hey folks, be honest... if you own your own business... how much do you charge per hour?

for example,... if you are a plumber, are your hourly rates going up at only 2% per year?

if you do concrete work,... has your rate you charge gone up by only 2% per year?

and the stuff you have to pay for, your truck, your insurance, labor, is it going up by 2% per year lately?

i charge for doing bee removal. my rate did not go up this year, but over the last 15 years it has gone up by about 5% per year. (roughly doubled over 15 years).

what i charge for honey has gone up by about 5% per year. (average over the last 10-15 years).

what i pay for insurance has gone up about 5% per year BUT... the coverage today is MUCH WORSE, than 15 years ago. so any talk of inflation there is useless. you pay more for a worse product.

gasoline is about the same as 14 years ago, but higher than last year.

lumber is much higher. absolutely crazy price increases recently. but up about 100% over 10 years. (i sometimes buy lumber for pallets, or boxes, or lids for beehives).

Thanks bear!

My main business the past 25 years has been coaching chess.

Currently the chess coach at 5 different schools in Evansville Indiana.

My rates have gone up 5%/year.

When you are a volunteer and don't do it for the money, it doesn't matter how much you multiply your fee by.

Anything times zero, is always..............ZERO (-:

Seriously though, I have noted rates to get my students into tournaments have doubled since the 1990's, if my fading memory is correct.

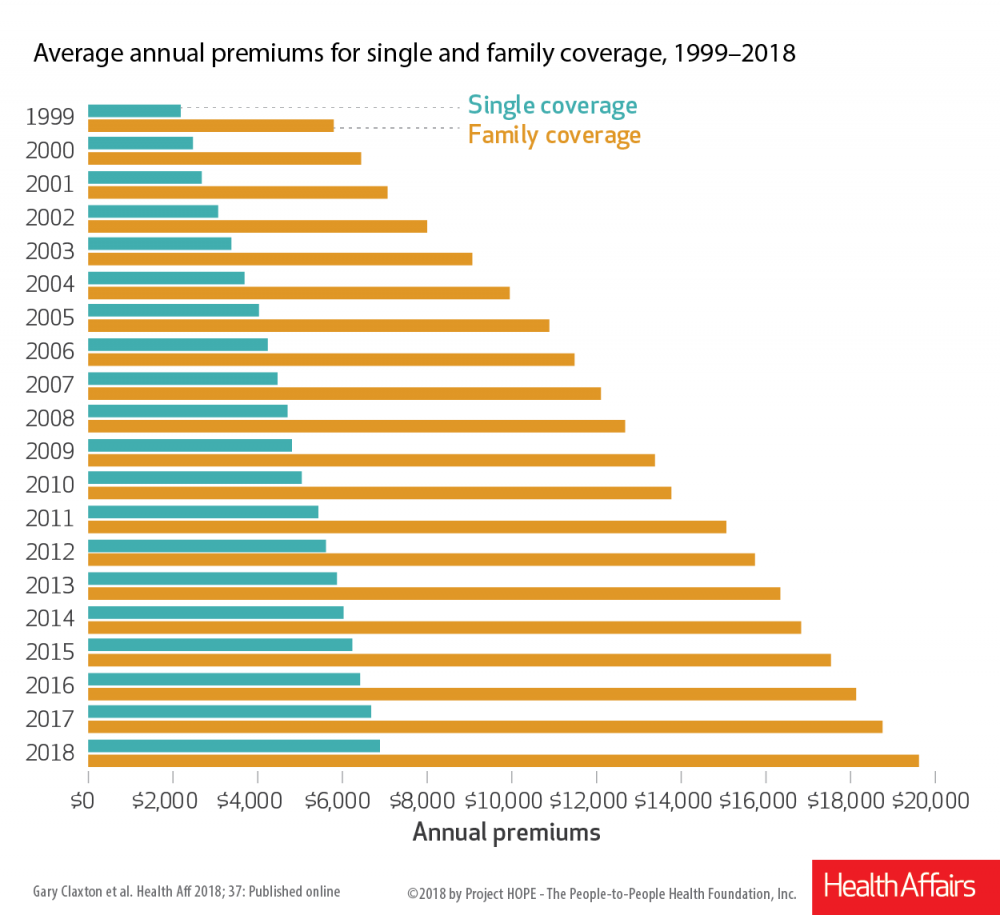

Even more serious, is that of all the expenses, health care (and college tuition) has by far been going up the most.

I recently went on Medicare and was pleasantly shocked at how the government sets a limit on the prices that it will pay health care providers.......just a fraction of their price gouging charge.........and they have to accept it.

Then I pay 20% of that much reduced rate.

My premium is only around $200/month.

For several years, my wife and I went without health insurance. I just refused to pay the insanely high rates.

https://www.ncsl.org/research/health/health-insurance-premiums.aspx

I was already strongly for socialized medicine but now am absolutely convinced this is what the US needs to fix our broken health care system.

https://howmuch.net/articles/price-changes-in-usa-in-past-20-years

This may be treading into NTR territory but there is a ton of overlap in discussions and the main reason we split the forums is to minimize emotional, non factually based political disagreements based on ideological differences.

When health care costs are devouring a massive portion of our incomes......it's hurting our economy and productivity(with much less money to spend buying stuff) and are an additive to inflation.

So here was a good discussion with lots of comprehensive information on the topic.......yes, I am promoting socialized medicine because it's the right thing to do(in my opinion) and not pretending otherwise but Americans are the ones that have alot to gain from it.

Socialized Medicine

https://www.marketforum.com/forum/topic/65512/

Looking at the chart on the changes in cost +/-, it seems there is a strong corelation between government involvment and costs. More government involvment indicates higher cost, lower government involvment/free market indicates lower cost.

That being the case, it seems at least counter intuitive to support an argument that the solution to higher costs in things like healthcare and education is... More government.

I think a good example of innovation we can all relate to is the rail road replacing other means of transportation

Faster, cheaper, larger loads /worker

Higher wages for the skilled engineer

Those who had the vision to build reaped the reward

Those who stayed with the old ways were left behind

And then of coarse Henry Ford was not the1st auto maker

He simply produced a cheaper reliable car [for the times] and paid higher wages

"it seems there is a strong correlation between government involvement and costs."

Just the opposite with health insurance.

As I stated, I just went on Medicaid on Feb 5th and experienced it first hand for the first time. It's for real.

The government fixes the rate/price they will pay for everything with Medicare.

On almost everything, the rates charged to me after the government dialed the rate down was 80% less/cheaper. Then, I only pay 20% of that 80% cheaper charge.

I am loving Medicare compared to my private health insurance!

The main reason that our rates are so high is BECAUSE of private health care companies(not insurers) that can charge anything they want since this is realm where consumers absolutely, positively cannot shop around for the best rates.......and the corruption of our political entities that benefit personally while screwing Americans.

If we did like Canada and the other developed countries, we would not have this problem.

Even the best private health insurance plan in existence in the US right now still has to pay the exorbitant, price gouging rates that health care providers charged............without the government fixing the rates like they do with Medicare.

As no brainer as it gets but politicians DON'T want you to know this because it would take away their golden goose, laying the golden eggs...........but you and me are paying the nasty high rates to feed the hungry goose.

Meanwhile, more and more doctors refuse medicare. And the cost of healthcare/insurance is up, due in large part, to government interference,

Doctors Refuse To Accept Medicare Patients (healthitoutcomes.com)

That article that you found from 8 years ago proves my point exactly.

Medicare....or government healthcare insurance IS in fact drastically lowering the cost to consumers and healthcare providers don’t like it.

I called 8 different doctors and healthcare providers here locally that my wife and I use and the Indiana hand and shoulder center out of town earlier this year when going on Medicare. Every single one of them accepts the fixed lower rates that Medicare pays.

I love my government healthcare insurance.....Medicare. It will be saving me tons of money with absolute confidence.

Please tell me something that I should not love about it?

sorry, folks, let me again point out what is incorrect in some of these graphs and posts.

the graph... 20 years of prices is wrong. i have seen other date/graphs that show wages Not keeping up with inflation. wages, and especially minimum wage have Not kept up with inflation now for 50 years.

it show the price of a new car has Not gone up in 20 years? that also is incorrect.

also, i know some seniors love their medicare, but this is because they get a LOT more out of it than what they paid in. this is one reason it will have a funding problem very soon.

if you calculate all that you paid in over the years, and adjust for inflation... it is Not enough to cover what you will get out of medicare. this is why seniors love it and think it is a great deal. they do NOT understand the math. this is why my grandkids will see a country with a much worse economy, larger inflation, and more stagnation.

the math for medicare is far worse than the math problem for SS.

you would have had to pay about 3 times the fica/medicare tax in order for the system to be financially healthy today

i think most of you did not answer my initial question.

how much more do you charge (in your business), and what cost changes have you seen?

here is another problem with the 20 yrs price chart... the price of a TV or clothes have not gone up, but those are items i rarely buy, so they do NOT factor into my inflation calculation.

the things i have to buy more frequently ... tires, vehicle repairs, insurance, fuel, queens, wood, etc.

the only thin that has not gone up much over the last 40 years is the electric bill.

Medicare tax 2.9%for life. about 40 years paid in advance. If you average 100,000 / year for those 40 years you paid $116,000. If you had invested those funds it would easily had doubled. So $232,000 Before you get ins for rest of your life. USA life expectancy is 79.8 years Therefore your cheep health care cost you $14,595/ year paid mostly in advance.

Great points bear,

I agree that the price of new cars has gone way up and that metric was definitely wrong but mainly showed that graph to display some other items that it does accurately represent.

On the Medicare, I also agree that the math doesn't add up and with the older population only getting larger, that system will be operating at a massive loss.

But that has 0 to do with my point, which is that Medicare forces the price down that health care providers charge to the cost that THEY dictate...........which is also lower than the rate they charge private health insurance companies and MUCH lower than they charge a non insured individual that doesn't get the insurance provider discount.

It's a massive racket actually with the consumer that does not have private insurance(paying astronomical rates), Medicare or free healthcare getting messed over to the point of it not being affordable for many(my wife and I for several years went with no insurance vs paying 18K just in yearly premiums).

Again, Medicare is the government forcing the major price gouging healthcare providers to obey their much lower, fixed price standards.

I think that if every doctor or hospital would be able to collude and refuse to take Medicare, theoretically you might be able to defeat them but there are just too many old people on Medicare and it has too much power from those many tens of millions of clients.

If the US went on socialized medicine, the number of clients would soar to hundreds of millions and the government would really be able to fix the price for every procedure and control the price of drugs for everyone. There is no question about it.

Would our doctors suddenly get incompetent because they were paid less?

Regardless, there is absolutely no other solution to fix the broken health care system...........which is broken because consumers couldn't afford it 10 years ago and now many prices have doubled.

How broken does it have to get?

The main item stopping the fix is the health care providers, with their massive lobby money owning the corrupt politicians who love to play the game that its because of the health insurance industry. I suppose that if we had one huge private health care insurance company( or several that colluded) that could dictate/fix prices and providers would have no choice, that would fix it, if that was legal............actually, we do have something like that right now for old people like me.............but the one huge entity is the government and its proven and practiced in the real world with Medicare.

Doesn't matter when the article was printed, it holds as true, if not more true, today. But that is just one of many points.

I don't understand why some people can't seem to understand what free markets and competition do to price. We are surrounded by many examples every day. The problem with medicine is that government and insurance have removed the consumer, a key factor, from the equation. We generally don't have any idea what we are paying so no one has any incentive to find solutions to reduce cost.

I hear arguments like "Medicine is different and it's tough to make a decision from the back of an ambulance", but how many medical procedures/treatments in your life started with an ambulance ride?

FInally, if you think a few lobbyists and some insurance companies and some healthcare professionals are going to get together and give you the best medical price/service possible, you've not been paying attention.

Medicare only looks good to you because government, with the help of insurance companies and medical providers has screwed things up so badly..

Thanks Tim!

The Bond Market is acting like the fed is going to keep rates low. Despite a 5%cpi. Bonds higher today.

"Medicare tax 2.9%for life. about 40 years paid in advance. If you average 100,000 / year for those 40 years you paid $116,000. If you had invested those funds it would easily had doubled. So $232,000 Before you get ins for rest of your life. USA life expectancy is 79.8 years Therefore your cheep health care cost you $14,595/ year paid mostly in advance."

Those are some interesting calculations cutworm.

Let me do some calculations below using your incorrect values, then on the next page I'll tell you why your hypothetical numbers and calculations based on them are very inaccurate.

Let's apply your above example to my actual life and pretend your tax rates are correct to come up with my taxes paid.

When I left the tv station in Sept 1993, I became a professional trader and paid 0 medicare tax and 0 SS tax since then. Declaring all my income on schedule C.

My last years working that job as chief meteorologist, my salary was around $34,000 but my first 3 years made $16,500.

The average income for those 11 years was around $25,000.

In high school, I had a lawn cutting business and paid no taxes.

Between 1974 to 1982 I was in college most of the time and worked part time most of those years and full time in the Summers but probably averaged $5,000/year.

So all those years combined, when paying Medicare tax made 315,000. (I made that much trading in 2 different years!)

So I paid around $9,135 in Medicare taxes in my life. I highly doubt that I or anybody else would have taken that 2.9% worth of money each year and invested it but lets just say that happened because your hypothetical says that it would have.

So $18,270 dollars is what I could have ended up with when I turned 65 earlier this year based on my real world life and numbers.

How much insurance would $18,270 for the rest of my life get me right now?

Well, my wife's company pays for an individual plan(not group insurance) that is costing the company $20,000/year for the 2 of us and has a $6,000 deductible and $8,000 max out of pocket expense, which I actually hit earlier this year because of several medical issues I have/had. I've been using both this insurance and medicare at the same time but go off the private insurance at the end of this month.

So the combination of the premium($10,000) + the max out of pocket expense($8,000) would have used up my saved medicare tax money from my entire life with it doubled from investing............ in just 1 year.

The biggest benefit, however is the massive savings because the government, forces the health care provider to accept rates that are around 20% of the listed sticker price for these procedures. Then, I pay 20% of that 20%, which around 4% of the listed/initial charge.

It's that massive cut to inflated/price gouging charges that all people in this country should be getting out of fairness..... not just people on government insurance(Medicare).

The only way that everybody will ever get it........is if everybody goes on government insurance. Social medicine.

OK, now lets explain why your hypothetical example is way off on the next page.

"Medicare tax 2.9%for life. about 40 years paid in advance. If you average 100,000 / year for those 40 years you paid $116,000. If you had invested those funds it would easily had doubled. So $232,000 Before you get ins for rest of your life. USA life expectancy is 79.8 years Therefore your cheep health care cost you $14,595/ year paid mostly in advance."

1. You are taxing a person at 2.9% going back 40 years. The Medicare tax rate was less than half of that in 1981. It did go up to 2.9% in 1986 and has stayed there since then.

2. If you were making $100,000, in 1981, you stopped paying the Medicare tax on any income greater than 29,700 in 1981. The maxing out gradually went up every year but didn't get above $100,00 until 2008.

3. Since I never maxed out, #2 did not affect me. However, my Medicare tax prior to 1986 was less than 2.9% and was MUCH lower than that before 1980. In 1977 it was just .9%. However, more than half of my income was taxed at 2.9%

One can guess that an actual person making $100,000 the past 40 years, paid in less than half the Medicare tax of what you assumed based on the actual tax laws/rates shown below.

Would that person have also invested that money every year for 40 years to use for health insurance when they turned 65?

Social Security and Medicare Tax Rates, Calendar Years 1937 – 2009

https://files.taxfoundation.org/legacy/docs/soc_security_rates_1937-2009-20090504.pdf

The salaries of Tv Meteorologists in the US range from $26,721 to $706,326 , with a median salary of $129,532 . The middle 57% of Tv Meteorologists makes between $129,532 and $320,511, with the top 86% making $706,326.

Let me be clear I'm not doubting your story but I used the above numbers. And I certainly do not condemn some one who makes less and I believe all labor is honorable.

Some will always pay less some more. The tax rate will go up as history suggest.

There's no limit on Medicare withholding like there is on FICA. If you make a million, you pay 2.9% (half from you, half from employer).

When I was working 1099, I'd take a "reasonable" salary, and pay myself the rest in dividends (capital gains), which were not subject to Medicare or FICA tax. Being self employed, I was on the hook for the entire amount since I was my own employer. That really adds up.

Pretty typical. Former dem candidate Edwards (two Americas) made it famous when he was winning massive judgements on his junk science law suits. He'd pay himself through a dummy corporation.