Please continue NG discussions here. Thanks.

EIA was ~neutral for a change.

Only a 5.7 cent range on EIA day is low ranged for an EIA release day. How low? I went all of the way back to 10/15/20 and still couldn't find a lower range EIA day and really not even that close to 5.7 cents. I think the lowest back that far was ~8 cents and most were 10 cents or more...sometimes a lot more. This is a sign not only of the neutrality of the release but also that not much of the heating season is left. Nevertheless, a pretty strong dose of chill for mid April is on the way in week 2, which would lower the injection ~15 bcf vs what a near normal week would yield and which would be ~~30 bcf lower injection than the prior very bearish week looks to be at. However, even with that, there would still be an injection associated with that week that is very likely to be higher than today's +20 as it looks now.

Thanks much Larry for getting to the new thread off to a wonderful start.

Agree completely with your assessment. I'll follow up with the latest in a minute.

We had a bit of a bounce before the regular close when the European model came out colder....possibly from that... possibly because we were getting ready to close..... but have not added to that, even with the ensemble being +7 HDD's greater after the bounce.

We are unchanged for the day after Wednesdays nice gains and Mondays collapse lower to test the March lows. https://www.marketforum.com/forum/topic/66971/#67555

Here is the link from the previous thread:

NG 3/22/21 - 4/8/21

57 responses |

Started by WxFollower - March 22, 2021, 2:51 p.m.

7 day temperatures for todays period, ending last Friday were close to average overall vs recent weeks that have yoyo'd up and down.

+++++++++++++++++++++++++++++++

Latest Release Apr 08, 2021 Actual 20B Forecast 21B Previous 14B

https://www.investing.com/economic-calendar/natural-gas-storage-386

Release DateTimeActualForecastPrevious

Apr 08, 2021 10:30 20B 21B 14B

Apr 01, 2021 10:30 14B 21B -32B

Mar 25, 2021 10:30 -36B -25B -11B

Mar 18, 2021 10:30 -11B -17B -52B

Mar 11, 2021 11:30 -52B -73B -98B

Mar 04, 2021 11:30 -98B -136B -338B

++++++++++++++++++++++

Weekly Natural Gas Storage Report

for week ending April 2, 2021 | Released: April 8, 2021 at 10:30 a.m. | Next Release: April 15, 2021

+20 BCF.......Neutral

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/02/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 04/02/21 | 03/26/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 305 | 307 | -2 | -2 | 382 | -20.2 | 303 | 0.7 | |||||||||||||||||

| Midwest | 398 | 401 | -3 | -3 | 475 | -16.2 | 400 | -0.5 | |||||||||||||||||

| Mountain | 115 | 112 | 3 | 3 | 92 | 25.0 | 106 | 8.5 | |||||||||||||||||

| Pacific | 198 | 194 | 4 | 4 | 202 | -2.0 | 194 | 2.1 | |||||||||||||||||

| South Central | 768 | 749 | 19 | 19 | 867 | -11.4 | 806 | -4.7 | |||||||||||||||||

| Salt | 235 | 226 | 9 | 9 | 264 | -11.0 | 248 | -5.2 | |||||||||||||||||

| Nonsalt | 533 | 523 | 10 | 10 | 604 | -11.8 | 558 | -4.5 | |||||||||||||||||

| Total | 1,784 | 1,764 | 20 | 20 | 2,019 | -11.6 | 1,808 | -1.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,784 Bcf as of Friday, April 2, 2021, according to EIA estimates. This represents a net increase of 20 Bcf from the previous week. Stocks were 235 Bcf less than last year at this time and 24 Bcf below the five-year average of 1,808 Bcf. At 1,784 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

By MarkB - April 8, 2021, 11:55 a.m.

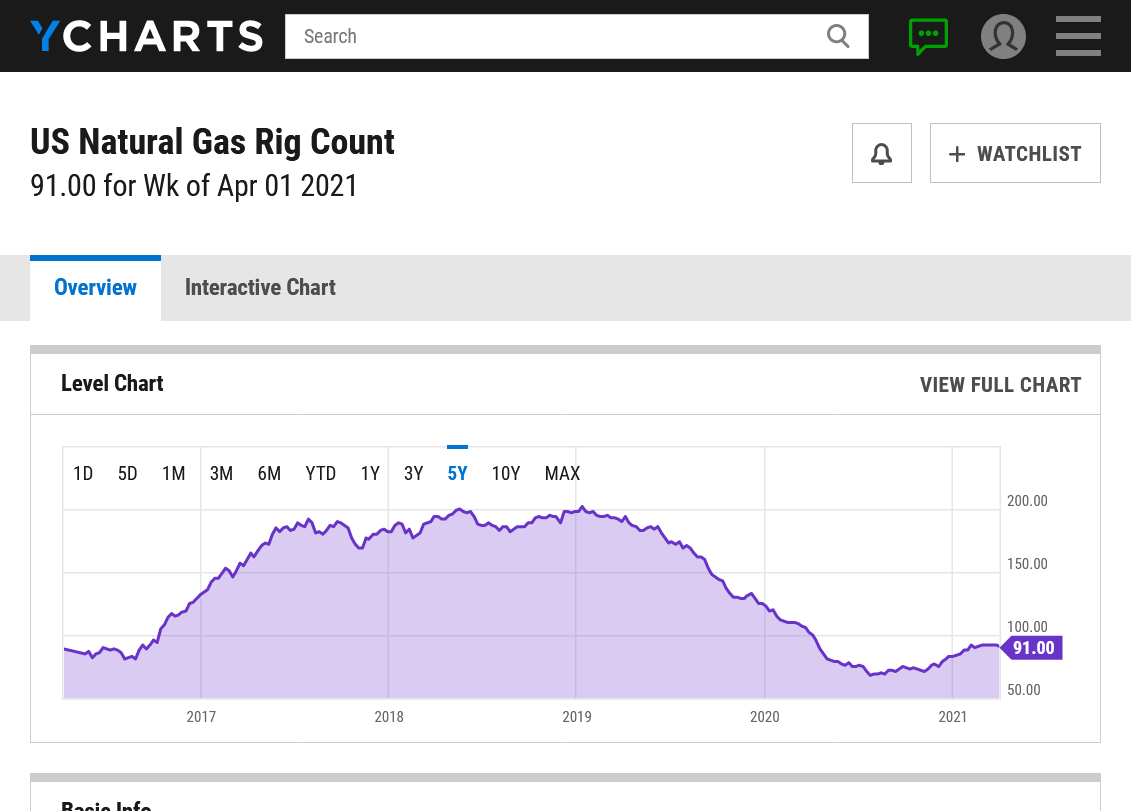

It seems quite the conundrum we have fundamentally. Rig count is only down by 1, ever so slightly bullish. Exports are up, bullish. Despite the nuetrality of the storage number, gas in storage is maintaining, and looks to possibly increase, bearish. And as you have pointed out, short of a few cold snaps, winter is over. HDDs going down, bearish.

No wonder we aren't getting too much action, especially on seaasonals.

++++++++++++++++++++++++++++++++++++

By metmike - April 8, 2021, 12:23 p.m.

Thanks Mark!

Speaking of the rig count. Up from the lowest of the last 10 years of 68 in July 2020 because of COVID last year but still well below the previous loftier levels:

https://ycharts.com/indicators/us_gas_rotary_rigs

European Ensemble was less chilly in week 2 and put a bit of pressure on ng prices in the PM.

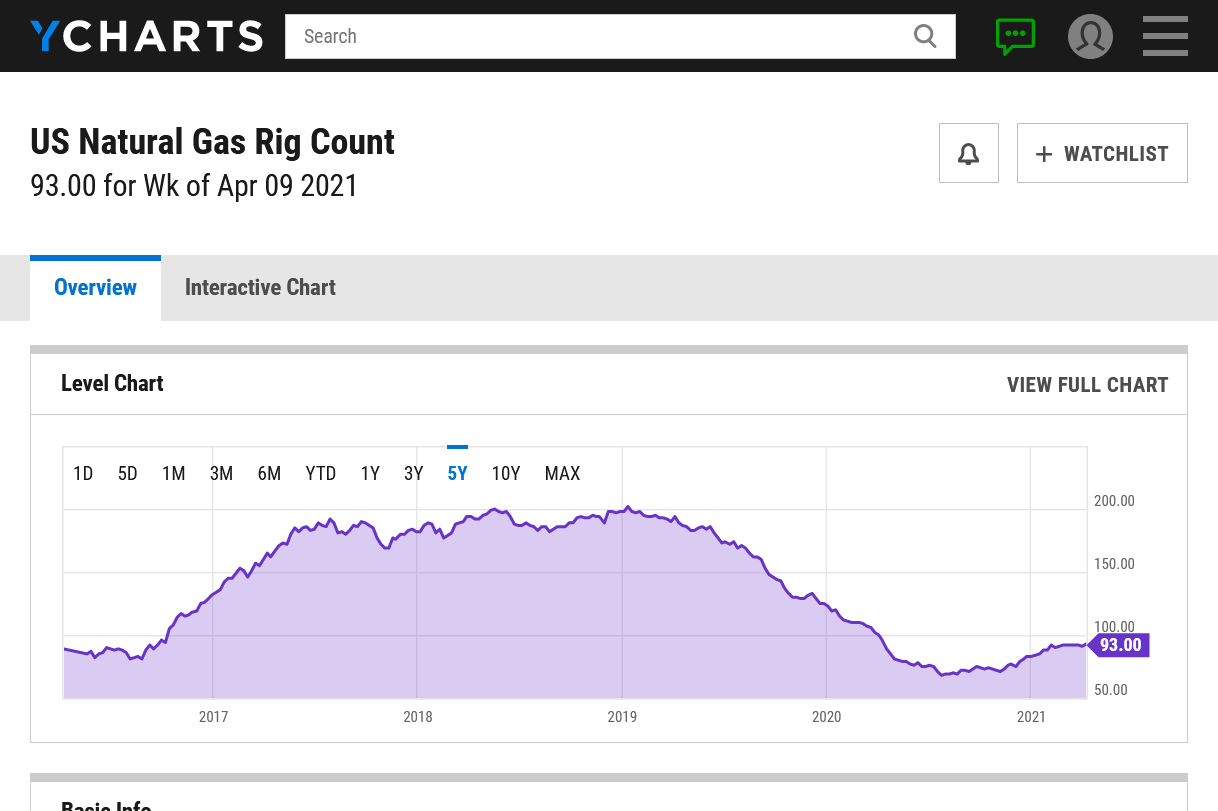

The U.S. natural gas rig count climbed two units to 93 for the week ended Friday (April 9) as an uptick in land drilling offset a pullback in the Gulf of Mexico, according to data published by Baker Hughes Co. (BKR). U.S. oil-directed rigs remained unchanged overall at 337. The total U.S. rig count ended…

metmike: Up from the lowest of the last 10 years of 68 in July 2020 because of COVID last year but still well below the previous loftier levels:

https://ycharts.com/indicators/us_gas_rotary_rigs

"Weather is colder, with more HDD's on all the models vs last Friday. They keep the chilly weather going well into week 2 today, numerous days longer than late last week.

We're talking late April now and CDD's , seasonally go higher than HDD's around May 10th.

This means that in a few weeks, cool weather will become bearish instead of bullish."

The death throes of winter. LOL. A/C is already rolling in the south. And summer is coming. Looking for the long opportunities.

Thanks Mark!!

I accidentally posted that message you have in quotes above on the old ng thread. Thanks for moving it here!

metmike: Strong overnight rally on colder temps over the weekend but it died during the day session, which closed slightly higher.

7 day temps ending last Friday for this Thursday's EIA report. VERY mild, especially in the Midwest. The injection should be pretty big for April.

Tuesday after the close

Wednesday early

04/14 07:56a CST DJ Natural Gas Climbs Toward 1-Month-High -- Market Talk

0856 ET - Natural gas prices rise 1% to $2.646/mmBtu and are on course to

close at their highest level since March 11 as spring snow Friday and Saturday

in Denver, and a stalling cold front across Texas and other midcontinent states

creates some unexpected, albeit moderate, late-season heating demand. Prices

have already risen for five straight sessions as investors hope the cooler

weather, along with some production issues in the east, will help keep a lid on

storage injections during this typically weak-demand, shoulder period.

(dan.molinski@wsj.com)

(END) Dow Jones Newswires 04/14 01:47p CST DJ Natural Gas Slips, Ending 5-Session Streak of Gains -- Market Talk 14:47 ET - Natural gas prices end the session a tiny, 0.04% lower from yesterday's closing price, at $2.618/mmBtu. The small declines brings to an end a five-session streak of price increases and suggests investors are once again turning a bit bearish as they await a weekly EIA storage report tomorrow that may show a large increase in inventories due to weak demand amid mild weather. A WSJ survey of analysts is forecasting, on average, a 66B cubic feet injection into storage for the week ended April 9, which would be well over double the normal 26-bcf injection for that week. (dan.molinski@wsj.com) (END) Dow Jones Newswires

Thanks much Larry! Sounds good to me.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 15, 2021 Actual 61B Forecast 67B Previous 20B

+61 BCF Bullish

Release DateTimeActualForecastPrevious

Apr 15, 2021 10:30 61B 67B 20B

Apr 08, 2021 10:30 20B 21B 14B

Apr 01, 2021 10:30 14B 21B - 32B

Mar 25, 2021 10:30 -36B -25B -11B

Mar 18, 2021 10:30 -11B -17B -52B

Mar 11, 2021 11:30 -52B -73B -98B

for week ending April 9, 2021 | Released: April 15, 2021 at 10:30 a.m. | Next Release: April 22, 2021

+61 BCF Bullish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/09/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 04/09/21 | 04/02/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 311 | 305 | 6 | 6 | 397 | -21.7 | 303 | 2.6 | |||||||||||||||||

| Midwest | 414 | 398 | 16 | 16 | 485 | -14.6 | 398 | 4.0 | |||||||||||||||||

| Mountain | 118 | 115 | 3 | 3 | 95 | 24.2 | 107 | 10.3 | |||||||||||||||||

| Pacific | 205 | 198 | 7 | 7 | 203 | 1.0 | 198 | 3.5 | |||||||||||||||||

| South Central | 798 | 768 | 30 | 30 | 906 | -11.9 | 827 | -3.5 | |||||||||||||||||

| Salt | 251 | 235 | 16 | 16 | 283 | -11.3 | 258 | -2.7 | |||||||||||||||||

| Nonsalt | 547 | 533 | 14 | 14 | 623 | -12.2 | 569 | -3.9 | |||||||||||||||||

| Total | 1,845 | 1,784 | 61 | 61 | 2,087 | -11.6 | 1,834 | 0.6 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding | |||||||||||||||||||||||||

Notice: Automated retrieval policy

Working gas in storage was 1,845 Bcf as of Friday, April 9, 2021, according to EIA estimates. This represents a net increase of 61 Bcf from the previous week. Stocks were 242 Bcf less than last year at this time and 11 Bcf above the five-year average of 1,834 Bcf. At 1,845 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

Natural gas futures prices rebounded Thursday as the government’s weekly inventory report proved bullish, and both weather forecasts and demand for U.S. exports remained favorable. The May Nymex contract settled at $2.658/MMBtu, up 4.0 cents day/day. June gained 3.7 cents to $2.730. NGI’s Spot Gas National Avg. rose 4.5 cents to $2.565, continuing a weeklong…

metmike: CDD's will seasonally be greater than HDD's in less than a month, though the flip could take place a week or so earlier this year.

Decent HDD's the next week(for this time of year).

The 12z EURO Ensemble came out with +9HDD's ....but the market didn't care very much. Too late in the heating season, I think.

Euro another +9 HDD's 0Z run. Pretty chilly addition.

Getting a modest bullish reaction to price.

metmike: Hey..................they stole that from me (-:

see previous post

04/16 01:54p CST DJ Natural Gas Ends at Highest in 5 Weeks -- Market Talk 14:54 ET - Natural gas prices finish the session with a gain of 0.8% and the week 6.1% higher at $2.680/mmBtu, the highest closing price since March 10. Prices have been rallying for nearly two weeks, climbing for seven of the past eight sessions as forecasts for cooler weather that will boost domestic gas demand combine with data showing more record-high exports of LNG and strong pipeline shipments of natural gas to the US's southern neighbor, Mexico. The chillier weather won't last long, nor will it create a huge increase in demand--but traders say at least it staves off by a few days the upcoming period of extremely-weak spring demand prior to summer. (dan.molinski@wsj.com) (END) Dow Jones Newswires

Thanks Larry!

Natural Gas Intelligence after the close Friday:

metmike: Amazing to see temps chilly enough to help us go higher this late in the heating season but there are other bullish factors........exports and seasonals.

Tue close:

After a meaningful step higher over the past week or so, natural gas futures steadied a bit on Tuesday and traded in a tight range. Small deviations in supply and demand ultimately sent the May Nymex contract down 2.2 cents to settle at $2.727, while the June contract slipped 1.5 cents to $2.803. Spot gas…

Wed Am:

April 21, 2021

metmike: Been tied up with other things but the cold is peaking with HDD usage peaking right now and we will be dropping back closer to around average.

Seasonal CDD's are slowly increasing and will pass up HDD's in the 2nd week of May. Both of them added up between now and mid May, normally don't amount to much unless we have something like the current extreme cold(thats ending) or extreme heat in early May(which is not forecast).

7 day temps for Thursday"s EIA report. Cold: Northwest to Rockies to Plains to W.Midwest. Warm East.

This was the previous week that gave us a +61 BCF injection that was considered bullish.

for week ending April 16, 2021 | Released: April 22, 2021 at 10:30 a.m. | Next Release: April 29, 2021

https://ir.eia.gov/ngs/ngs.html

+38 BCF BULLISH

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/16/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 04/16/21 | 04/09/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 325 | 311 | 14 | 14 | 400 | -18.8 | 309 | 5.2 | |||||||||||||||||

| Midwest | 421 | 414 | 7 | 7 | 492 | -14.4 | 401 | 5.0 | |||||||||||||||||

| Mountain | 118 | 118 | 0 | 0 | 96 | 22.9 | 109 | 8.3 | |||||||||||||||||

| Pacific | 210 | 205 | 5 | 5 | 209 | 0.5 | 203 | 3.4 | |||||||||||||||||

| South Central | 810 | 798 | 12 | 12 | 937 | -13.6 | 849 | -4.6 | |||||||||||||||||

| Salt | 256 | 251 | 5 | 5 | 299 | -14.4 | 268 | -4.5 | |||||||||||||||||

| Nonsalt | 554 | 547 | 7 | 7 | 638 | -13.2 | 582 | -4.8 | |||||||||||||||||

| Total | 1,883 | 1,845 | 38 | 38 | 2,134 | -11.8 | 1,871 | 0.6 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,883 Bcf as of Friday, April 16, 2021, according to EIA estimates. This represents a net increase of 38 Bcf from the previous week. Stocks were 251 Bcf less than last year at this time and 12 Bcf above the five-year average of 1,871 Bcf. At 1,883 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 22, 2021 Actual 38B Forecast 49B Previous 61B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 22, 2021 | 10:30 | 38B | 49B | 61B | |

| Apr 15, 2021 | 10:30 | 61B | 67B | 20B | |

| Apr 08, 2021 | 10:30 | 20B | 21B | 14B | |

| Apr 01, 2021 | 10:30 | 14B | 21B | -32B | |

| Mar 25, 2021 | 10:30 | -36B | -25B | -11B | |

| Mar 18, 2021 | 10:30 | -11B | -17B | -52B |

It made for a nice run.

Thursday after the close:

April 22, 2021

Friday early:

Like most Fridays, price action along the Nymex futures curve stagnated as traders continued to digest the latest storage and weather data. Volumes also were low with only days to go before the May contract rolls off the board. The prompt month capped the week at $2.730, off 1.9 cents from Thursday’s close. June slipped…

metmike: Since then, we've seen some good buying and higher prices.

Mike,

I think today's rise was largely due to the anticipation of a very bullish (for this late in April & vs the 5 year average) small injection on this week's EIA. This week's report's small injection is projected to be a significant 50+ bcf lower than the 5 year average and shows why last week's chill had been so bullish in advance of it. That in combination with a small increase in CDD related demand during today's 2 week forecast while forecasted HDDs were flat vs Fri didn't provide a forecasted 2 week DD drop to provide a counter to this rise. So, up it went even though it started off down.

04/26 01:52p CST DJ Natural Gas Closes at Nearly 8-Week High -- Market Talk

1452 ET - Natural gas prices got off to a slow start but finish the

session up 2.2% at $2.790/mmBtu, the highest closing price since March 3. A

sometimes seamless transition from peak-season winter demand to weak,

springtime demand has been anything but this year, and shifting weather

forecasts have generally been working in favor of market bulls as chilly

weather lingers and heaters remain turned on. That's also helped weekly EIA

storage reports notch a string of bullish injections compared to forecasts,

which might allow total storage to stay right near the five-year average until

summer arrives and demand picks up again. (dan.molinski@wsj.com)

(END) Dow Jones Newswires

Thanks Larry!

Here's another reason, which I forgot to add to this thread so far.

Here's those very chilly temperatures from last week that caused an unusual amount of HDD's for this late in the year. This is the 7 day period for Thursdays EIA report.

This was the previous week of temps and the EIA report that resulted:

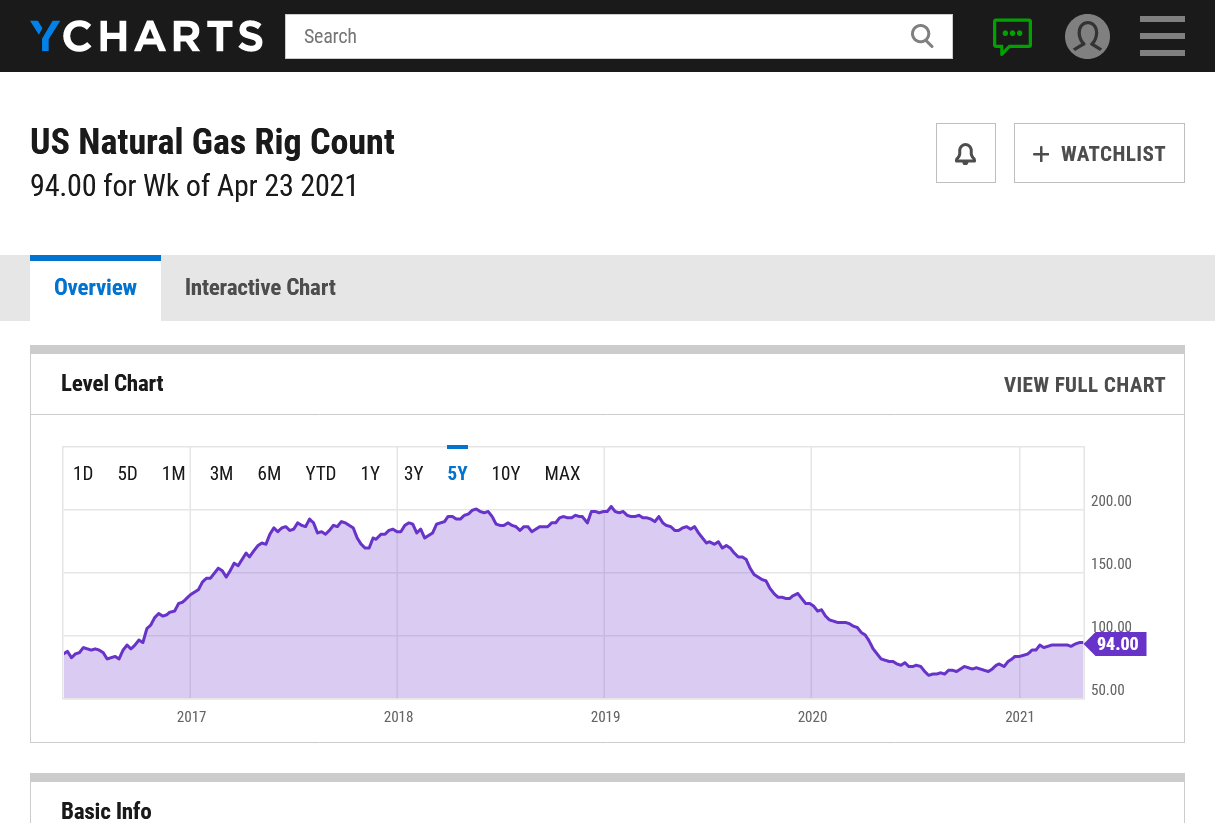

https://ycharts.com/indicators/us_gas_rotary_rigs

The rig count. Up from the lowest of the last 10 years of 68 in July 2020 because of COVID last year but still well below the previous loftier levels. Was flat at 94 rigs reported last week. Wonder how Joe L is doing.

Monday close:

Natural gas futures struggled to gain traction early Monday, but continuously strong export demand eventually pushed prices into the green. With options and the May Nymex contract’s expiration looming, the prompt month settled at $2.790, up 6.0 cents from Friday’s close. The June contract picked up 5.6 cents to land at $2.874. Spot gas prices…

Tuesday early:

Estimates showing a day/day drop in production helped natural gas futures extend their recent gains in early trading Tuesday. After picking up 6.0 cents in the previous session, the May Nymex contract was up 3.0 cents to $2.820/MMBtu at around 8:45 a.m. ET. The latest daily production estimate from Wood Mackenzie Tuesday showed a 2.4…

metmike: I am actually suspecting that the heat/CDD's in the forecast are a factor.

Natural gas futures continued riding high in early trading Wednesday, adding to their recent gains as analysts noted continued tightness in the supply/demand balance. The expiring May Nymex contract was up 3.7 cents to $2.910/MMBtu at around 8:45 a.m. ET. June was up 3.5 cents to $2.977. The May contract surged 8.3 cents in Tuesday’s

I'm going to start a new NG thread. Please continue posting in that one. Thanks.