http://www.321gold.com/editorials/mcclellan/mcclellan122221.html

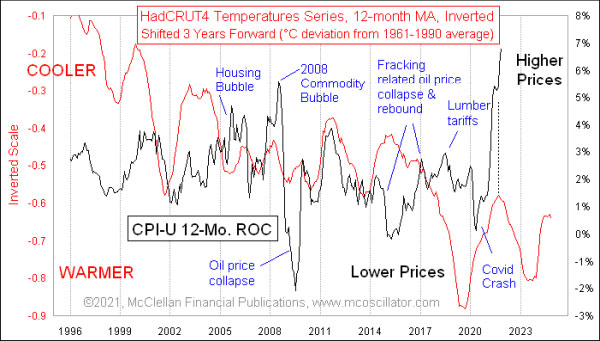

ok, so maybe this is not about short term trading, but...

i'm sure that metmike has something to add to this topic.

yes, i have seen articles before that suggests higher temps lead to better crops, and therefore more plentiful supply. this might keep a lid on the rise in prices for renewable resource prices. (grains, cotton, lumber, etc).

here is where this article is Wrong. in the 1800's (no central bank), there was No long term inflation problem. but ever since the 1930's, we have been printing and spending more fiat money, and we have had inflation. sometimes more inflation, and sometimes less, but the buck continues to lose value.

Very interesting speculation bear and worth some time to think about.

It's true that we are having a climate optimum and the warming temperatures are part of it but much of the increase in agricultural production(outside of technologically driven) is from the atmospheric fertilization from the increase in CO2.

So his correlation should be with CO2, not temperatures to be true.

He also ignores the technologically driven increases in crop yields/food production from better, higher yielding varieties thanks to seeds with traits that are superior to seeds from previous years. Better fertilization, spraying and other techniques. More efficient much more rapid planting/harvesting.

A small increase in tenths of a degree over the course of 2 decades?

Sure, that was a slight contributor too.

I guess that now that we have some major inflation, it means that we are having major global cooling. Interestingly, we've actually had some modest global cooling from the cold temperature anomalies in the tropic Pacific(known as a La Nina).

However, rather than tie all this to agricultural production from temperatures, I think that looking at energy prices might be even more useful.

Of course, one can also tie that to global temperatures too, if you want to look at what causes the greatest demand for heating and cooling. Cold during the WInter in the Northern Hemisphere.

However, there is something way more important than that right now.

THE WAR ON FOSSIL FUELS. This is causing the record natural gas prices in Europe right now as it caused them to have a drawdown in ng stocks. But they also had an unusually cold Winter last year.

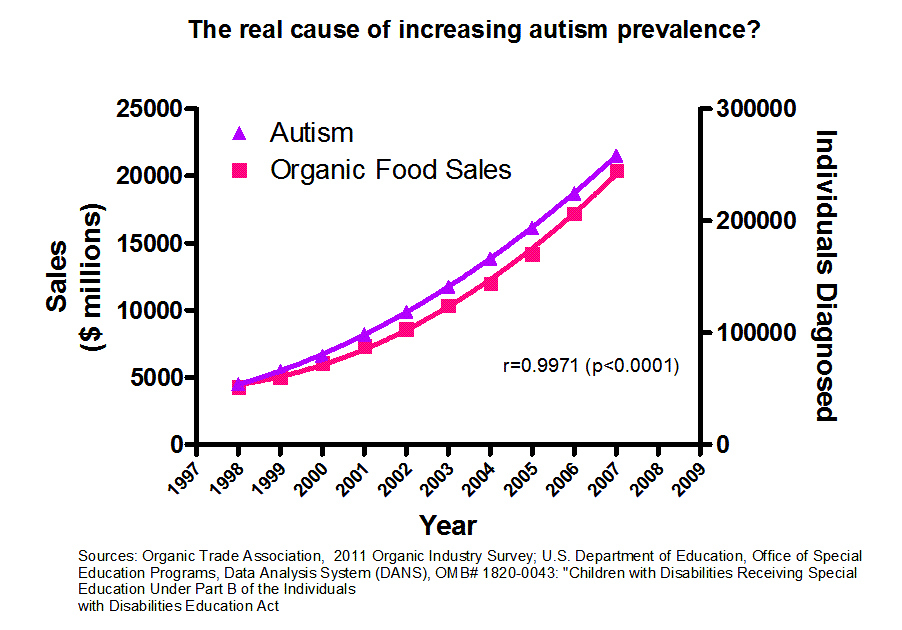

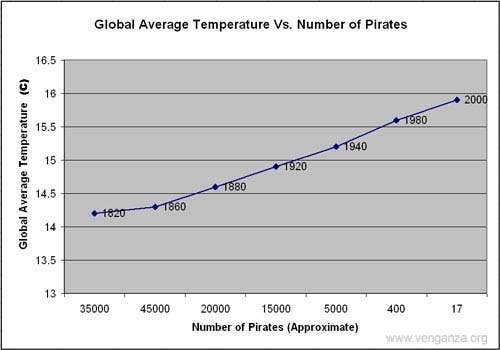

There is also this potential element to this correlation.........coincidence vs causation.

Determining correlations

11 responses |

Started by metmike - June 5, 2021, 11:08 a.m.

I saw also that he's been contending that this correlation is based on causation for something like 8 years now.

From 2013

https://www.mcoscillator.com/learning_center/weekly_chart/a_cooling_planet_means_price_inflation/

From 2015

Could his correlation be similar to these:

One of the first things you learn in any statistics class is that correlation doesn't imply causation. Nonetheless, it's fun to consider the causal relationships one could infer from these correlations.

https://www.buzzfeednews.com/article/kjh2110/the-10-most-bizarre-correlations

His connection to agriculture makes sense but he ignores all the other elements in agricultural production and ignores energy.

Cheap and reliable fossil fuels keep inflation LOW.

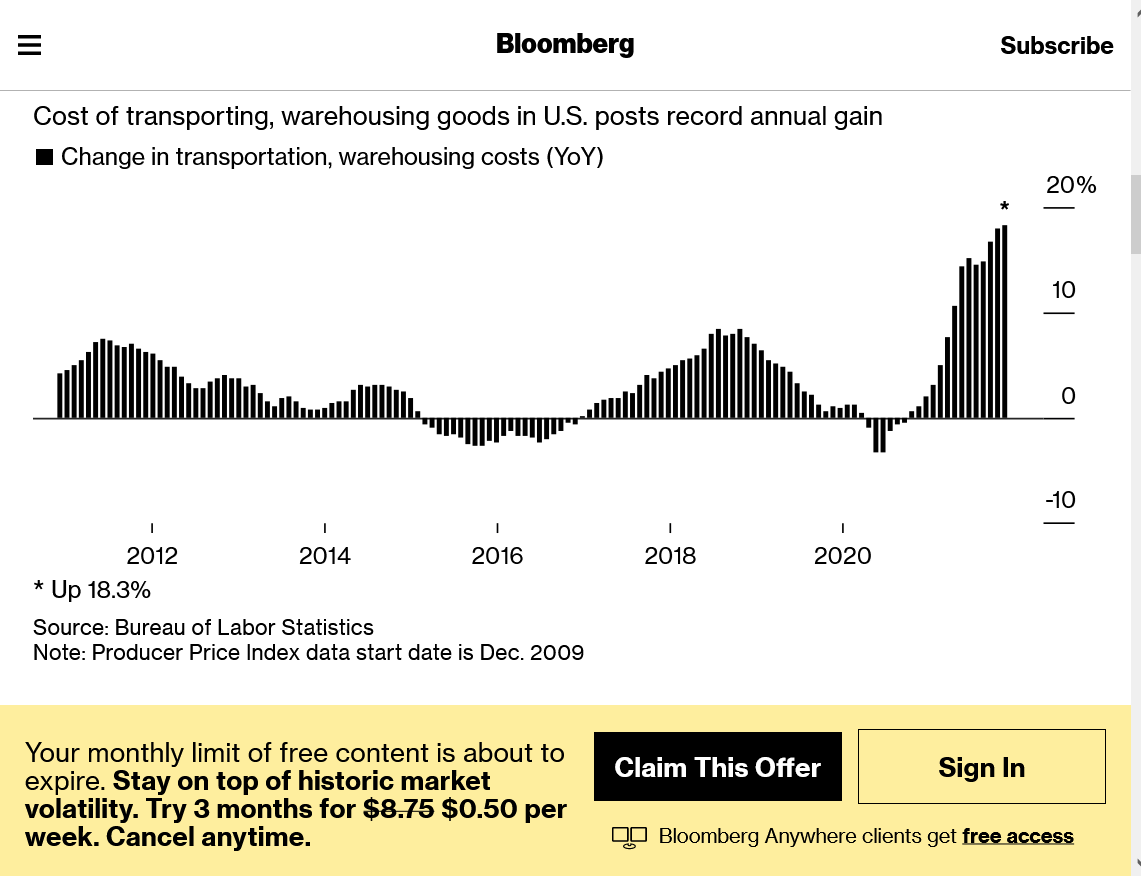

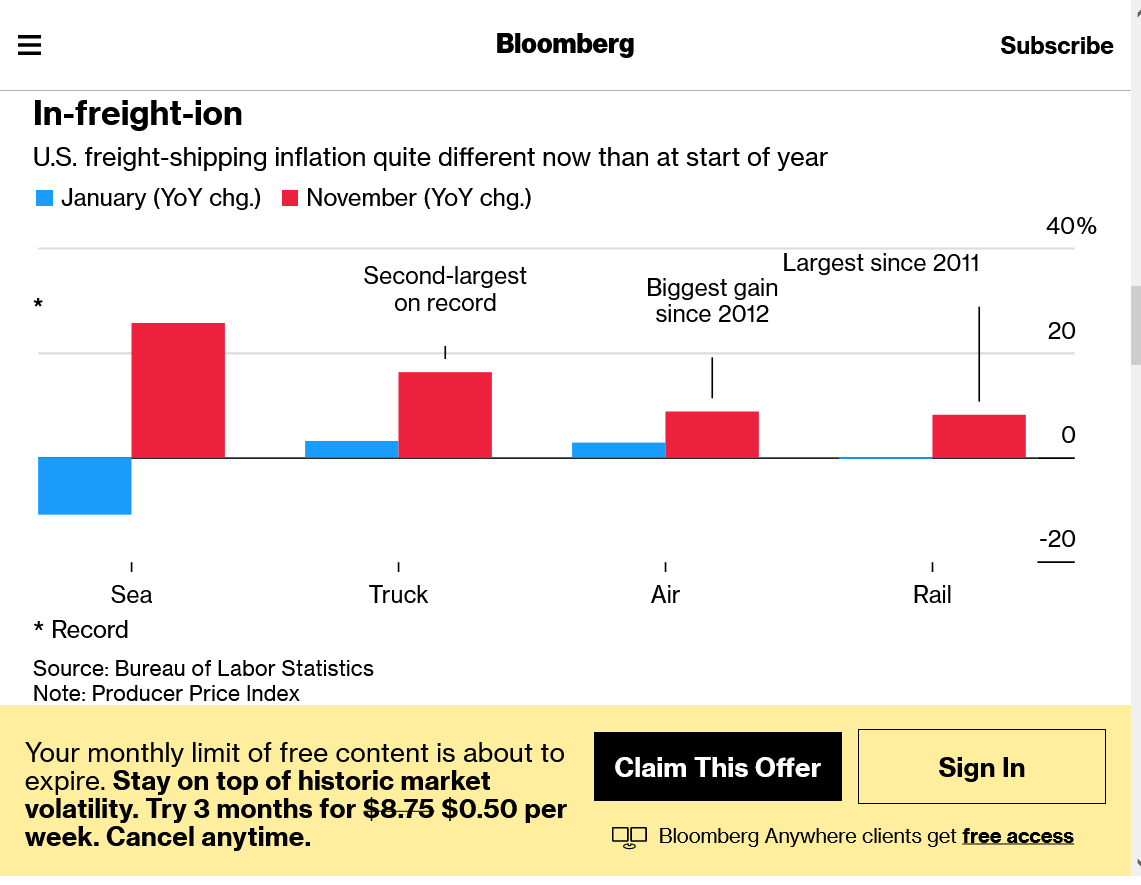

Expensive energy, like we are experiencing now, thanks in part to the war on fossil fuels in the developed countries, causes the price of everything to go higher(transportation costs).

The McClellans charts are way too noisy (Arrr- Mike said this better) to support any relationship. In any event, we had another week of oil stocks drawdown, this one driven more by reduced supply (down a bit over a million BPD, mostly on import/export balance) than demand (down from 23191 to 20454). I think the cycle of increased drilling when price is high, buying huge vehicles when it's low, and overall economic booms & busts is enough to explain most cycles.

Anyhow, 19th century prices were long term stable but there were a lot of crashes & panics along the way. Greenbacks, free silver, and gold led to some rather violent issues.

EIA this morning:

Killing Coal

11 responses |

Started by metmike - Nov. 21, 2021, 10:57 p.m.

I think that Patrick has it right with bringing up the drawdown in crude oil being a more important factor contributing to inflation.

Energy prices go higher because, like with every other commodity:

1. You have increased demand or

2. You have reduced supplies

When you have both, it's a double whammy.

When crude oil is near the lowest in storage in a decade and falling, there is no way that liquid energy prices won't go higher.

Increasing energy prices always contribute to inflation. How significant it is depends on many other factors that I am not an expert on.

If jet fuel and diesel and gasoline prices are all going much higher, the cost to transport all goods goes higher. It can matter a great deal in some situations.

Most business's will dial that into the cost they charge for their goods.

In addition to that, we are seeing huge shipping cost increases that are tied to factors independent of energy/fuel prices/costs! This gets passed on to consumers.

Freight Rates on Every Mode of Transport Are Boosting Inflation

These factors are much MUCH more important than the increase in agricultural production from a tiny increase in global temperatures the past 3 decades.

However, bringing this up, has allowed for a wonderful discussion related to some much bigger contributors to the current very high inflation.

There are several other contributing factors too that are probably greater than the tiny contribution from global temperatures.

However, if we would take the atmosphere back into a time machine and drop the global temperature to where it was 100 years ago, around 1 deg. C cooler and especially drop the CO2 level from the current level of almost 420 parts per million back to under 300 ppm............this really WOULD trigger massive inflation.

Why is that?

Because plant growth would be around 30% less robust with crop yields and world food production taking a similar hit.

Not only would food prices, possibly triple within 3 years as stocks of everything quickly get drawn down to nothing.........and we see all markets in a rationing mode......prices having to go high enough to stifle excessive demand that can't be met..........it's likely that 1 billion people would die from starvation.

No way could we feed close to 8 billion people with the old climate and CO2 levels of 1921. Maybe not even 7 billion.

But the gradual increases in production the past 30 years (from numerous positive factors, including climate) have also coincided with similar increases in the world population and people gobbling up the extra production.

More on that element:

Fake beer crisis/Death by GREENING!

11 responses |

Started by metmike - May 11, 2021, 2:31 p.m.

https://www.marketforum.com/forum/topic/69258/