Thanks Mike. Outstanding market to bring up.

Here are some additional factors.

1. Wheat has been in a strong uptrend since the lows back in Sept of 465.

2. That uptrend channel was tested and held in Nov-5050+ and Dec 520 and this past week came right down to the uptrend line, which was at 550 and barely held. We closed the week just above it.

3. Any lower trading next week will take us below this 5 month long uptrend channel higher and violate the uptrend from a charting/technical perspective.

4. But we are 40c off the highs of the 590+ from the week before last. The market has been hit with a spate of very bad news quickly, which has resulted in the plunge lower which could have been an over reaction. Sometimes, over reactions in the opposite direction of the trend lines, will violate the trendline briefly and end up as good opportunities to position in the direction of the long term trend when it bounces back to the other side of the trendline again. Not saying thats going to be the case here but we have some very uncertain(and potentially big fundamantals) news.

5. If the Coronavirus is responsible for 20c of the drop, then when people start realizing that it won't be a worst case scenario, we could bounce back. The Coronavirus news is making trading in many markets very treacherous right now.

6. Wheat prices getting so high may affect demand. Export sales for wheat last week were excellent but export inspections............which is the wheat actually shipped were horrible on Monday. https://www.marketforum.com/forum/topic/46469/

7. Funds have a massive long on in wheat. Open interest and volume in wheat is very small compared to beans/corn. If funds decide its time to cover this position by selling, their selling in low volume wheat will not be matched with huge buy orders just below the market like it is in corn and beans. This causes their trading in wheat to, at times to have a much more powerful affect on the market. When they are pushing it hard in the direction they want it to go in...............their position shows huge profits. However, when they are covering/getting out of huge position at the same time, the exit door is not that big and this is when the market can inflict major damage to them.

8. The severe drought in Australia was a big bullish factor for the surge in wheat prices late last year. There were some HUGE rains in key wheat producing areas recently that were VERY BEARISH for wheat. See them at the link below. They are a major producer of wheat. It looks like more drought relief/help for the Eastern parts of the country and a bit in the south but not much help in the SouthWest(that produces less wheat). Planting of the new Winter Wheat crop will be commencing soon and they will plant.....or not, based on having some good rains or not. The increase in recent rains was a bearish contributor to the falling price. More rains are needed.

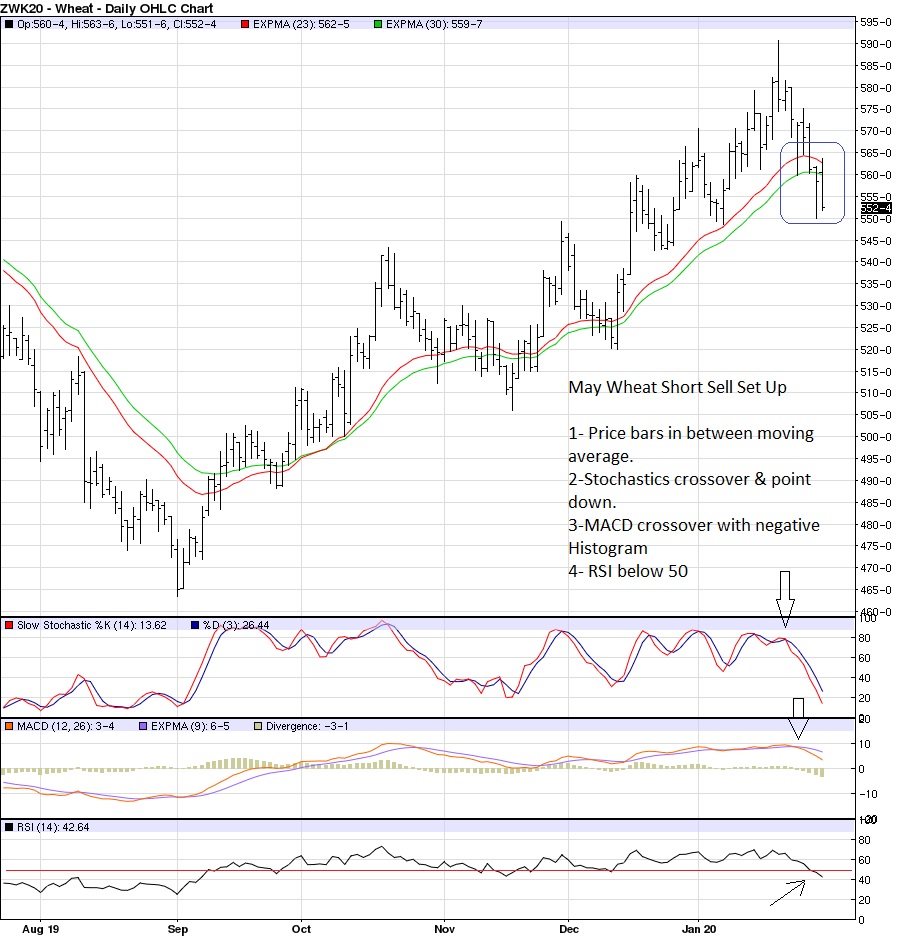

Huge funds will trade fundamentals and trends. Just as you observed and showed us with your chart, their trend/technical indicators may start flashing SELL signals if we drop much more than this. If fundamentals(demand) mentioned above are also in the toilet, its the recipe for a potential mass exodus of fund longs in a not so liquid market.

I think the Coronavirus is causing so much uncertainty and fear in the markets right now, that its throwing a monkey wrench into the reliability of technical and price indicators, especially on a short term basis.

Here is much more on the wheat market:

Look so Like wheat gapped lower on the open.

Possible bearish downside break away gap.

Failed gaps become potential exhaustion/reversal signals(gap and crap).

The formation now becomes potentially bullish for wheat because last nights gap lower was filled. However, there are some extreme forces pushing in different directions here which causes it to be a less reliable signal.

Should we close higher today, it would confirm the gap and crap, reversal.........at least today. Closing lower just means volatility in a market that is reacting to news with any gap signals negated but a lower close would still be negative.

News tomorrow that comes out mega bearish might cause us to go the other way but today, wheat acts like it wants to resume the uptrend.

After filling the Sunday Night gap, wheat has been strong, trading over 10c higher than that gap lower, which was a gap and crap/reversal higher formation based on the charts on todays vantage point.