https://www.oilandgas360.com/oil-slides-on-covid-19-resurgence-and-strong-dollar/

“The reality is that we’re now seeing a pretty active spread of the pandemic across Europe and it’s spreading again in North America, and that potentially will weigh on oil demand recovery,” said Lachlan Shaw, head of commodity research at the National Bank of Australia.

Some European countries were reviving curfews and lockdowns to fight a surge in new coronavirus cases, with Britain imposing tougher COVID-19 restrictions in London on Friday.

“Although we will are unlikely to enter such deep lockdowns as in the pandemic’s first wave, we still see restrictions, and they do have an effect in every aspect of our lives, including fuel consumption,” said Rystad Energy analyst Paola Rodriguez-Masiu.

Crude also fell as the dollar headed towards its best week in a month. [FRX/]

A technical committee of the Organization of the Petroleum Exporting Countries (OPEC) and allied oil producers, a group know as OPEC+, ended their meeting on Thursday expressing concerns about a weak demand outlook.

OPEC+ is set to ease its current supply cuts of 7.7 million barrels per day (bpd) by 2 million bpd in January.

Crude 3 month chart

| |

Crude 1 year chart below

| |

Crude 5 year chart below

| |

Crude 10 year chart below

| |

Unleaded Gasoline Price Charts:

| |

| |

5 year........are we headed back to the highs?

| |

Weekly US ending stocks of crude oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

Weekly ending stocks for unleaded gasoline.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

U.S. Crude Oil Inventories Latest Release Oct 15, 2020 Actual-3.818M Forecast-2.835M Previous 0.501M https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 21, 2020 | 10:30 | -3.818M | |||

| Oct 15, 2020 | 11:00 | -3.818M | -2.835M | 0.501M | |

| Oct 07, 2020 | 10:30 | 0.501M | 0.294M | -1.980M | |

| Sep 30, 2020 | 10:30 | -1.980M | 1.569M | -1.639M | |

| Sep 23, 2020 | 10:30 | -1.639M | -2.325M | -4.389M | |

| Sep 16, 2020 | 10:30 | -4.389M | 1.271M | 2.032M |

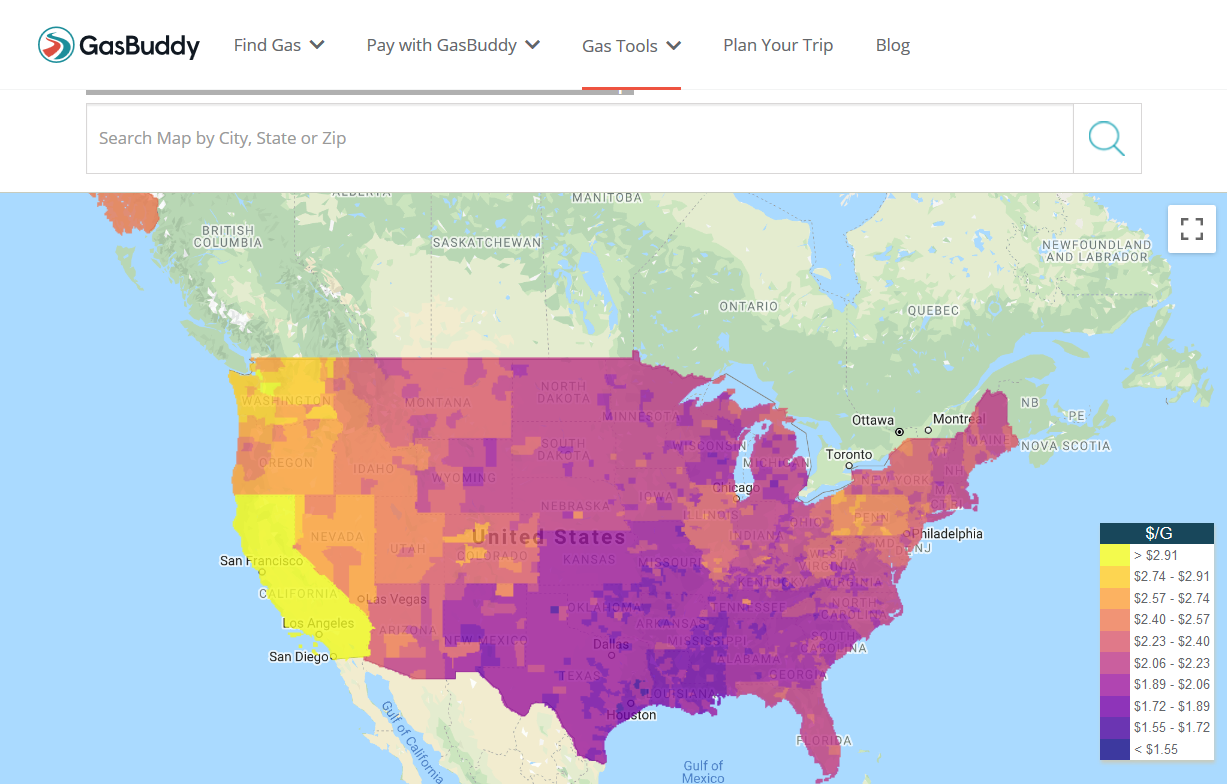

Current gas prices. They may seem low but we are being price gouged in some markets right now. This seems to happen more at this time of year for some reason.

https://www.gasbuddy.com/GasPriceMap?z=4&lng=-96.591588&lat=38.822395

https://www.quora.com/Why-are-west-coast-gasoline-prices-higher

https://www.oilandgas360.com/exclusive-only-a-quarter-of-bps-10000-job-cuts-to-be-voluntary/

The oil major announced plans in June to lay off almost 15% its 70,000-strong workforce as part of Chief Executive Bernard Looney’s plan to cut costs and “reinvent” the business for a low carbon future.

Many layoffs will come from office-based staff including BP’s core oil and gas exploration and production division, where thousands of engineers, geologists and scientists are set to leave. They will not impact frontline production facilities.

A BP spokesman confirmed the voluntary redundancy figure.

“We are continuing to make progress towards fully defining our new organisation … We expect the process to complete and for all staff to know their positions in the coming months,” BP said in a statement.

The oil industry is facing one of its biggest ever crises, with a collapse in demand and oil prices due to the COVID-19 pandemic and pressure from activists and investors to help battle climate change.

In an internal memo this week, BP said that out of 23,600 people eligible for voluntary redundancy, some 2,500 had applied, including about 500 people in senior roles.

“This means around a quarter of the headcount reduction that Bernard outlined in June, will be voluntary,” the memo said.

“We know that for some people for various reasons they feel that now is the right time for them to leave BP – but for many it will still have been a difficult decision,” the memo said.

Looney has promised to cut oil and gas output by 40% by the end of this decade, a radical pledge for an energy company, as he seeks to dramatically expand renewables production such as offshore wind and solar.

Investors have praised the drive, but also questioned the financial viability of the plan as renewables generate much lower returns.

BP’s shares currently trade at their lowest since 1995, when it was a much smaller company, and its dividend yield stands at a staggering 13%.

Its shares were up 1.5% at 1125 GMT.