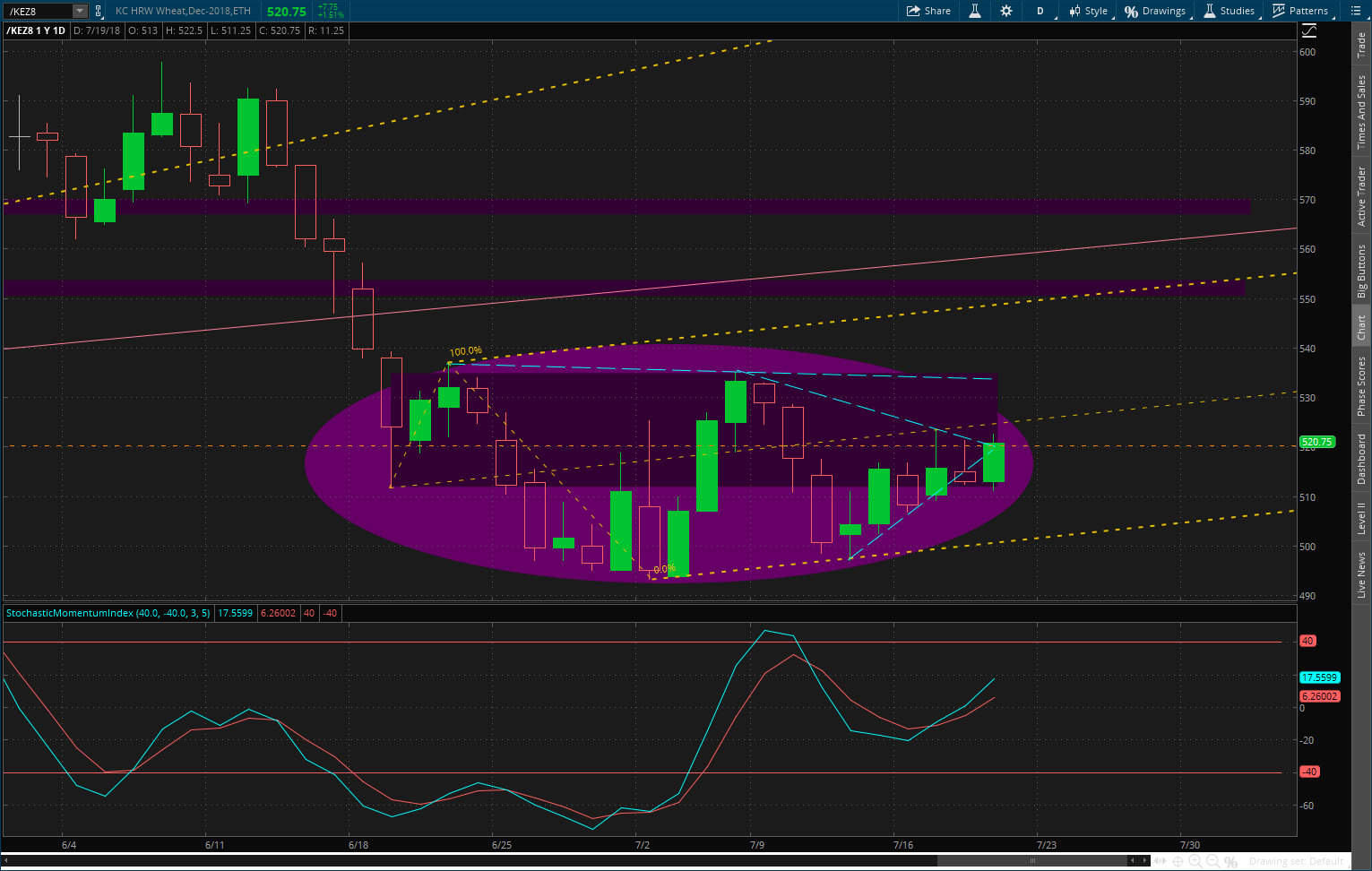

The dark chart is Dec KC Wheat daily, highlighting the purple Prince congestion blob that reminds me of a diamond pattern. I anticipate a symmetrical analog to the prior rapid descent. I expect to see a brisk retrace back up at least 50 cents from where we are now.

European Milling Wheat is rising up to new highs, breaking out topside from a flat top triangle congestion. Quite bullish. And United States wheat exports reported here this morning were a marketing year high. The situation with wheat crops worldwide apparently is the real deal that will not be going away anytime soon. Seems U.S. wheat price has shared the soybeans' woe unjustifiably. Perhaps it is U.S. wheat that will snap back to prior lofty levels and beyond much before the corn and beans might. I am long Kansas City high protein wheat in the December contract from $5.22.

European Milling Wheat is rising up to new highs, breaking out topside from a flat top triangle congestion. Quite bullish. And United States wheat exports reported here this morning were a marketing year high. The situation with wheat crops worldwide apparently is the real deal that will not be going away anytime soon. Seems U.S. wheat price has shared the soybeans' woe unjustifiably. Perhaps it is U.S. wheat that will snap back to prior lofty levels and beyond much before the corn and beans might. I am long Kansas City high protein wheat in the December contract from $5.22.

https://www.barchart.com/story/news/futures-news/grains/920990/wheat-just-my-opinion

European wheat futures appear geared up to take a stab at establishing new 2 year highs. This had US futures trading higher on Tuesday. The US winter wheat harvest is in its final 25% and spring wheat ratings stay strong. The strength in the US Dollar had little impact on the rallying US wheat futures as it is my thought that we are following the strength of Europe. We have to remember that the recently released World Supply-Demand outlined a scenario that was taken as bullish. For the past two years the European and Russian wheat markets have dictated direction. If they are indeed going to move higher the US will follow suit.

The interior cash wheat markets remain quiet while holding onto recent improvements. The export markets remain quiet with no real indication of better business. Chgo spreads ran noticeably higher while KC spreads just edged higher. The Chgo market tends to have a higher volatility vs. KC so its spread changes will be more noticeable. If you believe what the USDA laid out for us with its World views last week bull spreads should work.

If you put US wheat futures in a room where there is no outside influence all we are is a consolidating market. Fortunately US wheat futures are not in a room all by themselves so they are subject to whats happening in the outside world. In this case I have to think we will continue to be a follower of the rest of the world. European wheat futures (Paris) appear they want to go higher; 2 year highs are only 2-3 euros away. If new highs are seen in Paris the US futures will follow. If Europe fails to follow through to the upside the US current consolidation phase will continue.

Here is daily chart showing internal dynamics of the congestion glob, today's green candle an 'outside up' engulfing of the prior hollow red down.

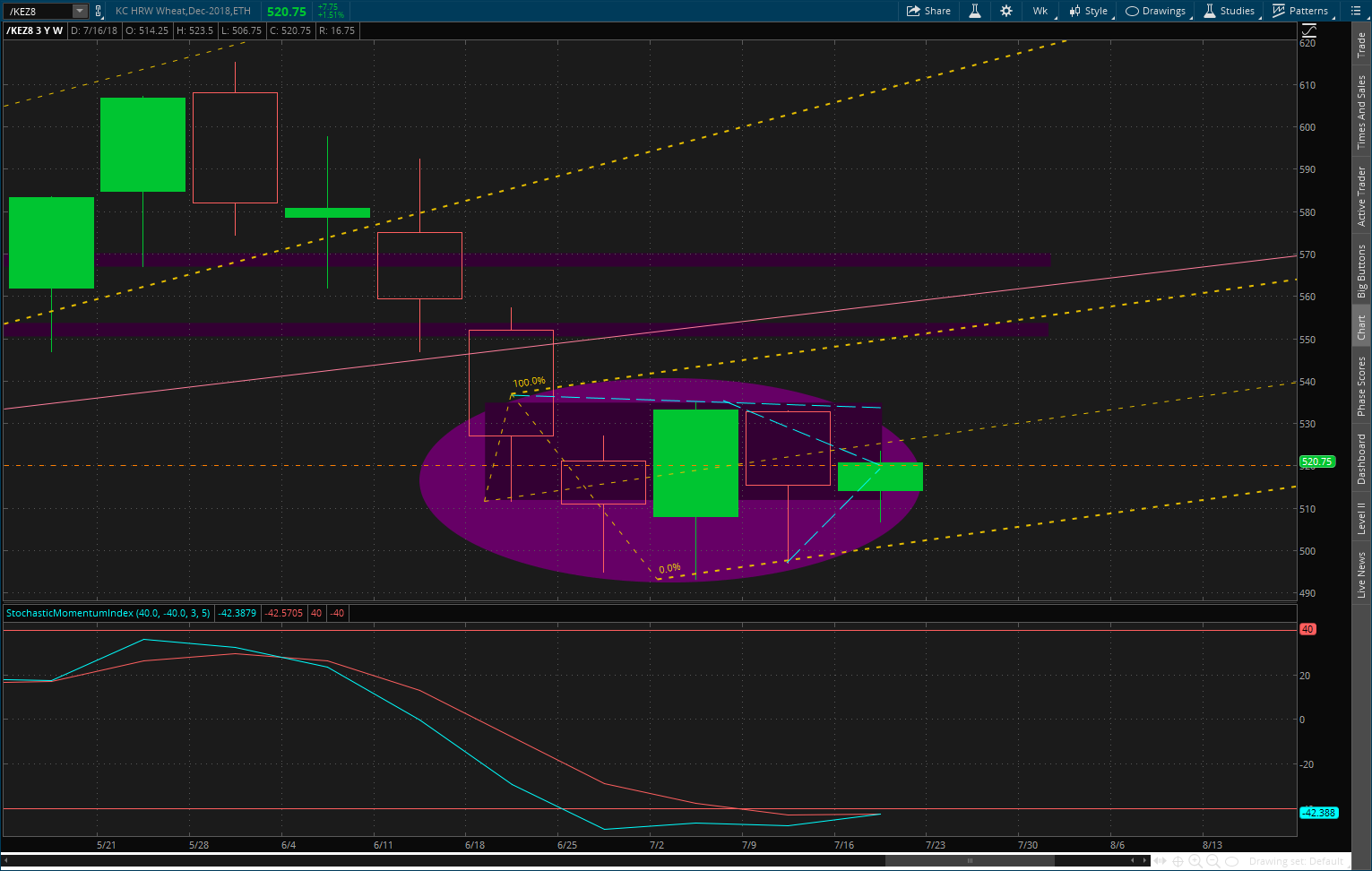

Here is closeup of that congestion in the KCZ18 wheat, but displayed as weekly candles. Note today is Thursday and thus the green bud final candle is still under construction. For bullish theme, it is easy to envision that the final candle will fill out further green as to engulf the prior down (hollow red) candle. That means about a 10 plus cent move higher tomorrow to finish out the week on a positive note and perhaps set up next week with a gap higher.

Here is closeup of that congestion in the KCZ18 wheat, but displayed as weekly candles. Note today is Thursday and thus the green bud final candle is still under construction. For bullish theme, it is easy to envision that the final candle will fill out further green as to engulf the prior down (hollow red) candle. That means about a 10 plus cent move higher tomorrow to finish out the week on a positive note and perhaps set up next week with a gap higher.

https://www.zmp.de/en/exchanges/matif-milling-wheat-no-2-price_future

Price quotation for 50 tons of milling wheat (ex silo Ruon, France). Prices in Euro per ton.

https://www.barchart.com/story/futures/grains/962076/market-update-grains-meats-softs

I adore her style of describing markets, here she is on wheat:

MARKET UPDATE

JUDY CRAWFORD

TRADES FOR FRIDAY, JULY 20, 2018

888-301-8120

jcrawford@zaner.com

EMOTION is your enemy more than any market will ever be.

GRAINS NOT READY EXCEPT FOR WHEAT? Wheat is the only one in the grain complex that has rallied and closed over both the 10 & 20 avg. on its daily chart. Also the 10 is now over the 20 on that chart. This technical change in wheat is what any market does when attempting a near term trend change to the upside and that increases the probability that the rally attempt will have more follow through. But the rest of the grain complex isn't doing as well. So far their 10 avg. is still way below the 20 avg. as has been the case during the entire selloff that started in early June. Only meal has had the 10 avg. gradually move up closer to the 20 avg. - suggesting an attempt at a trend change. So far corn and beans have rallied only up to their 10 avg. and been stopped each time. Meal, at the same time, keeps pushing up against its 20 avg. but stops. And bean oil isn't even near its 10 avg. to challenge it and its 20 avg. is still way above the 10 avg. In an uptrend you have the opposite - the 10 is above the 20, not below it as is the case currently with corn, beans, meal and bean oil. So if meal continues to hold on its daily chart, it could be the next one to change trend.

Some good points there.

Bean meal is often the leader in a bull bean market and sometimes the first to turn at the bottom. Meal will also move more in tandem with wheat(and corn) than bean oil and corn will also get pulled higher from wheat than beans.

Haven't followed bean meal or oil in years though.

Wheat also typically bottoms during or shortly after the Northern Hemisphere harvests it Winter wheat crop.........which has just happened.

So between now and October, wheat, historically, experiences its strongest price behavior:

Thank you for the seasonal harvest completion propulsion scenario!

YW,

Posted these charts below your other wheat post but they seem appropriate here too:

By metmike - July 19, 2018, 5:37 p.m.

"I agree that the lows of December 2016 for wheat are THE lows and we tested them in December 2017.

World grain stocks were going up then. Now they are going down. "

Last 10years of wheat prices:

Wheat 3 months

| |

Wheat 1 year chart below

| |

| |

| |

Topside breakout in Paris today as European milling wheat moves to new highs. And U.S. wheat is following, the high protein Kansas City fetching a greater premium now.