The American Petroleum Institute (API) reported on Tuesday a build in crude oil inventories of 4.174 million barrels for the week ending November 13.

Analysts had predicted an inventory build of 1.95-million barrels.

In the previous week, the API reported a large draw in oil inventories of 5.147-million barrels, after analysts had predicted a draw of 913,000 barrels for the week.

Oil prices were trading down on Tuesday afternoon before the API's data release despite significant vaccine news, as OPEC+ indicated that it could extend its current production cuts for an additional three months. Pressuring prices include widespread lockdowns, weaker than anticipated economic data in the United States, and Libya's surging oil production.

In the runup to Tuesday's data release, at 11:53 a.m. EDT, WTI had fallen by $0.48 (-1.16%) to $40.86 down roughly $0.50 per barrel on the week. The Brent crude benchmark had fallen on the day by $0.61 at that time (-1.39%) to $43.21—down about $0.40 per barrel on the week.

But oil prices ticked higher in the later afternoon hours.

U.S. oil production was unchanged in the last reporting week, at 10.5 million bpd, according to the Energy Information Administration—2.6 million bpd lower than the all-time high of 13.1 million bpd reached in March.

The API reported a build in gasoline inventories of 256,000 barrels of gasoline for the week ending November 13—compared to the previous week's 3.297-million-barrel draw. Analysts had expected a 450,000-barrel build for the week.

Distillate inventories were down by 5.024-million barrels for the week, compared to last week's 5.619-million-barrel draw, while Cushing inventories rose by 176,000 barrels.

Latest Release Nov 18, 2020 Actual 0.768M Forecast 1.650M Previous 4.278M

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Nov 18, 2020 | 10:30 | 0.768M | 1.650M | 4.278M | |

| Nov 12, 2020 | 11:00 | 4.278M | -0.913M | -7.998M | |

| Nov 04, 2020 | 10:30 | -7.998M | 0.890M | 4.320M | |

| Oct 28, 2020 | 09:30 | 4.320M | 1.230M | -1.001M | |

| Oct 21, 2020 | 09:30 | -1.001M | -1.021M | -3.818M | |

| Oct 15, 2020 | 10:00 | -3.818M | -2.835M | 0.501M |

Weekly US ending stocks of crude oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

Weekly ending stocks for unleaded gasoline.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

Crude 3 month chart

| |

Crude 1 year chart below

| |

Crude 5 year chart below

| |

Crude 10 year chart below

| |

Unleaded Gasoline Price Charts:

| |

| |

5 year........are we headed back to the highs?

| |

Current gas prices. They may seem low but we are being price gouged in some markets right now. This seems to happen more at this time of year for some reason.

Here in Southwest IN, the regional distributor is adding 25c to the fair value of the price for all the gas stations to increase their profits.

I've been getting gas at Sams, for $1.82 that doesn't use that source as a supplier.

All the other stations have been charging $2.09.

https://www.gasbuddy.com/GasPriceMap?z=4&lng=-96.591588&lat=38.822395

https://www.quora.com/Why-are-west-coast-gasoline-prices-higher

SINGAPORE/BEIJING – China’s commercial oil stockpiling sector, which emerged as a key swing buyer of crude as prices plunged earlier this year, is setting plans to grow again in 2021, supporting a further boost in imports.

Graphic – Global oil demand by region during Q2 and Q3 2020:

Overall, China’s crude oil imports are expected to grow 6%-8% in 2021, following 10% growth in the first 10 months of 2020, to near 12 million barrels per day, according to Energy Aspects’ Liu and Paola Rodriguez-Masiu at consultancy Rystad.

Beijing has boosted quotas for non-state buyers and purchases will also be underpinned by new refining units added by firms like privately-controlled Zhejiang Petrochemical Corp and Shenghong Petrochemical Corp, as well as expansions at Sinopec Corp plants.

Oil shipment data tracked by Refinitiv shows China is on course to import 339.5 million barrels of crude oil in November, which would mark a new record. That compares to 293.1 million in October and 293.8 million in November 2019, the data showed.

https://www.oilandgas360.com/oil-set-for-third-week-of-gains-on-vaccine-hopes/

NEW YORK – Oil prices edged higher on Friday, on track for a third consecutive weekly rise, buoyed by successful COVID-19 vaccine trials, while renewed lockdowns in several countries to limit the spread of the coronavirus capped gains.

Brent crude futures rose 36 cents to $44.56 a barrel by 10:38 a.m. EDT (1538 GMT).

The more active U.S. West Texas Intermediate (WTI) January crude contract gained 19 cents to $42.09 a barrel. The WTI contract for December, which expires on Friday, was up 14 cents to $41.88 a barrel.

Both benchmarks are up more than 4% so far this week.

Prospects for effective COVID-19 vaccines have bolstered oil markets this week. Pfizer Inc said it will apply to U.S. health regulators on Friday for emergency use authoritization of its vaccine, the first such application in a major step toward providing protection against the new coronavirus.

“Despite the fact that in reality it will take time for a global vaccine campaign to be implemented, time during which oil demand will suffer, positive news are breaking daily about the vaccine deliveries,” said Bjornar Tonhaugen, Rystad Energy’s head of oil markets.

Also boosting sentiment was hope that the Organization of the Petroleum Exporting Countries (OPEC), Russia and other producers will keep crude output in check. The group, known as OPEC+, were expected to delay a planned production increase.

OPEC+, which meets on Nov. 30 and Dec. 1, is looking at options to delay by at least three months from January the tapering of their 7.7 million barrel per day (bpd) cuts by around 2 million bpd.

“An assumed roll-over of current cuts by OPEC+ to Q1 2021 is probably in today’s price of $44 per barrel,” Nordic bank SEB said.

Still, smaller Russian oil companies are planning to pump more crude this year despite the output deal as they have little leeway in managing the production of start-up fields, a group representing the producers said.

Oil prices were getting some support from signs of movement on a stimulus deal in Washington after U.S. Senate Republican Majority Leader Mitch McConnell agreed to resume discussions on providing more COVID-19 relief as cases surge across the United States.

Oversupply concerns, however, continue to weigh as Libya has raised production to pre-blockade levels of 1.25 million bpd.

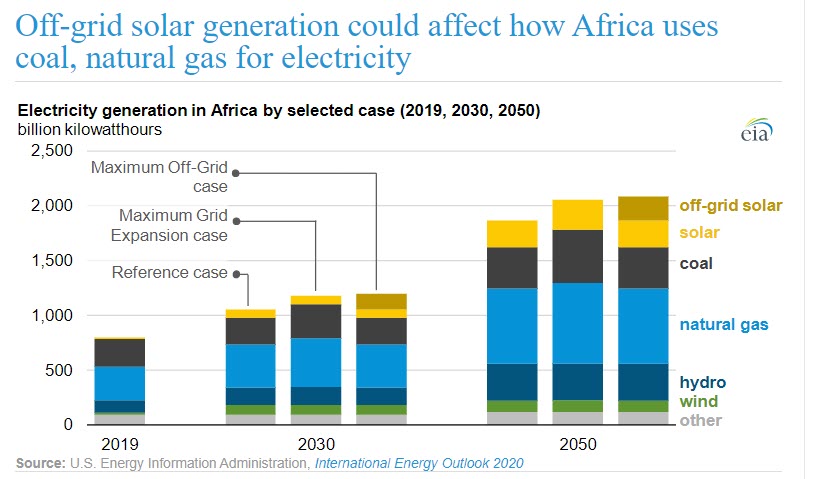

In the International Energy Outlook 2020 (IEO2020), the U.S. Energy Information Administration (EIA) projects electricity generation in Africa using two cases with different assumptions about how future electricity needs are fulfilled. In the Maximum Grid Expansion case, in which a centralized grid is developed to meet electricity demand throughout the continent, EIA projects that solar photovoltaic generators will meet 13% of Africa’s electricity generation in 2050. In this case, EIA’s projections do not include off-grid, stand-alone generators. In contrast, in the Maximum Off-Grid case, where demand growth in the southern half of the continent (Africa-South) is met by off-grid resources, solar energy—from both grid-connected and off-grid systems—will provide 21% of continent-wide electricity generation in 2050.

metmike: I bet that he does.