| Date | Prior | Current | Rating | |

| Pending Home Sales_M/M | Oct-21 | -2.30 | 7.5 | B- |

| Construction Spending_M/M | Oct-21 | -0.50 | 0.20 | C+ |

| Case/Shiller HPI_M/M | Sep-21 | 1.40 | 1.00 | C |

| FHFA HPI_M/M | Sep-21 | 1.00 | 0.90 | C |

| Dallas Fed Mfg | Nov-21 | 14.60 | 11.80 | C |

| Chicago PMI_M/M | Nov-21 | 68.40 | 61.80 | C |

| PMI Mfg_M/M | Nov-21 | 59.10 | 58.30 | C |

| ISM Mfg_M/M | Nov-21 | 60.80 | 61.10 | C+ |

| ISM Svc_M/M | Nov-21 | 66.70 | 69.10 | B- |

| Factory Orders_M/M | Oct-21 | 0.20 | 1.00 | C+ |

| Consumer Confidence_M/M | Nov-21 | 113.80 | 109.50 | C- |

| Redbook_W/W | 11/27/2021 | 15.30 | 16.90 | C+ |

| Jobless Claims_W/W | 11/27/2021 | 199K | 222K | C- |

| Employment Situation_M/M | Nov-21 | 531K | 210K | C- |

Jobless Claims gained about 23K from an historically low 199K to a nearly historically low 222K, but that's enough to get it a C-. Employers really don't want to part with employees in this environment.

Consumers got a little less confident. Not a good thing in the midst of holiday shopping, but Redbook would suggest it's not affecting shopping.

Pending Home Sales took a nice jump as did Construction Spending, all while House Pricies continue to soar at about 18% per annum.

MFG remains strong with Factory Orders showing nice strength.

The ISM and PMI reports remain wildly positive. Chicago moderated a bit but remains in the 60+. ISM Svc is just below 70! I can't recall readings this high.

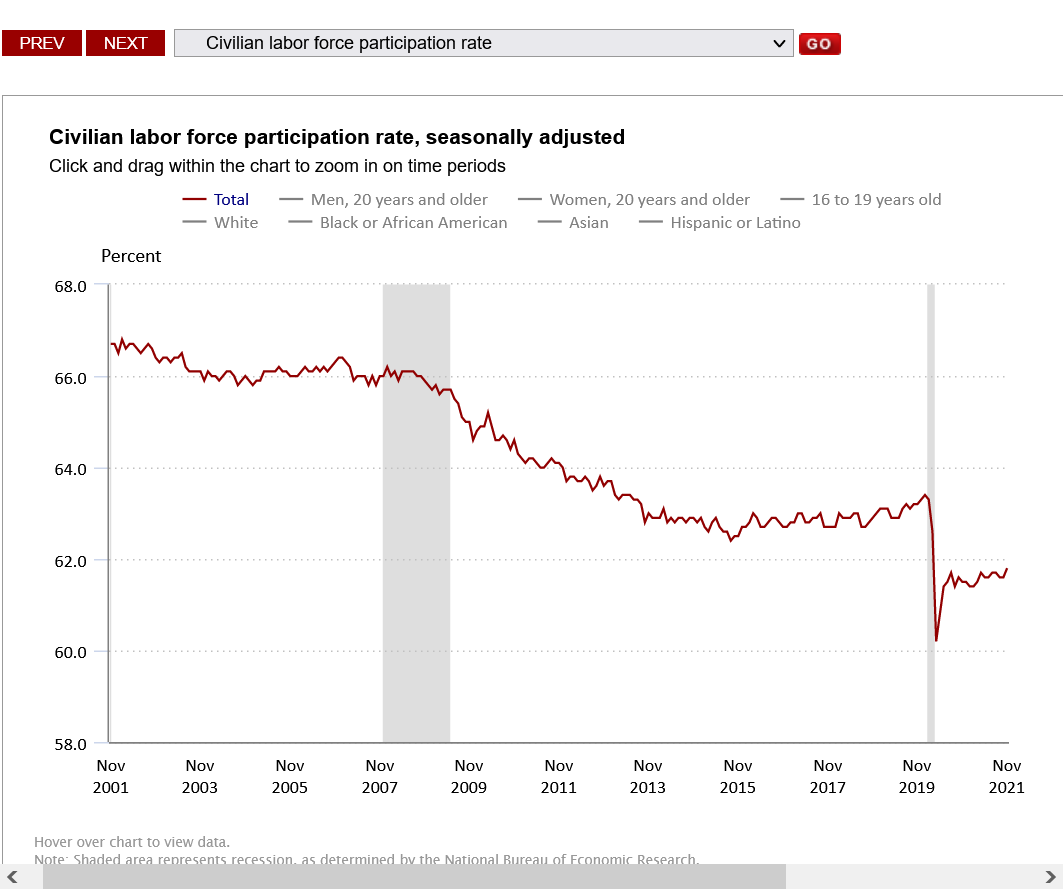

The headline this week is the Employment Situation. In normal times, a gain of 210K jobs is respectable. But these are not normal times. Economists expected between 5-600K. We still have about 4 million fewer in the work force than we did pre-pandemic, and we have over 10 million jobs open. This shortage continues to be felt, largely in the supply chain, and that is having ripple effects throughout the economy. It's quite possible those ripples will become a Tsunami.

Lot's of good news this week, but some foundational concerns restrict me to a C.

The headline this week is the Employment Situation. In normal times, a gain of 210K jobs is respectable. But these are not normal times. Economists expected between 5-600K. We still have about 4 million fewer in the work force than we did pre-pandemic, and we have over 10 million jobs open.

This is mind boggling when you think about it Tim and with the number of job openings that can't get filled.......you have to ask......"What would cause it to change greatly?"

And the answer seems to be........nothing that I can think of:

https://www.bls.gov/charts/employment-situation/civilian-labor-force-participation-rate.htm

The consequences are very counterproductive.

You have millions that are no longer productive in the work force.........no longer paying taxes....so the tax base shrinks, which means that you have to raise taxes on those that are working to get the same revenue.

https://www.investopedia.com/financial-edge/0811/the-cost-of-unemployment-to-the-economy.aspx

Yeah, non-productive are a double whammy. We spend money and lose revenue/productivity.

I really thought when we stopped the generous unemployment, people would head back to work. I don't understand what's going on.