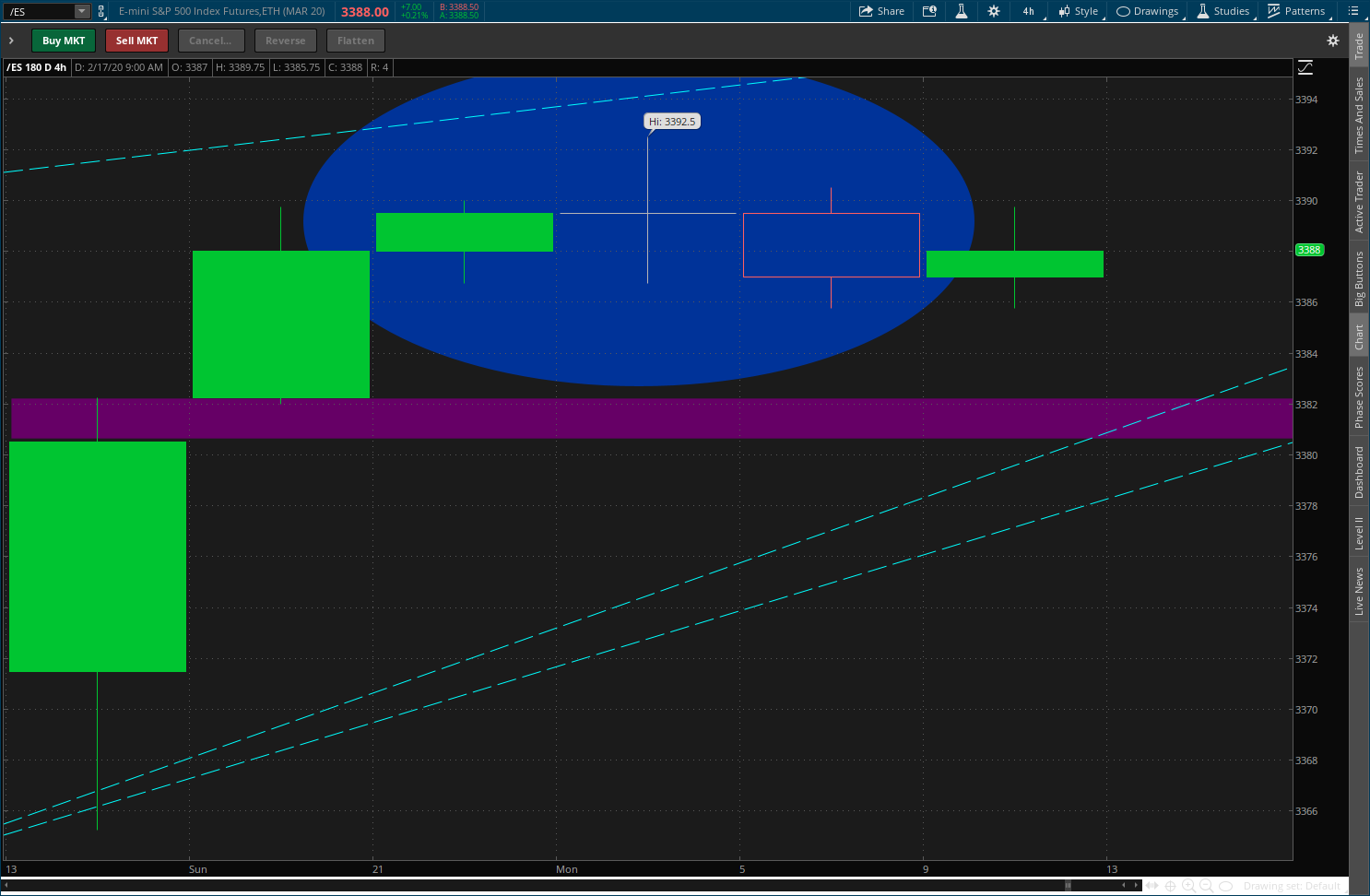

Befitting time for the bubble to begin deflating on the eve of holiday given to the Prezidents. First time trading the March es micro short at 3389.00. The all time high was earlier tonight at 3392.50 Here's a 4-hour candle chart. Purple gap zones below.

guess you must of missed Kudlow on tv announcing tax cuts 2.0, gdp of 3%, employment numbers, new trade deals, steady interest rates, etc.....this deal is going higher

I bought puts on the SPY and QQQ on Friday after noon. I always wanted to try the E-Micro mini. Did you get a good fill?

I say that a stock market crash is coming this summer that will take out the lows of the past 15 months.

other than an unexpected world wide debacle what would cause this event Richard?

Absolutely perfect cross, Japanese Doji candle marking the uppermost extremity of the S&P, specifically March es 2020. This is a 4-hour candle chart. She's good, until it is not. But here is a distinct possibilty of a so called inflection, cycle top, a corner, so to speak. A point of indecision that marks a crossroads. Micro es was heck of a lot more fluid than orange juice! Though OJ one can drink! Getting filled is easy, same as filling glass of OJ!

I have to think most people don't realize how dependant the world is on china supply chains

So: If you are looking for an unexpected Black Swan event, this is it and nobody can deny it

Some widget factory in china won't have workers show up for work and that wwidgit doesn't get made

Isn't this just common sense, that some plant else where will shut down for lack of widgits

I am sure most people have heard of JCB, the digger Co. They have closed their plant for lack of parts. I think that is USA folks

How many other plants close for lack of parts

And consider the summer clothing retail biz. Now is when those orders go in, and who makes most of the clothes, hand bags perfume lip stick etc

A lot of it comes from china, but where is the revenue if you don't have anything much to sell. The buyer will buy less and wait for a better selection. You guys know how your wives think if they can't find exactly what they want

Heck, china makes 1/2 of the worlds supply of face masks Reports of hoarding are already surfacing and china is busy trying to buy the other 1/2 of the world supply

Co.s that rely on a china supply chain will have to decide if china goes back to work, soon, and this is just a hiccup or is the supply chain broken for longer than revenues can take the hit from lost sales

Nobody knows when the revenue stream will show up as lower profits or even losses but you can bet the world will suffer a majot supply shock

When this affects stk prices is anybodies guess but common sense says it will

Do you know who the buyers of stks are today

From what I read [which may not be true but I think it is] the majority of buyers are stk buy backs

The majority of sellers are the CEO's of these same Co's that are using cheap money for stk buy backs. They aren't stupid. They are busy excersizing options before their Co's hits the brick wall. Yes, we have our share of zombie Co's. What kind of fool would waste money investing in R & D when stk buy backs increase stk value and increase end of yr compensation if the stk goes up

Throw in a supply chain disruption and you have the perfect storm for a selling spree

These CEO's know some thing will happen. This supply china interruption looks kind of dicey and thus the insiders are already heading for the exit. It's not illegal to exercise your options

When the selling starts, big time, the exit doors won't be big enough

I know there are a lot of optimistic people in this world and so far the stk buyers have been the big winners. But you have to be able to recognize a Black Swan event when it happens. And don't tell me we make or can make all the widgits here at home. We might have to do that, which would be good IMHO but do you know how long that would take to get up and running. How many Co's have the bank acct to wait for that to happen???

It so happens I speak from a bit of experience as our family makes parts for heavy construction machinery. Widgits are a very important part of the process. Do you have any idea what makes all those pretty lights go on, in the cab of any machine, to tell you something is wrong, or the screens that light up and tell you things are working well. We just plug em in, all in the correct place, and it works. Somebody else makes that stuff. Now if we can't get that stuff, guess what happens. We don't know how to make those wiring harnesses.

Now tell me why I am wrong

https://traderfeed.blogspot.com/2020/02/trading-hypotheses-and-trading-ideas.html

from Ph.D. Brett Steenbarger, trading wizard

"Ask any market participant about the stock index futures and they'll tell you that we're in a bull market of historic proportions. And they wouldn't be wrong. We've seen quite an upward trend recently. Still, market cycles can occur within the context of market trends; few trends move higher with no corrections whatsoever.

I note that at the market peak this week we saw 496 stocks across the major exchanges register fresh 3-month new highs. That compares with 751 at the January peak. Similarly, we registered 182 new 52-week highs among NYSE stocks on Friday, with 60 stocks making new 52-week lows. That compares with 226 new highs and 7 new lows at the January peak. At the January peak, we saw the percentage of SPX stocks trading above their 50, 100, and 200-day moving averages at 79%, 84%, and 80%, respectively. Most recently, those numbers are 65%, 72%, and 76%. Small cap stocks are trading below their January peak, as are stocks outside the U.S. In sum, as we've moved to new highs in February, the market has been losing strength relative to January, which is what we'd expect in a cyclical scenario.

Note that the point of control (the price with the greatest volume traded over the month) is 3325. If we do see a failed upside break vis a vis the February rise, I'd expect that level to be tested, as buyers would become the ones trapped."

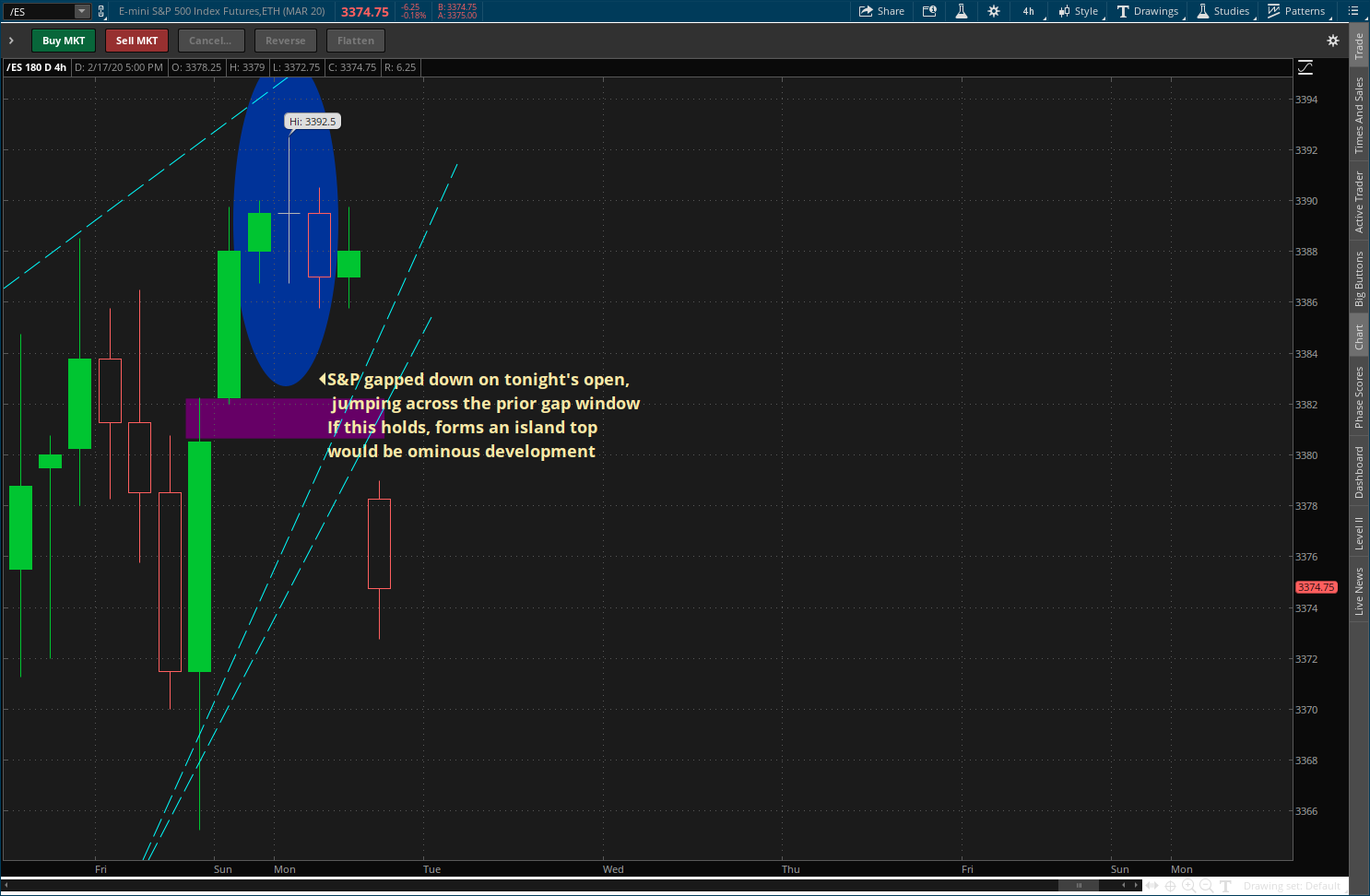

Continuing into the overnight, here pictured on the 4-hour candle chart. Definitely broke down out of the ascending wedge pattern. My tiny S&P March es micro showing profit from the get go. Currently up about $90, micro, yet meaningful. MES designation $726 margin requirement.

Continuing into the overnight, here pictured on the 4-hour candle chart. Definitely broke down out of the ascending wedge pattern. My tiny S&P March es micro showing profit from the get go. Currently up about $90, micro, yet meaningful. MES designation $726 margin requirement.

I am going to add further evidence to my prediction of a world recession coming or starting soon

Jaquar Land Rover U.K is the latest big name I see that will be affected by the broken supply chain from china

They are reporting they have enough parts for two more weeks of production, then the factory shuts down unless a new supply arrives, which looks rather dubious

There CEO is reseigning in Sept at the end of his contract

Reason given is he does not want to be involved in what he thinks will be a world recession

Further to that, some word is leaking out [not confirmed of coarse] that world banks are terrified of a world recession. They say they can not help the economy when a virus is the cause of recession

Now nobody can possibly find all the smaller factories affected by a broken supply chain of parts [widgits as I called them], but this is a serious event

Just more evidence that we will have a world recession and this recession will IMHO affect stk prices as many will want to sell, as the revenue shows less profit, and the exit door is not big enough

I wish we would sell our stk portfolio, I sold mine, but my wife has confidence our financial manager is aware of what is going on and will minimize the effect on her portfolio. I must admit, the latest summary show excellent returns on her portfolio but I am afraid all good thigs do come to an end

We just don't know when, but when factories have two weeks of parts and appl is already bracing for reduced profits, then I think now is the time to head for the exit door