Kinda what I've been saying. But I'd be lying if I said I have not taken some lumps. I am not as secure in my beliefs as I was a few months ago. I've made a decent amount so far but does my decades old paradigm still apply? I believe it does.

"A volatile stock market, spurred by mixed signals on trade, has stoked fears that the U.S. economy will take a sharp downturn in 2019. The recent tumult has prompted many investors and economists to raise the prospect of a coming recession. But those fears are overblown, and the stock market is overreacting.

There are three main outlooks for the U.S. economy in 2019: a recession, a visible slowdown short of a recession, and continued strong economic growth. Unlike more pessimistic prognosticators, my colleagues at the Conference Board and I expect something akin to the latter two scenarios: The U.S. economy will gradually slow during 2019 but GDP growth will not drop below 2%."

My best guess the economy slows significantly, as the effects of the tax cuts ("heroine injection") begin to wear off. Of course, how intense and prolonged the trade war becomes will be be a major factor and could send a maybe already teetering Europe into recession, which would be a drag on us. As I've said before, I expect corporate profit comparisons to be tougher in '19, due the tax cuts having the biggest effect in '18.

All in all with interest rates rising and the market still 25% above where it was when Trump got elected, it's hard for me to see why the market will be able to do any better than stumble along with the risk being to the downside.

I don't understand why you'd consider the tax cuts to be a temporary cash infusion. It's a significant and permanent reduction in taxes and the associated preparation/avoidance expenses. Earnings growth won't be as pronounced next year as this, but the money will be far more productive in the private sector. Even if all they do is stock buy backs.

"I don't understand why you'd consider the tax cuts to be a temporary cash infusion."

I don't consider them a temporary infusion and am no expert on all the tax ramifications. But with the lower rates earnings comparisons ('18 vs '17) were "exaggerated"/ more favorable than '19 vs '18 will be, since earnings will then be comparable (using the same tax rules). Also think most companies that wanted to repatriate $ probably did so in '18 and that individuals who saw an increase in their take home pay would have been more likely to have spent it right away in '18, but in '19 when they see no increase this effect will be missing.

As you well know the market looks ahead/discounts the future. Question is with the big rise in the market since Trump got elected, how much of the beneficial effects of the tax cuts were/are already built in vs the negative effects of the tariffs and interest rate increases.

Tariffs/Trade wars remain the 800 pound gorilla/wildcard. Interest rate hikes have been conditionally priced in. What is factored in right now are the mixed signals from the fed. Will there be 2 rate increases in 19 as the fed has indicated, or more? 2 have been priced in. Speculation of more is weighing on the market. The last jobs report supports staying the course.

Interesting note, 18 has been neutral to negative in equities in spite of the tax cuts and increased earnings. They have been over ridden by fed and trade war fears.

If there is a resolution to the tariff issue, I suspect we'll see a sustained bull.

Here be the 800 lb. gorilla.

The debt increased at a much higher rate during the Obama eco-reign. I honestly don't recall your alarmist posts during that time frame. I think that's because there were none.

.... thank you mister

p.s. ... farting rainbows....lmfao...

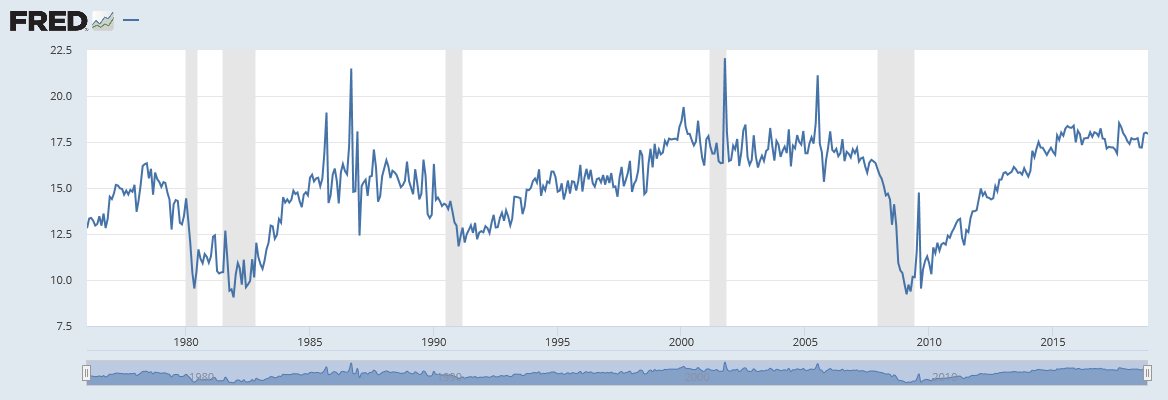

I can not write enough that the growth rates of M2 have gone down significantly. The FED controls M2, so the FED wants this slow down. I have no idea what they are up too, but I can only guess that a serious slow down will happen in 2019 so the FED can add money later on and have great growth into Nov 2020 with the next election.

The next recession is going to happen. The only details we don't know are when, why, & how bad. Granted, those are fairly significant questions.

A smaller thing that we do know (from experience, just like we know that there will be a recession) is that once the wind starts blowing, a lot a hidden problems and frauds will become visible. There are 2 things I look out for:

1) Powerful CEOs who create a personal myth instead of running a clearly explained business (Yeah, duh)

2) Intangible assets. Ever since the Accounting Overlords did away with amortization of intangibles without well defined lives, I've been waiting for this one to blow up. With the preponderance of corporations with less tangible assets than debt, watch for auditor resignations - they could mean a massive writedown is overdue.

I'm pretty sure that the next recession will catch most people - probably including me - by surprise, but it should be possible to avoid holding too many stocks that go to 0.

We will absolutely have a recession. It's an essential part of the economic cycle of capitalism. When, how serious? You're right. No one knows.

And there may very well be some smoke screens in corp reporting. We don't know till we know.

But I maintain the underlying eco-factors remain strong. t's rare to see an economic measure that is not somewhere between positive and extremely positive. The housing market is struggling a bit with higher interest rates, but other than that, just about everything is off the charts.

Thanks for the great comments tho. Really adds to the discussion.

Auto sales must be in the rarity category.

One aspect that none of you guys has mentioned, is inflation.

Inflation is felt differntly, on different levels. But the basic level is the consumer. The ones who drive the economy. Gas prices recently, have gone down. BUt food prices? Energy (other than gasoline)? Technology? Home ownership? Mortgage interest? All of these have added to the economic stress of the masses who drive the economy. When they can no longer afford the basics and the luxuries, economic downfall is emminent.

Auto sales are a little soft of late, but the overall trend is pretty good. Retail #'s, industrial production, job growth, GDP, inventories, etc, etc, all paint a fairly positive picture. And while inflation has picked up the pace, (a byproduct of economic growth), it appears wage growth is finally outpacing inflation at a healthy rate. With a tightening labor pool, this trend is likely to continue.