US economy grew a record 33.1% annual rate last quarter but the pandemic remains an enormous threat

https://www.cnn.com/2020/10/29/economy/gdp-report-third-quarter/index.html

New York (CNN Business)The US economy in the summer recovered much of the historically enormous ground it lost in the spring, expanding at the fastest rate on record in the third quarter, the Commerce Department reported Thursday.

Still, the recovery remains incomplete. The economic crisis that Covid-19 brought on is far from over, and the pandemic threatens to plunge the American economy into turmoil again as infection numbers continue to rise rapidly across the country.

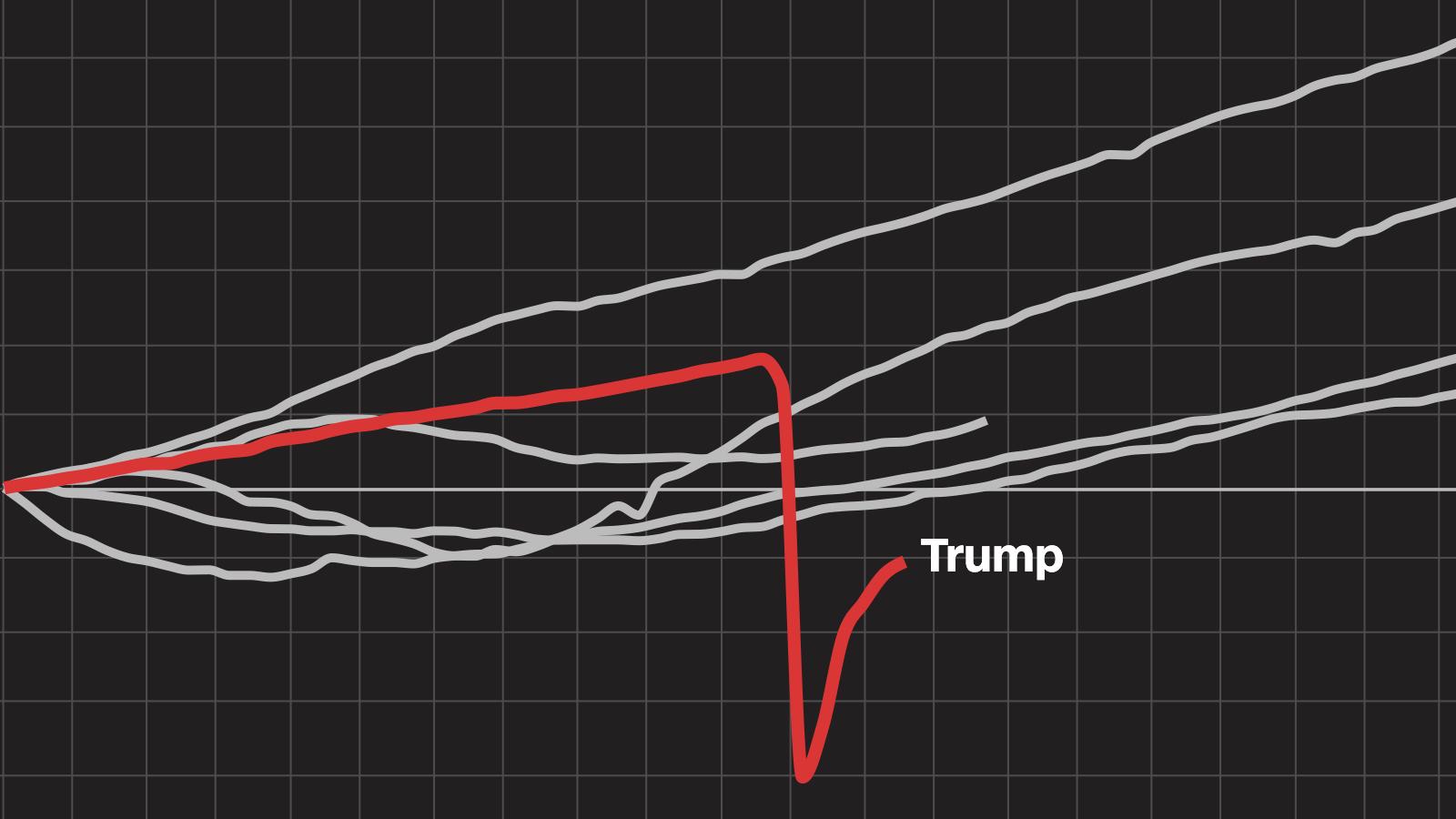

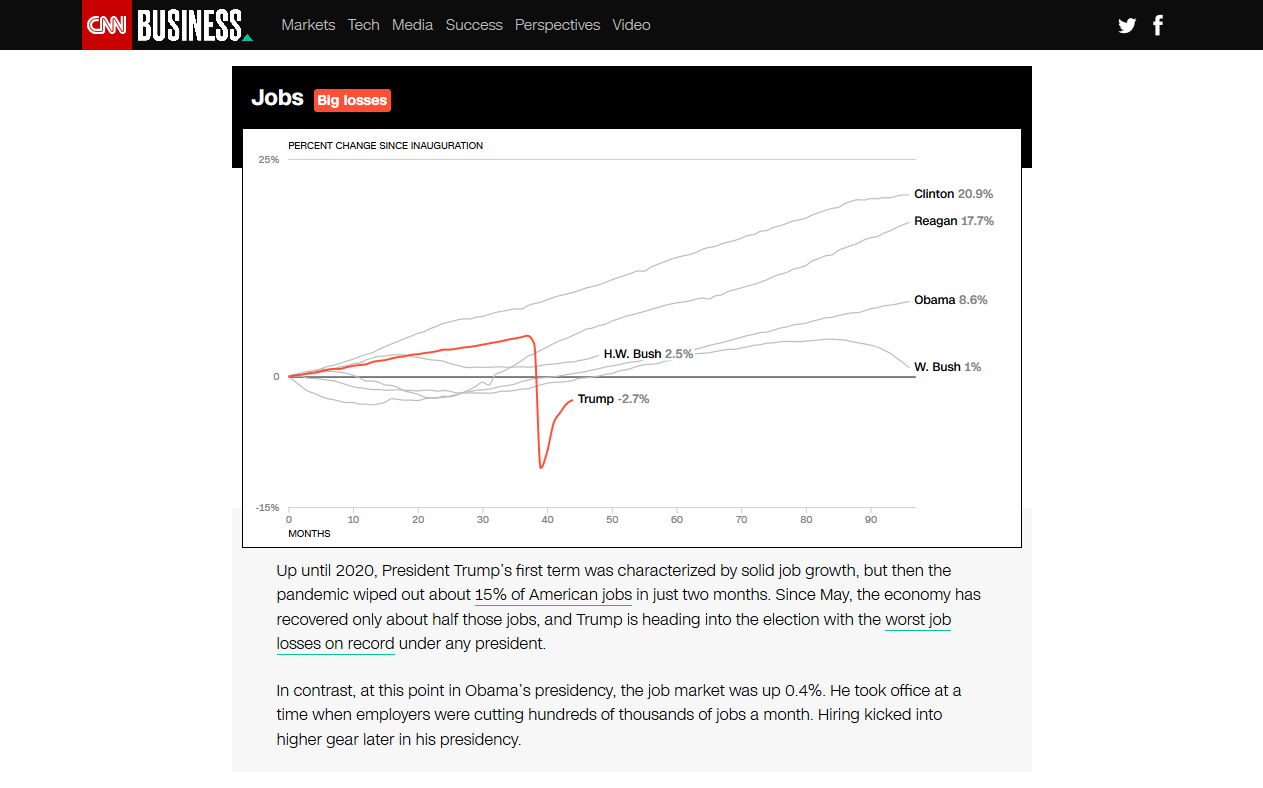

Interactive: These 10 charts show how the economy performed under Trump versus prior presidents

The third quarter, however, was one for the record books. Gross domestic product — the broadest measure of economic activity — grew at an annualized and seasonally adjusted rate of 33.1% between July and September. This was a faster rate of expansion than economists had predicted.

It was also the fastest growth rate since the government began to track quarterly GDP data in 1947. It represented a sharp, albeit partial, recovery from the prior three months, when the economy contracted at an annualized, seasonally adjusted rate of 31.4%.

But economists worry that the economy is slowing down again in the final three months of the year. Meanwhile, Covid-19 infections are spiking again and worries about renewed lockdown restrictions that could deepen the pandemic recession. In Europe, rising infection rates have already led to tighter rules.

The Back-to-Normal Index created by Moody's Analytics and CNN Business shows economic activity has barely changed in weeks.

Millions of people are still unemployed and rely on government benefits to make ends meet. As of September, the US labor market was still down 10.7 million jobs compared with pre-pandemic times.

Personal income fell in the third quarter, decreasing $541 billion following a $1.45 trillion increase in the second quarter, as the effect from pandemic programs, including stimulus checks waned.

Supplemental unemployment benefits of $600 per week expired at the end of July and have only partially been matched by an executive order signed by President Donald Trump.

As the impact of those stimulus programs wanes, it could hold back the recovery. That's because the US economy relies heavily on consumer spending.

Between July and September, a big increase in consumer spending, particularly on health care, food services and accommodation, as well as cars, drove the economy's bump. Overall, though, spending on services remains well below its pre-pandemic high.

On the other end of the spectrum, federal, state and local government spending decreased and the country imported more foreign goods, which is subtracted from GDP.

Economists expect much more modest growth — far below the 10% annualized mark — in the final quarter of the year. It will take until the end of 2021 for economic output to get back to where it was before the virus hit, said Gregory Daco, chief US economist at Oxford Economics.

.png)

.png)

.png)