I have asked several questions about future financial conditions

I think it is time for me to offer what I think will happen

1st of all if you want an early warning, watch what congress does with the deficit.

It doesn't matter if we have pub or Dem the predictable future trajectory will be higher deficits.

Which elected official would vote for austerity

2nd. Watch how the Fed re-acts to congressional deficits.

My prediction is the Fed can't do much about deficits

From wages to TP to boats

My pick up truck is worth more than I paid for it

Our machinery is worth as much or more than we paid for it, assuming it isn't parked in the weeds. It used to be a depreciating asset was an expensive purchase. Cars were expensive to own and maintain

Do you understand what is happening???

INFLATION like we have never seen in our life time

Buy some energy stks

Thanks Wayne!

Double digit inflation would crush the US economy because just the interest rate on the national debt would be in the trillions every year.

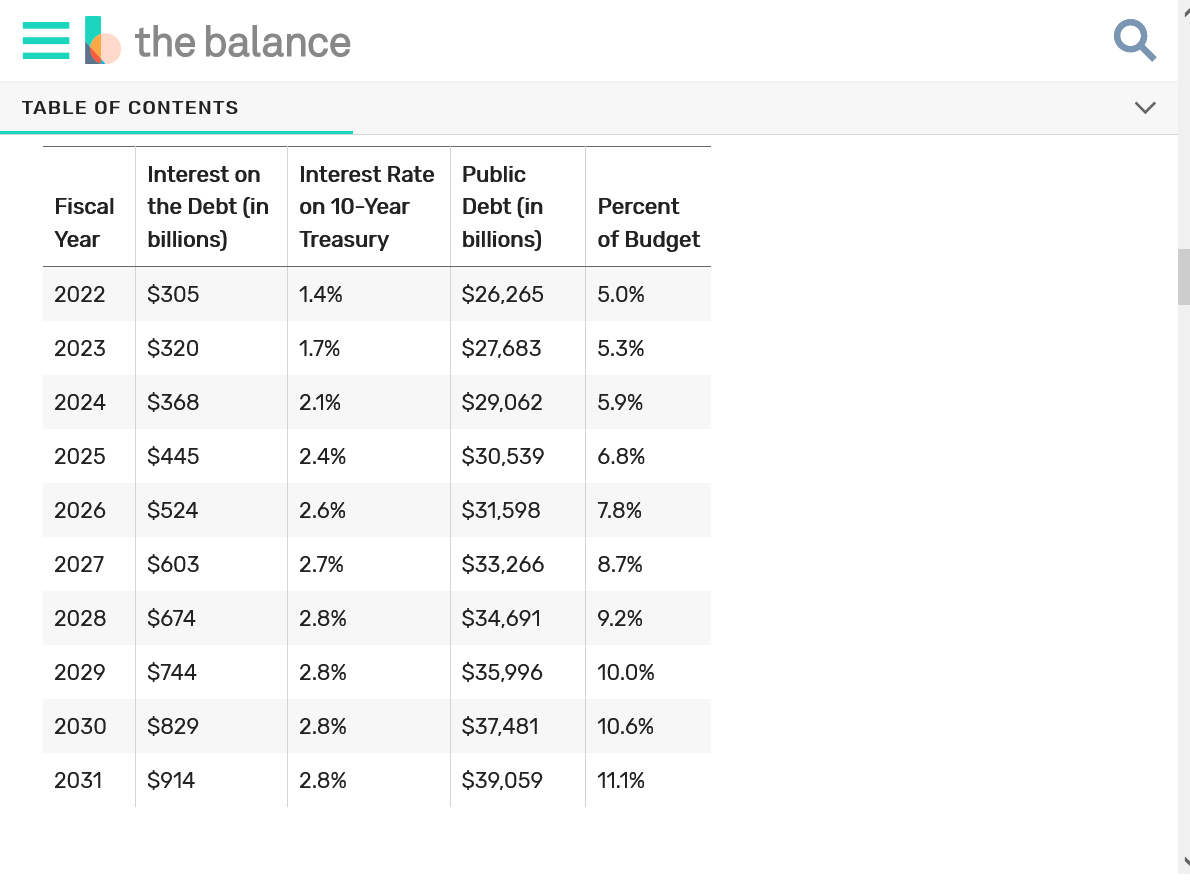

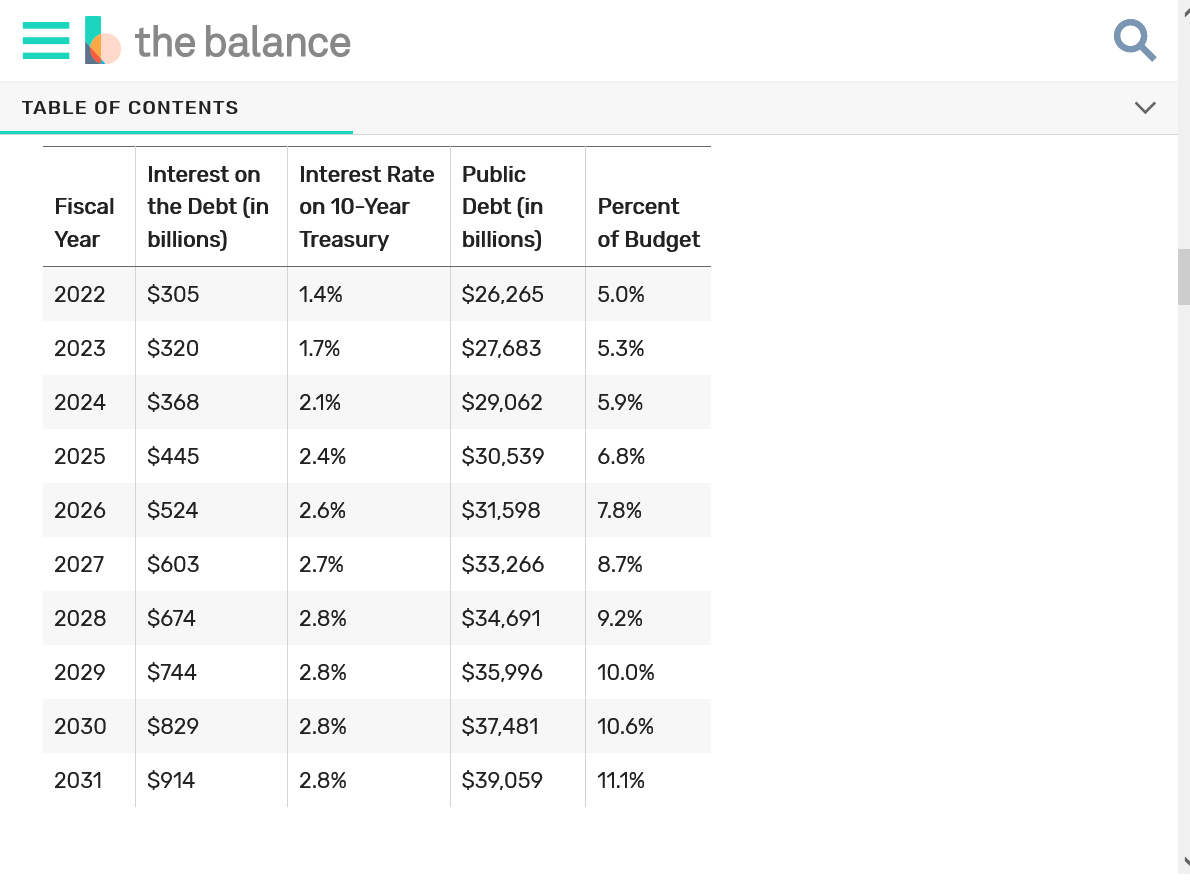

https://www.thebalance.com/interest-on-the-national-debt-4119024

Wayne.

Early warning on the deficit? If you haven't been watching Congress for the last 3 decades, then you are way behind. The future of that, is already here. It's become a target, to bankrupt the US. If that can be accomplished, then nearly every other country will fall like dominoes right behind us. The US has been a stalwart in supporting other country's economies, since WWII. Given the grants we are still giving to other countries, we still are.

Yet, it's a complex issue, that not even half of Americans can fathom or realize. For instance; we still send support to China, while also selling some of our debt to them, and paying interest on that debt. Just one example of the idiocy in our Congress.

But the Feds have this printing press, that can keep printing dollar bills. As long as Congress makes the promise to cover the debt of printing them. Currently, by raising the debt ceiling. It's like if I, as a bank, give you a credit card, that you can set your own limit on. And you can keep using that card, as long as you keep extending the limit, and as long as you keep paying the interest.

BUt when you can't pay the interest on it, and your holdings can't cover the debt, then your butt is mine! And every thing you own. It's no longer yours. It's mine now. And maybe I will rent it to you, at a premium. And if you can't afford it, too bad. Sucks to be you.

Is your truck really worth more than you paid for it? If you bought it new, then it lost 15% of it's value as soon as you drove it off the lot. I have only bought 1 new truck off the lot in my life. Never again. My current ride is a 1997 Silverado. Relatively easy and cheap to fix. Unlike those made after 2000. But as in real estate, your truck is only worth what the next sucker is willing to pay for it. The same goes for the machinery you use. Does it get the job done? Even if you have to have it repaired? And is the cost of repair vs replacement, a factor in your bottom line?

Aluminum foil, is something that most of us don't question in the use of, or throwing it into the recycle bin. But my grandmother was still in the habit of washing it and reusing it, from her days in the depression. Our society these days, has accepted a throw away attitude. Are farmers now throwing away equipment that is still useful?

Mark,

I really like your thinking on continuing to be happy with old stuff that still works well but just needs fixing or cleaning every once in awhile............instead of buying brand new stuff and adding to the waste of more natural resources while increasing the waste in our landfills.

I'm still driving my 2001 Ford Taurus. It's getting rusted out on the bottom and my wife asked why I spent $500 for repairs to the ignition system this year. I told her that the extra money just to insure a new car at 20 times the value would have been double that. And that would also have been the cost for less than 2 car payments if we financed a new car.

More personal savings...........less waste, more appreciation of value for something that accomplishes the main objective...........reliable transportation.

Hi Mark

I bought a used 2016 Dodge Ram 1500 4 door 4 x 4 Hemi for 22,000 Cad in 2016 with 22,000 plus klicks

22,000 Cad = approx 17,850. USD

22,000 klicks = approx 13,670 miles Call it 14,000 miles

Today that truck is used mostly for trips to the clinic for bacterial infection which is still with me. The clinic inspects and re-bandages my legs every 3 days so I drive every 3 days to the clinic, not much more. but I digress

That truck now has aprox 64,000 klicks which is approx 39,767 miles Call it 40,000 miles

Good luck finding a 2016 Ram 4 door 4 x 4 Hemi for 17,850 USD

I bought the truck from a guy who was having trouble making the payments. I went to the bank with him and paid the outstanding loan and owned a truck. I have a credit card that will cover that amount. I need a card with a high limit. Bought some machinery parts for approx 20,000 and they took my credit card. They would not take a cheque

Back to my predictions.

MM

I see your chat shows we are still in the billions of int payments by yr 2031 so trillions is a bit much. You need to read your own stuff before posting made up stuff, like trillions of int payments. I suppose eventually trillions will be the number but the dollar will be monetized so much it won't really be of concern

We will have bigger problems

Warning

Extreme caution about investing in Exxon Mobile. They have three greenies on their board and are trying to shut down two large gas fields which would have added huge profits but now, not so much

Maybe a futures contract in energy or a couple metals like copper or Magnesium unless the price is too high for your taste. I predict WTI oil at over 200. Propane will go higher

next 10 years, ... i say the stock market will not be any higher. (way too expensive currently). gold will be higher.

the only wrench is... the long bonds are telling us that inflation will not be surging higher long term.

is the bond market wrong? i think the bond market is wrong.

i would not buy bonds to only earn 2% per year for the next 30 years.

here is the calculation... 2% divided into 72 (remember the rule of 72?). that gives us 36. which means if you put 100 bucks into bonds, you will have 200 bucks by the year 2056.

do you think that 200 bucks in the year 2056 will buy as much as 100 bucks today? i don't think so.

i think gold and silver will keep up with inflation. but money loaned to uncle sam will not.

and stocks will go nowhere during this decade currently.

"MM

I see your chat shows we are still in the billions of int payments by yr 2031 so trillions is a bit much. You need to read your own stuff before posting made up stuff, like trillions of int payments."

Thanks Wayne!

Sorry that you are so confused about that but it was responding to your insistence below and me not explaining it well/completely:

"INFLATION like we have never seen in our life time"

Let me help you out. The chart is posted again below for you so that you don't have to scroll up and to explain it so that you understand . This is a projection based on the projected interest rate. Note that as the rate of interest goes up, the interest on the Debt goes up. The highest interest rate they project on 10-Year Treasury bonds is 2.8%, 10 years from now.

If we have mega inflation, there is no way that those rates can stay down there. Under your scenario, interest rates might be in the double digits as I suggested in that post.

If bonds were only paying 2.8% interest in 10 years and inflation was 10% for instance.........you would be LOSING 7.2% on the value of your money every year.........so interest rates WOULD also go much higher and the interest on the Debt would be more than double the numbers below, maybe triple+............trillions!

Did that explanation help you Wayne? Sorry if that wasn't clear in the previous post.

Hi Bear

I get your logic but markets are not logical

Remember when I posted to watch congress

I also said to watch the Fed

We have already increased the Debt ceiling and that is just until Dec The new debt ceiling is now the floor as one person said

After Dec. Congress has to do some thing more

The trajectory is higher debt ceilings. The only debate is how much higher.

Also people like Bernie, AOC etc have seized part of the Dems and want free this and that So there is a tug of war between those who want a smaller spending bill and those who want more

The thing is: everybody agrees on more spending. The only question is how high is the debt ceiling and how much more spending

This has to be funded by the Fed

Now China is selling treasuries, probably the smartest bunch in town as of now because Japan etc have stepped in and bought a boat load of treasuries. Why?/ I don't really know

But a huge amount of liquidity is going to enter the market to fund spending. Fed printing and selling treasuries

Where will this liquidity go

I know the old adage of P/E should determine value but we have passed the rubicon long ago when value has a meaning. People will buy stks for fear of losing out on profits. So far that has been the norm and unless you are a skilled scalper, buying is the only game in town. Why would that change

What do you think most investors will buy

As you said treasuries are a loser, in fact the spread between real inflation and bond yield has never been higher, for this generation of investors. Thus stks still sell as the better investment

Stks will sell so long as the Fed doesn't step in and raise int rates or stop buying to support the congressional spending

I don't think the Fed has the back bone to stop monetizing the debt

Biden wants his green plan, Bernie et all want free stuff, the Fed won't do anything to stop the ball rolling down hill, because they can't or won't. The only debate is how much higher will the deficit go. Balanced budgets is old school thinking to this generation of Wall St and congress Higher int rates is just plain silly to this generation of investors and would kill the economy

Stks will go up unless you can tell me where the liquidity will go. Or the Fed get's a back bone and sits down with congress and tells them no more higher deficits

Congress is not going to listen to that kind of talk

The 0.1 % don't want to lose the golden eggs of higher stks

The debt will be monetized and stks will go higher along with a lot of other stuff as inflation becomes permanent double digit. The Fed disagree but the Fed is wrong.. Unless the Fed finds a new way to calculate CPI. But real inflation is real inflation, no matter what the Fed says

This shortage of goods and other stuff will not be solved in a yr or two. Nobody has the skills to untangle the cargo unloading. Biden called in some people but did that do any good. Just made these people think they had to look after number one in the big picture. They went away with the thought people will pay higher prices. Stks will ride the wave of inflation

Every generation is different. The people who won't work see they can't earn more than MOM and Dad so why try. That hasn't happened since 1950. Labor might flex some muscle and unions may become stronger. Mom and Dad didn't want unions but this generation might see unions as a good thing, or the only good thing

This generation has never seen a true depression where stks crashed and did not recover. So this generation of Wall St will buy stks

As that 401k money rolls in every trader has to make a decision as to what to do with his/her allocation of funds. As one trader said: they just keep pushing all this money my way and expect me to make a profit

Every day the Fed has to decide what to do to fund spending