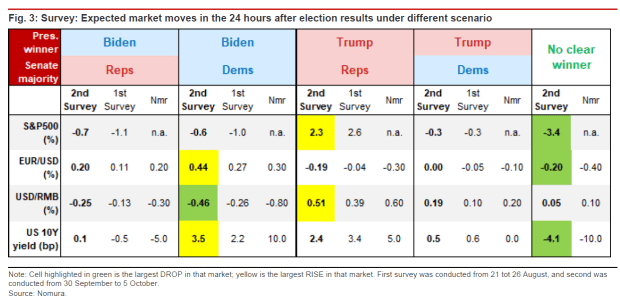

By far the worst scenario for the stock market, as measured by the S&P 500 SPX, +1.64%, would be no clear winner, according to this survey. The best scenario would be a re-election of Trump with a Republican Senate. Everything else would be a languid shrug.

On the bond side, the possibility of increased fiscal stimulus from a Democratic sweep would lift the yield on the 10-year Treasury TMUBMUSD10Y, 0.757% the most. By contrast, yields would fall sharply without a clear winner, with investors rushing to the safety of bonds.

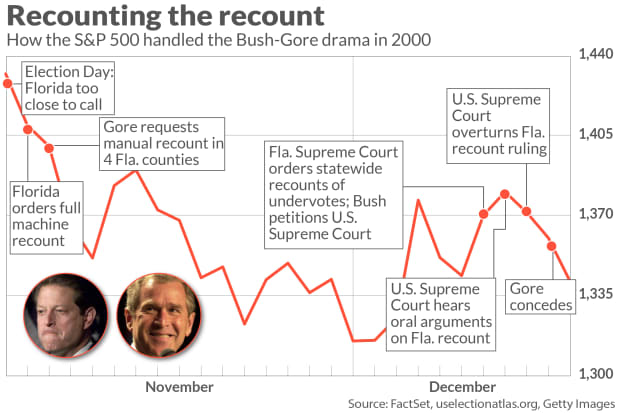

The possibility of a contested election has analysts looking at the election of 2000, as well as the less recent 1876 contest.

As fears of a contested presidential election rise, investors are taking a look at how the market behaved during the closest precedent — the 2000 Florida recount battle between Democrat Al Gore and Republican George W. Bush.

The chart above tracks the performance of the S&P 500 SPX, +1.64% from Election Day, which fell on Nov. 7, through Dec. 15. Over that period, the S&P 500 saw ups and downs, declining 8.4%.

By

I think the market is expecting a Biden win. The Senate is a bit of a wild card.

If Trump wins and the pubs hold the senate, we'll see a spike across the board in equities.

The one thing the market fears more than anything else is a contested election. "Let us know what we're dealing with and we'll deal with it".

Yes