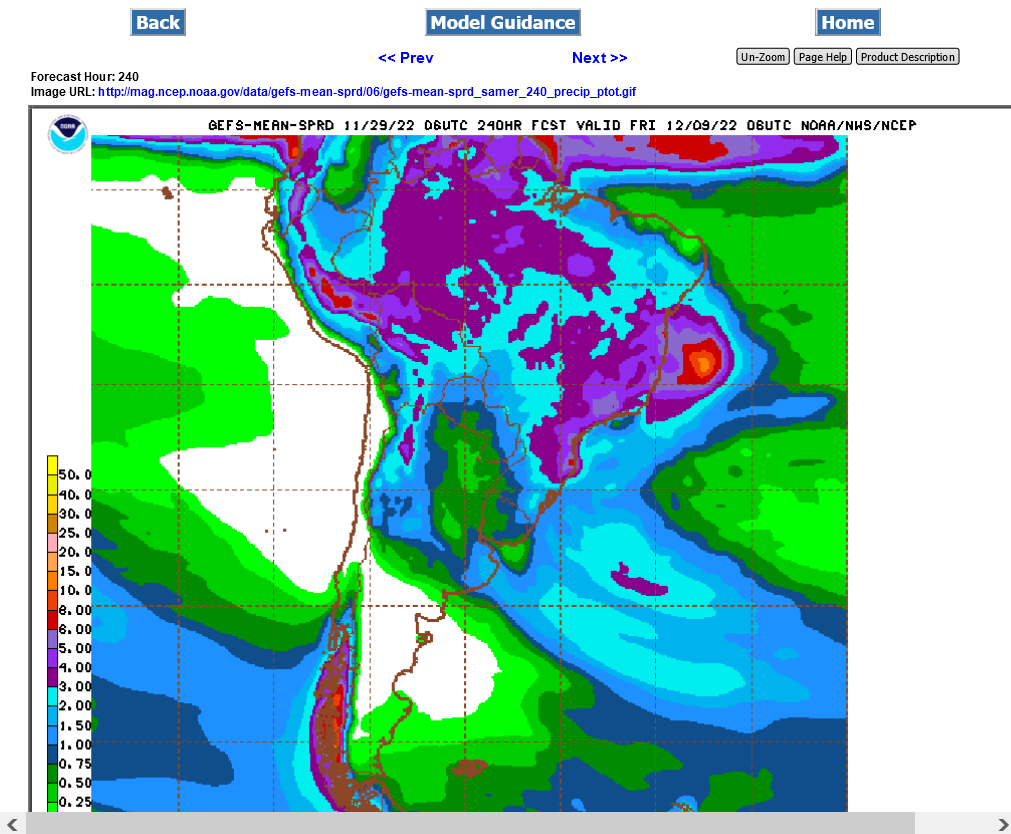

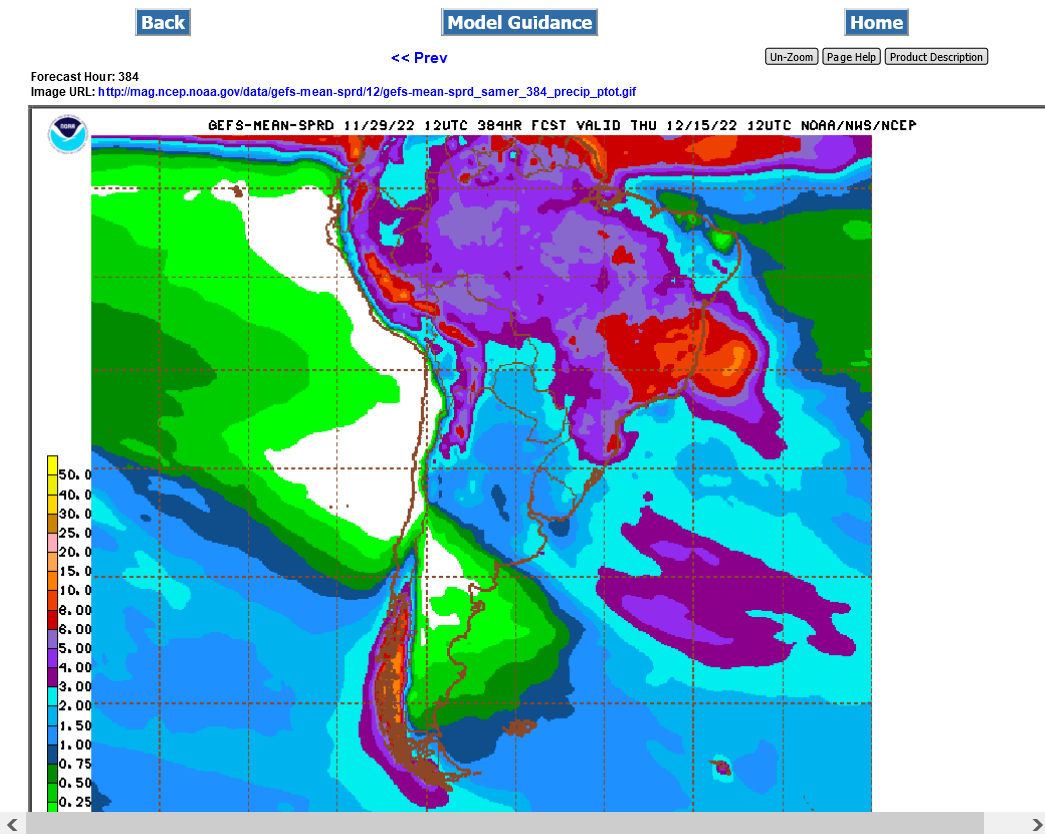

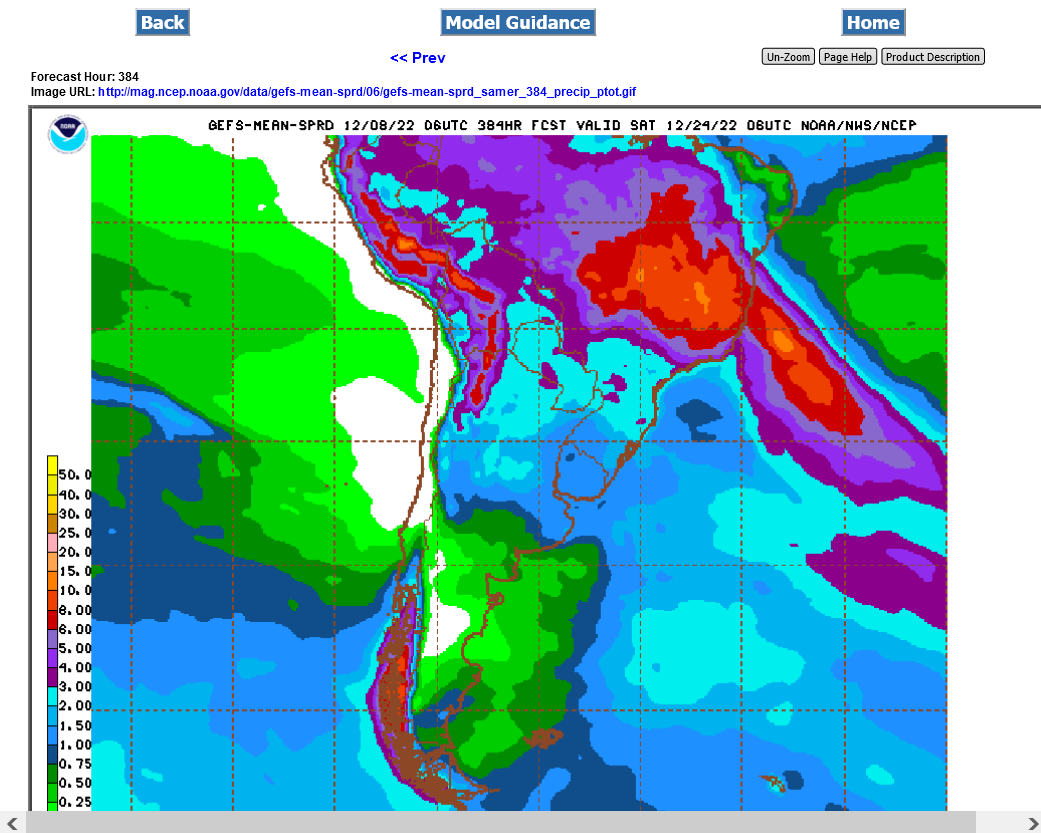

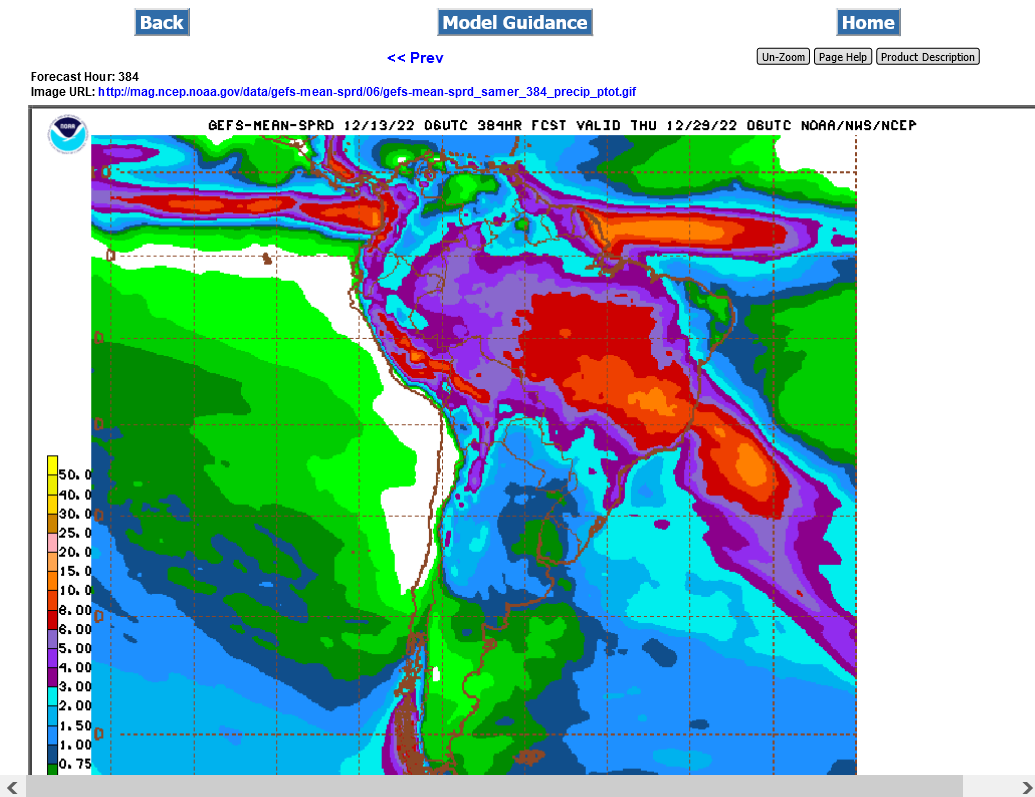

There's a major drought in the key growing region of N. Argentina right now:

https://www.marketforum.com/forum/topic/89848/

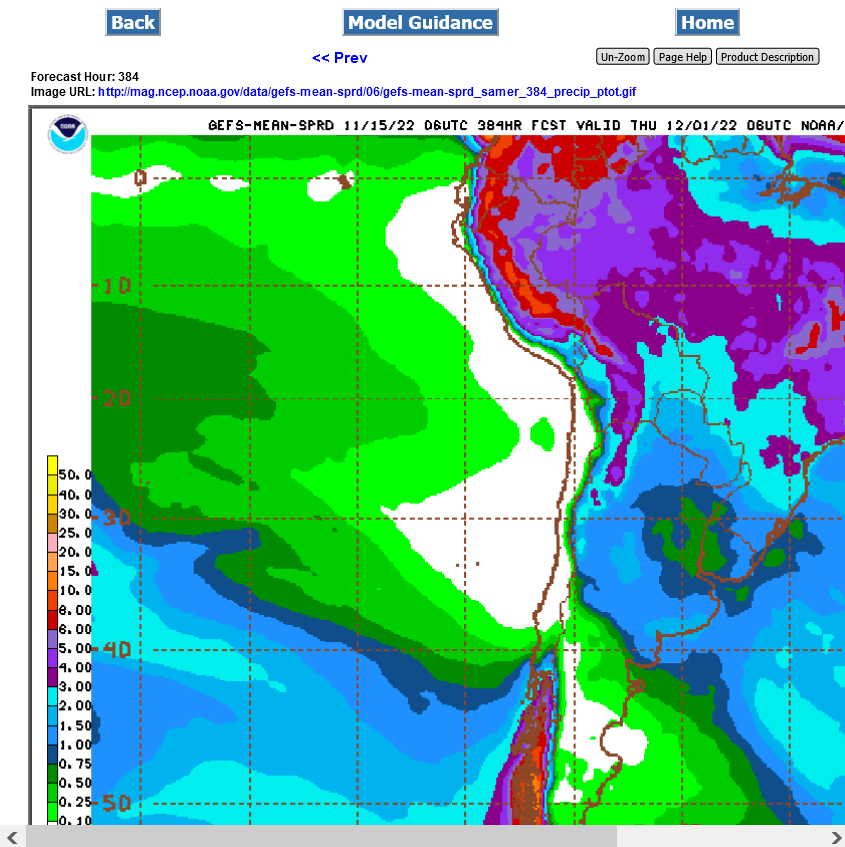

The hole in the big precip is right over some of the driest areas.

https://ipad.fas.usda.gov/rssiws/al/ssa_cropprod.aspx

Rains filling in just a bit in the driest area on the just out 18z GFS.

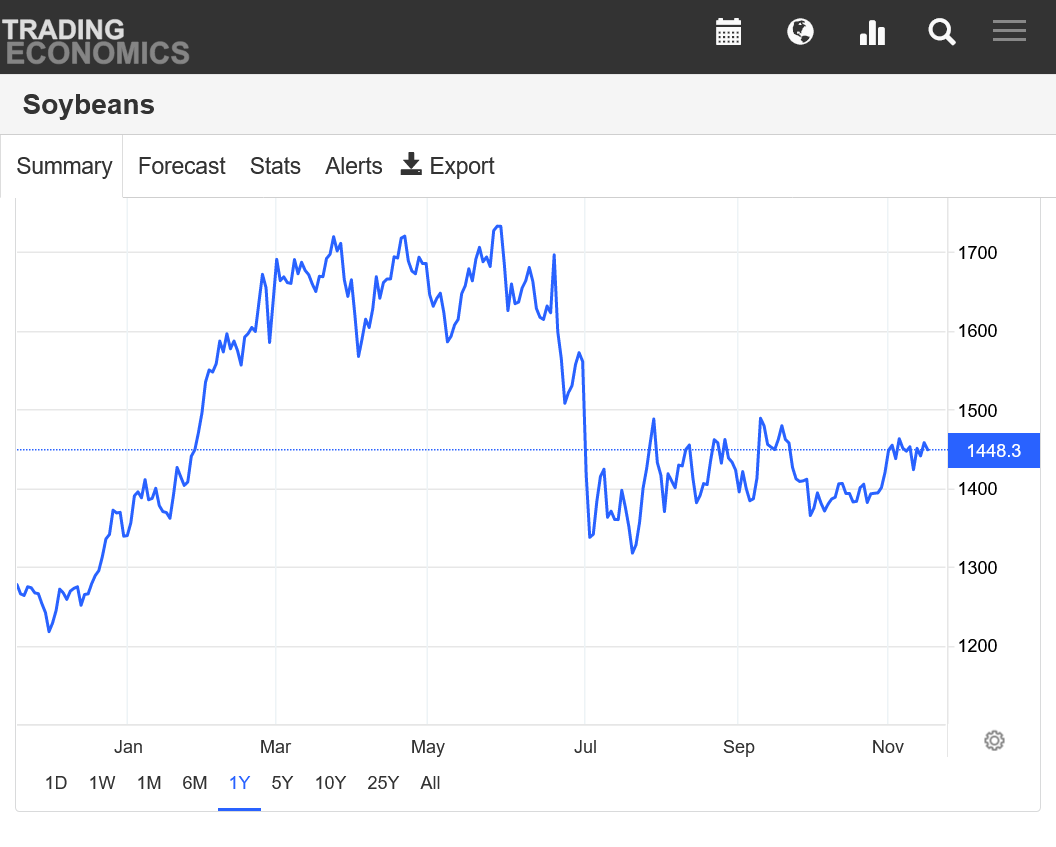

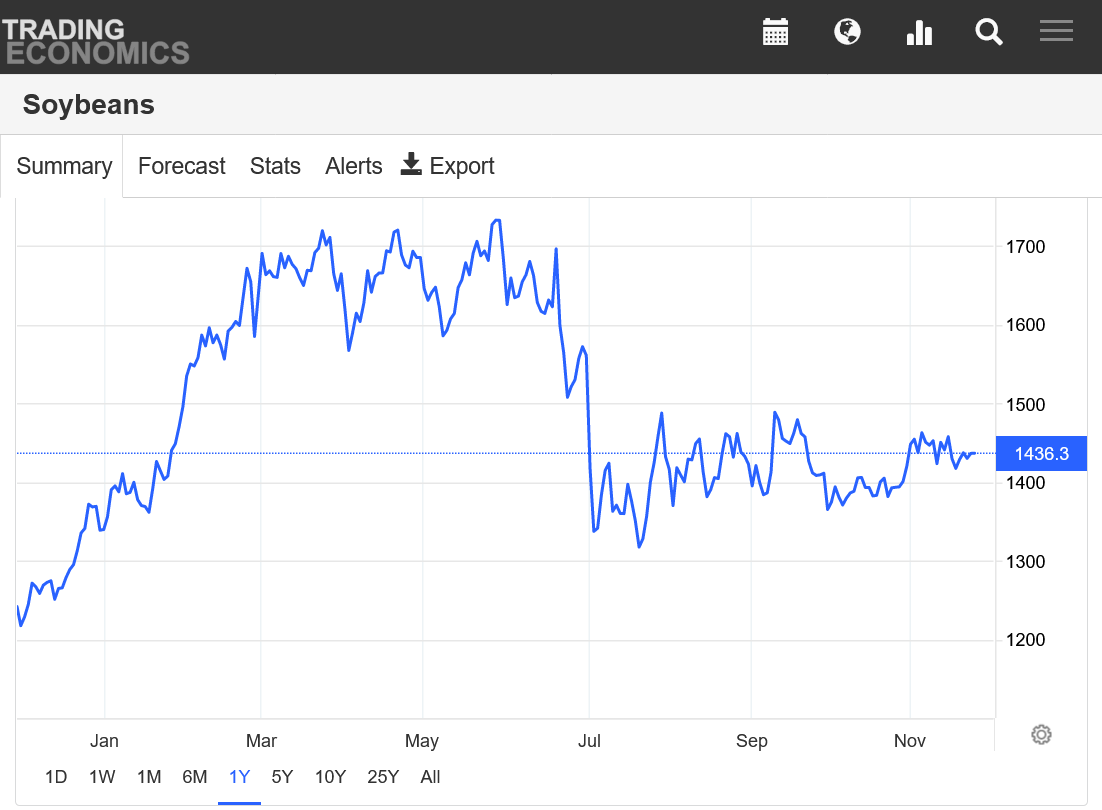

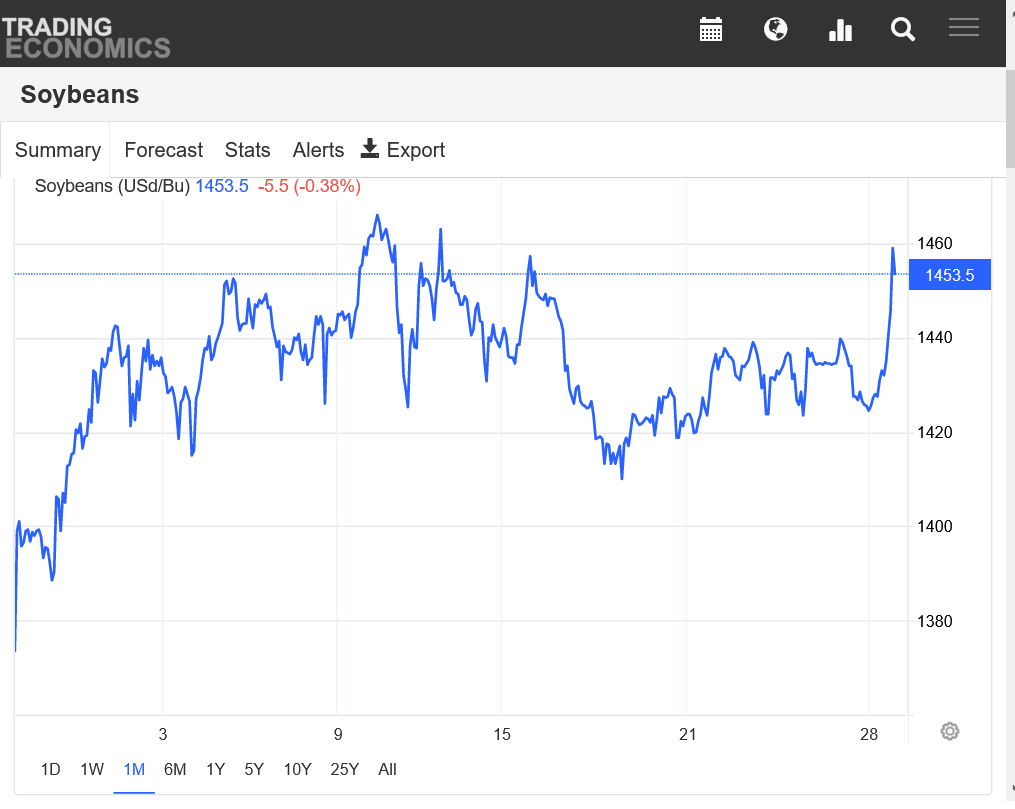

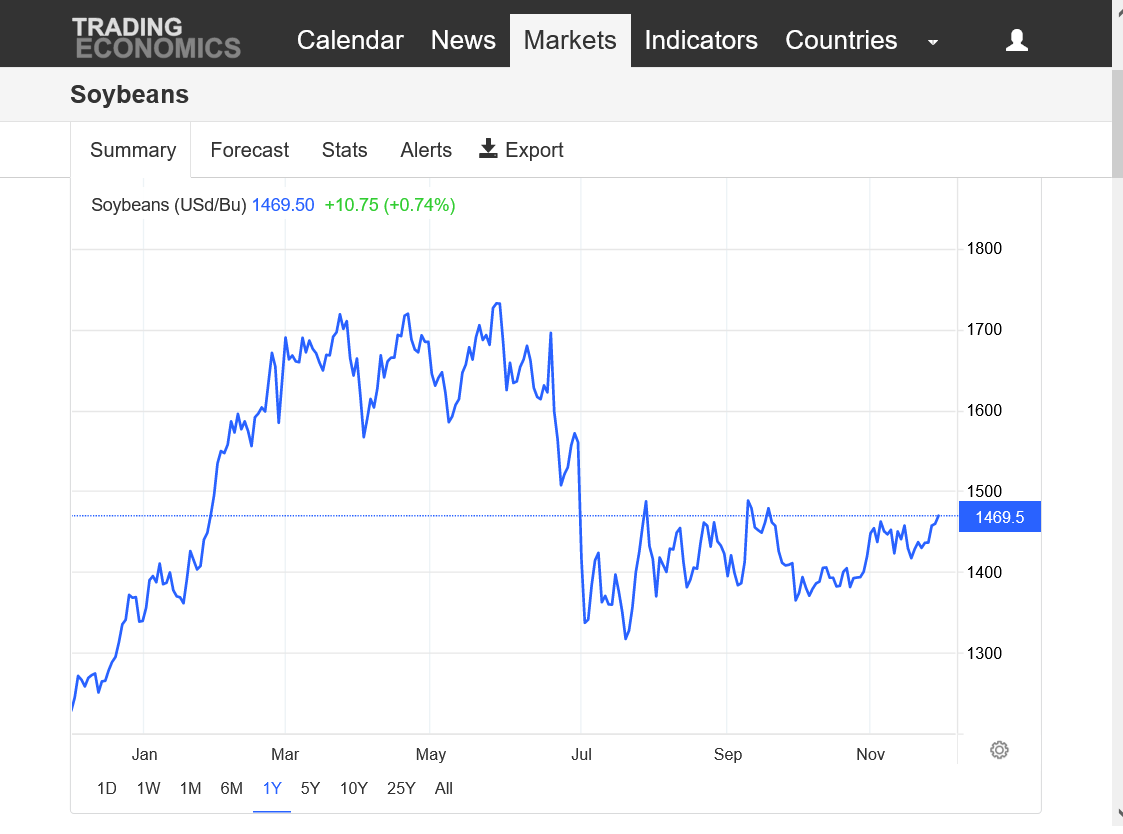

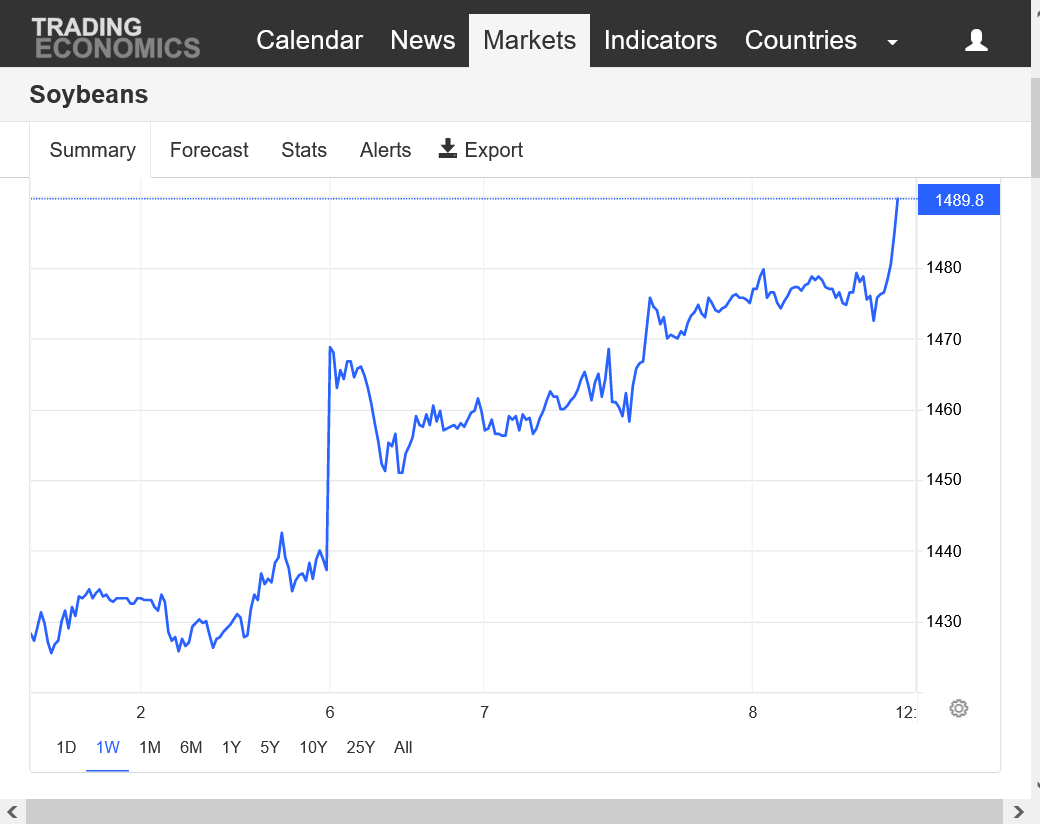

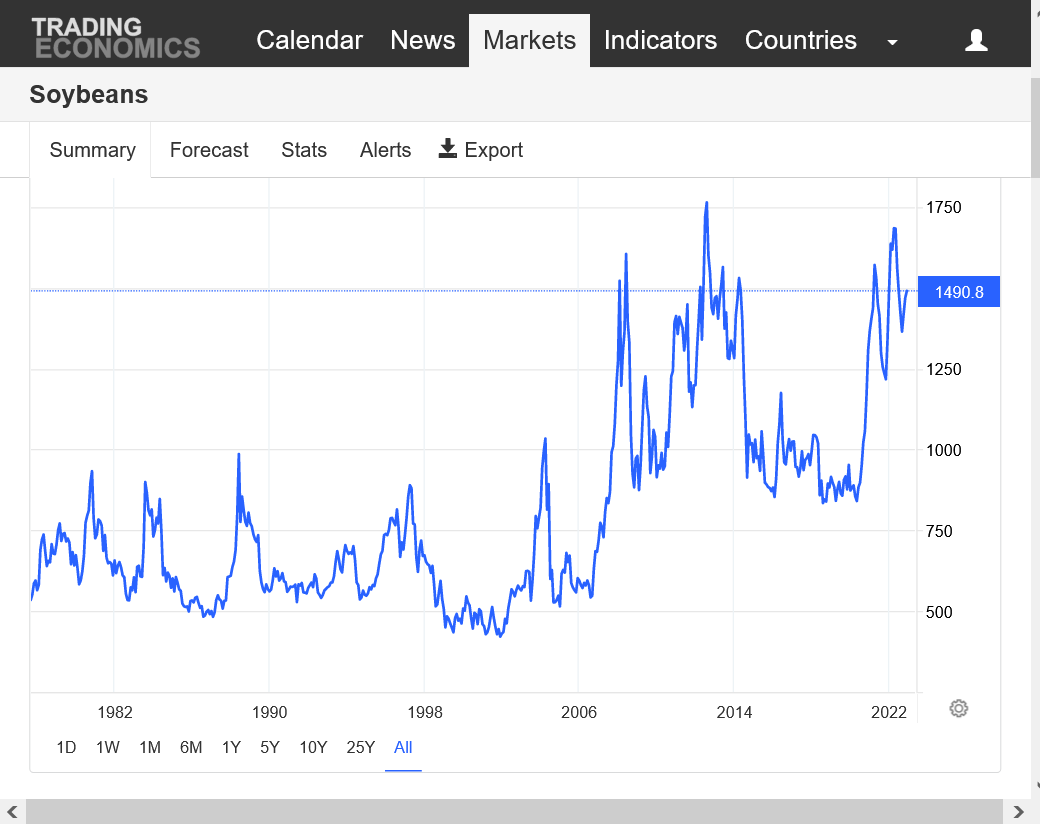

Not sure why you consider beans strong Jim? I just looked at a chart and it has been going sideways for months.

Disclaimer: I know nothing of the fundamentals of grains.

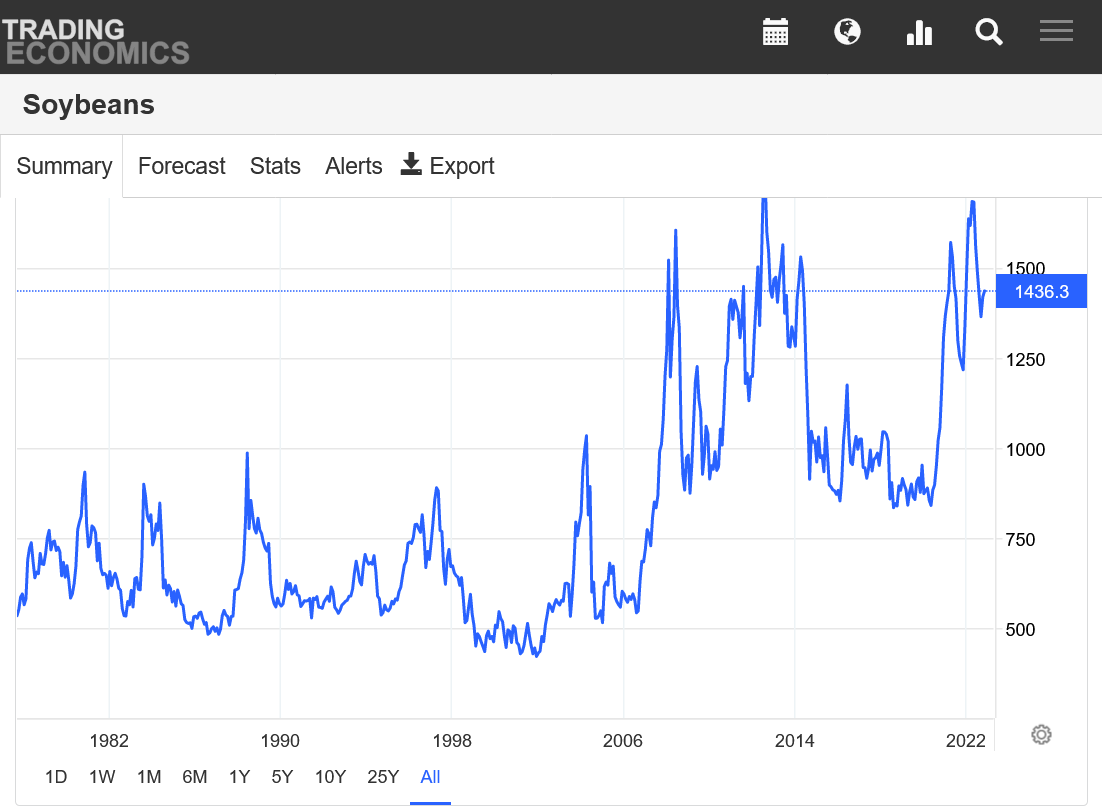

https://tradingeconomics.com/commodity/soybeans

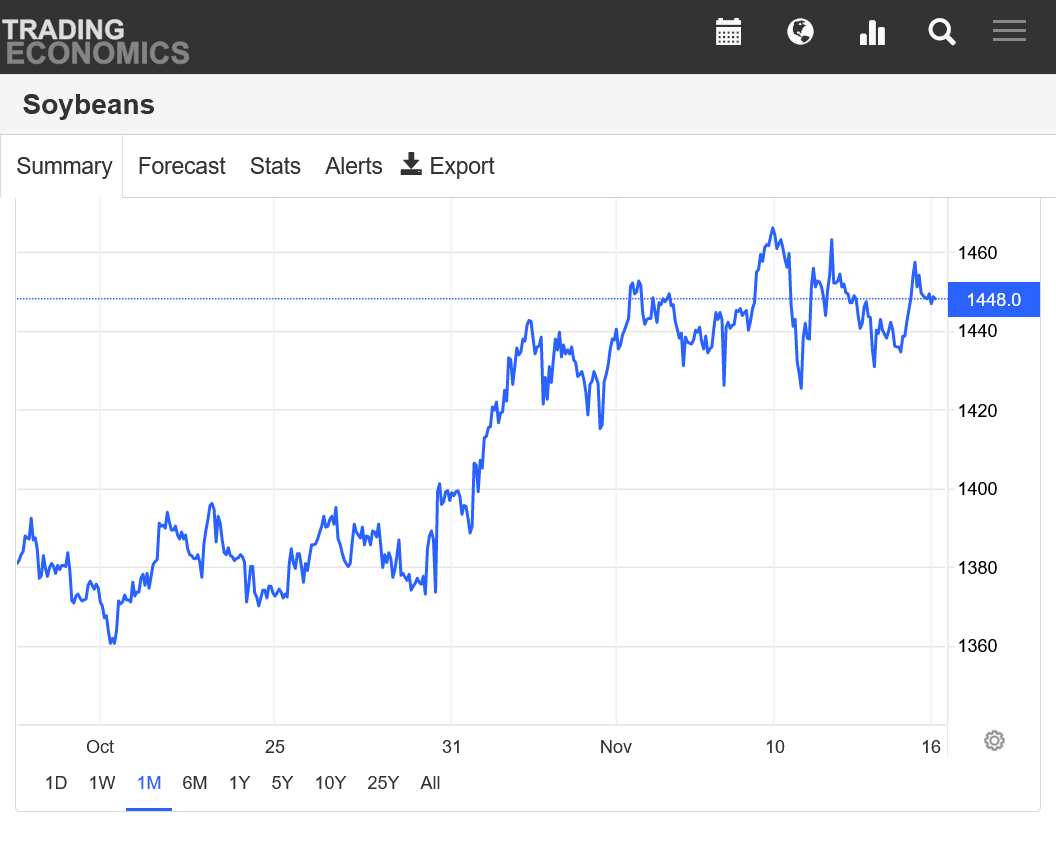

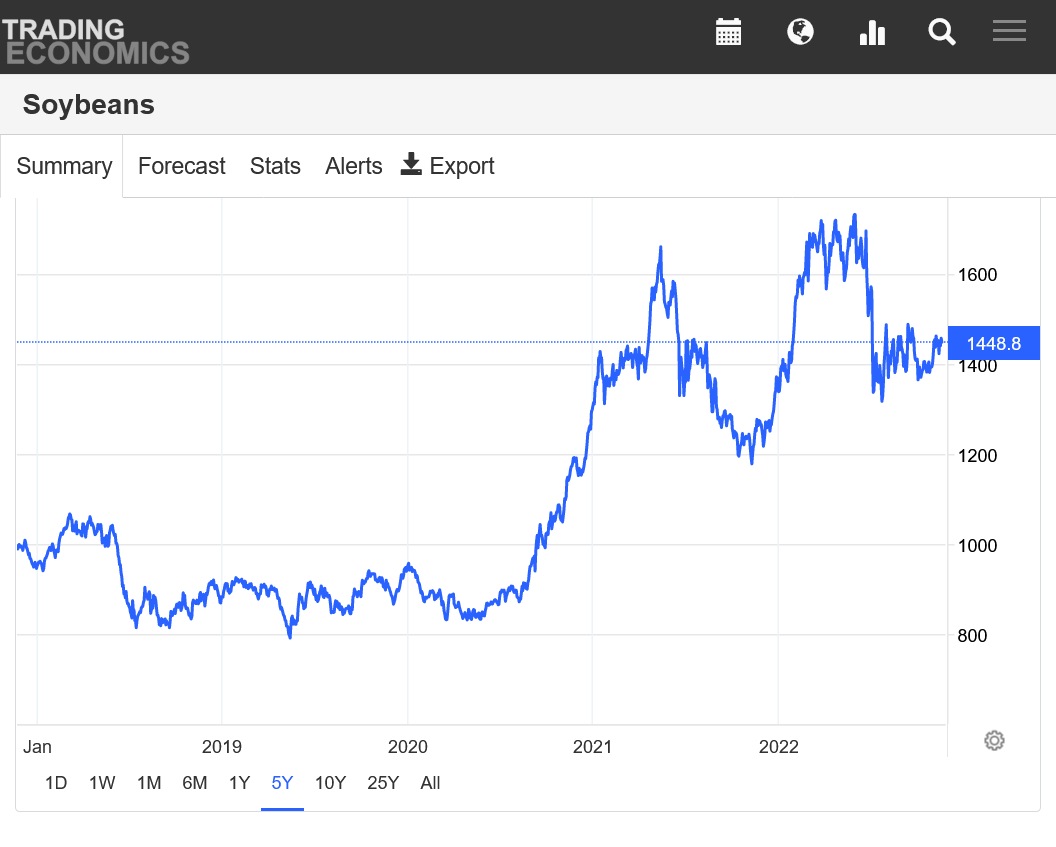

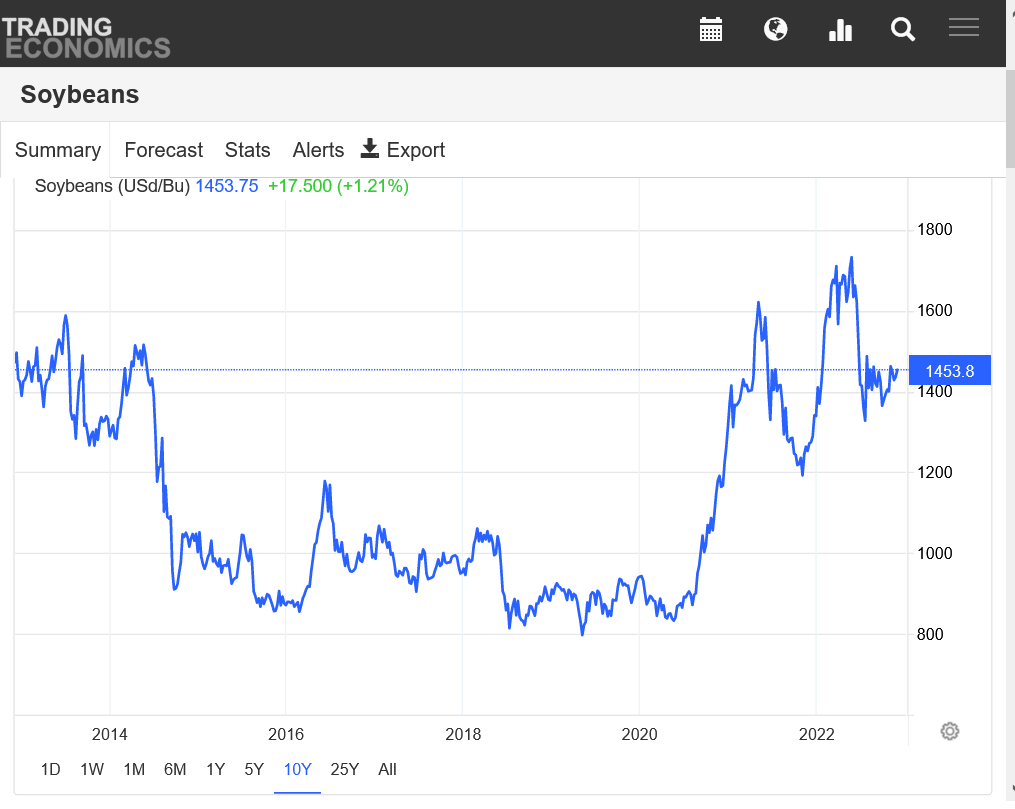

Beans 30 days. Up almost $1. Uptrend. Seems like strength to me the last month, joj!

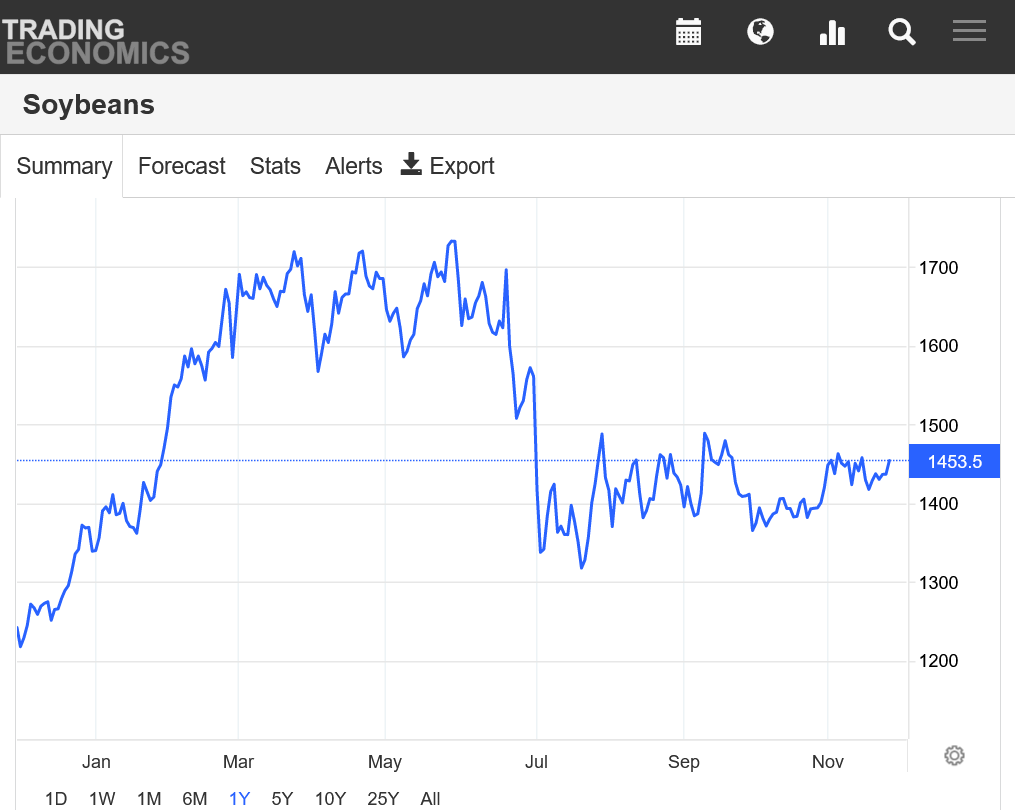

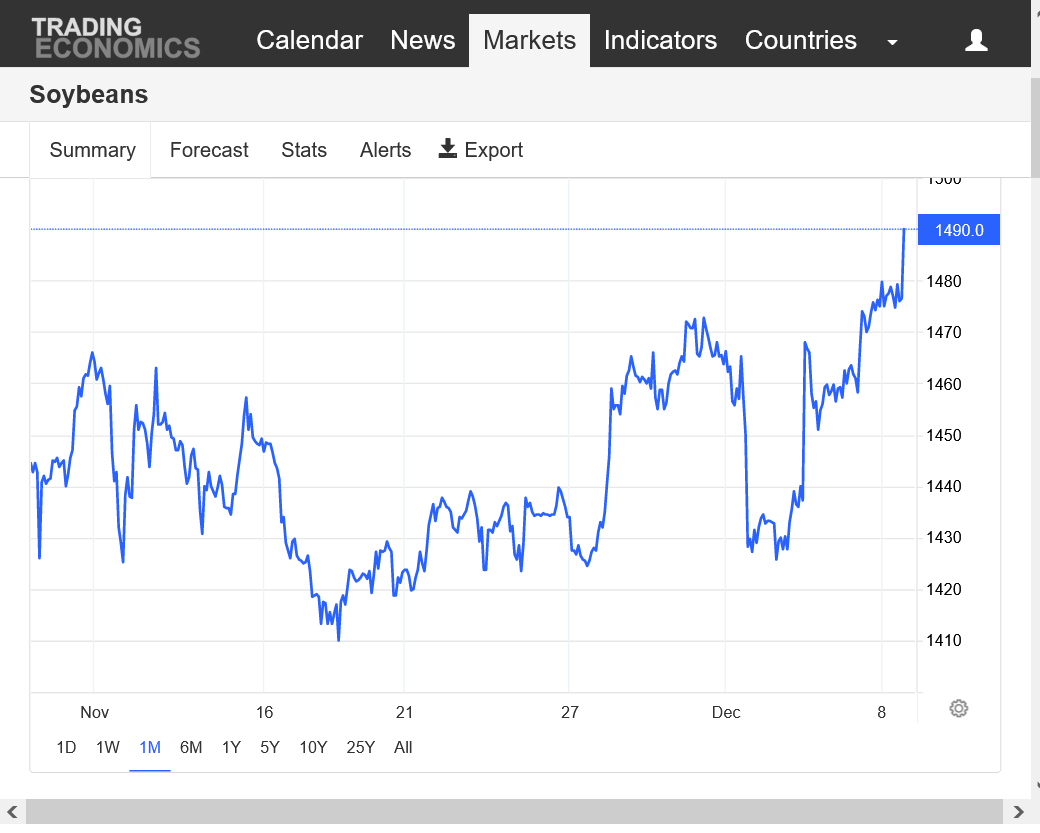

1 year below. Sideways/pause/wedge, since the start of July.

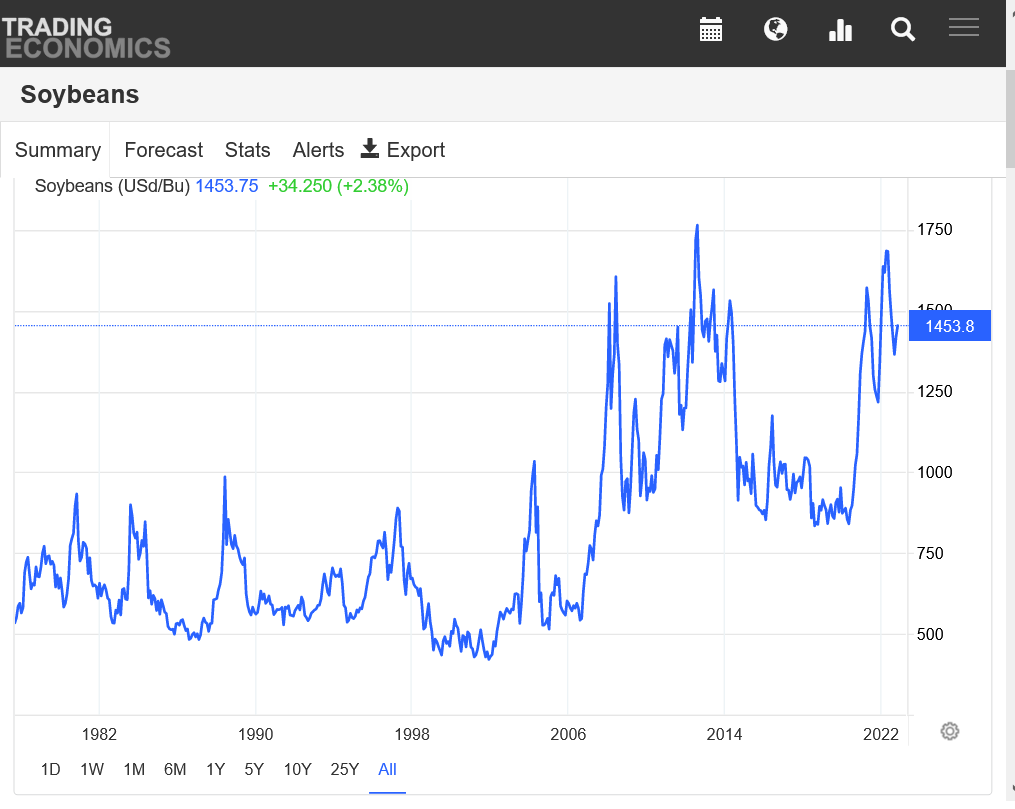

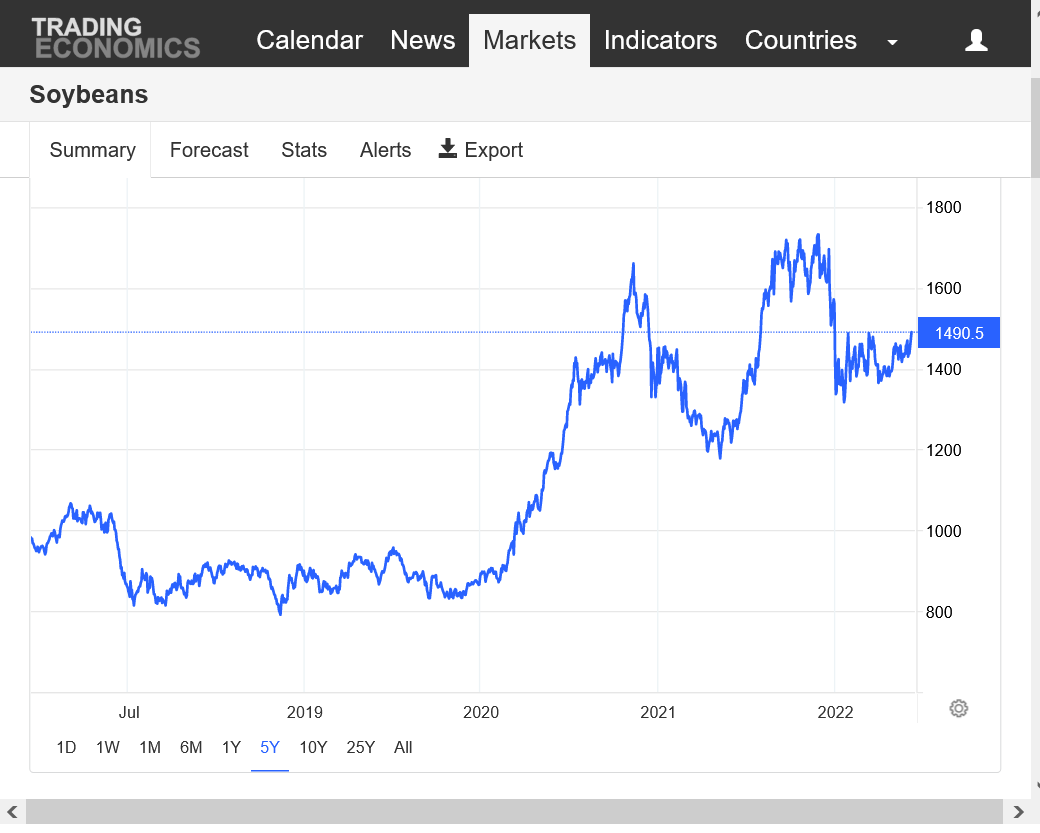

5 year below. Strong UPTREND since late 2021 intact. Higher lows. Higher high.

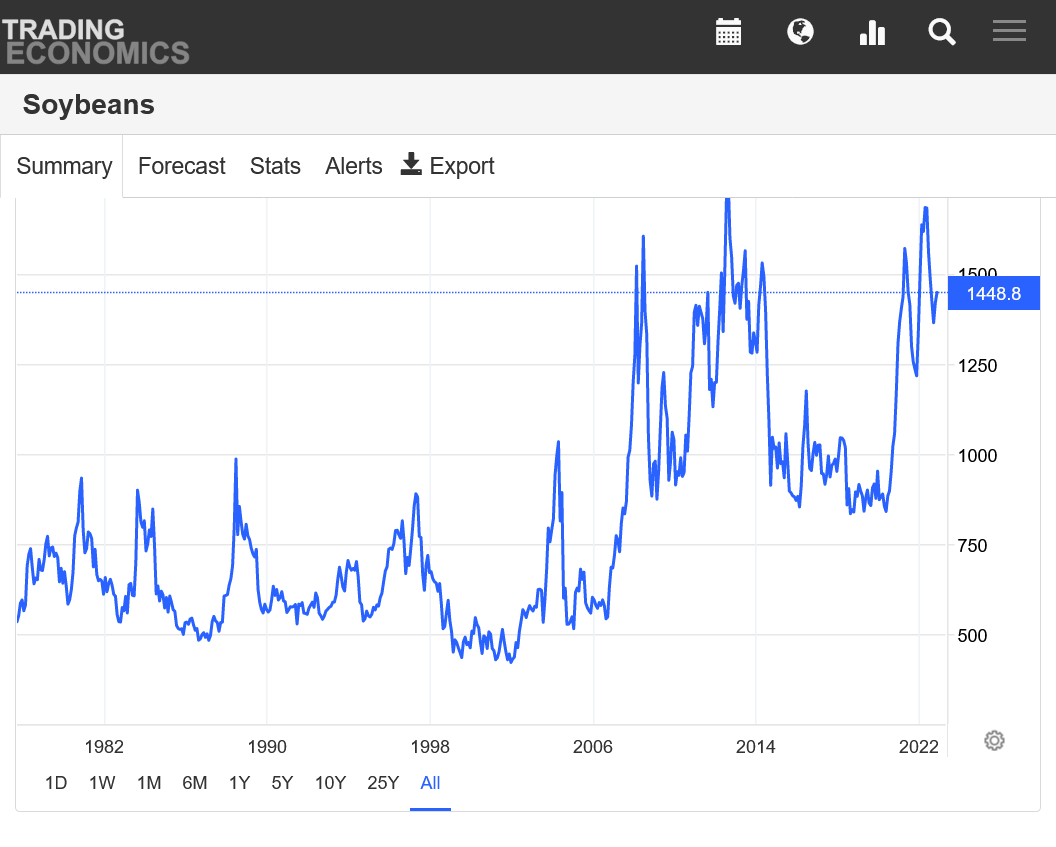

40+ years below. Potential uptrend the last 15 years? Triple top?

I see that one month uptrend. Perhaps in sympathy with gold and silver of late?

Historically, $14+ bean prices IMO are pretty darn strong.

I can appreciate that Argentina is having some weather issues, but that happens every year somewhere. My guess is that before this is all over someone from some agency will post a number of 160mmt for SA bean production.

Agree jim!

Might be the highest price in history for this time of year. We can see from the last graph, we've only traded above this for very brief periods that take up, probably something like 5% or less of the time and on 3 other occasions.

However, a severe drought does NOT happen every year to a huge area in a key producing country.

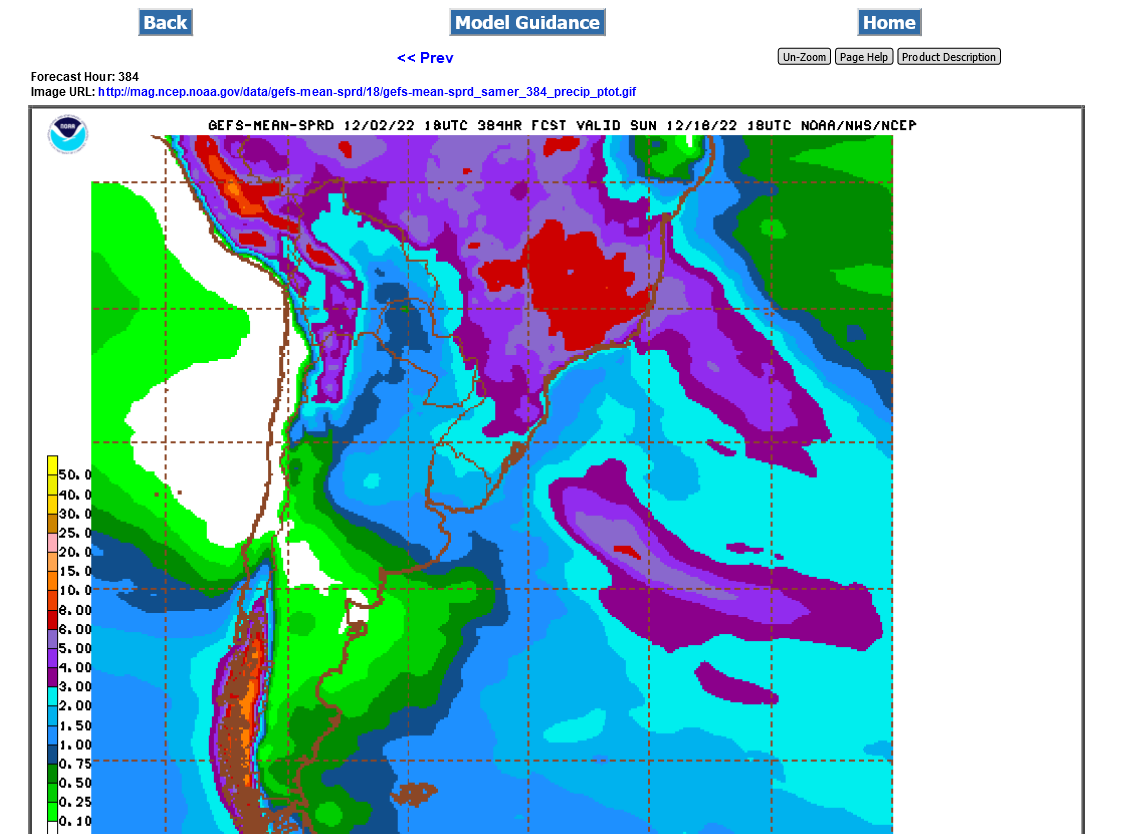

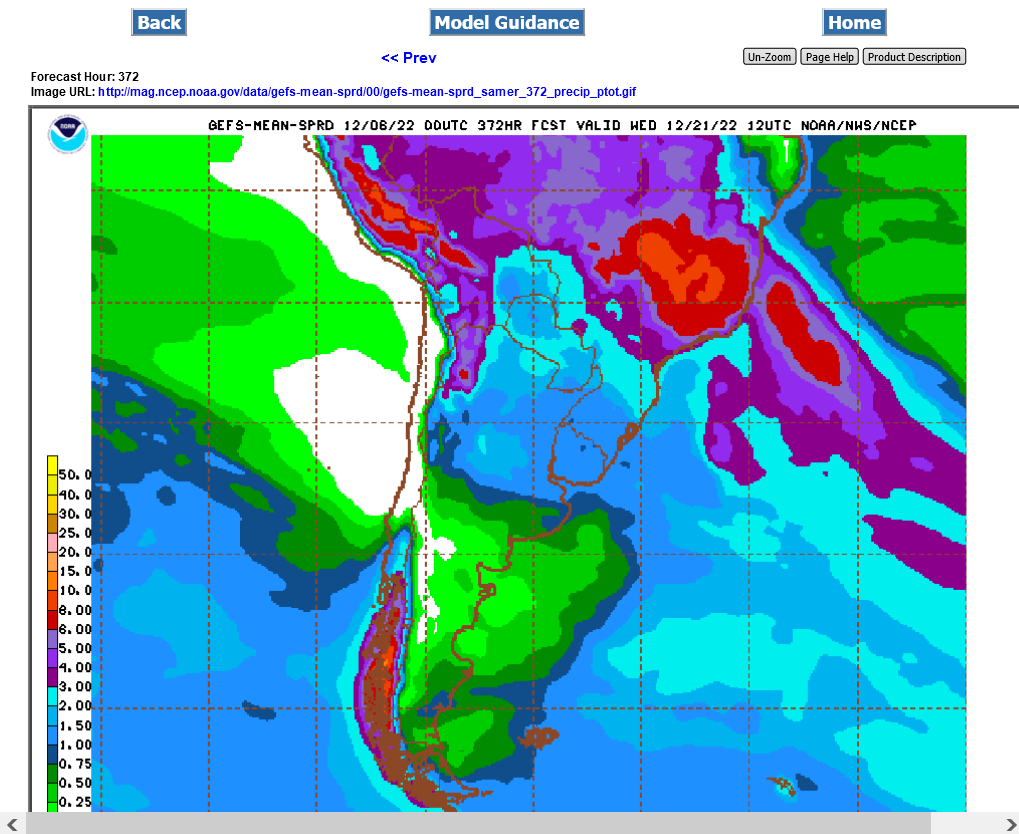

As mentioned yesterday the GFS ensemble mean has rains filling in a bit for the driest areas. Still not nearly enough to help much but just a slight uptick in the amount compared to earlier this week.

Again, just my opinion, but, over the last couple years, we have seen crops grown with little more than spit. Yes, Arg might be having a drought, but even weak rains will keep those beans alive and then one solid rain and bean plants will double in size almost over night.

But it’s just bar stool talk at this point. Lots of growing season to go.

Less spit in the forecast for drought spots of n.argentina in the last update (=:

Still just barely enough rain to get by in N.Argentina's drought area. Around an inch in 2 weeks with heat. Soils there are well drained and crops require at least an inch/week to do well.

Here's more:

IMHO alot of the strength in soybeans is coming from strength in soy oil. Will it continue? Who knows.

buck,

You're absolutely on to something there! Wonderful point!!!

+++++++++++++++++++

Add that to this, and it's making more sense!

Diesel/Heating oil crisis

15 responses |

Started by metmike - Nov. 18, 2022, 1:45 a.m.

The politics of renewable fuels tend to get some on this forum a little agitated ;), but focusing on the markets...

There is certainly uncertainty (<intentional, lol) in the future of renewable diesel, but I think it is clear that some users (airlines for one i think; trucking no way) will be willing to pay the premium for it. What the ramp up in demand turns out to be is anyone's quess. So future demand is positive but fuzzy. Supply looks to be increasing with multiple plants coming online in '23 and '24. A big question for soybean growers is how much will be produced from soyoil verses other oil/fat feedstocks. To me that is a big question.

So, getting around to trade ideas, which coming from me has less value than the electricity required to transmit this message over the interweb, it would lead me to the conclusion of strength in soybeans and soyoil, with weakness in soymeal which will essentially be a byproduct.

FWIW

My take is a little different. The government wants a significant ramp up in EV's. Whether it's cars or trucks and what the government wants, the government gets.

I'm not sure how ethanol and soyoil will have any increased use if GM alone expects to sell 1 million EV's in a couple years. That is a lot of fossil fuel use gone to the wayside. I think that has something to do with the fact that crude prices aren't going through the roof.

China is going hard on EV's. Europe is going hard on EV's. We live in interesting times. It will be interesting to see how this all fleshes out.

Jim,

Very true that electric cars don't use a combustion engine and the more they increase, the less ethanol and biodiesel will get blended but they do use fossil fuels for 90% of their electric charge that got burned elsewhere and transported thru power lines.

Also, all the trucks and trains that use most of the diesel are not converting to electric right now like the cars are.

California tells electric car owners NOT to charge vehicles. Energy crisis in California because of unreliable, fake green/anti environmental energy!September 2022 https://www.marketforum.com/forum/topic/88534/

buck,

I've never met a producer that wasn't a front row, loud cheerleader for bio fuels.

I would be the exact same way.

The war on fossil fuels would kill those markets by design if they were ever able to implement(impose) their impossible fake green, fake environmental energy plan.

However, since a magic green energy fairy does not exist and you can't defy the laws of physics or energy or nature........it won't happen.

The economic and inflationary (high energy cost) pain will be correlated to how far they push it.

There are lots of people grabbing power and gaining wealth that control the movement and are gatekeepers of messages, so the damage will likely go farther than common sense dictates.

In 30+ years and in retrospect, this will be seen as a sort of Dark Age and corrupt period in human history when it comes to this realm and climate science.

https://www.azquotes.com/author/30824-Richard_Lindzen

https://en.wikipedia.org/wiki/Richard_Lindzen

I agree Mike, but the fossil fuel that would power those electric power plants would be NG or gasp…coal. Not soy oil or ethanol, which is what we were talking about.

Absolutely Jim. That's a different part of this topic because electric cars are a tiny fraction of the cars out there in 2022/2023 and the diesel fuel crisis is NOW.

This is boosting demand for bio diesel that comes from soybeans.

https://www.marketforum.com/forum/topic/90891/#90926

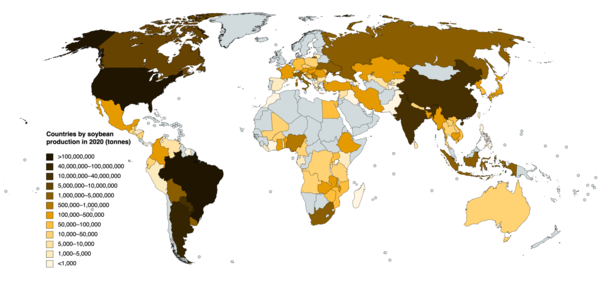

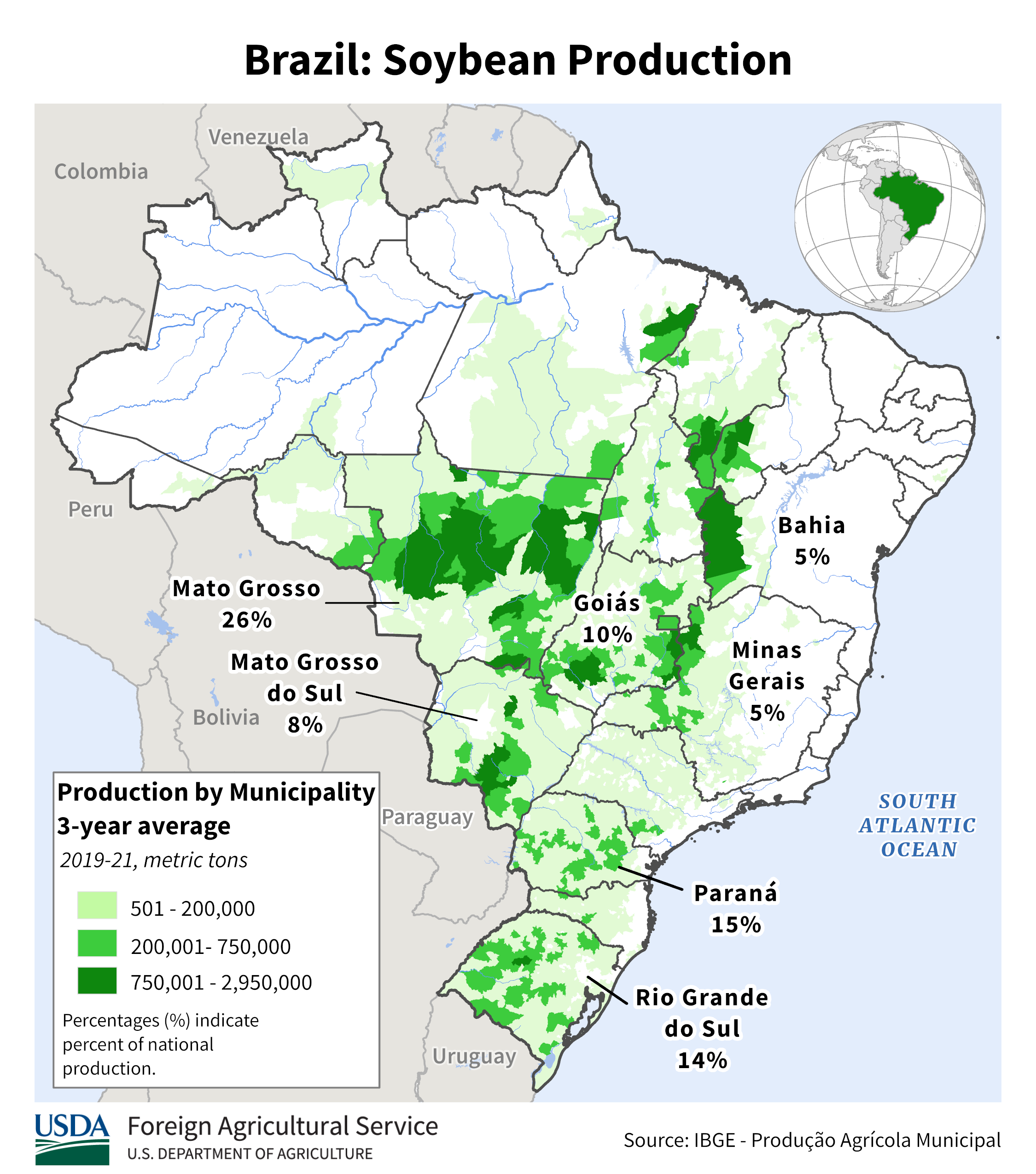

Brazil's production is much greater than Argentina and the weather in Brazil is much more important but we shouldn't overlook that this is because Brazil is massive and the production is really spread out to an area, something like 4-5 times the area growing beans in Argentina.

So the Argentina production is more concentrated in a much smaller area which is exactly where the severe drought is.

This means that the drought in that location will be high impact over extremely high production land and production losses will be greater than what Brazil would see over the same amount of land in drought.

https://en.wikipedia.org/wiki/List_of_countries_by_soybean_production

| Rank | Country | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|

| 1 | 121,797,712 | 114,316,829 | 117,912,450 | 114,732,101 | 96,394,820 | |

| 2 | 112,549,240 | 96,667,090 | 120,514,490 | 120,064,970 | 116,931,500 | |

| 3 | 48,796,661 | 55,263,891 | 37,787,927 | 54,971,626 | 58,799,258 | |

| 4 | 19,600,000 | 18,100,000 | 15,967,100 | 15,282,500 | 12,788,894 | |

| 5 | 11,226,000 | 13,267,520 | 10,932,970 | 13,158,730 | 13,159,000 | |

| 6 | 11,024,460 | 8,520,350 | 11,045,971 | 10,478,000 | 9,163,030 | |

| 7 | 6,358,500 | 6,145,000 | 7,416,600 | 7,716,600 | 6,596,500 | |

| 8 | 4,307,593 | 4,359,956 | 4,026,850 | 3,621,712 | 3,142,693 | |

| 9 | 2,829,356 | 2,990,845 | 2,942,131 | 2,671,046 | 3,203,992 | |

| 10 | 2,797,670 | 3,698,710 | 4,460,770 | 3,899,370 | 4,276,990 | |

| 11 | 1,990,000 | 2,828,000 | 1,334,000 | 3,212,000 | 2,208,000 | |

| 12 | 1,245,500 | 1,170,345 | 1,540,000 | 1,316,000 | 742,000 | |

| 13 | 1,040,000 | 980,000 | 953,571 | 538,729 | 859,653 | |

| 14 | 1,005,630 | 1,042,830 | 1,186,350 | 1,019,781 | 1,081,340 |

Concerning biodiesel, very much just IMO, the writing is on the wall and liquid fuels (bio and fossil) are on their way out. If we had the same diesel problems 10 years ago that we are having now, diesel prices would be $10 a gallon.

And a couple percent won't eat into what is going to be 160mmt crop from SA this year. Again....just my opinion.

Thanks Jim!

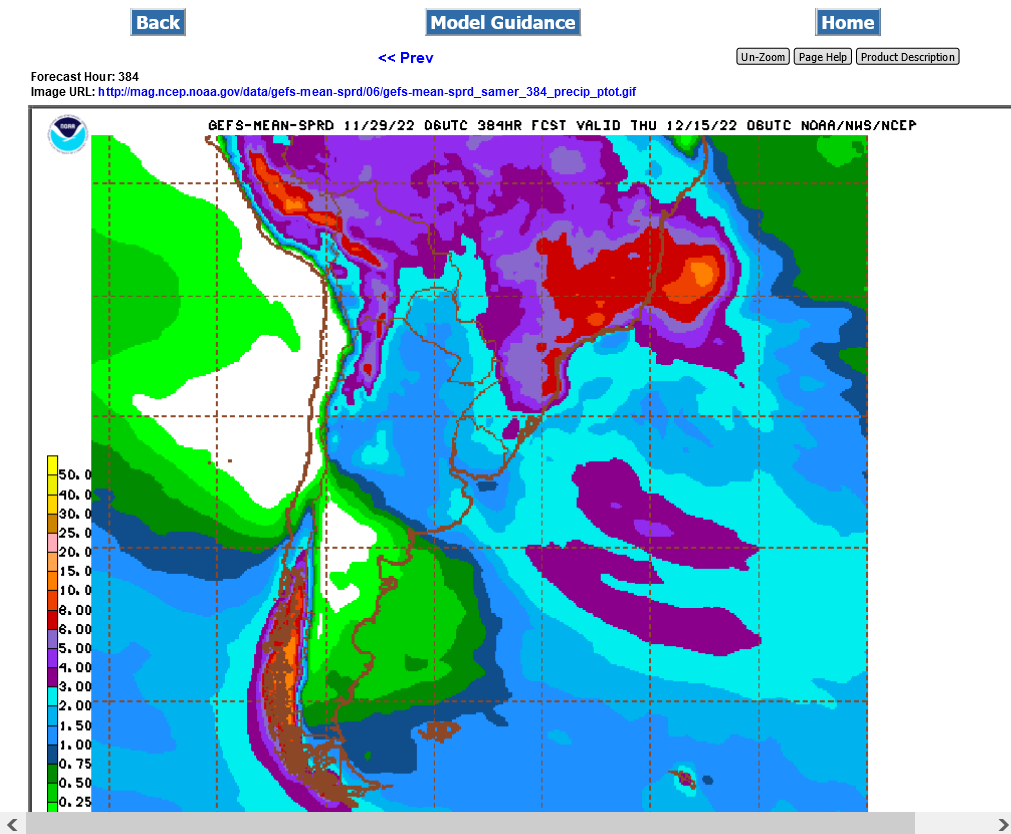

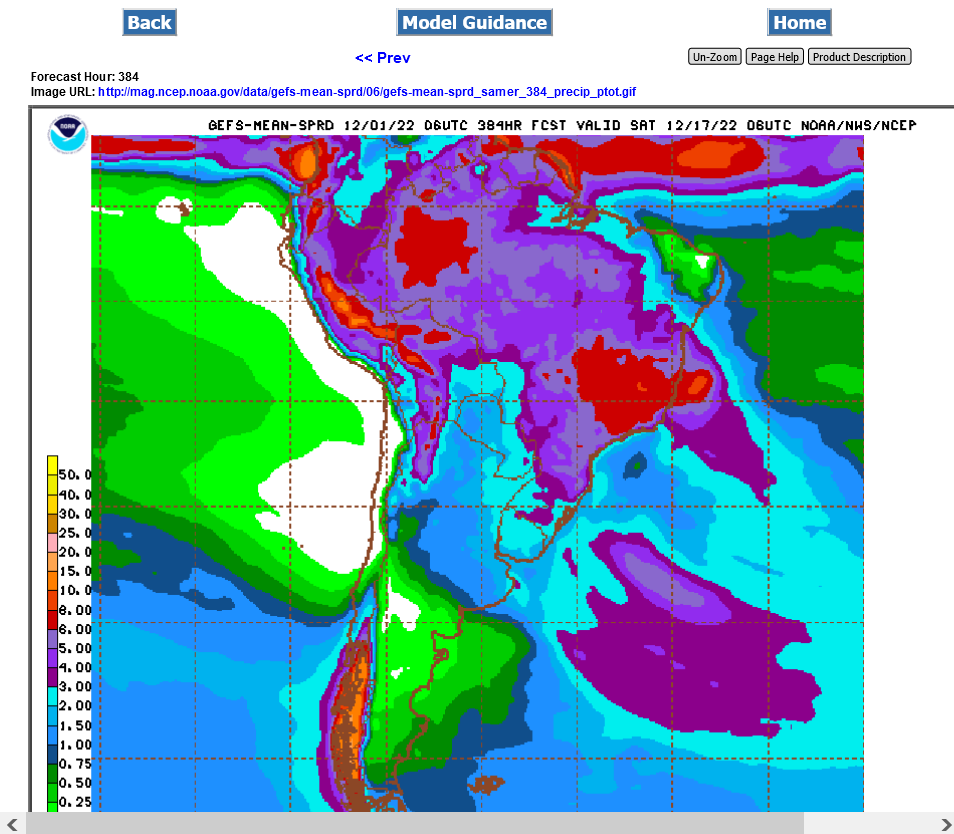

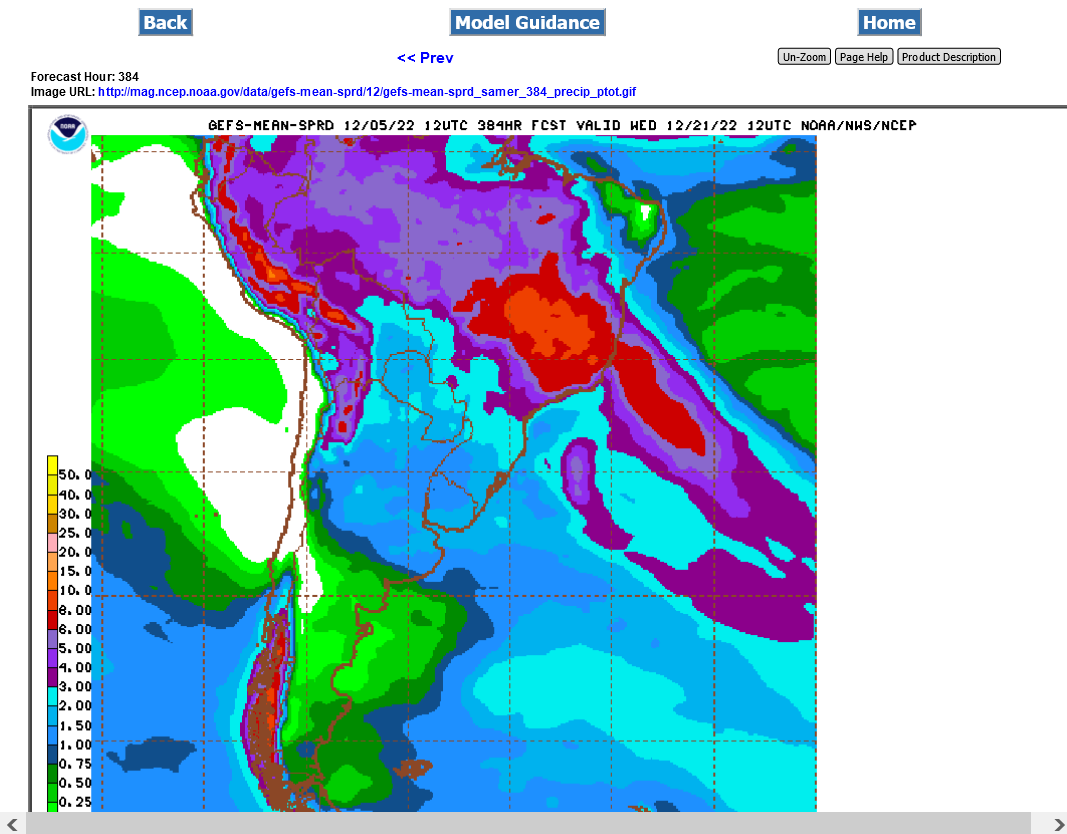

Slightly more rain for N.Argentina, mainly week 2:

More reliable GFS ensemble below:

https://mag.ncep.noaa.gov/Image.php

Unreliable GFS operational model below that updates automatically:

http://wxmaps.org/outlooks.php

++++++++++++++++++++++++

++++++++++++++++++++++++

In addition, here's the temps. This is pretty bullish for beans.

https://tradingeconomics.com/commodity/soybeans

1 year below Bull or Bear flag/wedge/pennant? Breaking support or resistance will tell.

Beans 40 years below. In lofty territory! Triple top or new, much higher trading ahead with a bull flag???

When NASA touts a promising battery technology, you have to sit up and take notice. https://www.nasa.gov/aeroresearch/nasa-solid-state-battery-research-exceeds-initial-goals-draws-interest

Thanks much Jim!

Sounds interesting.

Very sadly, the science world has changed a great deal in recent decades.

In 2022, the major objective of scientists is to get funded. To do that, they will say or claim anything.

That absolutely includes NASA.........that ain't what it used to be.

+++++++++++++++++

For instance, CO2 is well mixed in the global atmosphere. Somehow, all those smart dudes are failing to notice that almost all the warming is taking place in the highest latitudes/coldest places in the Northern Hemisphere.

Exactly like what happened during the Holocene climate OPTIMUM between 9,000 to 5,000 years ago that was actually almost 2 deg. C warmer than the current temperature there at times and there was less Arctic ice compared to now during those times.

https://climate.nasa.gov/vital-signs/global-temperature/

https://en.wikipedia.org/wiki/Holocene_climatic_optimum

Of 140 sites across the western Arctic, there is clear evidence for conditions that were warmer than now at 120 sites. At 16 sites for which quantitative estimates have been obtained, local temperatures were on average 1.6±0.8 °C higher during the optimum than now. Northwestern North America reached peak warmth first, from 11,000 to 9,000 years ago, but the Laurentide Ice Sheet still chilled eastern Canada. Northeastern North America experienced peak warming 4,000 years later. Along the Arctic Coastal Plain in Alaska, there are indications of summer temperatures 2–3 °C warmer than now.[9] Research indicates that the Arctic had less sea ice than now.[10]

++++++++++++++++++++++++++++++

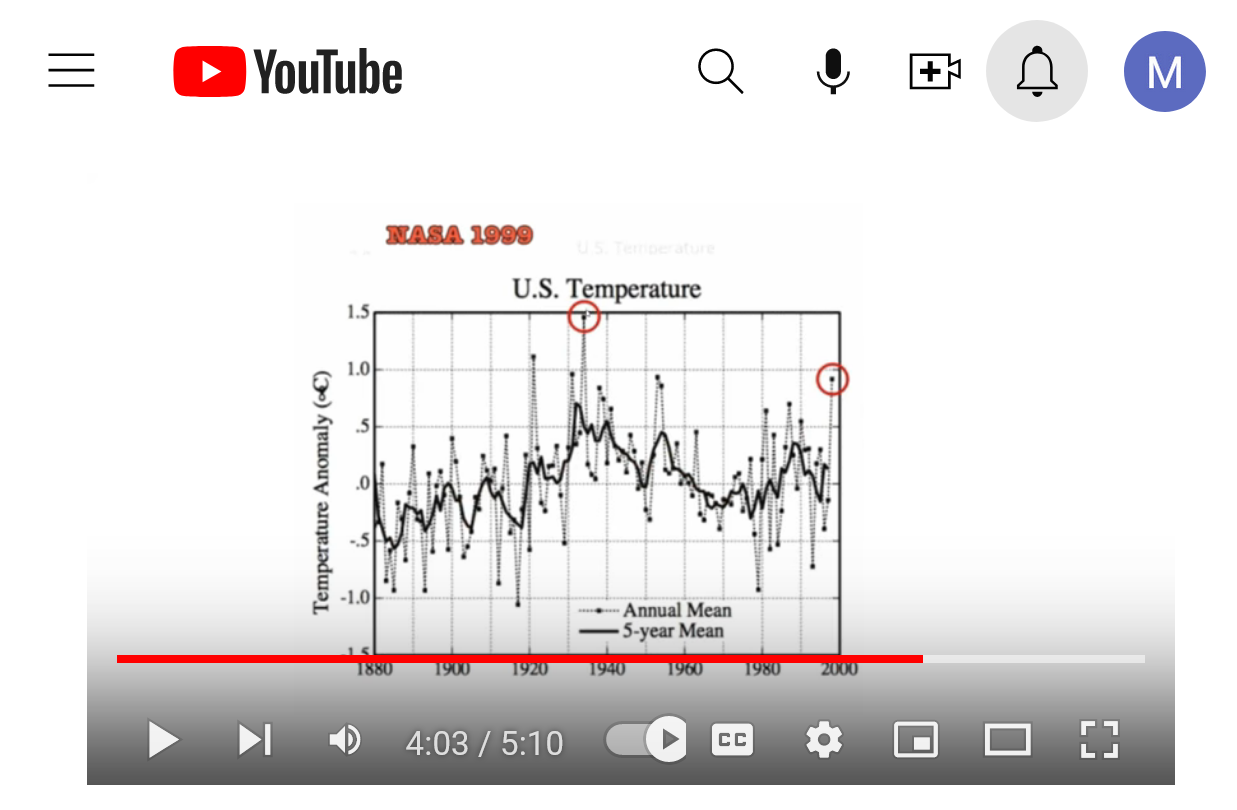

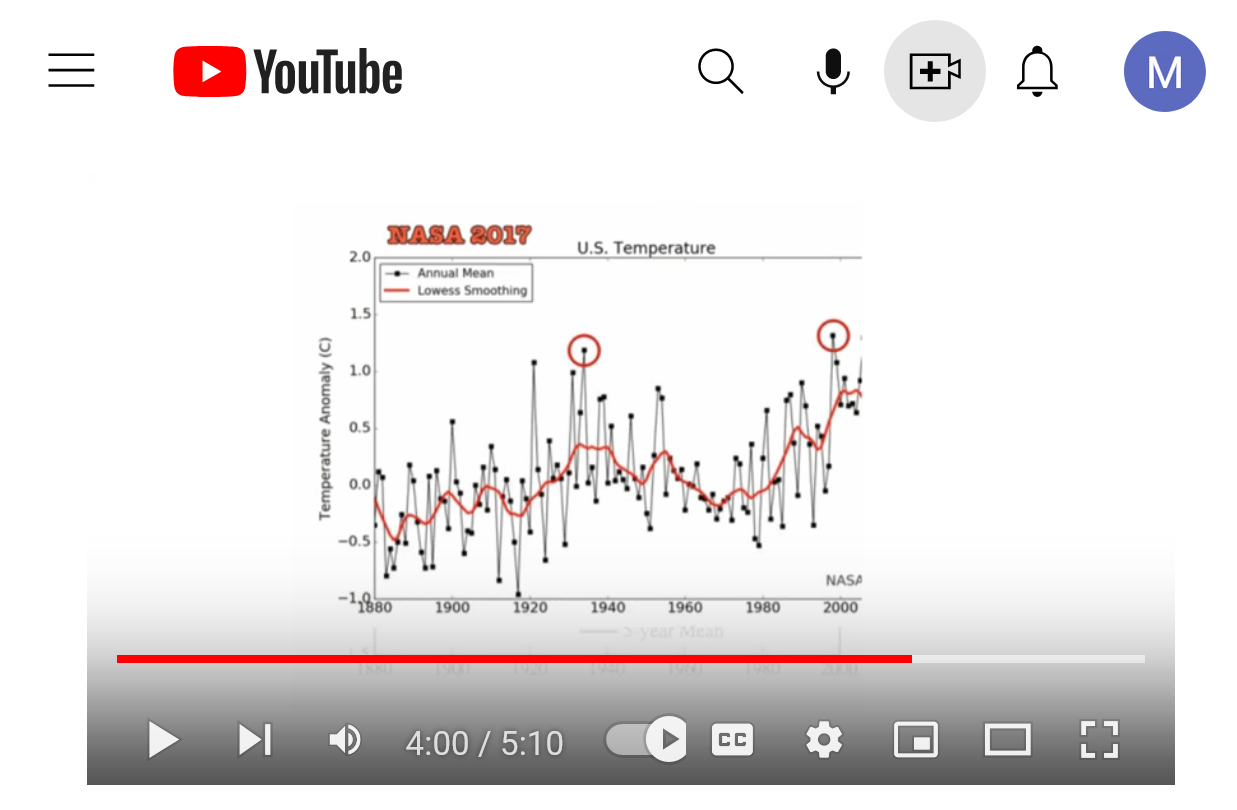

They adjusted/changed temperatures below to eliminate the heat intensity of the 1930's Summers in the US as the hottest.

Almost half of the all time state hottest temps were set in 1930s.

https://www.youtube.com/watch?v=mt14zqcghXo

+++++++++++

https://www.marketforum.com/forum/topic/86882/#87765

https://www.marketforum.com/forum/topic/87422/#87425

Heat waves below(which has also been taken down/adjusted)

In some realms, NASA cares more about funding, crony capitalism and political agenda than they do honest science.

In other words, Jim the story is an excellent post and could be something profound but since NASA deceives to get funding, as well as doing legit science, we can't know which one it is this time.

Fair enough. That's pretty much the game of all researchers at the end of the day.

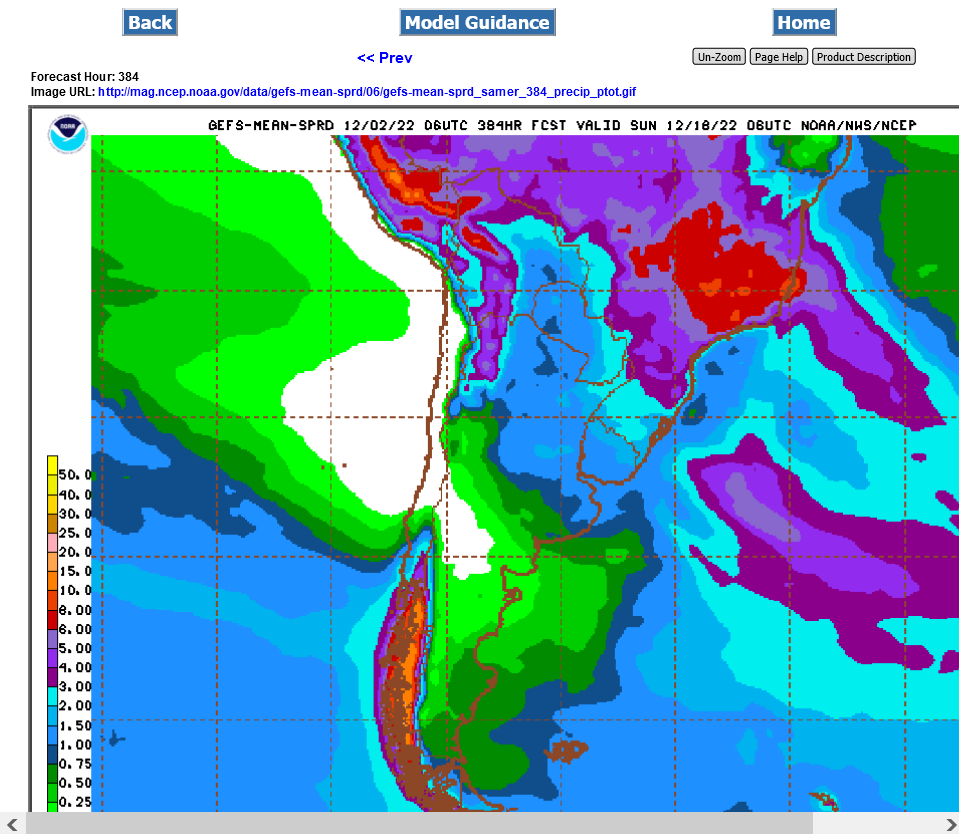

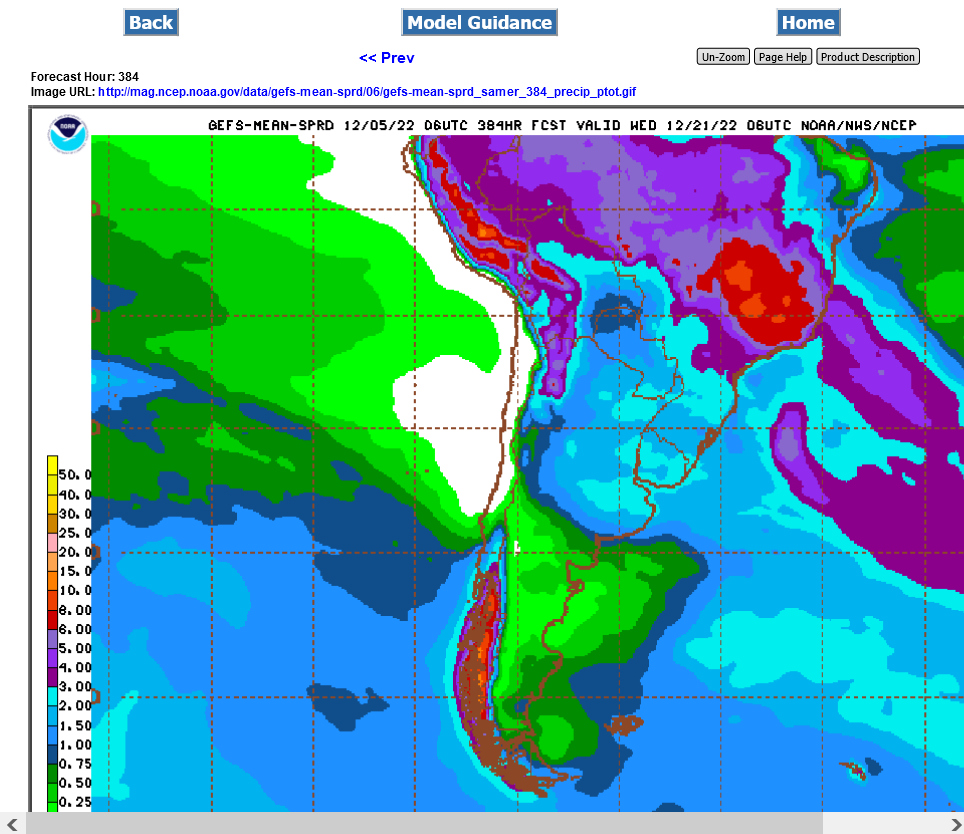

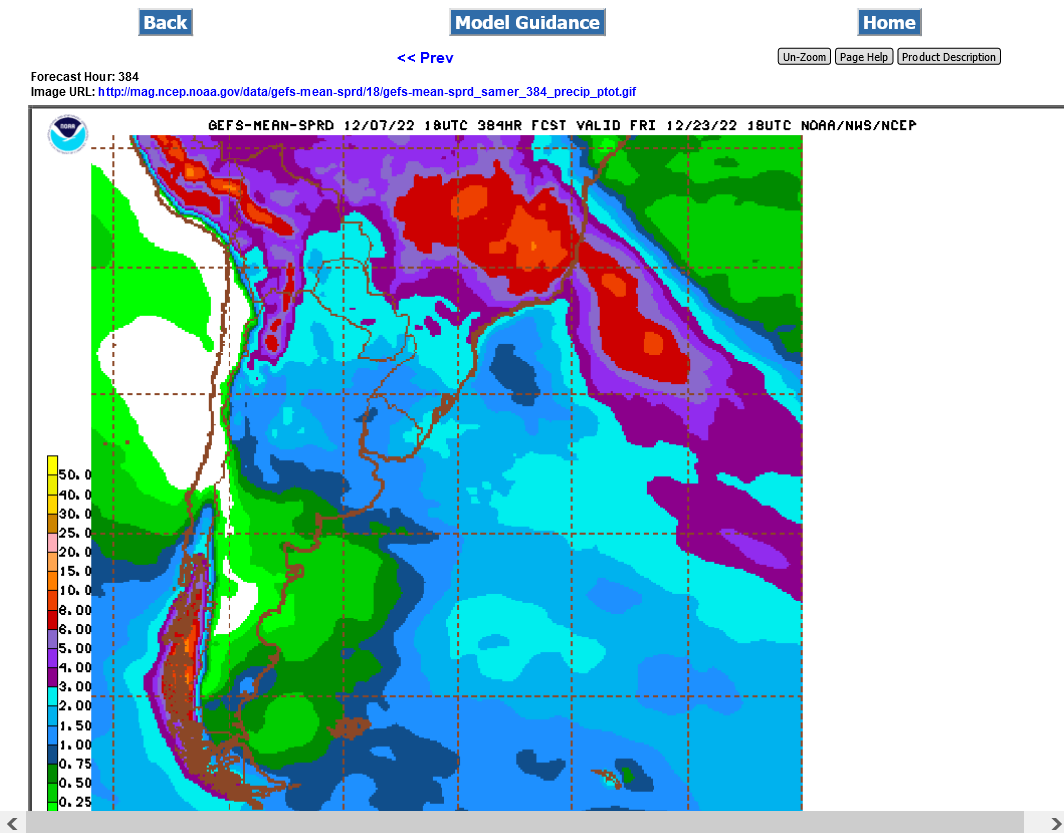

Still the same. Some, but not enough rain for N.Argentina in severe drought. Also, very intense heat, some of which will spill into far SW.Brazil.

Jan beans +17c at the moment.

https://mag.ncep.noaa.gov/Image.php

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Soybean.png

https://tradingeconomics.com/commodity/soybeans

Bumping up to some tough resistance today.

1. 1 month chart

2. 1 year chart

3. 10 years

4. 40 years

Not much change for N.Argentina.

Severe drought continues with some extreme heat but then a possible change to better chances of rain in week 2.

1. 10 day rain totals. Wimpy

2. 15 day rain totals.....increasing rains? but still not enough

https://mag.ncep.noaa.gov/Image.php

Thanks very, VERY much Jim!

I hadn't realized that much of Southwest/S Brazil was dry(and more), assuming otherwise without looking recently but this looks right and a big enlightenment for me.

Global precip. % of normal for different periods from 7 days to 180 days(6 months). Note the droughts in the US and key soybean production areas of N.Argentina.

Links are always included here so that everybody can use them independently or even bookmark them.

https://www.cpc.ncep.noaa.gov/products/Global_Monsoons/gl_obs.shtml

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.7day.figb.gif

https://www.cpc.ncep.noaa.gov/products/Global_Monsoons/gl_obs.shtml

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.90day.figb.gif

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.180day.figb.gif

++++++++++++++++++++

Bean areas Brazil from earlier.

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Soybean.png

+++++++++++++

Latest GFS ensemble: Still too dry in Argentina but 3" of rain in Brazil in 15 days is actually close to average for those locations. Less than that, 2 inches in light blue in far S/SW Brazil is a bit below average and with heat and dry soils, not optimal.

https://mag.ncep.noaa.gov/Image.php

In the S. Hemisphere, we heading into the equilalent of June here in the NH. December+ weather will be huge for their crops. This drought is being caused by the current La Nina, which isn't going anywhere for awhile.

Beans in an uptrend since the July 21st low.

Beans overcame some short term chart resistance today but 1489 is HUGE resistance

https://tradingeconomics.com/commodity/soybeans

Thanks Jim!

https://www.marketforum.com/forum/topic/91180/#91182

By metmike - Dec. 1, 2022, 7:53 a.m.

beans getting pressure from increase in rains? And encountering chart selling resistance?

+++++++++++++++++++

Yep.......the increase in rains in the forecast in N.Argentina!!!!

Note the light blue has shifted much farther west into N.Argentina, almost doubling previous rain forecasts. This was the GFS from 4 hours ago when beans were down only slightly. Beans -37c now.

These are entirely week 2 rains in N.Argentina with what could bring the best pattern to help the drought a bit in a long time

Beans 160mmt. Remember where you heard it. :)

Thanks jim!

Drier overnight but wetter than earlier this week for key N.Argentina bean growing.

18z was a bit wetter again for N. Argentina. This is all week 2 rain below.

https://mag.ncep.noaa.gov/Image.php

+++++++++++++++++++++

Some extreme, record level type heat this week in N.Argentina!

Then, rain chances increase.

https://mag.ncep.noaa.gov/Image.php

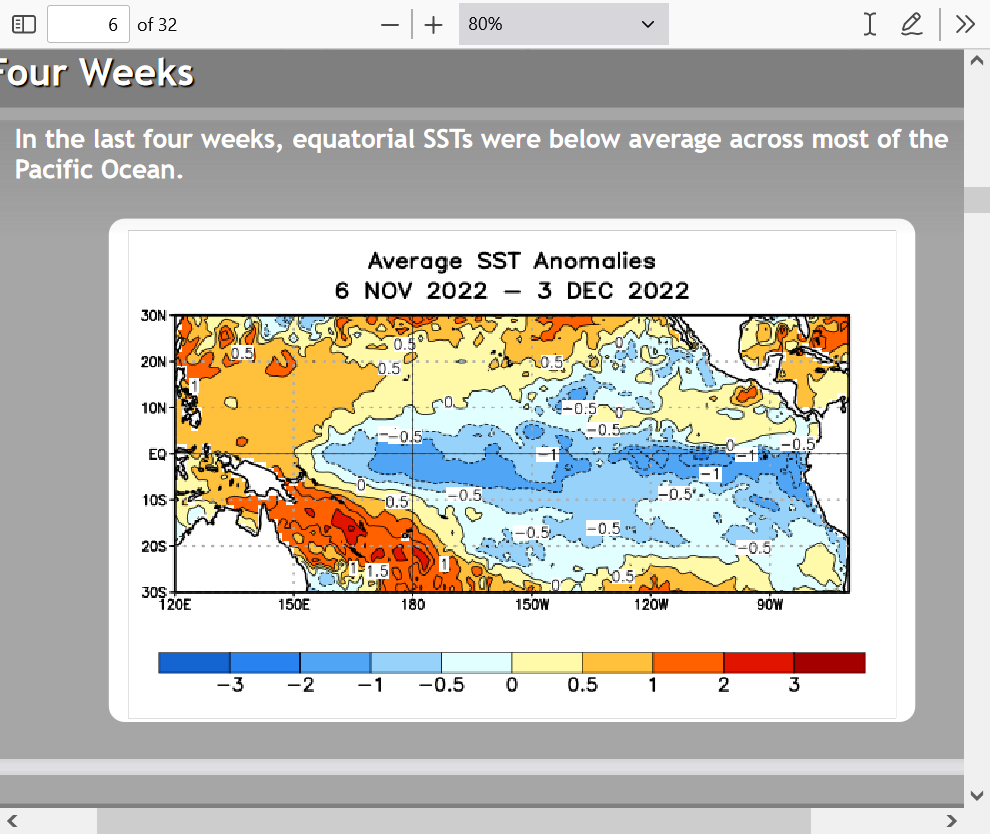

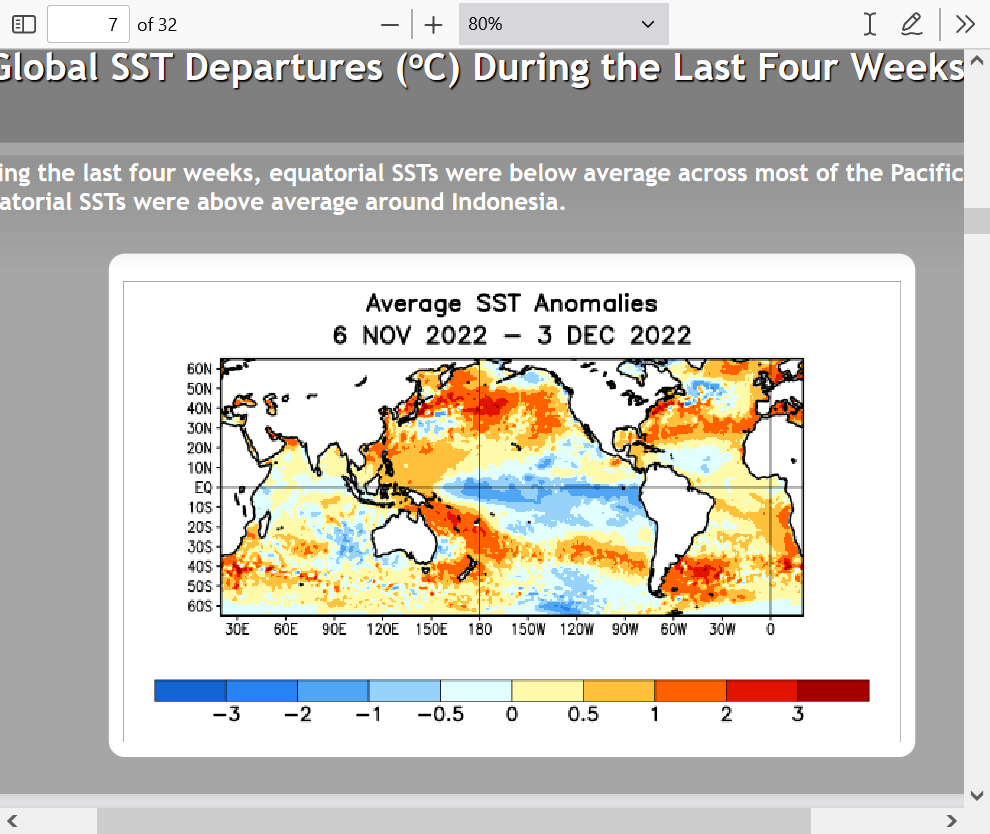

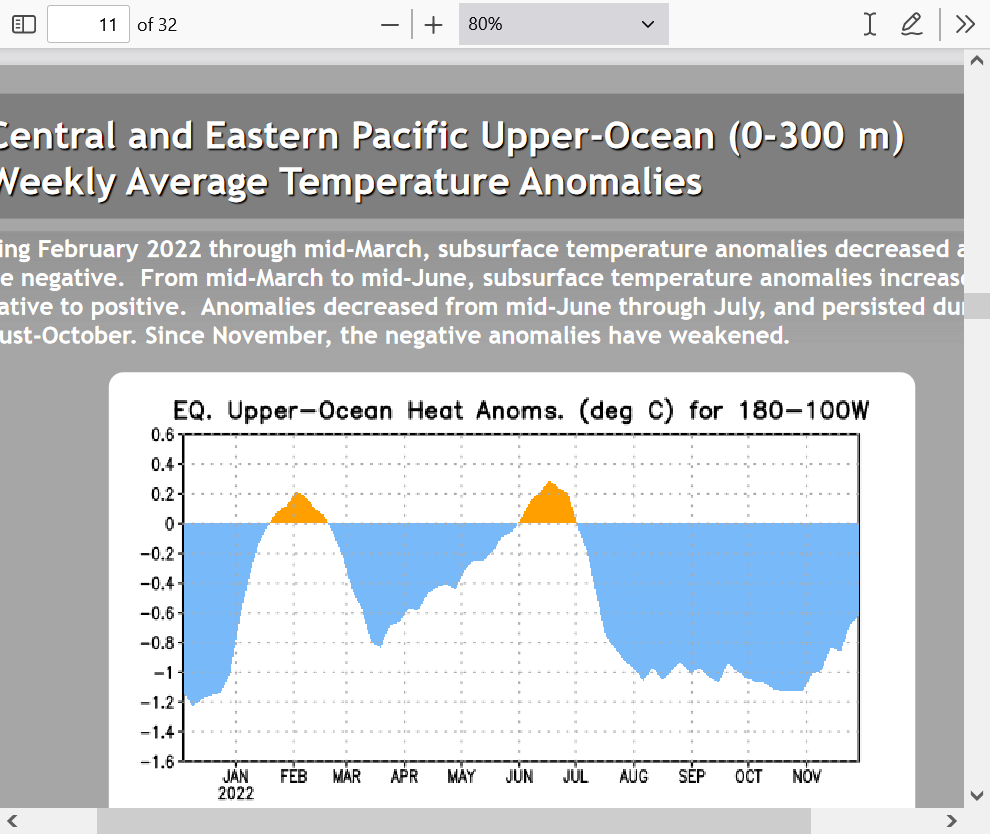

Just a reminder that this is being caused by the currentl La Nina in the Pacific.

Just updated:

ENSO: Recent Evolution,

Current Status and Predictions

Summary

ENSO Alert System Status: La Niña Advisory

La Niña is present.*

Equatorial sea surface temperatures (SSTs) are below average across most of

the Pacific Ocean.

The tropical Pacific atmosphere is consistent with La Niña.

There is a 76% chance of La Niña during the Northern Hemisphere winter

(December-February) 2022-23, with a transition to ENSO-neutral favored in

February-April 2023 (57% chance).

FROM FRIDAY:

Turned out to be a decent day for CBOT #soybeans considering the weakness in grains and oil. Contract ended up fractionally Friday at $14.38-1/2 per bu after falling 2.7% Thursday - the largest one-day decline since Sept. 30. Nov23 closed at $13.77-3/4.

By metmike - Dec. 5, 2022, 12:28 p.m.

Planting paces of #soybeans & #corn in #Argentina is still slower than normal, but they are at least advancing and not falling further behind. As of Thursday the ag ministry reports 44% of soy and 45% of corn planted for harvest in early 2023.

++++++++++++

A third of early planted #soybeans in #Argentina are already in regular/poor condition due to dry weather. There are no substantial rain chances in the current forecast for at least 2 weeks, and next week looks to be pretty hot.

Just out 12z run took a bit of rain out of N.Argentina. No more light blues of 2".

Rain amounts taken out at 12z were out at 18z and now 0z. So the forecast turned more bullish late Monday morning/Noon maps and has continued. Only an inch of rain in N.Argentina the next 2 weeks, less than half the average with intense heat this week.

https://mag.ncep.noaa.gov/Image.php

Still less than half the average rain in Argentina the next 2 weeks.

Lets say Argentina has a catastrophic drought, what is the worst case scenario? 30mmt of beans.

Thanks much Jim!

You keep saying bearish things about beans and the weather not impacting them enough to be price bullish(for weeks)........and they keep going higher from the market thinking the weather is bullish enough to impact the price.

The configuration of rains is shifting in week 2, so that could bring a chance for better rains in the driest areas(just saying it "might" but the weather is still bullish at the moment) and we're getting close to mega resistance, so maybe that will stop the beans.

Also, I wouldn't want to be long if Argentina's weather ever shifted to more rains.

1. 1 week

2. 1 month

3. 5 years

4. 40+ years

93% of the area planted to #soybeans in Cordoba, one of #Argentina's top producing provinces, is under drought conditions. 47% is in exceptional drought. That is the worst since 2009, but very close to 2009's high. Image source is NOAA.

My reasoning is that Brazil had a rough year last year and lost roughly 25mmt. Let’s say Brazil produces their 150mmt. Even if Argentina has a bad year, the SA total could still be much larger than last year. With demand down and stocks still expected to rise because of low demand, why buy?

25 met was to extreme. More like 15mmt.

https://ipad.fas.usda.gov/countrysummary/Default.aspx?id=BR&crop=Soybean

why buy? Jim if a train was coming down the tracks you best pay attention, even if you don't believe it at first

Is that train, potentially one of the biggest bean crops ever? $14 for beans with ES where they are? Nah bruh…..

There is a couple dollars of Putin’s war premium in that price.

Beans not acting very good to start the week.

Let's put up some stats here. In just the last 18 months, this has been the trend of price. In the meantime, world ES are climbing up towards 15% since October of 2020, in record territory. What is the price trying to accomplish here?

Global soybean ending stocks are set to be the lowest in four years (feednavigator.com) From October of 2020

The chart is from the last approximately 18 months.

Possibly 200 mmt of beans from SA this year? And this is the price action? Could be one heck of a crash.

Great post Jim!

Weather is still bullish in Argentina:

And extremely bearish Brazil. And one good rain could change Argentina's bean fortunes. Corn might be worth watching to go long.

one good rain could change Argentina's bean fortunes

Jim,

Extreme drought, record heat and 1 good rain are still the recipe for a really bad crop.

It's going to start being a case of how big of a disaster the Argentina crop will be unless we see a PATTERN CHANGE in the next several weeks that brings SEVERAL good rains. With the La Nina(cold water anomalies in the Pacific) continuing, things are not looking good.

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.90day.figb.gif

50% of the bean crop isn’t in the ground yet.

But your point is noted.

50% of the bean crop isn’t in the ground yet.

Thanks Jim,

You continue with this flawed thinking, that there's so much of the crop yet to plant so the weather isn't hurting seed in the bag.

Seed in the bag at the end of the year is 0 yield.

The reason that only 50% of the crop is not planted at this stage is that it's been too dry to plant the beans. If that continues, farmers are not going to risk the very expensive input costs on the likelihood of harvesting a crop that doesn't yield enough to pay that and them for their efforts.

If 10% of the crop never gets planted, that's 10% at 0 yield. Average that with the poor yields from the crop that faces adversity growing in the ground and you have some major production losses.

I get that Brazil will likely have a massive crop but bearish spinning Argentina's extremely bullish weather/crop is missing piece of the puzzle.

Producers in Argentina are going to have to face some tough choices. It's like mid June for them right now and getting late to plant full season, high yielding beans because of not enough daylight hours left in the season(they will flower before having developed much) and late season cold risks.

They can still plant shorter season, lower yielding beans that often go in after wheat into early January. Things may be different down there but early planting is usually a good thing and late planting almost always bad.

And the weather can still change but the pattern currently does not favor that.......so we go with what we know with high confidence.

How much has avian flu, swine flu and covid changed world bean demand?

Good question, becker. I have no idea. Others?

Its not flawed thinking yet. When the trade gets concerned I’m thinking we will see it in corn prices first, but that hasn't happened…..yet

You also cant discount the fact that if Brazil hits its current target, thats over 25mmt than last year. Thats over half of Argentinas crop. Yes Argentina is dry. I get it. But even if Argentina only grows half a crop, and Brazil grows over a 150mmt, the total will be roughly the same as last year. The wuestion is, what is that worth? $10? $15? $20?

Thanks Jim,

Sorry if I wasn't clear on the flawed thinking.

Your thinking most of the time is top notch and much appreciated but what I was referring to was ONLY the statement that 50% of the crop not being planted now meaning that its too early to hurt the bean crop that's still in the seed bag.

It's already hurting in 2 ways.

1. Delayed planting will hurt yields. The bean reproductive cycle responds to day length. (photo-sensitivity), unlike corn that responds to growing degree days. Depending on the variety, some 30+ days after the days become shorter, the beans will get a signal to flower, get pollinated, then set pods, then fill pods(end of July and mainly August for the Northern Hemisphere).

If you plant early......30+ days before the shortest day, they will have 60+ days before they flower to acquire massive development. Deep roots to pull in nutrients from the soil and and foliage to collect energy from the sun to use to fill pods and make them plump which is what yield is all about.

If you plant beans close to the shortest day, they will have only 30 days to develop these positive plant characteristics. No matter how perfect the weather, a small bean plant will always UNDER perform a large bean plant all things being equal for the reasoning above. You can't defy this law of agronomy. You can plant a shorter season soybean to compensate but it will underperform longer season beans planted early.

This is actually a fascinating topic:

https://en.wikipedia.org/wiki/Photoperiodism

Photoperiodism is the physiological reaction of organisms to the length of night or a dark period. It occurs in plants and animals. Plant photoperiodism can also be defined as the developmental responses of plants to the relative lengths of light and dark periods. They are classified under three groups according to the photoperiods: short-day plants, long-day plants, and day-neutral plants.

2. Producers/farmers know this but many of them are not planting early this year. Because the drought will subject the beans to enough early adversity to offset any benefits from planting early. They know too that planting late and the drought is a double whammy and risks input costs +their time. In the US, better to take the crop insurance. Not sure what the Argentina government has to help farmers but the longer the delays, the more likely we have XX% of acres that never get planted because of the reasoning above.

So my point was that you are using a very bullish fact to support a bearish spin for Argentina.

The other stuff is good.