KEY EVENTS TO WATCH FOR:

Wednesday, November 30, 2022

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 209.8)

Composite Idx, W/W% (previous +2.2%)

Purchase Idx-SA (previous 174.4)

Purchase Idx-SA, W/W% (previous +2.8%)

Refinance Idx (previous 373.6)

Refinance Idx, W/W% (previous +1.8%)

8:15 AM ET. November ADP National Employment Report

Private Sector Jobs, Net Chg (expected +190000; previous +239000)

8:30 AM ET. 3rd Quarter Preliminary Corporate Profits

8:30 AM ET. 3rd Quarter 2nd estimate GDP

Annual Rate, Q/Q% (expected +2.7%; previous +2.6%)

Chain-Weighted Price Idx, Q/Q% (expected +4.1%; previous +4.1%)

Corporate Profits, Q/Q% (previous +7.4%)

PCE Price Idx, Q/Q% (previous +4.2%)

Purchase Price Idx, Q/Q% (previous +4.6%)

Real Final Sales, Q/Q% (previous +3.3%)

Core PCE Price Idx, Q/Q% (previous +4.5%)

Consumer Spending, Q/Q% (previous +1.4%)

8:30 AM ET. October Advance Economic Indicators Report

9:45 AM ET. November Chicago Business Barometer - ISM-Chicago Business Survey - Chicago PMI

PMI-Adj (expected 47.0; previous 45.2)

10:00 AM ET. October Job Openings & Labor Turnover Survey

10:00 AM ET. October Pending Home Sales Index

Pending Home Sales (previous 79.5)

Pending Home Sales Idx, M/M% (expected -5.5%; previous -10.2%)

Pending Home Sales Idx , Y/Y% (previous -31.0%)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 431.665M)

Crude Oil Stocks, Net Chg (Bbl) (previous -3.69M)

Gasoline Stocks (Bbl) (previous 210.998M)

Gasoline Stocks, Net Chg (Bbl) (previous +3.058M)

Distillate Stocks (Bbl) (previous 109.101M)

Distillate Stocks, Net Chg (Bbl) (previous +1.718M)

Refinery Usage (previous 93.9%)

Total Prod Supplied (Bbl/day) (previous 19.878M)

Total Prod Supplied, Net Chg (Bbl/day) (previous -1.209M)

2:00 PM ET. U.S. Federal Reserve Beige Book

3:00 PM ET. October Agricultural Prices

Farm Prices, M/M% (previous -0.2%)

Thursday, December 1, 2022

7:30 AM ET. November Challenger Job-Cut Report

Job Cuts, M/M% (previous +13%)

8:30 AM ET. October Personal Income & Outlays

Personal Income, M/M% (expected +0.4%; previous +0.4%)

Consumer Spending, M/M% (expected +0.8%; previous +0.6%)

PCE Price Idx, M/M% (previous +0.3%)

PCE Price Idx, Y/Y% (previous +6.2%)

PCE Core Price Idx, M/M% (expected +0.3%; previous +0.5%)

PCE Core Price Idx, Y/Y% (expected +5.0%; previous +5.1%)

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (expected 235K; previous 240K)

Jobless Claims, Net Chg (previous +17K)

Continuing Claims (previous 1551000)

Continuing Claims, Net Chg (previous +48K)

8:30 AM ET. U.S. Weekly Export Sales

9:45 AM ET. November US Manufacturing PMI

PMI, Mfg (expected 47.6; previous 50.4)

10:00 AM ET. October Metropolitan Area Employment & Unemployment

10:00 AM ET. October Construction Spending - Construction Put in Place

New Construction (expected -0.2%; previous +0.2%)

Residential Construction

10:00 AM ET. November ISM Report On Business Manufacturing PMI

Manufacturing PMI (expected 49.8; previous 50.2)

Prices Idx (previous 46.6)

Employment Idx (previous 50.0)

Inventories (previous 52.5)

New Orders Idx (previous 49.2)

Production Idx (previous 52.3)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 3564B)

Working Gas In Storage, Net Chg (Cbf) (previous -80B)

11:00 AM ET. November Global Manufacturing PMI

PMI, Mfg (previous 49.4)

12:00 PM ET. November Monthly U.S. Retail Chain Store Sales Index

2:00 PM ET. SEC Closed Meeting

4:00 PM ET. November Domestic Auto Industry Sales

4:30 PM ET. Foreign Central Bank Holdings

4:30 PM ET. Federal Discount Window Borrowings

Friday, December 2, 2022

8:30 AM ET. November U.S. Employment Report

Non-Farm Payrolls (expected +200K; previous +261K)

Unemployment Rate (expected 3.7%; previous 3.7%)

Avg Hourly Earnings (USD) (previous 32.58)

Avg Hourly Earnings-Net Chg (USD) (previous +0.12)

Avg Hourly Earnings, M/M% (expected +0.3%; previous +0.37%)

Avg Hourly Earnings, Y/Y% (expected +4.6%; previous +4.73%)

Overall Workweek (previous 34.5)

Overall Workweek Net Chg (previous +0)

Government Payrolls (previous +28K)

Private Payroll (previous +233K)

Participation Rate (previous 62.2%)

Non-Farm Payrolls Bench Net Chg

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The STOCK INDEXES: The December NASDAQ 100 was higher overnight as it consolidates some of the decline off last-Friday's high. Overnight trading sets the stage for a higher opening when the day session begins trading.Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at 11,368.52 would signal that a short-term top has been posted. If December renews the rally off October's low, the 62% retracement level of the August-October crossing at 12,547.94 is the next upside target. First resistance is the 50% retracement level of the August-October crossing at 12,150.94. Second resistance is the 62% retracement level of the August-October crossing at 12,547.94. First support is the 50-day moving average crossing at 11,368.52. Second support is the November 10th low crossing at 10,808.00.

The December S&P 500 was higher overnight as it consolidates some of the decline off last-Friday's high. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 3921.94 would signal that a short-term top has been posted. If December extends the rally off the October 13th low, the 75% retracement level of the August-October decline crossing at 4136.35 is the next upside target. First resistance is the 62% retracement level of the August-October declinecrossing at 4024.30. Second resistance is the 75% retracement level of the August-October decline crossing at 4136.35. First support is the 20-day moving average crossing at 3921.94. Second support is the 50-day moving average crossing at 3808.07.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: December T-bonds were steady to higher overnight as they consolidate some of the rally off October's low. Overnight trading sets the stage for a steady to higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off October's low, October's high crossing at 129-12 is the next upside target. Closes below the 20-day moving average crossing at 124-01 would signal that a short-term top has been posted. First resistance is August's high crossing at 129-12. Second resistance is the 50% retracement level of the August-October decline crossing at 131-15. First support is the 10-day moving average crossing at 126-19. Second support is the 20-day moving average crossing at 124-01.

December T-notes was steady to higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off October's low, the 38% retracement level of the August-October decline crossing at 113.280 is the next upside target. Closes below the 20-day moving average crossing at 111.287 would signal that a short-term top has been posted. First resistance is the 38% retracement level of the August-October-decline crossing at 113.280. Second resistance is the 50% retracement level of the August-October decline crossing at 115.142. First support is the 20-day moving average crossing at 111.287. Second support is November's low crossing at 109.105.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

ENERGIES:Januarycrude oil was higher overnight as it extends the rally off Monday's low. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $83.68 would signal that a short-term low has been posted. If January extends the decline November's high, the 50% retracement level of the 2020-2022 rally crossing at $72.40 is the next downside target. First resistance is the 10-day moving average crossing at $79.72. Second resistance is the 20-day moving average crossing at $83.68. First support is Monday's low crossing at $73.60. Second support is the 50% retracement level of the 2020-2022 rally crossing at $72.40.

January heating oil was higher overnight as it consolidates some of the decline off November's high. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are oversold but are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $3.4307 would signal that a short-term low has been posted. If January renews the decline off November's high, the 87% retracement level of the September-November rally crossing at $3.0325 is the next downside target. First resistance is the 50-day moving average crossing at $3.4023. Second resistance is the 20-day moving average crossing at $3.4307. First support is the 75% retracement level of the September-November rally crossing at $3.1276. Second support is the 87% retracement level of the September-November rally crossing at $3.0325.

January unleaded gas was higher overnight as it consolidates some of the decline off November's high. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are oversold but are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $2.4535 would confirm that a short-term low has been posted. If January renews this month's decline, September's low crossing at $2.1536 is the next downside target. First resistance is the 10-day moving average crossing at $2.3587. Second resistance is the 20-day moving average crossing at $2.4535. First support is Monday's low crossing at $2.2196. Second support is September's low crossing at $2.1536.

January natural gas was lower overnight and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 6.829 would signal that a short-term top has been posted. If January resumes the rally off October's low, the 62% retracement level of the August-October decline crossing at 8.449 is the next upside target. First resistance is last-Wednesday's high crossing at 8.177. Second resistance is the 62% retracement level of the August-October decline crossing at 8.449. First support is the 20-day moving average crossing at 6.829. Second support is the November 16th low crossing at 6.132.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The December Dollar was lower overnight and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI have turned neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the November 21st high crossing at $107.895 would confirm that a short-term low has been posted. If December renews the decline off September's high, the 50% retracement level of this year's rally crossing at $104.650 is the next downside target. First resistance is the 20-day moving average crossing at $107.640. Second resistance is the 50-day moving average crossing at $110.261. First support is the November 15th low crossing at $105.155. Second support is the 50% retracement level of this year's rally crossing at $104.650.

The December Euro was higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $1.02440 would signal that a short-term top has been posted. If December extends the rally off September's low, the 38% retracement level of the 2021-2022 decline crossing at $1.07137 is the next upside target. First resistance is Monday's high crossing at $1.05135. Second resistance is the 38% retracement level of the 2021-2022 crossing at $1.07137. First support is the 20-day moving average crossing at $1.02240. Second support is the 50-day moving average crossing at $1.00170.

The December British Pound was higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought, diverging but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off September's low, the 50% retracement level of the 2021-2022 decline crossing at 1.2312 is the next upside target. Closes below the 20-day moving average crossing at 1.1762 would signal that a short-term top has been posted. First resistance is last-Friday's high crossing at 1.2161. Second resistance is the 50% retracement level of the 2021-2022 decline crossing at 1.2312. First support is the 20-day moving average crossing at 1.1762. Second support is the 50-day moving average crossing at 1.1451.

The December Swiss Franc was higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 1.04270 would signal that a short-term top has been posted. If December extends the rally off last-Monday's low, August's high crossing at 1.07550 is the next upside target. First resistance is the November 15th high crossing at 1.07275. Second resistance is August's high crossing at 1.07550. First support is the 20-day moving average crossing at 1.04270. Second support is the 50-day moving average crossing at 1.02597.

The December Canadian Dollar was higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Multiple closes below the 50-day moving average crossing at $73.66 would open the door for a possible test of November's low crossing at $72.44. Closes above last-Friday's high crossing at $75.11 would signal that a short-term low has been posted. First resistance is last-Friday's high crossing at $75.11. Second resistance is November's high crossing at $75.63. First support is the 50-day moving average crossing at $73.66. Second support is November's low crossing at $72.44.

The December Japanese Yen was lower overnight. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought, diverging but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If December extends the rally off October's, the 62% retracement level of the August-October decline crossing at 0.072241 is the next upside target. Closes below the 20-day moving average crossing at 0.070768 would signal that a short-term top has been posted. First resistance is the November 15th high crossing at 0.072925. Second resistance is the 62% retracement level of the August-October decline crossing at 0.072241. First support is the 20-day moving average crossing at 0.070768. Second support is the 50-day moving average crossing at 0.069631.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

PRECIOUS METALS: Decembergold was higher overnight. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below last-Wednesday's low crossing at $1719.00 would confirm that a short-term top has been posted. If December renews the rally off November's low, August's high crossing at $1824.60 is the next upside target. First resistance is November's high crossing at $1791.80. Second resistance is August's high crossing at $1824.60. First support is last-Wednesday's low crossing at $1719.00. Second support is the 50-day moving average crossing at $1697.70.

December silver was higher overnight and sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the November 21st low crossing at $20.600 would confirm that a short-term top has been posted. If December resumes the rally off October's low, the 50% retracement level of the March-August decline crossing at $22.466 is the next upside target. First resistance is the November 15th high crossing at $22.380. Second resistance is the 50% retracement level of the March-August decline crossing at $22.448. First support is the November 21st low crossing at $20.600. Second support the 50-day moving average crossing at $20.018.

December copper was higher overnight as it consolidates some of the decline off November's high. The high-range trade overnight sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above last-Friday's high crossing at 3.6885 would signal that a short-term low has been posted. If December renews the decline off November's high, the 50-day moving average crossing at 3.5201 is the next downside target. First resistance is last-Friday's high crossing at 3.6885. Second resistance is November's high crossing at 3.9600. First support is the 50-day moving average crossing at 3.5201. Second support is the October 31st low crossing at 3.3615.

GRAINS http://quotes.ino.com/ex changes/?c=grains

March corn was higher overnight as it extends the trading range of the past three-weeks. Overnight trading sets the stage for a higher opening when the day sessions begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 50-day moving average crossing at $6.82 would confirm that a short-term low has been posted. If March renews the decline off the October 31st high, the August 18th low crossing at $6.11 1/2 is the next downside target. First resistance is the 50-day moving average crossing at $6.82. Second resistance is the October 31st high crossing at $7.04 3/4. First support is the November 15th low crossing at $6.53 1/2. Second support is the August 18th low crossing at $6.11 1/2.

March wheat was higher overnight as it consolidates some of the decline off October's high and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off October's high, August's low crossing at $7.60 1/4 is the next downside target. Closes above the 20-day moving average crossing at $8.27 1/2 would temper the near-term bearish outlook. First resistance is the 20-day moving average crossing at $8.27 1/2. Second resistance is the 50-day moving average crossing at $8.66 1/2. First support is Monday's low crossing at $7.73 1/4. Second support is August's low crossing at $7.60 1/4.

March Kansas City wheat was higher overnight as it consolidates some of the decline off November's high. Overnight trading sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off October's high, September's low crossing at $8.65 1/4 is the next downside target. Closes above the 50-day moving average crossing at $9.47 1/2 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $9.27 3/4. Second resistance is the 50-day moving average crossing at $9.47 1/2. First support is Tuesday's low crossing at $8.84 1/4. Second support is September's low crossing at $8.65 1/4.

March Minneapolis wheat was steady to higher overnight as it extends the July-November trading range. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off November's high, the September 19th low crossing at $9.15 is the next downside target. Closes above the 50-day moving average crossing at $9.66 would temper the near-term bearish outlook. First resistance is the 50-day moving average crossing at $9.66. Second resistance is the November 15th high crossing at $9.91 1/4. First support is the September 19th low crossing at $9.15. Second support is the November 7th low crossing at $8.93.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

January soybeans was higher overnight and sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are becoming overbought but remain neutral to bullish signaling sideways to higher prices are possible near-term. If January extends the rally off October's low, the 62% retracement level of the September-October decline crossing at $14.55 1/4 is the next upside target. Closes below the 50-day moving average crossing at $14.19 would signal that a short-term top has been posted. First resistance is the 62% retracement level of the September-October decline crossing at $14.55 1/4. Second resistance is the September 21st high crossing at $14.93 1/2. First support is the November 17th low crossing at $14.06 3/4. Second support is the October 26th low crossing at $13.80 1/2.

January soybean meal was higher overnight and the high-range overnight trade sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If January extends the rally off November's low, the November 9th high crossing at $416.60 is the next upside target. Closes below Monday's low crossing at $401.40 would temper the near-term friendly outlook. First resistance is the November 9th high crossing at $416.60. Second resistance is October's high crossing at $419.10. First support is November's low crossing at $394.50. Second support is the October 19th low crossing at $389.80.

January soybean oil was higher overnight as it extends the rally off the November 21st low. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If January extends the rally off the November 21st low, November's high crossing at 75.94 is the next upside target. If January renews the decline off November's high, the 50-day moving average crossing at 68.48 is the next downside target. First resistance is November's high crossing at 75.94. Second resistance is June's high crossing at 78.78. First support is the 50-day moving average crossing at 68.48. Second support is the October 13th low crossing at 62.40.

LIVESTOCKhttp://quotes.ino.com/exchanges/?c=livestock

February hogs closed down $0.63 at $84.13.

February hogs closed lower on Tuesday as it extended this month's decline. The low-range close sets the stage for a steady to lower opening when Wednesday's session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If February extends this week's decline, the 62% retracement level of the October rally crossing at $82.29 is the next downside target. Closes above the 10-day moving average crossing at $88.72 would signal that a short-term low has been posted. First resistance is November's high crossing at $91.35 Second resistance is October's high crossing at $91.80. First support is the 50% retracement level of the October rally crossing at $84.12. Second support is the 62% retracement level of the October rally crossing at $82.29.

February cattle closed up $0.18 at $156.33.

February cattle closed higher on Tuesday as it consolidated some of the decline off last-Wednesday's high. The mid-range close sets the stage for a steady to higher opening on Wednesday. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at $153.84 would signal that a short-term top has been posted. If February renews the rally off September's low, monthly resistance crossing at $159.54 is the next upside target. First resistance is October's high crossing at $154.25. Second resistance is monthly resistance crossing at $159.54. First support is the 50-day moving average crossing at $153.84. Second support is the October 14th low crossing at $146.72.

January Feeder cattle closed up $1.28 at $178.15.

January Feeder cattle closed higher on Tuesday as it consolidated some of the decline off last-Monday's high. The high-range close sets the stage for a steady to higher opening when Wednesday's session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If January extends the decline off last-Monday's high, the November 15th low crossing at $176.33 is the next downside target. Closes above the 20-day moving average crossing at $179.43 would signal that a short-term low has been posted. First resistance is last-Monday's high crossing at $181.50. Second resistance is the 62% retracement level of the August-October decline crossing at $184.56. First support is the November 15th low crossing at $176.33. Second support is October's low crossing at $172.10.

FOOD & FIBERhttp://quotes.ino.com/ex changes/?c=food

March coffee closed higher on Tuesday as it extends the rally off last-week's low. The high-range close sets the stage for a steady to higher opening on Wednesday. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the decline off August's high, the 75% retracement level of the 2020-2022 rally crossing at $14.74 is the next downside target. If March extends today's rally, November's high crossing at $17.82 is the next upside target. First resistance is November's high crossing at $17.82. Second resistance is the 50-day moving average crossing at $18.61. First support is the 75% retracement level of the 2020-2022 rally crossing at $14.74. Second support is the 87% retracement level of the 2020-2022 rally crossing at $13.04.

March cocoa closed slightly lower on Tuesday. The mid-range close sets the stage for a steady to slightly lower opening on Wednesday. Stochastics and the RSI are neutral to bearish signaling sideways to lower prices are possible near-term. If March renews this month's decline, the 50-day moving average crossing at 23.81 is the next downside target. If March extends this week's rally, November's high crossing at 25.77 is the next upside target.

March sugar closed slightly higher on Tuesday. The high-range close sets the stage for a steady to higher opening on Wednesday. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 19.39 would confirm that a short-term top has been posted while opening the door for additional weakness near-term. If March renews the rally off September's low, April's high crossing at 20.63 is the next upside target.

March cotton closed higher on Tuesday as it consolidates some of the decline off November's high. The high-range close sets the stage for a steady to higher opening on Wednesday. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off November's high, October's low crossing at 70.10 is the next downside target. If March renews the rally off October's low, the reaction high crossing at 97.77 is the next upside target.

Thanks tallpine!

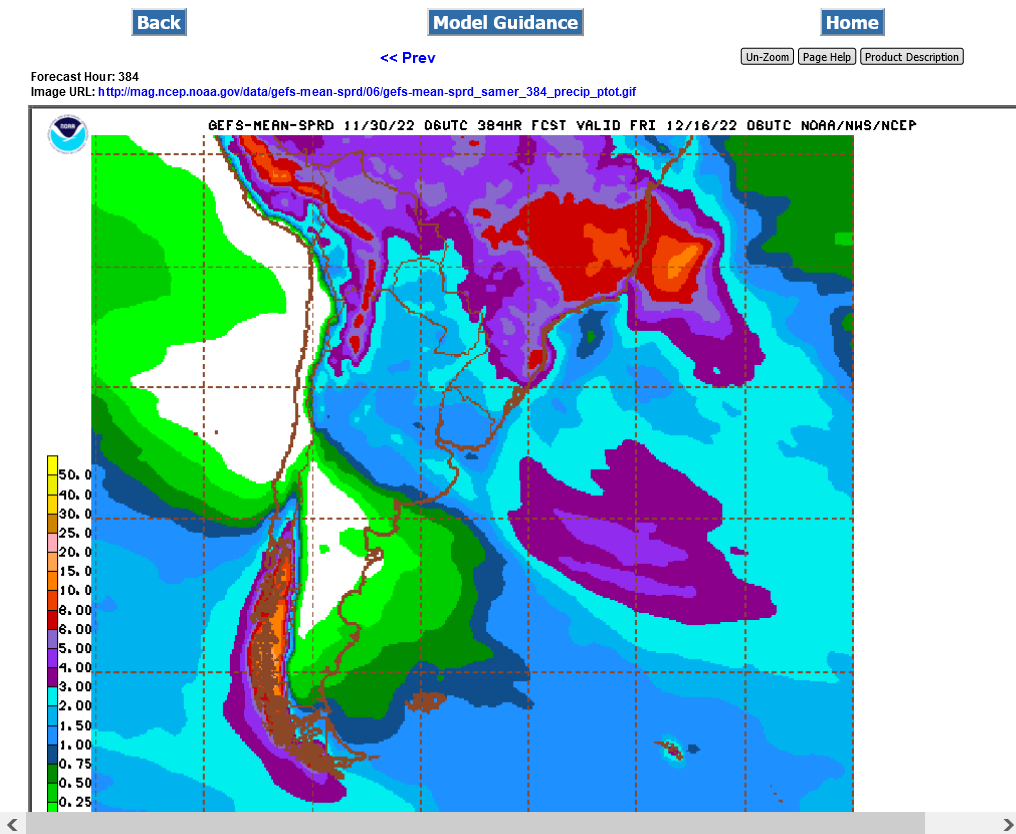

Beans getting more traction from SA weather, though the forecast hasn't changed that much(which has been bullish, especially in Argentina).

Beans could be breaking out to the upside!

NG running out of steam on cold threats in December not getting colder and supplies gushing in