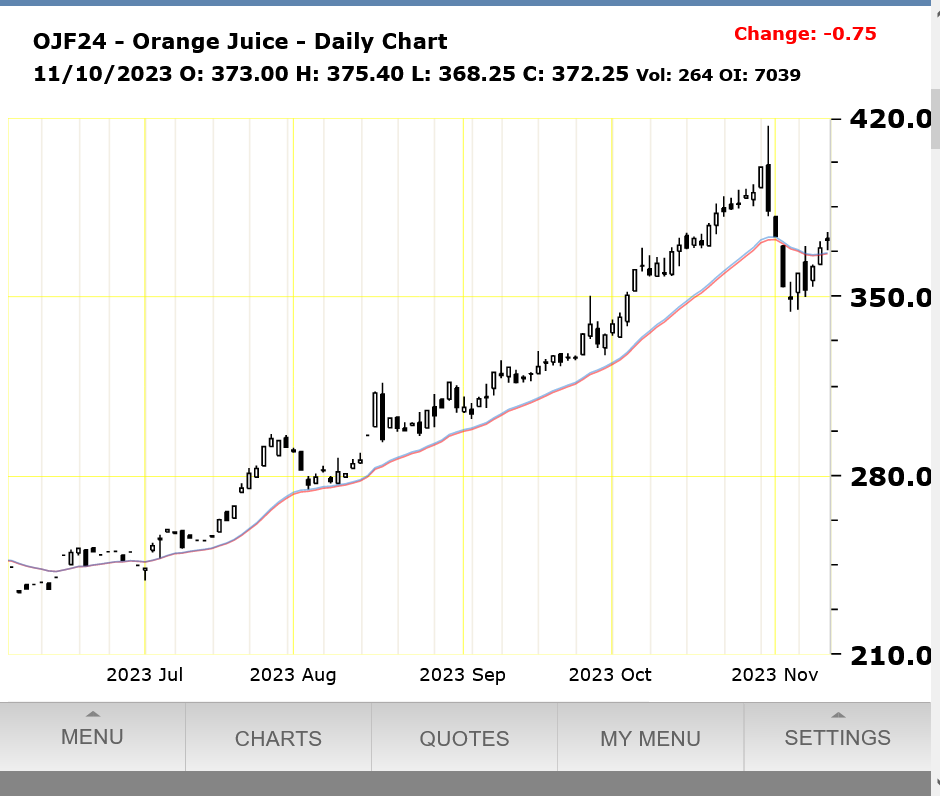

Big key reversal in OJ today

LOL I SAW THAT. JUST LAST WEEK I WAS WONDERING WHY RETAIL OJ, HASN'T SKY ROCKETED, IN COST. I REMEMBER WHEN SUANNAH WAS TRADING OJ @ 55.00!!!

LOL I WAS TADIN' SUGAR @ 11.00

Thanks, cutworm!

Previous OJ posts. Scroll down from this link:

https://www.marketforum.com/forum/topic/99516/#99600

OJ is a very thinly traded market which, before this move caused it to be extremely volatile but this last historic move is one that I can't think is matched by any other market.....ever. Maybe you guys know of another one.

The front month November spiked above 440 today, shortly after the open, then closed lower at 414.95.

This is still around 14c higher than any other close in history, except yesterdays close and it had to stop going up somewhere/time.

I sure wouldn't want to try to predict whats next or trade oj right now!

OJ opened a bit lower but that was a gap lower and now we're lock limit down, -10c.

That would be a powerful downside breakaway gap lower which is extremely bearish at the end of a long move up, especially with the reversal lower the previous day.

Total volume for the main month, January has only been 287 contracts which is extremely low volume for any commodity.

Stopped out of a short last week at 392.10 trying to pick a top. Appears Monday was the day! A short at 7:15 AM would have been THE ticket!

Thanks much, tjc!

You love picking tops and bottoms. Me too! Very high risk and reward, though you use stops to limit losses.

One of the most frustrating trades is nailing a market/trade.......but being slightly early and getting taken out with a loss just before the confirmation of being right.

Your reply was spot on.

I also tried a short in the 382 area. Each time risking new highs on the day. Both times "successfully" stopped out to have higher opens the next day.

"Shoulda" tried the third time !

You definitely display the understanding and skill for recognizing when markets that you follow are overdone in 1 direction and getting ready to go the other way.

I think part of it is the analytical challenge of applying a host of indicators that provide clues and then, interpreting them to predict the future(of that market). Do you agree?

Weather forecasting is similar in many ways.

OJ has been collapsing lower since the reversal that cutworm tipped us off about on Tuesday to start this thread!

I believe from looking at the chart and watching the price several times, that Wednesday had a downside breakaway gap and finished lock limit down, then Thursday gapped lower(and below the moving averages on this chart) and finished limit down with the expanded limits.

We gapped lower today on the open but are showing signs of holding with some buying at these levels that's matching sellers. The total volume for January has been 568 contracts in just over an hour+.

That amount of buying wouldn't support many markets for more than a few minutes but OJ is EXTREMELY thinly traded.

https://futures.tradingcharts.com/chart/OJ/

On Friday, OJ closed 67.75c lower than it's spike, all time high on Halloween.

However, unlike the previous 3 days of closing on the lows (Wed/Thur lock limit down) on Friday, we closed mid-range but still -4.90c from the Thursday close.

An interesting and revealing statistic with the January OJ.

November is still trading with only a few contracts volume/open interest, so January is the front/main month with the most volume AND open interest.

Open interest are the contracts that traders hold after the close/overnight.

From the time that January OJ started trading, the open interest increased every single day thru this last Monday. That's pretty typical for any deferred contract month as it gets closer to the front month, where the most action/trading/volume takes place.

In the case of January OJ, it was the aggressive buyers who were driving this market much higher as OI continued to increase.

On Monday, we had the highest life of contract open interest for January OJ at 8,111 contracts.

Then we had the reversal lower Tuesday and open interest dropped for the first time ever to 8,031 with some liquidation of positions.

On Wednesday, open interest only dropped a tiny bit to 8007 contracts. I can assure you that it would have plunged lower but OJ spent most of the day at lock limit down with longs trying to cover at any price using market sell orders all day that went unfilled because nobody wanted to buy(thats what always happens at lock limit down/up-trading dries up).

On Thursday, with the market trading freely again and with expanded limits we saw OI collapse down to 7,693! Traders trapped in longs on Wednesday, were bailing in droves on Thursday when they had the chance but at a price they didn't like.

Traders like that (get me out at any price) are what cause moves like we saw on Wed/Thu that end up in lock limits. There were very few traders that WANTED IN as first time shorts that would be wanting to sell at limit down. The plunge in OI tells us that exactly.

Another way to put it is that its sort of like a big room full of hundreds of people and they suddenly, all want out at the same time......but there's only 1 tiny exit that lets 1 person out every 20 minutes as they all want out at the same time and the door closes at 1pm.

If you're first in line, early enough you are lucky enough to get out that day. That was the situation on Wednesday with extremely low volume.

On Thursday, they opened several more doors so that traders wanting out, had that opportunity(with more traders willing to buy at the much lower price even as the sellers overwhelmed the market much of the day).

Friday's updated OI isn't available yet but the trade was more balanced between buy and sell orders and most of the PANIC sellers at any price from the previous 2 days were already out.

And I know EXACTLY how you felt watching the OJ this week, tjc!

The only thing worse than a massive loss is to be right but early and get taken out for a loss.....right before a huge pay day.

But what could you do?

There was no way to know if the spike would end at 417 or 437 or some other price in a emotional market doing a parabolic move up like this.

Sometimes, near the top its the top pickers who went short a bit too early, getting stopped out that help provide the last bit of buying fuel to hit the ultimate top!!

OJ bouncing a bit today. +5c

Just 118 contracts traded the first 25 minutes in Jan. OJ.

Back to unch with 432 contracts traded in over 2 hours!

The panic liquidation, "get me out at the market" action described above, with the downside breakaway gaps and lock limit down moves only lasted for several days last week.

The weak longs bailed last week and this week has featured an uptrending technical chart formation, as seen below.

Very similar to the market action during the previous 4 months(before last week).

We're still 45c below the 417 high on Oct. 30th, when cutworm alerted us to the SUPER, MAJOR reversal DOWN that day.

https://futures.tradingcharts.com/chart/OJ/

Looking to sell Monday

So, probably today or Tuesday better!

Keep us posted, tjc,

Volume this week was EXTREMELY light with today being the lightest at only 453 contracts traded in the January.

That's almost 100 contracts less than last Wednesday, Nov. 1's extremely low volume day because we were lock limit down much of the day with no buyers.

We had 2 very low volume days just before the huge spike high reversal on Halloween(which was high volume).

The range today was around 7c, which historically would be pretty wide but not recently with the extreme volatility.

We closed lower than the open (negative) but that was also the case on Tuesday that had extremely wide range but held the lows of Monday.

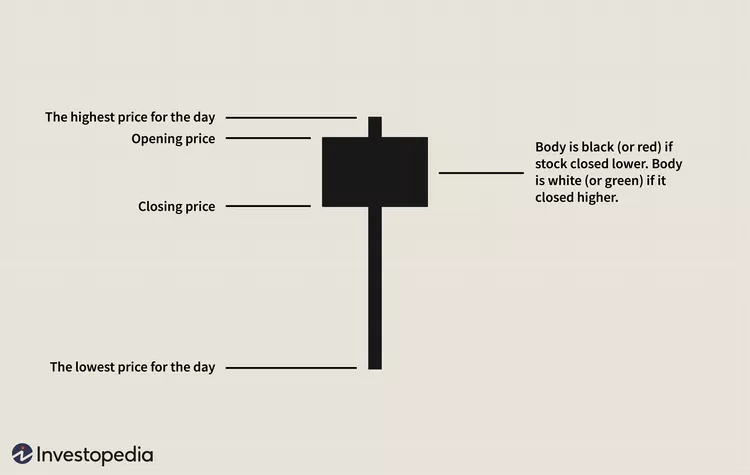

I wouldn't put alot of faith in signals here but the candlestick formation today was a hanging man.

Hanging man is best applied at the top of a longer duration move than just 1 week.

Here's a few more candlestick patterns. John LOVES candlestick analysis!

https://www.ig.com/us/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615

School's In - Shooting Star Trading Started by 7475 - Dec. 18, 2022, 8:25 a.m. https://www.marketforum.com/forum/topic/91508/

Here's another one for our candy(stick) man at MarketForum (-:

https://www.jaspersoft.com/articles/what-is-a-candlestick-chart

++++++++++++++

This is over an hour long below FOR BEGINNERS

+++++++++++

I read a book on candlestick patterns in the 1990's back when I hand plotted/graphed 15+ different markets at the end of every trading day.

I would plot the open, high, low and close(which is what candlesticks are all about). I would draw trend lines and support/resistance lines.

I had a weekly chart service that delivered in Monday's mail and I would start fresh with those charts every Monday Night(which had computed half a dozen other indicators thru the previous week).

That was in the stone age, before the internet (-:

I really think that hand plotting those graphs using the open, high, low and close every single day, imparted an understanding that you just can't get from looking at a graph made by somebody else.

Here is where I think it helped the most on.

For every market, I would try to predict where it was going. Even markets that I never traded, like silver and gold. I would identify areas of support/resistance and observe every markets response at those levels and especially try to predict what would come next based on what the chart patterns were showing.

This is what candlesticks are best at helping with. They don't predict the length of moves or price objectives(other Western indicators are needed) but they are great at predicting turning points, reversals and changes in market mentality.

As a meteorologist that has used data and weather charts for hours every day of my life to predict the future weather and loved every second of the analysis, hand plotting this market data was a labor of love and fun!

When I was a Green Hand In FFA my vo-ag teacher had us hand charting the prices of corn wheat and beans. We had charts that went down 2 walls of the classroom on big poster boards. At the end of the year the teacher quit and bought 2 large farms. It wasn't till 20 years later that I remembered and started using charts again.

So did the teacher use trading profits to buy the farms, cutworm?

I have no proof either way. I lost all contact before I could find out.

It funny to compare the basic, primitive ways that we used decades ago to what’s on the internet that’s A Billion times better technology.

However, there are still a few things done the old school way by your own hands that are better teachers than viewing the end product from somebody else having done the same thing.

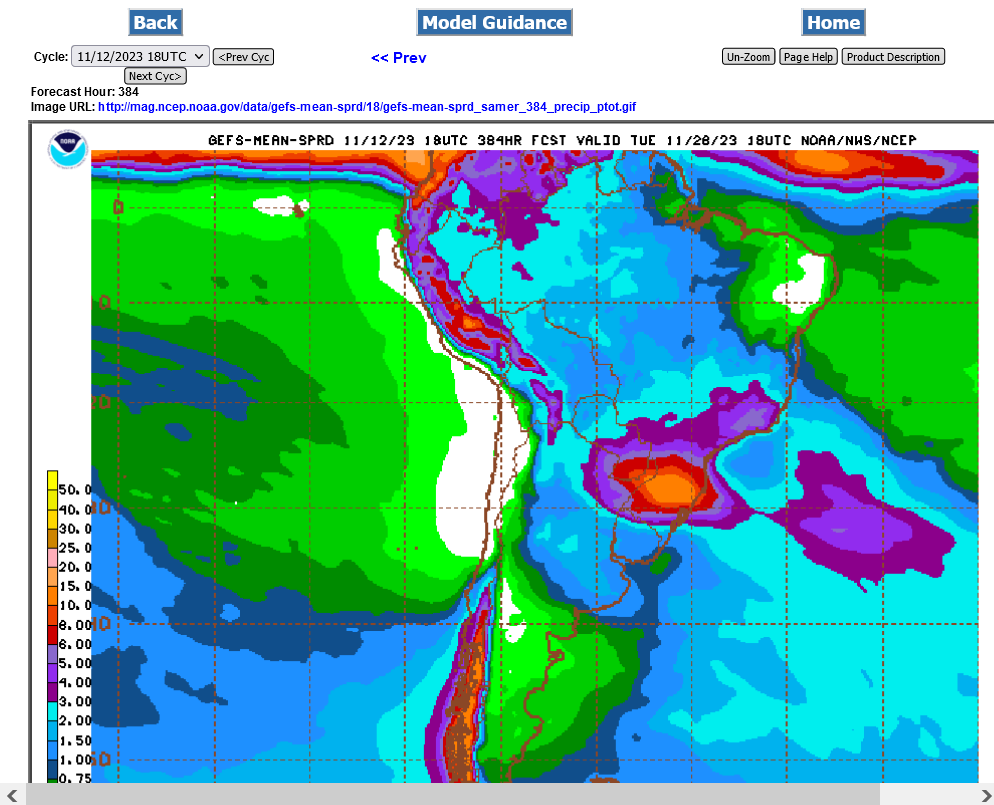

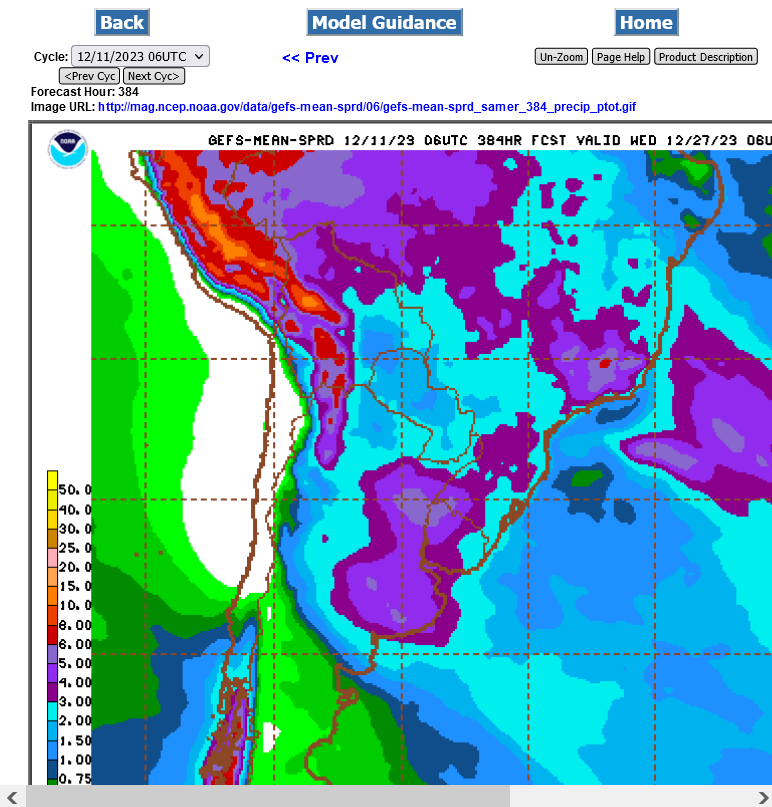

How is the weather in the Brazilian orange areas?

Great question, cutworm. Looks great.

Heavy rains south of OJ production. Dry area MUCH farther north.

+++++++++++

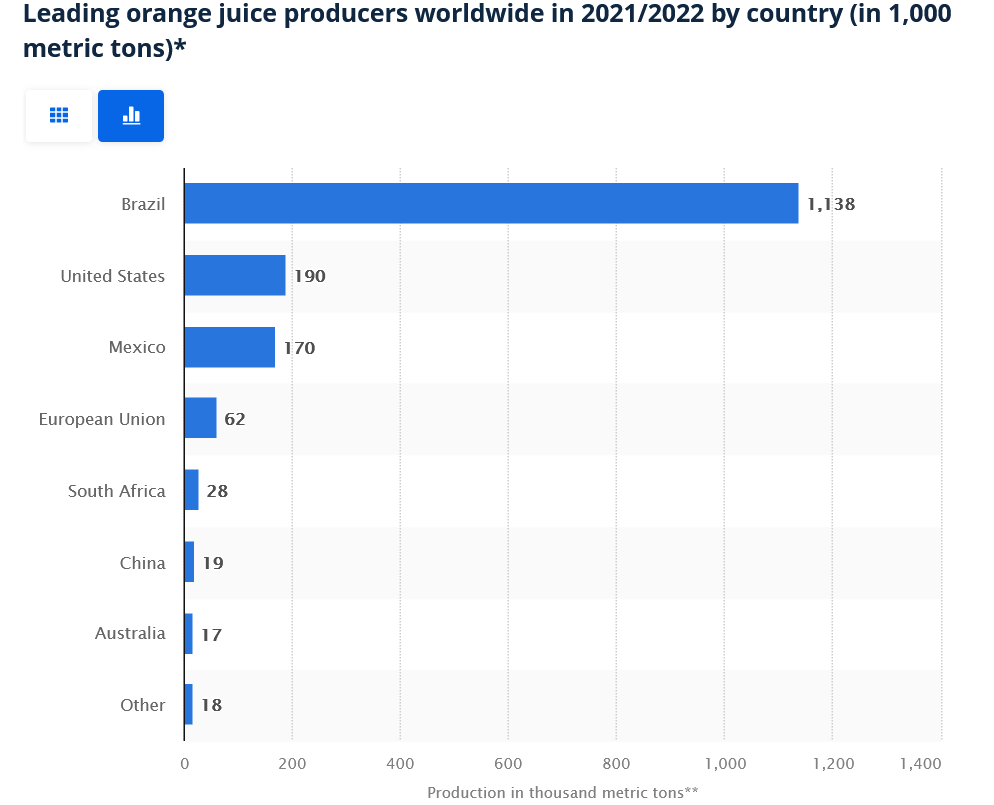

Brazil blows away the rest of the world combined in production! U.S. production has been decimated in recent years.

https://www.statista.com/statistics/1044896/world-orange-juice-major-producers/

Maybe the several days of intense heat coming up are bullish for OJ? I question that but will have to look at their flowering and development cycle to see if a stretch of intense heat in mid November can abort flowers or buds or disrupt the plants reproductive functions.

It won't last and there should be decent rains but Oj is lock limit +10c right now.

https://futures.tradingcharts.com/chart/OJ/

OJ certainly on a terror!

Was looking to sell Tuesday, but the almost immediate climb to limit up quieted my desire to sell.

Nearly at its previous high of 417. Perhaps i shall "sit on my hands"!

Glad you didn't sell on Tuesday, tjc!

Insane. Never seen a market like this the past 3+ decades. Fun to watch!

We made a new all time high earlier at 419.95 but has backed off slightly to 416.25, just below the 417 previous top.

If one were playing with plastic chips and not real money, they could short here and put in a stop above today's high but for all I know, this market could be in a supply crisis and panic buying by commercials that need to fill needs at any cost could take us to $5.

Or shorts that cry uncle at points higher than this.

Please do not use my paper trading for fun strategy in the real market.

https://futures.tradingcharts.com/chart/OJ/#google_vignette

MetMike

Your trading suggestion is a form of one i have used in the PAST when trading hours were MUCH SHORTER. After the first hour of trade i would sell a new low or buy a new high.

YOUR suggestion to sell with a stop on a new high IS a viable "try". (Probably works, since I have no intention to so do)

I believe the 'flooding' in Florida has exasperated an already 'depressed' USA supply, so no idea of a top.

Sell stop unchanged to be part of a key reversal?

On that paper trade, when we dropped to 405 just after 10am, which was a bit lower on the day, I would have lowered the buy stop to around 409-410 and been out because the market said it didn't want to follow thru with a potential downside reversal.

CRAZY! Higher in first few minutes!!

Yes, up to new all time record high but just barely. The market doesn't know what to do here at the moment.

MetMike

Totally agree market does not know its direction today, other than it is firm.

Might be a day, now that OJ has traded for over two hours, to sell stop a new low (fill might be $1-2 from order). Decent volume (for OJ), so a short at new low (might) be warranted.

My Sunday notes: look to sell a higher open Wednesday on the theory no one left to buy.

Lock limit +10c with 413 contracts traded in the January and not likely to have much volume if we stay locked up.

Lock limits almost always feature lower volume because the market(in this case) doesn't have enough sellers at 425.8, just buyers, limit up price and so there's no trading until a seller steps in.

If we were lower, the market could still trade up to FIND sellers. We can't do that when trading where theres a price limit, 10c above the Friday close.

I would guess that if the market was trading freely right now, there would be trades taking place at a price HIGHER than this limit.

If we close here, then we have an expanded limit on Tuesday. Its 20c!

Limit Rules on 13.8 below.

The day after a limit at 10c, the limit goes to 20c and remains there if we are limit again. If not, the limit goes back to 10c.

In what other market would we be having a conversation like this?

Answer: NONE!

13-1

ICE Futures U.S.®, Inc.

FCOJ RULES

https://www.ice.com/publicdocs/rulebooks/futures_us/13_FCOJ.pdf

https://www.investopedia.com/terms/d/daily_trading_limit.asp

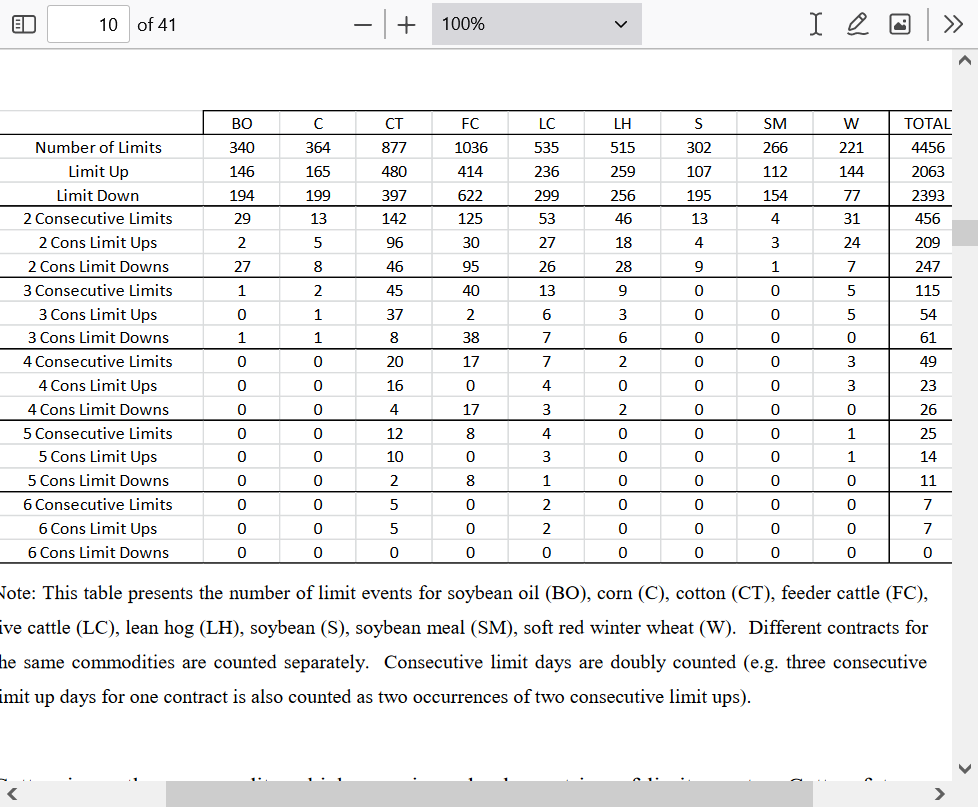

Some interesting stuff here:

Cotton and Cattle have the most limits! Then hogs and wheat!

OJ not part of their study but I would guess that OJ is up there.

OJ limit moves would mostly come from news.

1. Crop reports

2. Weather events(freezes in the in the past but FL hurricanes might be at the top and droughts especially in Sao Paulo, Brazil would do it today.

3. News of adverse impact from disease or other pathogen/damaging agent.

4. Historically low stocks/supply right now. And unlike soybeans, that have new production every 6 months that will respond to higher prices immediately with An increase in planted acreage, newly planted OJ trees take several years to produce and theres only a few tropical locations that can grow large scale oranges.The FL crop has been decimated for years by a disease that can’t be controlled and a hurricane last year made it worse.

On Commodity Price Limits*

Rajkumar Janardanan

SummerHaven Investment Manage

LIMIT LOCKED

So, tomorrow, initially, would presume a higher open, and if market does not know true value (it does not) probably opens more than $10 higher into the expanded limit.

Inclined to see Wednesday open. Will it be above Tuesday high? Any 'sign' of no new buyers and/or 'going' to take profit or close out trade going into the TG holiday?

Added #4 to post above to describe the current situation

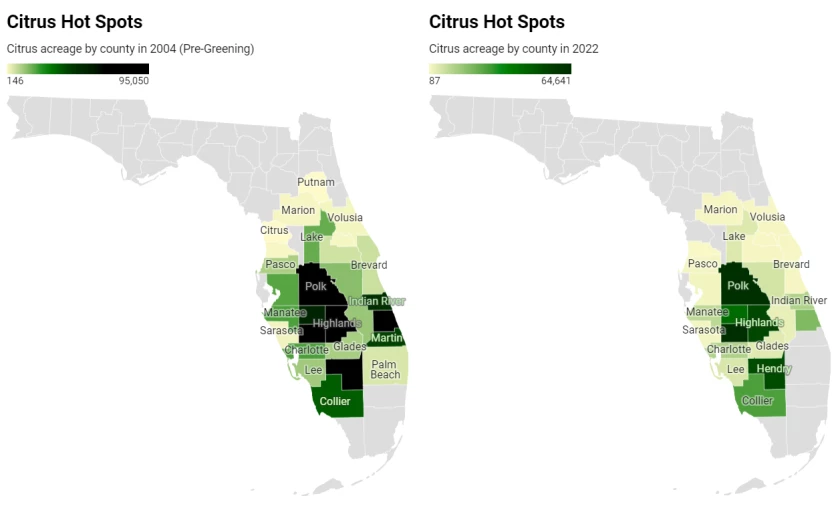

more on citrus GREENING p, the name of the uncontrolled bacteria disease decimating the FL citrus industry when back in my office.

It started in 2005. Transmitted by an insect that came from Asia.

New hybrids are being developed. Maybe some effective pesticides. Agrochemical science and plant geneticists will figure this out. They always do!

There may be a price to pay, money or otherwise but hopefully the solution will be very effective and not too costly.

I have seen this type of market chart before. traded this chart pattern in cattle and beans. years ago. This is how I traded it.

It is unknown how many gap up days and or limit days before top.

For a short:

Look for gap up day that closes below the open and very near the low of the day. Preferability a wide-ranging day.

Aggressive is to sell at the end of that day. stop high of the day

less aggressive is to sell a lower open the next session. if a gap lower the stoploss is1 cent above gap

use smaller than 1/2 normal trading size

Take into consideration the holiday coming up, EXTRA RISK for Monday after

This is not a trade recommendation. You are responsible for your own actions.

Great post, cutworm!

In the long run, that advice you gave would make money for sure, taking advantage of market psychology and signs of a buying exhaustion.

Like a gap and crap. Gap higher after a strong upmove that will either lead to a continuation of more new highs from new even more bullish news OR fails with of a buying exhaustion because the market ran out of new bulls to keep the move going and it drops down low enough to FILL THE GAP into the previous trading sessions range.

Even successful strategies like you described fail "sometimes" because each situation is completely different, which you made us aware of but this is the perfect discussion to be happening on the trading forum for people that love analyzing markets and trading...thanks!

I found this link to be loaded with great info when looking for citrus green info.

Animal and Plant Health Inspection Service

U.S. Department of Agriculture

Citrus Greening

This insect killed several of our ash trees )-:

++++++++++++

Producers like cutworm and mcfarm know all about insects that like yummy crops!

WUSF Published May 8, 2023

Last year, Florida citrus inventory stood at 361,656 acres of orange and grapefruit trees statewide. That’s less than half the 1996 acreage, when more than 800,000 acres of sweet-smelling trees stretched across the state.

Orange production is measured in 90-pound boxes. More than 40 million of them were filled in the 2021-2022 season. That’s a fraction—roughly 16%—of the 240 million boxes filled 20 years ago in 2003-2004, before greening settled across Florida.

The most recent USDA forecast for the 2022-23 season stands at 16.1 million boxes. The sharp decrease is due in large part to Hurricane Ian ripping through southwest Florida. The disease exacerbated the challenges farmers face in the wake of the Category 4 storm.

+++++++++

Reminder of how Sao Paulo, Brazil now produces more than the rest of the world combined.

https://www.marketforum.com/forum/topic/100189/#100531

++++++++++++

This may be the most BULLISH news of all:

Reuters

For the whole of the country's citrus belt, the disease's incidence increased to 38% from 24.4% last year, the biggest percentage jump since 2008.

This OJ market is not trading disease/supply, this is 'too well known'. It is trading momentum, backed by a 'sense' that up is the correct direction based upon supply issues. Market is searching for when is too much.

Tomorrow open may be the key. Will it open up limit ($20), which could be the easiest trade. One looks to see if it comes off limit, sell and when short, place a stop one buck below limit and watch. If it opens say 8-12 higher, sell with stop on new high, because Wednesday could be another $20 higher. Hardest may be a lower open, which I would not sell, but would buy stop today's high AND take a quick profit, somewhere! NOTE: ICE does not 'show' a bid ask until after the open, so it is very hard to place an anticipatory order.

AT SOME POINT, there will be a price when demand for OJ is destroyed, and wholesalers will back away as they have no market until OJ drops a very significant amount.

"This OJ market is not trading disease/supply, this is 'too well known'."

Thanks, tjc!

Let me clarify, the overall supply side fundamentals that got us here came from the disease and absolutely the market has known about this for a very long time.

Those fundamentals can determine the range possible for any commodity to trade most of the time. The fundamentals being a key to price determining value.

However, this is so unprecedented and extreme that this thinly traded market has nothing to compare it too in order to even guess at an upside target.

People actually in the business might have some valuable thoughts on that but the rest of us, won't find it on a past chart or in the past data that we get.

The only thing that makes sense is to make educated guesses like we are that use momentum and reactions.

What's sort of funny here, is that there are dozens of other markets to trade. Why would a person pick the most insane, low volume, high volatility market?

A big reason is the gambler in us, as well as the analyst and competitor that likes the challenge.

Honestly, I traded 200 lots of OJ on several occasions 2 decades ago. That equated to 30,000/c. I lost more than I made and it was because I was gambling with a huge account and didn't have any other good trades and was looking for some action.

Good way to lose money. My first several years, I never lost on a trade(except for a huge loss from holding over a weekend). Not once did I trade for the action. I waited and waited and waited. Then, when everything lined up perfectly and we had a weather pattern shift, I maxed out with the size of the order. A few extremely stressful moments initially with the drawdown because of the size that always turned to euphoria.

It's that euphoria that a trader feels which can make them want the feeling again BEFORE the trade set up is perfect again.

+++++++++

I noted that OJ traded off the limit for a several trades around 10:30 am this morning, then locked up again.

MetMike

In all honesty, this OJ market is fun to 'predict', but is NOT tradeable mostly due to liquidity.

All our 'previous' major exploits were in beans and NG, while volatile, liquidity allowed entry and exit. I am currently not in a position to endure a locked limit exposure into the next day, so SIT ON HANDS! Furthermore, no option volume to even explore a put to withstand one/two days wrong before being 100 points correct.

BUT, it is darn good 'fun' to 'prognosticate'!!

Will mostly watch, but... Is anybody going to hold longs past Wednesday morning???

Is anybody going to hold longs past Wednesday morning???

The other side is just as important

Is anybody going to hold shorts past Wednesday morning???

I'm guessing that there are commercial hedges that need to stay in till the crop comes in, and they can offset. just a guess

SO FAR, the open is/near the high. KNOW WHERE YOU ARE WRONG!

Longs holding are sitting on profits.

We really don't know what the break down is for the open interest in OJ.

cutworm made a reasonable guess.

Where are hedging producers at? How do they normally use this market? Has this been completely disrupted? If they hedged/sold in the past and used the same strategy this year, they could have been blown out.

Commercials? Are they chasing it here.

Whats happening with alternative ways to conduct business buying/selling?

OJ the first hour is down 6c now but not far from the previous highs so, for the moment is still finding some buyers at these levels after opening higher and selling off to -10c for the day and acting like it was game over for the longs with a potential collapse lower.

-15c and threatening to put in a double top formation from the previous 417 top.

We had some buying come in, or in OJ, maybe just lack of sellers so we closed over 10c above the lows and just above the previous high of 417.

Anything could happen here so this is not a prediction but the market action (to me) is acting more like a pause than anything else........at the moment.

I would guess that it won't take much for it to have a limit up or limit down day and still not shed a bright light on long term direction.

yes the holiday is a dangerous time for this market right now.

OJ treading water just above the -10c limit. We hit the limit with numerous trades earlier but have enough buying to stay above that as opposed to being lock limit down with too many sellers and no buyers at that price.

266 total contracts traded in the Jan with most of the trading session behind us. Extremely low volume, even for OJ, the commodity with the lowest volume.

MarketForum

Huge reversal in OJ today. Now up limit.

I believe MetMike was very accurate in his assessment that the decline in OJ represented a PAUSE, not a top.

I missed today's action in OJ and Feeders.

In addition to OJ, I strongly suggest everyone take a look at coffee and cotton!

(Missed a second purchase of a kc call yesterday---wish it had filled (buy was within the bid/ask, but not filled). Added to Jan ct calls positions this morning.

Remember what you paid for this post!

Thanks for your valued insight and the compliment, tjc!

OJ down 8.5c early with 88 contracts traded. That's insanely low volume.

The chart pattern below appears to be a well defined bull flag, which is a pause/continuation pattern which is valid, unless we break decisively thru 400, with some follow thru....... then its a double top, with the previous high of 417.

We're losing momentum but that will happen when you have a flag/pennant formation that represents a loss of enthusiasm to attract new buyers(in a bull market) but still enough buyers that see value to offset selling when prices drop much.

OK, while I was typing, we hit limit down, -10c (no surprise there-its OJ) with 158 contracts traded in 35 minutes.

Adjusting my above description.

If we close lock limit down and gap lower on Friday, then the formation is a powerful, double top and the lower open on Friday is a downside break away gap.

I don't have the exact fundamentals or daily news that could be driving this market. Since I use weather to trade and this isn't a weather market, we're just having fun sharing insights, mostly technical about the most insane market that trades anywhere.

Been especially tied up with chess at 5 schools but things are getting less hectic with sign ups almost over.

We can't break 400 today because the limit and current price is 401. If we build up a substantial pool of unfilled selling orders at the lock limit down price/401 today(because nobody wants to buy at that price). It would serve as an indicator for a Friday, downside breakaway gap.

And THAT would look very powerful on the chart after us being in this treading water, uncertainty/pause type signature for the past 2 weeks.

https://futures.tradingcharts.com/chart/OJ/#google_vignette

MetMike

Great summary of OJ chart.

IF, IF Tuesday was a daily cycle low at 398 AND OJ merely tests it tomorrow (three days after a top/low markets usually test), the upward trend could resume.

VERY DIFFICULT to take ANY position today/tomorrow!

Thanks, tjc!

You are clearly our authority on cycles here!

OJ was up on the day for awhile,

then crashed.

lock limit down the last 2 hours and poised to have a gap lower on Tuesday that would be a downside breakaway gap.

We had the anticipated downside breakaway gap on the open this morning and are down a whopping -15c right now but trading because of the expanded limit(which is normally 10c)

Because of the expanded limit and trading BELOW the standard limit, the market is being allowed to plunge far enough to generate some good buying for OJ.

Over 1,000 contracts traded for Jan which is huge.

At the old lock limit -10c, the volume would be far less than 50% of what it is. We would have seen nothing but sellers at that price and nobody with enough offsetting buy orders to take us off lock limit down.

However, today most of the volume has come from aggressive buying around this current level, which is well below -10c.

Looks like the expanded limit is 20c and we might have touched that earlier.

-15.70 right now.

An OJ short would have been REAL SWEET!

In my Sunday notes, I wrote: Daily and Weekly low due this week, most likely Tuesday/Wednesday, that being 32/33 day and 14th week. Past cycles would not "allow" a low past Friday

It appears OJ DID put in a daily and weekly cycle low Wednesday. Currently limit up.

Would expect 3-5 week rally. May or may not make new highs.

DISCLOSURE---OJ remains a difficult commodity to trade. Low volume and frequent limit moves makes entry/exit challenging. I have no position. Watch for possible 3 day rule to enter long side.

Great call on the cycle low, tjc.

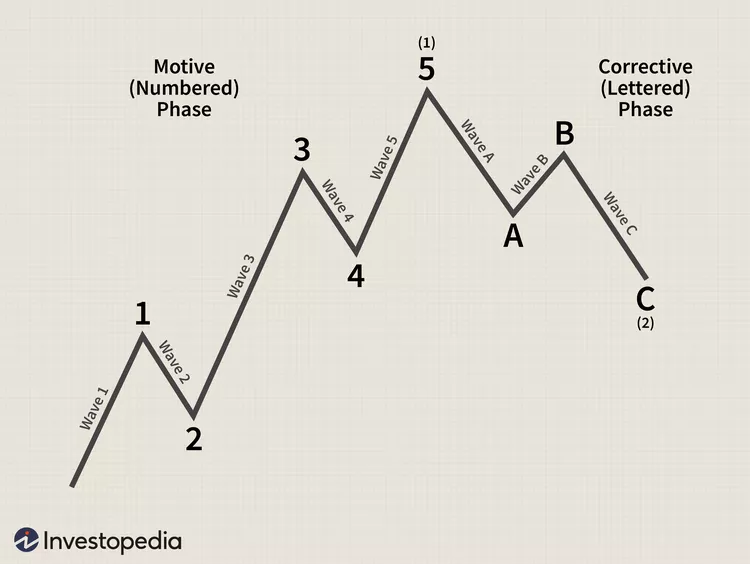

Markets often trade like waves in the ocean within the time frame of your cycle highs and lows. Eventually topping or bottoming at the end of a trend.

I don't use this trading but others, like tjc are tuned into it and generously share it here.

https://www.investopedia.com/terms/e/elliottwavetheory.asp

This is a simplified illustration of the principle.

Every market will act differently and rarely have this exact pattern.

Although some markets will move in tandem-like the liquid energies because they have common fundamentals.

https://www.tradingsim.com/blog/why-do-gasoline-and-oil-futures-move-differently

OJ stalled out today. Front month, Jan still has 3 times the volume of March.

I believe that today's strength in both OJ and KC is likely tied to below average rain(less than last week) for key growing regions for production of those commodities.

Not completely dry but maybe 50% of average and heat.

Honestly, this last 6z GEFS solution is only modestly bullish for C.Brazil with the driest anomalies in S.Brazil(including OJ)

Today was 'the' three day rule. Buy and set stop at the low achieved prior thereto.

OJ might scream

Still very hard to trade.

Thanks, joj.

Another lock limit finish today. This time limit up. This sets up a likely gap higher open on Tuesday. I wasn't watching to see how many unfilled buy orders there were at limit up but that can sometimes be misleading.