Nothing more of significance this week.

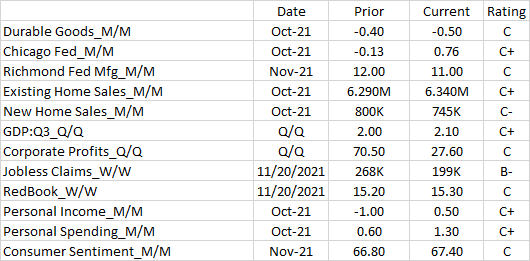

New Home Sales down a tic or 2 and Existing up as this market tries to discover itself.

GDP for Q3 is steady at a relatively disapointing level. Q4 is still forecast in the 8%+ range. Let's watch.

Corporate profits are not making sense to me, but are high and volitale. Need to do some digging.

Personal Income and Spending both had a good reading, but Consumers are understandably concerned.

Durable Goods were down for a 2nd month but Core Capital was up by .6.

Chicago showed decent growth and Richmond is steady and strong.

Most notable (as discussed) is the Jobless Claims this week at a level I've never seen. So much for my belief that it could not go much lower. But with a tight labor market and the holidays approaching, I guess anything is possible.

Going with a C+ this week. Happy Thanksgiving.

Thanks much Tim!

So jobless claims the best in over 50 years gets a B-.

What does it need to be to get an A?

That's a good question MM. Not sure it can get an A, at least not in a relative grading system. Add to that, weekly measures are not as significant, IMO, as monthly or quarterly ones. Of course, when it was in the +2 million range collapse, it got an F.

199K is an amazing number. Probably an outlier and very possibly adjusted in the week(s) to come, but it's 70K less than last week, or roughly 25%.. A slightly larger than typical deviation, but not a chart buster. Better than average, or B-.

Maybe it's like Option writing. Limited and defined upside, unlimited down side.