Monthly payrolls were up 263,000 which was hotter than the expected 200K.

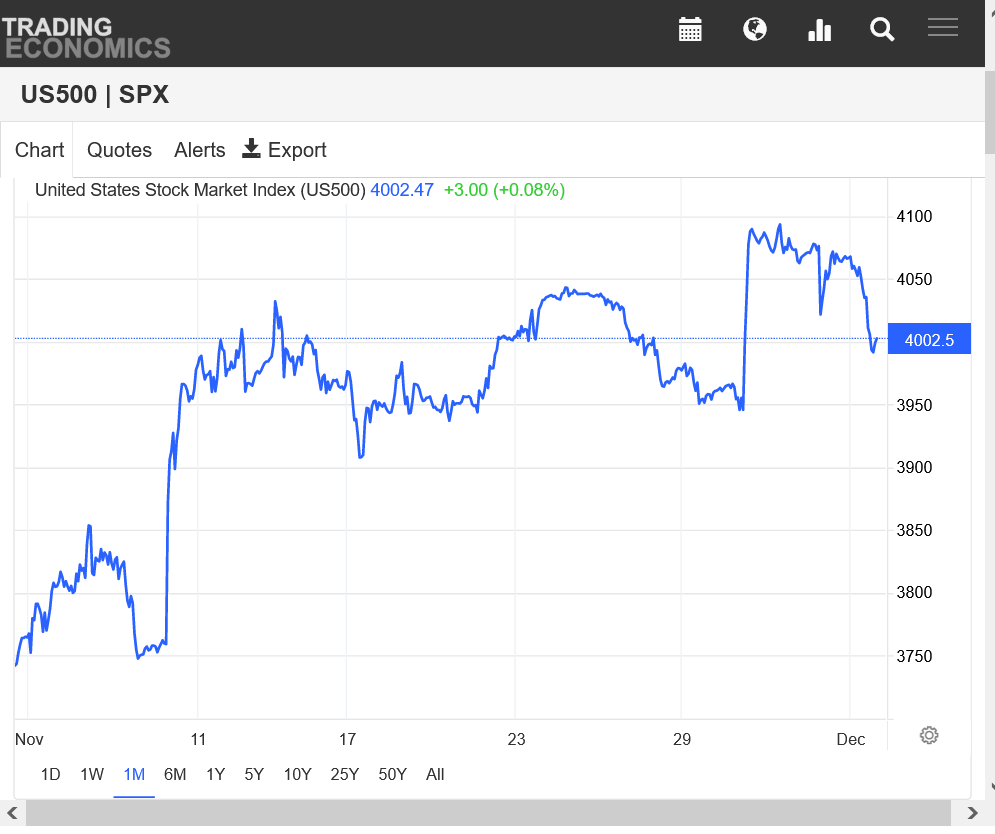

S&Ps were down 60 points in premarket trade (1.5%).

As of this posting S&Ps are testing unchanged, which I consider good action. (Still 50 minutes till the close)

Moderate words by Fed chief Powell 2 days ago and the market ripped higher. Today's number could have reversed it. It did not.

The inverted yield curve, often pointed out by bear, historically portends a recession. And the market is a little less attractive to me here (15% off the lows).

But near term the action is really bullish.

Thanks much sharing this joj!

You've been on top of the stock market with lots of good input about what matters to the market.

I was clearly wrong on this post. Markets are humbling.

Join the club joj!

I was extremely wrong about the weather turning colder in the East this week!

https://tradingeconomics.com/spx:ind

jobs report? Was it not reported some 4 million who disappeared from the jobs market during covid have not turned up?

here is a contrarian thought.

EVERYONE is pointing to the inverted curve, and saying there will be a recession next year.

but when too many people are on the same side of the boat...

makes me wonder.

Excellent point bear!

This inverted yield curve is the most widely reported inverted yield curve in my lifetime.

The other thing I can't shake is the tight labor market. When has there ever been a recession with low Unemployment? Has that ever happened? (On the other hand, tight labor is inflationary)

Technically, in spite of all the headwinds, the S&Ps have not touched the pre-pandemic highs.

here are my long term thoughts...if you love having a trading range...

when stocks are grossly overpriced, then you then to have a very long bear market until markets get back to being very cheap.

when the p/e on the dow hits a high in 1999, stocks were still lower in 2010 than what they were in 1999.

when stocks were overpriced in 1969, they went over 10 years and were still no higher in 1981.

stocks by some measures were higher than ever in early 2021, and will go sideways until past 2031...

you might collect a dividend, but i see a trading range for the next 10-12 years.