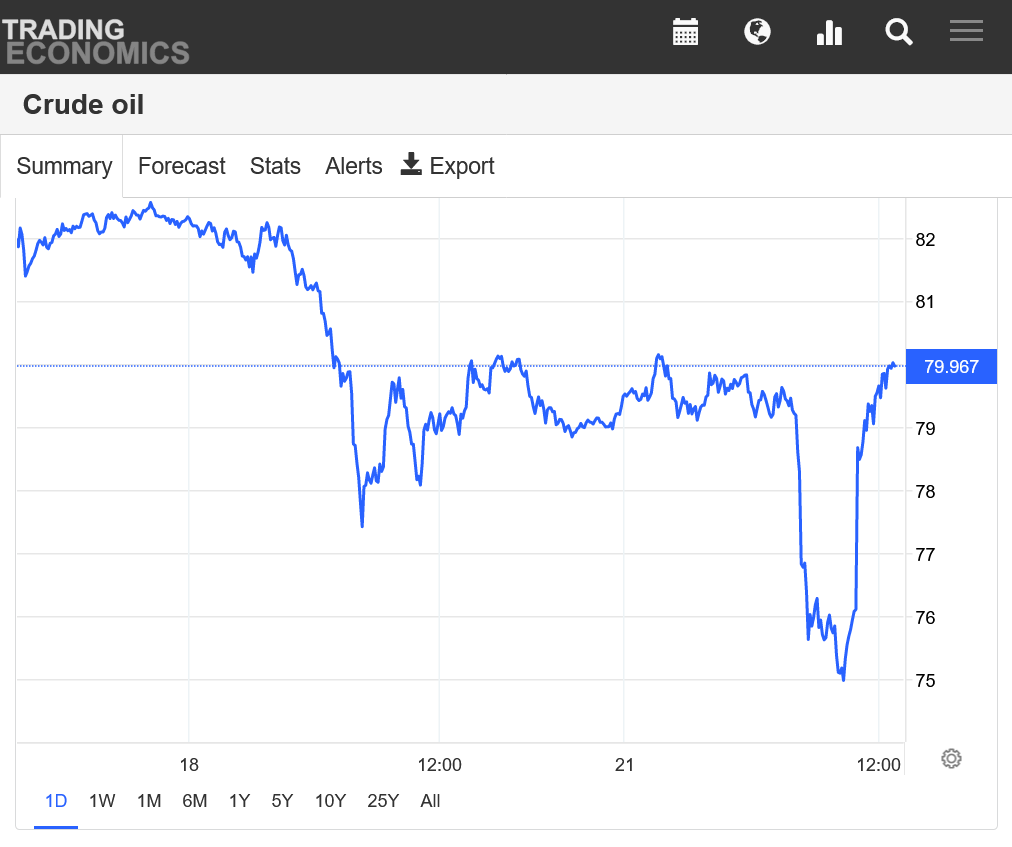

Crude is down 10$ in the last few trading sessions and WTI down $4.25 today. I've heard the guy on Goldman Sachs saying that it is only temporary due to Russia pumping oil to finance the war on Ukraine and potential lockdowns due to recent outbreaks of Covid.

I'm interested in Jim's point of view and any others who have knowledge of the energy markets.

That's a huge drop, joj.

Thanks for bringing it to our attention.

December crude, the front month is expiring today.

Other thoughts?

https://tradingeconomics.com/commodity/crude-oil

1 year below-double top

5 year. Still trying to hold an uptrend-at major support. Bull flag/pennant/wedge? A failure here breaks the formation downwards to a bearish interpretation.

35 years below-triple top? At major support if its a bull flag?

There is a lot going on with crude obviously. China still locks down hard over covid and that always brings up demand fears. The withdrawals from the SPR have muddied the overall picture too. How much impact have those withdrawals had? Quite a bit IMO.

We are reaching the end of the withdrawals though. The midterms are over, so Biden doesn't have to buy votes anymore. Production in the US has picked up slightly, too. The weekly EIA reports will set the trend now.

While crude oil stocks and unleaded stocks are low, they're not horrible, at the moment. The question is, where are they going? If the SPR has been adding 1mbbls a day and it stops, and all of a sudden we start having anything over 5 mbbls a week in shortages showing up in the weekly report, we could be off to the races. Imagine where we would be if Biden hadn't released that roughly 200 mbbls. Well, we could be there in a couple months/spring.

So that's my thinking. My bias would be up. If you're long, you are given lots of opportunities to get in when emotional trading drops the price $4-$5-$6. I would definitely use options though. Just today, prices have swung $4-$5.

If the war between Russia and Ukraine ends (or someone puts a projectile in Putin's head), all bets are off. That's the scary part. I think the minute that happens most energy prices (and most likely grain prices as well) collapse.

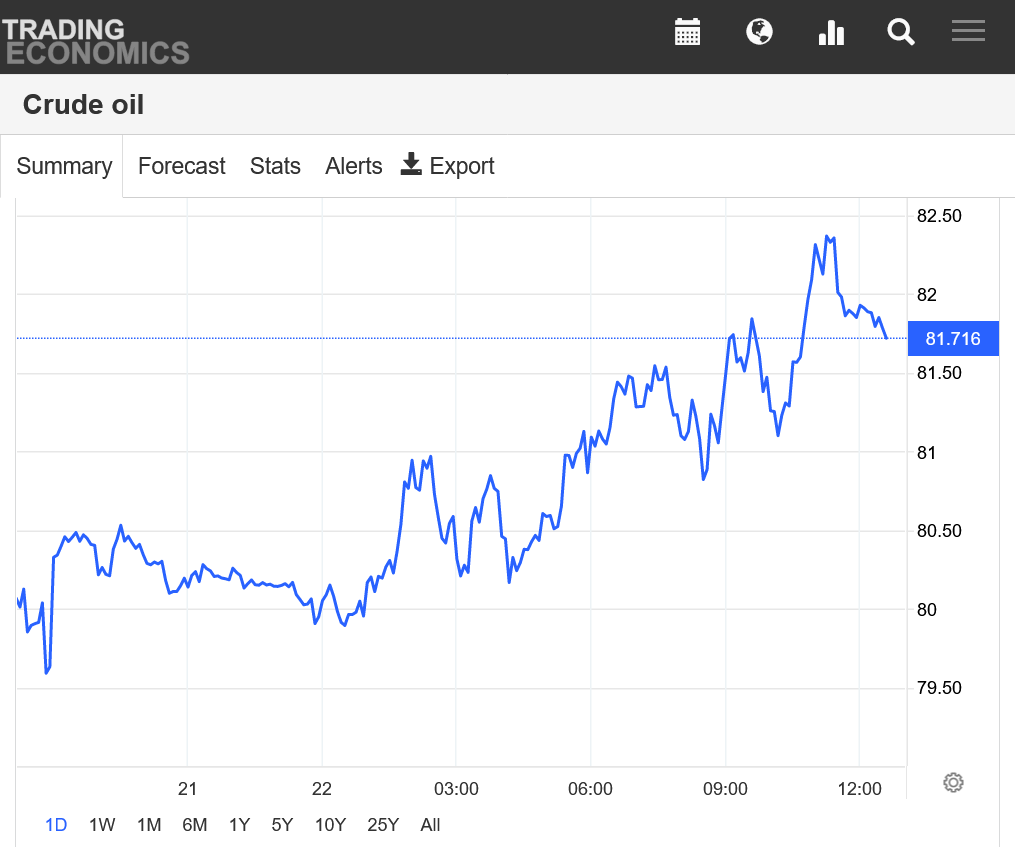

Big reversal higher. Probably the extreme spike earlier/below was tied to the expiring December that goes off the board in less than 45 minutes(last minute longs having to liquidate?), though there could have been some news in there.

Haven't been following crude but this is a great trading topic.

Daily below

Also, the markets are waiting to hear G-7 plans for their Russian oil price cap, which are expected to emerge this week. The price cap seeks to curb Russian oil sales by banning G-7 companies from providing shipping and related services unless that oil is sold below the cap price. The cap is due to come into force for new bookings after December 5, although there will be a grace period until January 19 for ships to unload cargoes that were loaded before the cap went into effect. The price cap embargo should be supportive of global oil prices since it is likely to crimp Russian oil exports and reduce the supply of world oil.

DON'T HOLD YER BREATH WE'RE GETTIN' PLAYED, IMO

Fake news, price caps and hyping seasonal slowdowns in oil demand. They are pulling all the stops out to get oil prices down before the likely winter shortages.

https://tradingeconomics.com/commodity/crude-oil

1 day, 1 week, 1 month, 1 year, 10 years, 25 years, 50 years below.