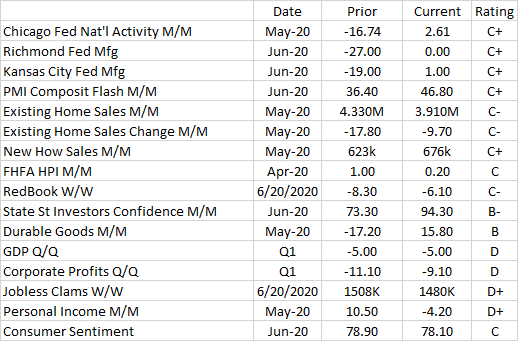

Somewhat mixed this week, but I see encouraging signs.

Personal Income took a big hit in May. Not surprising with jobless claims remaining at about 1.5 million. The decrease in New Claims is slower than I'd like to see. Hopefully see significant drops in the not too distant.

Q1 GDP and Corporate Profits are negative, but that's no surprise. Q2 may look worse.

Existing Homes sales slowed their decent but remain strongly negative, somewhat offset by a healthy bump in New Home Sales.

Redbook remains negative, but as mentioned, it's a subset of retail and On-Line is booming as the streets remain crowded with assorted delivery trucks.

Consumer Sentiment is steady at historically low levels yet State Street Investors mirror my opinion as their confidence showed a significant improvement.

Chicago, Richmond and Kansas City Fed all showed marked improvement as did the PMI Flash.

The most encouraging news this week for me is in Durable Goods which showed nothing short of a remarkable turnaround in May.

As stated, a somewhat mixed week but slightly positive IMO. I'll go with a C+ largely weighted with the Durable Goods. Suck Factor remains at 8 with the Jobless Claims remaining in the Stratosphere.

Thanks Tim!

Especially for your optimism.

You're welcome.

My optimism is based on objective data from multiple sources. (See Above)

I respect that way of thinking.

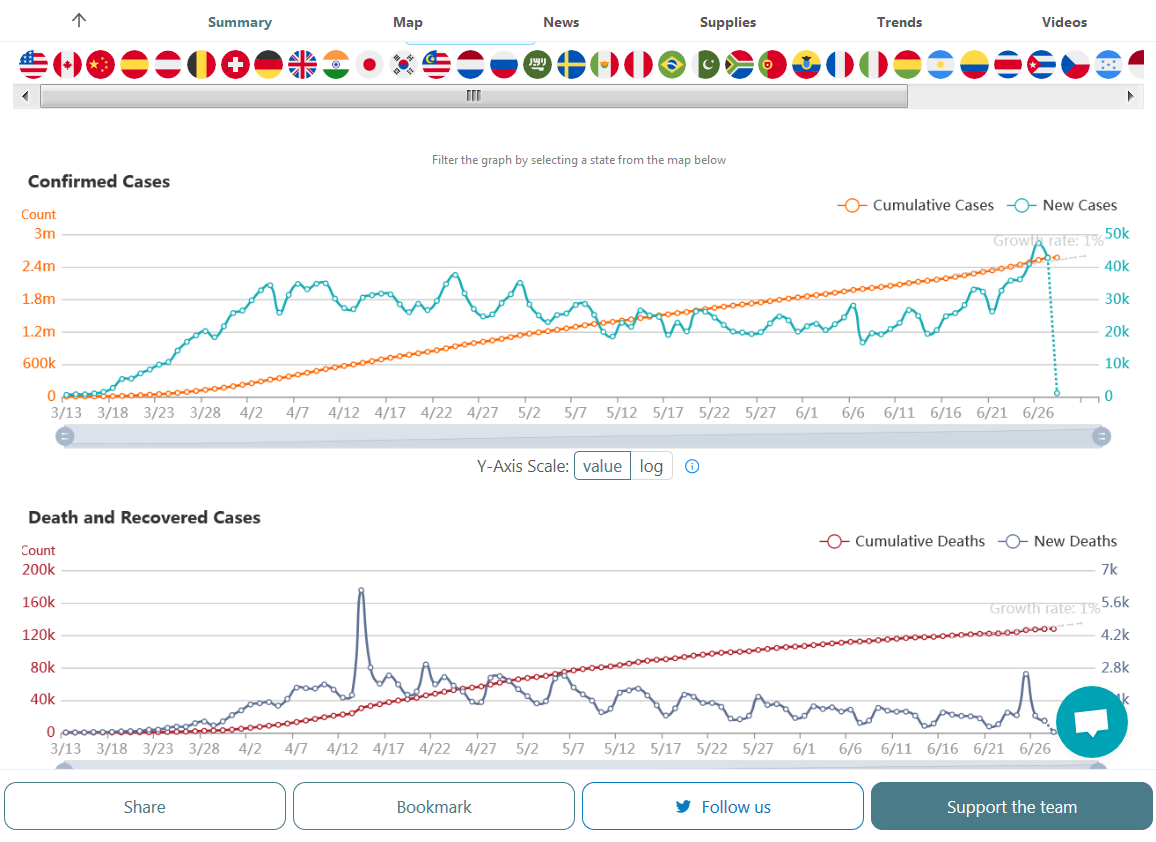

Let’s hope increasing COVID numbers for new cases testing positive don’t scare people again or get too out of control.

That's the wild card. These numbers can change dramatically based on the perception of covid. It appears to me that deaths are decreasing and that is the only meaningful metric at this point, IMO.

Should they start climbing, we need to reevaluate.

Until that point, the economy should continue in recovery mode and the ascent could be steep at times.

We can be sure that maybe around half the new cases DETECTED are from our increased ability to test and detected new cases.

Deaths are a lagging indicator by something like 2 weeks.........the time it takes to test positive and die in many cases.

Even though tested positive numbers sarted going up over 2 weeks ago and those people should have resulted in the death rate going up by now, other than a spike higher on one day, Thursday we have not see the death rate go up yet.

That 1 day jump to more than 3 times the day before and any day since makes no absolutely no sense, other than 1 state(s) suddenly getting a report from a source for a long/cumulative period that came in all at once. This happened to new cases several weeks ago, when Michigan, for 1 day reported 20 times the number of the days before and after.

Here's the latest on COVID numbers:

New daily positives with the much higher rate of testing and opening up.............and widespread protesting with no social distancing have been going up the last 2 weeks. Friday set a new high for new cases. Possibly, over half of this is from the increase in testing. Some is surely from opening up and poor habits and some from the protests.

Deaths have been going down steadily for 2 months but those spiked higher for 1 day, on Thursday.

Find this data here: https://coronavirus.1point3acres.com/en

Daily new infection cases in zig zag blue below. Cumulative new cases in orange on graph 1.

On graph 2, deaths in zig zag purple. Totals deaths in red.

There is a lot more than just corona to worry about, although corona will be with us for much longer than anybody wants to even think about. Corona is a cousin of HIV and the best we can do is live with it and treat infections with medical assistance

Equities may have a short lived rally but we are long term bearish as is the economy

Your optimism about a sharp or even moderate recovery is ill founded

My opinion is based on data. Yours is based on unfounded speculation that has lead you to predict a bear market for several years now, You might be right someday, but it hasn't happened yet,

Speculation you say?? Ha

You have a problem with somebody that disagree??

I have my feet on the ground and speak with approx 1 million of family business debt that needs to be serviced

Lets take a look

2nd wave infection ramifications unknown as of yet but probably not good. Will our off shore workers arrive and not become infected?? Business all over the country face the same uncertainty

Continued high unemployment

Higher food prices as food processing plants operate at reduced capacity. If our food processing is shut down, then that is a huge disruption to the grocery shelf, and higher prices. The Co. we work with has more grocery shelf sales than even I know, it is so massive

Jobs will disappear and never return for short .medium/ possible long term. Could be considered as the above high unemployment

Upper income spenders can not support the economy

Increased defaults on bank loans, car loans house loans, credit card, rent. etc. What if we can't sell our crop. Do we default on a loan??? What if the Cares program is not re-newed?? No matter, many are having financial problems, no more Cares just increases the problem. Of coarse you probably don't need the Cares help

Investors that depend on rent income default their bank loans or adjust the payment schedule for both parties benefit

Increased small business going out of business and employees losing jobs, same as unemployment above except more fodder for the unemployment numbers

Zombie larger Co's default if Fed doesn't keep buying junk bonds etc Will Americian Airlines survive their debt, with out Fed help???

Inner city RE down graded to junk value as demonstrators force residents and business to re-locate

State and local tax revenue lower cutting service and jobs lost

I think that is enough to say the economy is in trouble

Speculation???

Of coarse I have been saying this for some time

This is reality and nobody knows when reality catches up

I said we would have millions of world infections. That didn't happen immediately after I posted. Some things take time but do happen. I am looking forward

We all know irrational can last longer etc etc

But who can ignore the massive deficit???

I suppose deficits don't matter. We all know the Fed is propping up asset prices

V shaped recovery is impossible, as is a U shaped or L shaped, both rather low odds

As one article explained, we have N.P. B

No plan B

The price of gold might be one of the best forward looking indicators. I don't know when or if this is an indicator, but I think so.

Do you dispute the above as you say I am speculating

I suppose you think, until it happens it is speculation

I suppose you think, until it happens it is speculation

Well, that is the definition of speculation.