Some nice surprises this week.

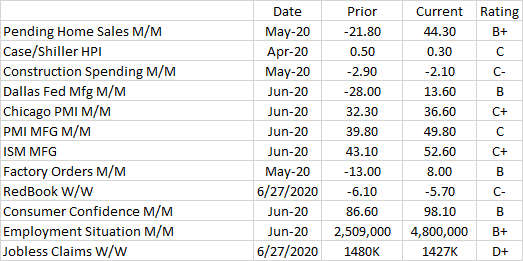

Jobless Claims are coming down much too slowly, IMO. This trend has to reverse for a recovery to continue.

Redbook continues to show softness, but is moderating. Overall Retail is improving.

Construction Spending is still soft but I expect that to change, probably next month.

Housing Prices coninue a steady climb and Pending Home Sales was a real shocker with a 44+% increase.

Chicago PMI showed promise and Dallas MFG moved into the positive. As we know, this metric closely tracks the energies. PMI MFG remains barely negative while ISM went into positive territory for the 1st time since March, if memory serves. Factory Orders also entered positive territory. Between these and Durable Goods, we are seeing the awakening of the MFG sector. assuming the trend continues. We live in a world where caveats are required :-)

I am flat out Gobsmacked at Consumer Confidence coming in at 98+..We've felt better, but this is pretty good.

The obvious headline this week is the Employment Situation with a net gain of 4.8 MILLION. Looking behind the numbers, with jobless claims remaining high, the tsunami effect of the virus is still working it's way through the food chain, but remember, continuing claims are dropping faster than new claims. Also, with wage growth at 5%, we know that lower paid workers are still feeling a mighty sting from the virus. The 600/week supplement expires in the next week. If congress does not continue it, we'll likely see many return to work. Many would chose not to work if it involved a pay cut.

I think the week deserves a solid C+, which is quite possibly conservative. Suck factor remains at 8 with the GDP in negative territory and jobless claims above 1 million. I think it's a strong possibility the GDP may not remain negative for as long as I originally thought.

Note the significant improvement in the FED Q2 GDP forecast. Still strongly double digit negative -35.2 but we are 2 business days into the quarter. The outlook is changing and if the trend continues.....?

https://www.frbatlanta.org/-/media/Documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf

Thanks very much Tim for the wonderful information!