Corn and beans up strong tonite

Is this a demand issue or excess cash looking for ROI

Does open interest look strong to you??

I have no idea what to make of that

Rumours of corn in china worth 10.00 USD

Did china have multiple crop failures

Much ink was used reporting on china crop failures but the CCP would never admit to much

Flooding water even entered storage places and spoiled reserves. Now that is not good if true. Then insect infestations, flooding ruined crops. China had both flooding and dry with insect infestations

Food supply is the one thing the CCP fears the most. They will buy, have already bought all of Argentina beans and truckers are on strike, at ports, which seems more serious this yr

Reports of 100 boats waiting to load, with more arriving every day which just increases the back log of boats at anchor.

China will be forced to buy USA beans to fill the temporary supply gap, no matter the price. Physical is more important than price especially if purchase is hedged

Maybe you have some thoughts as I just rattled of some thoughts as they came to my mind.

Thanks Wayne,

I'll try to comment later on Monday and hope others have some thoughts.

Here's the SA weather:

When you consider that both the US and SA have had pretty good crops for a number of years now and SA still had to get beans from the US to meet their sales, one has to wonder if we haven't reached some kind of tipping point of food supply.

What if the US or SA has a really bad year?

This is all coming from China demand.

Maybe they had a bad crop last year or they are stocking up.

Or their pig population is rebounding....but does it really matter? Demand is demand and right now there is tooo much demand and not enough supply, after pretty decent crop years.

Thanks Jim!

Sold a load of corn yesterday for $5.00 river open delivery. It's been 6 or 7 years since I've sold for $5.

Congrats bowyer!

@kannbwx#AGTRIVIA: CBOT Futures Most-active #corn, #wheat, #soybeans and product futures all hit their 2020 highs on the same day (Dec. 31), which hasn't happened since at least 1972. But those 5 have hit their yearly lows all on the same day twice since 1972 - in which 2 years?

Most-active CBOT #corn, #soybeans, #wheat, soymeal & soyoil had never reached their annual highs all on the same day until 2020 (December 31). But that has happened twice when it comes to the lows: 2019 (May 13) and 2008 (December 5). #AGTRIVIA

2020 #corn futures don't really have a twin, but 2010 is probably the closest example pattern-wise. 1993 also had some similarities, less so during mid-year. Those past % gains were MUCH larger. Annual increase in most-active futures: 2020 +25%, 2010 +52%, 1993 +41%.

If you bet one year ago that most-active CBOT #soybeans in 2020 would trade nearly identically to 2010, maybe you're already on your own private island somewhere and you're def not reading this tweet Seriously though, the resemblance is uncanny. +37 in 2020, +34% in 2010.

And now to address the most obvious and logical next question, how 2011 unfolded:

Taking this a step further, look how tightly packed together July-November 2021 #soybeans had been with the 2008 and 2011 spreads. That is until mid-December. 2008 peaked Dec 17 & 2011 on Jan 12. Adding in 2014 gives a similar pattern as 2021 (though delayed a month or two).

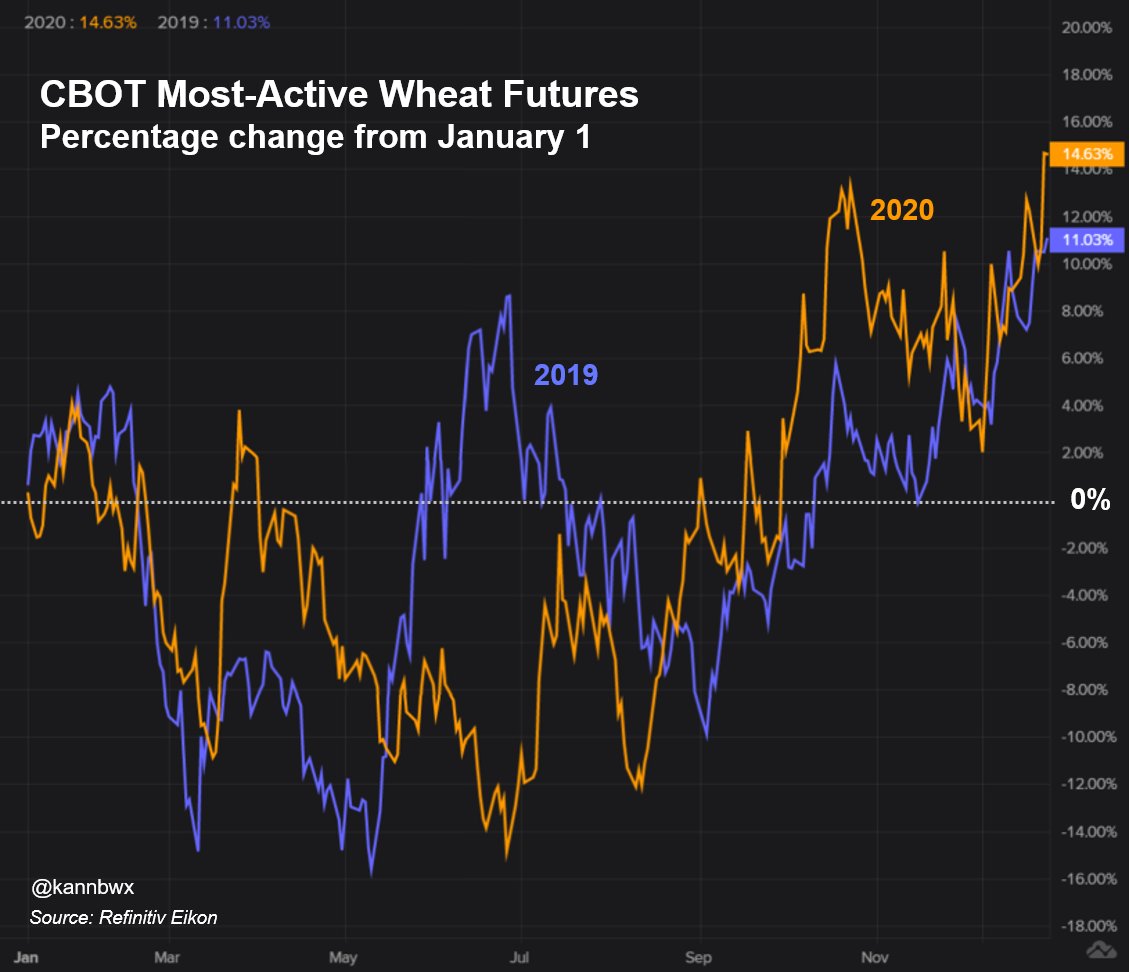

CBOT #wheat doesn't have a carbon copy for 2020 either, but 2019 and 1994 are the closest IMO. 2019 would be such a better match if not for the divergence in June. Annual % gain:

2020 +15%, 2019 +11%, 1994 +6%

U.S. #ethanol stocks last week fell for the first time in 10 weeks, but output is running 9% below avg, the worst vs avg since late Sept. Implied ethanol usage during Christmas week was -16% avg and gasoline demand was -14% avg in prior week (both worst departures since June)

Both gasoline demand and implied ethanol use made a recovery versus average in the latest week ended Jan. 1 to 12% below the 3yr avg. Always important to compare numbers versus avg instead of in absolute terms to avoid being misled by normal seasonal fluctuations.

Province of Ontario has mandated 15% ethanol in pump gasoline

Ottawa is thinking of the same, which means all of Canada

As you know Canada is a member of the Paris Accord

Now before you get too excited the 1st increment will be 11% followed by increments to 15% by 2030

This is part of Canada's contribution to global warming

I am not saying to have to agree, just what some are thinking

Ontario is the largest corn producer province in Canada Ontario uses more than 1/3 of total corn produced for ethanol

So now we will increase our use of ethanol

You folks ruined our fat cattle/cow industry so now we produce ethanol

Most of the remainder goes to the feather trade

New chicken barns sprouting every yr